Acaricides Market Report

Published Date: 02 February 2026 | Report Code: acaricides

Acaricides Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Acaricides market, covering market size, growth trends, segmentation, and regional insights. It also explores industry dynamics and forecasts from 2023 to 2033, aiming to equip stakeholders with valuable insights for strategic planning.

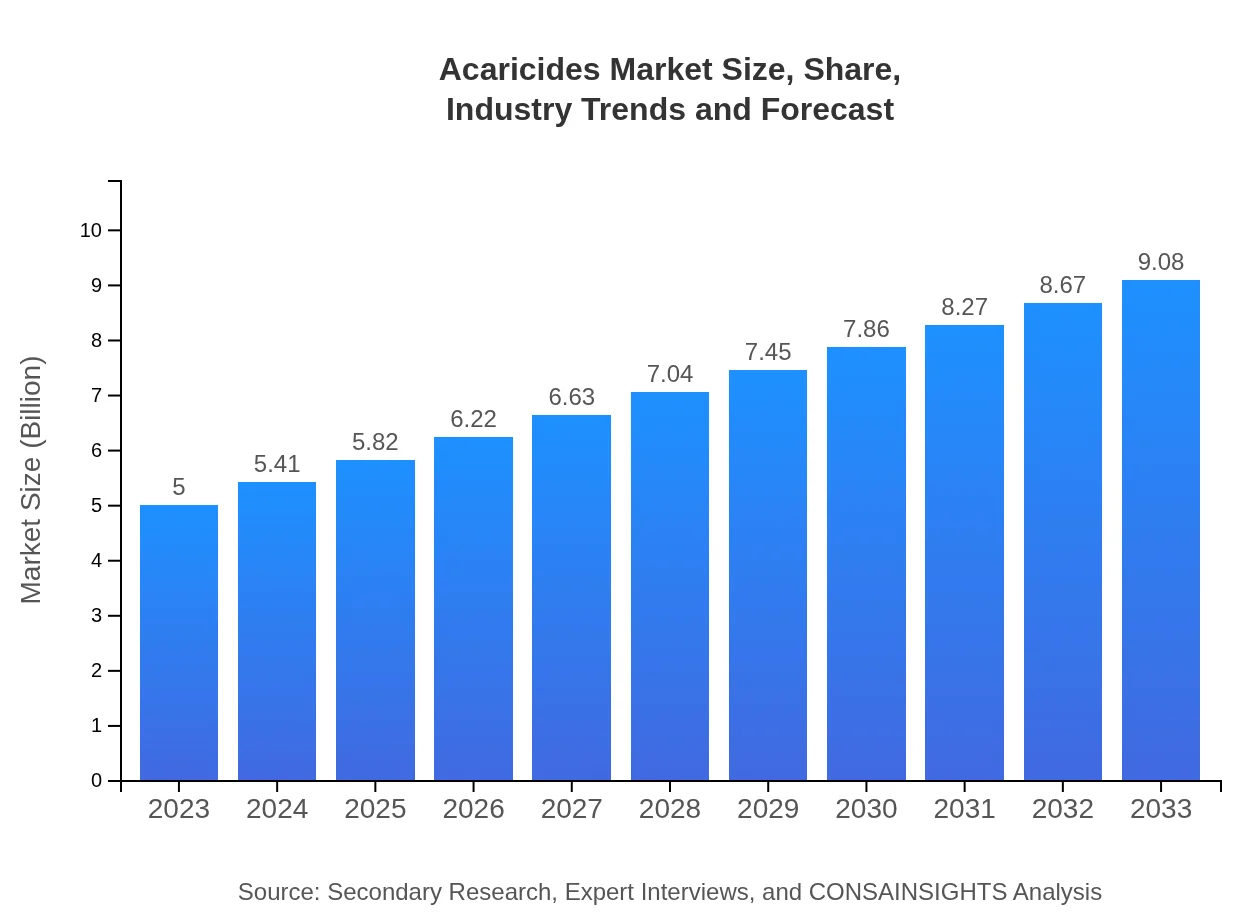

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Acaricides Market Overview

Customize Acaricides Market Report market research report

- ✔ Get in-depth analysis of Acaricides market size, growth, and forecasts.

- ✔ Understand Acaricides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acaricides

What is the Market Size & CAGR of the Acaricides Market in 2023?

Acaricides Industry Analysis

Acaricides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acaricides Market Analysis Report by Region

Europe Acaricides Market Report:

Europe's Acaricides market is projected to grow from $1.35 billion in 2023 to $2.46 billion by 2033. Stringent regulations and the push towards organic farming significantly influence market transitions.Asia Pacific Acaricides Market Report:

In the Asia Pacific region, the Acaricides market is estimated at $0.95 billion in 2023, projected to grow to $1.72 billion by 2033. The growth is attributed to increased agricultural productivity and the adoption of modern farming techniques, particularly in countries like China and India.North America Acaricides Market Report:

North America currently holds a significant market with a size of $1.95 billion in 2023, expected to expand to $3.54 billion by 2033. The growing focus on sustainable agriculture and advanced pest management practices are key growth factors.South America Acaricides Market Report:

The South American Acaricides market started at $0.47 billion in 2023 and is expected to reach $0.85 billion by 2033. Increased crop production and pest management awareness in Brazil and Argentina are major driving forces.Middle East & Africa Acaricides Market Report:

The Middle East and Africa market shows a slow but steady growth, with the size growing from $0.28 billion in 2023 to $0.51 billion by 2033, driven by rising agricultural investments in the region.Tell us your focus area and get a customized research report.

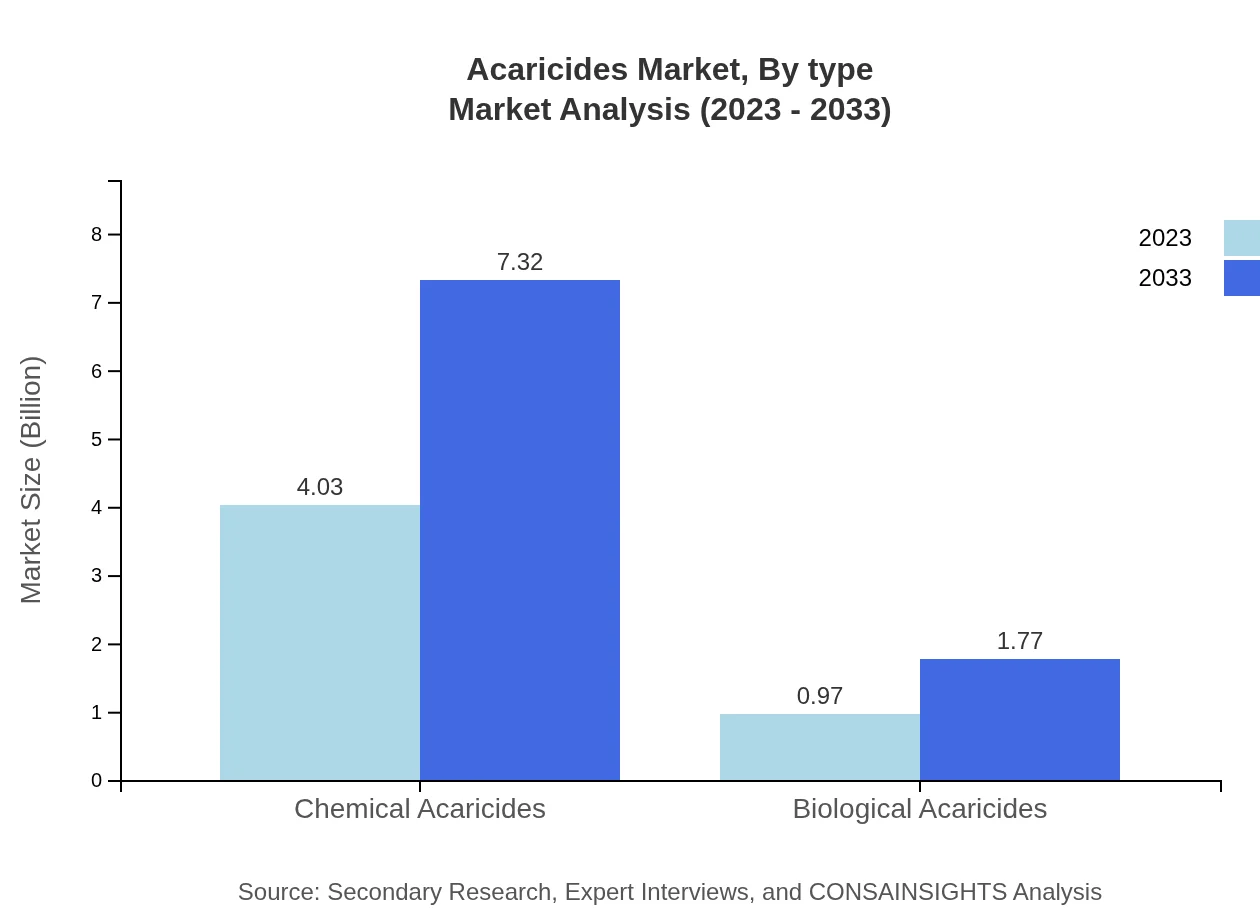

Acaricides Market Analysis By Type

The market is dominated by Chemical Acaricides, which account for approximately 80.54% of the total market share, with a market size forecast of $4.03 billion in 2023, growing to $7.32 billion by 2033. Biological Acaricides, while smaller in share, are rapidly gaining traction, expected to increase from $0.97 billion to $1.77 billion during the same period.

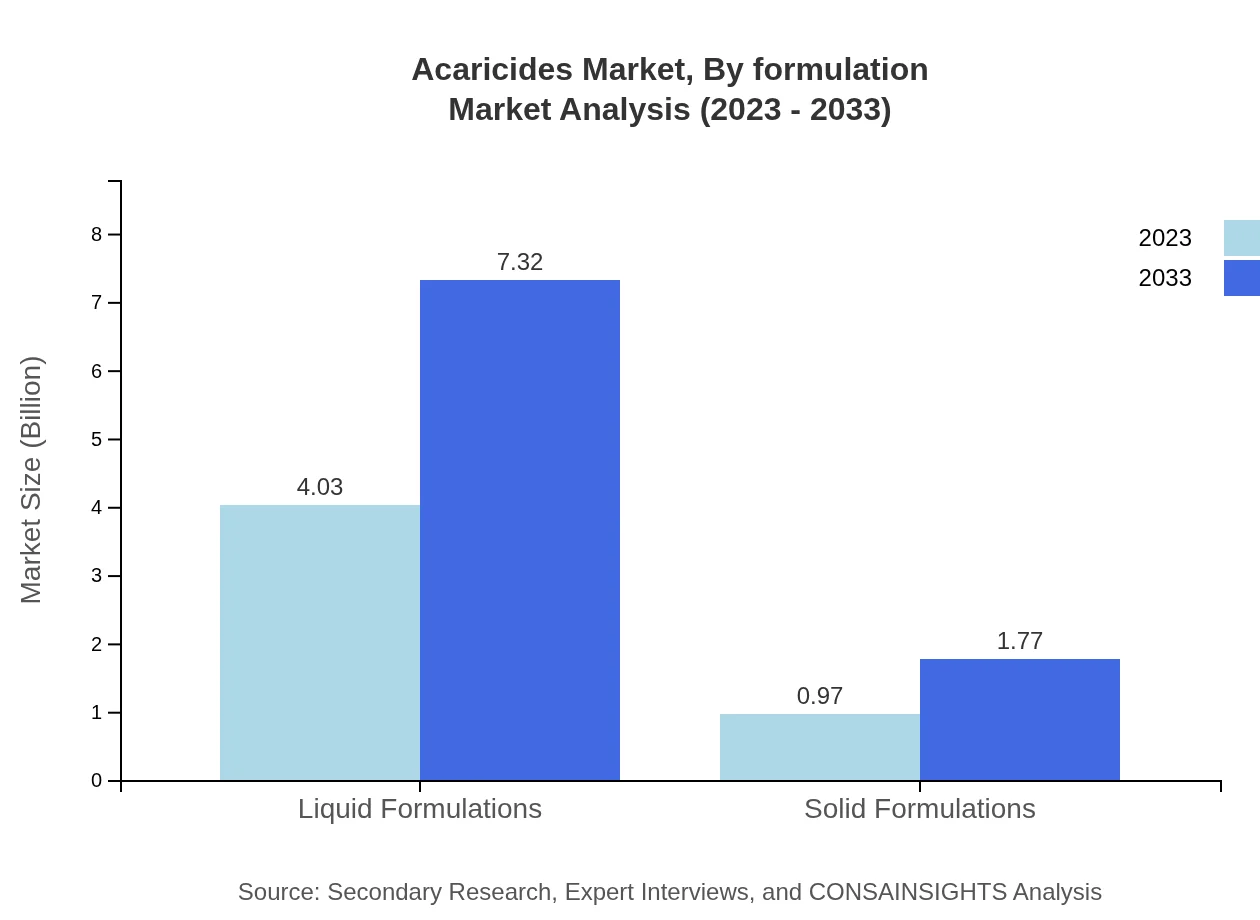

Acaricides Market Analysis By Formulation

Liquid formulations maintain a significant market presence, reflecting the preference for easy-to-apply products. Expected to grow from $4.03 billion in 2023 to $7.32 billion by 2033, liquid formulations dominate with an 80.54% market share, while solid formulations are expected to rise from $0.97 billion to $1.77 billion.

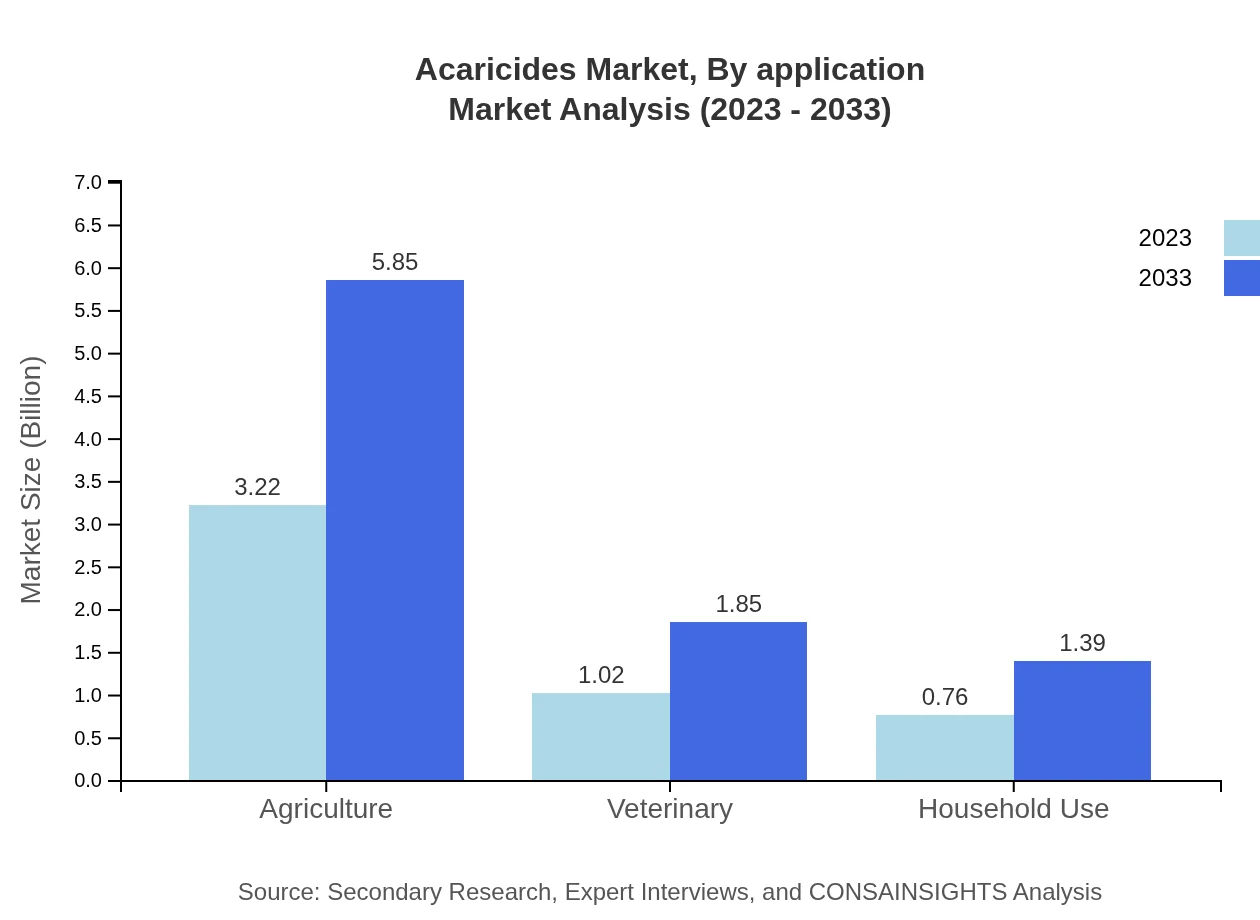

Acaricides Market Analysis By Application

Agriculture remains the largest application sector, projected to grow from $3.22 billion to $5.85 billion. The Veterinary sector, contributing significantly at a share of 20.38%, is anticipated to grow from $1.02 billion to $1.85 billion. Household use is also gaining momentum, with expected growth from $0.76 billion to $1.39 billion.

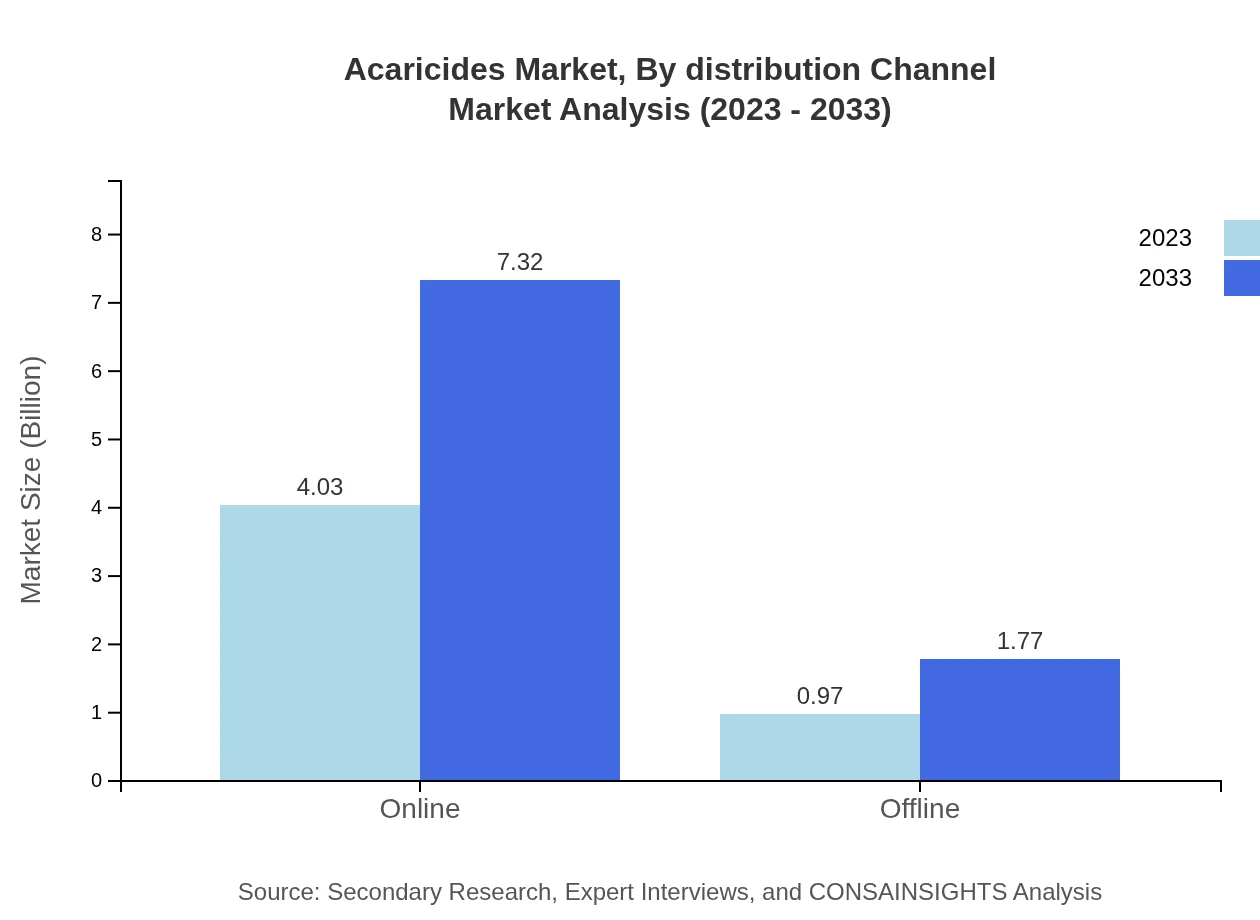

Acaricides Market Analysis By Distribution Channel

Online distribution channels are emerging rapidly, with a market size anticipated to jump from $4.03 billion to $7.32 billion, reflecting changing consumer purchasing habits. Offline channels remain relevant, with projected growth from $0.97 billion to $1.77 billion.

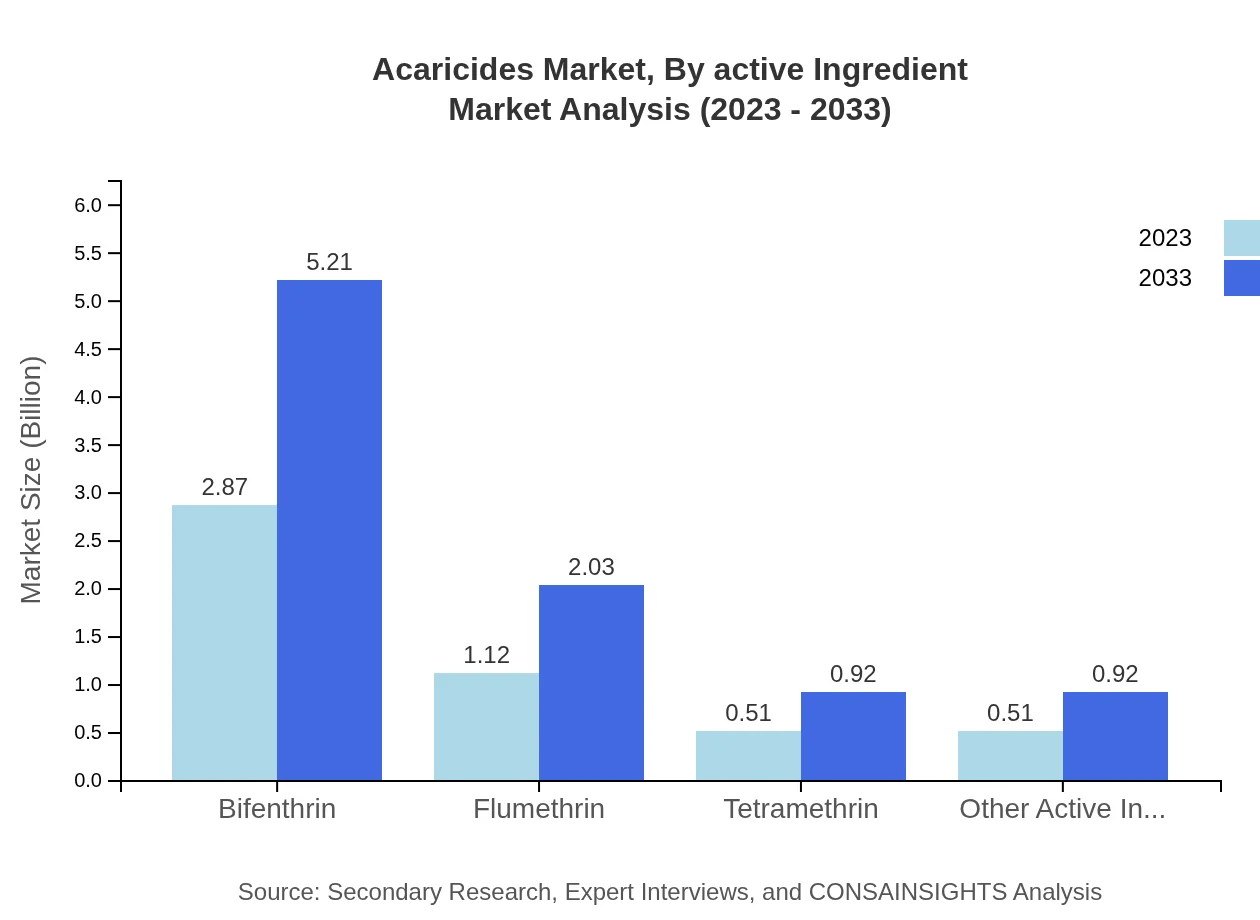

Acaricides Market Analysis By Active Ingredient

Active ingredients vary in popularity, with Bifenthrin leading with a market share of 57.34%, growing from $2.87 billion to $5.21 billion by 2033. Flumethrin and Tetramethrin also play important roles, reflecting diverse pest management needs across different sectors.

Acaricides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acaricides Industry

Bayer AG:

A global leader in agriculture and pest management, Bayer is known for its innovative acaricides that yield effective pest control while promoting environmental sustainability.Syngenta AG:

Syngenta is a major player in the agrochemical sector, providing a range of chemical and biological solutions, including advanced acaricides that address diverse agricultural needs.Corteva Agriscience:

A leader focused on sustainable agriculture, Corteva provides cutting-edge acaricides that enhance productivity while emphasizing environmentally friendly solutions.FMC Corporation:

FMC is recognized for its innovative pest control solutions, consistently developing effective acaricides that lead to resilient agricultural products.We're grateful to work with incredible clients.

FAQs

What is the market size of acaricides?

The acaricides market is projected to reach approximately $5 billion by 2033, with a CAGR of 6%. This growth reflects an increasing demand, propelled by advancements in agricultural technology and rising pest control measures.

What are the key market players or companies in the acaricides industry?

Key players in the acaricides industry include industry leaders such as Bayer CropScience, Syngenta AG, and BASF. These companies dominate through extensive research and development, providing innovative solutions within the acaricides space.

What are the primary factors driving the growth in the acaricides industry?

Growth in the acaricides industry is primarily driven by increased agricultural production, government support for pest control measures, and heightened awareness of pest-related diseases, motivating farmers to use acaricides more effectively.

Which region is the fastest Growing in the acaricides market?

North America is the fastest-growing region in the acaricides market, expected to see growth from $1.95 billion in 2023 to $3.54 billion by 2033. This growth underscores rising agricultural productivity and effective pest management in the region.

Does ConsaInsights provide customized market report data for the acaricides industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the acaricides industry, ensuring that clients receive relevant data and insights that align with their business requirements.

What deliverables can I expect from this acaricides market research project?

Deliverables include detailed market analysis reports, growth forecasts, competitive landscape assessments, and insights on market trends, enabling stakeholders to make informed decisions based on comprehensive data.

What are the market trends of acaricides?

Current trends in the acaricides market indicate a shift towards biological acaricides, reflecting heightened sustainability efforts. There's also an increasing preference for online sales channels, with segmented data showing significant growth towards liquid formulations.