3d Radar Market Report

Published Date: 03 February 2026 | Report Code: 3d-radar

3d Radar Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the 3D Radar market from 2023 to 2033, offering insights into market size, segmentation, technological advancements, regional dynamics, and key industry players, providing a detailed view of the future trends and growth opportunities.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

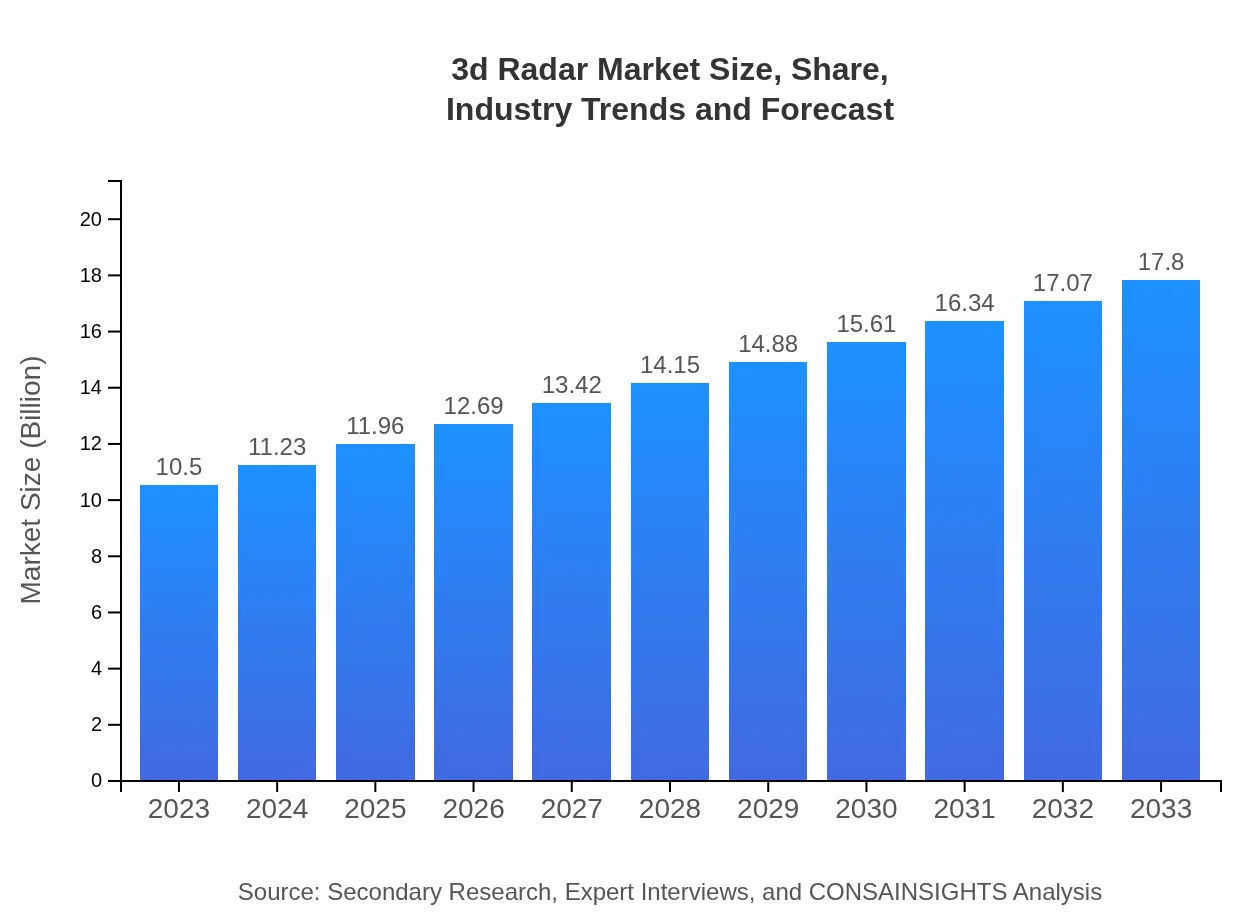

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $17.80 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, Raytheon Technologies, Thales Group, Boeing |

| Last Modified Date | 03 February 2026 |

3d Radar Market Overview

Customize 3d Radar Market Report market research report

- ✔ Get in-depth analysis of 3d Radar market size, growth, and forecasts.

- ✔ Understand 3d Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Radar

What is the Market Size & CAGR of 3D Radar market in 2023?

3d Radar Industry Analysis

3d Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3d Radar Market Analysis Report by Region

Europe 3d Radar Market Report:

Europe’s market is forecasted to grow from USD 3.49 billion in 2023 to USD 5.92 billion in 2033, fueled by increasing security requirements and government investments in advanced radar systems amid geopolitical tensions.Asia Pacific 3d Radar Market Report:

The Asia Pacific region is poised for significant growth, with a market size projected to rise from USD 1.91 billion in 2023 to USD 3.24 billion by 2033. This rapid growth can be attributed to increasing defense budgets among countries such as India and China and the growing demand for advanced surveillance systems.North America 3d Radar Market Report:

North America leads the global market, with a current size of USD 3.75 billion projected to grow to USD 6.35 billion by 2033. Key factors include the expansion of defense spending, rapid technological advancements, and the presence of major industry players.South America 3d Radar Market Report:

In South America, the 3D Radar market size is expected to increase modestly from USD 0.21 billion in 2023 to USD 0.36 billion by 2033. The region's market growth is driven by investments in infrastructure and emergent technologies in defense sectors.Middle East & Africa 3d Radar Market Report:

The Middle East and Africa is projected to see a market size growth from USD 1.14 billion in 2023 to USD 1.93 billion by 2033, with particular emphasis on defense and civil applications driving demand for sophisticated 3D Radar technology.Tell us your focus area and get a customized research report.

3d Radar Market Analysis By Technology

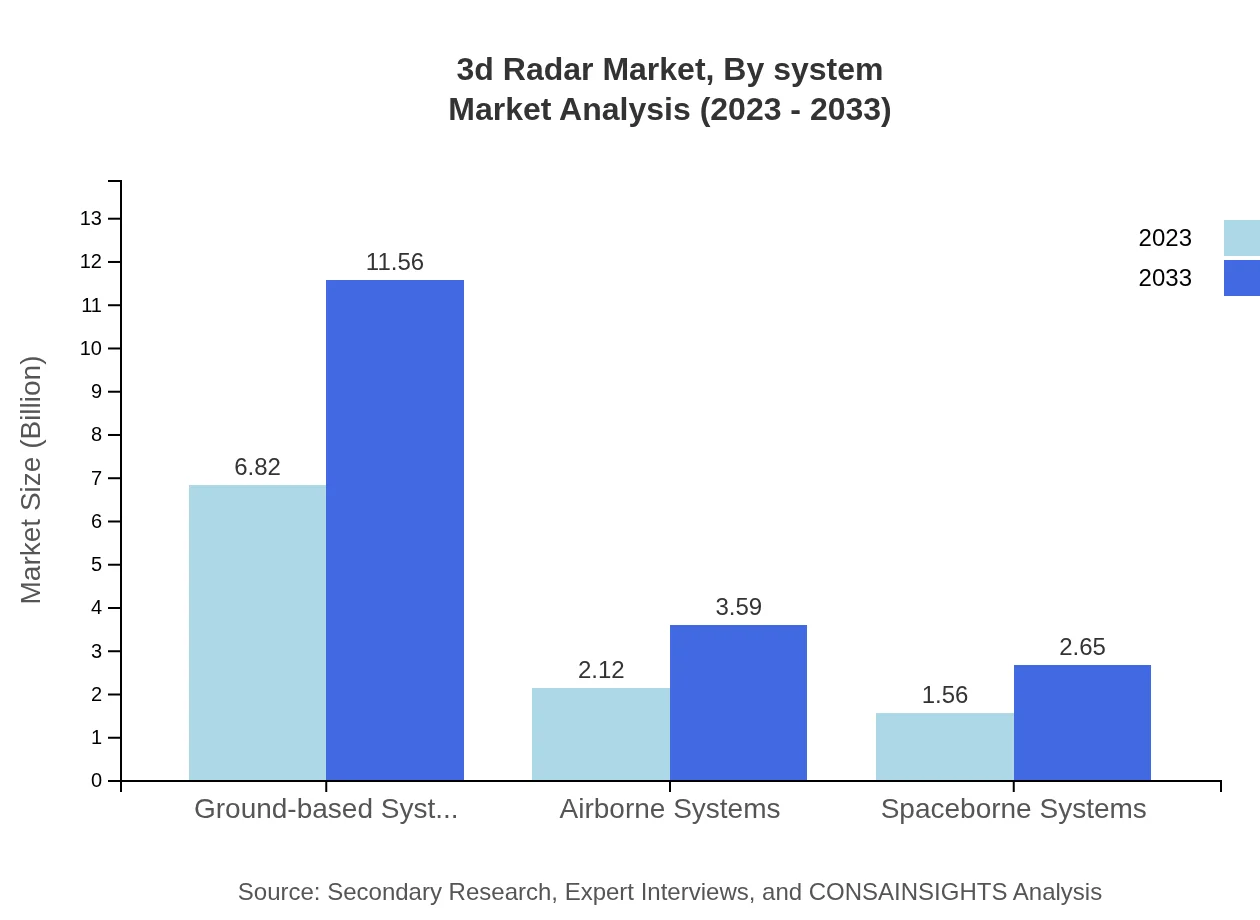

The market is primarily categorized into Ground-based Systems, Airborne Systems, and Spaceborne Systems. In 2023, Ground-based Systems hold a market share of 64.95% and are expected to maintain this share by 2033, showcasing stability in defense-related applications. Airborne and Spaceborne Systems are also gaining traction, especially for surveillance and reconnaissance due to their strategic advantages.

3d Radar Market Analysis By Application

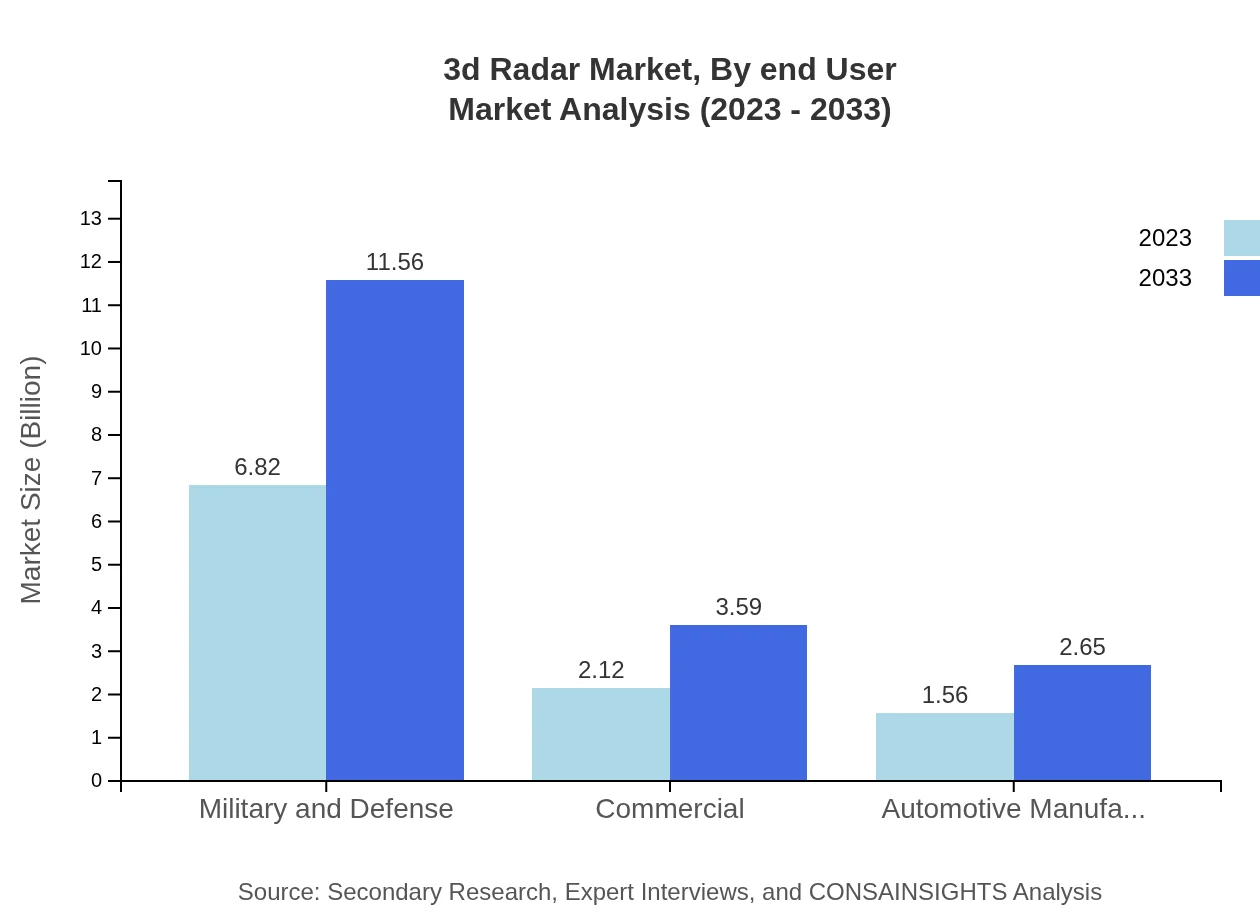

The 3D Radar market application spans segments such as Military and Defense, Commercial, and Automotive. Military and Defense applications dominate with a share of 64.95% in 2023, highlighting the critical role of radar systems in national security. Commercial applications, particularly in smart transportation and infrastructure, are evolving rapidly, presenting new opportunities for growth and integration of radar technologies.

3d Radar Market Analysis By System

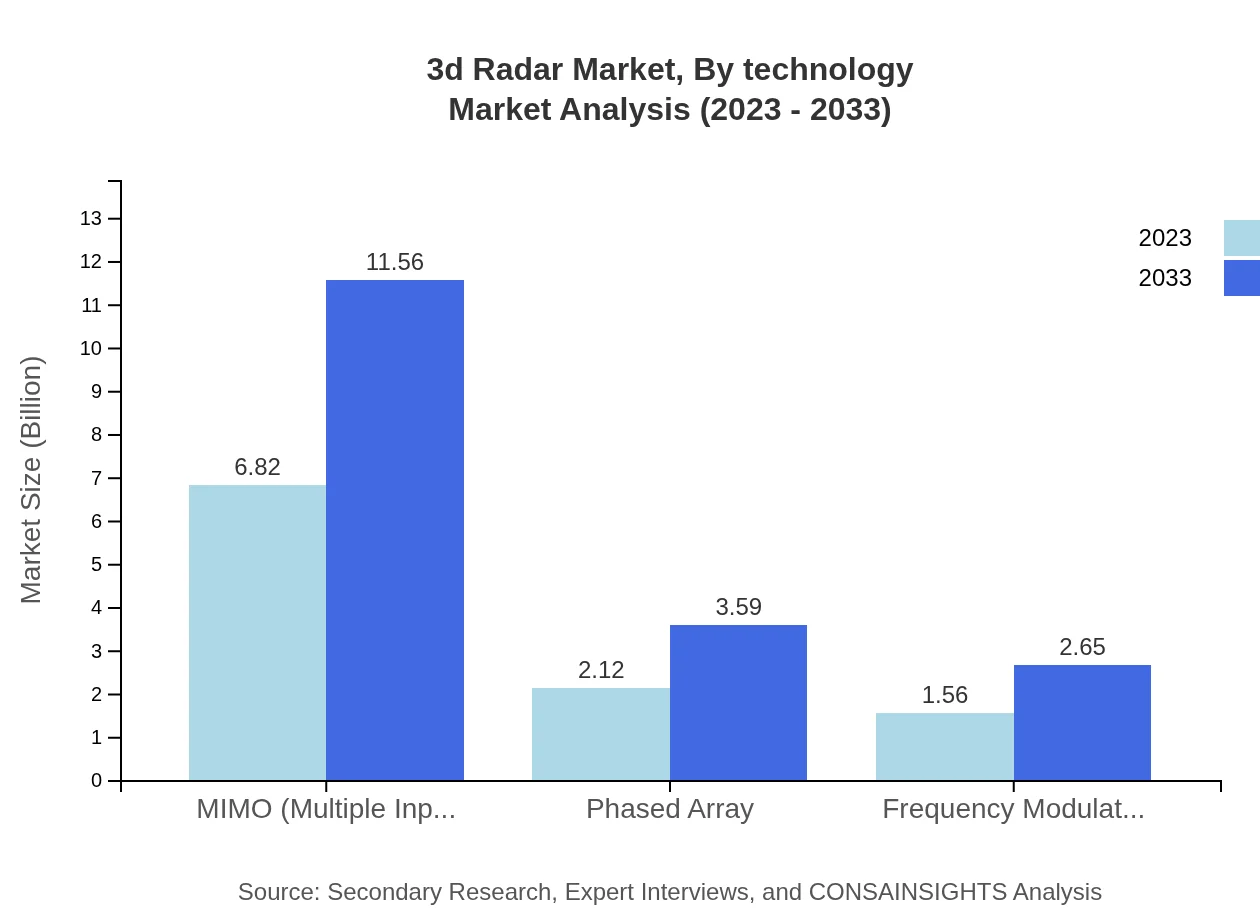

The 3D Radar systems are categorized into MIMO Systems, Phased Array Systems, and Frequency Modulated Continuous Wave (FMCW) systems. MIMO technologies hold a significant share with applications spanning from defense to automotive sectors. With a market share of 64.95% in 2023, they are anticipated to maintain their competitive edge thanks to advanced signal processing capabilities.

3d Radar Market Analysis By End User

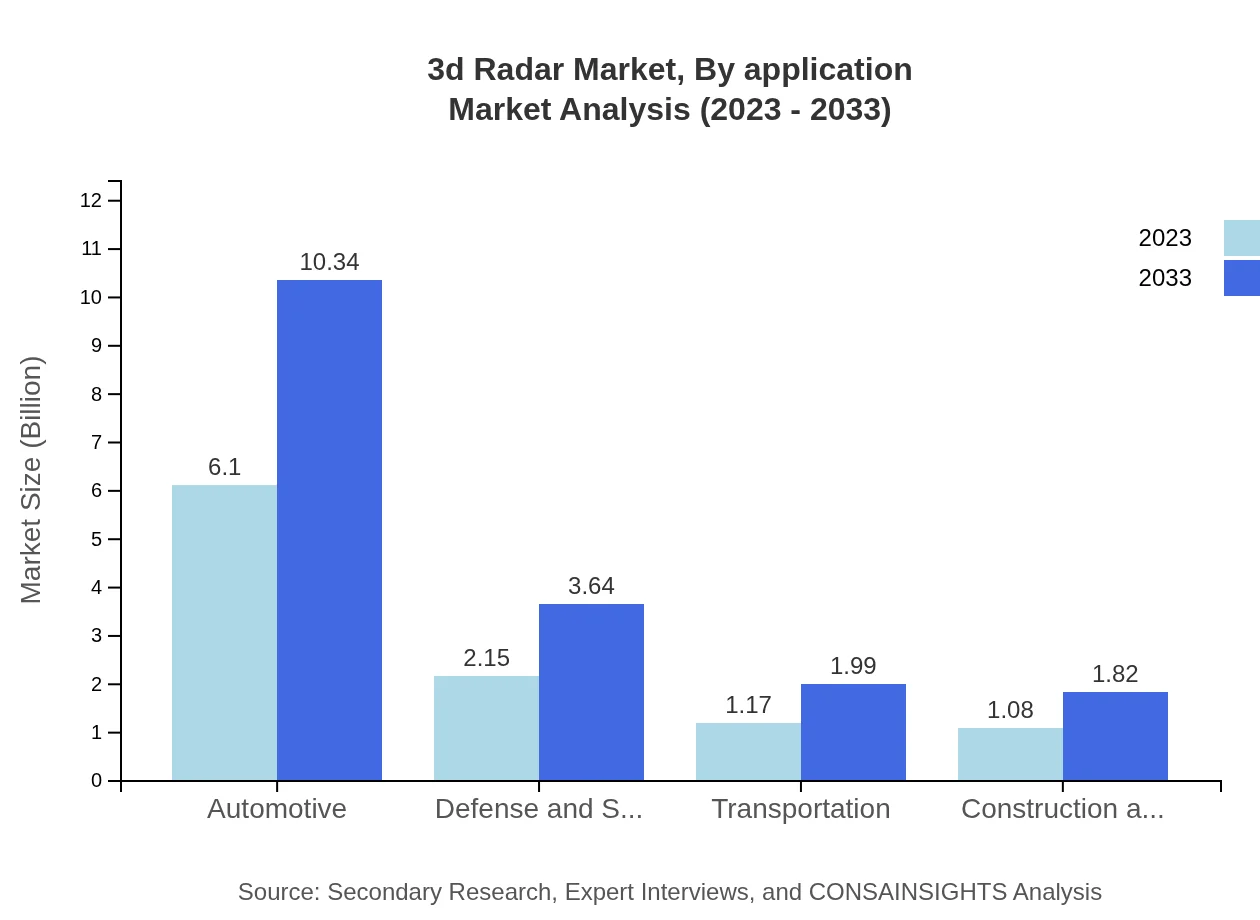

End-user industries for 3D Radar include Automotive, Defense and Security, Transportation, and Construction. Automotive applications are particularly noteworthy, with a significant growth trajectory expected from USD 6.10 billion in 2023 to USD 10.34 billion by 2033, due to the rise of autonomous driving technologies demanding enhanced radar capabilities. The defense sector remains the cornerstone of market growth and stability.

3D Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3d Radar Industry

Lockheed Martin:

A leading defense contractor, Lockheed Martin is at the forefront of developing advanced radar systems for military applications, offering high-performance 3D Radar solutions.Northrop Grumman:

Northrop Grumman specializes in integrated radar systems and has made significant contributions to the 3D Radar market, particularly in aerospace and defense.Raytheon Technologies:

Raytheon is known for its innovative radar technology and plays a crucial role in supplying 3D Radar systems for air traffic control and defense applications.Thales Group:

Thales Group provides cutting-edge radar solutions, focusing on defense and security applications, enhancing situational awareness through 3D Radar technology.Boeing :

Boeing offers advanced radar solutions that are instrumental in military surveillance, helping to shape the future of the 3D Radar market.We're grateful to work with incredible clients.

FAQs

What is the market size of 3D Radar?

The 3D Radar market is valued at approximately $10.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 5.3% from 2023 to 2033. This growth reflects increasing applications across various industries.

What are the key market players or companies in the 3D Radar industry?

Key players in the 3D Radar industry include corporations such as Raytheon Technologies, Lockheed Martin, and Northrop Grumman. These companies are pivotal in technological advancements and military applications of 3D radar systems.

What are the primary factors driving the growth in the 3D Radar industry?

Growth in the 3D Radar industry is primarily driven by advancements in radar technology, increasing defense budgets, the rise of automation in industries, and growing demand for surveillance and security solutions worldwide.

Which region is the fastest Growing in the 3D Radar market?

The North America region is achieved significant growth in the 3D Radar market, projected to expand from $3.75 billion in 2023 to approximately $6.35 billion by 2033. This growth is supported by robust investment in defense and security technology.

Does ConsaInsights provide customized market report data for the 3D Radar industry?

Yes, ConsaInsights offers tailored market report data specific to the 3D Radar industry, allowing clients to receive insights customized to their research needs and strategic objectives across various sectors.

What deliverables can I expect from this 3D Radar market research project?

Expect comprehensive deliverables such as detailed market analysis reports, segment-wise breakdown, competitor profiling, and forecasting data that includes regional insights and growth trends in the 3D Radar market.

What are the market trends of 3D Radar?

Current trends in the 3D Radar market include increased integration of AI technology for enhanced data analysis, a surge in demand for autonomous systems, and an expansion of applications in sectors like automotive and construction.