Ac Electric Motor Sales In Oil And Gas Market Report

Published Date: 22 January 2026 | Report Code: ac-electric-motor-sales-in-oil-and-gas

Ac Electric Motor Sales In Oil And Gas Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the AC electric motor sales in the oil and gas sector, covering comprehensive insights on market dynamics, trends, regional analysis, and forecasts for the years 2023 to 2033.

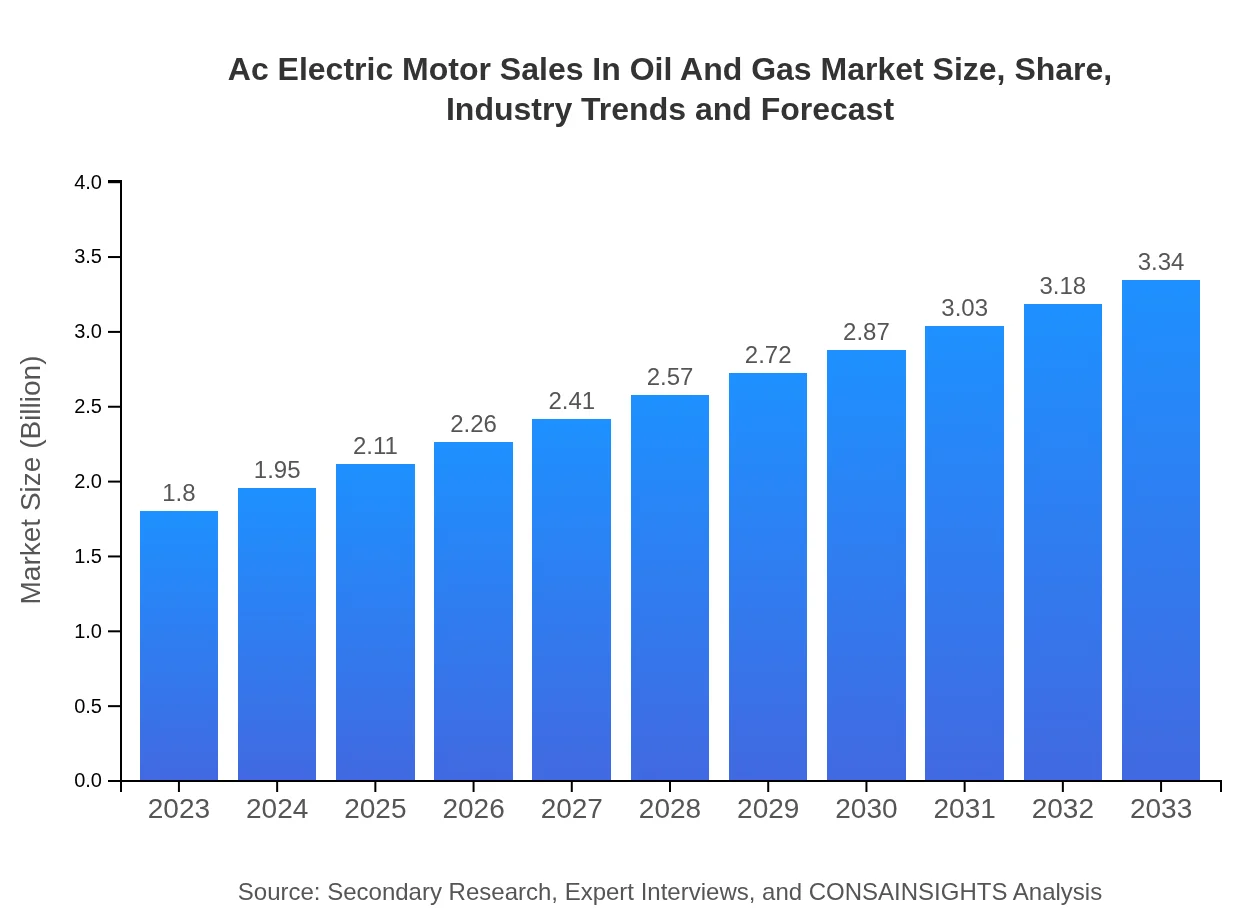

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Siemens AG, General Electric Co., ABB Ltd., Schneider Electric SE |

| Last Modified Date | 22 January 2026 |

AC Electric Motor Sales In Oil And Gas Market Overview

Customize Ac Electric Motor Sales In Oil And Gas Market Report market research report

- ✔ Get in-depth analysis of Ac Electric Motor Sales In Oil And Gas market size, growth, and forecasts.

- ✔ Understand Ac Electric Motor Sales In Oil And Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ac Electric Motor Sales In Oil And Gas

What is the Market Size & CAGR of AC Electric Motor Sales In Oil And Gas market in 2023?

AC Electric Motor Sales In Oil And Gas Industry Analysis

AC Electric Motor Sales In Oil And Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

AC Electric Motor Sales In Oil And Gas Market Analysis Report by Region

Europe Ac Electric Motor Sales In Oil And Gas Market Report:

Europe's market size is set to grow from $0.47 billion in 2023 to $0.87 billion in 2033, supported by strict regulations on emissions and a strong focus on sustainable energy, prompting investments in efficient electric motor technologies.Asia Pacific Ac Electric Motor Sales In Oil And Gas Market Report:

The Asia Pacific region is expected to witness substantial growth, with market size expanding from $0.38 billion in 2023 to $0.71 billion in 2033, driven by increasing oil and gas exploration activities and infrastructure investments in countries like China and India.North America Ac Electric Motor Sales In Oil And Gas Market Report:

North America is anticipated to lead the market with a rise from $0.59 billion in 2023 to $1.09 billion in 2033, fueled by the ongoing investments in unconventional oil and gas production and technological advancements in motor efficiencies.South America Ac Electric Motor Sales In Oil And Gas Market Report:

In South America, the market size is projected to grow from $0.17 billion in 2023 to $0.32 billion in 2033. Factors such as the development of shale gas resources and enhanced oil recovery techniques contribute to this growth.Middle East & Africa Ac Electric Motor Sales In Oil And Gas Market Report:

The Middle East and Africa will see market growth from $0.19 billion in 2023 to $0.35 billion in 2033. The expansion of oil production projects and the need for technological upgrades in existing power systems are primary growth drivers.Tell us your focus area and get a customized research report.

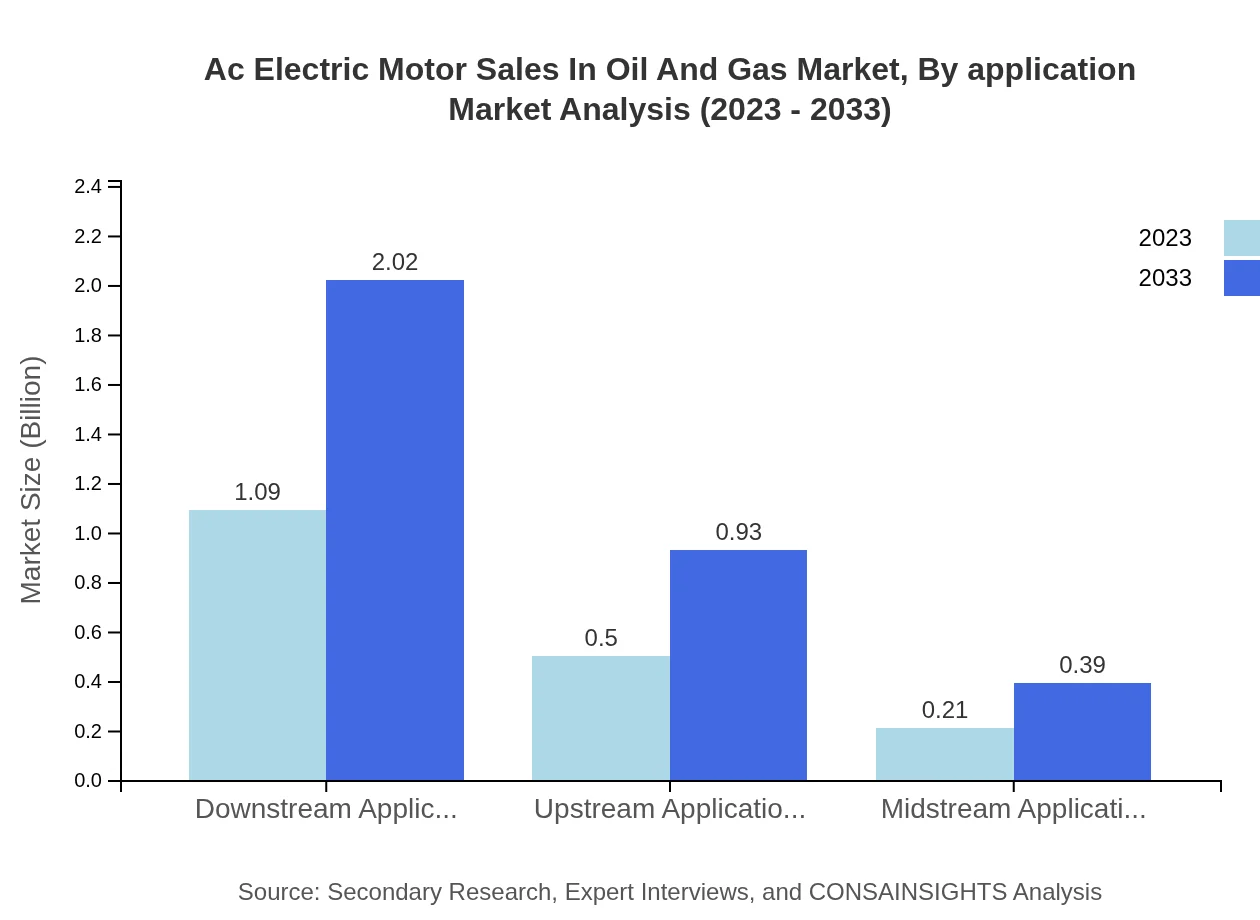

Ac Electric Motor Sales In Oil And Gas Market Analysis By Application

Applications for AC electric motors in oil and gas include upstream, midstream, and downstream sectors. The upstream segment, involving exploration and production activities, will see size expansion from $1.09 billion in 2023 to $2.02 billion by 2033, constituting approximately 60.6% of the market share throughout this period.

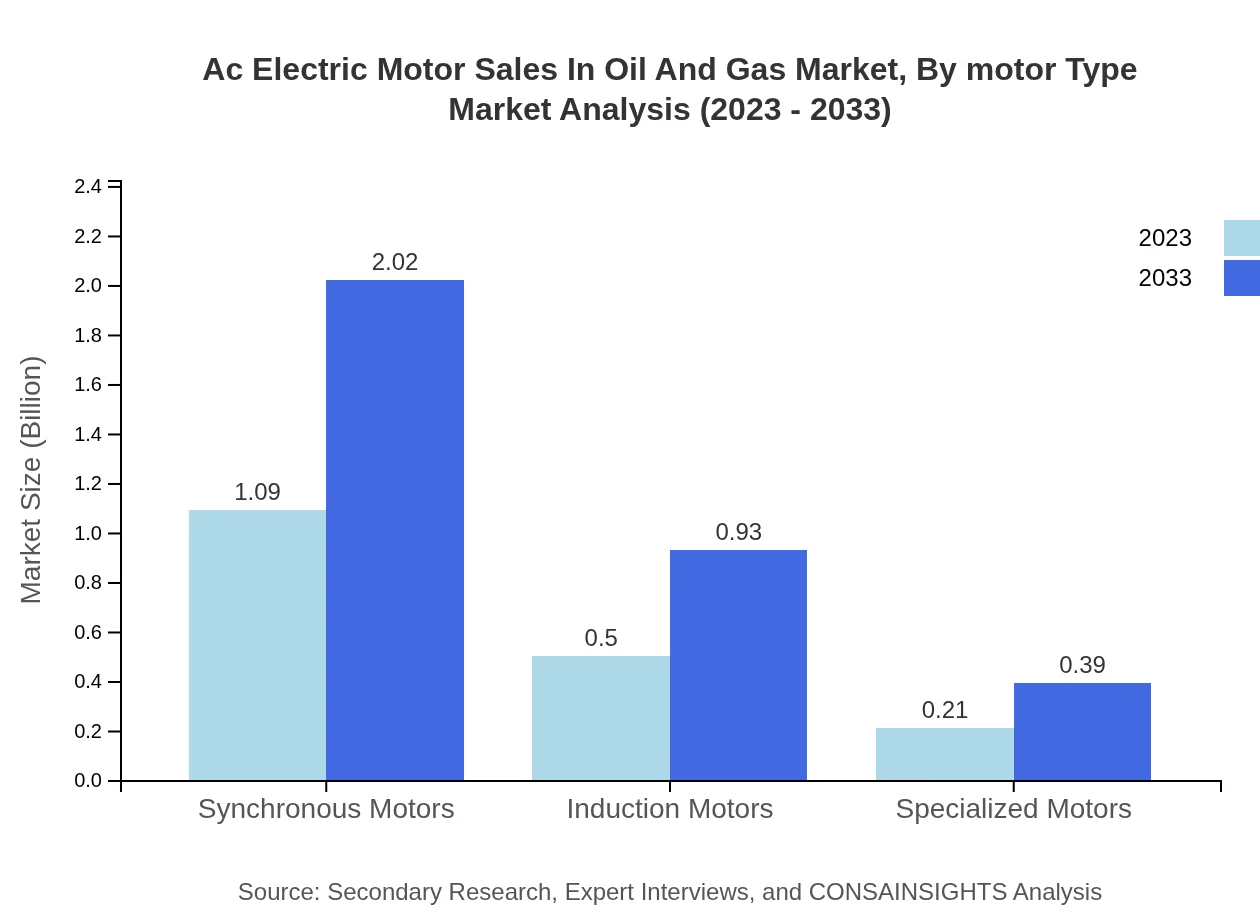

Ac Electric Motor Sales In Oil And Gas Market Analysis By Motor Type

In terms of motor types, synchronous motors dominate the market with a size shift from $1.09 billion in 2023 to $2.02 billion in 2033, accounting for a consistent 60.6% share. Induction motors follow with a projected size increase from $0.50 billion to $0.93 billion over the same period.

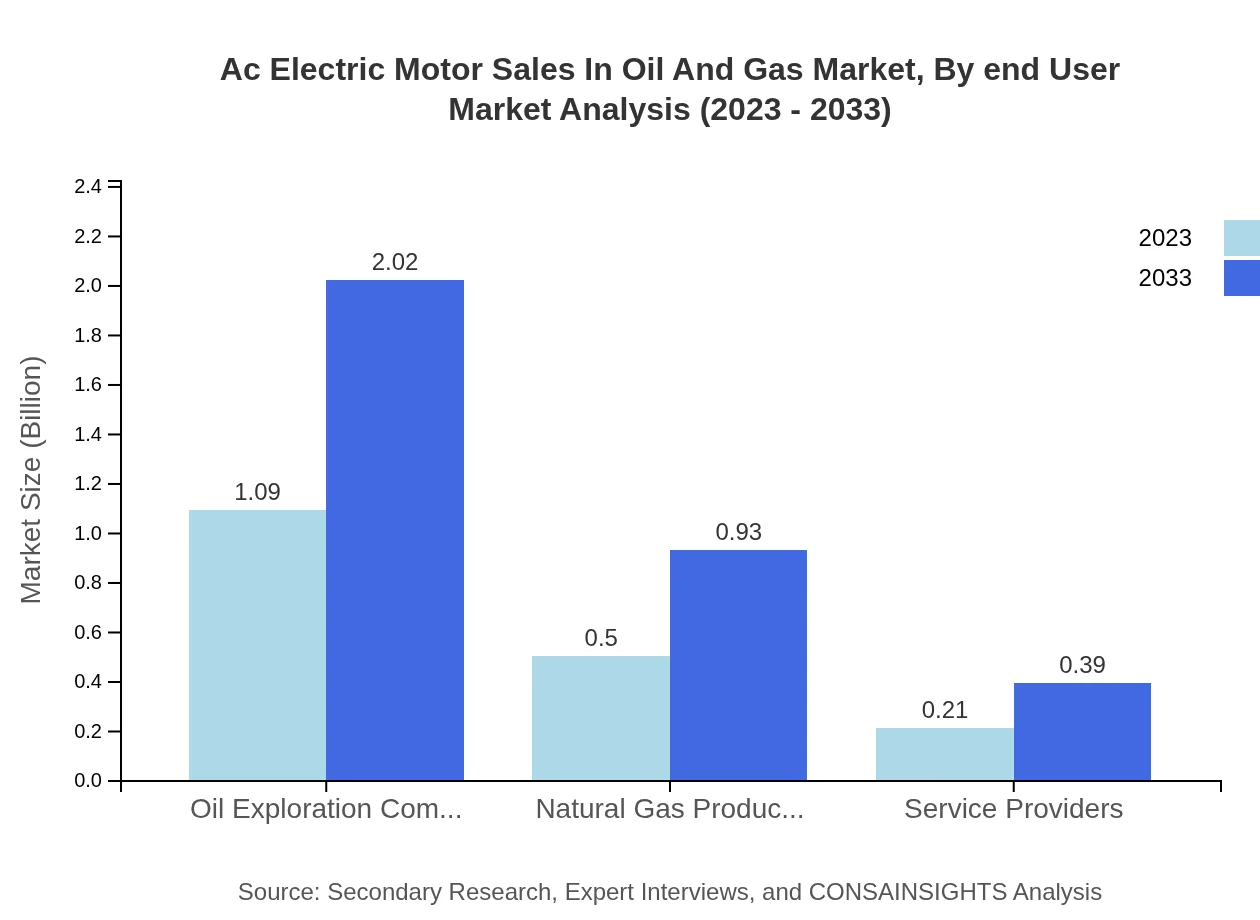

Ac Electric Motor Sales In Oil And Gas Market Analysis By End User

End-user analysis reveals that oil exploration companies constitute the largest segment, expected to grow from $1.09 billion in 2023 to $2.02 billion in 2033. Natural gas producers and service providers follow, exhibiting steady growth patterns, facilitating a diversified market presence.

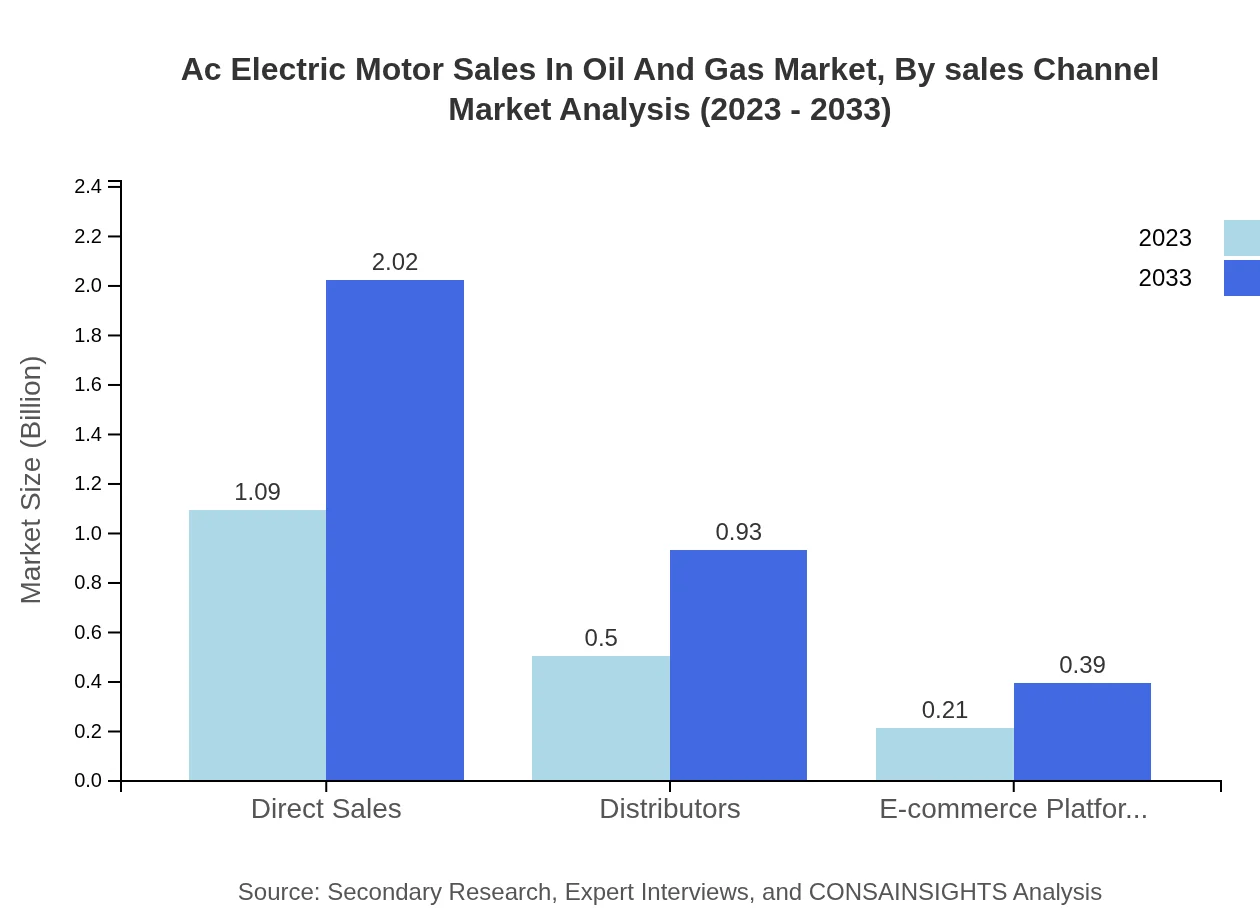

Ac Electric Motor Sales In Oil And Gas Market Analysis By Sales Channel

Sales through direct channels constitute the majority at $1.09 billion in 2023, growing to $2.02 billion, showcasing the importance of direct engagements with clients. Distributors and e-commerce platforms are increasingly becoming pivotal as market dynamics shift towards digital channels.

AC Electric Motor Sales In Oil And Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in AC Electric Motor Sales In Oil And Gas Industry

Siemens AG:

Siemens AG is a global leader in electrical engineering and electronics, providing innovative and efficient solutions for AC electric motors widely used in various sectors, including oil and gas.General Electric Co.:

General Electric Co. is a prominent player in the energy sector, producing high-efficiency electric motors that cater to the specific needs of the oil and gas industries.ABB Ltd.:

ABB Ltd. specializes in electrification and automation technologies, offering advanced AC motors designed to enhance energy efficiency in oil and gas operations.Schneider Electric SE:

Schneider Electric SE focuses on digital transformation of energy management, providing state-of-the-art AC motors that support sustainable practices and reliable operations in oil and gas.We're grateful to work with incredible clients.

FAQs

What is the market size of ac Electric Motor Sales In Oil And Gas?

The AC electric motor sales in the oil and gas sector is anticipated to reach $1.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.2%. This growth reflects increasing demands for electrification in energy exploration.

What are the key market players or companies in this ac Electric Motor Sales In Oil And Gas industry?

Key market players include major manufacturers and suppliers of electric motors such as Siemens, ABB, and Schneider Electric, which are pivotal in providing innovative motor solutions tailored for the oil and gas sector.

What are the primary factors driving the growth in the ac Electric Motor Sales In Oil And Gas industry?

Growth is driven by rising energy efficiency regulations, investments in renewable energy, enhanced automation in exploration, and advancements in motor technology that promote sustainability in oil and gas operations.

Which region is the fastest Growing in the ac Electric Motor Sales In Oil And Gas?

North America is the fastest-growing region, projected to expand from $0.59 billion in 2023 to $1.09 billion by 2033, showcasing a growing focus on electric mobility and sustainable energy practices in the oil and gas industry.

Does ConsaInsights provide customized market report data for the ac Electric Motor Sales In Oil And Gas industry?

Yes, ConsaInsights offers tailored market reports, providing insights specific to client needs, ensuring that stakeholders in the oil and gas sector can make informed decisions based on customized analysis.

What deliverables can I expect from this ac Electric Motor Sales In Oil And Gas market research project?

Deliverables include detailed market sizing data, growth forecasts, competitive analysis, trend insights, and segment-specific reports aiding in strategic decision-making for businesses involved in the electric motor market.

What are the market trends of ac Electric Motor Sales In Oil And Gas?

Current trends include a shift towards sustainable technologies, increased demand for high-efficiency motors, and the integration of smart motors, all aimed at reducing operational costs and enhancing performance in oil and gas applications.