3d Scanning Market Report

Published Date: 22 January 2026 | Report Code: 3d-scanning

3d Scanning Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 3D scanning market, detailing market size, segmentation, regional insights, and trends. The forecast period covers 2023 to 2033, offering predictions and an examination of key driving factors influencing growth.

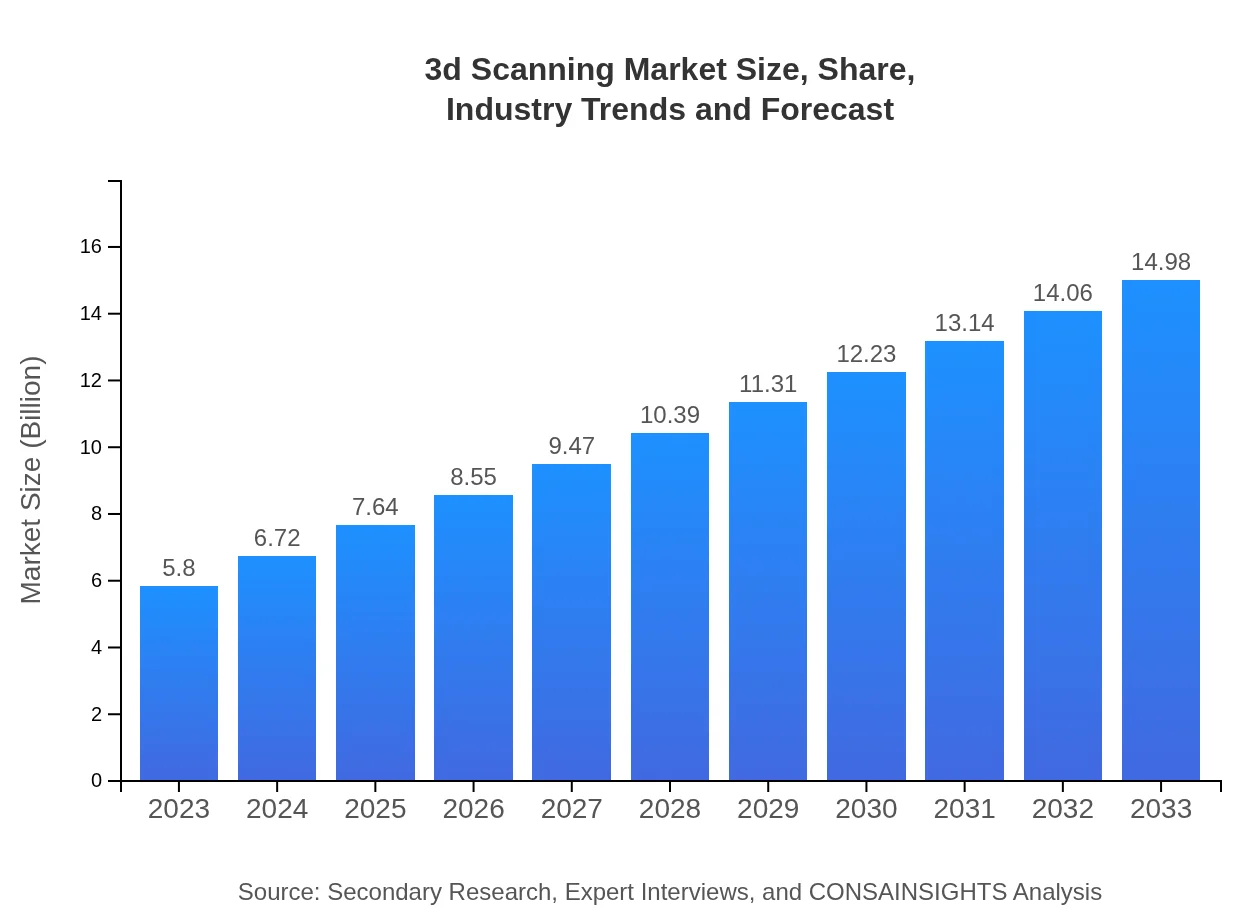

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 9.6% |

| 2033 Market Size | $14.98 Billion |

| Top Companies | Hexagon AB, Faro Technologies, Inc., Creaform Inc., Leica Geosystems AG, 3D Systems Corporation |

| Last Modified Date | 22 January 2026 |

3D Scanning Market Overview

Customize 3d Scanning Market Report market research report

- ✔ Get in-depth analysis of 3d Scanning market size, growth, and forecasts.

- ✔ Understand 3d Scanning's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Scanning

What is the Market Size & CAGR of 3D Scanning market in 2023 and 2033?

3D Scanning Industry Analysis

3D Scanning Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3D Scanning Market Analysis Report by Region

Europe 3d Scanning Market Report:

The European market is estimated to grow from $1.46 billion in 2023 to $3.77 billion by 2033. Factors include stringent regulations in manufacturing quality assurance and the increasing adoption of digital technologies across industries, reinforcing Europe’s commitment to innovation and sustainability.Asia Pacific 3d Scanning Market Report:

The Asia Pacific region is projected to expand significantly, with the market size increasing from $1.22 billion in 2023 to $3.15 billion in 2033. Factors contributing to this growth include rising manufacturing activities, particularly in countries like China and India, improved infrastructure, and government initiatives aimed at modernizing industries.North America 3d Scanning Market Report:

North America dominates the 3D scanning market, with a market size of $1.90 billion in 2023, projected to reach $4.90 billion by 2033. The region benefits from a robust manufacturing base, strong technological infrastructure, and high spending on R&D, particularly in the automotive and healthcare sectors.South America 3d Scanning Market Report:

The South American market size for 3D scanning is expected to grow from $0.53 billion in 2023 to $1.38 billion by 2033. Growth factors include increased interest in architectural preservation and development projects, alongside the rising adoption of technology in various sectors.Middle East & Africa 3d Scanning Market Report:

The Middle East and Africa market is expected to rise from $0.69 billion in 2023 to $1.78 billion by 2033. Industry growth is driven by infrastructure development and increased investments in cultural heritage preservation, alongside growing interest in smart city initiatives.Tell us your focus area and get a customized research report.

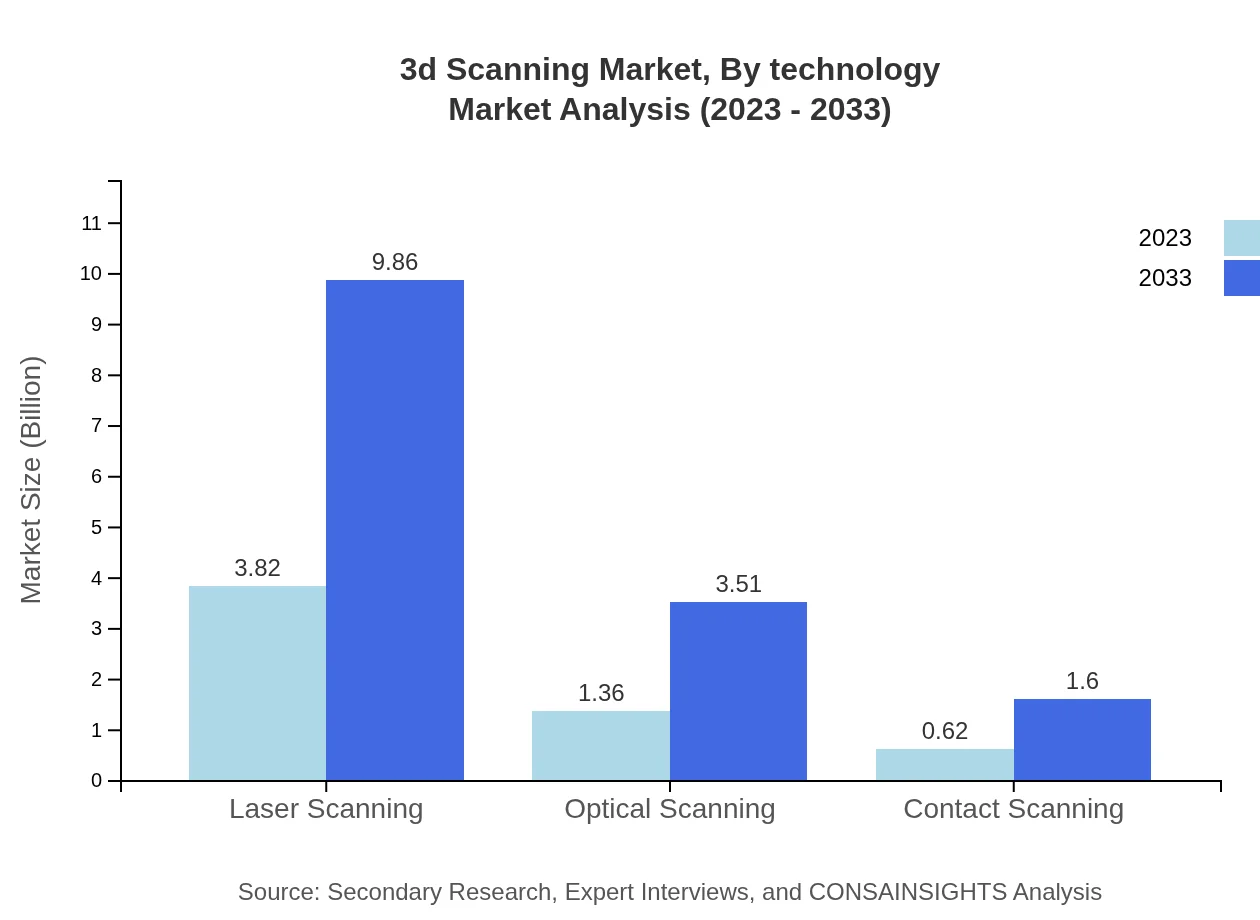

3d Scanning Market Analysis By Technology

The 3D scanning market by technology is dominated by laser scanning, which represented a market size of $3.82 billion in 2023 and is expected to reach $9.86 billion by 2033, maintaining a 65.84% market share. Optical scanning, following with a market size of $1.36 billion in 2023 and a projected growth to $3.51 billion by 2033, represents 23.45% share. Contact scanning, contributing $0.62 billion in 2023 and expected to reach $1.60 billion by 2033, holds a 10.71% share, illustrating the diversification of scanning technologies and their applications in different industries.

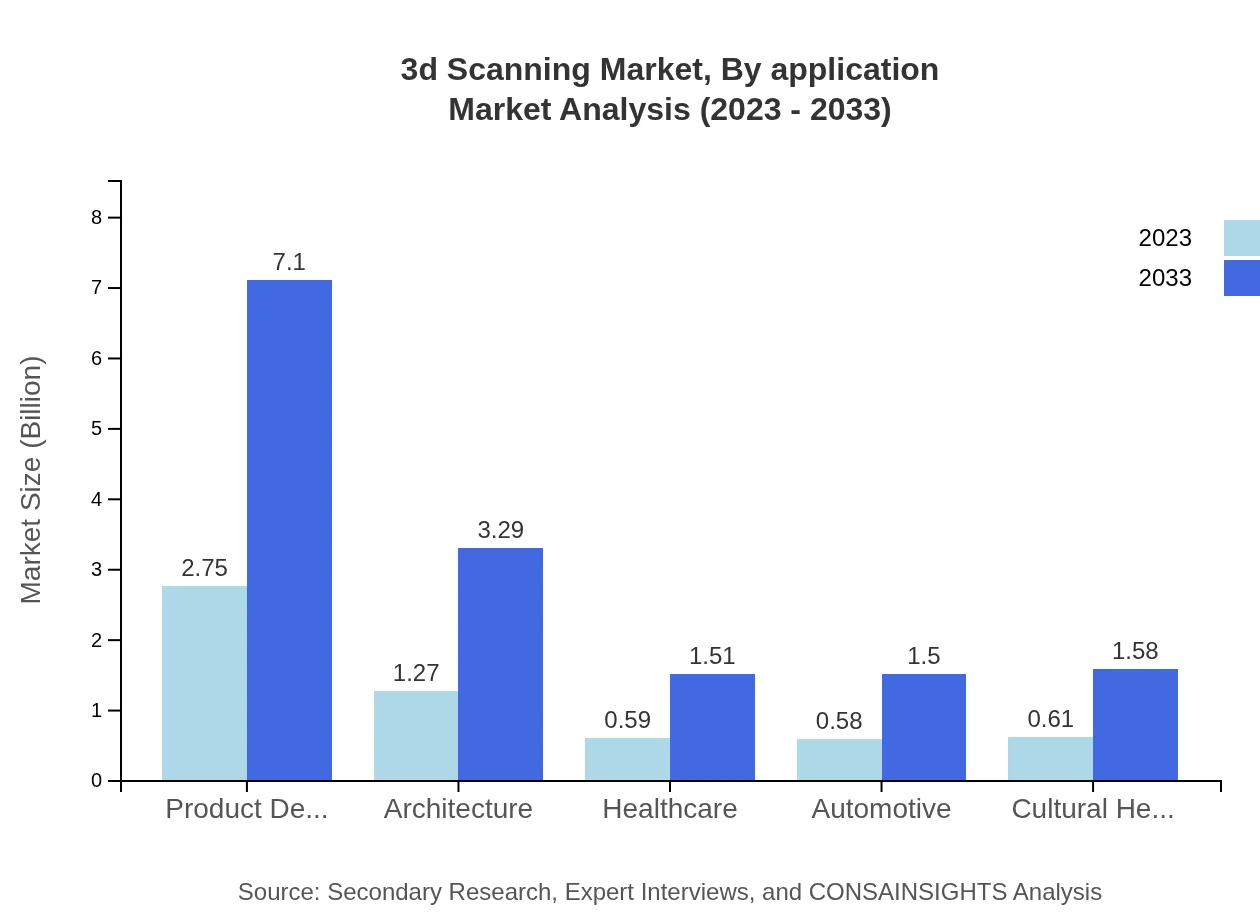

3d Scanning Market Analysis By Application

Examining the market by applications, manufacturing holds the largest share, beginning at $2.75 billion in 2023 and forecasted to grow to $7.10 billion by 2033, representing 47.37% of the market. Other notable applications include construction, healthcare, and education, which, despite smaller initial market sizes ($1.27 billion, $0.59 billion, and $0.61 billion respectively in 2023), show promising growth trajectories as industries adopt 3D scanning for enhanced outcomes in design and validation.

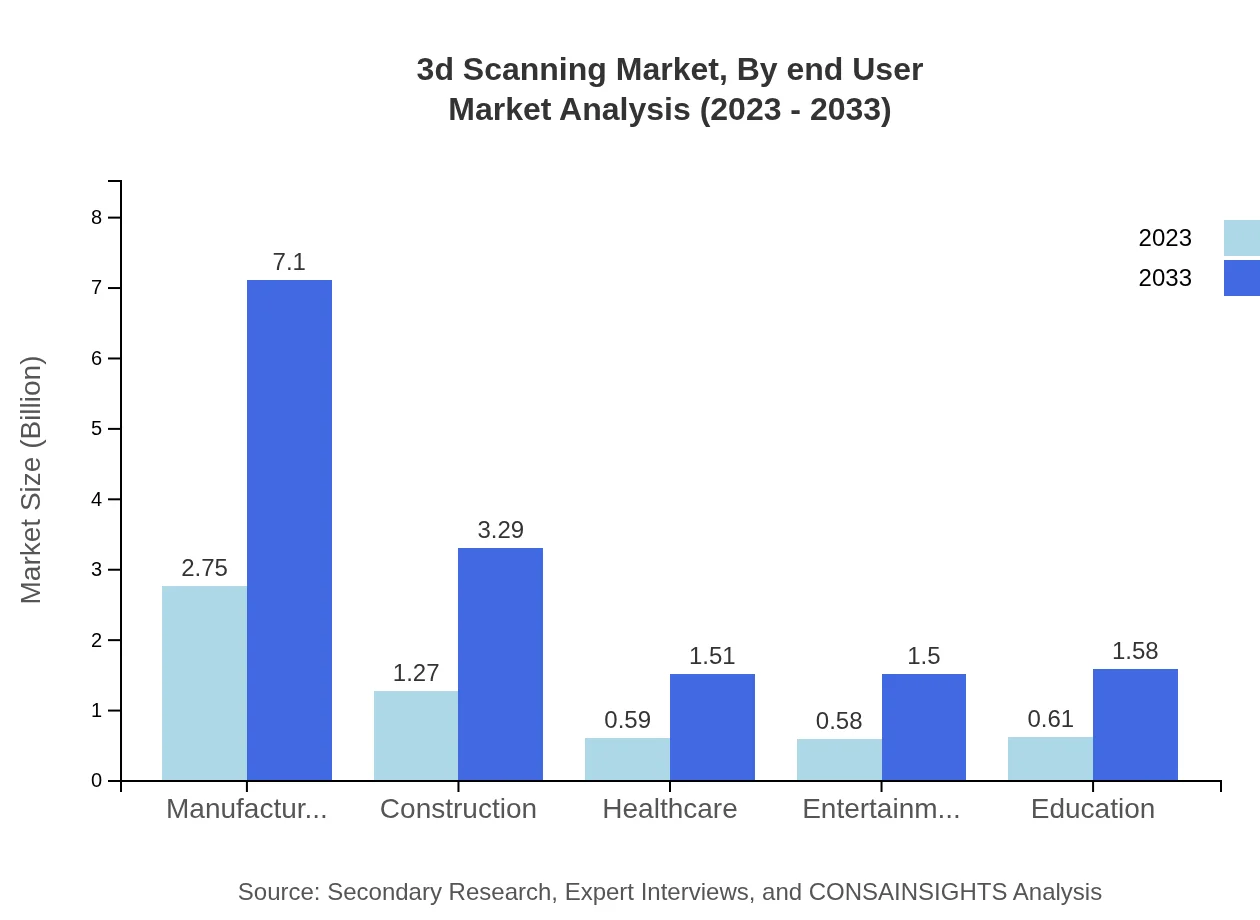

3d Scanning Market Analysis By End User

The end-user industry analysis shows that the manufacturing sector utilizes 3D scanning extensively, starting with a market share of 47.37% in 2023 and remaining substantial by 2033. The construction industry accounts for 21.95% of the market initially, with expected growth driven by demand for precision modeling. A diverse array of end users, including healthcare and automotive, helps diversify and stabilize the 3D scanning market.

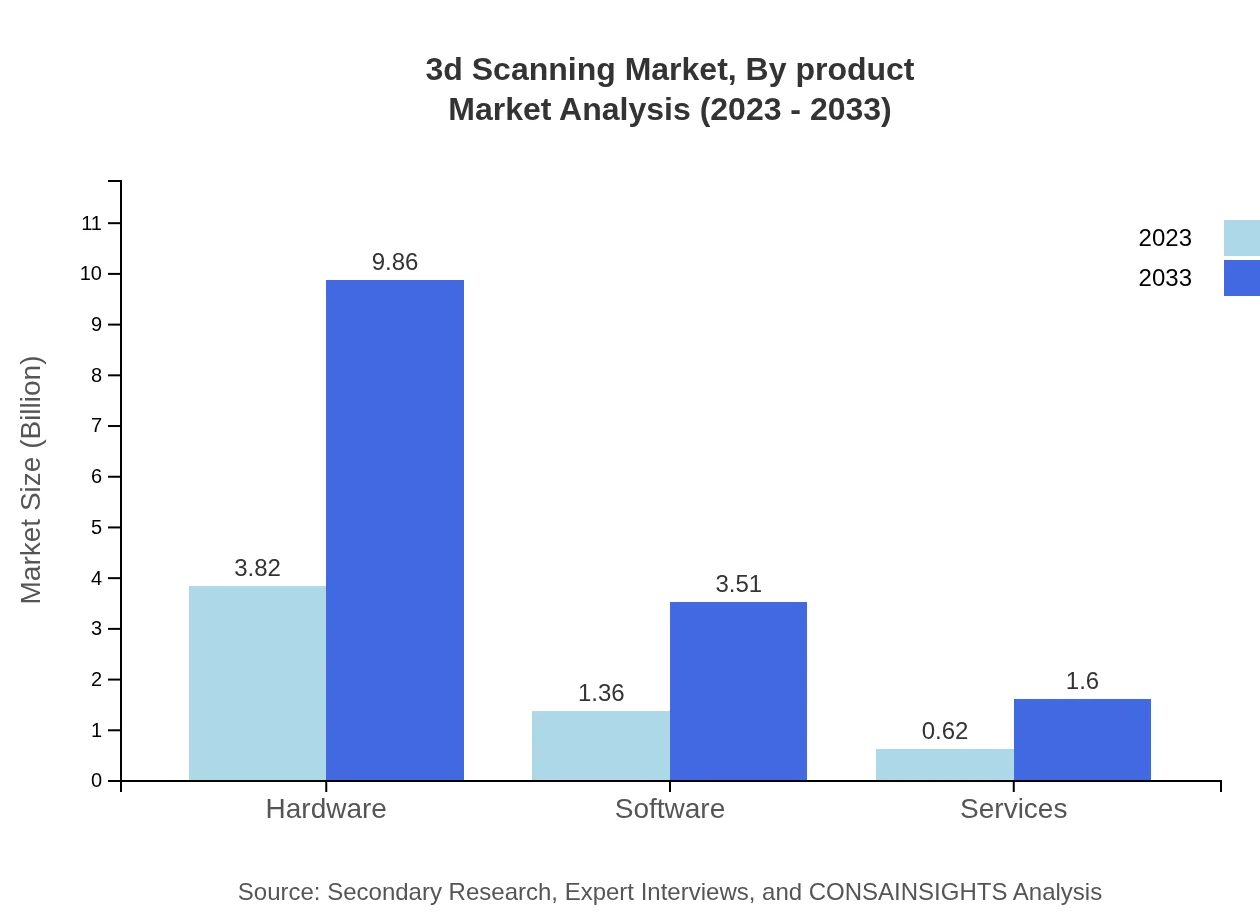

3d Scanning Market Analysis By Product

Product analysis reveals that hardware components dominate the market, anticipated to maintain a leading position with a size of $3.82 billion in 2023, rising to $9.86 billion by 2033. Software and services also exhibit significant roles, with software beginning at $1.36 billion and services at $0.62 billion, showcasing how each product category contributes to the broad adoption of 3D scanning technologies across sectors.

3D Scanning Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3D Scanning Industry

Hexagon AB:

A leading global provider of engineering and geospatial solutions, Hexagon AB offers advanced 3D scanning technologies for various applications, including manufacturing and construction.Faro Technologies, Inc.:

Faro Technologies specializes in 3D measurement and imaging solutions, providing high-precision laser scanners widely used in architecture, engineering, and construction.Creaform Inc.:

Creaform is known for developing portable 3D scanning technology and software, catering mainly to the industrial sector for quality control and product development.Leica Geosystems AG:

Part of Hexagon, Leica Geosystems is a prominent player in the 3D scanning market, delivering reliable hardware and software solutions that enhance survey and construction workflows.3D Systems Corporation:

3D Systems offers a comprehensive portfolio of 3D scanning products, focusing on combining scanners with software solutions for a more streamlined approach to 3D modeling.We're grateful to work with incredible clients.

FAQs

What is the market size of 3D scanning?

The 3D scanning market is valued at $5.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.6%. This growth is fueled by increasing applications in various sectors such as manufacturing, healthcare, and construction.

What are the key market players or companies in the 3D scanning industry?

The 3D scanning industry features major players such as FARO Technologies, Hexagon AB, Trimble Inc., 3D Systems Corporation, and Nikon Metrology. These companies lead the market by offering innovative scanning solutions and technologies.

What are the primary factors driving the growth in the 3D scanning industry?

Key factors driving the growth of the 3D scanning industry include the rapid adoption of 3D technology in manufacturing, advancements in scanning technologies, increasing demand for accurate measurement and inspection, and the growing trend of digitization in various sectors.

Which region is the fastest Growing in the 3D scanning?

North America is the fastest-growing region in the 3D scanning market, with the market expected to increase from $1.90 billion in 2023 to $4.90 billion by 2033. Europe and Asia Pacific are also leading regions contributing significantly to market expansion.

Does ConsaInsights provide customized market report data for the 3D scanning industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the 3D scanning industry. Clients can request personalized insights and detailed analyses based on unique criteria or market segments.

What deliverables can I expect from this 3D scanning market research project?

Deliverables from the 3D scanning market research project may include comprehensive market size reports, segmentation analysis, competitive landscape, trend identification, and forecasts. Additionally, custom insights can be provided to assist strategic decision-making.

What are the market trends of 3D scanning?

Current trends in the 3D scanning market include growing integration of AI technologies, increased use in construction and architecture, mobile scanning solutions, and enhanced user capabilities with software tools for better data visualization and management.