Ablation Technologies Market Report

Published Date: 31 January 2026 | Report Code: ablation-technologies

Ablation Technologies Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the dynamics of the Ablation Technologies industry from 2023 to 2033, providing insights into market sizing, growth trends, regional analysis, and competitive landscape.

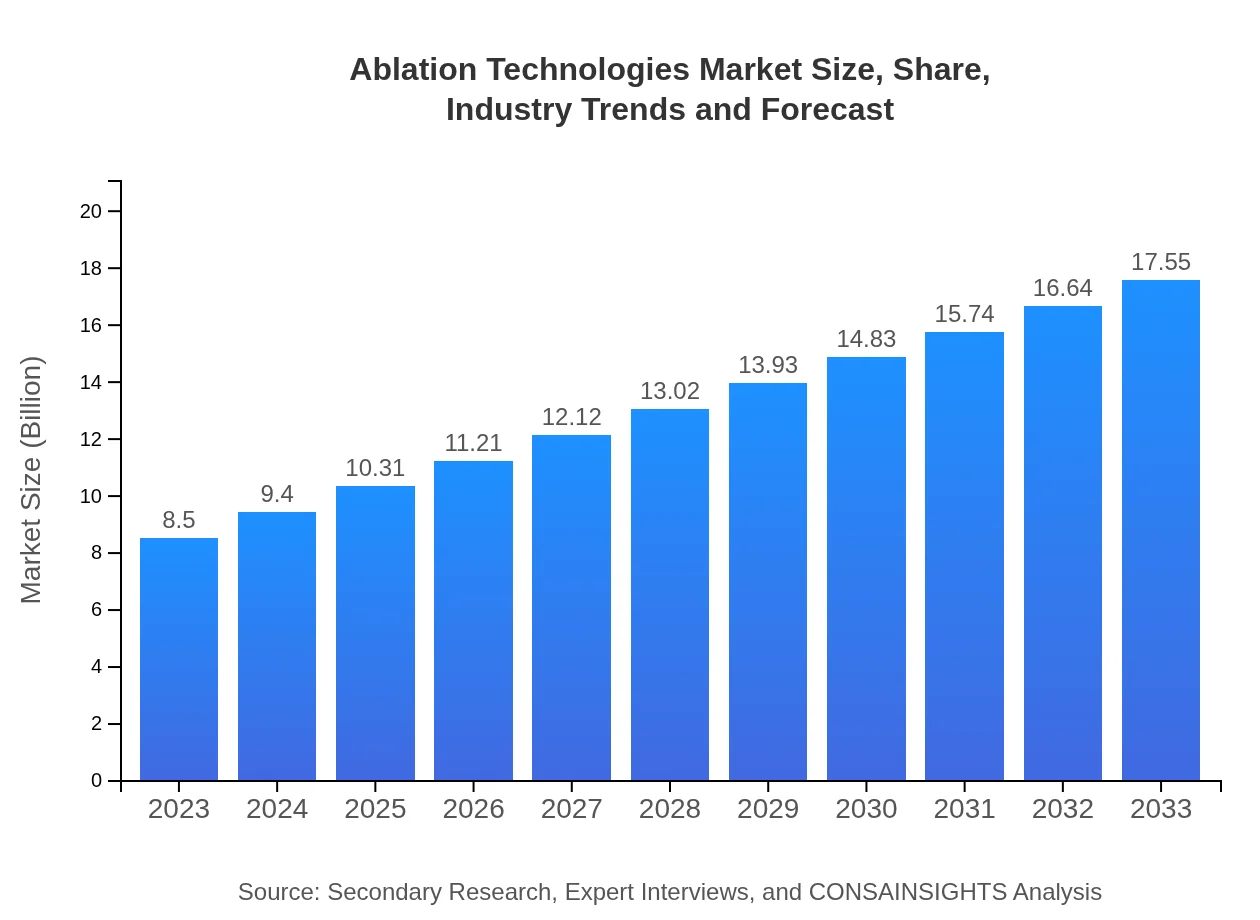

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $17.55 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, AngioDynamics, Hologic, Inc. |

| Last Modified Date | 31 January 2026 |

Ablation Technologies Market Overview

Customize Ablation Technologies Market Report market research report

- ✔ Get in-depth analysis of Ablation Technologies market size, growth, and forecasts.

- ✔ Understand Ablation Technologies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ablation Technologies

What is the Market Size & CAGR of Ablation Technologies market in 2023?

Ablation Technologies Industry Analysis

Ablation Technologies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ablation Technologies Market Analysis Report by Region

Europe Ablation Technologies Market Report:

Europe's market size for Ablation Technologies is estimated at $3.00 billion in 2023, projected to rise to $6.19 billion by 2033. Factors driving growth include regulatory approvals, a strong emphasis on research and development, and increasing incidence of chronic illnesses.Asia Pacific Ablation Technologies Market Report:

The Asia Pacific region is projected to see growth in the Ablation Technologies market, with a size of approximately $1.42 billion in 2023, expected to reach $2.93 billion by 2033. The growth can be attributed to increasing healthcare investments, rising prevalence of chronic diseases, and a growing emphasis on advanced medical technologies.North America Ablation Technologies Market Report:

North America holds a significant share of the Ablation Technologies market, with a size of about $2.86 billion in 2023 and an anticipated size of $5.90 billion by 2033. The region benefits from advanced healthcare facilities, high adoption rates of new technologies, and a large elderly population.South America Ablation Technologies Market Report:

In South America, the Ablation Technologies market size is approximately $0.68 billion in 2023, projected to grow to about $1.41 billion by 2033. Growing healthcare awareness and improvements in healthcare infrastructure are spurring demand across countries in this region.Middle East & Africa Ablation Technologies Market Report:

The Middle East and Africa market is expected to grow from $0.55 billion in 2023 to $1.13 billion by 2033. The growth is influenced by increasing healthcare investments and rising awareness regarding novel therapeutic techniques.Tell us your focus area and get a customized research report.

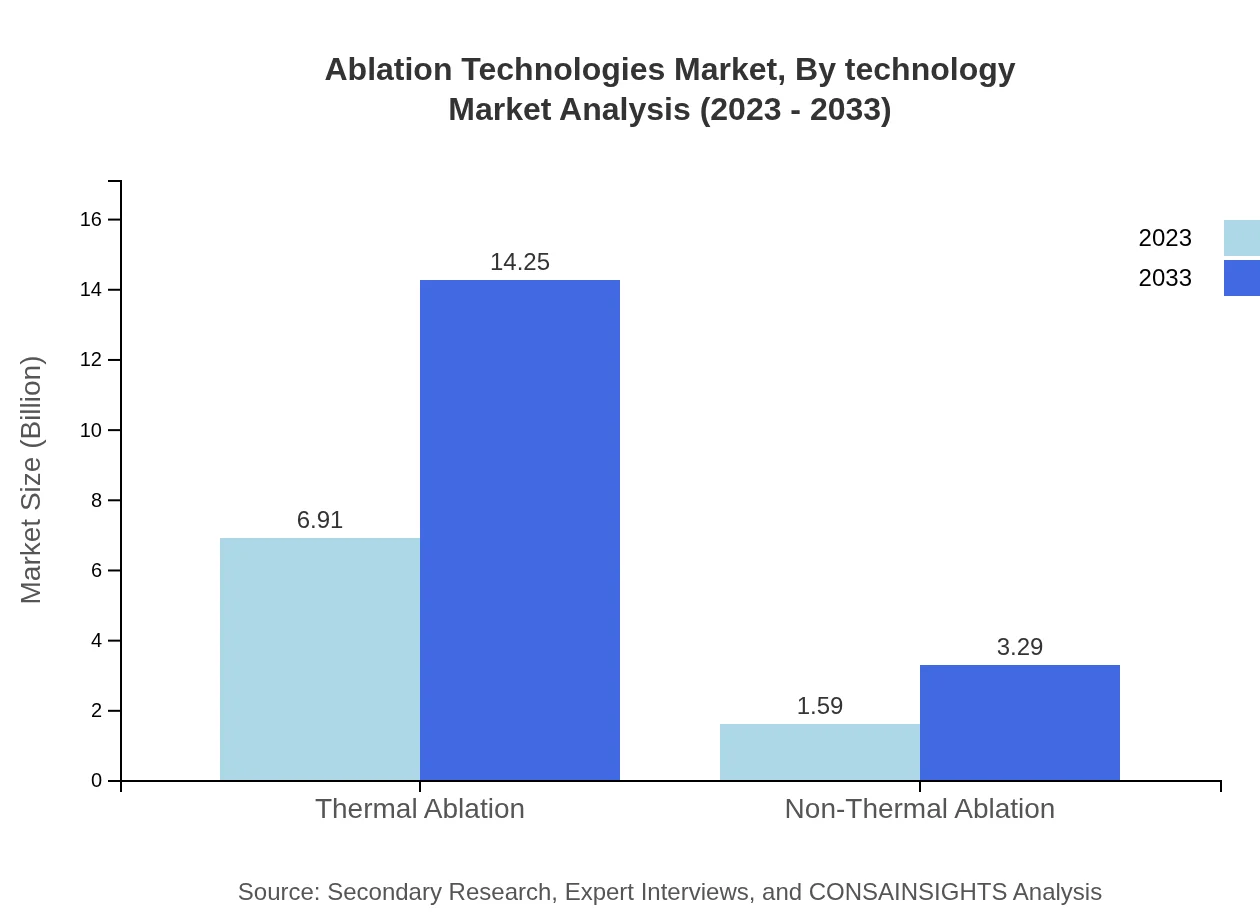

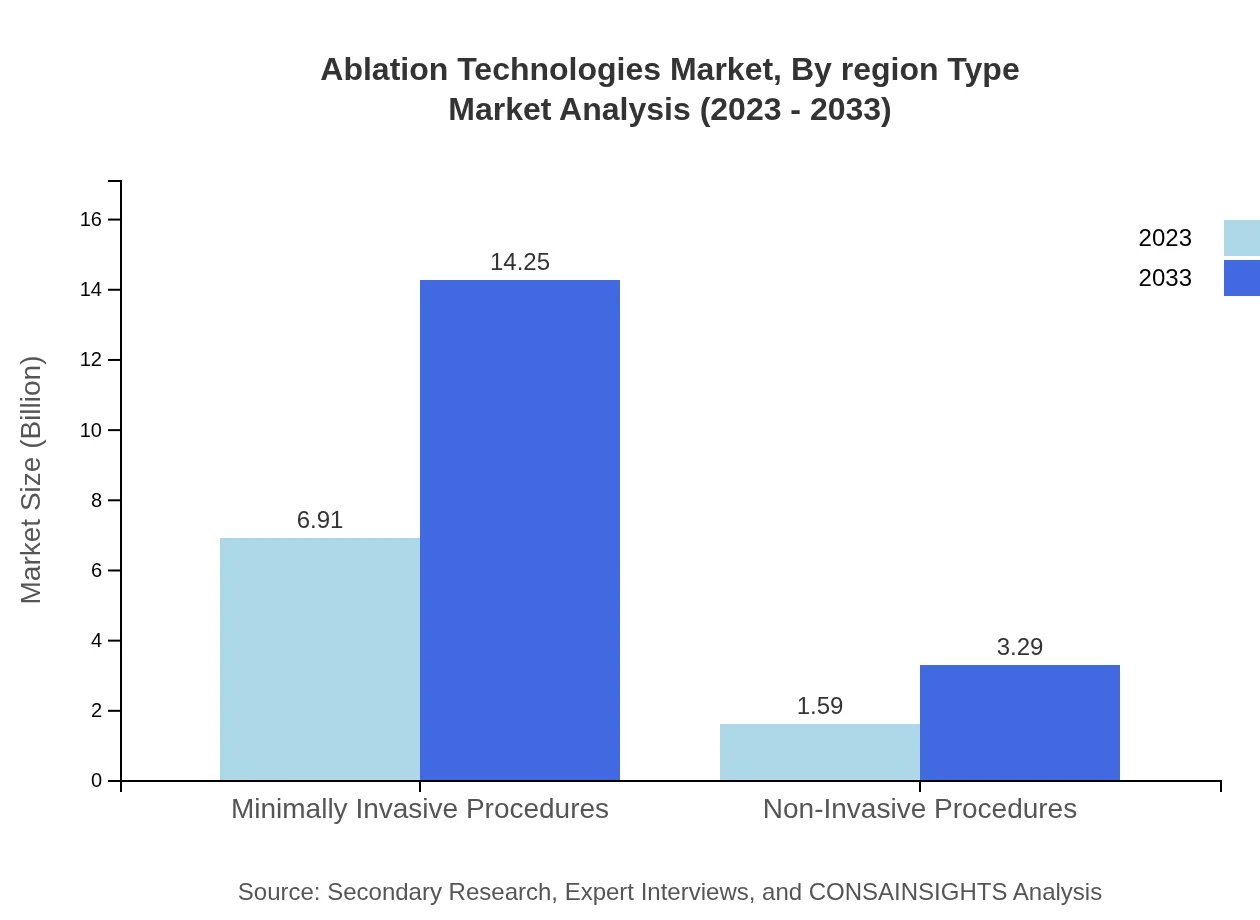

Ablation Technologies Market Analysis By Technology

The Ablation Technologies market by technology is divided predominantly into thermal and non-thermal technologies. In 2023, thermal ablation dominates with market shares of approximately 81.24%, demonstrating its significant preference in medical settings. This segment is expected to grow to around $14.25 billion by 2033. Non-thermal ablation, although smaller, also shows potential growth from $1.59 billion in 2023 to $3.29 billion in 2033.

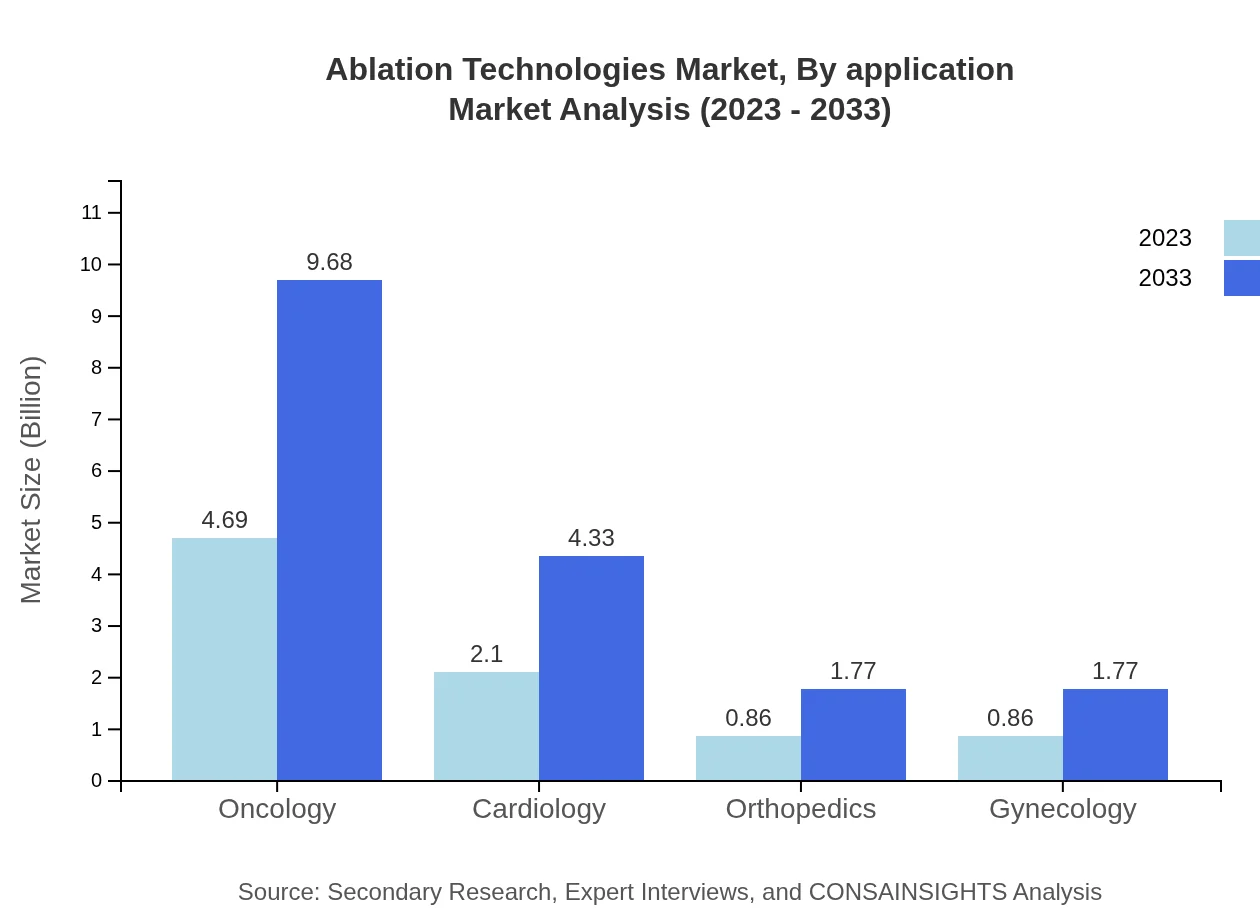

Ablation Technologies Market Analysis By Application

By application, the market is primarily divided into oncology, cardiology, orthopedics, and gynecology. The oncology segment is noteworthy, contributing about $4.69 billion in 2023 and expected to expand to $9.68 billion by 2033, maintaining around 55.15% market share. The cardiology segment holds a significant share as well, projected to grow from $2.10 billion in 2023 to approximately $4.33 billion by 2033.

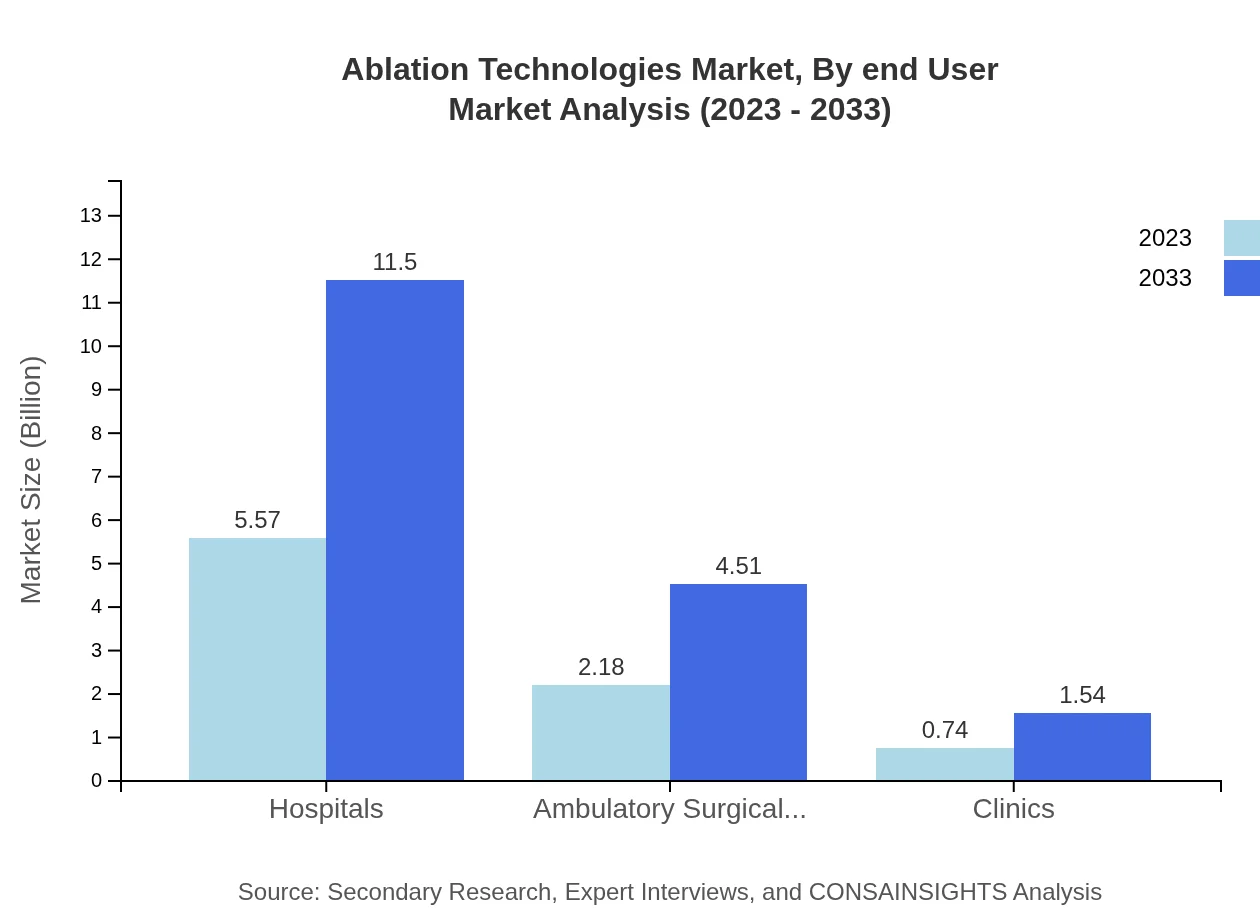

Ablation Technologies Market Analysis By End User

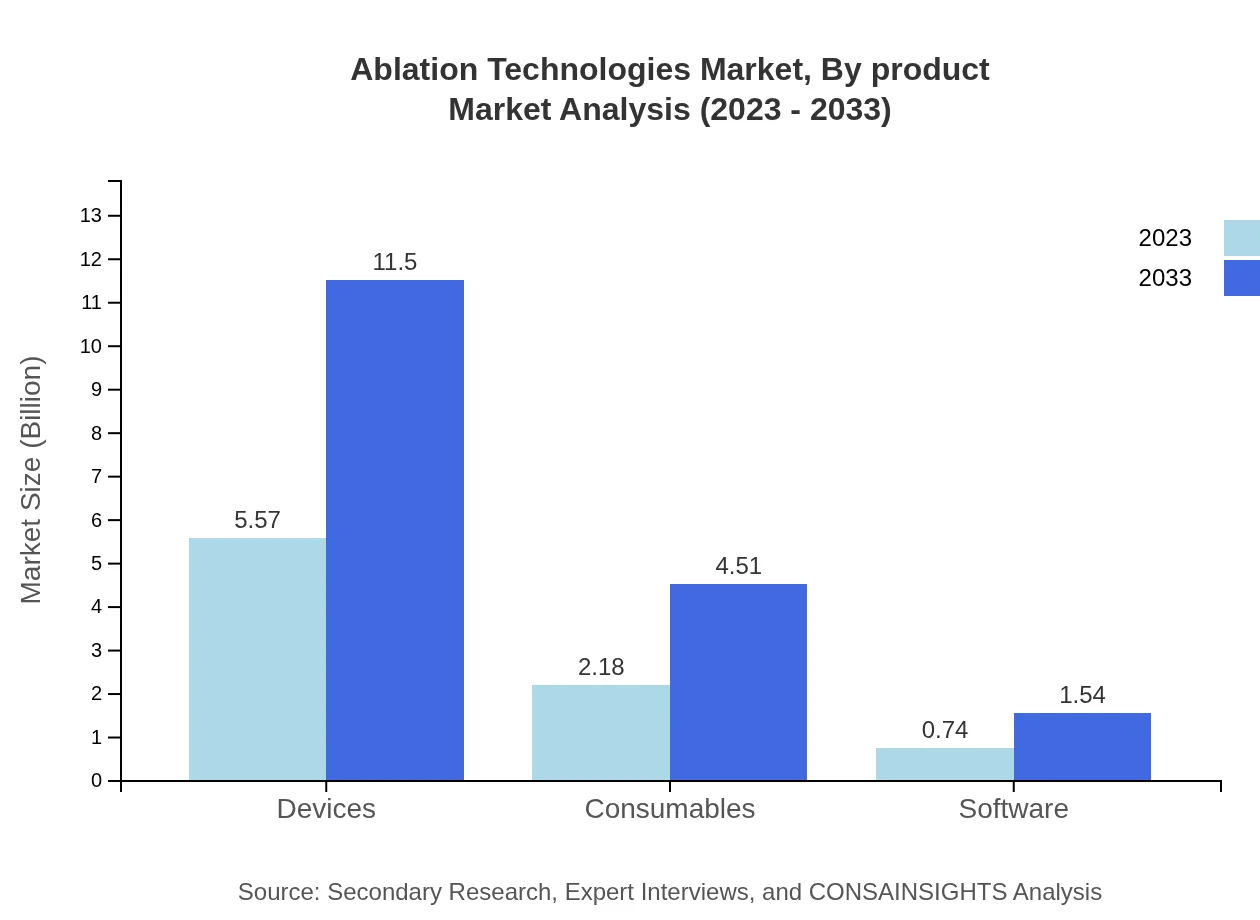

End-user analysis of the Ablation Technologies market reveals hospitals as the primary consumers, expected to maintain a significant share of 65.56% with revenues of about $5.57 billion in 2023 and growing to $11.50 billion by 2033. Ambulatory surgical centers also represent a substantial segment, with projections rising from $2.18 billion to $4.51 billion in the same timeframe.

Ablation Technologies Market Analysis By Region Type

The Ablation Technologies market exhibits varied trends across regions, with North America leading in innovation and spending, while Asia-Pacific shows rapid growth due to improving healthcare systems and increasing surgical procedures. Europe is characterized by stringent regulations and high technological adoption, while South America is gradually growing with healthcare advancements. The Middle East and Africa face challenges but are witnessing increased investments in healthcare.

Ablation Technologies Market Analysis By Product

The Ablation Technologies market can also be segmented into devices, consumables, and software. The devices segment dominates with a market size of $5.57 billion in 2023, steadily growing to about $11.50 billion by 2033. Consumables hold a share of approximately 25.68% with growth anticipated from $2.18 billion to $4.51 billion. Software remains a smaller but growing segment, expected to reach around $1.54 billion by 2033 from an initial size of $0.74 billion.

Ablation Technologies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ablation Technologies Industry

Medtronic :

A leading company in medical technologies, Medtronic specializes in various ablation technologies and has a strong presence in cardiac and vascular therapies.Boston Scientific:

Boston Scientific is known for its advanced therapeutic solutions, including a wide array of ablation devices that cater to different medical applications.Abbott Laboratories:

Abbott focuses on innovative therapies and technologies in the cardiovascular space, providing top-tier ablation solutions.AngioDynamics:

Specializing in minimally invasive medical devices, AngioDynamics offers a range of ablation technologies particularly for vascular access and oncology.Hologic, Inc.:

A global leader in women's health, Hologic develops unique ablation technologies designed to treat gynecological conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of ablation Technologies?

The ablation technologies market is projected to reach $8.5 billion by 2033, growing at a CAGR of 7.3% from an estimated market size of $4.5 billion in 2022. This growth reflects rising demand in various medical applications.

What are the key market players or companies in the ablation technologies industry?

Key players in the ablation technologies market include Medtronic, Boston Scientific, Johnson & Johnson, and Abbott Laboratories. These companies are major contributors, leveraging advanced technologies and innovative approaches to enhance their product offerings.

What are the primary factors driving the growth in the ablation technologies industry?

Key factors fueling growth include increasing prevalence of chronic diseases, advancements in minimally invasive surgery, and the efficiency of ablation techniques in treating various medical conditions, thereby improving patient outcomes and driving market demand.

Which region is the fastest Growing in the ablation technologies market?

The fastest-growing region in the ablation technologies market is Europe, projected to expand from $3.00 billion in 2023 to $6.19 billion by 2033, driven by technological adoption and healthcare spending enhancements in the region.

Does ConsaInsights provide customized market report data for the ablation technologies industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to access in-depth analysis and detailed insights relevant to the ablation technologies industry.

What deliverables can I expect from this ablation technologies market research project?

Deliverables from this market research project typically include a comprehensive report, market forecasts, competitive analysis, segment insights, and strategic recommendations to guide business decisions in the ablation technologies market.

What are the market trends of ablation technologies?

Current trends in the ablation technologies market include a shift towards thermal ablation techniques, increasing adoption of outpatient surgeries, and innovations in device technology, which are all contributing to enhanced patient safety and operational efficiency.