2 Ethyl Hexanol Market Report

Published Date: 02 February 2026 | Report Code: 2-ethyl-hexanol

2 Ethyl Hexanol Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the 2 Ethyl Hexanol market highlights the current market trends, size, and projections from 2023 to 2033, providing insights into industry dynamics, competitive landscape, and growth opportunities.

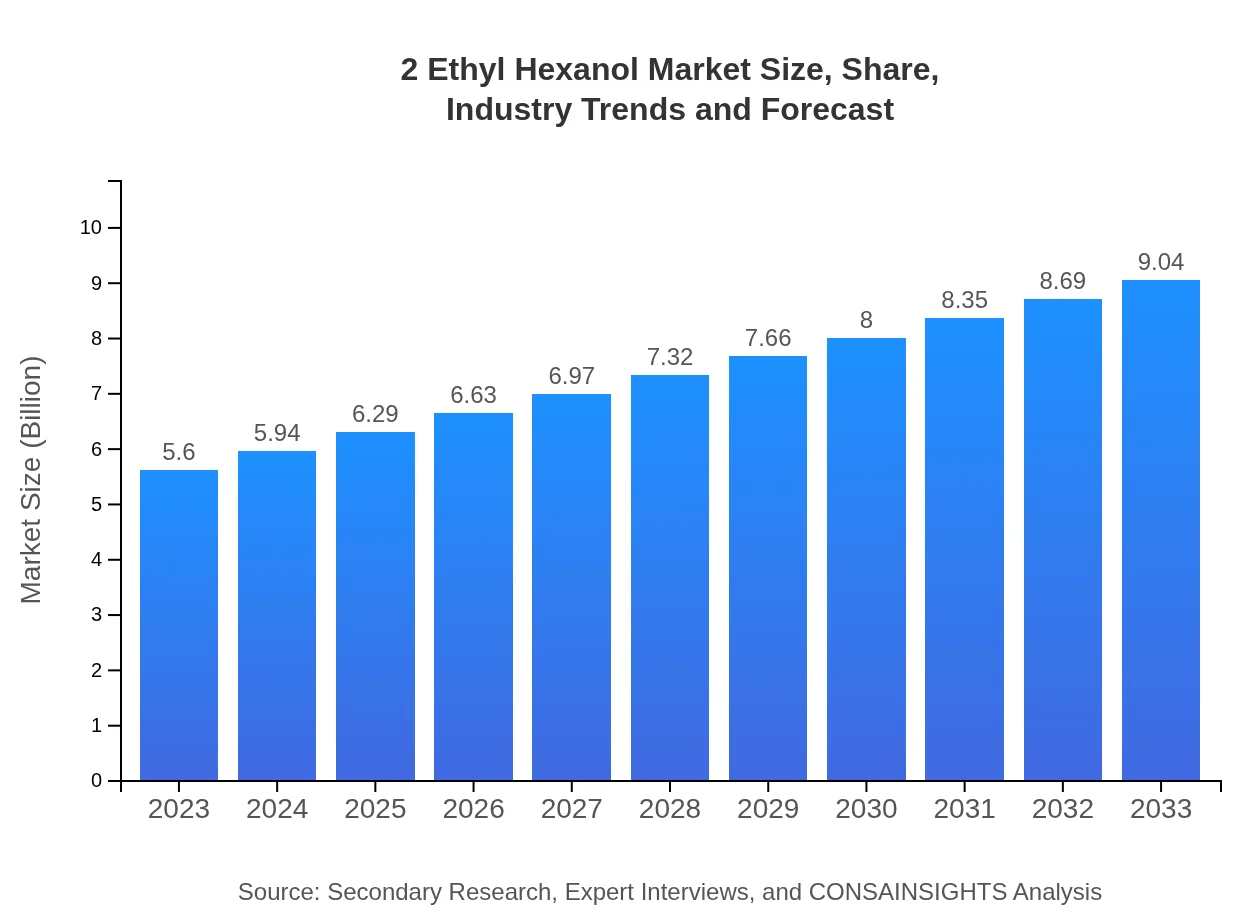

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.04 Billion |

| Top Companies | BASF SE, Eastman Chemical Company, Chevron Phillips Chemical Company, SABIC, LG Chem |

| Last Modified Date | 02 February 2026 |

2 Ethyl Hexanol Market Overview

Customize 2 Ethyl Hexanol Market Report market research report

- ✔ Get in-depth analysis of 2 Ethyl Hexanol market size, growth, and forecasts.

- ✔ Understand 2 Ethyl Hexanol's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 2 Ethyl Hexanol

What is the Market Size & CAGR of 2 Ethyl Hexanol market in 2023?

2 Ethyl Hexanol Industry Analysis

2 Ethyl Hexanol Market Segmentation and Scope

Tell us your focus area and get a customized research report.

2 Ethyl Hexanol Market Analysis Report by Region

Europe 2 Ethyl Hexanol Market Report:

The European 2 Ethyl Hexanol market is expected to witness growth from $1.59 billion in 2023 to $2.57 billion by 2033. The region's stringent environmental regulations and a shift towards sustainable manufacturing processes drive demand. Key industries contributing to this growth include automotive, coatings, and construction sectors, with a notable shift towards bio-based chemical solutions.Asia Pacific 2 Ethyl Hexanol Market Report:

The Asia Pacific region, projected to grow from $1.07 billion in 2023 to $1.72 billion by 2033, is the largest market for 2 Ethyl Hexanol. This growth is fueled by rapid industrialization, especially in countries like China and India, combined with significant investments in the automotive and construction sectors. Moreover, the increasing demand for plasticizers in PVC applications further supports expansion in this region.North America 2 Ethyl Hexanol Market Report:

The North American market is anticipated to grow from $2.04 billion in 2023 to $3.30 billion by 2033. The region's robust automotive sector and increasing investments in infrastructure projects significantly contribute to this growth. Additionally, the rising trend towards eco-friendly products accelerates the demand for 2 Ethyl Hexanol, especially in Canada and the United States.South America 2 Ethyl Hexanol Market Report:

In South America, the market for 2 Ethyl Hexanol is expected to rise from $0.22 billion in 2023 to $0.36 billion by 2033. The growth is primarily driven by the expanding automotive industry and increased construction activities. The region’s focus on sustainable practices also fosters demand for bio-based 2 Ethyl Hexanol, which is gradually improving market conditions.Middle East & Africa 2 Ethyl Hexanol Market Report:

The Middle East and Africa market for 2 Ethyl Hexanol is projected to rise from $0.67 billion in 2023 to $1.08 billion by 2033. This growth stems from rising infrastructural investments and the burgeoning petrochemical industry. Furthermore, increased demand for plasticizers in construction applications is expected to fuel market expansion in the region.Tell us your focus area and get a customized research report.

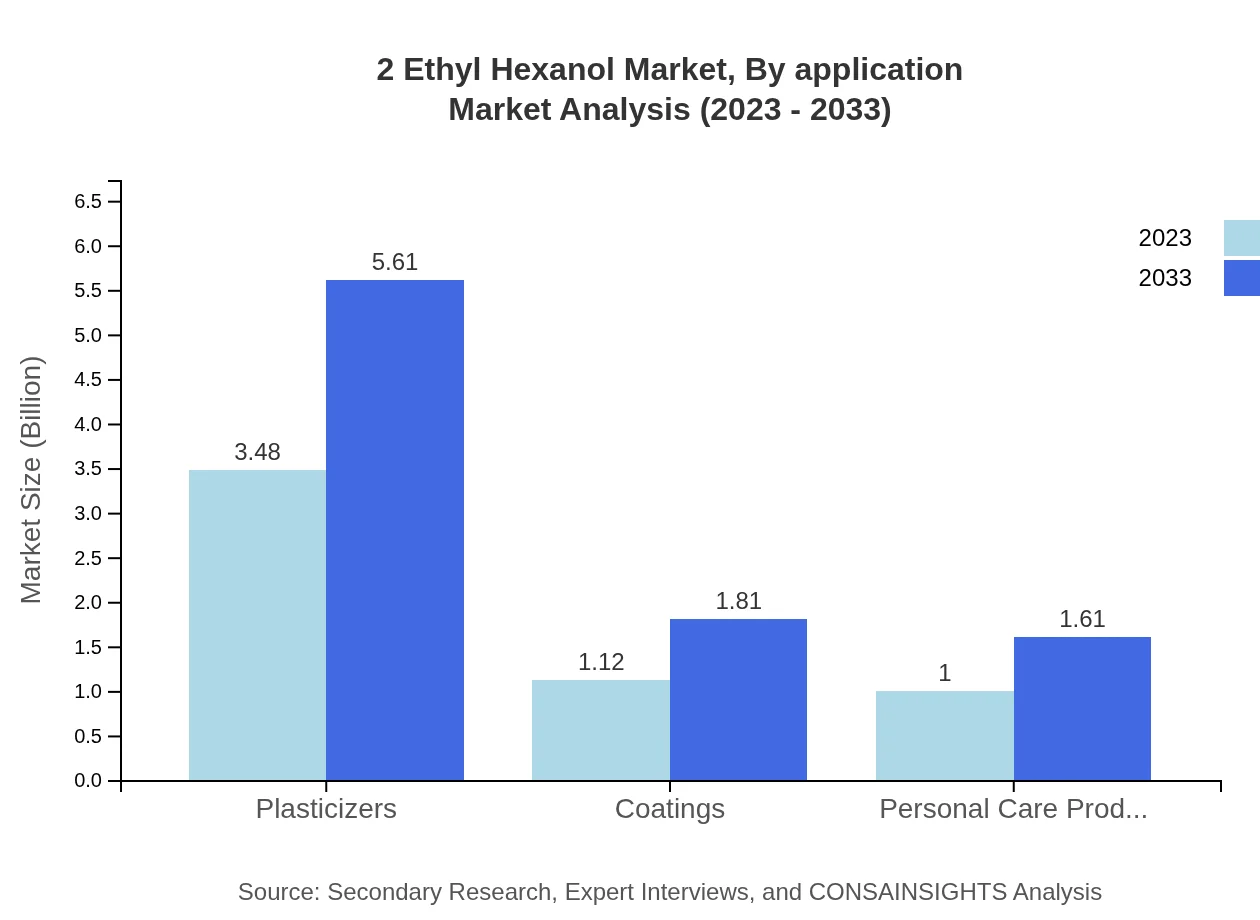

2 Ethyl Hexanol Market Analysis By Application

The 2-Ethylhexanol market's application segment showcases significant contributions from plasticizers, which dominate the market with a size of $3.48 billion in 2023 and expected to rise to $5.61 billion by 2033. Coatings closely follow with a market size of $1.12 billion in 2023, anticipated to reach $1.81 billion by 2033. Personal care products also represent a significant segment, growing from $1.00 billion in 2023 to $1.61 billion by 2033, reflecting increasing consumer demand for specialty chemicals.

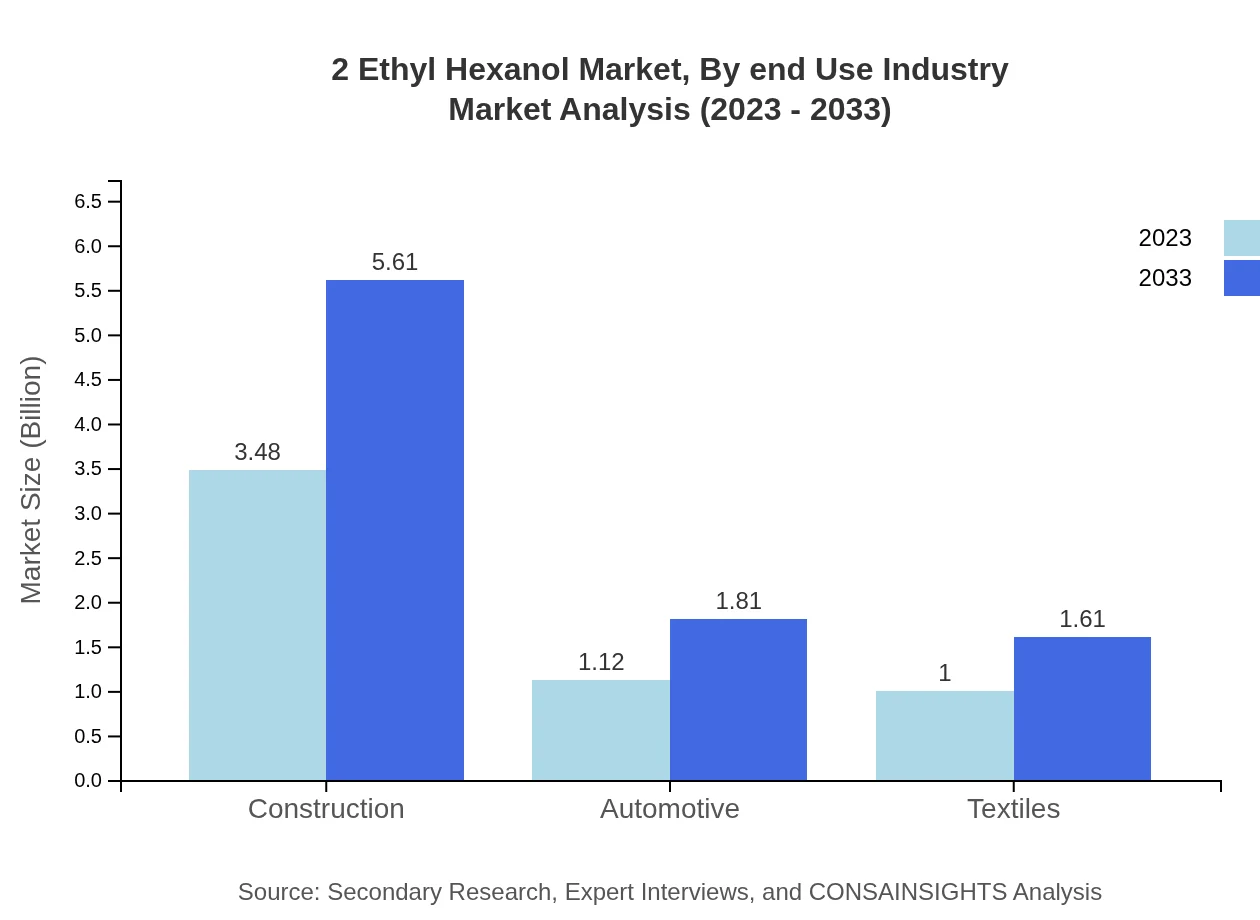

2 Ethyl Hexanol Market Analysis By End Use Industry

Key end-use industries for 2-Ethylhexanol include construction, automotive, and textiles. In construction, the market is expected to expand significantly, with a size of $3.48 billion in 2023, growing to $5.61 billion by 2033. The automotive industry also demonstrates robust growth, projected to rise from $1.12 billion to $1.81 billion during the same period, highlighting the compound's crucial role as a solvent and additive.

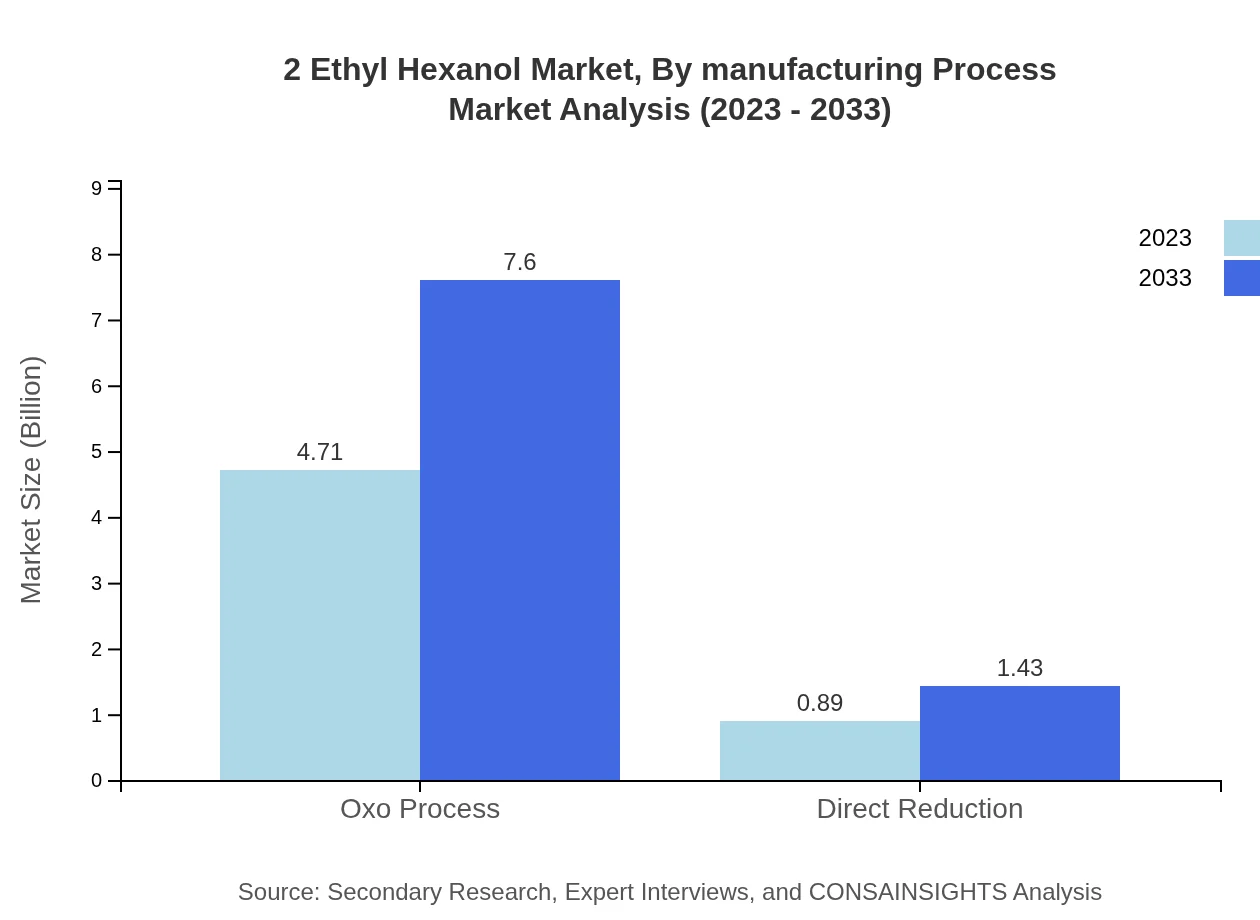

2 Ethyl Hexanol Market Analysis By Manufacturing Process

The primary manufacturing process for 2-Ethylhexanol is the Oxo process, which accounts for the majority market share. This method not only supports high efficiency but also aligns with global trends towards reduced emissions and waste. The integration of more sustainable practices within this production method enhances the compound’s appeal in eco-conscious markets.

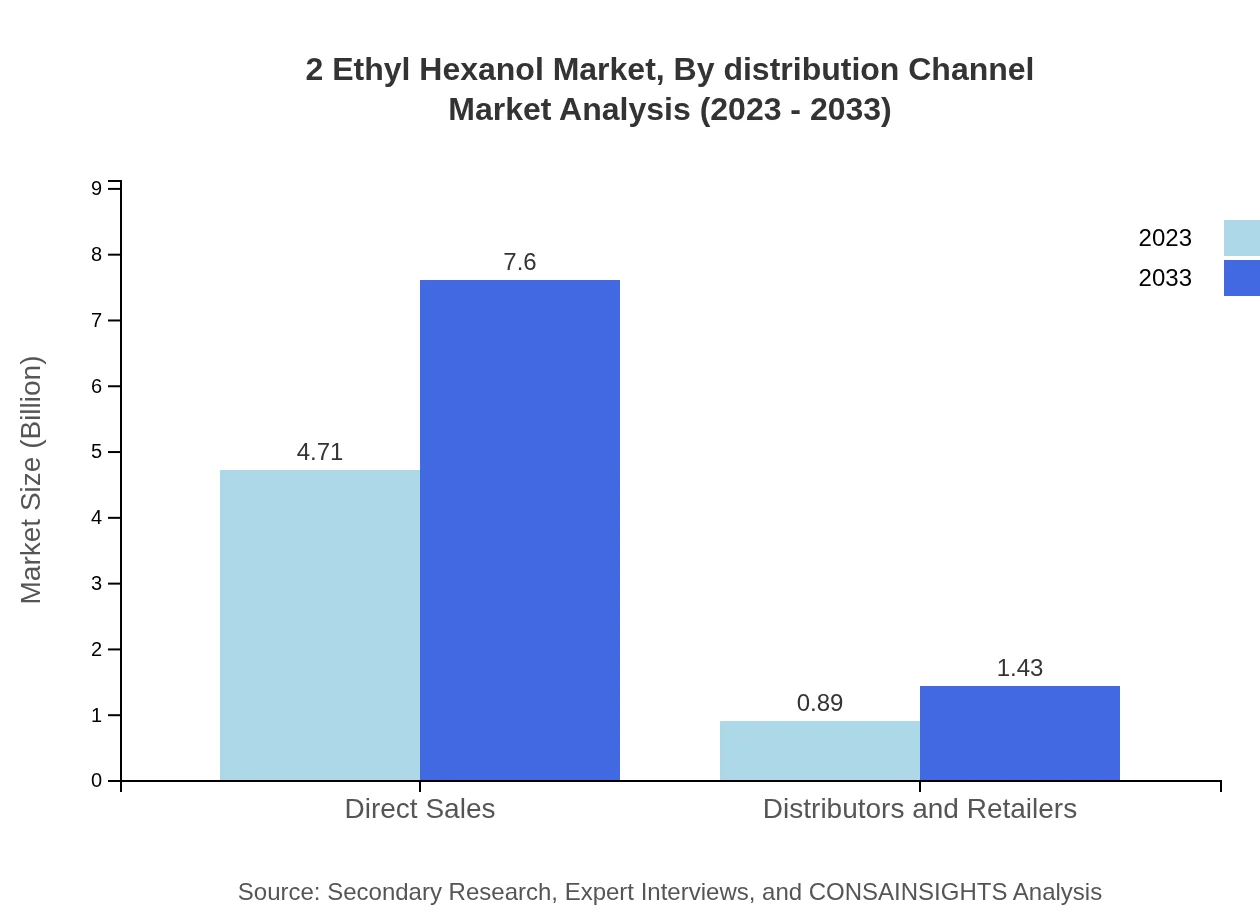

2 Ethyl Hexanol Market Analysis By Distribution Channel

Direct sales dominate the distribution of 2-Ethylhexanol with a share of 84.12% in 2023, expected to remain steady through 2033. This channel benefits from direct engagement with manufacturers, ensuring a steady supply chain, while distributors and retailers contribute to the remaining market share, facilitating access to broader customer bases.

2 Ethyl Hexanol Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 2 Ethyl Hexanol Industry

BASF SE:

One of the world's leading chemical companies, BASF SE plays a pivotal role in the production and distribution of 2 Ethyl Hexanol, driving innovations and sustainable practices within the industry.Eastman Chemical Company:

A prominent global manufacturer, Eastman Chemical Company significantly contributes to the 2 Ethyl Hexanol market through its diverse product portfolio and commitment to sustainability.Chevron Phillips Chemical Company:

Chevron Phillips is a major player in the petrochemical sector, producing high-quality 2 Ethyl Hexanol utilized in various applications, including plasticizers and solvents.SABIC:

SABIC is a leader in the effective and innovative production of 2 Ethyl Hexanol, focusing on sustainability and eco-friendly manufacturing processes.LG Chem:

A key chemical company in Asia, LG Chem actively participates in the global 2 Ethyl Hexanol market, promoting advancements in production technology and opening paths for sustainable chemical solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of 2 Ethyl Hexanol?

The global 2-ethyl-hexanol market is projected to reach a size of approximately $5.6 billion by the year 2033, exhibiting a compound annual growth rate (CAGR) of 4.8% from 2023 to 2033.

What are the key market players or companies in this 2 Ethyl Hexanol industry?

The 2-ethyl-hexanol market comprises several prominent players, including BASF SE, Eastman Chemical Company, and Oxea GmbH. These companies significantly drive innovations and market growth.

What are the primary factors driving the growth in the 2 Ethyl Hexanol industry?

Key growth factors for the 2-ethyl-hexanol industry include increasing demand for plasticizers in construction and automotive applications, as well as growth in personal care sectors which utilize 2-ethyl-hexanol.

Which region is the fastest Growing in the 2 Ethyl Hexanol?

The fastest-growing region for 2-ethyl-hexanol is Asia Pacific, expected to grow from $1.07 billion in 2023 to $1.72 billion by 2033. This growth is driven by rapidly expanding manufacturing sectors.

Does ConsaInsights provide customized market report data for the 2 Ethyl Hexanol industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the 2-ethyl-hexanol industry, including deep dives into market segments and regional analyses.

What deliverables can I expect from this 2 Ethyl Hexanol market research project?

Expect comprehensive deliverables including detailed market size forecasts, competitive landscape analysis, growth trend assessment, and insights into consumer behavior patterns and segment performance.

What are the market trends of 2 Ethyl Hexanol?

Market trends for 2-ethyl-hexanol include a shift towards sustainable plasticizers and increased investment in R&D. The growth in the automotive sector also drives significant advancements in its applications.