3d Printed Electronics Market Report

Published Date: 31 January 2026 | Report Code: 3d-printed-electronics

3d Printed Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 3D Printed Electronics market from 2023 to 2033, focusing on market dynamics, trends, regional assessments, and growth forecasts. Insights into market size, segmentation, and key players are included to guide strategic decision-making.

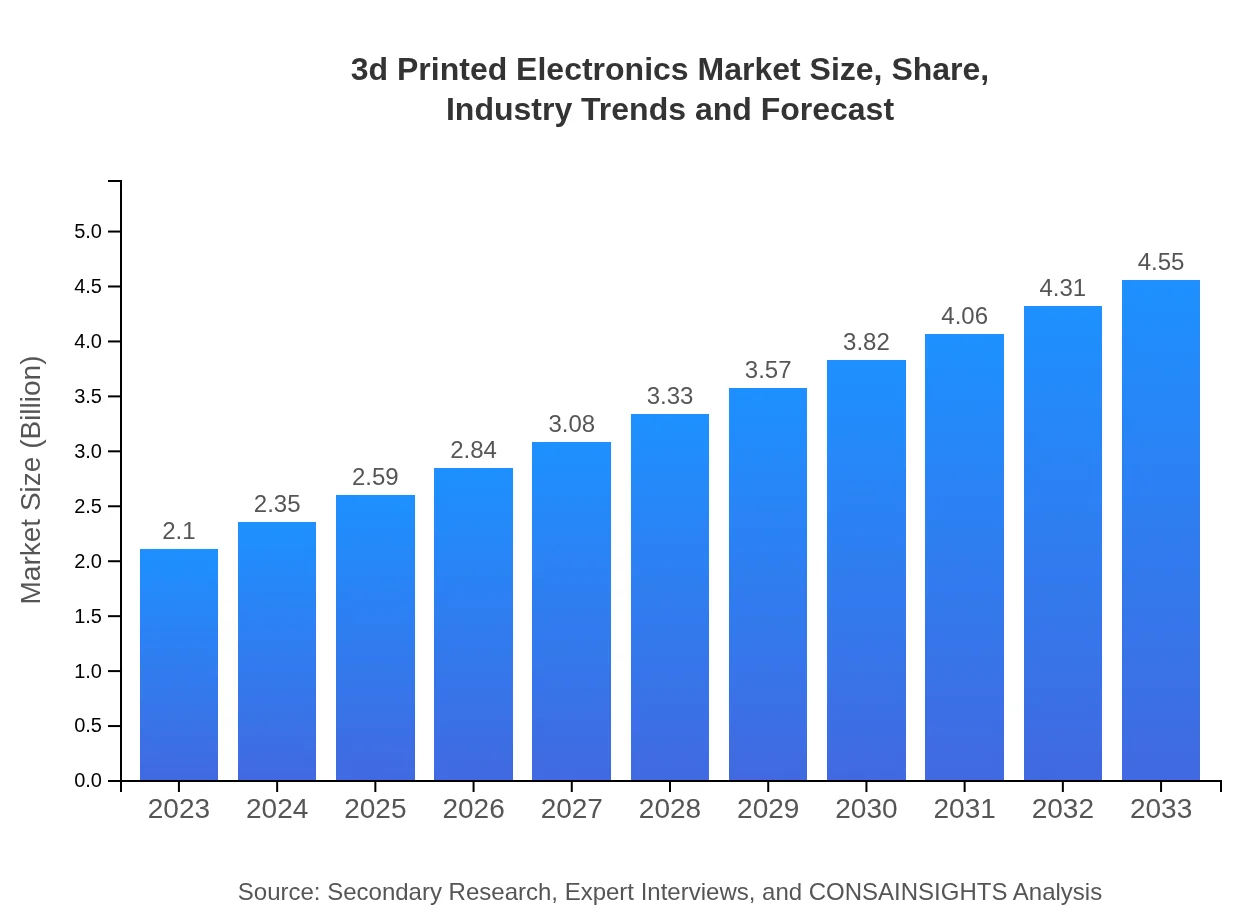

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $4.55 Billion |

| Top Companies | HP Inc., Stratasys Ltd., Nano Dimension, Desktop Metal |

| Last Modified Date | 31 January 2026 |

3d Printed Electronics Market Overview

Customize 3d Printed Electronics Market Report market research report

- ✔ Get in-depth analysis of 3d Printed Electronics market size, growth, and forecasts.

- ✔ Understand 3d Printed Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Printed Electronics

What is the Market Size & CAGR of 3d Printed Electronics market in 2023?

3d Printed Electronics Industry Analysis

3d Printed Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3d Printed Electronics Market Analysis Report by Region

Europe 3d Printed Electronics Market Report:

The European market is forecasted to grow from $0.72 billion in 2023 to $1.56 billion by 2033. Stricter regulations regarding electronic waste and a shift towards sustainable practices are expected to significantly impact market developments.Asia Pacific 3d Printed Electronics Market Report:

The Asia Pacific region is anticipated to witness significant growth in the 3D Printed Electronics market, projected to expand from $0.40 billion in 2023 to $0.86 billion by 2033. The growth is fueled by thriving electronics manufacturing industries, particularly in countries like China, Japan, and South Korea, where technological advancements and investments in R&D are prevalent.North America 3d Printed Electronics Market Report:

North America holds a prominent position in the 3D Printed Electronics market, with a projected market size of $0.67 billion in 2023, anticipating growth to $1.46 billion by 2033. The presence of leading technology companies and extensive research initiatives are key drivers of this growth.South America 3d Printed Electronics Market Report:

In South America, the market is expected to grow from $0.20 billion in 2023 to $0.42 billion by 2033. Increasing investments in technology and a rising demand for personalized electronics are expected to contribute to the market's growth in this region.Middle East & Africa 3d Printed Electronics Market Report:

The market in the Middle East and Africa is expected to experience growth, from $0.12 billion in 2023 to $0.26 billion by 2033, driven by increasing adoption of advanced manufacturing technologies and investments in technology infrastructure.Tell us your focus area and get a customized research report.

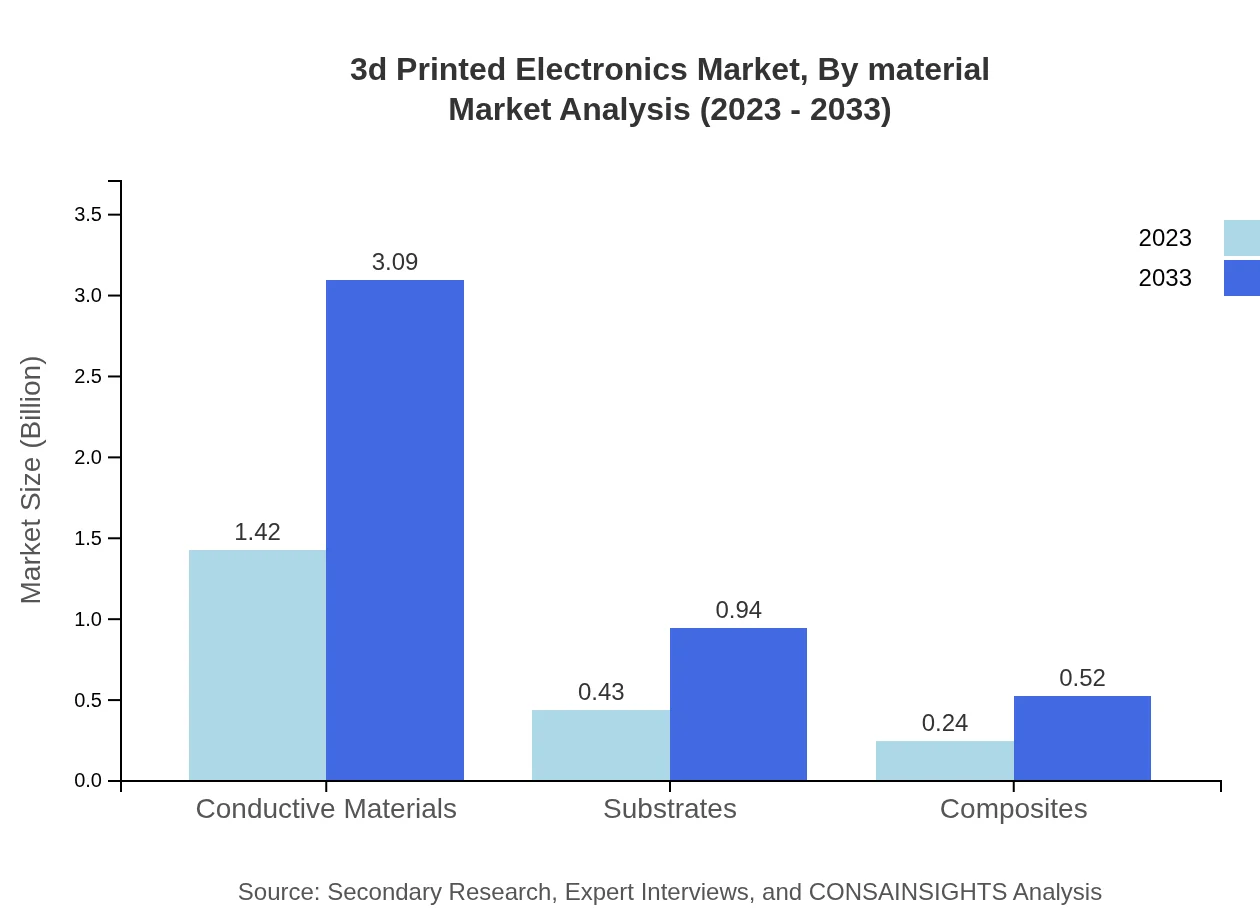

3d Printed Electronics Market Analysis By Material

The segmentation by material in the 3D Printed Electronics market includes conductive materials, substrates, and composites, which together accounted for a substantial share of the market in 2023. Conductive materials are particularly significant, expected to grow from $1.42 billion in 2023 to $3.09 billion by 2033.

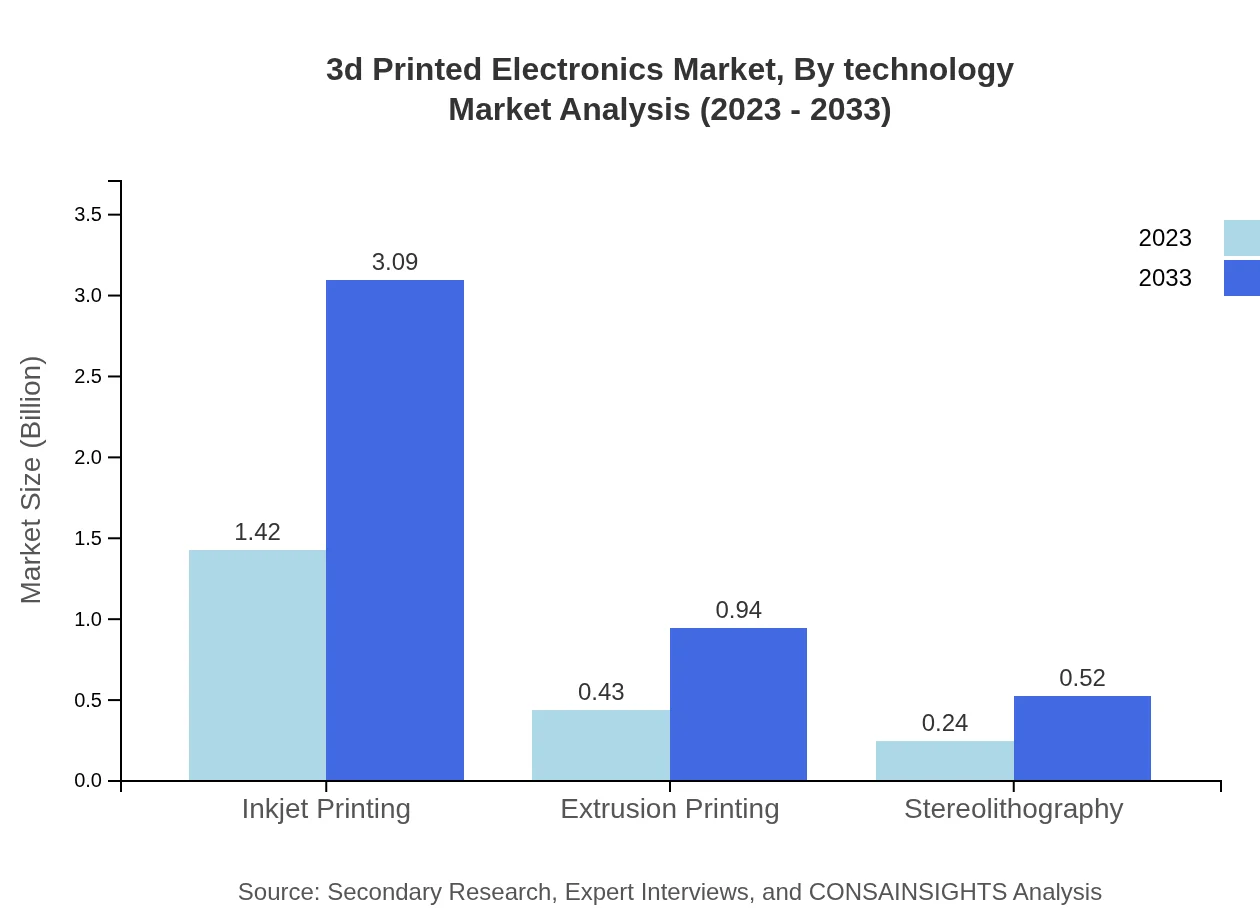

3d Printed Electronics Market Analysis By Technology

Various 3D printing technologies like inkjet printing, extrusion printing, and stereolithography play crucial roles in facilitating the advancements in the market. Inkjet printing, for instance, is expected to maintain a strong market position, projected to grow significantly from $1.42 billion in 2023 to $3.09 billion by 2033.

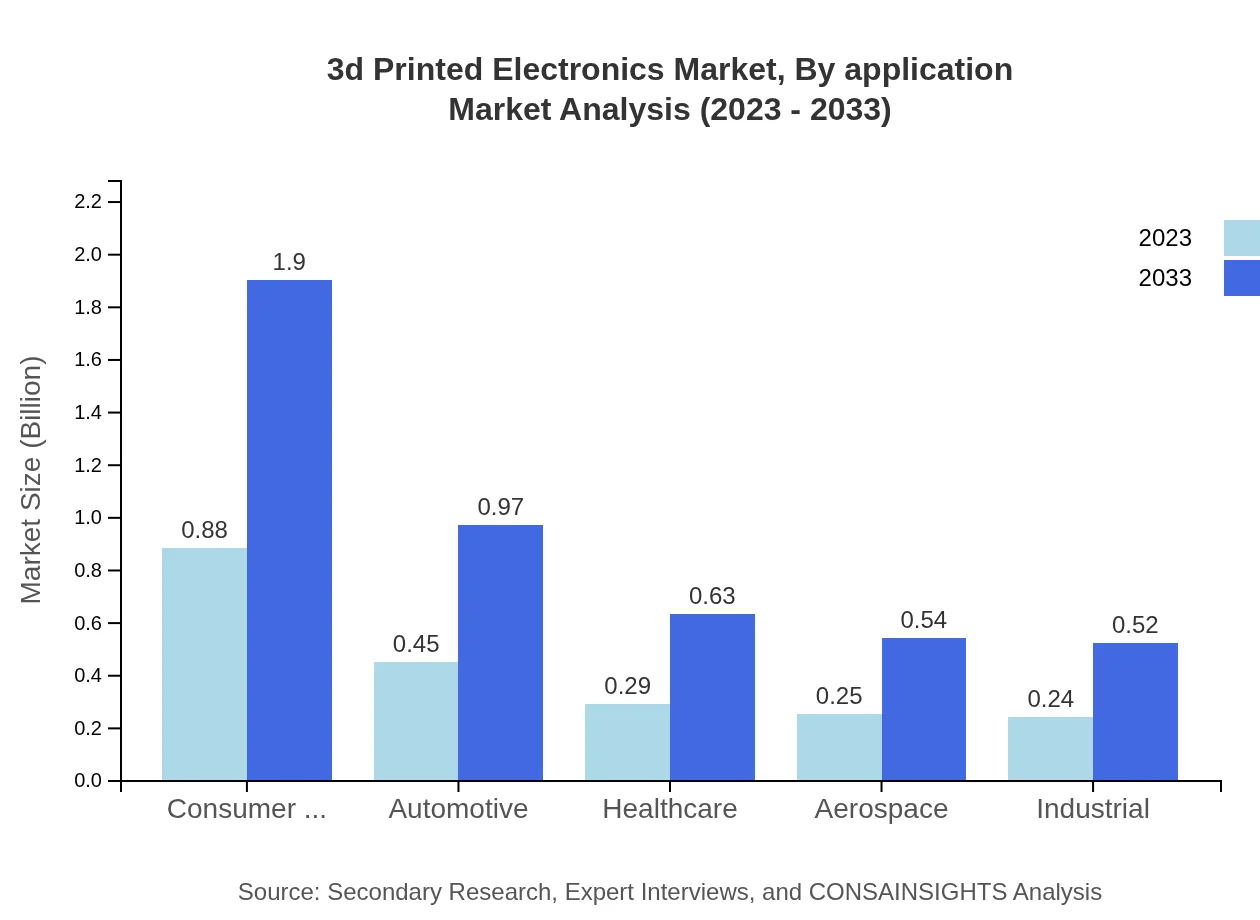

3d Printed Electronics Market Analysis By Application

Applications encompass consumer electronics, automotive, healthcare, and aerospace. The consumer electronics segment is notably significant, expected to expand from $0.88 billion in 2023 to $1.90 billion by 2033, driven by the increasing demand for personalized electronic devices.

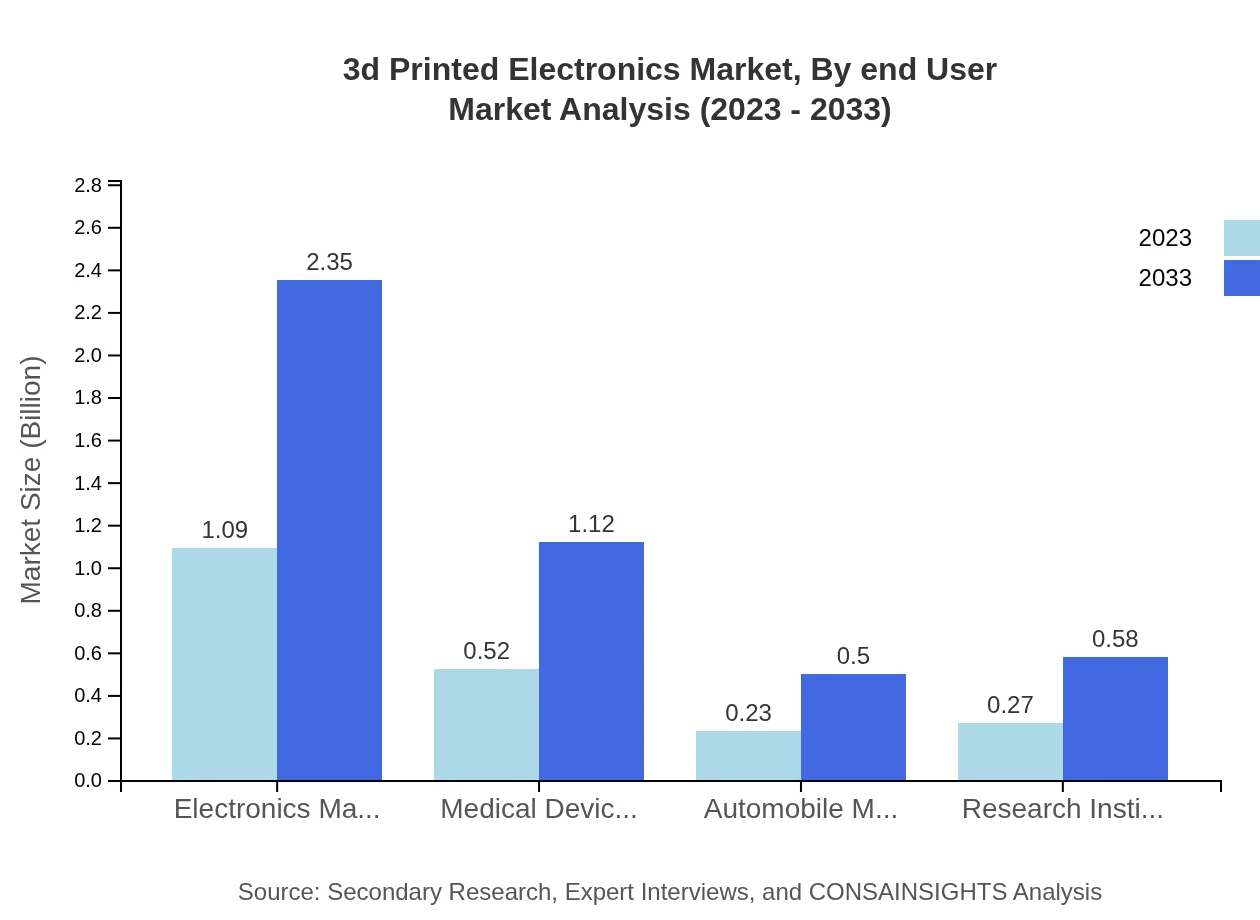

3d Printed Electronics Market Analysis By End User

Key end users in the market include electronics manufacturers, automotive players, medical device producers, and research institutions. The electronics manufacturers segment is anticipated to dominate, growing from $1.09 billion in 2023 to $2.35 billion by 2033.

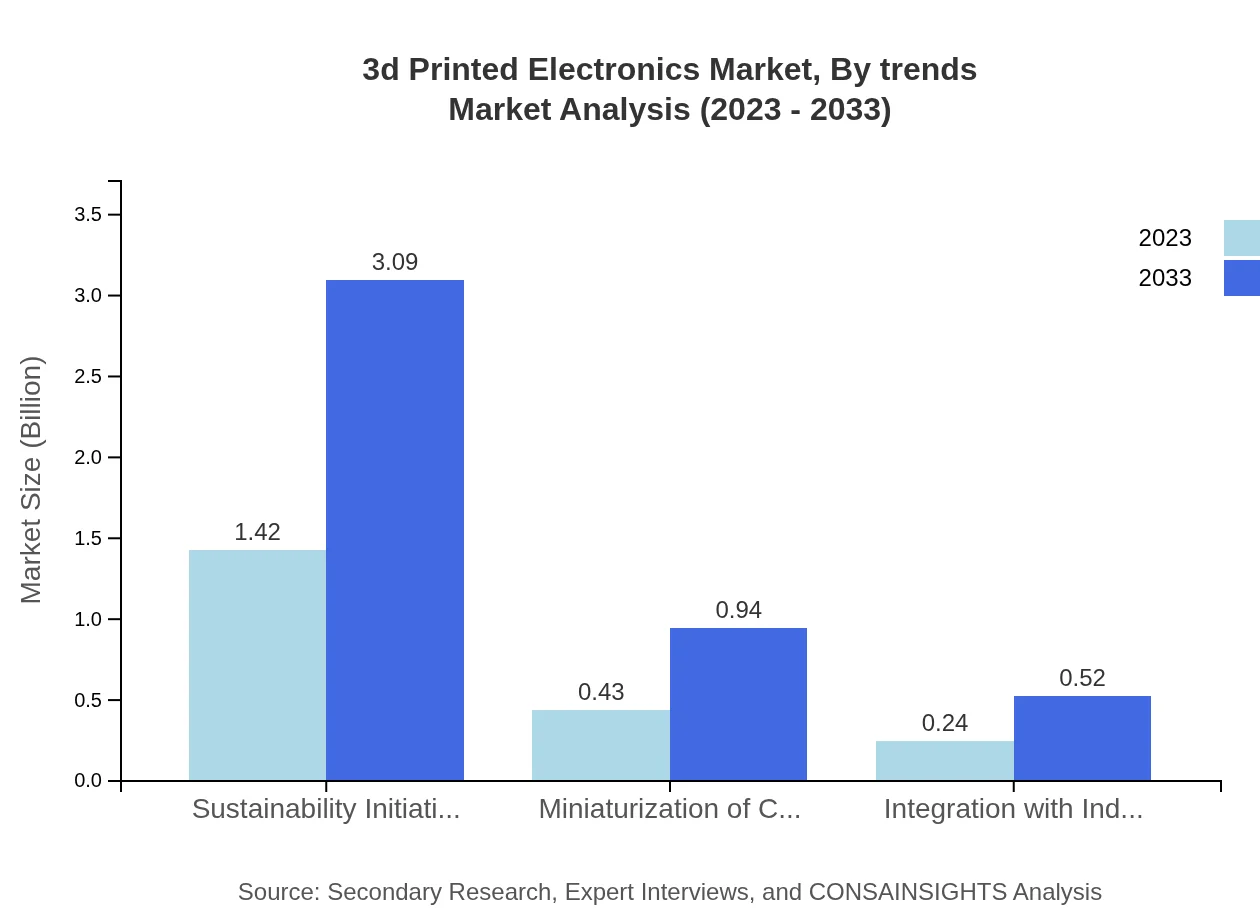

3d Printed Electronics Market Analysis By Trends

Trends such as sustainability initiatives and the miniaturization of components are shaping the market landscape. Sustainability initiatives alone are projected to grow from $1.42 billion in 2023 to $3.09 billion by 2033, indicating a shift towards more eco-friendly manufacturing processes.

3d Printed Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3d Printed Electronics Industry

HP Inc.:

HP Inc. is a major player in 3D printing technology, offering innovative solutions that integrate electronics manufacturing with 3D printing capabilities, facilitating rapid prototyping and production.Stratasys Ltd.:

Stratasys Ltd. specializes in additive manufacturing and 3D printing solutions for various industries, contributing significantly to the advancement of 3D Printed Electronics technology and applications.Nano Dimension:

Nano Dimension focuses on the development of advanced 3D printing technology specifically for electronics, providing innovative solutions to the complex designs required in this field.Desktop Metal:

Desktop Metal is known for its innovative approaches in the metal 3D printing space, and its technologies are increasingly being adapted for electronic components fabrication.We're grateful to work with incredible clients.

FAQs

What is the market size of 3D Printed electronics?

The market size of 3D-printed electronics is projected to reach approximately $2.1 billion by 2033, growing at a CAGR of 7.8%. This growth highlights increasing adoption in various industries, driven by advances in 3D printing technology.

What are the key market players or companies in the 3D Printed electronics industry?

Key players in the 3D-printed electronics industry include major companies such as Nano Dimension, 3D Systems, and HP Inc. These companies leverage innovative technologies to offer cutting-edge solutions in additive manufacturing and conductive materials.

What are the primary factors driving the growth in the 3D Printed electronics industry?

The growth in the 3D-printed electronics industry is primarily driven by advancements in sustainable technologies, the miniaturization of electronic components, and the integration with Industry 4.0, alongside increasing demand from sectors like healthcare and consumer electronics.

Which region is the fastest Growing in the 3D Printed electronics market?

Among various regions, Europe and North America are experiencing significant growth in the 3D-printed electronics market. By 2033, Europe's market is expected to reach $1.56 billion, while North America is projected to grow to $1.46 billion, reflecting robust demand.

Does ConsaInsights provide customized market report data for the 3D Printed electronics industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the 3D-printed electronics industry. Clients can receive insights into market trends, segment data, and forecasts based on individual business needs.

What deliverables can I expect from this 3D Printed electronics market research project?

Deliverables from the 3D-printed electronics market research project may include comprehensive market analysis, competitor analysis, regional market breakdowns, segment insights, and growth forecasts to guide strategic decision-making.

What are the market trends of 3D Printed electronics?

Current trends in the 3D-printed electronics market include a shift towards sustainability initiatives, increased miniaturization, and enhanced applications in industries such as healthcare, automotive, and consumer electronics, emphasizing the evolving landscape of technology.