2k Protective Coatings Market Report

Published Date: 02 February 2026 | Report Code: 2k-protective-coatings

2k Protective Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 2k Protective Coatings market, highlighting key insights, industry trends, and future forecasts from 2023 to 2033, including market size, segmentation, regional analysis, and competitive landscape.

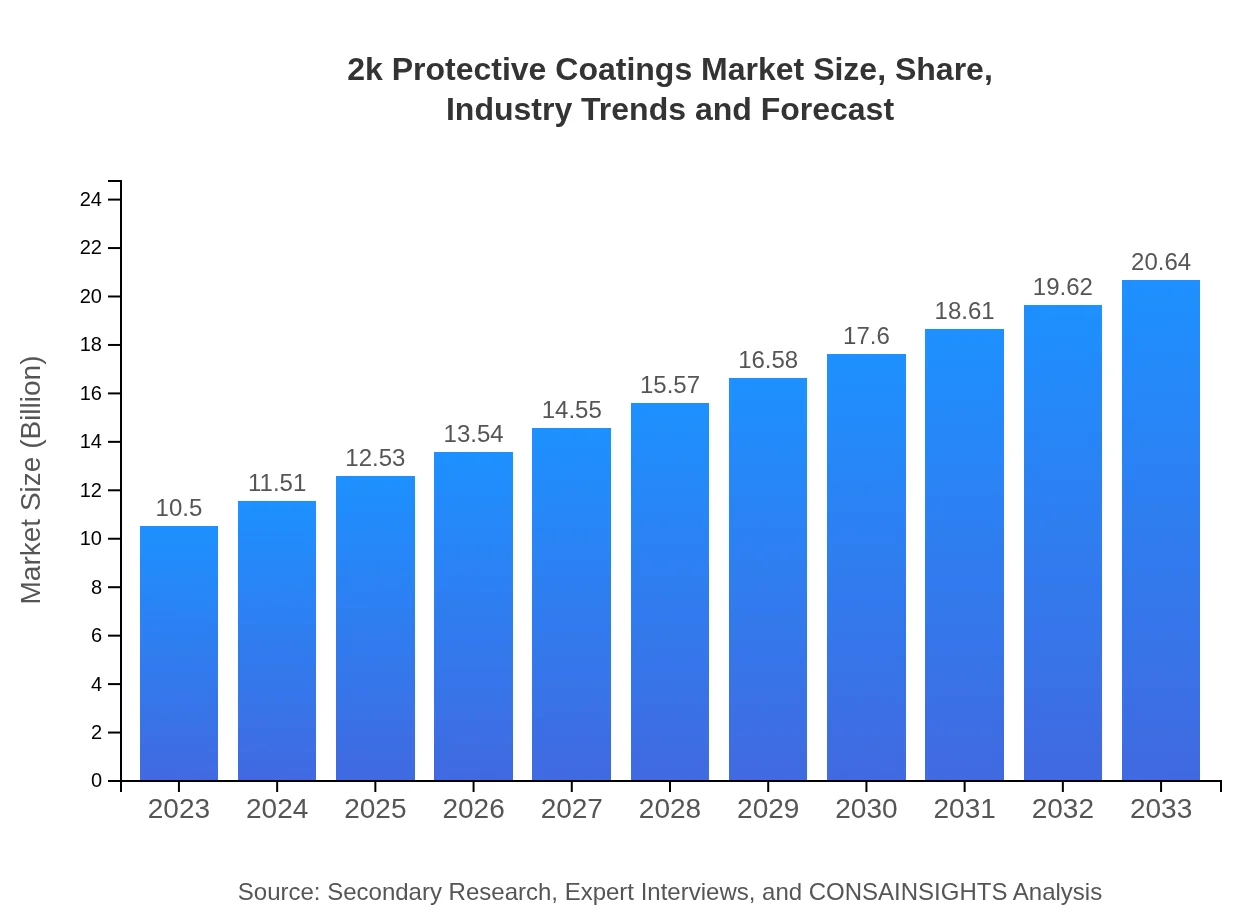

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | BASF, The Sherwin-Williams Company, PPG Industries, AkzoNobel |

| Last Modified Date | 02 February 2026 |

2k Protective Coatings Market Overview

Customize 2k Protective Coatings Market Report market research report

- ✔ Get in-depth analysis of 2k Protective Coatings market size, growth, and forecasts.

- ✔ Understand 2k Protective Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 2k Protective Coatings

What is the Market Size & CAGR of 2k Protective Coatings market in 2023?

2k Protective Coatings Industry Analysis

2k Protective Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

2k Protective Coatings Market Analysis Report by Region

Europe 2k Protective Coatings Market Report:

With a starting market size of $3.11 billion in 2023, the European market for 2K Protective Coatings is projected to grow to $6.11 billion by 2033. The region's growth is driven by increasing emphasis on sustainable practices and advancements in coating technology, making it a crucial market for compliance-oriented industries.Asia Pacific 2k Protective Coatings Market Report:

In 2023, the Asia Pacific region holds a market size of $2.01 billion and is projected to reach $3.95 billion by 2033, primarily driven by rapid industrialization, urbanization, and increased investments in infrastructure projects. The region is witnessing a surge in demand across industries such as construction and automotive, which are crucial end-users of 2K Protective Coatings.North America 2k Protective Coatings Market Report:

The North American market is projected to expand from $3.73 billion in 2023 to $7.33 billion by 2033. The growth in this region is largely fueled by stringent regulations that promote the use of eco-friendly coatings and a resurgence in manufacturing and construction sectors, particularly in the U.S.South America 2k Protective Coatings Market Report:

South America is expected to see steady growth, with a market size of $0.51 billion in 2023, growing to $1.00 billion by 2033. The growth is supported by increasing construction activities and awareness of high-performance protective solutions in various applications across countries like Brazil and Argentina.Middle East & Africa 2k Protective Coatings Market Report:

The Middle East and Africa market is expected to grow from $1.14 billion in 2023 to $2.25 billion by 2033, spurred by rising investments in infrastructure projects and a growing focus on oil and gas exploration activities that utilize protective coatings to combat harsh environmental conditions.Tell us your focus area and get a customized research report.

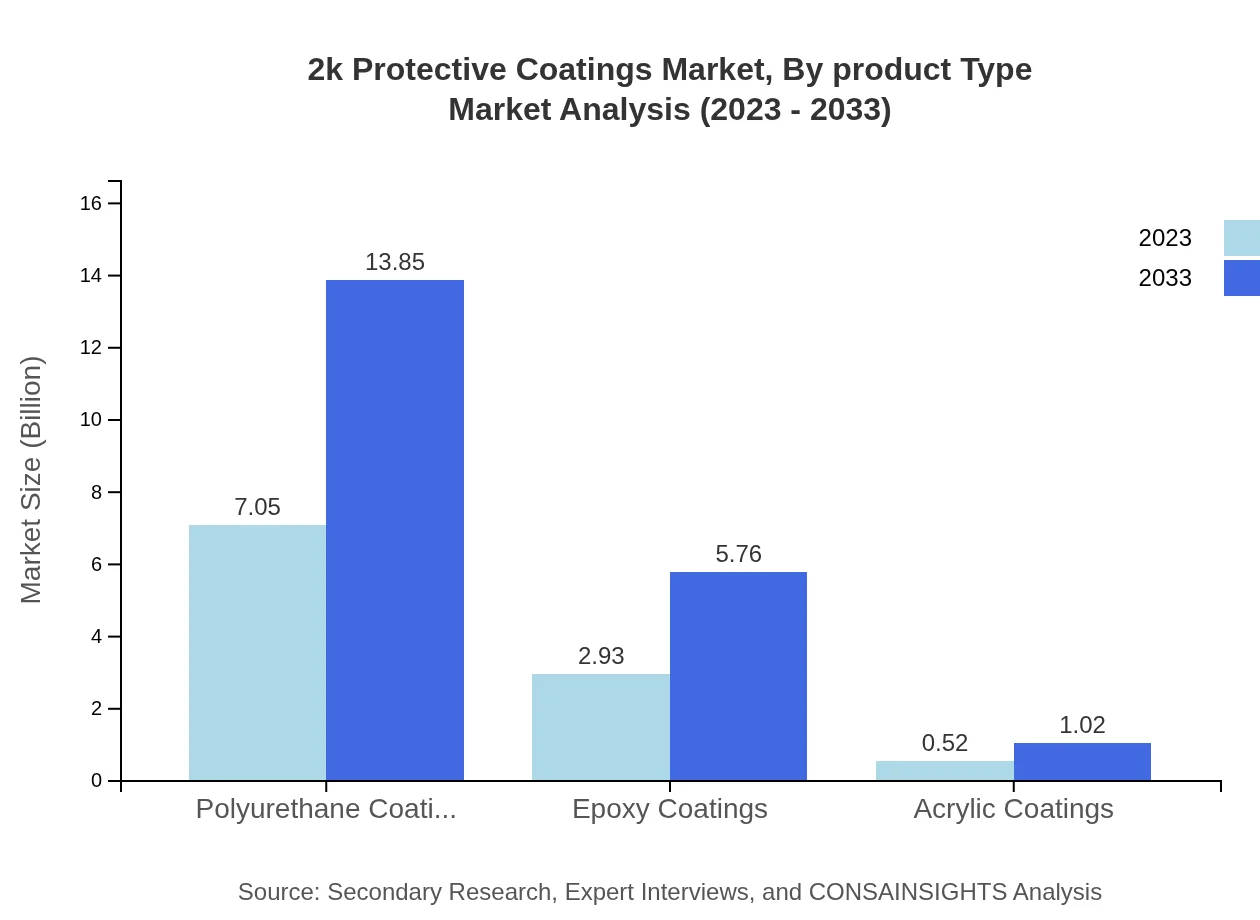

2k Protective Coatings Market Analysis By Product Type

In the 2K Protective Coatings market, solvent-borne coatings account for a significant market share at 67.13% in 2023, with a size of $7.05 billion, growing to $13.85 billion by 2033. Water-borne coatings follow with a share of 27.92%, emphasizing a trend towards environmentally friendly solutions. The market for powder coatings is also growing steadily, indicative of the diverse needs in various industries.

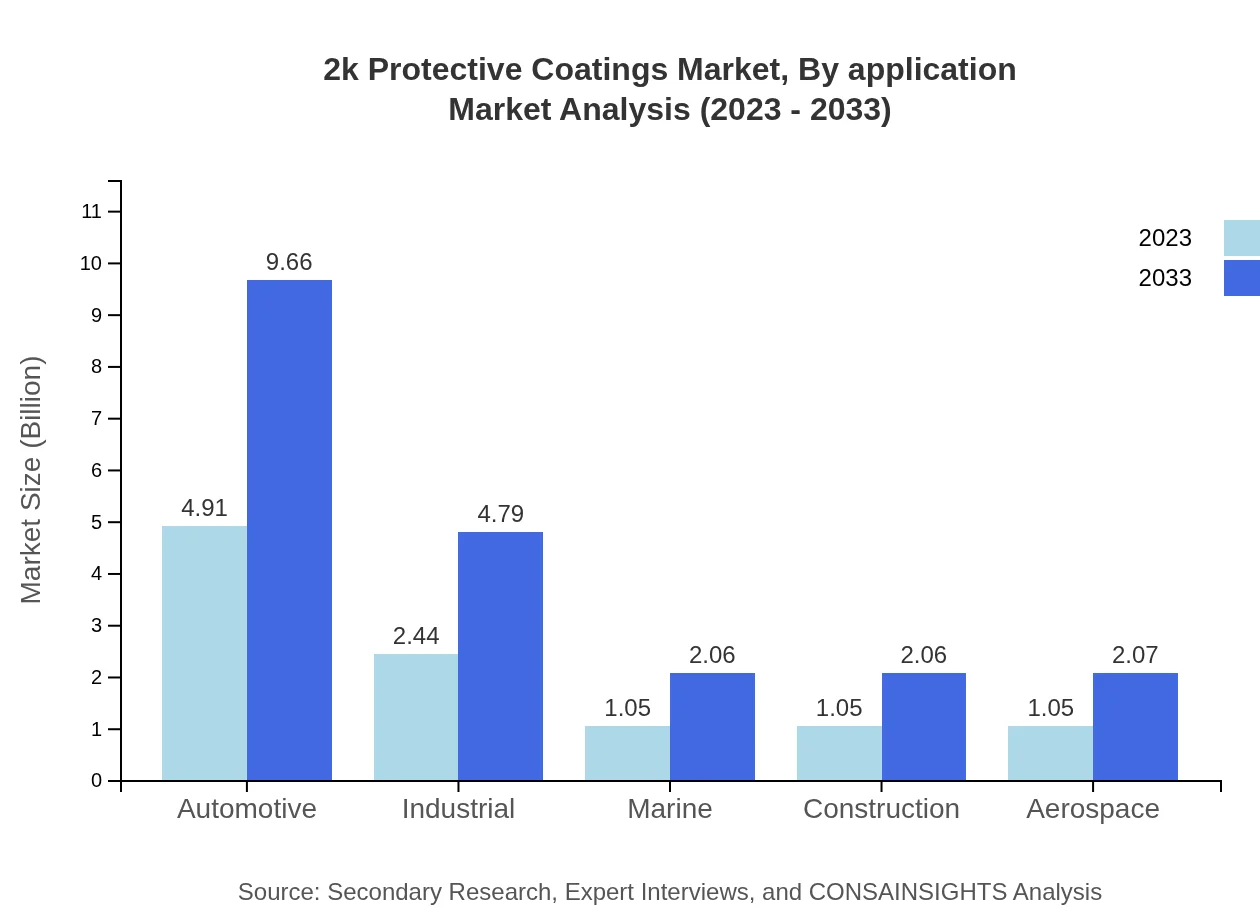

2k Protective Coatings Market Analysis By Application

The construction industry dominates the 2K Protective Coatings market with a size of $6.08 billion in 2023 and is expected to reach $11.94 billion by 2033, maintaining a significant share of 57.86%. The automotive sector is another major segment, valued at $4.91 billion in 2023, underlining the essential role of coatings in enhancing vehicle longevity and aesthetics.

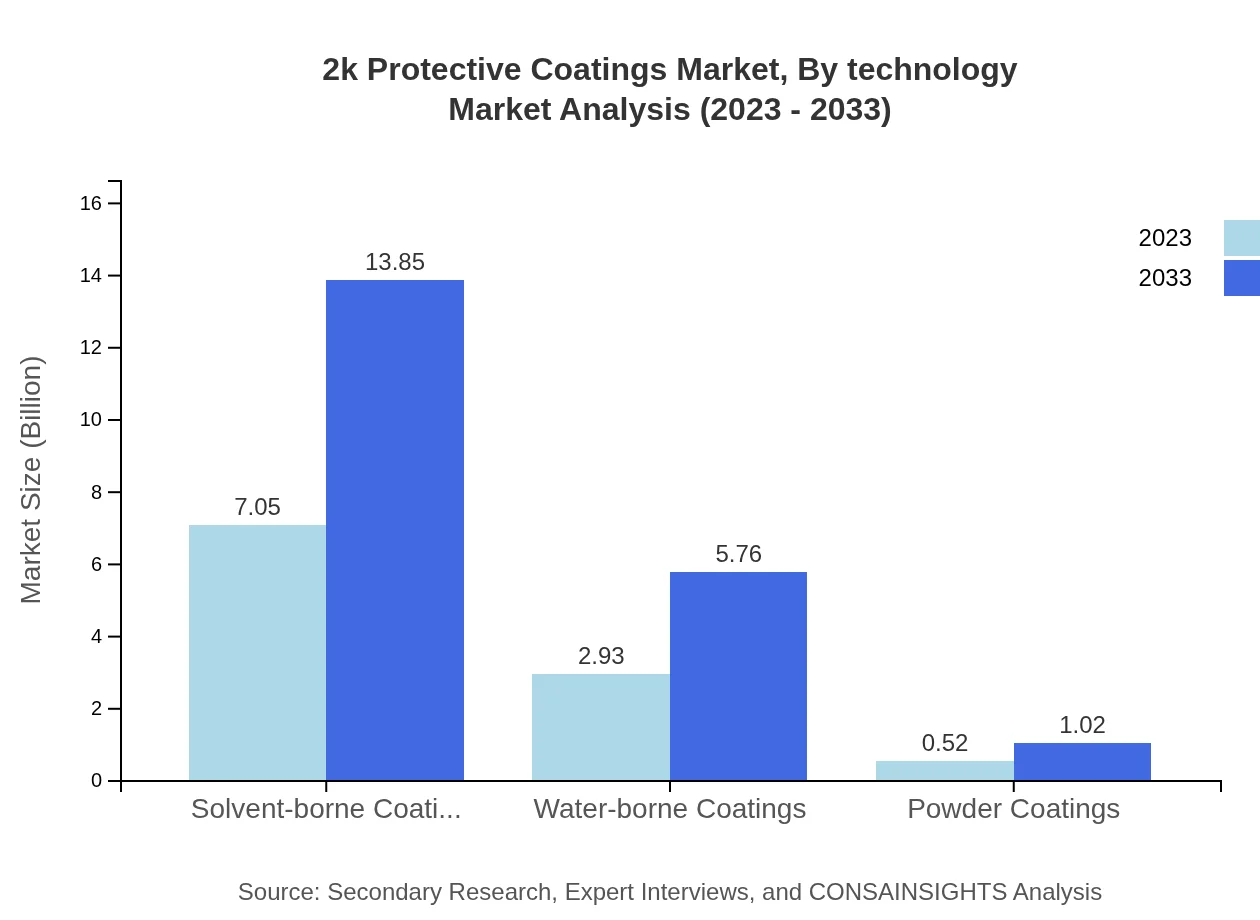

2k Protective Coatings Market Analysis By Technology

The adoption of advanced technologies such as nanotechnology and smart coatings is gaining traction in the 2K Protective Coatings market. This segment is witnessing innovative developments that enhance corrosion resistance and improve the physical properties of coatings, which are crucial in high-performance applications.

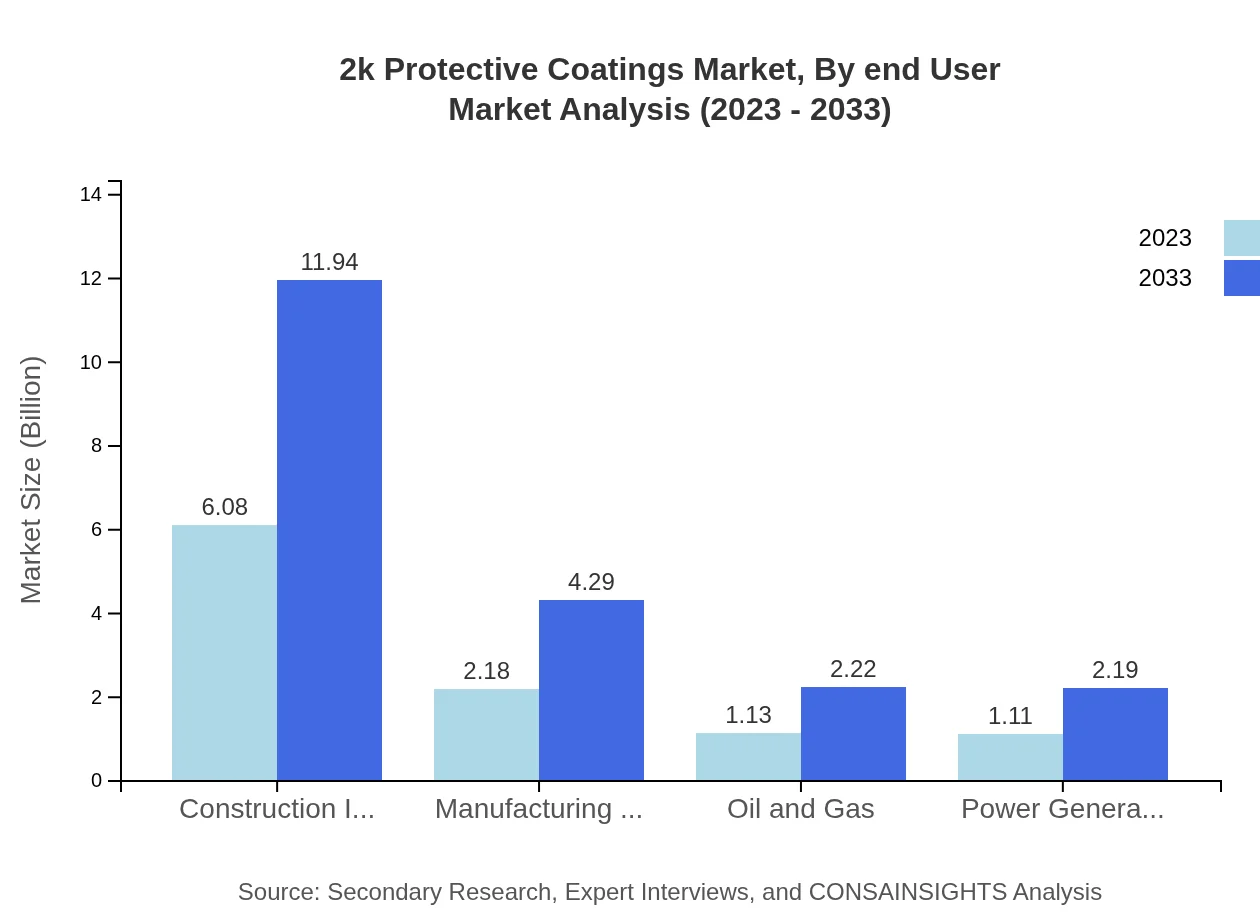

2k Protective Coatings Market Analysis By End User

End-user applications for 2K Protective Coatings span various industries, with construction and manufacturing leading the demand. The oil and gas sector and power generation follow, attributing increasing needs for protective coatings capable of withstanding harsh environments and operational demands.

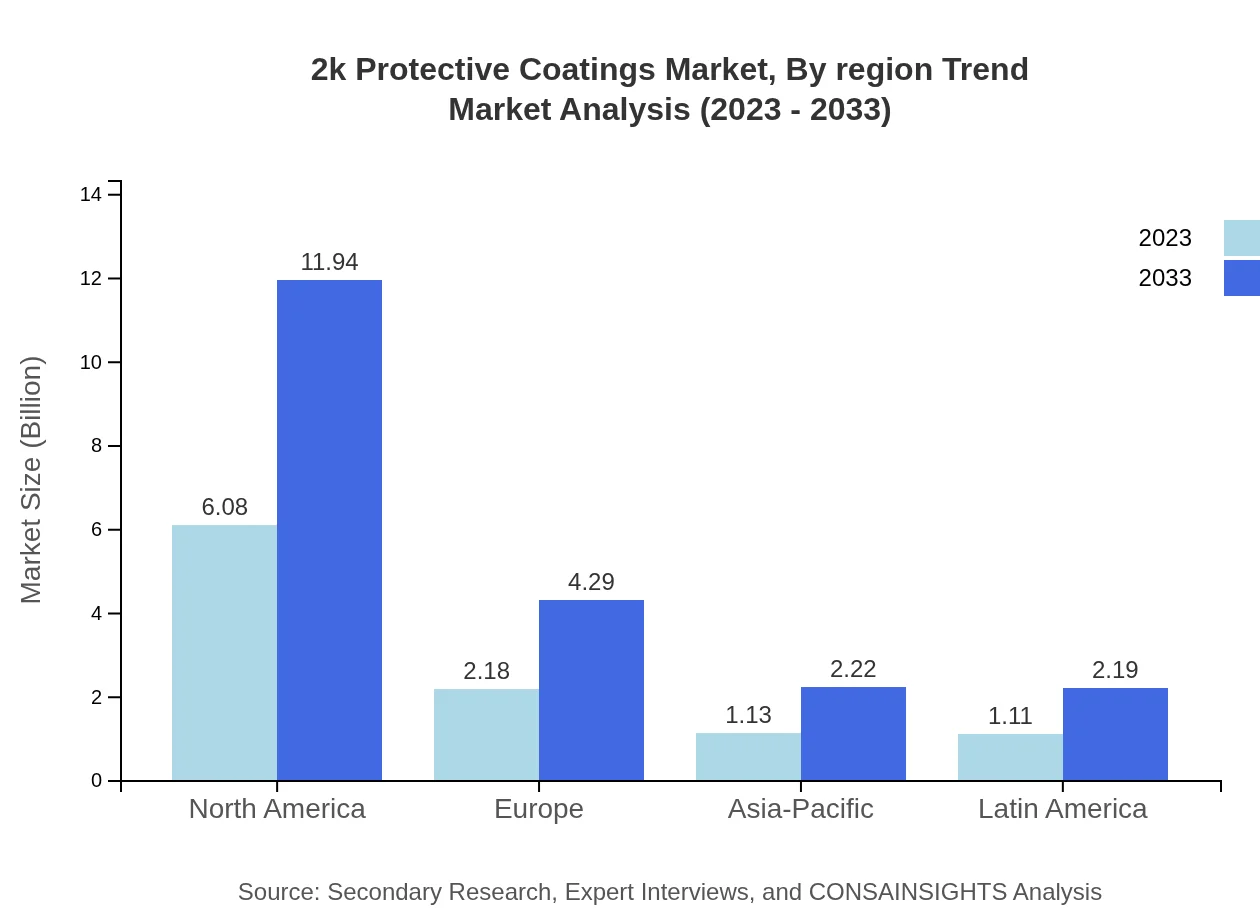

2k Protective Coatings Market Analysis By Region Trend

Regional trends indicate a favorable market outlook in emerging economies, particularly in Asia Pacific and Latin America, where rapid industrial expansion is expected to boost demand. Conversely, established markets in North America and Europe may focus more on sustainability and innovation in coatings technology to maintain growth amidst regulatory pressures.

2K Protective Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 2K Protective Coatings Industry

BASF:

BASF is a leading global chemical company with a strong portfolio in coating solutions. Their 2K Protective Coatings are known for their innovation and sustainability, addressing the diverse needs of various end-users.The Sherwin-Williams Company:

Sherwin-Williams is renowned for its high-performance coatings, including a comprehensive range of 2K Protective Coatings that cater to industrial and commercial applications, emphasizing product quality and customer satisfaction.PPG Industries:

PPG Industries is a major player in the coatings sector, offering a wide variety of 2K Protective Coatings designed for critical applications in automotive, aerospace, and industrial markets, supported by advanced technologies.AkzoNobel:

AkzoNobel specializes in decorative paints and coatings, with a robust line of 2K Protective Coatings recognized for their durability and environmental sustainability, making them a preferred choice for multiple industries.We're grateful to work with incredible clients.

FAQs

What is the market size of 2k Protective Coatings?

The global 2K protective coatings market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant heights as industries increasingly demand advanced protective solutions.

What are the key market players or companies in this 2K protective coatings industry?

Key players in the 2K protective coatings market include companies such as PPG Industries, Sherwin-Williams, AkzoNobel, RPM International, and BASF, all of which contribute significantly to innovation and market growth.

What are the primary factors driving the growth in the 2K protective coatings industry?

Driving factors for the 2K protective coatings market include increasing demand from the construction industry, rising environmental regulations, advancements in coating technology, and the growing need for durable and high-performance coatings across various sectors.

Which region is the fastest Growing in the 2K protective coatings?

The Asia Pacific region is experiencing rapid growth in the 2K protective coatings market, with a projected increase from $2.01 billion in 2023 to approximately $3.95 billion by 2033, due to industrial expansion and rising construction activities.

Does ConsaInsights provide customized market report data for the 2K protective coatings industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs. This includes tailored analysis on market segments, trends, and forecasts in the 2K protective coatings industry.

What deliverables can I expect from this 2K protective coatings market research project?

Expect comprehensive market analysis reports, segmented data insights, growth forecasts, competitive landscape evaluations, and customized recommendations designed to inform strategic decisions in the 2K protective coatings market.

What are the market trends of 2K protective coatings?

Current trends in the 2K protective coatings market include a shift towards eco-friendly formulations, the rising use of smart coatings with enhanced functionalities, and an increasing preference for customized solutions in various industrial applications.