5g Testing Equipment Market Report

Published Date: 31 January 2026 | Report Code: 5g-testing-equipment

5g Testing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the 5G Testing Equipment market, covering insights on market size, segments, regional analysis, and trends for the forecast period from 2023 to 2033.

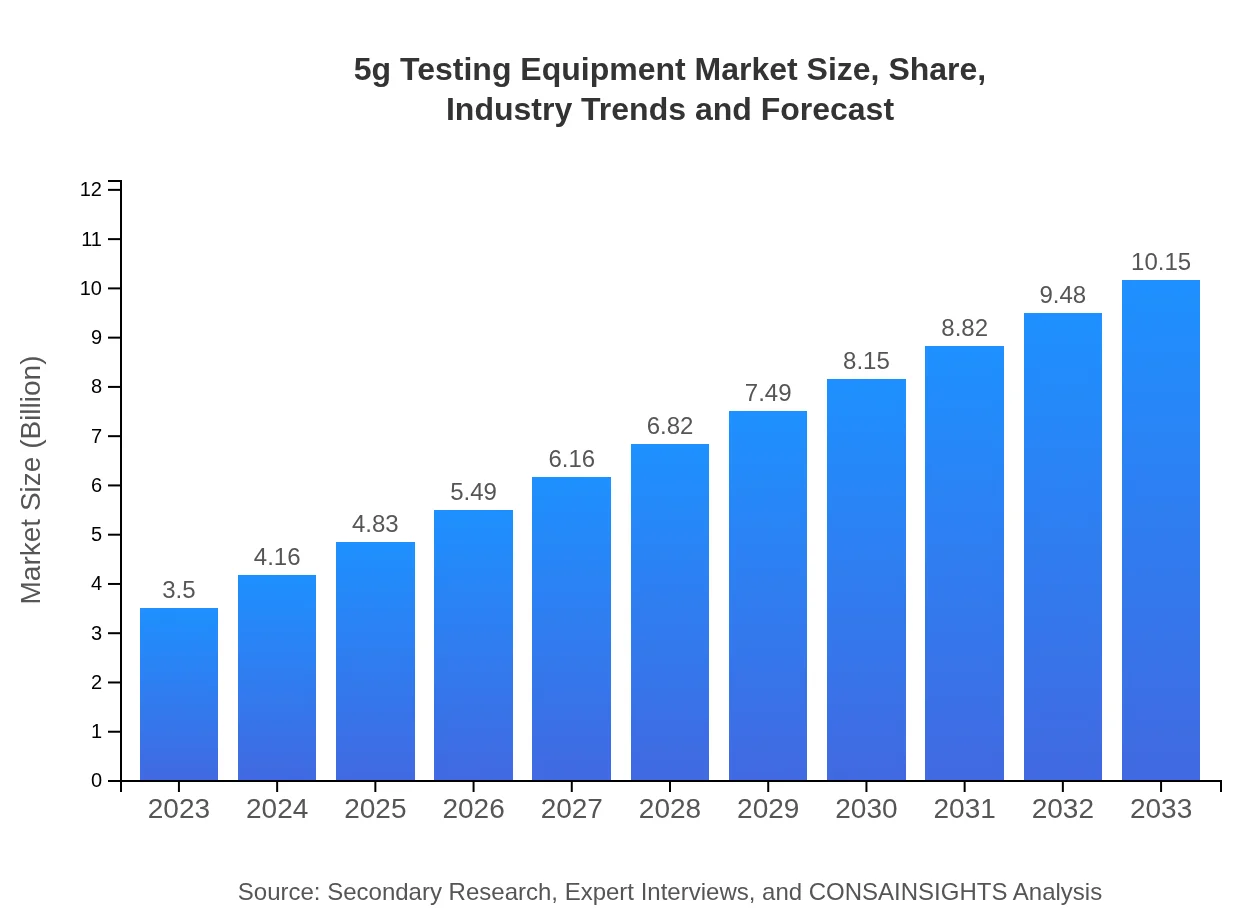

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 10.8% |

| 2033 Market Size | $10.15 Billion |

| Top Companies | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, Spirent Communications, Viavi Solutions Inc. |

| Last Modified Date | 31 January 2026 |

5g Testing Equipment Market Overview

Customize 5g Testing Equipment Market Report market research report

- ✔ Get in-depth analysis of 5g Testing Equipment market size, growth, and forecasts.

- ✔ Understand 5g Testing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 5g Testing Equipment

What is the Market Size & CAGR of 5g Testing Equipment market in 2023?

5g Testing Equipment Industry Analysis

5g Testing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

5g Testing Equipment Market Analysis Report by Region

Europe 5g Testing Equipment Market Report:

In Europe, the market is projected to grow from $0.89 billion in 2023 to $2.57 billion by 2033. The region is experiencing a shift toward advanced testing technologies to meet stringent compliance and performance standards. Increased collaboration between government bodies and private sectors to establish interconnected frameworks is also boosting growth.Asia Pacific 5g Testing Equipment Market Report:

The Asia Pacific region is expected to experience significant growth in the 5G Testing Equipment market, with a market size of approximately $0.72 billion in 2023, projected to reach around $2.08 billion by 2033. Rapid technological advancements, coupled with government initiatives to promote digital infrastructure, are major driving forces. Countries like China, Japan, and South Korea are leading this growth due to their status as early adopters of 5G technology.North America 5g Testing Equipment Market Report:

North America currently holds a leading position in the 5G Testing Equipment market, valued at $1.33 billion in 2023 and expected to grow to approximately $3.87 billion by 2033. A strong focus on innovation, extensive R&D activities, and the presence of major telecommunications companies drive market growth. The U.S. is expected to maintain its dominance due to aggressive rollout plans for 5G services across various sectors.South America 5g Testing Equipment Market Report:

In South America, the 5G Testing Equipment market is set to grow from $0.28 billion in 2023 to $0.82 billion by 2033. Factors contributing to this growth include increasing investments in telecommunications infrastructure and the gradual shift towards modernized digital ecosystems. Brazil and Argentina are anticipated to be key players in this transformation as they enhance their network capabilities.Middle East & Africa 5g Testing Equipment Market Report:

The Middle East and Africa region is predicted to grow from $0.28 billion in 2023 to $0.80 billion by 2033. The focus on developing smart cities, along with various governments investing in 5G technology, is providing a positive outlook for the 5G Testing Equipment market. Despite challenges related to regulatory hurdles and technological integration, countries like the UAE and South Africa are making strides in 5G adoption.Tell us your focus area and get a customized research report.

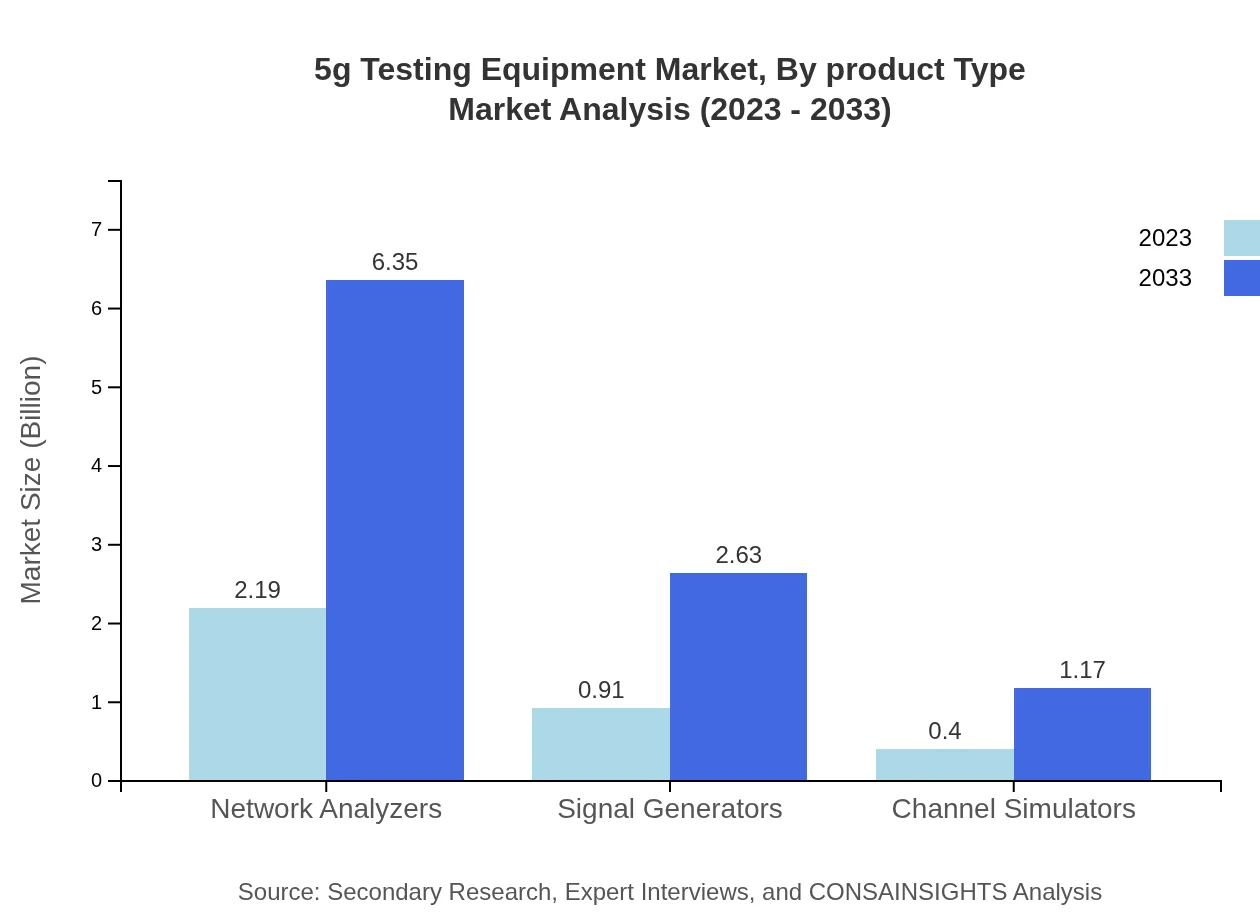

5g Testing Equipment Market Analysis By Product Type

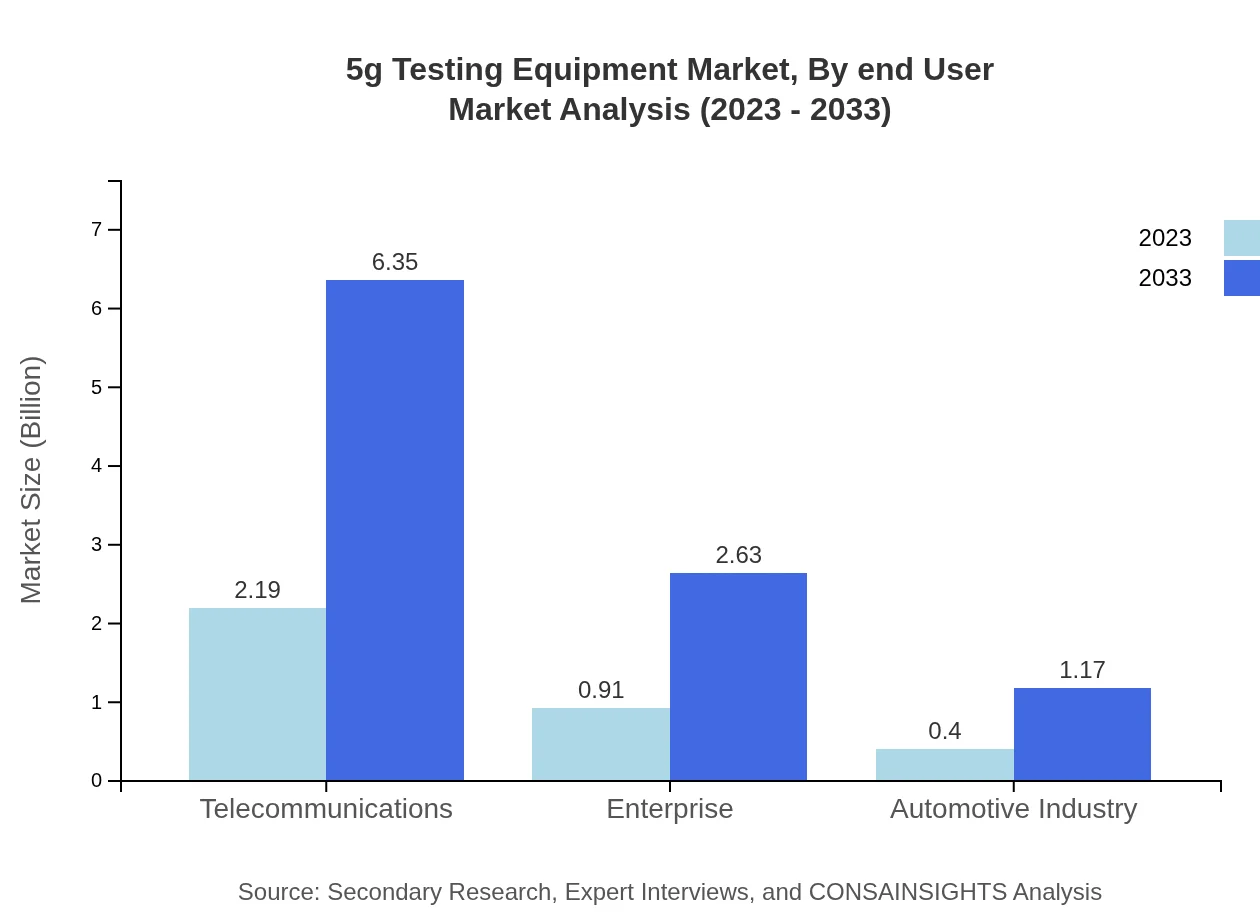

In 2023, the telecommunications segment leads the market with a size of $2.19 billion, expected to grow to $6.35 billion by 2033, capturing a significant share of 62.58%. The enterprise segment follows closely with a projected market growth from $0.91 billion in 2023 to $2.63 billion by 2033, representing approximately 25.88% of the market share. Other significant segments include automotive testing, which is expected to rise from $0.40 billion to $1.17 billion and is notable for its 11.54% share.

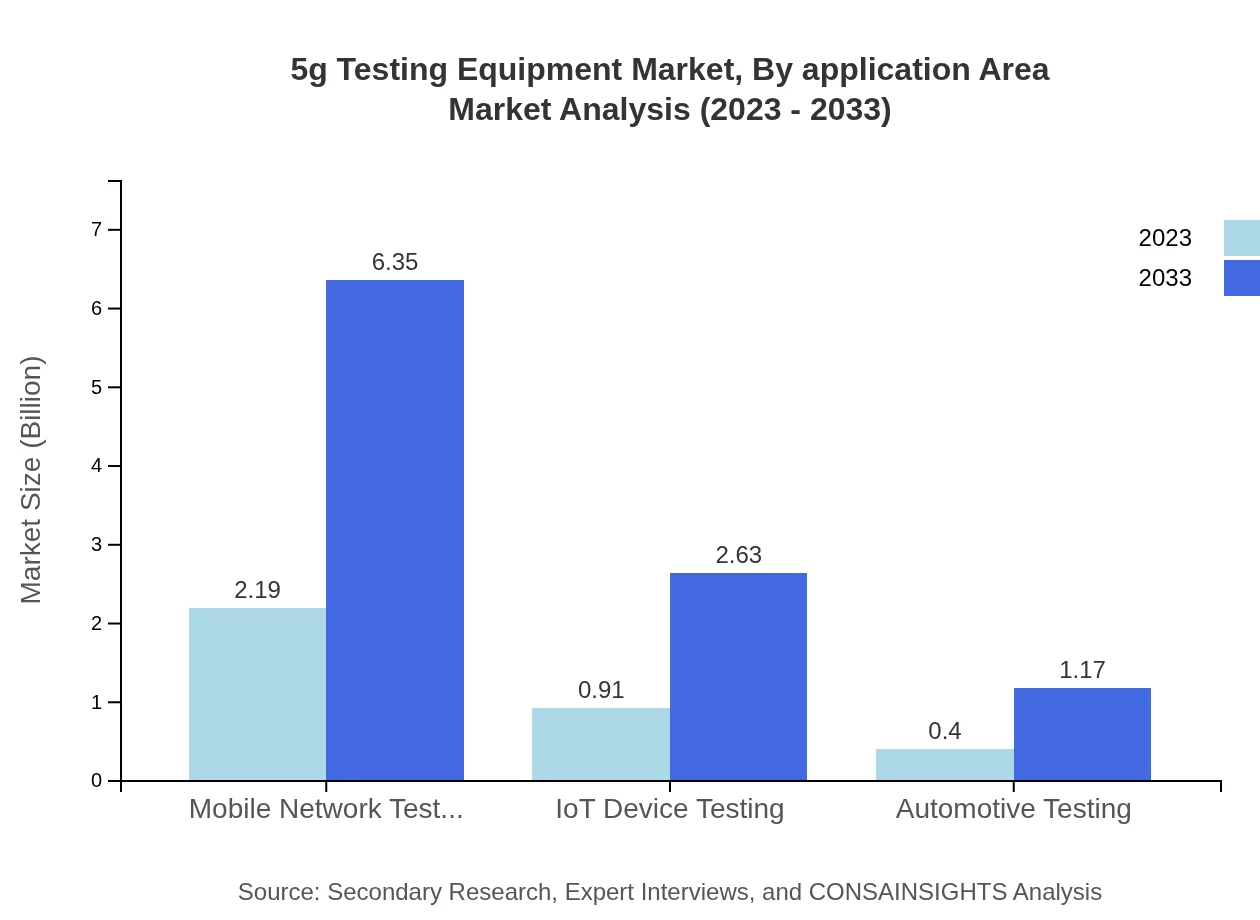

5g Testing Equipment Market Analysis By Application Area

The 5G Testing Equipment market, by application area, showcases critical growth in mobile network testing, expected to grow from $2.19 billion in 2023 to $6.35 billion by 2033. This area comprises a hefty share of 62.58%. IoT Device Testing follows at $0.91 billion, projected to reach $2.63 billion, representing a stable 25.88% share in 2023.

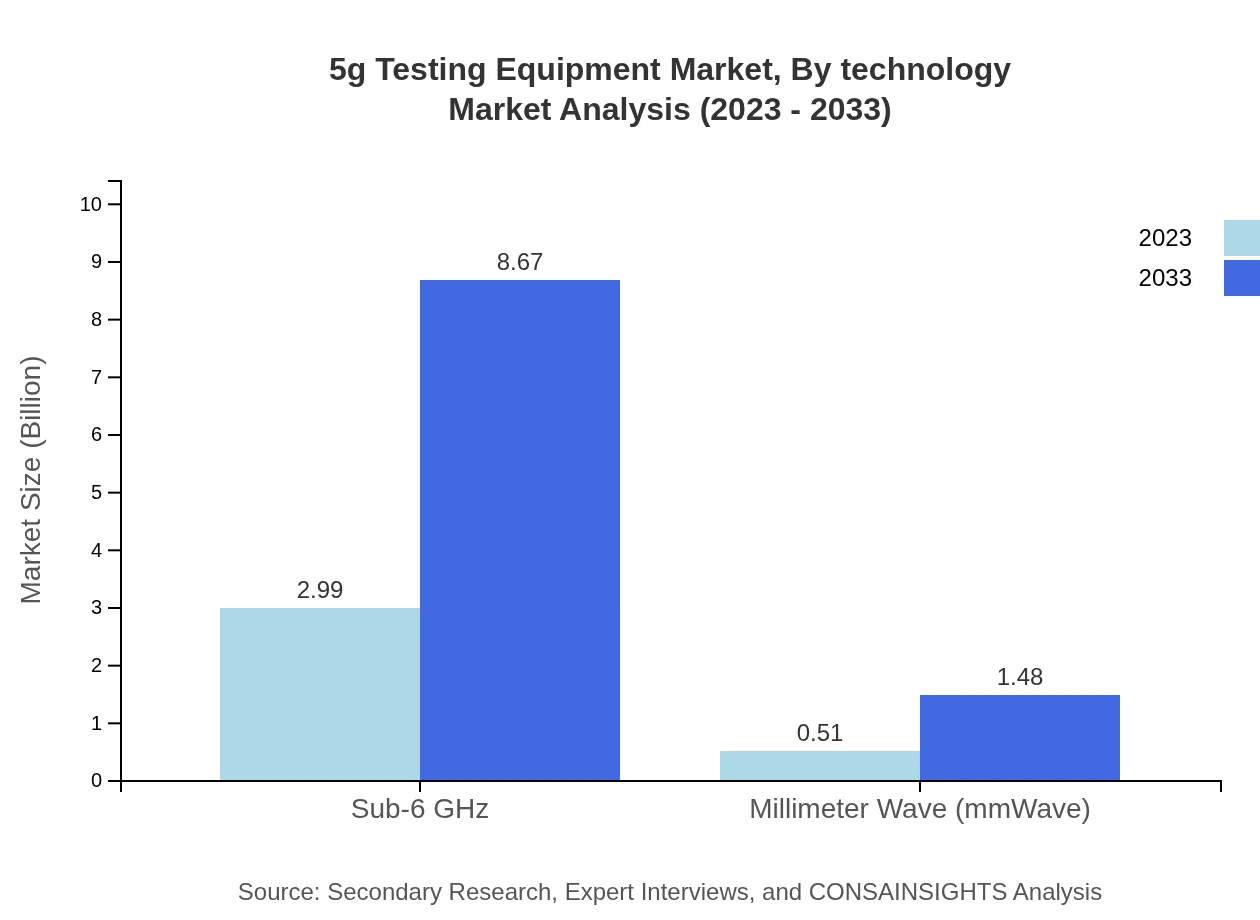

5g Testing Equipment Market Analysis By Technology

The market focusing on Sub-6 GHz technology takes the lion's share, projected to expand from $2.99 billion in 2023 to $8.67 billion by 2033, capturing 85.4% of the market share. Millimeter Wave (mmWave), starting at $0.51 billion, is anticipated to grow to $1.48 billion, holding a smaller yet significant 14.6% of the market.

5g Testing Equipment Market Analysis By End User

End-user demographics indicate a diversified interest, with telecommunications players at the forefront. However, automotive and enterprise sectors are rapidly following, emphasizing the growing need for effective 5G validation tools across various applications. The automotive industry's share is enhancing as vehicle networks become increasingly reliant on 5G connectivity.

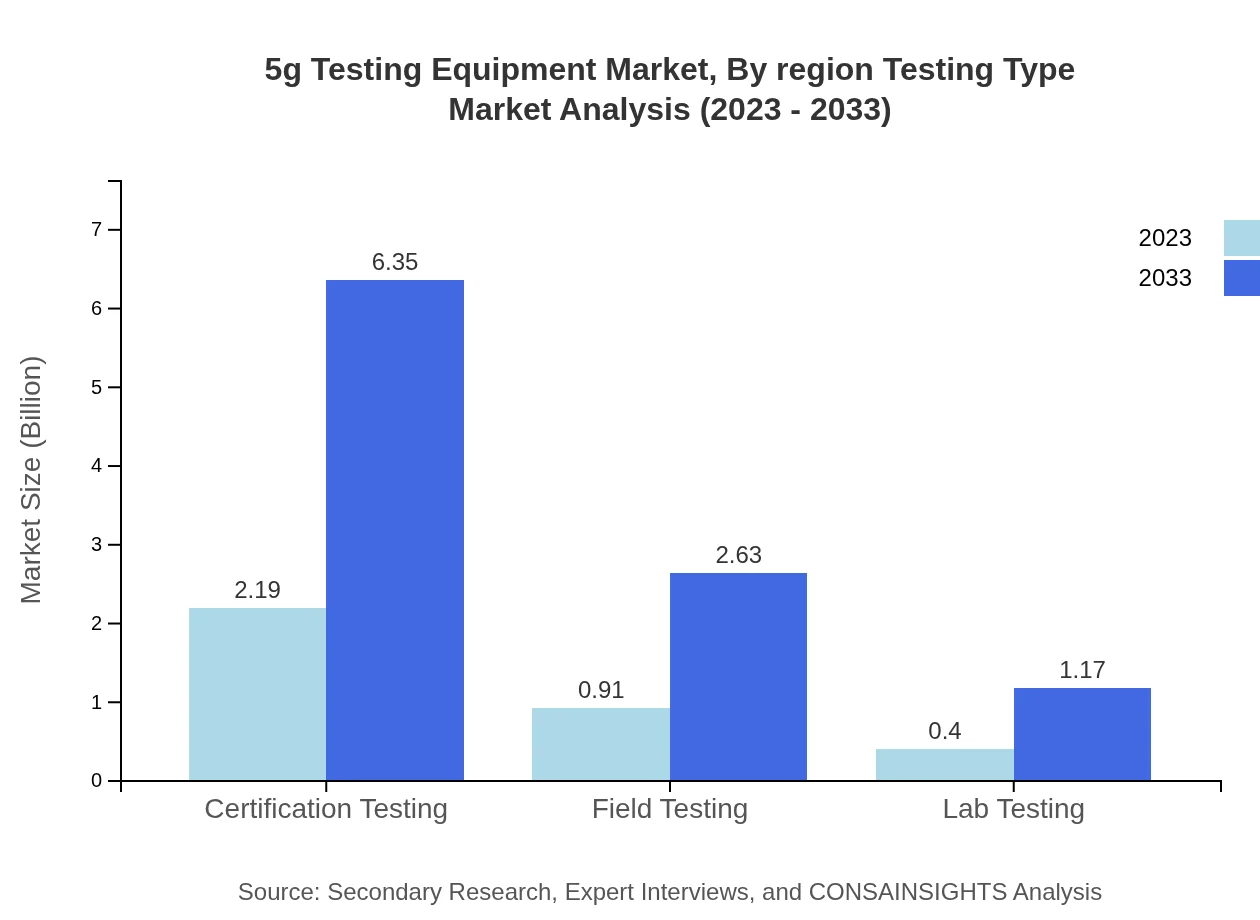

5g Testing Equipment Market Analysis By Region Testing Type

Breaking down by testing type, the Certification Testing segment dominates with a size of $2.19 billion in 2023, expected to maintain its 62.58% share, soaring to $6.35 billion by 2033. Mobile Network Testing plays a crucial role for both telecommunications and enterprise sectors, while lab testing is also gaining traction with growth from $0.40 billion to $1.17 billion.

5g Testing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 5g Testing Equipment Industry

Keysight Technologies:

A pioneer in test and measurement solutions, specializing in 5G testing technologies and services globally.Rohde & Schwarz:

A global leader in mobile communications testing equipment, known for their advanced and precise testing solutions for 5G networks.Anritsu Corporation:

Provides cutting-edge telecommunications testing equipment, focusing on next-generation network deployment and validation.Spirent Communications:

Offers robust testing solutions for 5G networks across various industries, including telecoms and government sectors.Viavi Solutions Inc.:

Delivers smart network solutions and advanced 5G testing applications, enhancing operational performance.We're grateful to work with incredible clients.

FAQs

What is the market size of 5g Testing Equipment?

The market size of 5G testing equipment was valued at approximately $3.5 billion in 2023. It is projected to grow at a compound annual growth rate (CAGR) of 10.8% reaching significant valuation trends as the market evolves by 2033.

What are the key market players or companies in this 5g Testing Equipment industry?

Key players in the 5G testing equipment industry include leading companies such as Rohde & Schwarz, Keysight Technologies, Anritsu Corporation, and Tektronix, all of whom are instrumental in software, hardware, and analytics services essential for 5G deployment.

What are the primary factors driving the growth in the 5g Testing Equipment industry?

The growth of the 5G testing equipment industry is primarily driven by robust advancements in telecommunications infrastructure, increased demand for high-speed networks, the proliferation of IoT devices, and the rising need for network reliability and performance optimization.

Which region is the fastest Growing in the 5g Testing Equipment?

The fastest-growing region in the 5G testing equipment market is North America, projected to grow from $1.33 billion in 2023 to $3.87 billion by 2033. Europe and Asia Pacific are also witnessing significant growth, driven by major 5G deployments.

Does ConsaInsights provide customized market report data for the 5g Testing Equipment industry?

Yes, Consainsights offers customized market report data tailored to the 5G testing equipment industry. Our team collaborates closely with clients to provide reports that meet their specific needs and insights, ensuring relevant and actionable data.

What deliverables can I expect from this 5g Testing Equipment market research project?

Expected deliverables include comprehensive market analysis reports, segmentation data, regional insights, competitive landscape analysis, forecasts, and actionable recommendations that will help stakeholders make informed decisions in the 5G testing equipment space.

What are the market trends of 5g Testing Equipment?

Current market trends include the shift towards automated testing solutions, the growing importance of network slicing, increasing focus on IoT device testing, and the emergence of advanced technologies like AI and machine learning for enhanced network performance.