3d Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 3D sensor market, offering insights into market size, growth potential, regional performance, technology trends, and major players. The forecast covers a period from 2023 to 2033.

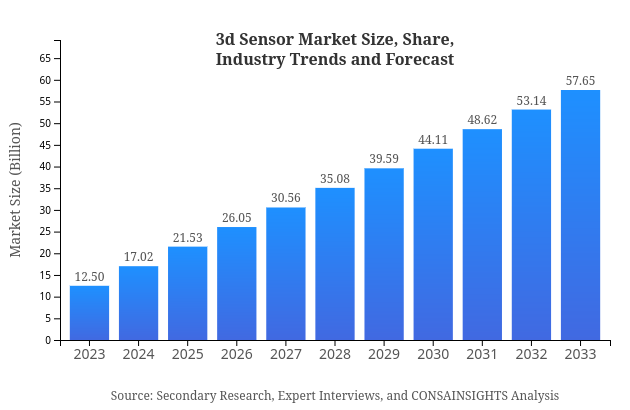

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 15.7% |

| 2033 Market Size | $57.65 Billion |

| Top Companies | Texas Instruments, Intel Corporation, Sony Corporation, LeddarTech, Cognex Corporation |

| Last Modified Date | 15 November 2024 |

3D Sensor Market Overview

What is the Market Size & CAGR of the 3D Sensor market in 2023?

3D Sensor Industry Analysis

3D Sensor Market Segmentation and Scope

Request a custom research report for industry.

3D Sensor Market Analysis Report by Region

Europe 3d Sensor Market Report:

The European market is anticipated to grow from $4.09 billion in 2023 to $18.88 billion by 2033, propelled by stringent regulations in sectors like automotive and healthcare, which demand advanced sensing solutions for enhanced safety and accuracy.Asia Pacific 3d Sensor Market Report:

In Asia Pacific, the market for 3D sensors is expected to grow from $2.28 billion in 2023 to $10.53 billion by 2033, reflecting a significant rise due to increased investments in smart technologies and a thriving manufacturing base in countries like China and Japan.North America 3d Sensor Market Report:

North America leads the 3D sensor market, projected to expand from $4.29 billion in 2023 to $19.78 billion by 2033. High demand from the automotive sector and advancements in consumer electronics drive this growth, along with strong government support for technological innovation.South America 3d Sensor Market Report:

The South American market, albeit smaller, is predicted to increase from $0.16 billion in 2023 to $0.73 billion by 2033. This growth can be attributed to the gradual adoption of automation and technological advancements in sectors like mining and agriculture.Middle East & Africa 3d Sensor Market Report:

The Middle East and Africa region is expected to see growth from $1.68 billion in 2023 to $7.74 billion by 2033. The rise in technological adoption and infrastructure development across various sectors are key contributors to this market expansion.Request a custom research report for industry.

3d Sensor Market Analysis By Technology

Global 3D Sensor Market, By Technology Market Analysis (2024 - 2033)

The 3D sensor market can be analyzed by technology types, which include Time of Flight (ToF), Laser Scanning, and Structured Light. The ToF segment is dominant in market size, expected to grow from $7.75 billion in 2023 to $35.77 billion in 2033, representing 62.04% market share. Laser scanning and structured light follow, holding significant shares, indicative of their broad applicability in various sectors.

3d Sensor Market Analysis By Application

Global 3D Sensor Market, By Application Market Analysis (2024 - 2033)

Applications of 3D sensors include automotive, healthcare, industrial, consumer electronics, and aerospace, with automotive applications projected to grow from $6.02 billion in 2023 to $27.78 billion by 2033, constituting approximately 48.18% of the market. Healthcare applications also showcase promising growth, highlighting the technology's versatility.

3d Sensor Market Analysis By End User

Global 3D Sensor Market, By End-User Industry Market Analysis (2024 - 2033)

End-user industries such as manufacturing, retail, healthcare, and aerospace employ 3D sensors for enhanced functional capabilities. The manufacturing sector stands out with a forecasted growth from $2.65 billion in 2023 to $12.22 billion by 2033, emphasizing the technology's role in improving operational efficiencies.

3d Sensor Market Analysis By Sensor Type

Global 3D Sensor Market, By Sensor Type Market Analysis (2024 - 2033)

Sensor types, including image sensors, proximity sensors, and depth sensors, play a crucial role in the 3D sensor landscape. Image sensors, for example, are expected to grow from $7.75 billion in 2023 to $35.77 billion by 2033, holding the largest share at 62.04%, indicating their prominent use in various applications.

3D Sensor Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in 3D Sensor Industry

Texas Instruments:

A leading technology company, Texas Instruments focuses on developing innovative semiconductor solutions including advanced 3D sensing technologies utilized in various applications such as automotive and industrial sectors.Intel Corporation:

Intel is a pioneering company in the technology sector, investing heavily in 3D sensing technologies for applications that require high performance and accuracy, catering to industries such as robotics, automotive, and consumer electronics.Sony Corporation:

Sony is renowned for its advanced imaging sensors and has significantly contributed to the 3D sensor market, providing innovative solutions for gaming, smartphones, and automotive applications.LeddarTech:

LeddarTech specializes in environmental sensing solutions, particularly their 3D LiDAR technology that enhances various applications in automotive safety and smart transportation systems.Cognex Corporation:

Cognex is a leader in machine vision systems, offering robust 3D sensors that enhance manufacturing processes and quality control in industrial applications.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of 3D Sensor?

The 3D sensor market is currently valued at approximately $12.5 billion with a projected compound annual growth rate (CAGR) of 15.7% from 2023 to 2033, indicating substantial growth potential in the upcoming years.

What are the key players or companies in the 3D Sensor industry?

Key players in the 3D sensor market include prominent organizations like Texas Instruments, Lumentum Holdings, and OmniVision Technologies, among others, whose innovations drive advancements and shape industry trends.

What are the primary factors driving the growth in the 3D sensor industry?

The growth of the 3D sensor market is primarily driven by advancements in automation, increasing demand in automotive applications, and enhanced capabilities in consumer electronics, alongside rising investments in R&D.

Which region is the fastest Growing in the 3D Sensor market?

The North American region is the fastest-growing market for 3D sensors, expected to expand from $4.29 billion in 2023 to $19.78 billion by 2033, showcasing remarkable growth opportunities in technology applications.

Does ConsaInsights provide customized market report data for the 3D Sensor industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the 3D sensor industry, providing in-depth insights and analysis that are crucial for strategic decision-making.

What deliverables can I expect from this 3D Sensor market research project?

Deliverables from this market research project will include comprehensive reports, actionable insights, segment analysis, growth forecasts, and recommendations tailored to enhance strategic initiatives in the 3D sensor industry.

What are the market trends of 3D Sensor?

Current trends in the 3D sensor market include the rise of AI and machine learning integrations, increased focus on automation in manufacturing, and growing applications in healthcare, enhancing overall demand in various sectors.