Abrasives Market Report

Published Date: 02 February 2026 | Report Code: abrasives

Abrasives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the abrasives market from 2023 to 2033, covering critical insights into market trends, size, regional performance, and technological innovations impacting the industry.

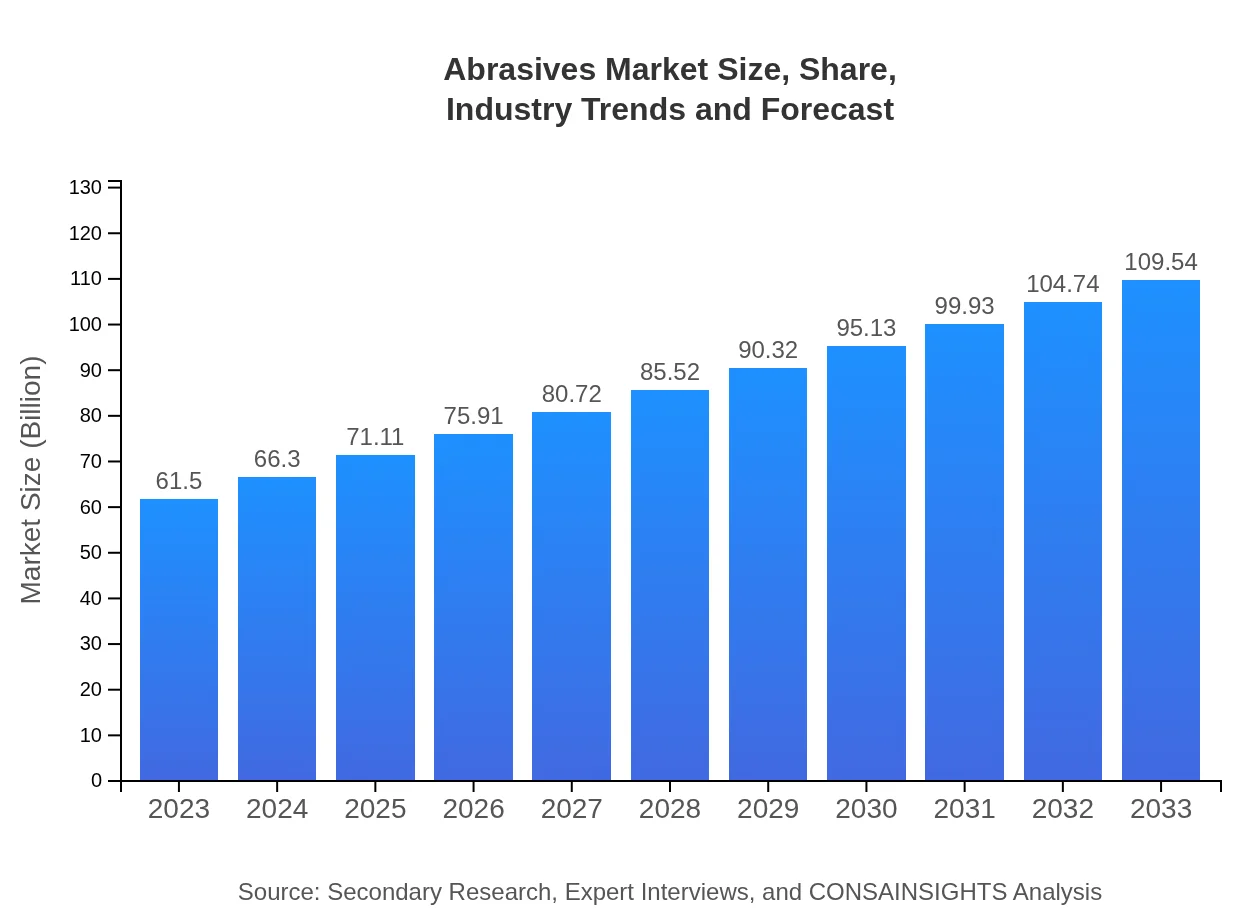

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $61.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $109.54 Billion |

| Top Companies | Abrasive Technology, Saint-Gobain, 3M, Pferd |

| Last Modified Date | 02 February 2026 |

Abrasives Market Overview

Customize Abrasives Market Report market research report

- ✔ Get in-depth analysis of Abrasives market size, growth, and forecasts.

- ✔ Understand Abrasives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Abrasives

What is the Market Size & CAGR of Abrasives market in 2023?

Abrasives Industry Analysis

Abrasives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Abrasives Market Analysis Report by Region

Europe Abrasives Market Report:

Europe's market was valued at USD 17.72 billion in 2023 and is anticipated to grow to USD 31.56 billion by 2033. The region benefits from strict manufacturing standards and a focus on high-performance product development.Asia Pacific Abrasives Market Report:

The Asia Pacific region exhibited a market size of USD 12.61 billion in 2023 and is forecasted to grow to USD 22.47 billion by 2033. The growth is propelled by rapid industrialization, especially in China and India, and a burgeoning construction sector.North America Abrasives Market Report:

North America held a market size of USD 20.12 billion in 2023, projected to expand to USD 35.84 billion by 2033. The rise is attributed to advancements in automotive and aerospace manufacturing sectors, alongside substantial investments in infrastructure.South America Abrasives Market Report:

In South America, the abrasives market was valued at USD 3.59 billion in 2023, expected to reach USD 6.40 billion by 2033. Brazil and Argentina are the primary markets, driven by their developing economies and increasing manufacturing facilities.Middle East & Africa Abrasives Market Report:

The Middle East and Africa showed a market size of USD 7.45 billion in 2023, with expectations to reach USD 13.28 billion by 2033. Growth in the construction and oil & gas sectors are key drivers for increasing demand in this region.Tell us your focus area and get a customized research report.

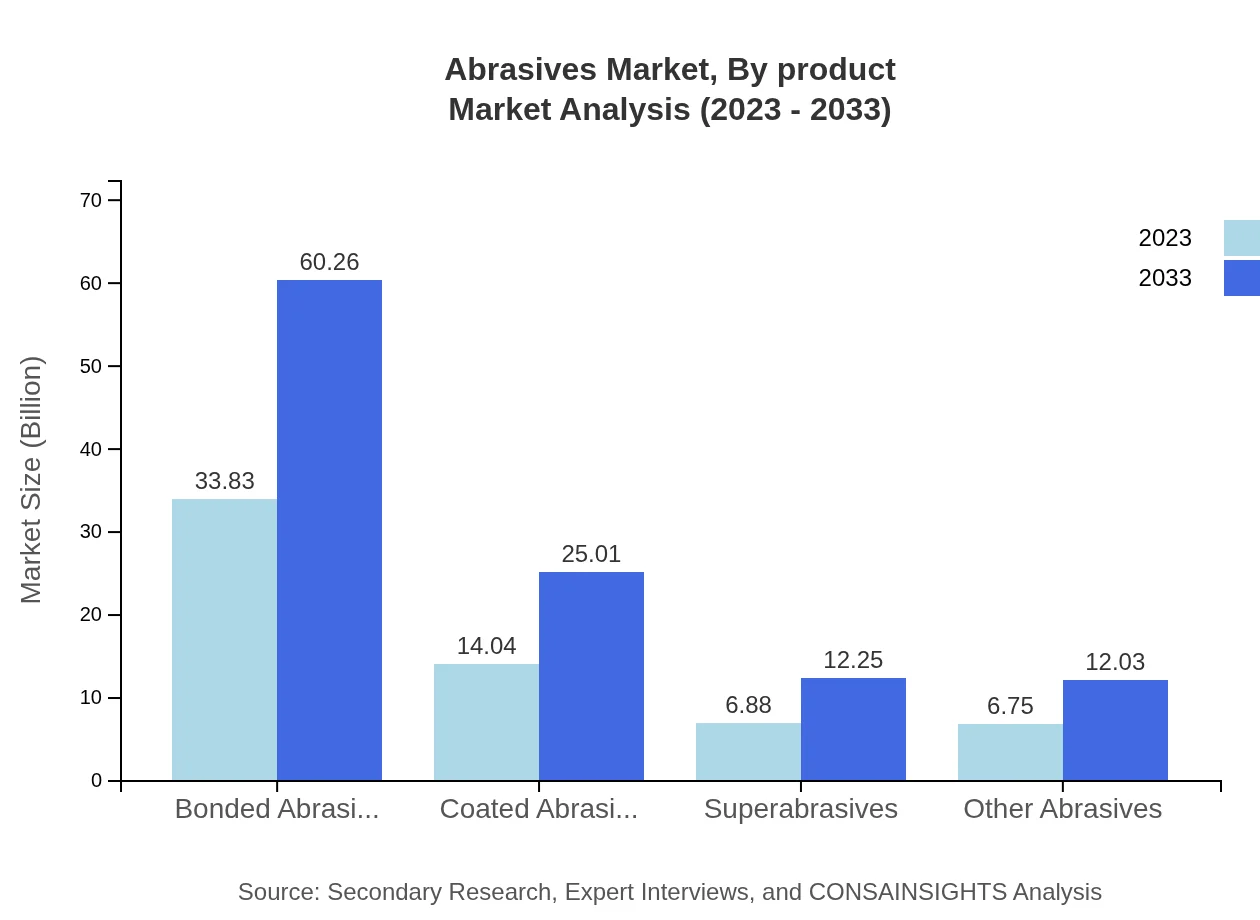

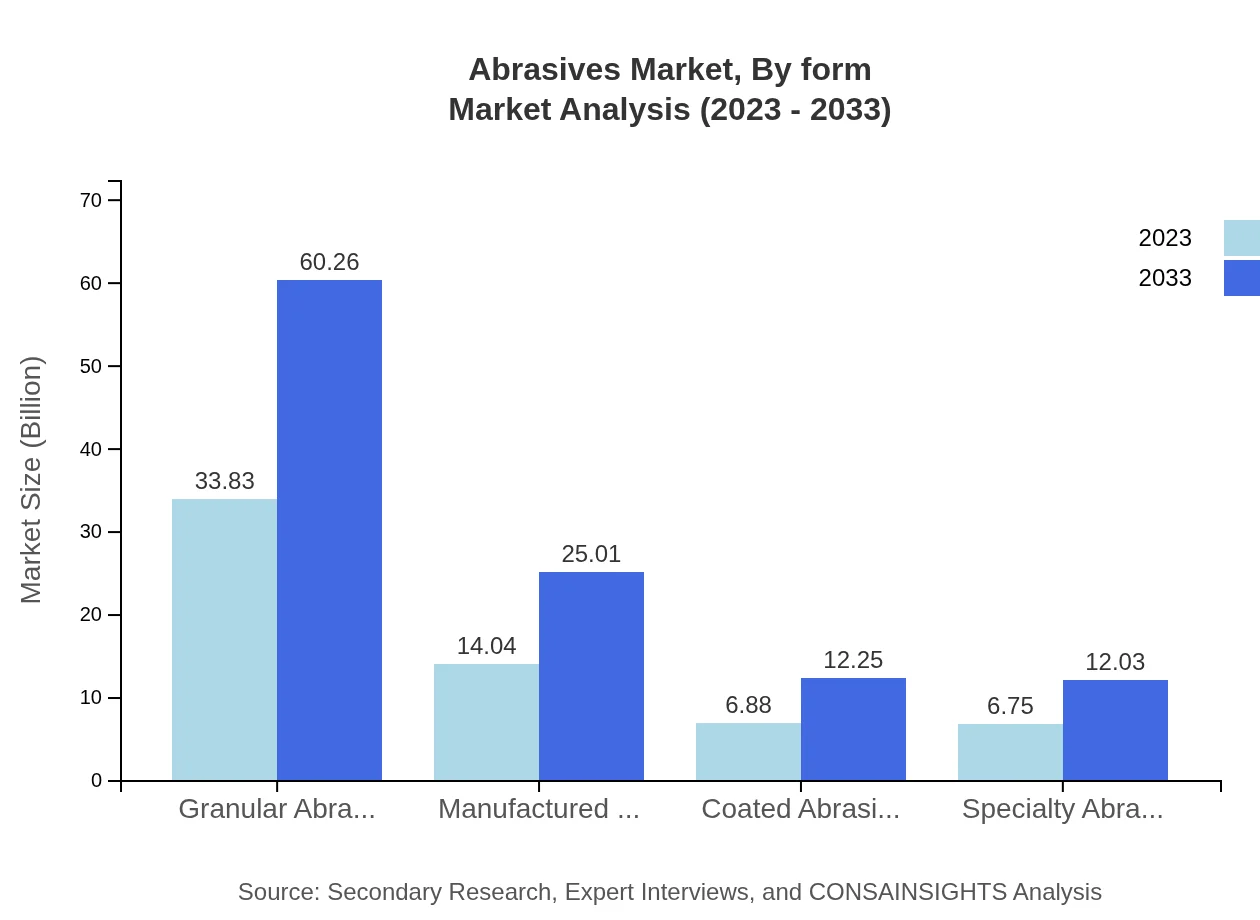

Abrasives Market Analysis By Product

Granular abrasives dominate the market with a size of USD 33.83 billion in 2023, expected to reach USD 60.26 billion by 2033, holding a 55.01% share throughout the forecast period. Bonded and coated abrasives also contribute significantly, with sizes of USD 14.04 and USD 6.88 billion in 2023, respectively.

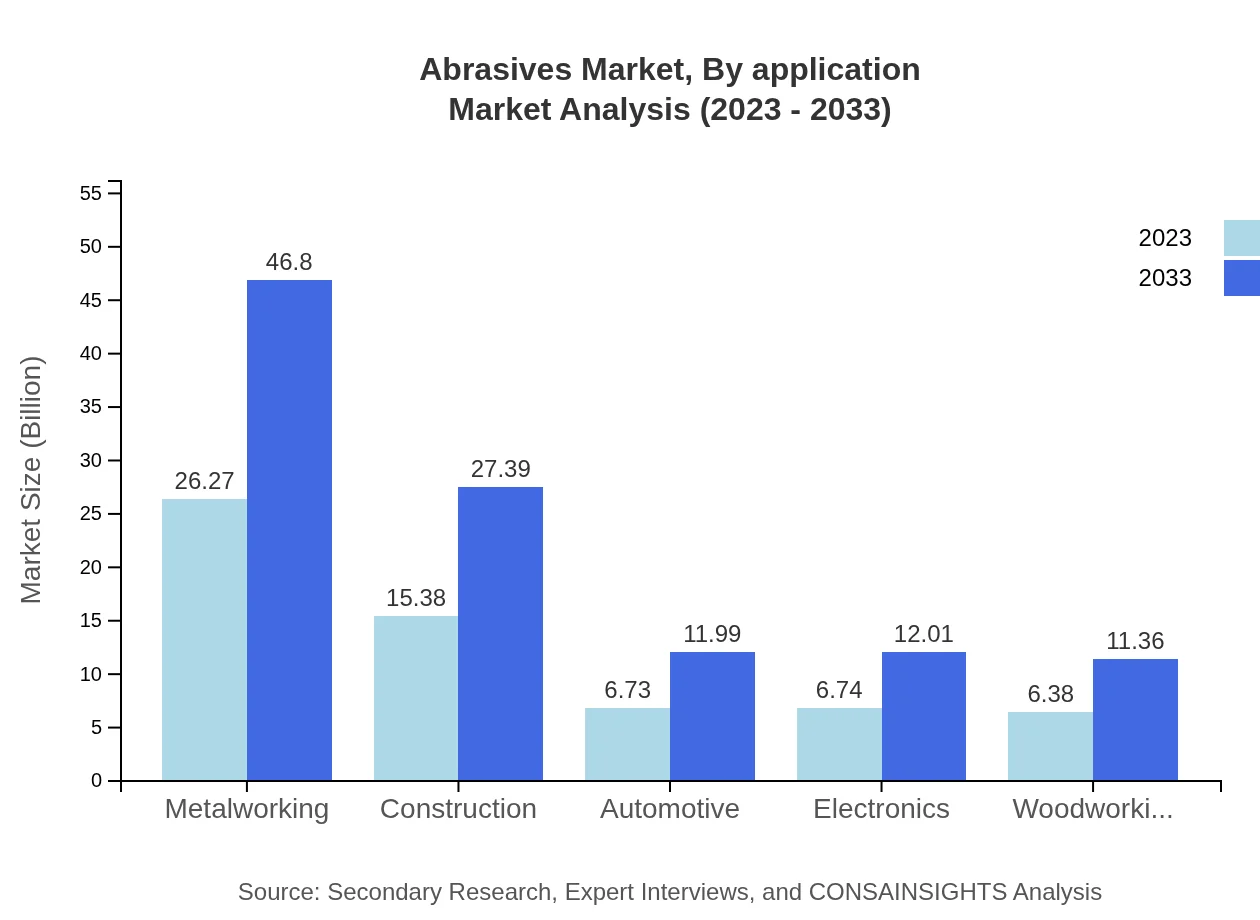

Abrasives Market Analysis By Application

The manufacturing sector leads with a market size of USD 26.27 billion in 2023, projected to grow to USD 46.80 billion by 2033. The construction and automotive sectors also show considerable sizes, affirming the diverse applications of abrasives.

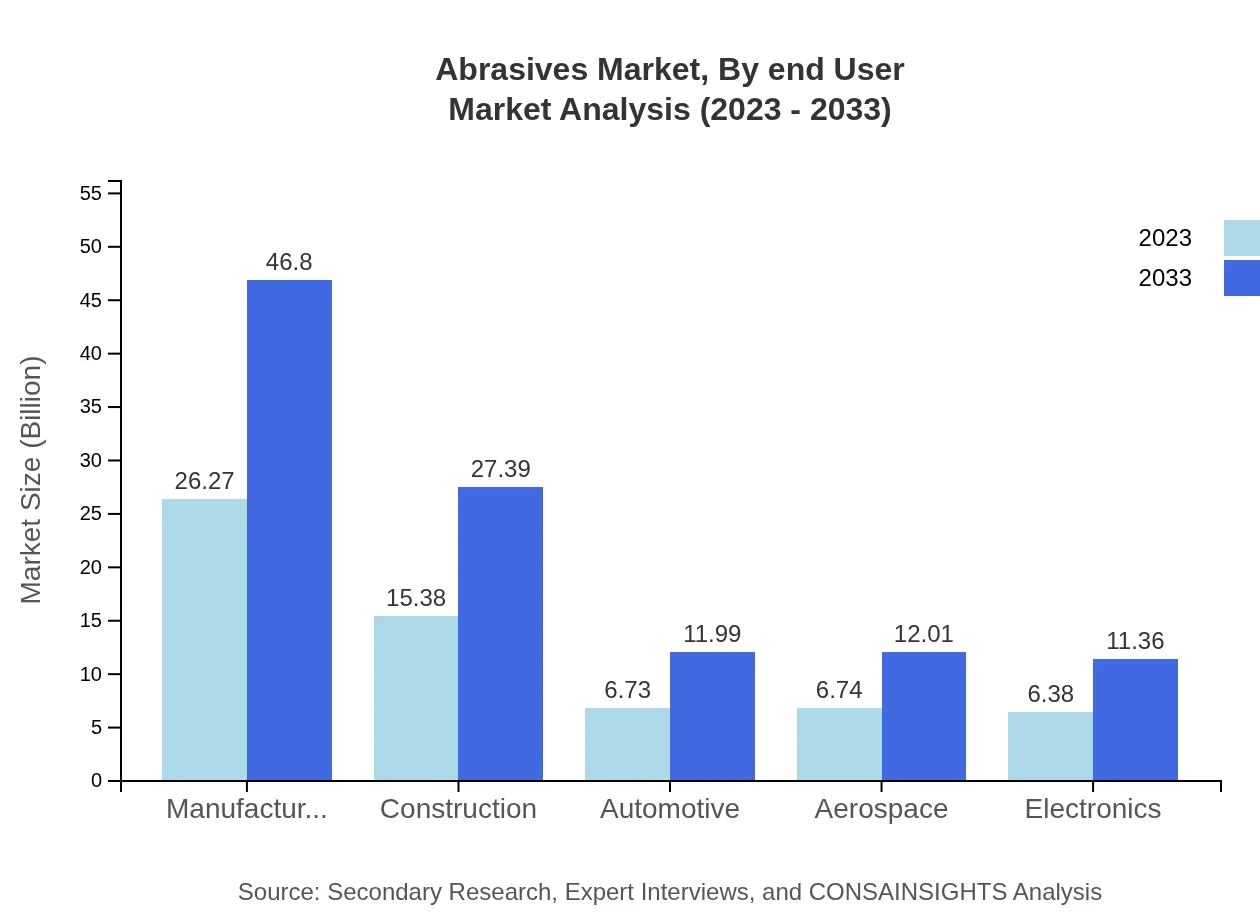

Abrasives Market Analysis By End User

The aerospace segment, sized at USD 6.74 billion in 2023, is expected to reach USD 12.01 billion by 2033. Other industries, such as electronics and woodworking, also show notable growth prospects due to increased demand for precision-engineered products.

Abrasives Market Analysis By Form

Superabrasives accounted for USD 6.88 billion in 2023, anticipated to reach USD 12.25 billion by 2033. This segment is vital for high-efficiency cutting and polishing processes in specialized applications.

Abrasives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Abrasives Industry

Abrasive Technology:

A leading manufacturer known for developing advanced superabrasives and cutting tools for various industrial applications.Saint-Gobain:

A global leader in the production of abrasives along with construction materials, focusing on sustainability and innovation.3M:

A diversified technology company that produces coated and bonded abrasives renowned for their efficiency and reliability in manufacturing.Pferd:

A provider of fine cutting tools and abrasives prominently used in metalworking and automotive sectors, committed to quality and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of abrasives?

The global abrasives market is projected to reach approximately $61.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.8% from 2023. This growth is driven by ongoing industrialization and technological advancements.

What are the key market players or companies in the abrasives industry?

Prominent players in the abrasives market include 3M Company, Saint-Gobain, and Tyrolit Group. These companies lead due to their innovative products and expansive distribution networks, significantly influencing market dynamics.

What are the primary factors driving the growth in the abrasives industry?

Key growth drivers for the abrasives industry include rising demand in manufacturing and automotive sectors, advancements in abrasive technologies, and increasing applications in construction and metalworking industries, all contributing to market expansion.

Which region is the fastest Growing in the abrasives market?

Asia Pacific is the fastest-growing region in the abrasives market, projected to expand from $12.61 billion in 2023 to $22.47 billion by 2033. This growth is fueled by rapid industrialization and an increasing manufacturing base.

Does ConsaInsights provide customized market report data for the abrasives industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the abrasives industry, allowing for targeted insights and strategic recommendations based on individual business goals.

What deliverables can I expect from this abrasives market research project?

Deliverables from the abrasives market research project include a comprehensive report, detailed market analysis, growth forecasts, competitive landscape, and segmented insights, ensuring a complete understanding of the market.

What are the market trends of abrasives?

Current market trends in abrasives include increased demand for eco-friendly and advanced materials, automation in manufacturing, and the rise of online sales channels, shaping the industry's direction towards innovation and sustainability.