Accounts Receivable Automation Market Report

Published Date: 02 February 2026 | Report Code: accounts-receivable-automation

Accounts Receivable Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Accounts Receivable Automation market, detailing market trends, size, and CAGR from 2023 to 2033. Insights include regional analysis, industry landscape, market segmentation, and key players impacting the market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

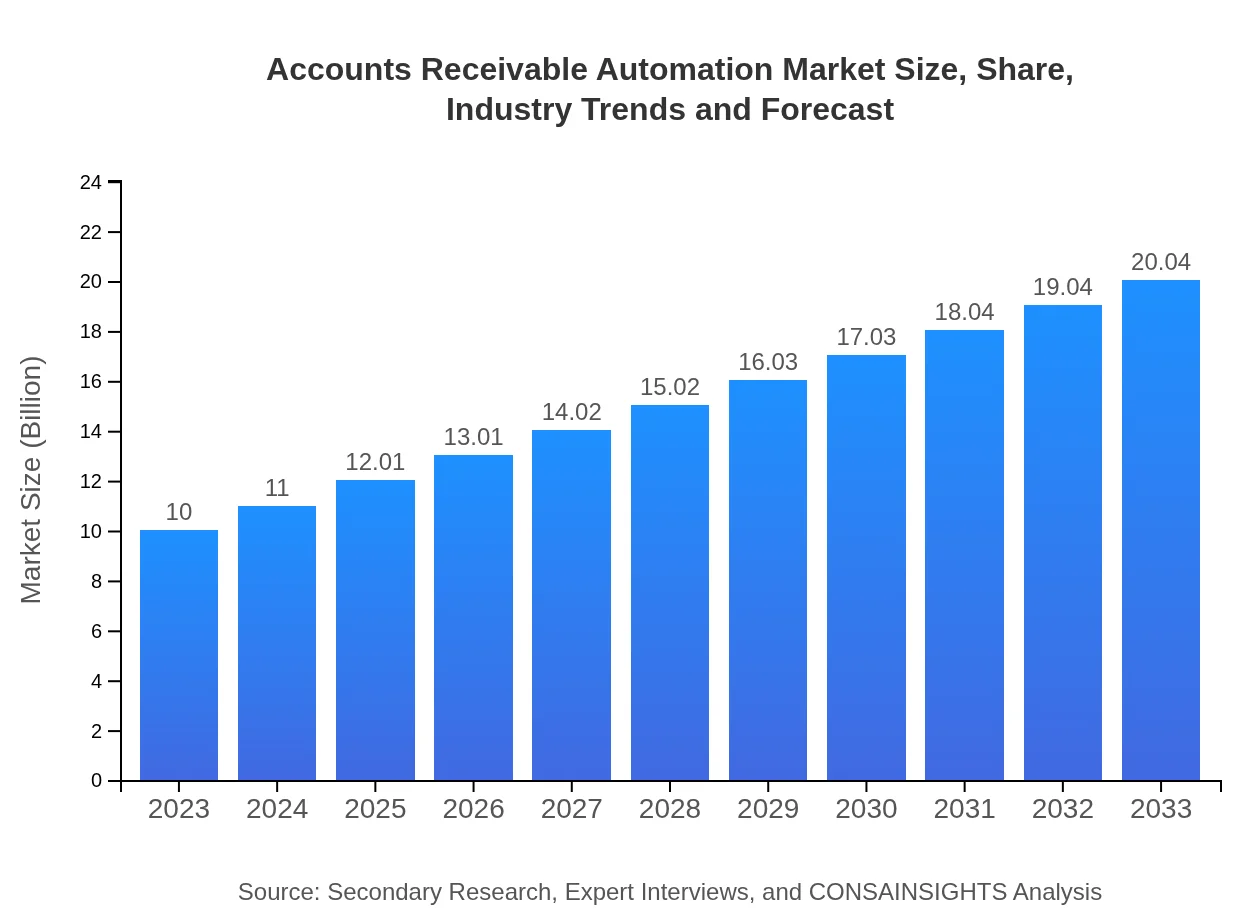

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | SAP SE, Oracle Corporation, Bill.com, BlackLine |

| Last Modified Date | 02 February 2026 |

Accounts Receivable Automation Market Overview

Customize Accounts Receivable Automation Market Report market research report

- ✔ Get in-depth analysis of Accounts Receivable Automation market size, growth, and forecasts.

- ✔ Understand Accounts Receivable Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Accounts Receivable Automation

What is the Market Size & CAGR of Accounts Receivable Automation market in 2023 and 2033?

Accounts Receivable Automation Industry Analysis

Accounts Receivable Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Accounts Receivable Automation Market Analysis Report by Region

Europe Accounts Receivable Automation Market Report:

Europe's Accounts Receivable Automation market is estimated at USD 2.56 billion in 2023, growing to USD 5.13 billion by 2033. Factors contributing to this market's growth include stringent regulations on credit management, increasing automation of accounting processes, and the focus on enhancing customer payment experiences in countries like Germany, France, and the UK.Asia Pacific Accounts Receivable Automation Market Report:

In 2023, the Accounts Receivable Automation market in the Asia Pacific region is valued at USD 2.05 billion and is set to grow to USD 4.11 billion by 2033. The growth is driven by the rapid adoption of technology in countries like China and India, where businesses are looking to streamline operations and enhance customer experiences. The increasing push towards digital finance and government incentives for tech adoption are further propelling this growth.North America Accounts Receivable Automation Market Report:

The North America region leads the market with an estimated value of USD 3.65 billion in 2023, projected to grow to USD 7.31 billion by 2033. The region is characterized by sophisticated financial ecosystems and a strong emphasis on technological advancements, driving widespread adoption of automation solutions across various industries.South America Accounts Receivable Automation Market Report:

South America’s Accounts Receivable Automation market, valued at USD 0.53 billion in 2023, is expected to witness growth to USD 1.06 billion by 2033. The expansion is driven by the ongoing modernization of financial processes and the need for efficiently managing receivables in a turbulent economic climate, especially in Brazil and Argentina.Middle East & Africa Accounts Receivable Automation Market Report:

The Middle East and Africa market, valued at USD 1.22 billion in 2023, is forecasted to reach USD 2.44 billion by 2033. Growth in this region is fueled by a burgeoning demand for streamlined financial processes, and increasing investments in fintech solutions that automate traditional accounting practices.Tell us your focus area and get a customized research report.

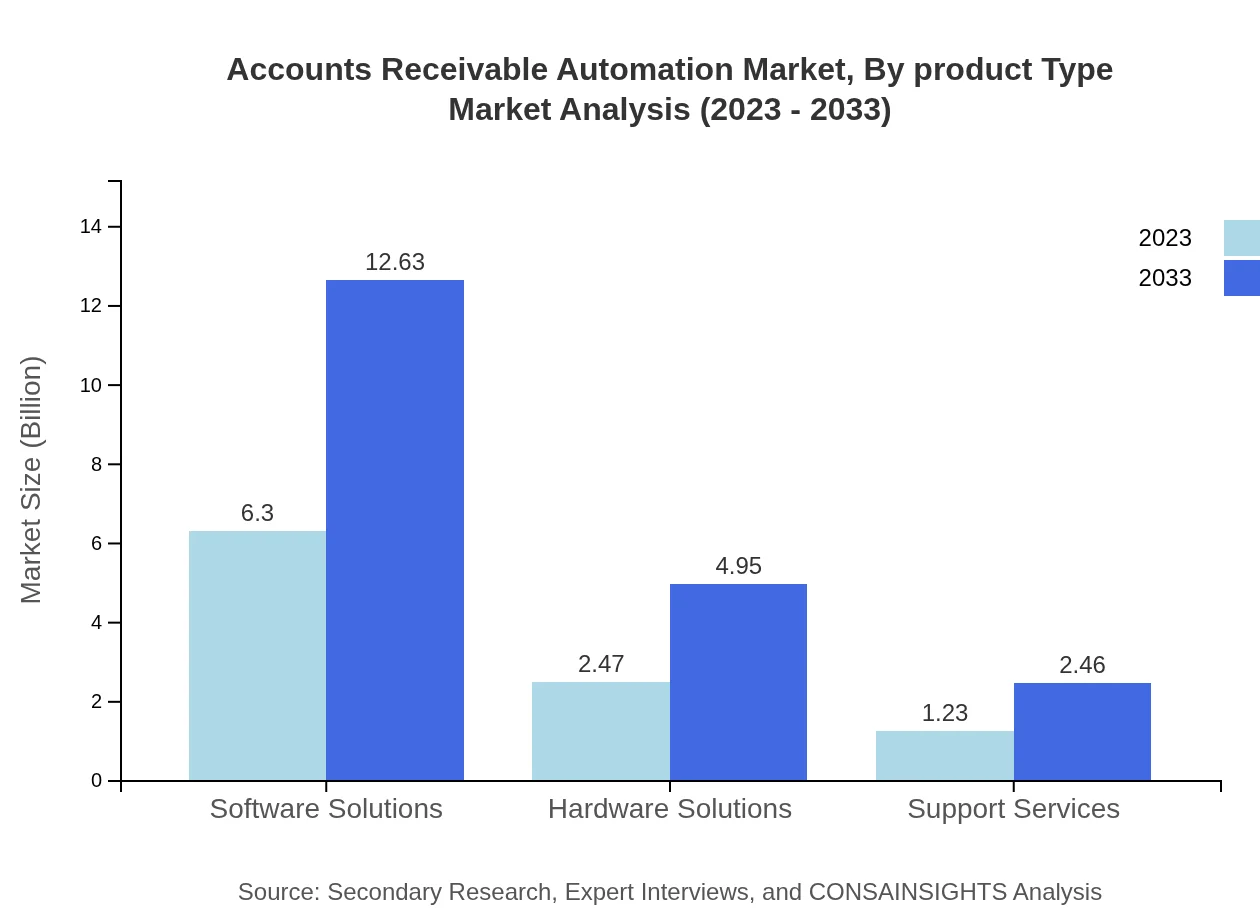

Accounts Receivable Automation Market Analysis By Product Type

The market is primarily classified into Software Solutions, Hardware Solutions, and Support Services. Software solutions dominate with a market size of USD 6.30 billion in 2023, anticipated to reach USD 12.63 billion by 2033, indicating a strong market preference for digital solutions. Hardware solutions and support services are progressively gaining traction, catering to comprehensive automation needs.

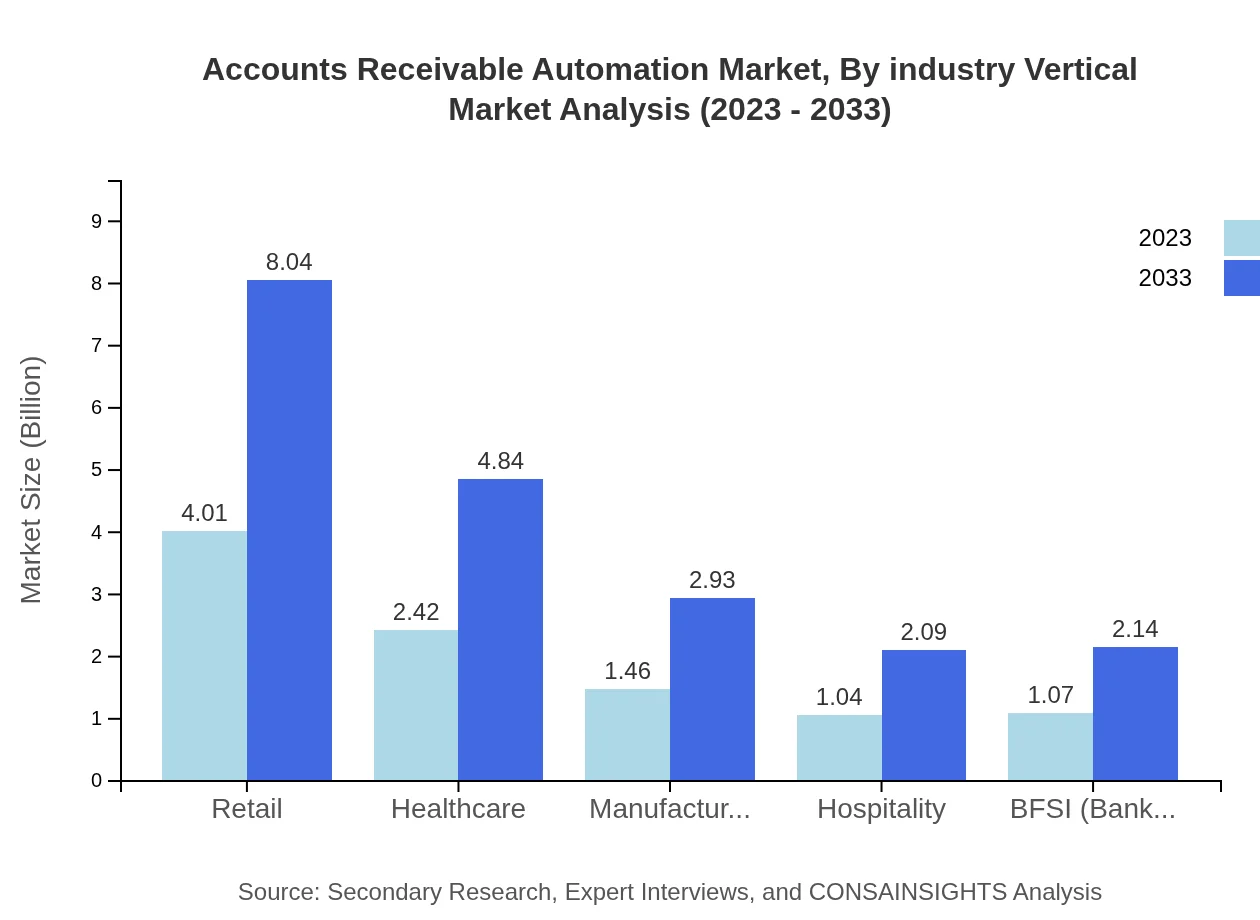

Accounts Receivable Automation Market Analysis By Industry Vertical

The industry vertical segment highlights BFSI, retail, healthcare, manufacturing, and hospitality as significant contributors to the market. The BFSI sector holds 10.68% of the market share in 2023, while retail and healthcare are also growing rapidly due to the need for effective receivables management to enhance customer service and reduce DSO.

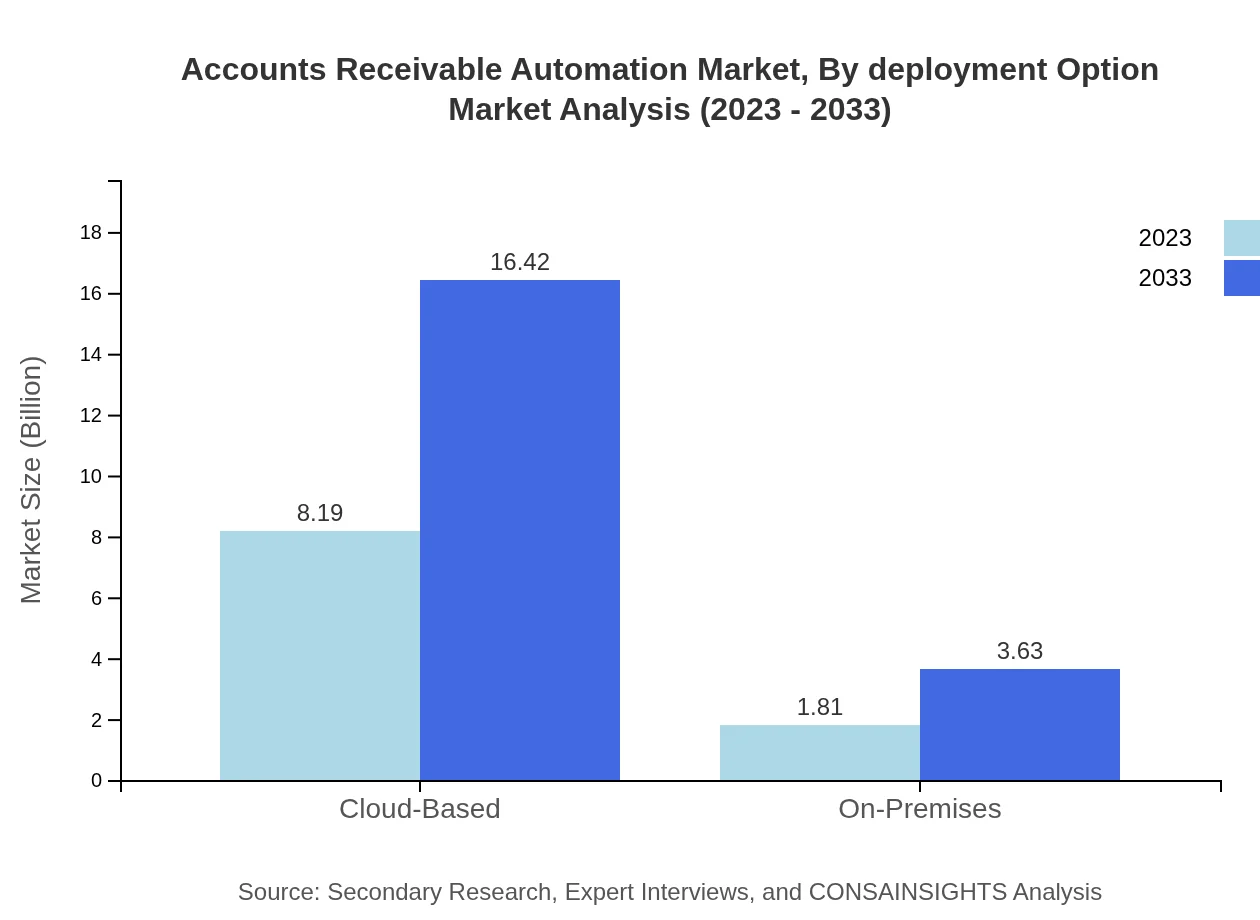

Accounts Receivable Automation Market Analysis By Deployment Option

Cloud-based solutions dominate the market with a size of USD 8.19 billion in 2023 and a share of 81.9%. Conversely, on-premises solutions make up 1.81 billion in 2023, with an 18.1% share. The preference for cloud-based solutions is increasing due to their accessibility, scalability, and cost efficiency.

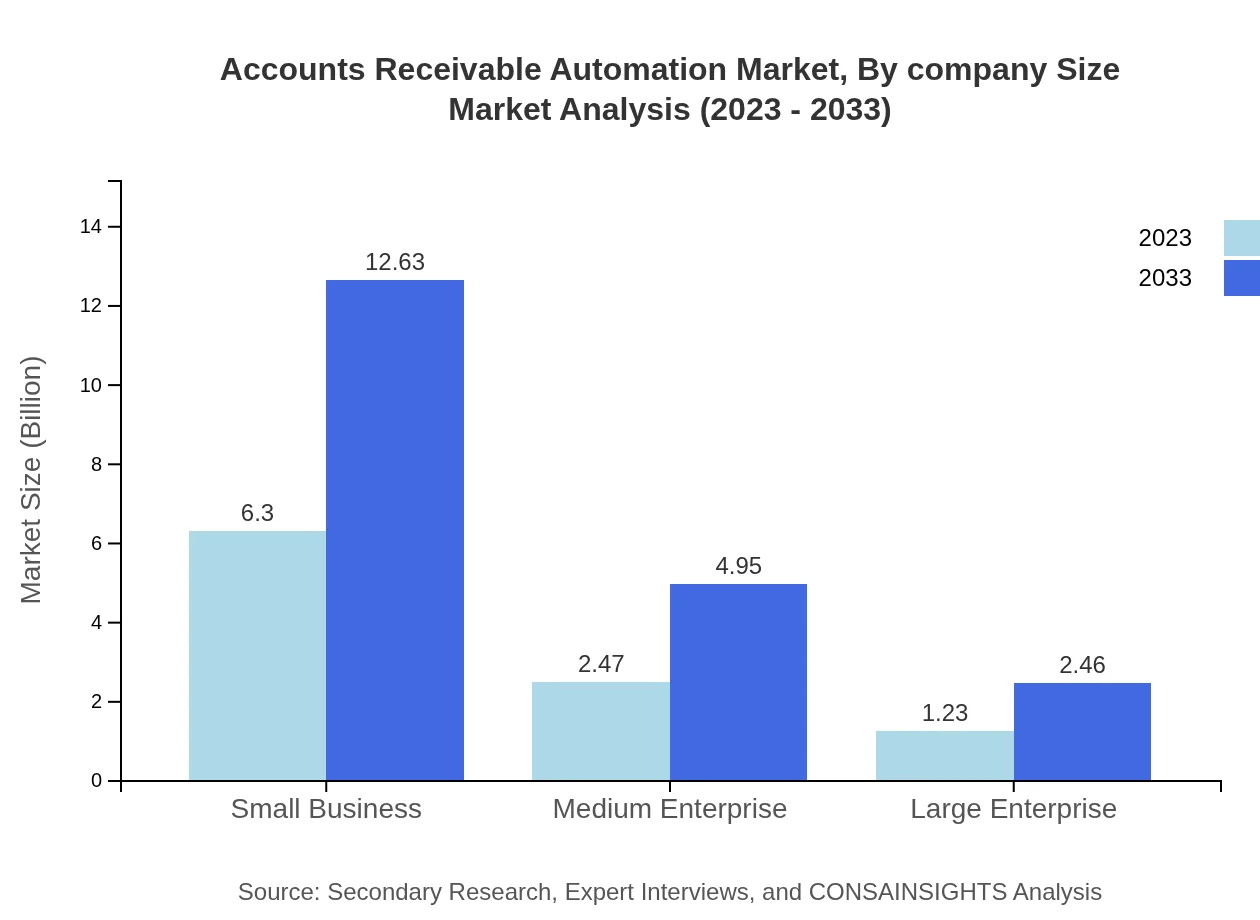

Accounts Receivable Automation Market Analysis By Company Size

The market showcases significant growth among small businesses, with a market size of USD 6.30 billion in 2023. Medium enterprises stand at USD 2.47 billion, while large enterprises contribute USD 1.23 billion. The increasing preference for automating accounts receivable processes is driving adoption among all company sizes, with small businesses leading through software-as-a-service (SaaS) solutions.

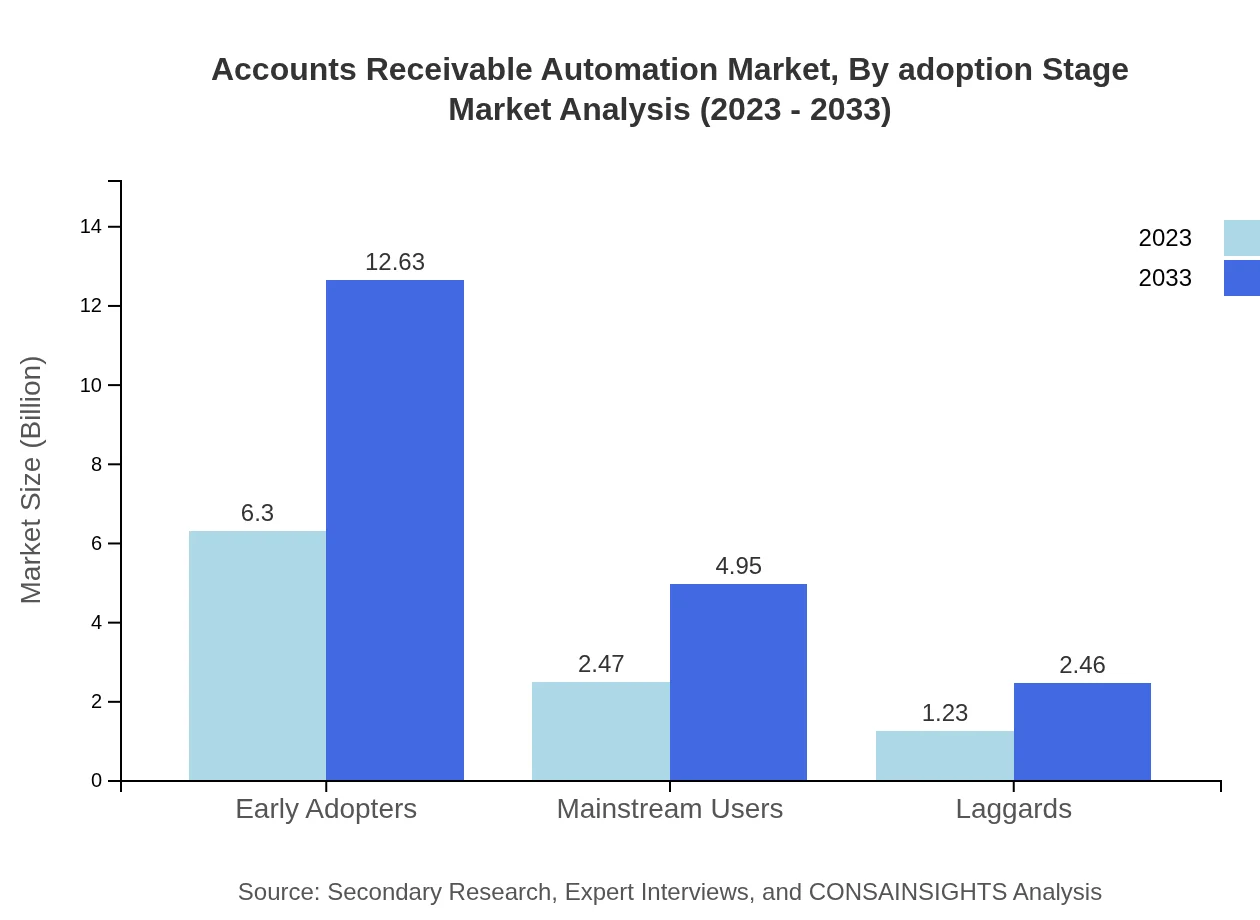

Accounts Receivable Automation Market Analysis By Adoption Stage

Market segmentation based on adoption stage shows early adopters holding a substantial market size of USD 6.30 billion in 2023, reflecting a 63.03% share. Mainstream users and laggards are also growing steadily as technology becomes more integrated into standard operations.

Accounts Receivable Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Accounts Receivable Automation Industry

SAP SE:

A leading provider of enterprise software solutions, SAP offers robust accounts receivable automation tools that integrate seamlessly with other financial processes.Oracle Corporation:

Oracle's cloud solutions for accounts receivable automation help businesses manage receivables efficiently, offer predictive analytics, and improve cash flow management.Bill.com:

Specializing in automated accounts payable and receivable solutions, Bill.com helps businesses streamline their invoicing and payment processes.BlackLine:

BlackLine provides cloud-based solutions for financial close and reconciliation, enhancing the automation of accounts receivable processes.We're grateful to work with incredible clients.

FAQs

What is the market size of accounts Receivable Automation?

The accounts-receivable-automation market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 7% from 2023. This growth is driven by increased automation adoption and efficiency in financial processes.

What are the key market players or companies in this accounts Receivable Automation industry?

Key players in the accounts-receivable-automation industry include global software solution providers and fintech companies that specialize in financial automation tools, enhancing efficiency and scalability for businesses across various sectors.

What are the primary factors driving the growth in the accounts Receivable Automation industry?

Main growth drivers include the need for improved cash flow management, reduction of human errors, and enhanced efficiency through automation. Businesses increasingly seek solutions that streamline operations and reduce costs.

Which region is the fastest Growing in the accounts Receivable Automation?

North America is currently the fastest-growing region in the accounts-receivable-automation market, with a market size projected to increase from $3.65 billion in 2023 to $7.31 billion by 2033, driven by high technology adoption.

Does ConsaInsights provide customized market report data for the accounts Receivable Automation industry?

Yes, ConsaInsights offers customized market report data specific to accounts-receivable-automation, tailored to the unique needs and requirements of various clients for more impactful analysis.

What deliverables can I expect from this accounts Receivable Automation market research project?

Expect comprehensive deliverables including detailed market analysis, trend evaluations, competitive landscape assessments, and insights into consumer behavior crucial for strategic planning in accounts-receivable-automation.

What are the market trends of accounts Receivable Automation?

Emerging trends in accounts-receivable-automation include increased use of AI and machine learning for credit risk assessment and growing adoption of cloud-based solutions that enhance remote financial management.