A Glass Fiber Market Report

Published Date: 02 February 2026 | Report Code: a-glass-fiber

A Glass Fiber Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report explores the A Glass Fiber market, providing insights into market dynamics, size, trends, and projections for the period from 2023 to 2033. Key findings include an analysis of regional and segment performance, along with anticipated future growth opportunities.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Owens Corning, Saint-Gobain |

| Last Modified Date | 02 February 2026 |

A Glass Fiber Market Overview

Customize A Glass Fiber Market Report market research report

- ✔ Get in-depth analysis of A Glass Fiber market size, growth, and forecasts.

- ✔ Understand A Glass Fiber's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in A Glass Fiber

What is the Market Size & CAGR of A Glass Fiber market in 2023?

A Glass Fiber Industry Analysis

A Glass Fiber Market Segmentation and Scope

Tell us your focus area and get a customized research report.

A Glass Fiber Market Analysis Report by Region

Europe A Glass Fiber Market Report:

The European A Glass Fiber market is currently valued at $2.99 billion in 2023 and is expected to reach $4.92 billion by 2033. Environmental regulations and the adoption of sustainable materials are significant drivers in Europe, supporting the adoption of advanced glass fiber composites in automotive and construction applications.Asia Pacific A Glass Fiber Market Report:

In 2023, Asia Pacific’s A Glass Fiber market size is anticipated to be approximately $1.91 billion, projected to grow to $3.14 billion by 2033. This growth is fueled by robust industrial activity, increased construction spending, and the burgeoning automotive sector in countries like China and India, as they focus on infrastructural development and modernization.North America A Glass Fiber Market Report:

North America's A Glass Fiber market is projected to grow from $3.60 billion in 2023 to $5.92 billion by 2033. The region is witnessing a surge in demand from the automotive and aerospace sectors, where glass fibers are increasingly utilized for lightweight construction to meet stringent fuel efficiency standards.South America A Glass Fiber Market Report:

The South American market for A Glass Fiber, valued at $0.45 billion in 2023, is expected to reach $0.74 billion by 2033. The growth in this region is supported by the expanding construction sector and increasing use of glass fiber composites in infrastructure projects, driven by both local demand and international investment.Middle East & Africa A Glass Fiber Market Report:

The A Glass Fiber market in the Middle East and Africa is projected to grow from $1.05 billion in 2023 to $1.73 billion by 2033. The increase in infrastructure developments, particularly in the Gulf Cooperation Council (GCC) countries, and growing investments in renewable energy projects are driving demand for glass fiber-based products.Tell us your focus area and get a customized research report.

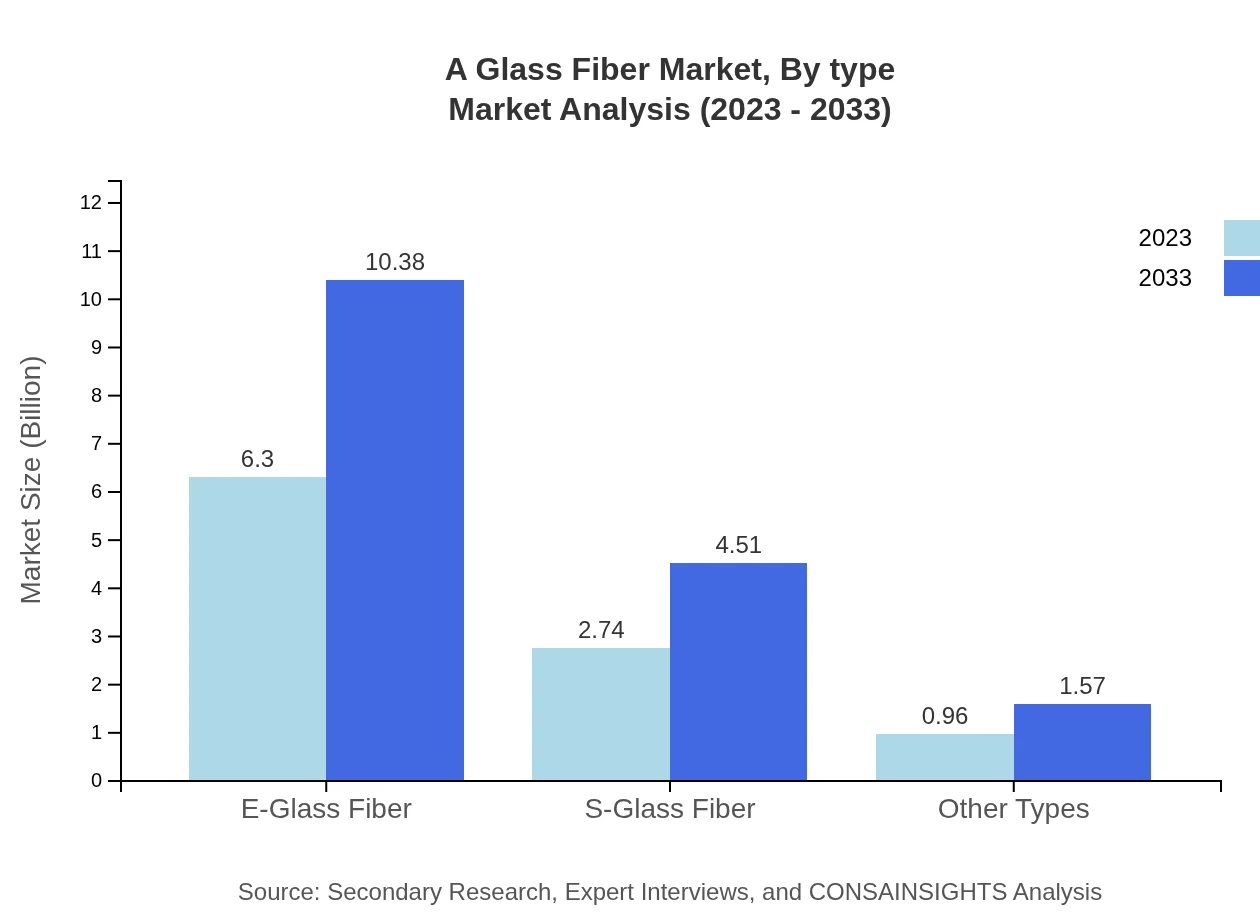

A Glass Fiber Market Analysis By Type

E-Glass Fiber dominates the market with a size of $6.30 billion in 2023 and projected growth to $10.38 billion by 2033, maintaining a market share of 63.05%. S-Glass Fiber is also significant, anticipated to increase from $2.74 billion in 2023 to $4.51 billion in 2033, capturing 27.39% of the market.

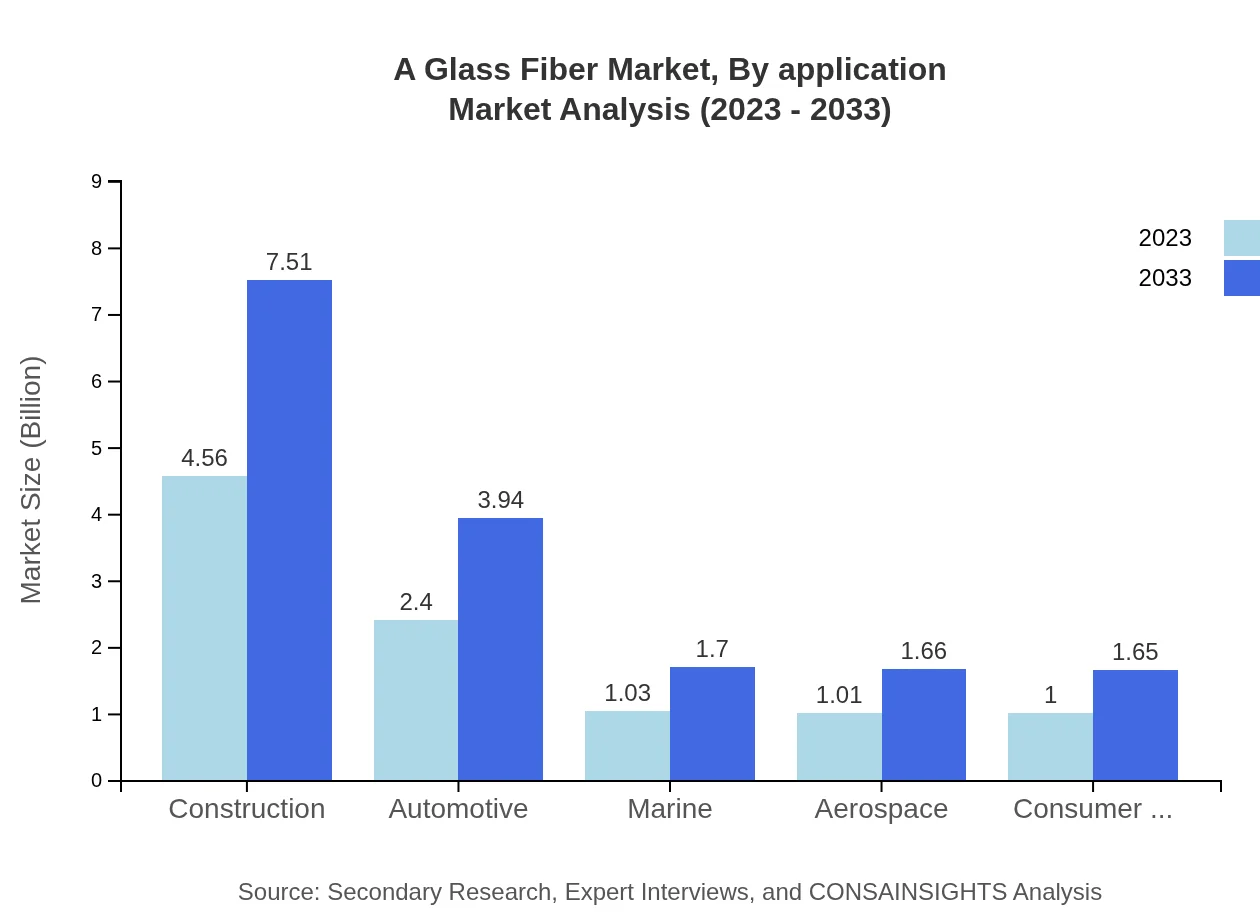

A Glass Fiber Market Analysis By Application

In the construction industry, the market size is pegged at $4.56 billion in 2023, expected to rise to $7.51 billion by 2033, holding a 45.61% share. The automotive industry showcases growth from $2.40 billion to $3.94 billion (23.95% share), while aerospace and marine applications are also significant.

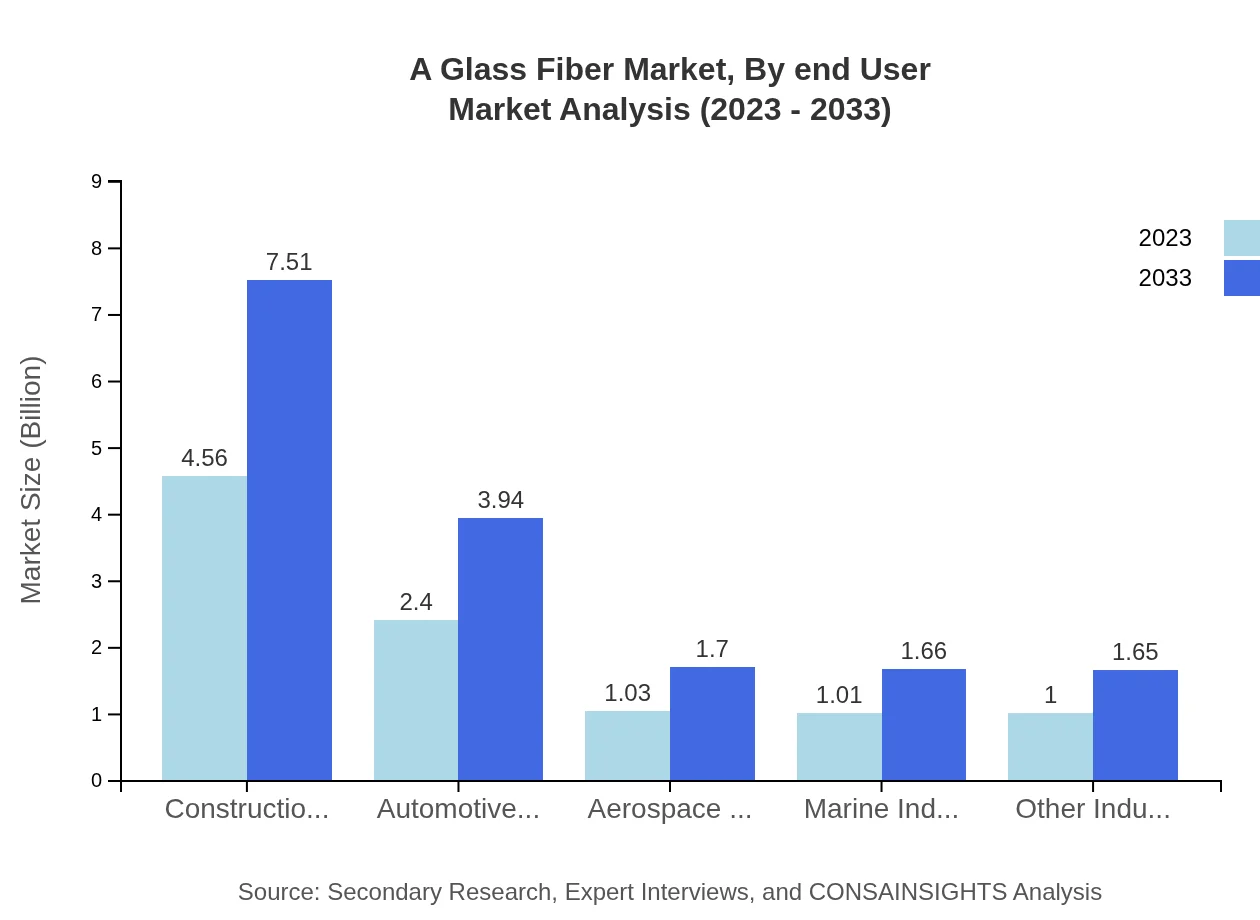

A Glass Fiber Market Analysis By End User

The future for end-user industries paints an optimistic picture for glass fibers, with construction leading the way. The aerospace and automotive sectors continue to leverage advancements in glass fiber technology to meet regulatory demands and enhance performance.

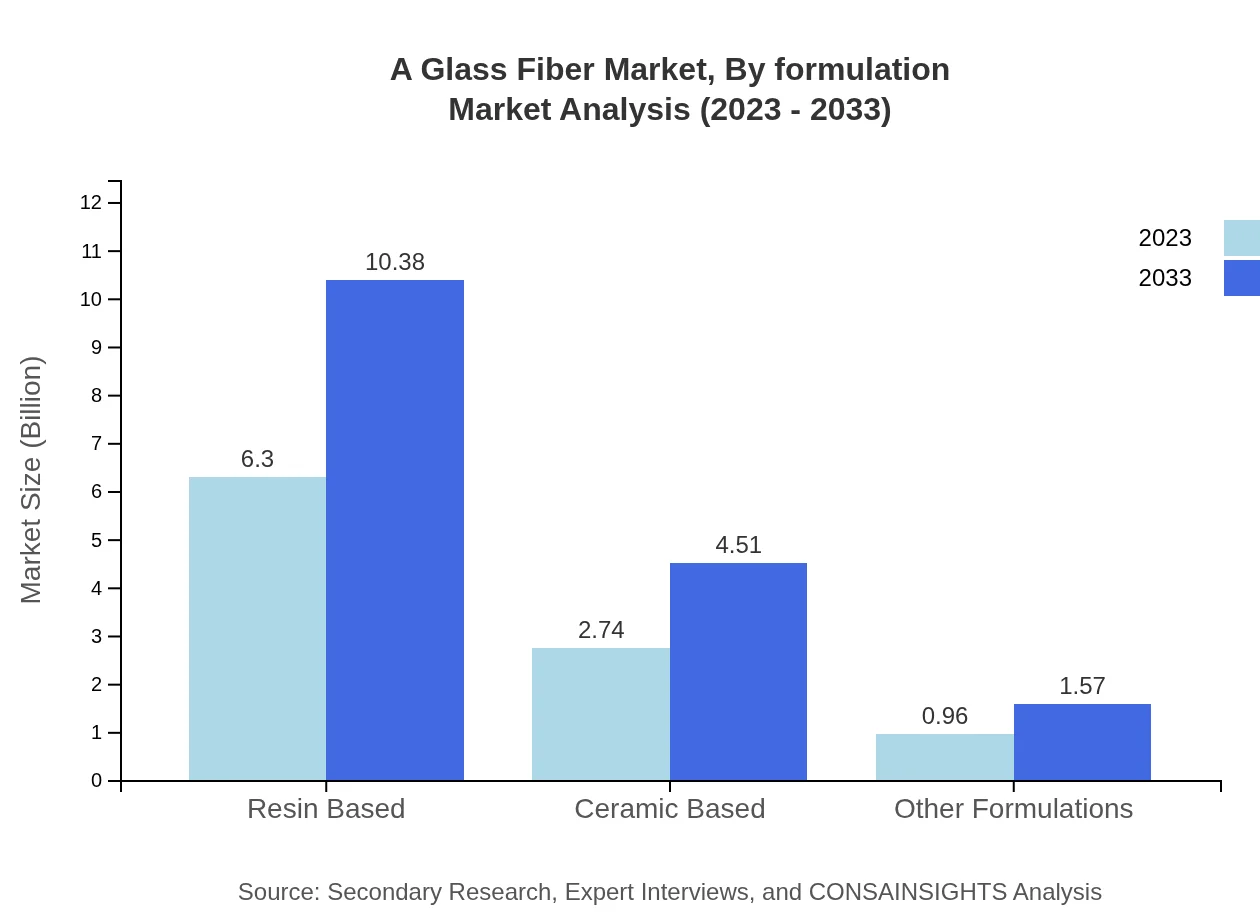

A Glass Fiber Market Analysis By Formulation

Resin-based formulations account for the largest market share, expected to grow from $6.30 billion to $10.38 billion by 2033 (63.05%), while ceramic-based formulations also show substantial growth potential.

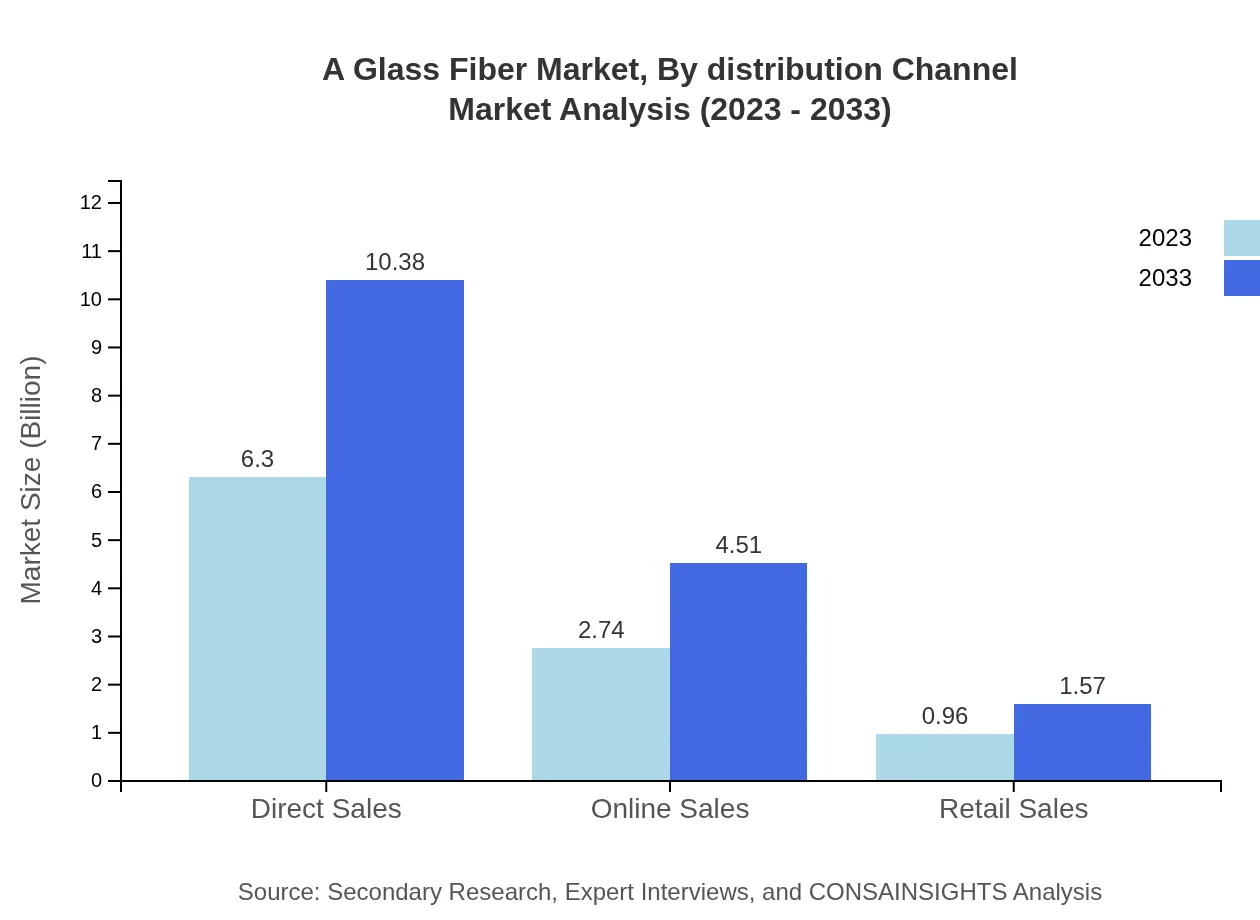

A Glass Fiber Market Analysis By Distribution Channel

Direct sales remain the dominant channel for A Glass Fiber, projected to grow significantly to match market demands, while online sales are expected to gain traction as e-commerce continues to evolve.

A Glass Fiber Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in A Glass Fiber Industry

Owens Corning:

A leading producer of glass fiber composites and insulation products, Owens Corning is known for its innovation in advanced glass fiber technology utilized across various sectors.Saint-Gobain:

Saint-Gobain operates in various segments including construction and automotive, providing high-performance glass fiber solutions and contributing to the sustainability of the materials industry.We're grateful to work with incredible clients.

FAQs

What is the market size of a Glass Fiber?

The global a-glass-fiber market was valued at approximately $10 billion in 2023, with a projected growth rate of 5% CAGR. This indicates a significant demand in various industries, leading to an expected increase in market size by 2033.

What are the key market players or companies in the a Glass Fiber industry?

Key players in the a-glass-fiber market include companies like Owens Corning, Saint-Gobain, Jushi Group, and PPG Industries. These companies drive innovation, supply chain enhancements, and sustainability efforts within the a-glass-fiber industry.

What are the primary factors driving the growth in the a Glass Fiber industry?

Growth in the a-glass-fiber industry is primarily driven by rising demand in construction, automotive, and aerospace sectors. Furthermore, technological advancements and increased application in composite materials play a critical role in boosting market expansion.

Which region is the fastest Growing in the a Glass Fiber?

The Asia Pacific region is identified as the fastest-growing market for a-glass-fiber, with a projected increase from $1.91 billion in 2023 to $3.14 billion by 2033, highlighting the increase in manufacturing and construction activities.

Does ConsaInsights provide customized market report data for the a Glass Fiber industry?

Yes, ConsaInsights offers customized market reports for the a-glass-fiber industry. This includes tailored insights, specific regional data, and segment analyses to meet various client needs and strategic decisions.

What deliverables can I expect from this a Glass Fiber market research project?

Expected deliverables include comprehensive market analysis reports, trend assessments, forecast data, competitive landscape reviews, and insights on customer preferences, all focused on the a-glass-fiber industry.

What are the market trends of a Glass Fiber?

Current market trends in a-glass-fiber include increasing applications in green building materials, rising adoption in composite manufacturing, and advancements in glass fiber technology, all contributing to enhanced product performance.