Acetone Market Report

Published Date: 02 February 2026 | Report Code: acetone

Acetone Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Acetone market, examining market size, growth trends, and competitive landscape from 2023 to 2033. Key data and projections inform stakeholders about future opportunities and market dynamics in this crucial chemical sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

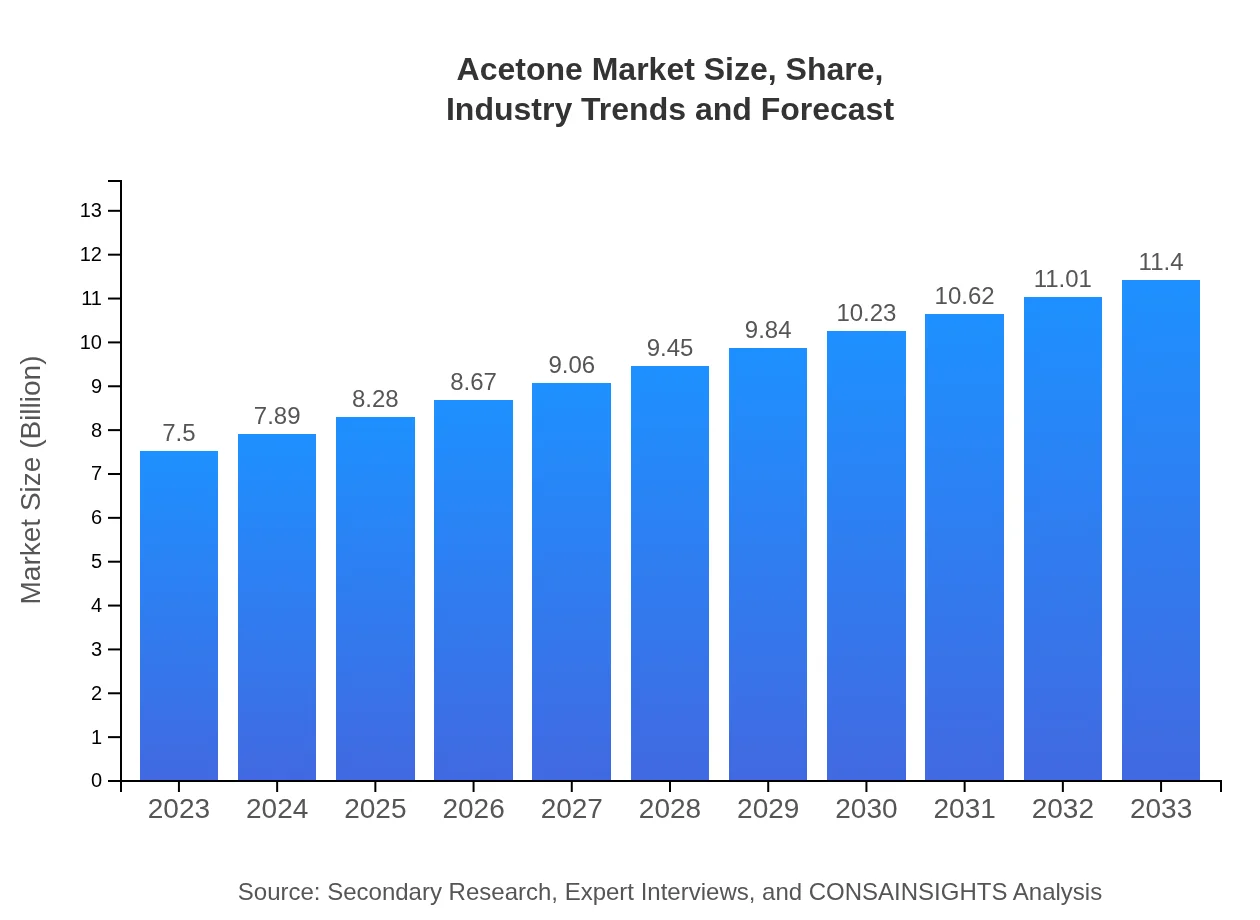

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $11.40 Billion |

| Top Companies | Kraton Corporation, BASF SE, Royal Dutch Shell, Mitsui Chemicals |

| Last Modified Date | 02 February 2026 |

Acetone Market Overview

Customize Acetone Market Report market research report

- ✔ Get in-depth analysis of Acetone market size, growth, and forecasts.

- ✔ Understand Acetone's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acetone

What is the Market Size & CAGR of Acetone market in 2023?

Acetone Industry Analysis

Acetone Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acetone Market Analysis Report by Region

Europe Acetone Market Report:

In Europe, the Acetone market is projected to expand from 2.41 billion USD in 2023 to 3.66 billion USD by 2033. Strong environmental regulations and growth in the automotive sector, particularly in Germany and France, are key factors propelling this growth. Advances in bio-based Acetone technologies also play a pivotal role in market dynamics.Asia Pacific Acetone Market Report:

The Asia-Pacific region is poised for significant growth, with the market size expected to rise from 1.35 billion USD in 2023 to 2.05 billion USD in 2033. Key growth drivers include increasing industrialization and a strong automotive sector across countries like China and India, where Acetone serves critical roles in manufacturing and construction.North America Acetone Market Report:

North America is expected to experience robust growth, with the market forecasted at 2.64 billion USD in 2023 and reaching approximately 4.01 billion USD by 2033. The surge is driven by advancements in technology and the increasing usage of Acetone in pharmaceuticals and automotive applications, especially in the US and Canada.South America Acetone Market Report:

In South America, the Acetone market value is anticipated to grow from 0.14 billion USD in 2023 to 0.21 billion USD by 2033. This growth is attributed to rising demands in the pharmaceuticals and cosmetics industries, with Brazil representing the largest market share, benefiting from a burgeoning consumer base.Middle East & Africa Acetone Market Report:

The Middle East and Africa region anticipates growth from 0.97 billion USD in 2023 to 1.47 billion USD by 2033. Growing industrial activities and rising investments in the petrochemical sector are fueling Acetone demand, particularly in UAE and Saudi Arabia, where manufacturing is rapidly advancing.Tell us your focus area and get a customized research report.

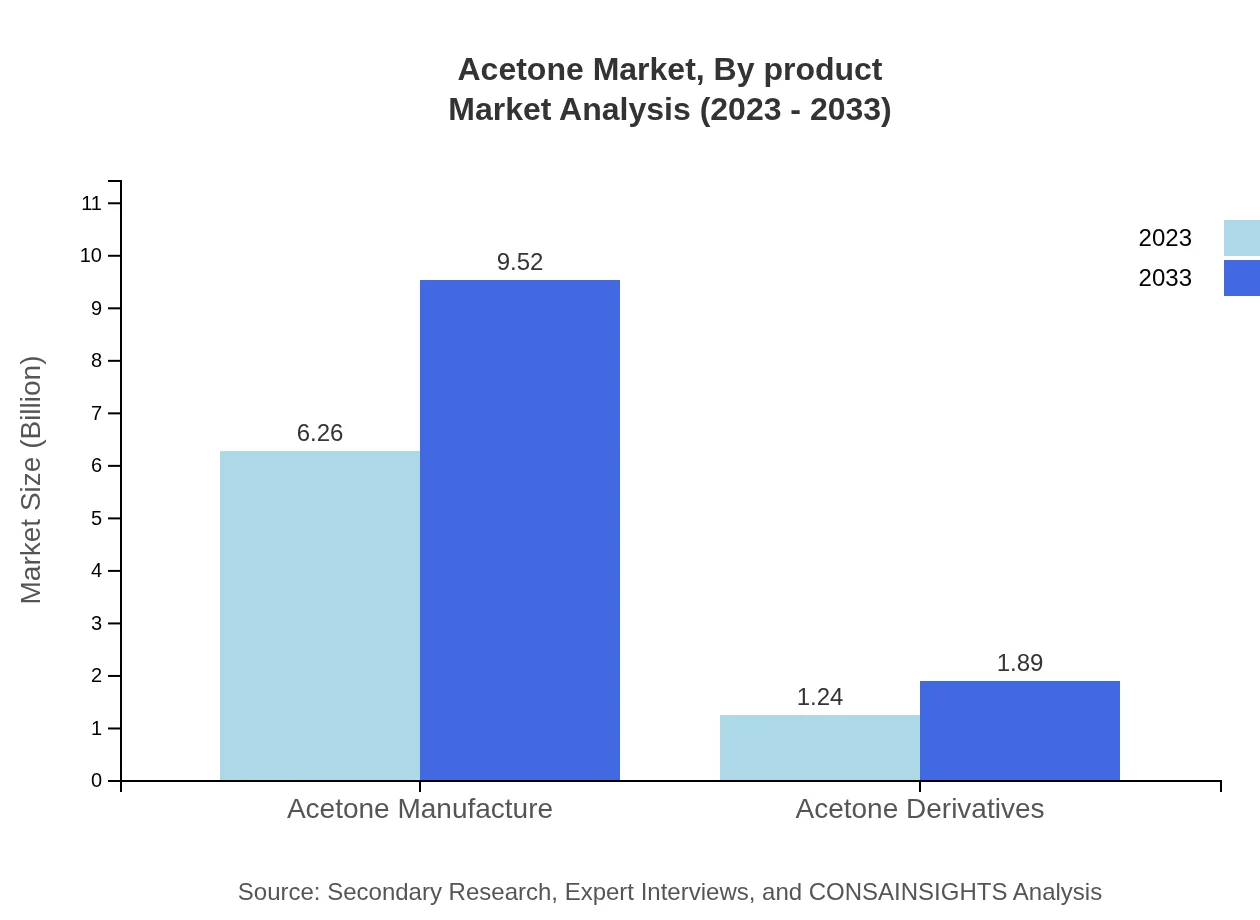

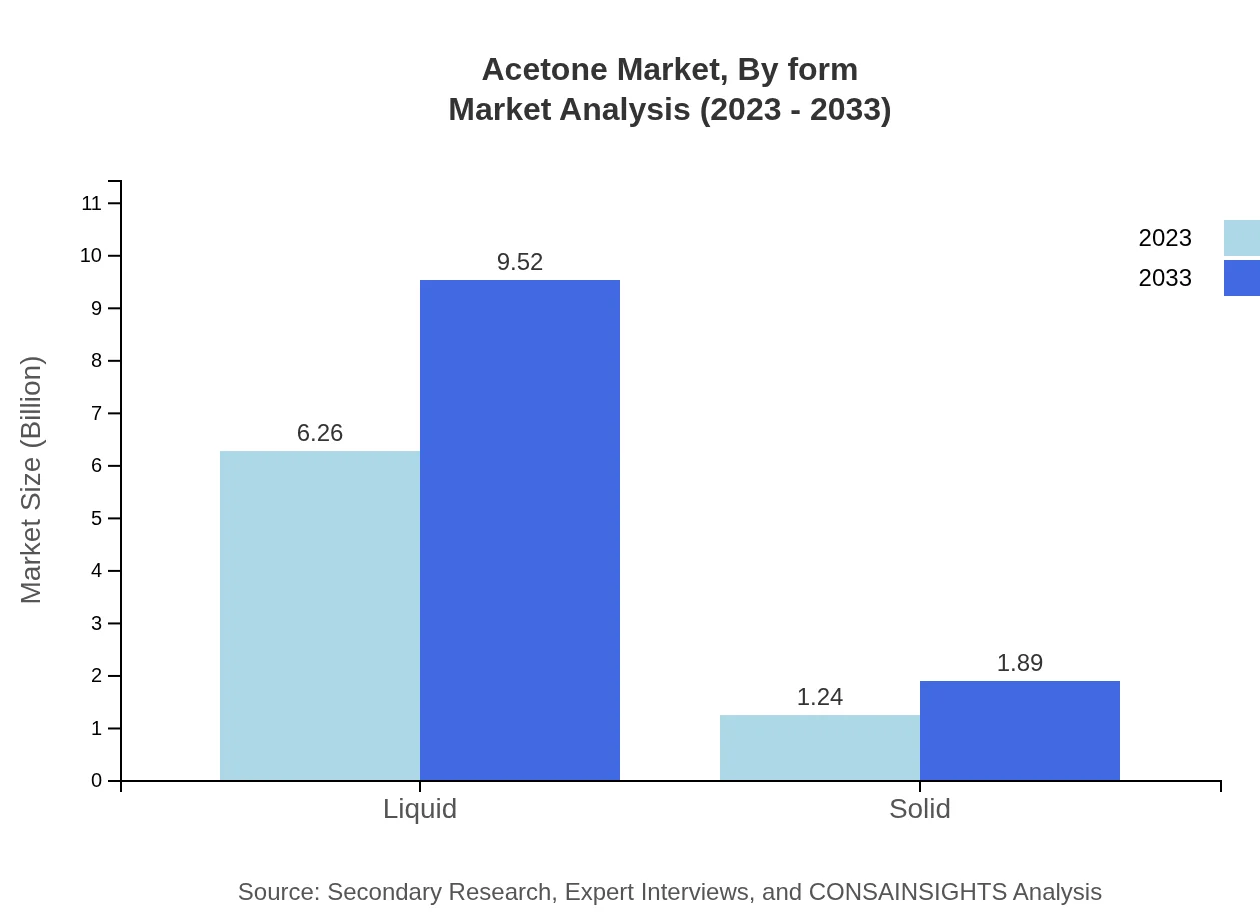

Acetone Market Analysis By Product

The Acetone market, categorized by product type, shows significant differentiation between liquid and solid Acetone. Liquid Acetone holds a predominant market share (approximately 83.45% in 2023) due to its widespread application as a solvent in various industries. Solid Acetone, although less common, is anticipated to gain traction for specific niche applications, growing from a market value of 1.24 billion USD in 2023 to 1.89 billion USD by 2033, representing a potential shift in consumer preference for specific applications.

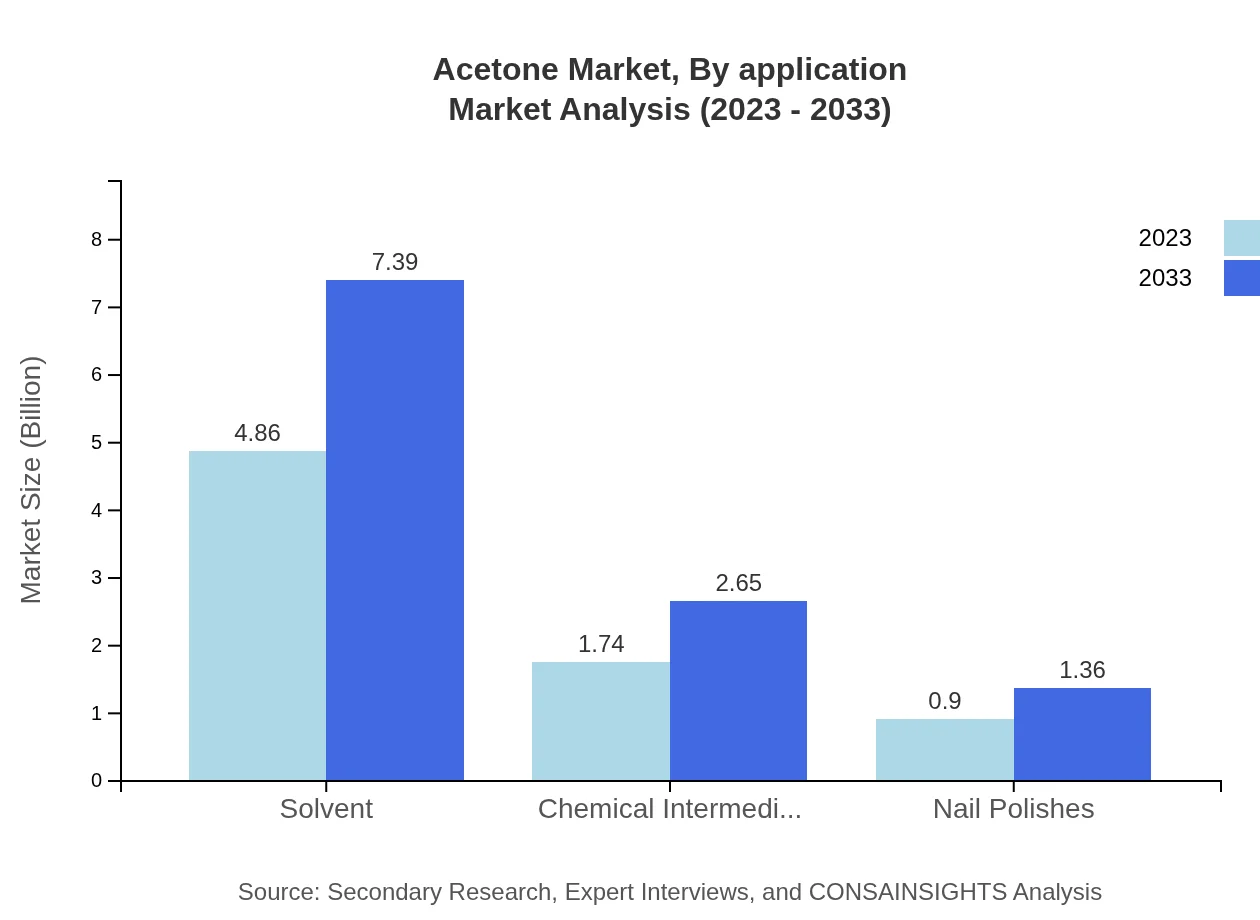

Acetone Market Analysis By Application

The application segment of the Acetone market reveals diversified end-uses ranging from automotive to pharmaceuticals. The automotive sector shows the largest share, capturing about 57.78% of the market, while other significant applications include solvents (64.82% share) and various chemical intermediates. The growth in pharmaceuticals and cosmetics further supports the overall market trajectory, confirming an upward trend projected to reach 6.59 billion USD in automotive applications by 2033.

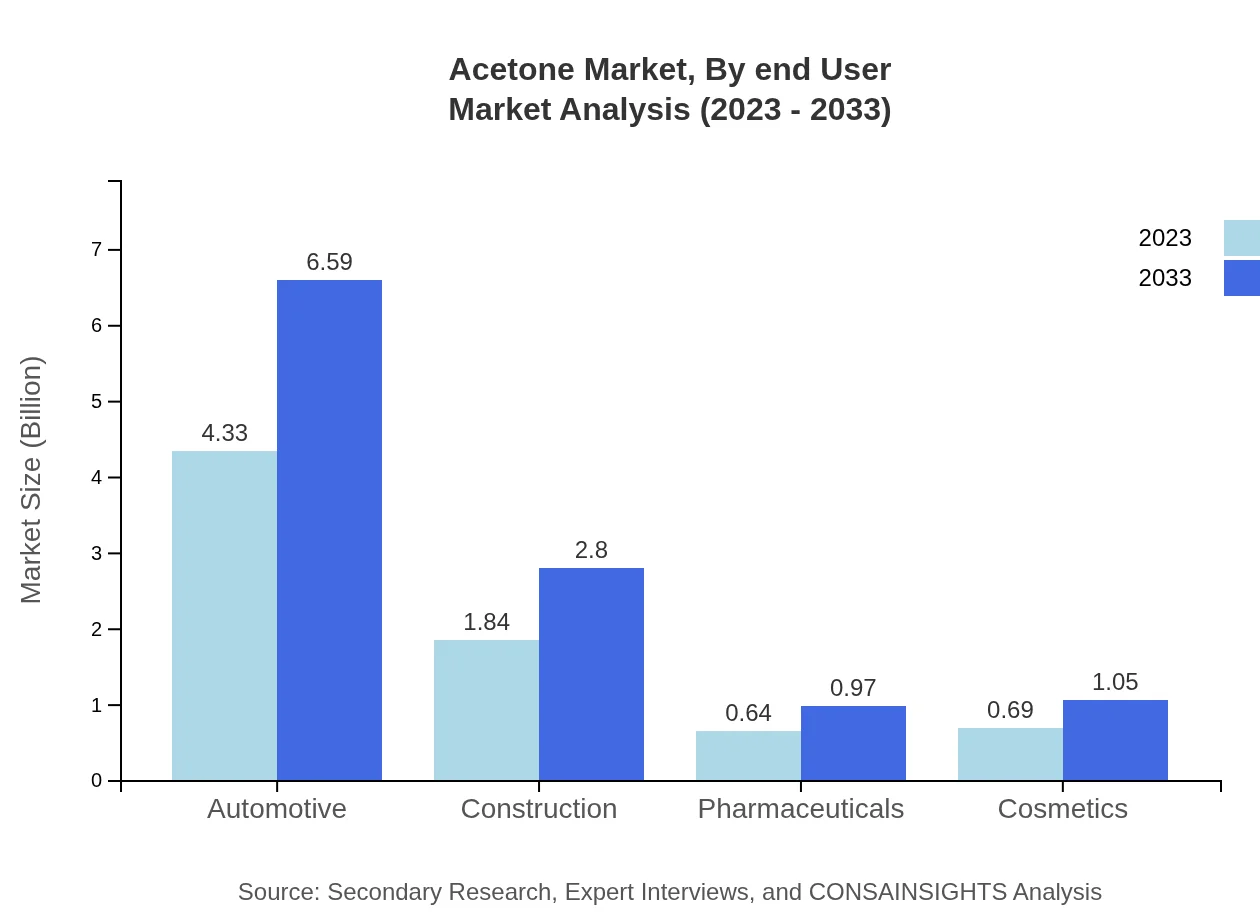

Acetone Market Analysis By End User

End-users in the Acetone market include automotive, construction, pharmaceuticals, and cosmetics sectors. Automotive applications lead the market, constituting 57.78% in 2023. It is followed by construction at 24.52% and pharmaceuticals at 8.52%. This distribution reflects the essential role of Acetone across multiple sectors, reinforcing its importance as a critical chemical in both traditional and emerging industries.

Acetone Market Analysis By Form

The market for Acetone primarily distinguishes between liquid and solid forms. Liquid Acetone dominates significantly, garnering an early forecast value of 6.26 billion USD in 2023 and expected to reach 9.52 billion USD by 2033. Solid Acetone, accounting for a smaller share, nonetheless shows growth potential due to its suitability for specific applications, reflected in its projected increase over the next decade.

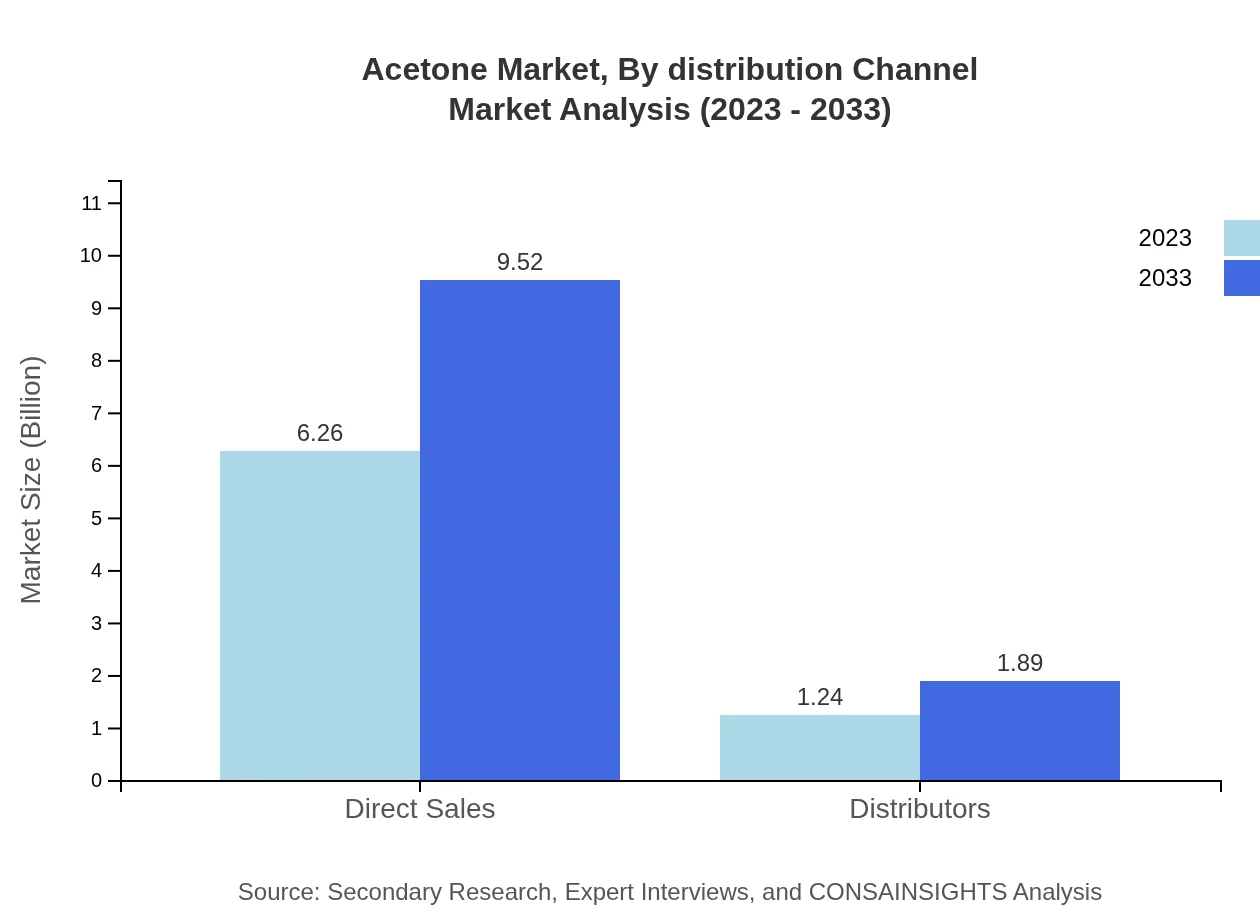

Acetone Market Analysis By Distribution Channel

Distribution channels for Acetone include direct sales and distributors, with direct sales accounting for 83.45% of the market share in 2023 due to the efficiency and cost-effectiveness of procurement. The distributor channel, while smaller at 16.55%, remains a crucial element of market expansion, enabling product access across broader geographies and promoting competitive pricing strategies.

Acetone Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acetone Industry

Kraton Corporation:

Kraton Corporation is a leading global producer of innovative polymers and blends derived from renewable resources and petroleum. Their commitment to sustainability has placed them at the forefront of eco-friendly products, including Acetone applications.BASF SE:

BASF SE is a global leader in chemicals, including Acetone production. Their diversified portfolio and commitment to research and development positioned them as industry leaders capable of adapting to market changes.Royal Dutch Shell:

Royal Dutch Shell is a major player in the Oil and Gas sector, also producing chemicals, including Acetone. Their integrated operations and robust supply chain allow them to effectively meet market demands and environmental regulations.Mitsui Chemicals:

Mitsui Chemicals is a Japanese multinational chemical company involved in the production of Acetone. The company focuses on creating innovative solutions that meet customer needs while adhering to sustainability goals.We're grateful to work with incredible clients.

FAQs

What is the market size of acetone?

The acetone market is valued at approximately $7.5 billion in 2023 and is projected to grow at a CAGR of 4.2%. By 2033, the market is expected to expand significantly, driven by increasing demand across various applications.

What are the key market players or companies in the acetone industry?

Key market players in the acetone industry include global chemical companies involved in production, distribution, and innovation. Leading firms typically dominate the market, leveraging their capabilities to meet rising demand and enhance product offerings.

What are the primary factors driving the growth in the acetone industry?

Factors driving growth in the acetone industry include rising demand from automotive, pharmaceuticals, and chemical sectors. Additionally, advancements in production technologies and increased consumer awareness about product applications further fuel market expansion.

Which region is the fastest Growing in the acetone market?

The Asia Pacific region is the fastest-growing area in the acetone market, expected to reach $2.05 billion by 2033, up from $1.35 billion in 2023. This growth is attributed to increasing industrialization and demand from various sectors.

Does ConsaInsights provide customized market report data for the acetone industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the acetone industry. Clients can receive insights that focus on particular regions, competitive landscapes, and market segments to aid decision-making.

What deliverables can I expect from this acetone market research project?

Deliverables from the acetone market research project include detailed market analysis reports, trend forecasts, competitive assessments, and region-specific insights. These documents aim to support strategic planning and investment decisions.

What are the market trends of acetone?

Current market trends in acetone include increased demand for sustainable and bio-based acetone alternatives. Furthermore, the growth of the nail and cosmetic industry, along with technological advancements in production processes, also influence market dynamics.