Acephate Market Report

Published Date: 02 February 2026 | Report Code: acephate

Acephate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Acephate market from 2023 to 2033, highlighting key trends, market size, growth projections, regional insights, and the competitive landscape.

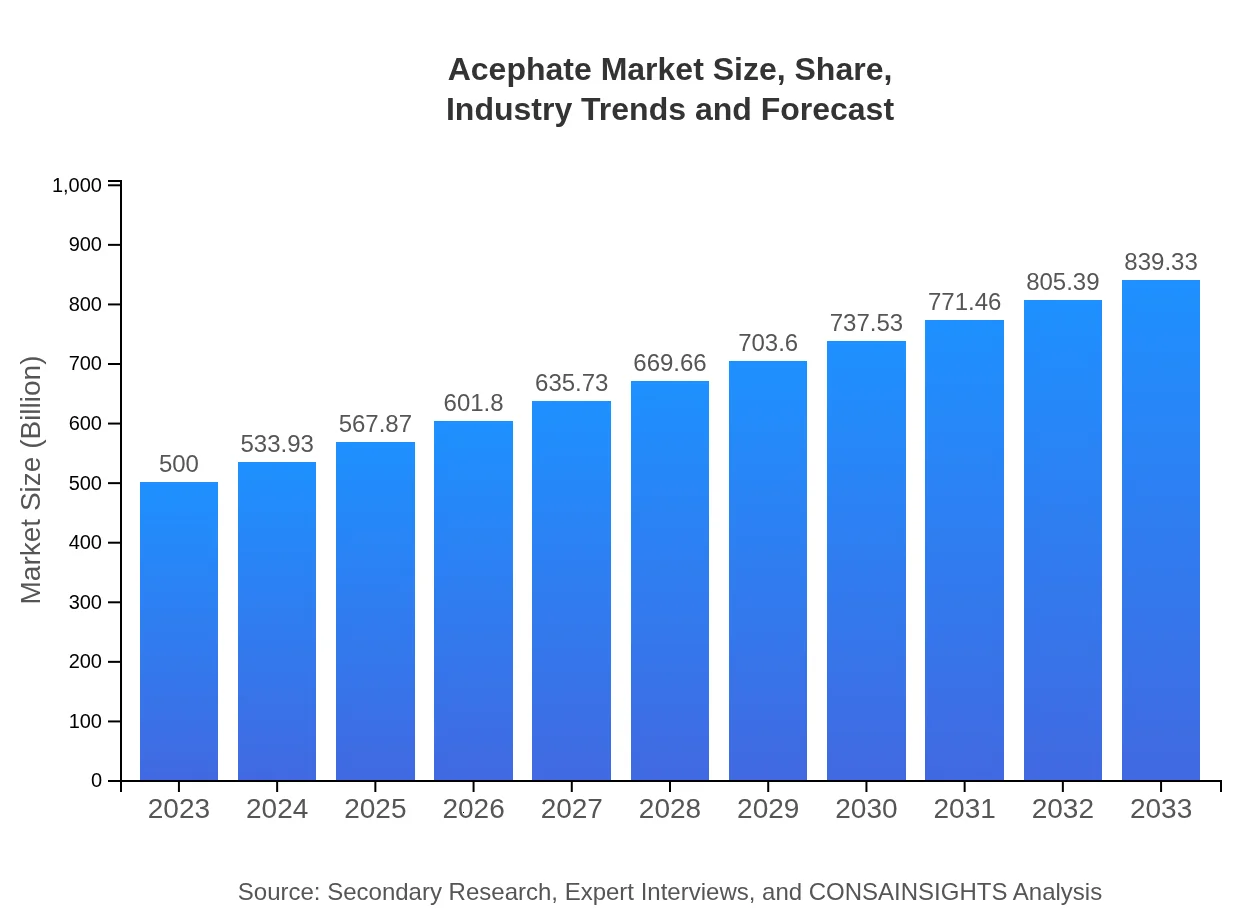

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $839.33 Million |

| Top Companies | Syngenta AG, Bayer AG, ADAMA Agricultural Solutions Ltd., Nufarm Limited |

| Last Modified Date | 02 February 2026 |

Acephate Market Overview

Customize Acephate Market Report market research report

- ✔ Get in-depth analysis of Acephate market size, growth, and forecasts.

- ✔ Understand Acephate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acephate

What is the Market Size & CAGR of Acephate market in 2023?

Acephate Industry Analysis

Acephate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acephate Market Analysis Report by Region

Europe Acephate Market Report:

The European market is estimated to rise from $149.55 million in 2023 to $251.04 million by 2033. Environmental regulations regarding pesticide use may steer innovation, emphasizing the importance of integrating Acephate within sustainable agricultural practices.Asia Pacific Acephate Market Report:

In the Asia Pacific region, the Acephate market is forecasted to grow from $94.15 million in 2023 to $158.05 million by 2033. The surge is attributed to rising agricultural activities and a focus on increasing crop productivity in countries like India and China.North America Acephate Market Report:

North America is expected to witness a robust growth in the Acephate market, from $182.35 million in 2023 to $306.10 million by 2033. The growth is stimulated by increased awareness among farmers about pest management and the need for highly effective insecticides, alongside advancements in agricultural technology.South America Acephate Market Report:

South America's Acephate market is projected to expand from $30.25 million in 2023 to $50.78 million by 2033. This growth is driven by the region's strong agricultural sector and rising demand for effective pest control solutions following various pest infestations.Middle East & Africa Acephate Market Report:

The Middle East and Africa region is projected to grow from $43.70 million in 2023 to $73.36 million by 2033. Economic development and modernization of agricultural practices contribute significantly to the rising demand for Acephate in pest management.Tell us your focus area and get a customized research report.

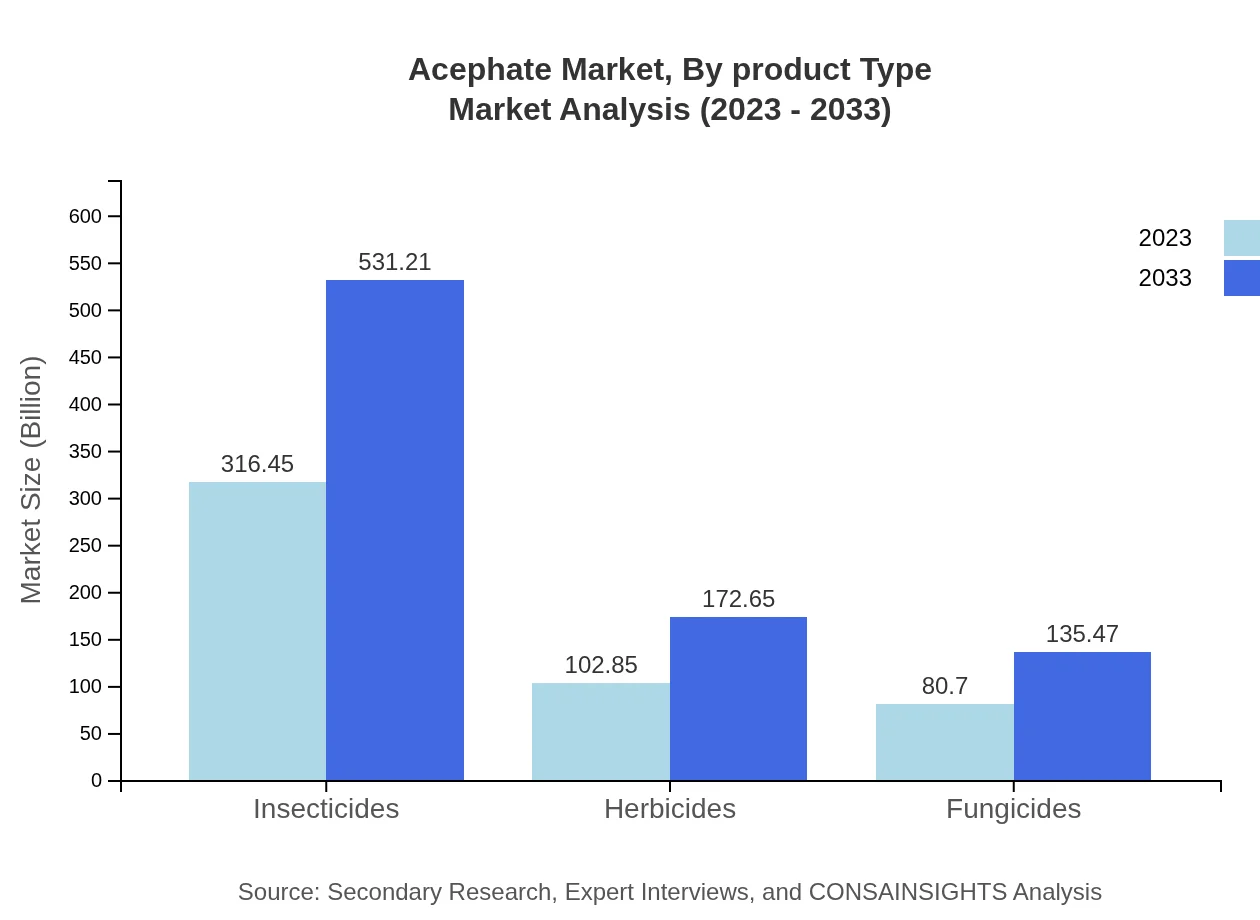

Acephate Market Analysis By Product Type

In the segment by product type, insecticides lead significantly with a market size of $316.45 million in 2023, projected to reach $531.21 million by 2033, accounting for around 63.29% market share during this period. This growth is primarily due to the increasing emphasis on crop protection and pest management in agriculture.

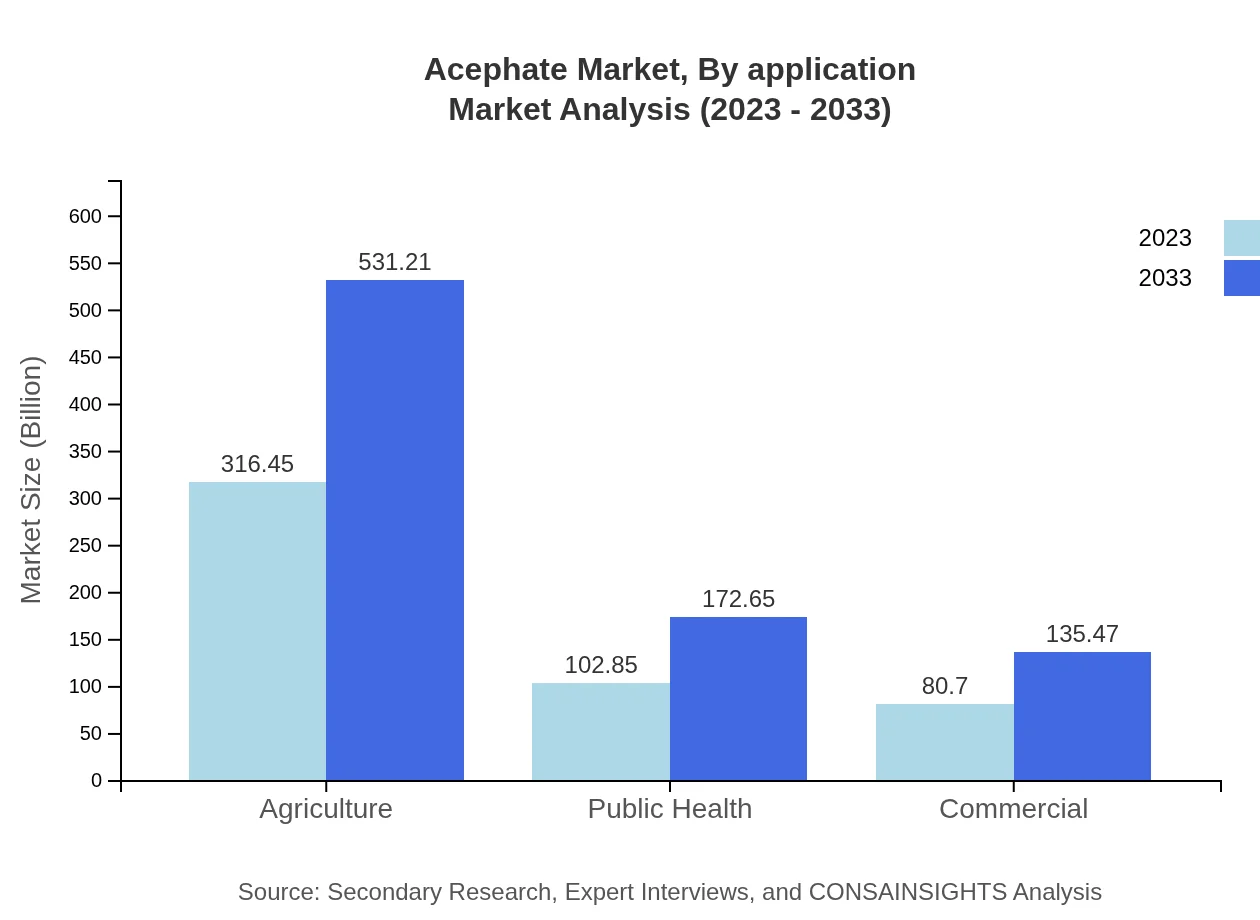

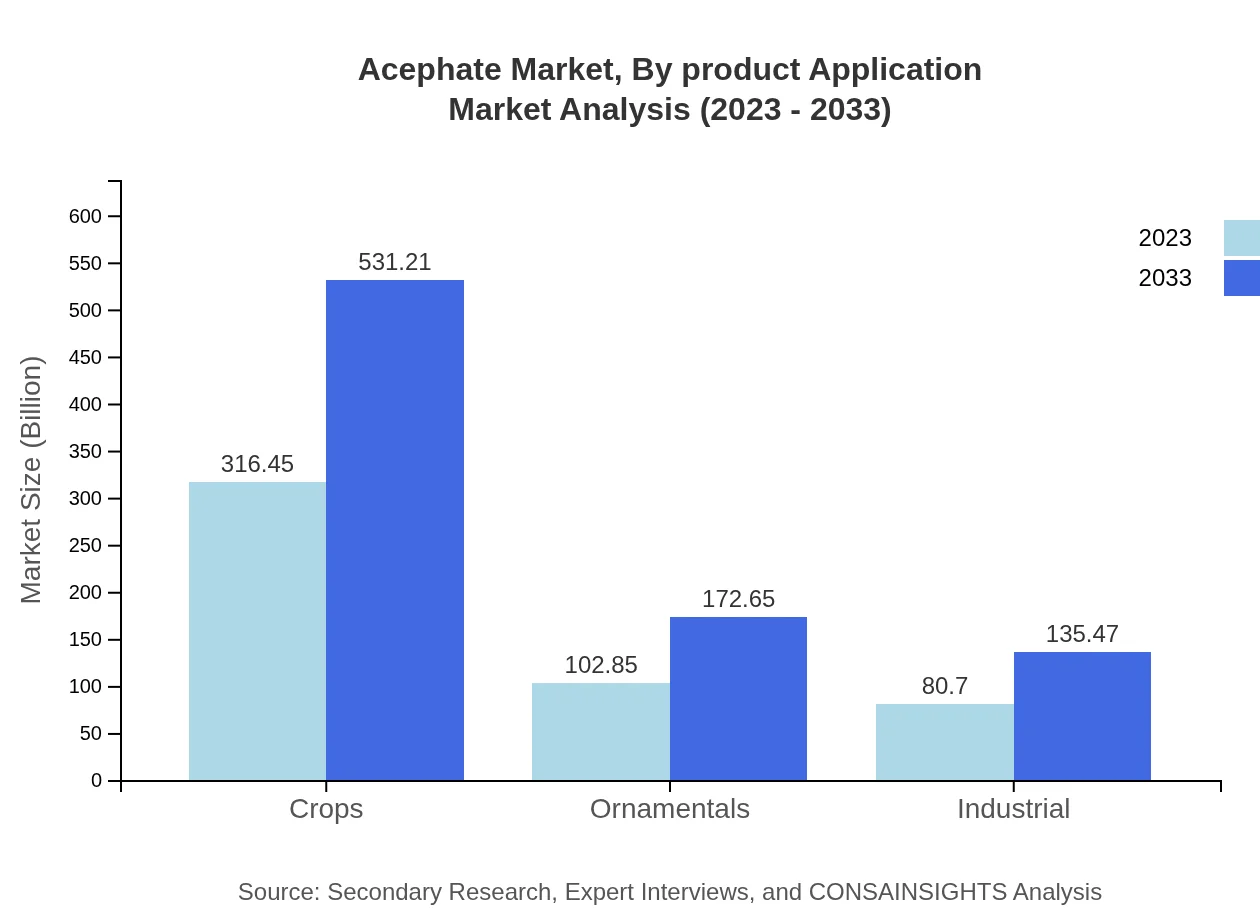

Acephate Market Analysis By Application

The primary applications of Acephate include agriculture, particularly in crops and ornamentals. The agriculture sector alone exhibits considerable value, starting at $316.45 million in 2023 and anticipating growth to $531.21 million by 2033, maintaining a significant market share of 63.29%. Pest control companies also appear relevant, indicating a robust demand for pest management solutions.

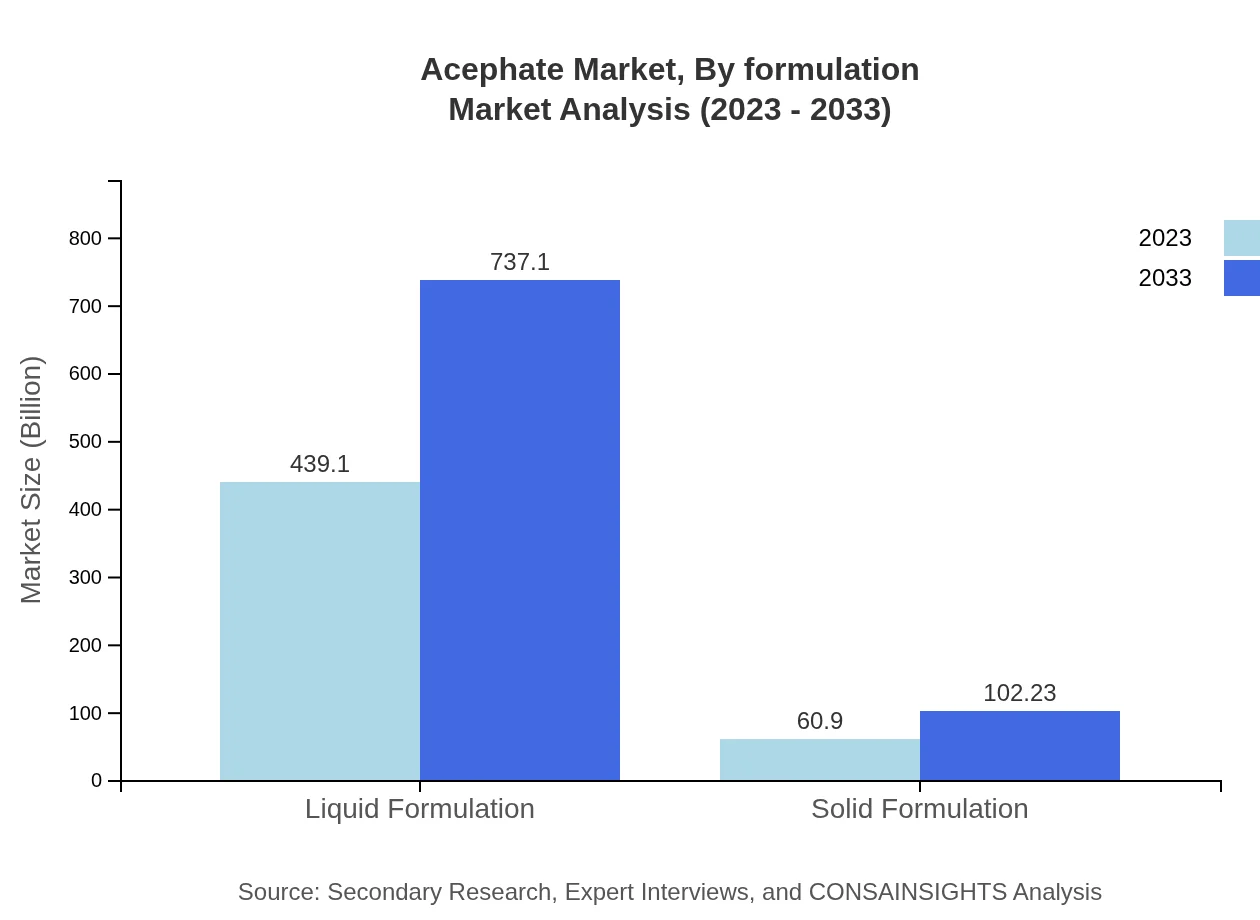

Acephate Market Analysis By Formulation

By formulation, liquid formulations dominate the Acephate market with a market size of $439.10 million in 2023, expected to grow to $737.10 million by 2033, holding an 87.82% share. The demand for liquid formulations assists in enhancing efficacy in pest control, necessary for competitive agriculture practices.

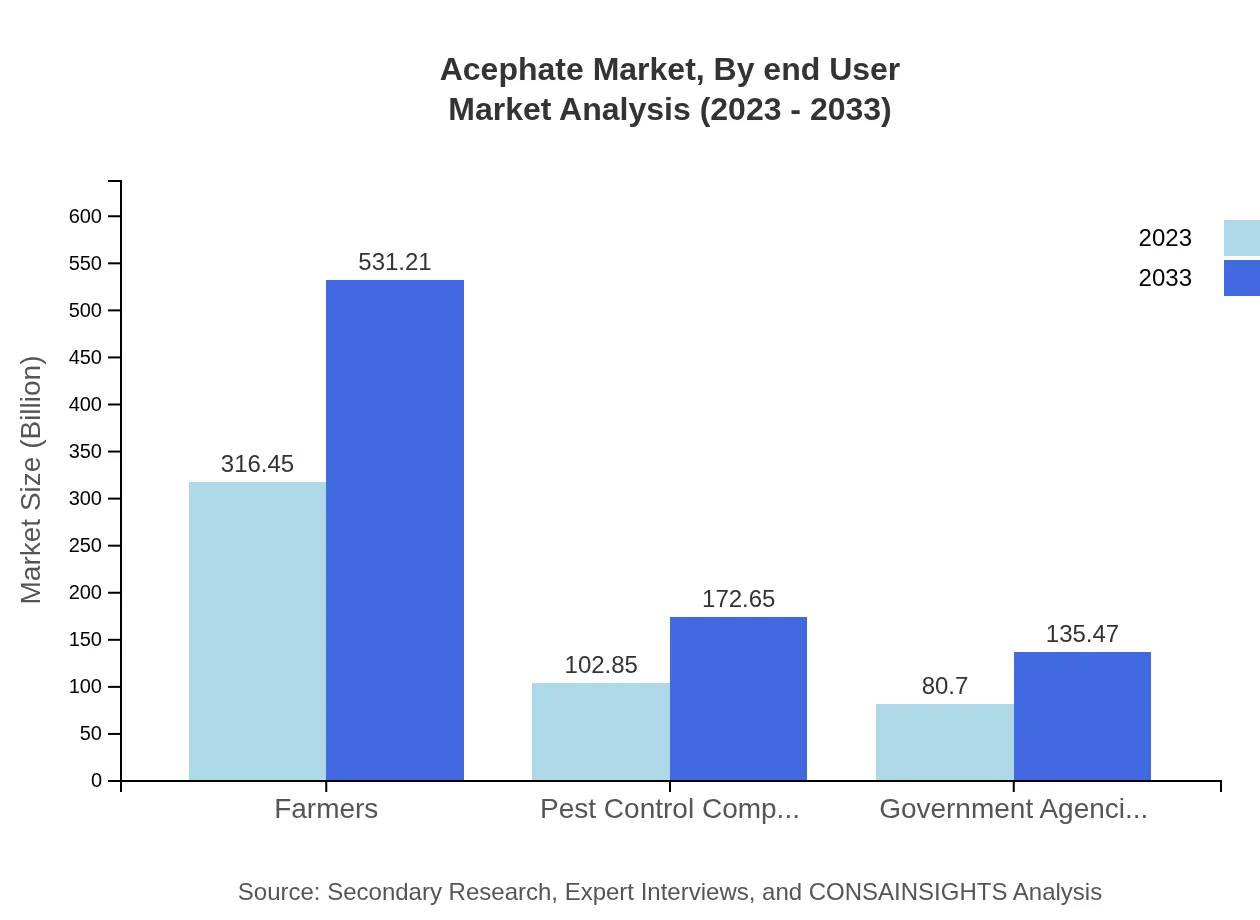

Acephate Market Analysis By End User

Farmers represent the largest end-user segment of the Acephate market. The market size for farmers is $316.45 million in 2023, projected to grow to $531.21 million by 2033, capturing a robust market share of 63.29%. Additionally, government agencies and pest control companies play crucial roles, each expanding their operations for better pest management.

Acephate Market Analysis By Product Application

Acephate’s application in various product categories like insecticides, herbicides, and fungicides positions it favorably. Insecticides account for $316.45 million in 2023, reaching $531.21 million by 2033, while herbicides and fungicides trail behind, emphasizing the critical role of pest control in agricultural productivity.

Acephate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acephate Industry

Syngenta AG:

Syngenta is a leading global agribusiness company that produces seeds and crop protection products, including Acephate. Their innovative approach focuses on sustainable agriculture, enhancing yield and pest control.Bayer AG:

Bayer AG engages in crop science, providing innovative solutions for significant agricultural challenges. Bayer’s Acephate formulations contribute to pest management strategies worldwide.ADAMA Agricultural Solutions Ltd.:

ADAMA specializes in crop protection products, including Acephate. Their mission includes providing farmers with effective solutions tailored to address pests while maintaining economic viability.Nufarm Limited:

Nufarm is an agricultural chemicals company known for its significant portfolio in crop protection. Their focus on innovation ensures they supply effective pest control solutions, including Acephate.We're grateful to work with incredible clients.

FAQs

What is the market size of acephate?

The global acephate market was valued at approximately $500 million in 2023, with an expected compound annual growth rate (CAGR) of 5.2%. Projections indicate significant growth in market size over the next decade, driven by increased agricultural demand.

What are the key market players or companies in the acephate industry?

Key players in the acephate market include major agrochemical firms and manufacturers that specialize in insecticides. These companies are instrumental in driving innovation and market penetration, contributing to the expansion of acephate as a vital pesticide.

What are the primary factors driving the growth in the acephate industry?

Growth in the acephate industry is fueled by rising agricultural productivity needs, increasing pest infestations, and heightened awareness of crop protection. Additionally, advancements in agricultural technologies and supportive government policies also play a critical role.

Which region is the fastest Growing in the acephate market?

The fastest-growing regions for the acephate market are North America and Europe. For example, North America's market is projected to grow from $182.35 million in 2023 to $306.10 million by 2033, showcasing a robust upward trajectory.

Does ConsInsights provide customized market report data for the acephate industry?

Yes, ConsInsights offers customized market report data catering to specific needs within the acephate industry. This enables businesses and researchers to obtain tailored insights based on their unique requirements and market focus.

What deliverables can I expect from this acephate market research project?

Expect comprehensive deliverables from the acephate market research project, including detailed reports, market forecasts, regional analysis, competitive landscape assessments, and insights on prevailing trends, as well as customized data tailored to specific queries.

What are the market trends of acephate?

Current trends in the acephate market include increased adoption of eco-friendly formulations, growing emphasis on food safety, and innovations in pest control technology. Additionally, there is a notable shift toward integrated pest management strategies to enhance crop yield.