3d Printing Gases Market Report

Published Date: 22 January 2026 | Report Code: 3d-printing-gases

3d Printing Gases Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis and insights into the 3D Printing Gases market, covering key trends, regional performance, segmentation, and forecasts from 2023 to 2033. The study provides an overview of current market dynamics, size, and growth rates driven by advancements in 3D printing technologies.

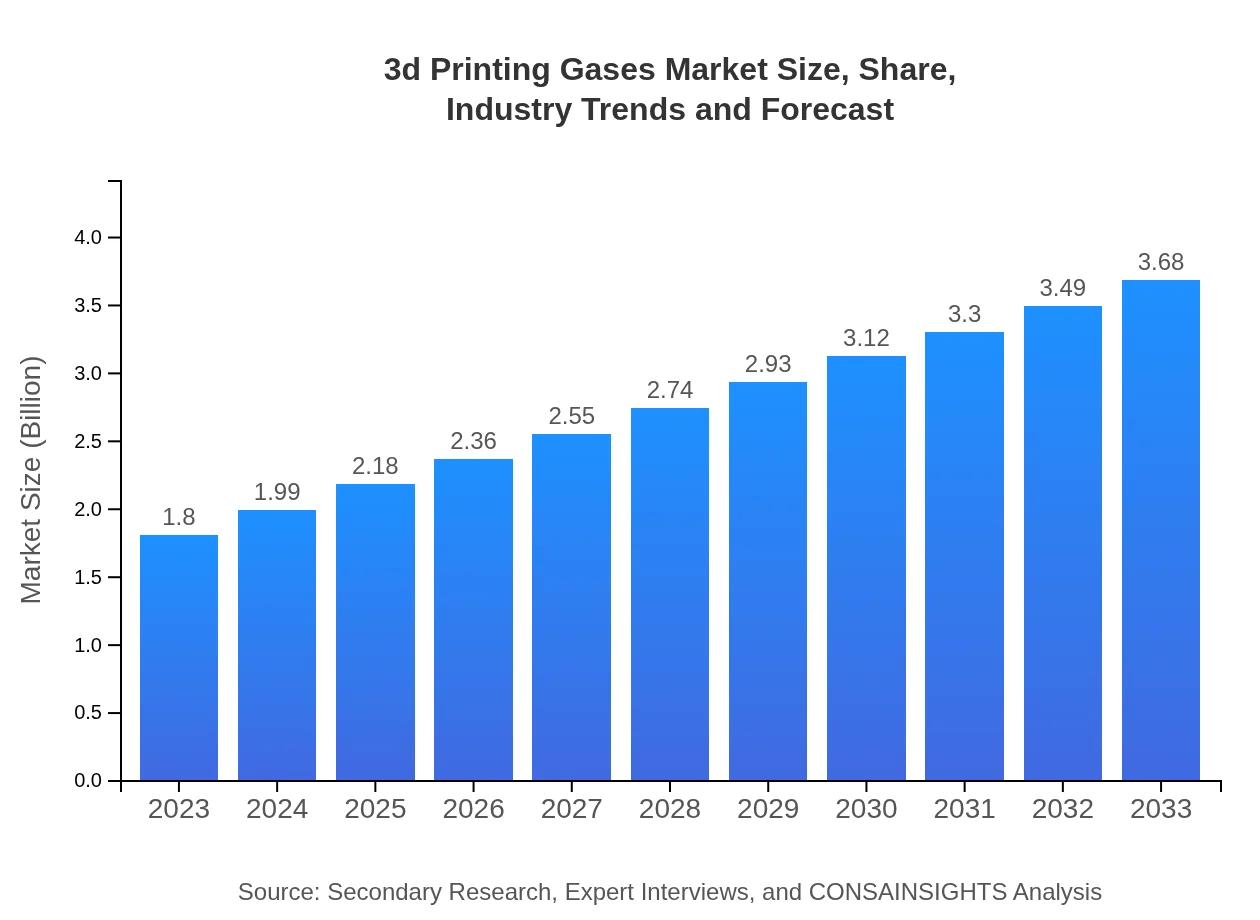

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.68 Billion |

| Top Companies | Air Products and Chemicals, Inc., Linde plc, Praxair Technology, Inc., Air Liquide S.A., Matheson Tri-Gas, Inc. |

| Last Modified Date | 22 January 2026 |

3d Printing Gases Market Overview

Customize 3d Printing Gases Market Report market research report

- ✔ Get in-depth analysis of 3d Printing Gases market size, growth, and forecasts.

- ✔ Understand 3d Printing Gases's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Printing Gases

What is the Market Size & CAGR of 3d Printing Gases market in 2023?

3d Printing Gases Industry Analysis

3d Printing Gases Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3d Printing Gases Market Analysis Report by Region

Europe 3d Printing Gases Market Report:

The European market is projected to increase from $0.47 billion in 2023 to $0.96 billion by 2033, driven by the region's strong emphasis on innovation and high-quality manufacturing standards. Countries like Germany and France are at the forefront of adopting 3D printing technologies for various applications.Asia Pacific 3d Printing Gases Market Report:

In the Asia Pacific region, the market for 3D printing gases is projected to grow significantly from $0.36 billion in 2023 to $0.73 billion by 2033. The rise in manufacturing activities, coupled with increased investments in technology, is driving this growth. Countries like China and Japan are leading in adopting additive manufacturing technologies, fostering a robust market for associated gases.North America 3d Printing Gases Market Report:

North America remains the largest market, expanding from $0.67 billion in 2023 to approximately $1.36 billion by 2033. This growth is powered by technological advancement and strong demand from the aerospace and automotive industries, which leverage 3D printing for rapid prototyping and production.South America 3d Printing Gases Market Report:

The South American market, although smaller, is anticipated to grow from $0.15 billion in 2023 to $0.31 billion by 2033. This growth can be attributed to the increasing interest in 3D printing from sectors such as healthcare and consumer goods, bolstered by government initiatives to support technology adoption.Middle East & Africa 3d Printing Gases Market Report:

The Middle East and Africa market are expected to see gradual growth from $0.16 billion in 2023 to $0.32 billion by 2033. The region is witnessing increased investments in 3D printing capabilities, supported by strategic initiatives aimed at diversifying economies and enhancing technological skills.Tell us your focus area and get a customized research report.

3d Printing Gases Market Analysis By Gas Type

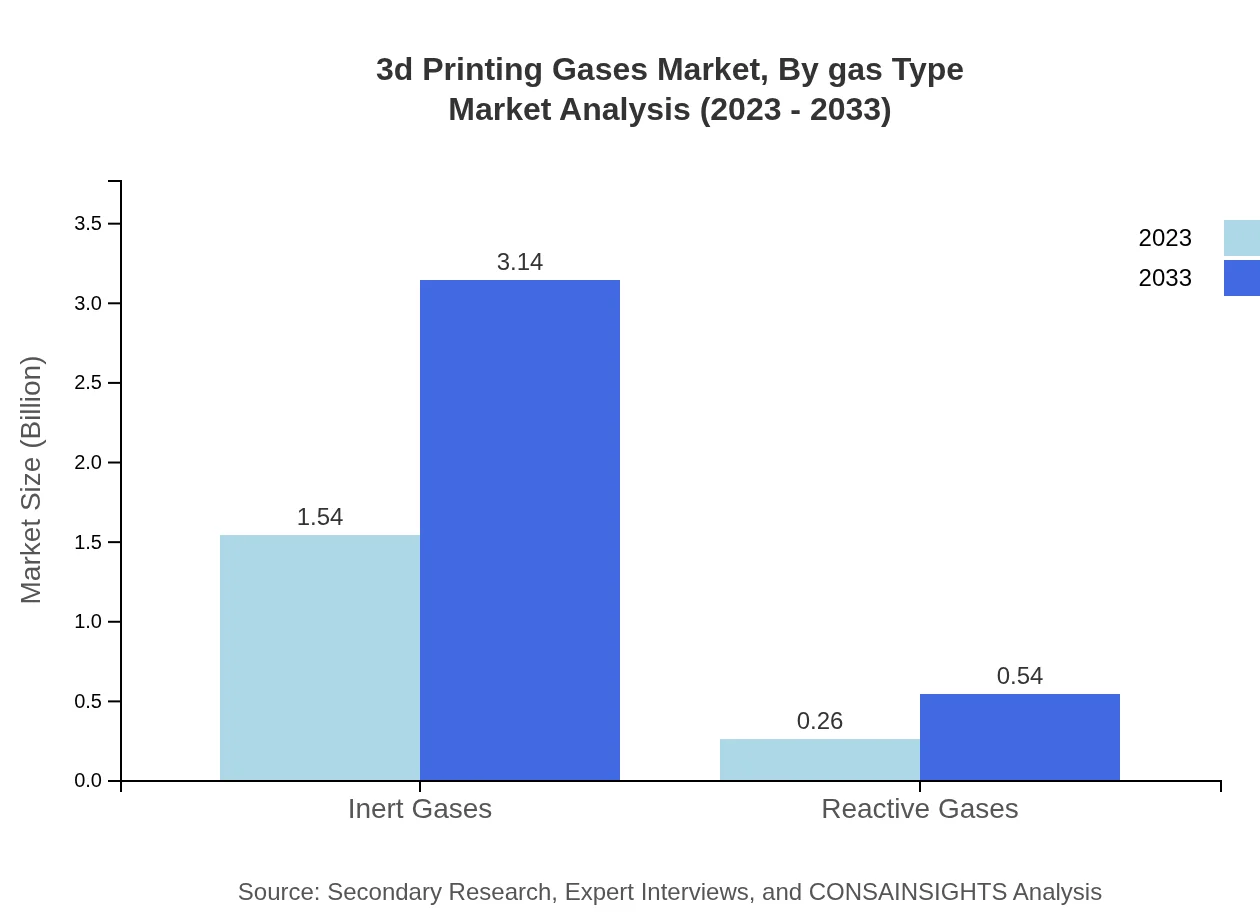

The analysis of the 3D printing gases market by gas type shows that inert gases dominate the space, accounting for approximately 85.31% of market share in 2023, with a market size of $1.54 billion. The market for inert gases is expected to double by 2033. Meanwhile, reactive gases currently hold a smaller share at 14.69%, representing a growing niche with anticipated significant advancements in material properties and applications.

3d Printing Gases Market Analysis By Application

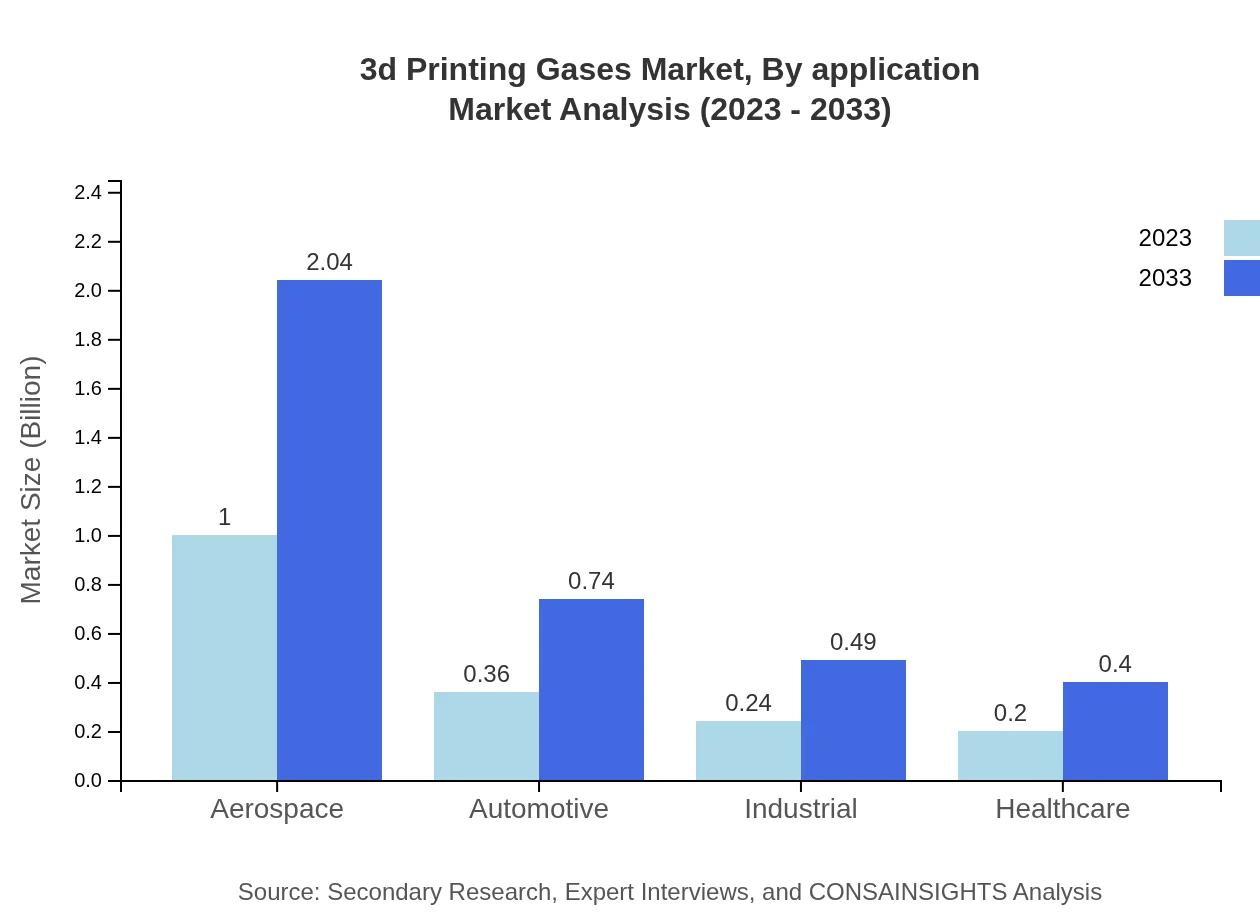

From an application standpoint, the aerospace sector leads, with a market size of around $1.00 billion in 2023, rising to $2.04 billion by 2033. Other notable applications include automotive and healthcare, where 3D printing allows for tailored product designs and quick iterations in production processes.

3d Printing Gases Market Analysis By End User

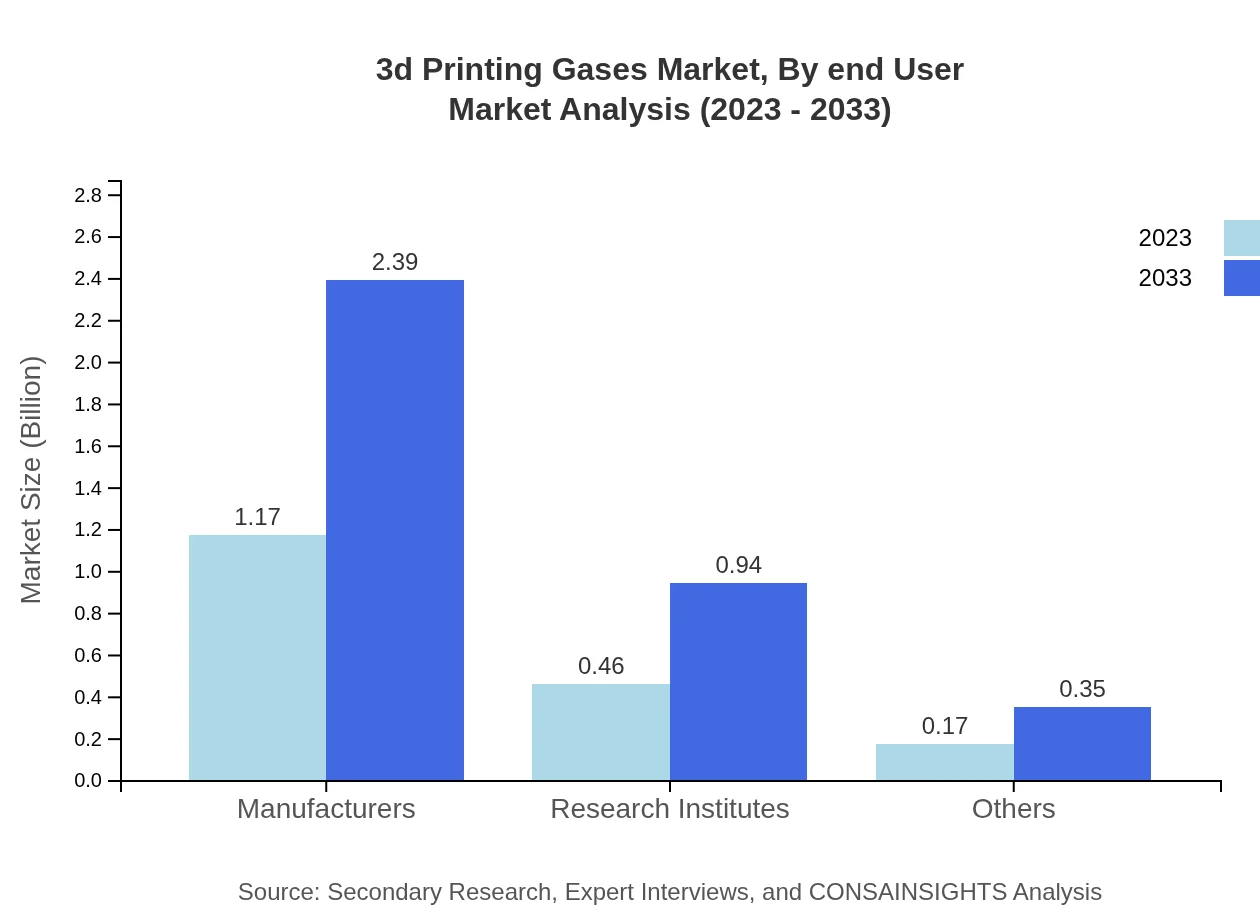

The end-user segmentation highlights strong demand from manufacturers, which represent 64.99% of the total market. Research institutes follow, accounting for 25.52%. The ongoing collaboration between industry and research is essential for advancements in materials and technologies supporting the 3D printing gas market.

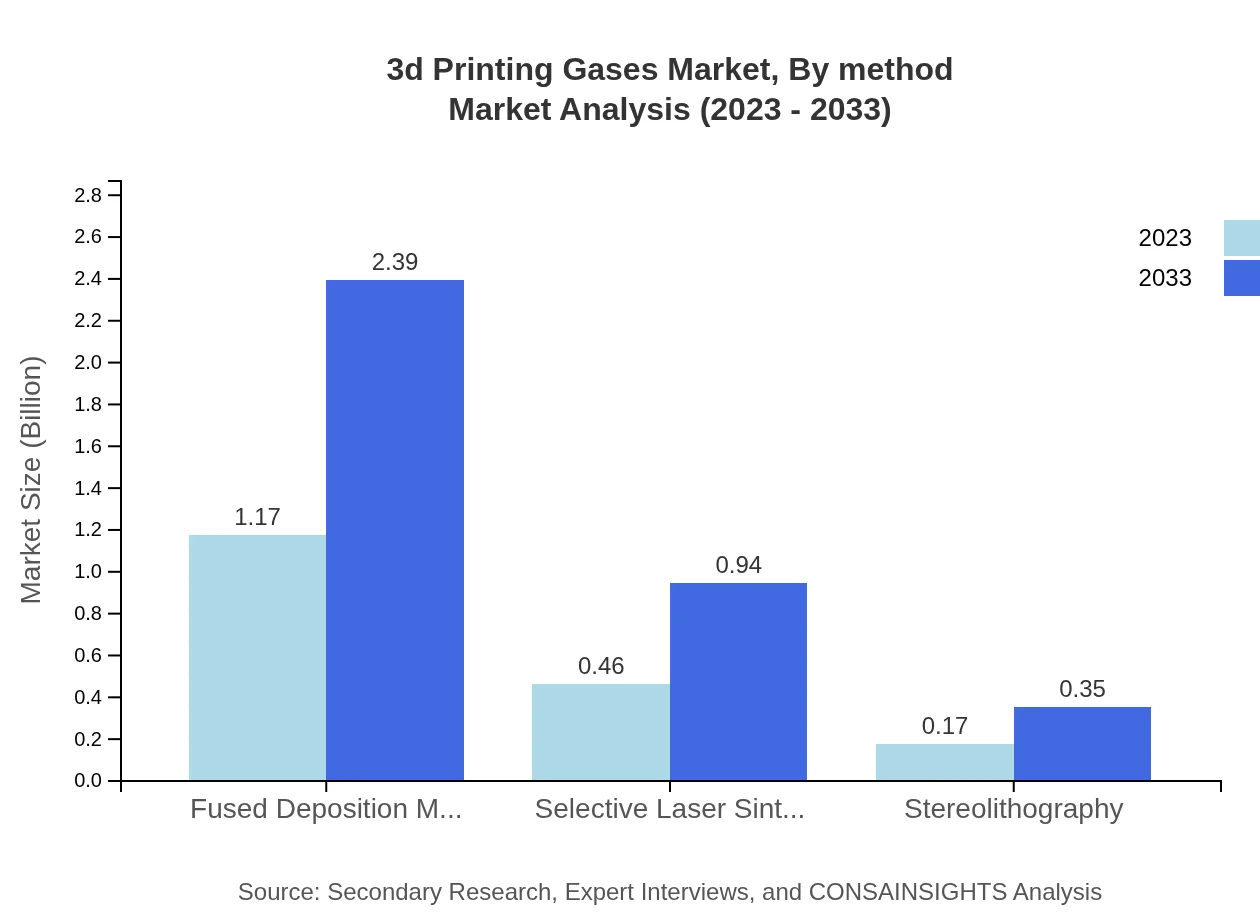

3d Printing Gases Market Analysis By Method

Market analysis by method indicates a significant preference for Fused Deposition Modeling (FDM), which holds a market size of $1.17 billion in 2023. This is expected to grow substantially, illustrating the dominant presence of FDM technologies in various sectors, particularly aerospace and automotive.

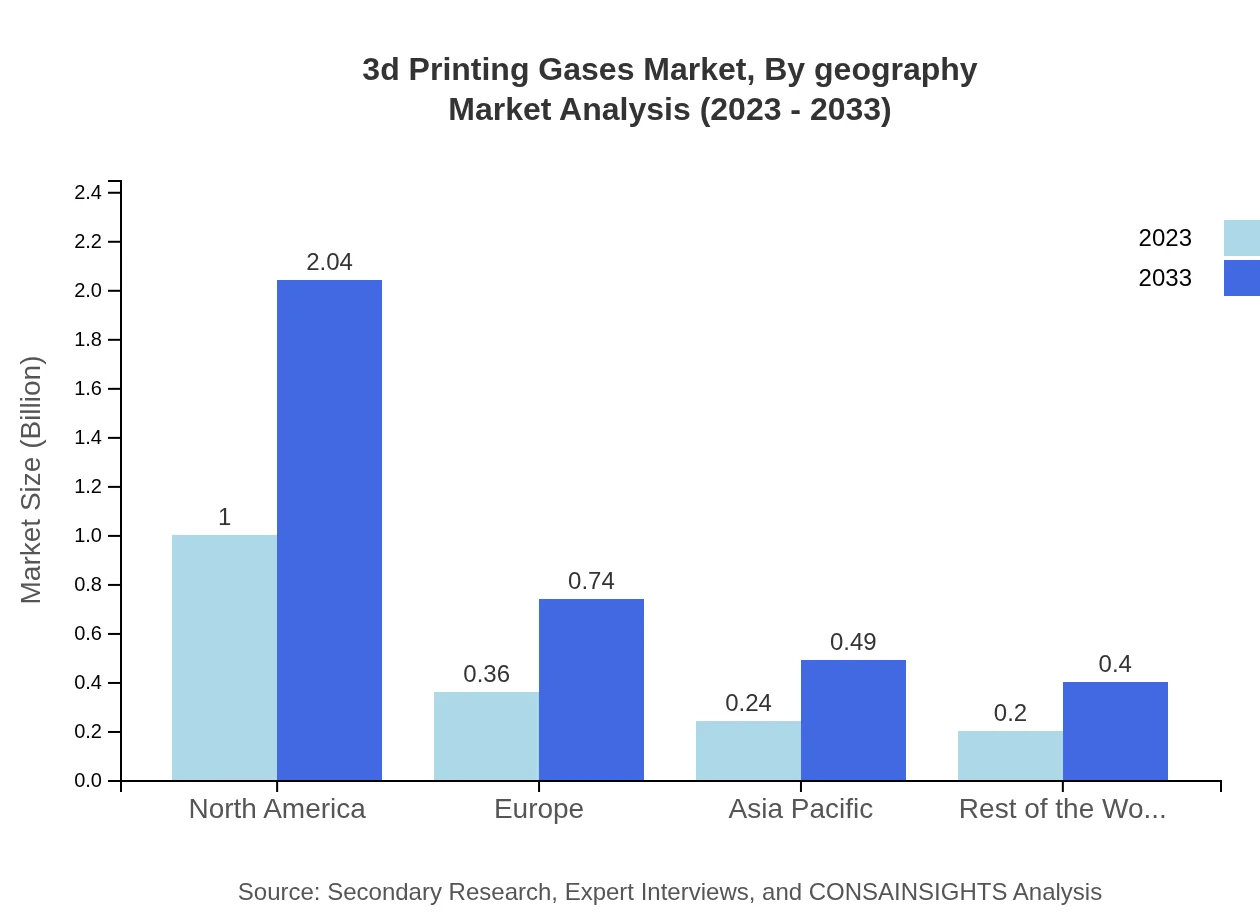

3d Printing Gases Market Analysis By Geography

Geographical analysis of the 3D printing gases market shows North America holding a significant share of 55.54%, primarily driven by established industrial sectors. Europe follows with a 20.23% share, and growing markets in Asia Pacific and Latin America indicate rising global interest and investment in 3D printing technologies.

3d Printing Gases Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3d Printing Gases Industry

Air Products and Chemicals, Inc.:

A leading supplier of industrial gases, Air Products provides a range of gases for various applications in 3D printing, helping businesses improve efficiency and product quality.Linde plc:

Linde is a prominent global industrial gas company that offers innovative gas solutions tailored for the additive manufacturing sector, emphasizing superior performance and safety.Praxair Technology, Inc.:

As a key player in the industrial gas market, Praxair focuses on providing high purity gases that are crucial for various 3D printing processes, enhancing operational capabilities.Air Liquide S.A.:

Air Liquide is known for its advanced gas production technologies, providing critical inputs for 3D printing, particularly in research and metal printing applications.Matheson Tri-Gas, Inc.:

Matheson specializes in specialty gases and equipment for the 3D printing industry, committing to innovation and customer-centric solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of 3d Printing Gases?

The market size of 3D-printing gases is projected at $1.8 billion in 2023, with a CAGR of 7.2% expected through 2033, indicating robust growth potential in the industry over the next decade.

What are the key market players or companies in the 3d Printing Gases industry?

Key players in the 3D-printing gases market include major industrial gas suppliers and technology specialists that provide applications in various sectors like aerospace, automotive, and healthcare.

What are the primary factors driving the growth in the 3d Printing Gases industry?

Growth factors include advancements in materials technology, increasing demand from aerospace and automotive sectors, and expanding applications of 3D printing in healthcare and industrial sectors.

Which region is the fastest Growing in the 3d Printing Gases?

North America is the fastest-growing region for 3D-printing gases, with the market expected to expand from $0.67 billion in 2023 to $1.36 billion by 2033, capitalizing on high industrial adoption.

Does ConsaInsights provide customized market report data for the 3d Printing Gases industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the 3D-printing gases industry, providing detailed analyses and data relevant to diverse business requirements.

What deliverables can I expect from this 3d Printing Gases market research project?

Expected deliverables include comprehensive market analysis, regional insights, competitive landscape overview, segment breakdown, and detailed forecasts and trends within the 3D-printing gases market.

What are the market trends of 3d Printing Gases?

Market trends include the growing reliance on inert gases, increased automation in manufacturing processes, and heightened focus on sustainability and eco-friendly practices within the 3D printing sector.