Acetic Anhydride Market Report

Published Date: 02 February 2026 | Report Code: acetic-anhydride

Acetic Anhydride Market Size, Share, Industry Trends and Forecast to 2033

This detailed report covers the Acetic Anhydride market from 2023 to 2033. It highlights market size, segmentation, trends, and key insights that will help stakeholders make informed decisions.

| Metric | Value |

|---|---|

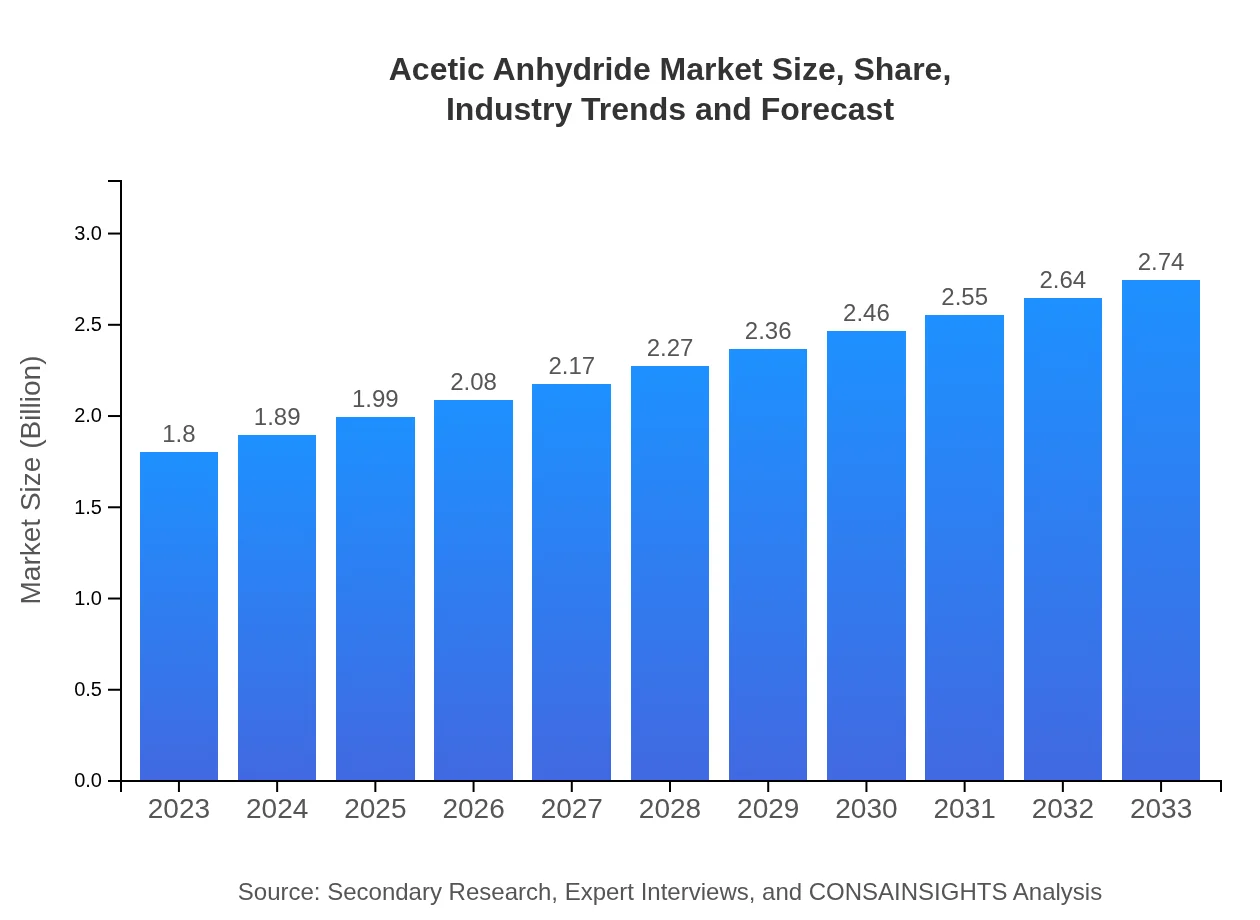

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $2.74 Billion |

| Top Companies | Celanese Corporation, BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company |

| Last Modified Date | 02 February 2026 |

Acetic Anhydride Market Overview

Customize Acetic Anhydride Market Report market research report

- ✔ Get in-depth analysis of Acetic Anhydride market size, growth, and forecasts.

- ✔ Understand Acetic Anhydride's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acetic Anhydride

What is the Market Size & CAGR of Acetic Anhydride market in 2023?

Acetic Anhydride Industry Analysis

Acetic Anhydride Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acetic Anhydride Market Analysis Report by Region

Europe Acetic Anhydride Market Report:

Europe's market, estimated at $0.44 billion in 2023, is expected to reach $0.67 billion by 2033. The European market dynamics are influenced by stringent environmental regulations and the push for sustainable approaches to production. The automotive and textile industries play a significant role in driving demand.Asia Pacific Acetic Anhydride Market Report:

In the Asia Pacific region, the Acetic Anhydride market is expected to grow from $0.38 billion in 2023 to $0.58 billion by 2033. The growth in this region is propelled by rapid industrialization and increasing investments in infrastructure, especially in countries like China and India. The demand for textiles and packaging materials significantly influences Acetic Anhydride consumption.North America Acetic Anhydride Market Report:

North America, valued at $0.67 billion in 2023, is forecasted to reach $1.03 billion by 2033. The region benefits from strong pharmaceutical and healthcare sectors, with Acetic Anhydride being a key ingredient in the synthesis of various drugs. Increasing demand for biopharmaceuticals and environmentally-friendly practices will further boost market growth.South America Acetic Anhydride Market Report:

South America's Acetic Anhydride market is projected to increase from $0.16 billion in 2023 to $0.24 billion in 2033, driven by the expansion of the agricultural and food processing sectors. The region is experiencing growth in chemicals production, which is expected to enhance market potential in the long term.Middle East & Africa Acetic Anhydride Market Report:

The Middle East and Africa region is anticipated to grow from $0.14 billion in 2023 to $0.21 billion by 2033. Increased investments in industrial sectors and advancements in chemical processing technologies are expected to foster growth within this market.Tell us your focus area and get a customized research report.

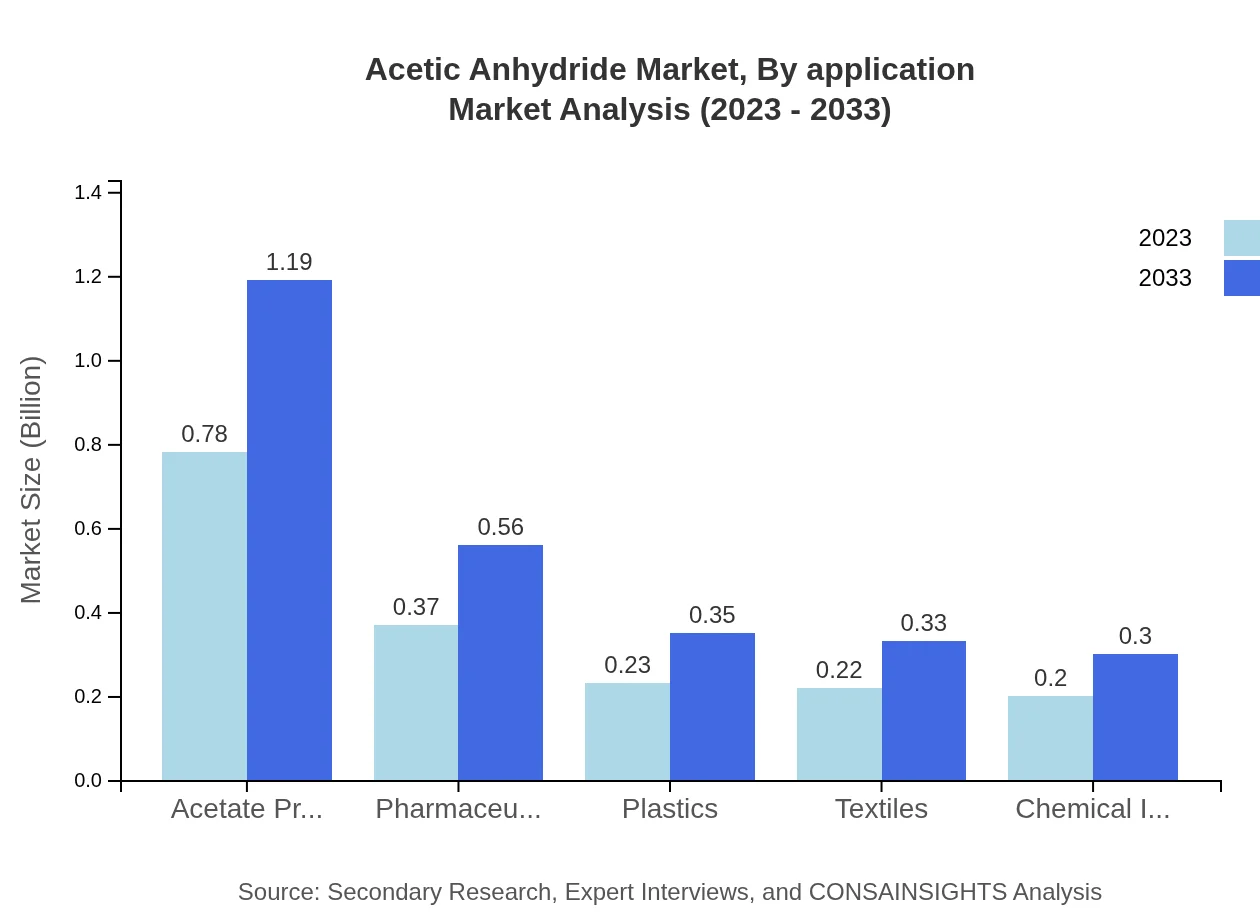

Acetic Anhydride Market Analysis By Application

The Acetic Anhydride market, by application, includes sectors such as chemical intermediates, pharmaceuticals, food production, textiles, and plastics. Chemical intermediates and pharmaceutical applications are expected to dominate, reflecting significant share values. Acetic Anhydride serves crucial roles in reactions necessary for manufacturing various essential products.

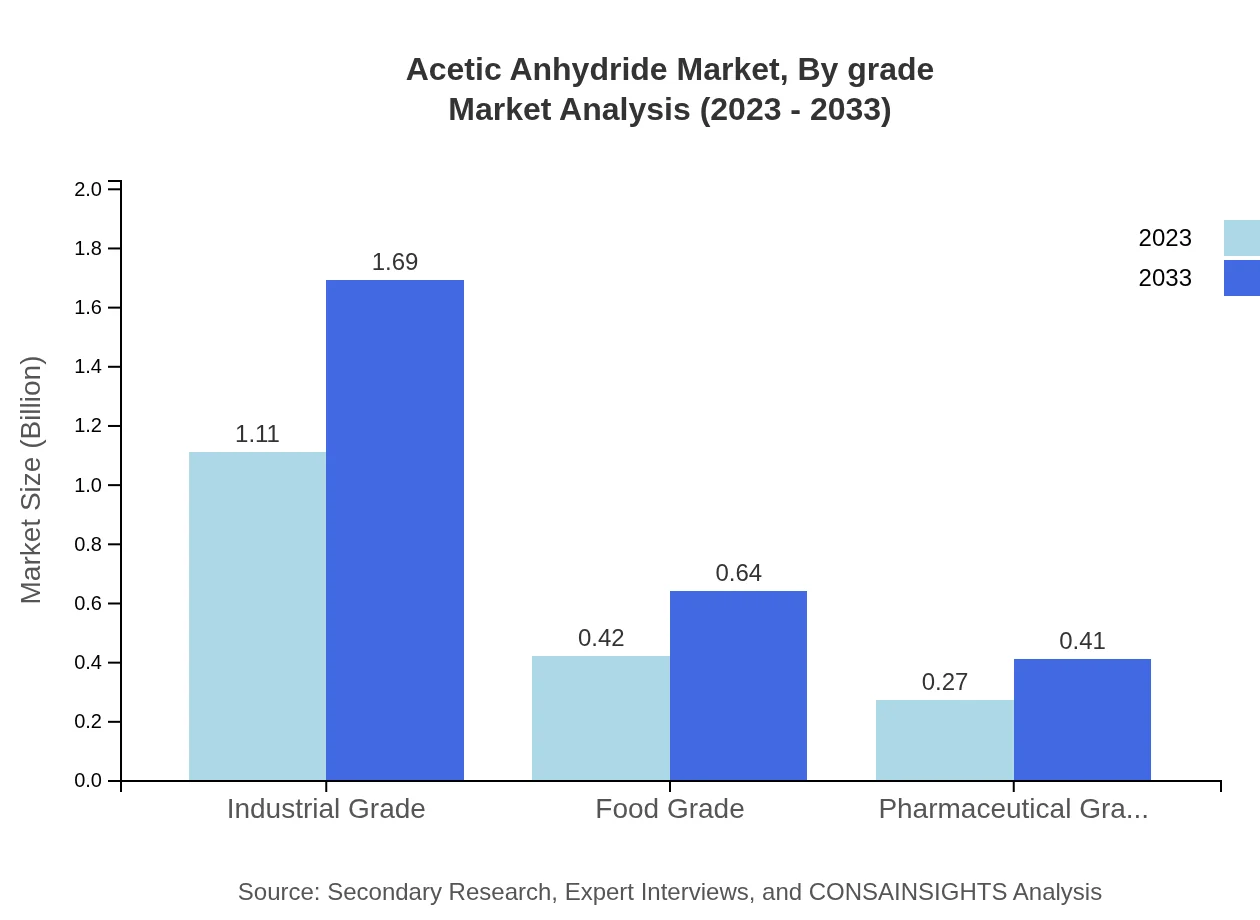

Acetic Anhydride Market Analysis By Grade

The market is segmented by grade into industrial, food, and pharmaceutical grades. The industrial grade segment holds the largest market share due to its broad use in chemical synthesis and manufacturing processes. The food and pharmaceutical grades are gaining traction due to strict adherence to quality and safety regulations in food processing and drug manufacturing.

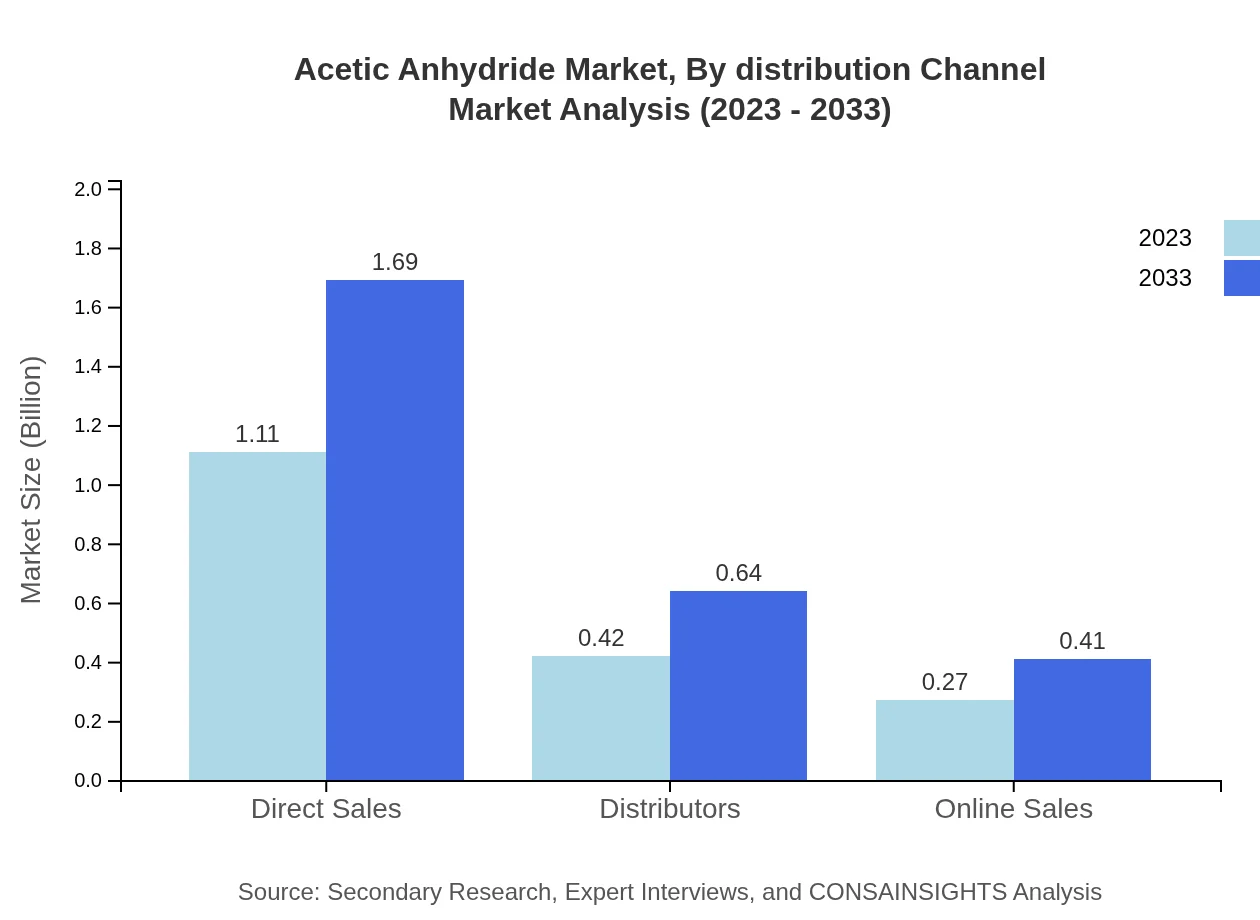

Acetic Anhydride Market Analysis By Distribution Channel

Distribution channels play a key role in the supply dynamics of the Acetic Anhydride market. Segments include direct sales, distributors, and online sales. Direct sales remain prominent, accounting for a majority share, while online sales are gaining momentum due to the digital shift in procurement processes.

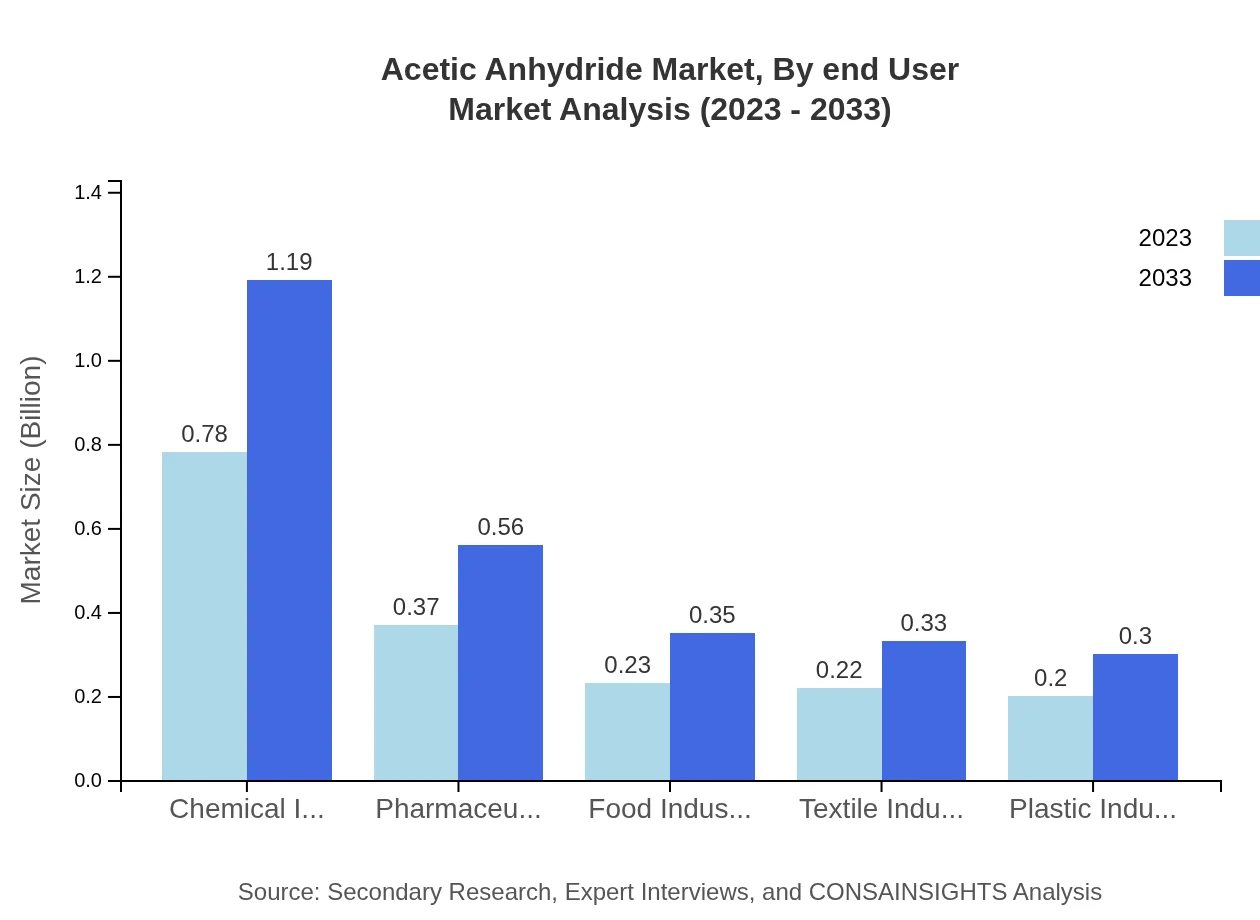

Acetic Anhydride Market Analysis By End User

The end-user segment analysis identifies major industries such as pharmaceuticals, textiles, and plastics. Each sector showcases varying demand patterns and growth trajectories, with the pharmaceutical industry being a key revenue driver due to its reliance on Acetic Anhydride in drug synthesis and formulation.

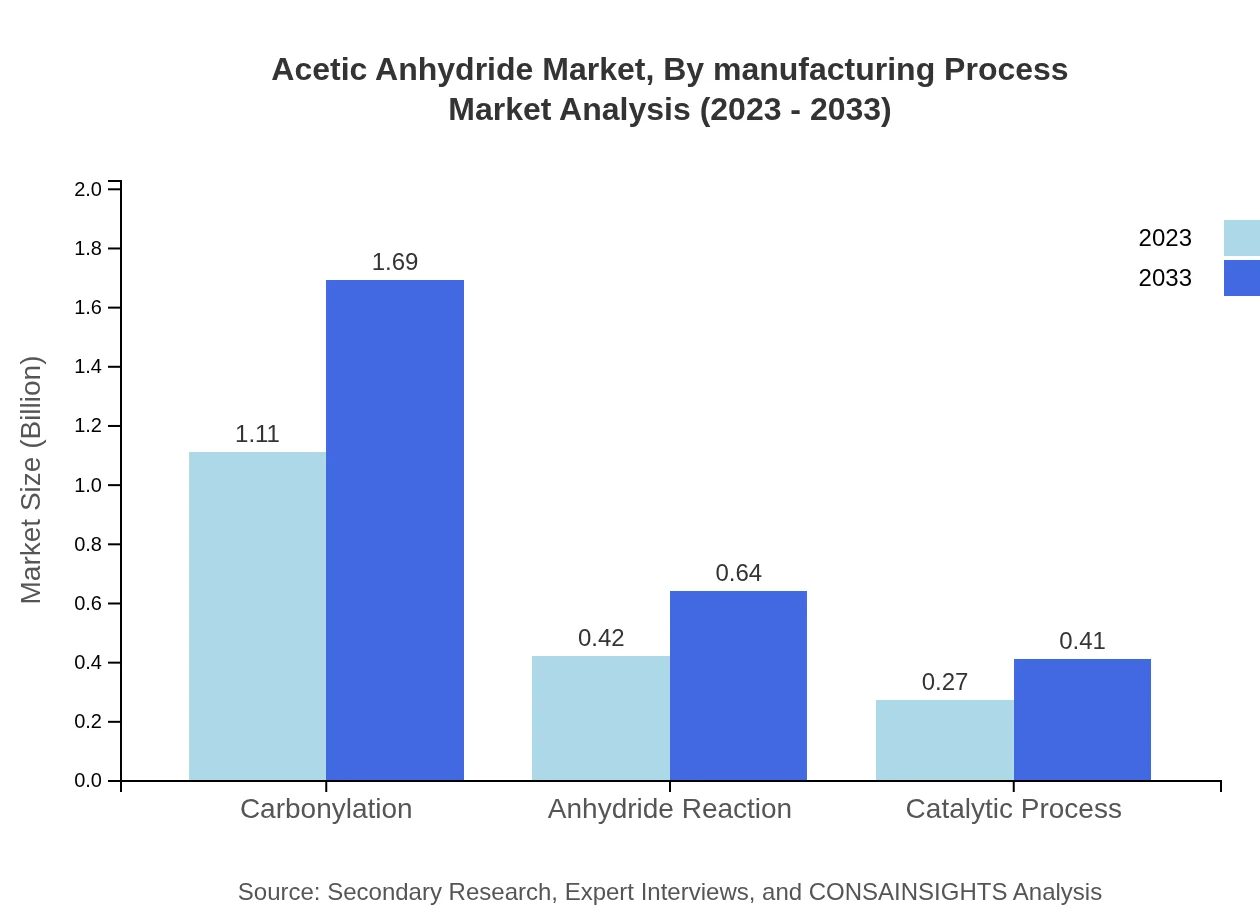

Acetic Anhydride Market Analysis By Manufacturing Process

Acetic Anhydride production utilizes processes such as carbonylation and anhydride reaction. The carbonylation process is widely adopted due to its efficiency in producing pure anhydride with minimal environmental impact. Innovations in production techniques are anticipated to enhance yield and reduce operational costs.

Acetic Anhydride Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acetic Anhydride Industry

Celanese Corporation:

A global leader in the production of Acetic Anhydride, Celanese is known for its innovative chemical solutions and commitment to sustainability.BASF SE:

BASF is a major player in the chemical industry, focusing on high-performance products including Acetic Anhydride with applications in various end-user sectors.Eastman Chemical Company:

An established name in chemical production, Eastman specializes in various grades of Acetic Anhydride, catering to global market needs.Mitsubishi Gas Chemical Company:

With a focus on chemical innovation, Mitsubishi offers high-purity Acetic Anhydride and is involved in multiple applications globally.We're grateful to work with incredible clients.

FAQs

What is the market size of acetic anhydride?

The global acetic anhydride market is valued at approximately $1.8 billion in 2023 and is projected to grow at a CAGR of 4.2% through 2033. This indicates a substantial increase, highlighting the material's rising demand in various sectors.

What are the key market players or companies in the acetic anhydride industry?

Prominent players in the acetic anhydride market include major chemical manufacturers such as Celanese Corporation, Mitsubishi Chemical Corporation, and Eastman Chemical Company. These companies lead the industry through innovation and expansive production capabilities.

What are the primary factors driving the growth in the acetic anhydride industry?

Key drivers for the growth of the acetic anhydride market include increasing demand in pharmaceuticals, textiles, and plastics. The surge in industrial applications and production of acetate derivatives also significantly contributes to the market expansion.

Which region is the fastest Growing in the acetic anhydride market?

The Asia Pacific region is the fastest-growing market for acetic anhydride, with projections of market growth from $0.38 billion in 2023 to $0.58 billion in 2033, showcasing increasing industrial activities and production facilities.

Does ConsaInsights provide customized market report data for the acetic anhydride industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the acetic anhydride industry, ensuring comprehensive insights and data relevant to distinct segments and market trends.

What deliverables can I expect from this acetic anhydride market research project?

Deliverables from the acetic anhydride market research project include detailed reports on market sizes by region, segmentation insights, competitive landscape analysis, trend forecasting, and customized recommendations based on specific client objectives.

What are the market trends of acetic anhydride?

Current trends in the acetic anhydride market highlight a growing emphasis on sustainable and efficient production processes. Additionally, increased adoption in bio-based applications and rising demand for environmentally friendly chemicals are shaping market dynamics.