1-4 Butanediol Market Report

Published Date: 02 February 2026 | Report Code: 1-4-butanediol

1-4 Butanediol Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 1-4 Butanediol market from 2023 to 2033, offering insights into market size, trends, segmentation, regional dynamics, and leading players in the industry.

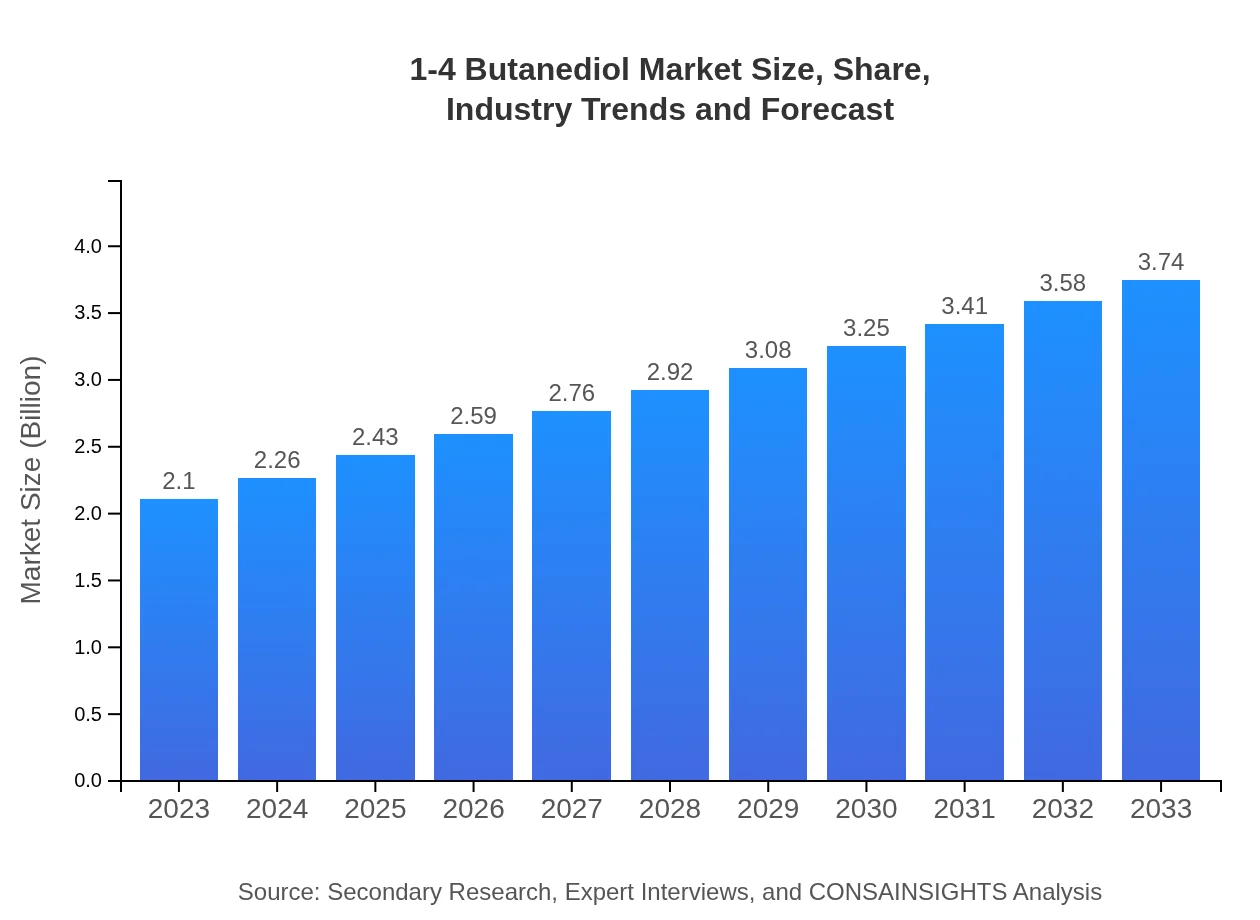

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $3.74 Billion |

| Top Companies | BASF SE, Invista, Dairen Chemical Corporation, Asahi Kasei Corporation |

| Last Modified Date | 02 February 2026 |

1-4 Butanediol Market Overview

Customize 1-4 Butanediol Market Report market research report

- ✔ Get in-depth analysis of 1-4 Butanediol market size, growth, and forecasts.

- ✔ Understand 1-4 Butanediol's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 1-4 Butanediol

What is the Market Size & CAGR of 1-4 Butanediol market in 2023?

1-4 Butanediol Industry Analysis

1-4 Butanediol Market Segmentation and Scope

Tell us your focus area and get a customized research report.

1-4 Butanediol Market Analysis Report by Region

Europe 1-4 Butanediol Market Report:

The European market for 1-4 Butanediol was valued at approximately USD 0.53 billion in 2023 and is anticipated to grow to USD 0.94 billion by 2033. Sustainability initiatives and a focus on bio-based chemicals are stimulating market expansion.Asia Pacific 1-4 Butanediol Market Report:

The Asia Pacific region is a significant contributor to the global 1-4 Butanediol market, with a projected market size of USD 0.45 billion in 2023, expected to reach USD 0.80 billion by 2033. This growth is driven by burgeoning industrialization and an expanding manufacturing base in countries like China and India.North America 1-4 Butanediol Market Report:

North America is projected to remain a crucial market for 1-4 Butanediol, with market size estimates of USD 0.77 billion in 2023 and USD 1.36 billion by 2033. Rising demand from automotive and electronics sectors serves as key growth drivers.South America 1-4 Butanediol Market Report:

In South America, the market for 1-4 Butanediol has seen steady growth, predicted to increase from USD 0.19 billion in 2023 to USD 0.34 billion by 2033. The chemical industry is growing in Brazil and Argentina, supporting broader usage across sectors.Middle East & Africa 1-4 Butanediol Market Report:

The Middle East and Africa region currently represents a smaller segment of the market with a value of USD 0.17 billion in 2023 and an estimate of USD 0.30 billion by 2033. Opportunities exist for growth as industrial capabilities expand.Tell us your focus area and get a customized research report.

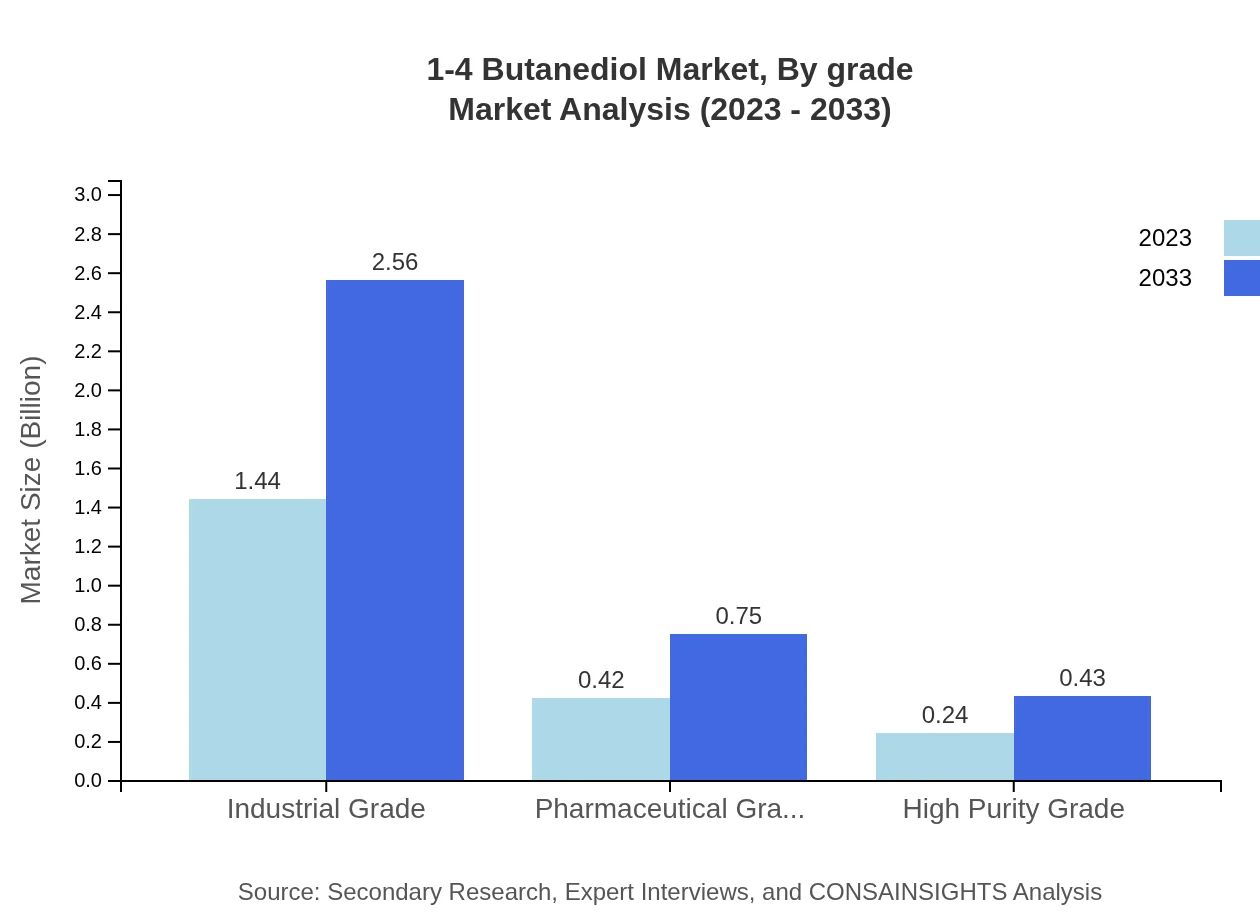

1-4 Butanediol Market Analysis By Grade

The market is primarily segmented into industrial grade, pharmaceutical grade, and high purity grade, with industrial grade accounting for the largest market share. For instance, the industrial grade market size is estimated at USD 1.44 billion in 2023, projected to reach USD 2.56 billion by 2033, reflecting a steady demand across manufacturing sectors.

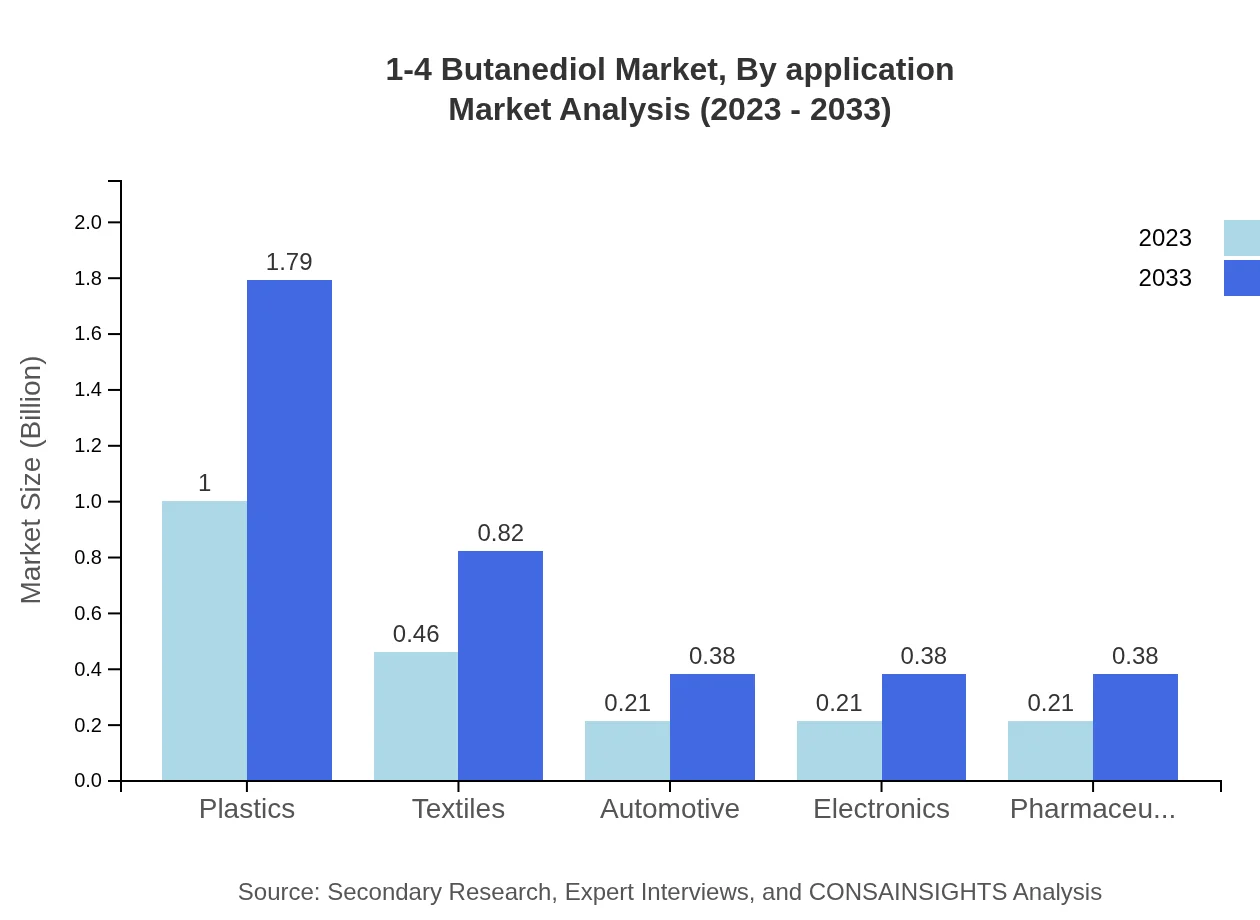

1-4 Butanediol Market Analysis By Application

The application segments include plastics, textiles, automotive, pharmaceuticals, and electronics. The plastics segment holds a significant market share of 47.74%, with a size of USD 1.00 billion in 2023, expected to grow to USD 1.79 billion by 2033, indicating the versatility of BDO in creating various polymer products.

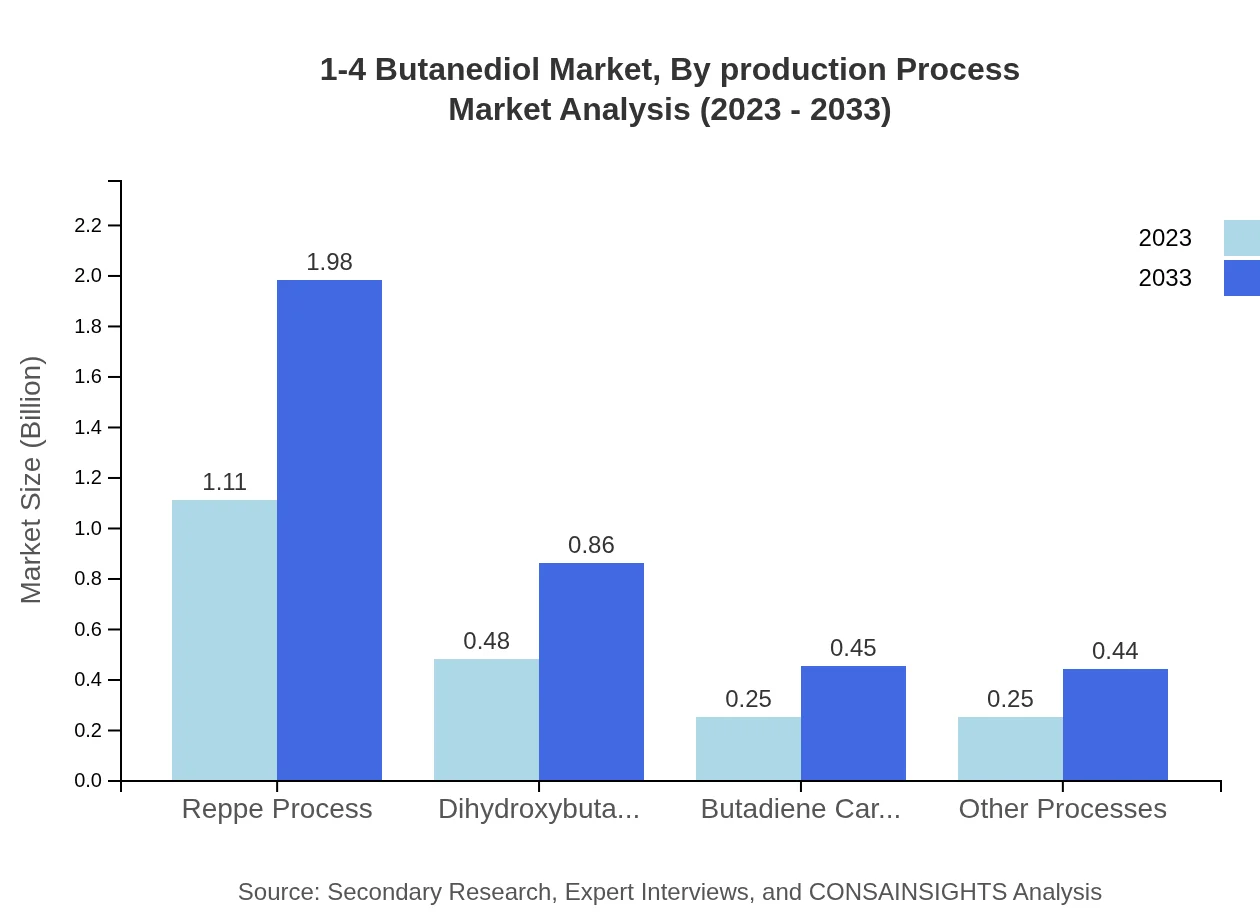

1-4 Butanediol Market Analysis By Production Process

Production methods include the Reppe process and Butadiene carbonylation. The Reppe process currently leads the market with a size of USD 1.11 billion in 2023, expected to grow to USD 1.98 billion by 2033, capturing a major share due to its efficiency and lower environmental impact.

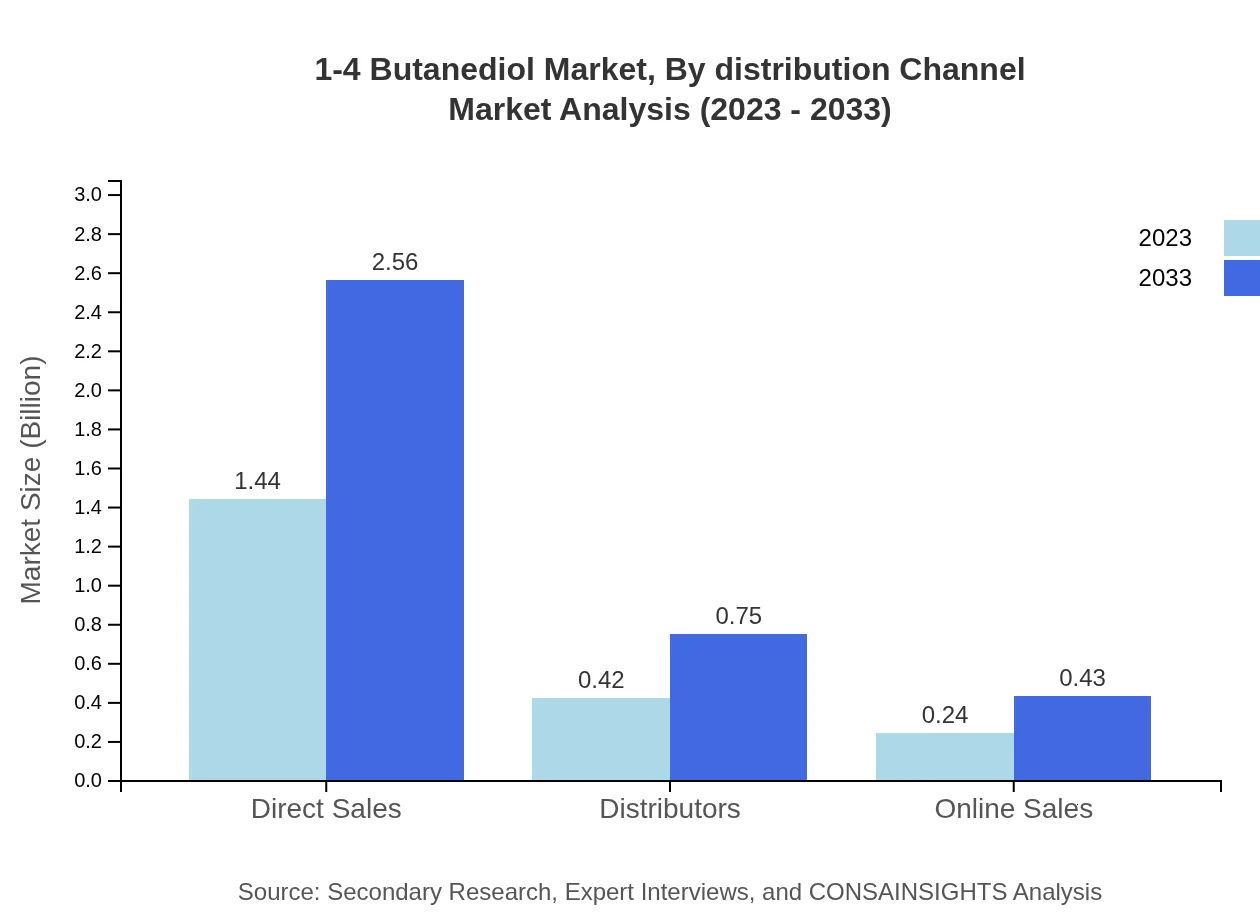

1-4 Butanediol Market Analysis By Distribution Channel

Distribution channels for 1-4 Butanediol include direct sales, distributors, and online sales. Direct sales account for 68.44% of the market with a size of USD 1.44 billion in 2023, projected to rise to USD 2.56 billion by 2033, showcasing the prevalent sales method in the industry.

1-4 Butanediol Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 1-4 Butanediol Industry

BASF SE:

A global chemical company headquartered in Germany, BASF is a leading producer of 1-4 Butanediol and offers various grades and formulations to meet market demands.Invista:

Invista, a subsidiary of Koch Industries, is a prominent player in the 1-4 Butanediol market, specializing in developing advanced materials and manufacturing technologies.Dairen Chemical Corporation:

Based in Taiwan, Dairen Chemical is known for its significant contributions to the production of chemicals including BDO, serving global markets.Asahi Kasei Corporation:

A Japanese multinational company involved in various sectors, Asahi Kasei produces high-purity BDO used in high-end applications, emphasizing sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of 1-4 Butanediol?

The global market size for 1-4-butanediol (BDO) is projected at $2.1 billion in 2023, with a compound annual growth rate (CAGR) of 5.8% expected through 2033, showcasing significant growth potential in the coming years.

What are the key market players or companies in the 1-4 Butanediol industry?

Key players in the 1-4-butanediol market include companies like BASF SE, Eastman Chemical Company, and Indorama Ventures Public Company Limited, who dominate through innovations and advancements in production techniques.

What are the primary factors driving the growth in the 1-4 Butanediol industry?

The growth in the 1-4-butanediol industry is driven by increased demand from end-user industries such as textiles, plastics, and automotive, along with a growing shift towards eco-friendly manufacturing processes and applications in pharmaceuticals.

Which region is the fastest Growing in the 1-4 Butanediol market?

The Asia Pacific region is the fastest-growing market for 1-4-butanediol, estimated to reach $0.80 billion by 2033, driven by rapid industrialization and increasing demand from the chemical and textile sectors.

Does ConsaInsights provide customized market report data for the 1-4 Butanediol industry?

Yes, ConsaInsights offers customized market report data for the 1-4-butanediol industry, allowing clients to tailor reports according to specific needs and preferences for comprehensive insights.

What deliverables can I expect from this 1-4 Butanediol market research project?

Deliverables from the 1-4-butanediol market research project include detailed market analysis, trend identification, segment data analysis, actionable insights, and comprehensive reports to guide strategic decisions.

What are the market trends of 1-4 Butanediol?

Current market trends in 1-4-butanediol include increasing focus on sustainable production methods, a rise in demand for high-purity grades, and significant technological advancements in manufacturing processes to enhance efficiency.