Acids And Nutrients In Animal Nutrition Market Report

Published Date: 02 February 2026 | Report Code: acids-and-nutrients-in-animal-nutrition

Acids And Nutrients In Animal Nutrition Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Acids and Nutrients in Animal Nutrition market, offering insights into current trends, market dynamics, and future forecasts covering the period from 2023 to 2033. It provides a comprehensive view of market size, segmentation, regional analysis, and leading players.

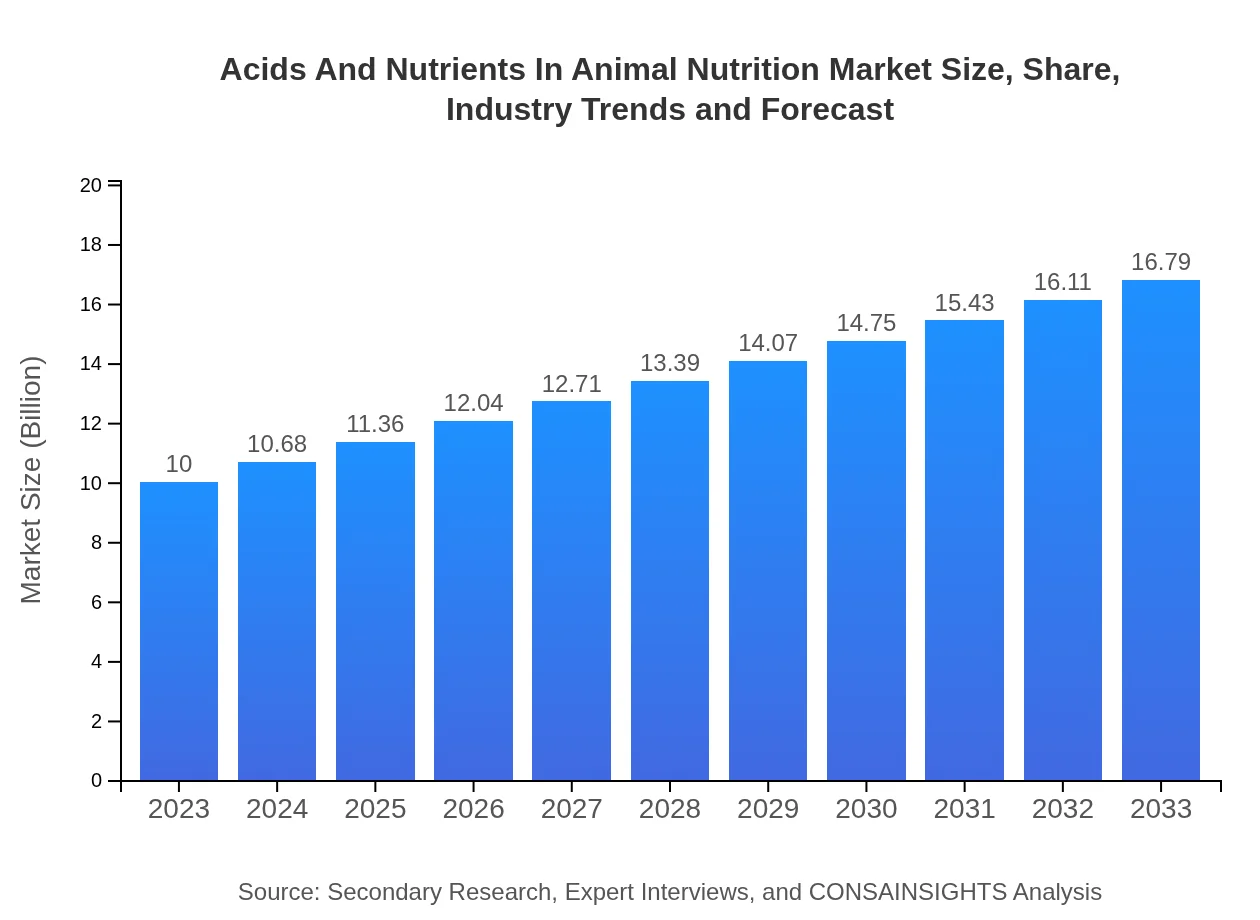

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | Cargill, Inc., DSM Nutritional Products, BASF SE, Nutreco N.V. |

| Last Modified Date | 02 February 2026 |

Acids And Nutrients In Animal Nutrition Market Overview

Customize Acids And Nutrients In Animal Nutrition Market Report market research report

- ✔ Get in-depth analysis of Acids And Nutrients In Animal Nutrition market size, growth, and forecasts.

- ✔ Understand Acids And Nutrients In Animal Nutrition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acids And Nutrients In Animal Nutrition

What is the Market Size & CAGR of Acids And Nutrients In Animal Nutrition market in 2023?

Acids And Nutrients In Animal Nutrition Industry Analysis

Acids And Nutrients In Animal Nutrition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acids And Nutrients In Animal Nutrition Market Analysis Report by Region

Europe Acids And Nutrients In Animal Nutrition Market Report:

Europe represents a competitive market with a size of $2.59 billion in 2023, projected to reach $4.35 billion by 2033. Heightened regulatory measures regarding feed additives and rising consumer demand for organically raised livestock are key growth drivers.Asia Pacific Acids And Nutrients In Animal Nutrition Market Report:

The Asia Pacific region, a significant market for Animal Nutrition, accounted for approximately $2.16 billion in 2023 and is projected to grow to $3.62 billion by 2033. The rapid urbanization and dietary changes in countries such as China and India, coupled with rising livestock production, drive this growth.North America Acids And Nutrients In Animal Nutrition Market Report:

The North American market is estimated at $3.22 billion in 2023 and is set to rise to $5.41 billion by 2033. The mature livestock industry underpins growth, supported by innovations in feed technologies and stringent food safety regulations.South America Acids And Nutrients In Animal Nutrition Market Report:

In South America, the market value stood at $0.72 billion in 2023 with a forecast of $1.21 billion by 2033. The increasing demand for high-quality meat products in regions like Brazil and Argentina is enhancing market growth, supported by extensive agricultural practices.Middle East & Africa Acids And Nutrients In Animal Nutrition Market Report:

The Middle East and Africa market registered a size of $1.30 billion in 2023, expected to grow to $2.19 billion by 2033. Increasing awareness of animal welfare, along with governmental support for enhancing livestock productivity, fosters growth in this region.Tell us your focus area and get a customized research report.

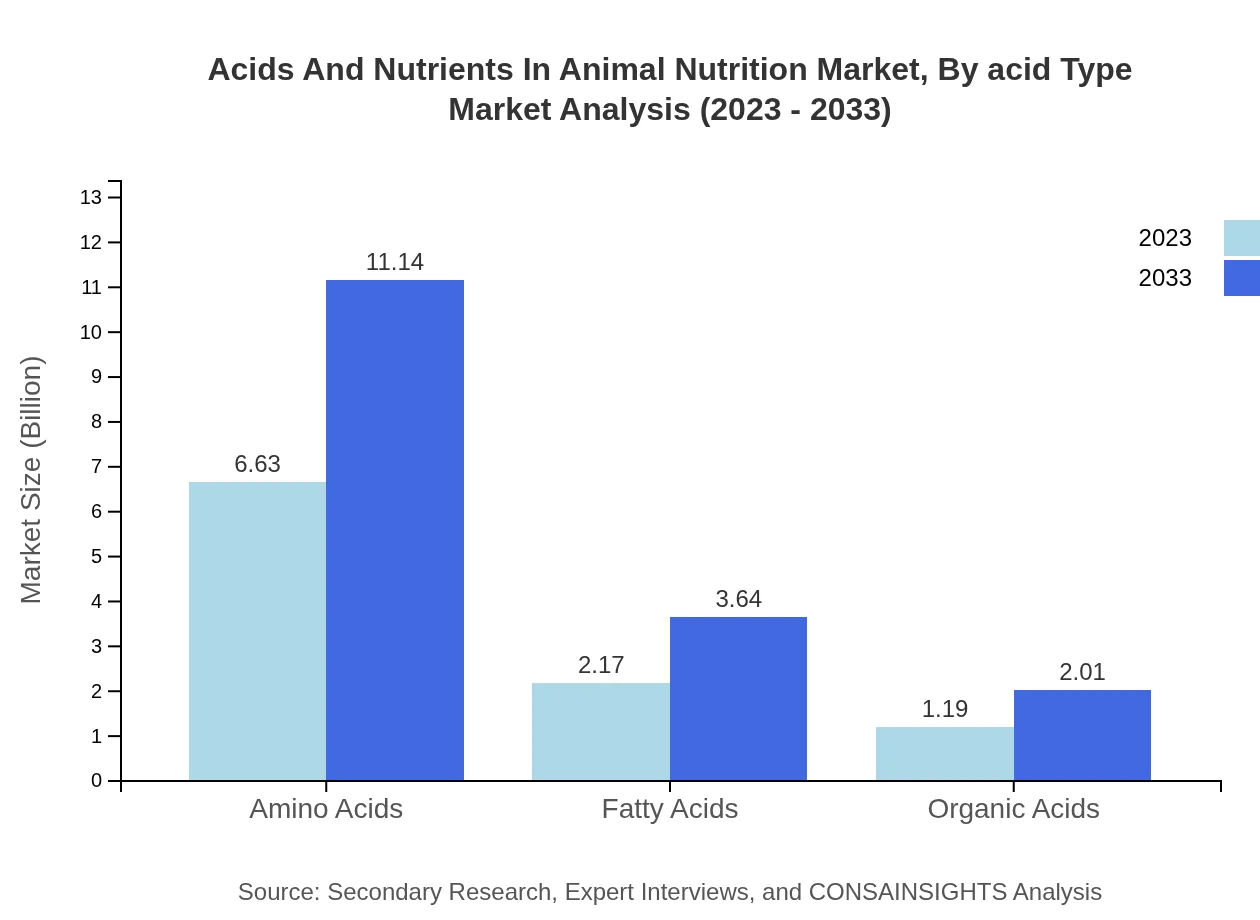

Acids And Nutrients In Animal Nutrition Market Analysis By Acid Type

Amino acids dominate the market, constituting the largest segment valued at $6.63 billion in 2023, set to increase to $11.14 billion by 2033. Fatty acids and organic acids serve essential functions in promoting growth and health in various animal types, reflecting their vital role in nutritional formulations.

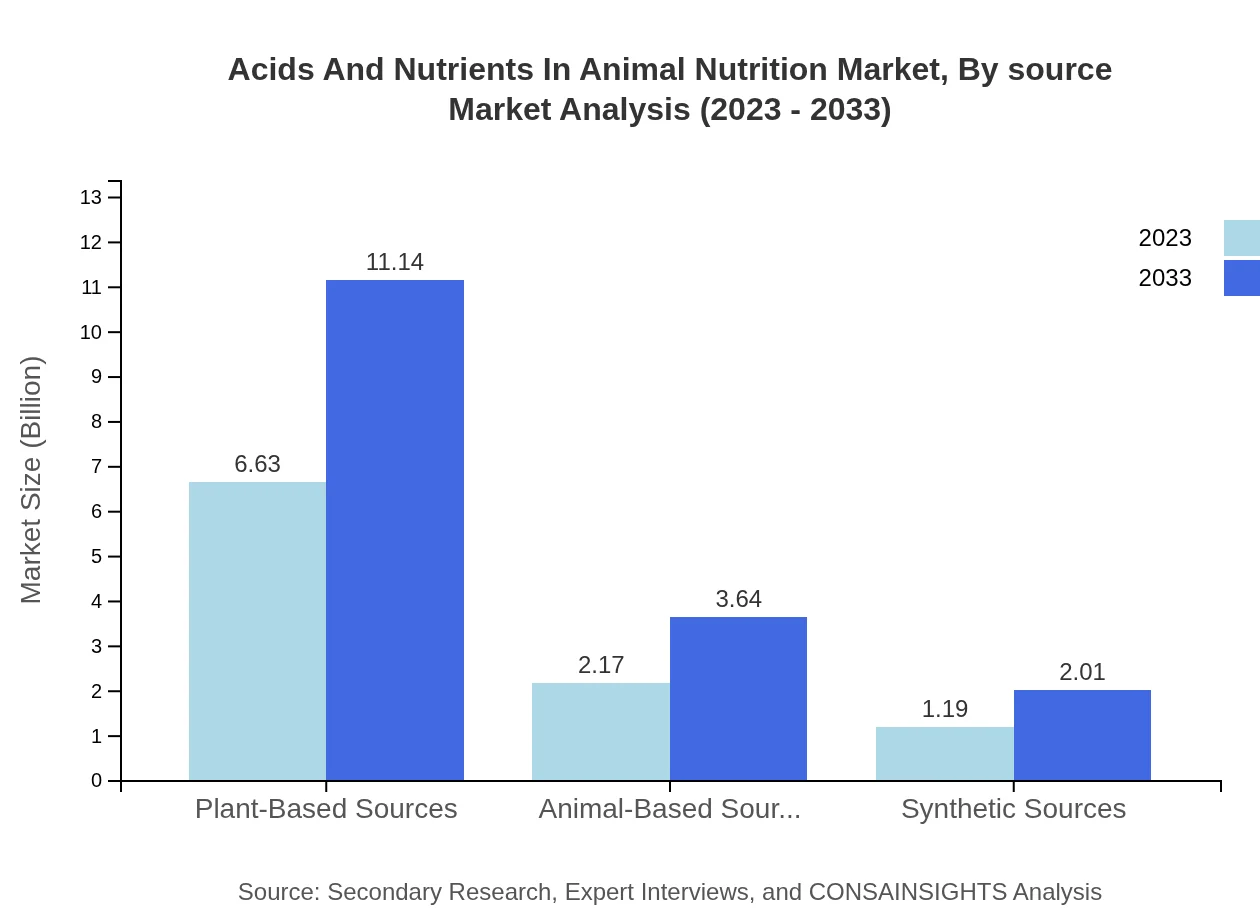

Acids And Nutrients In Animal Nutrition Market Analysis By Source

Plant-based sources hold a significant share, valued at $6.63 billion in 2023 and forecasted to reach $11.14 billion by 2033. Both animal-based and synthetic sources are crucial, valued at $2.17 billion and $1.19 billion in 2023, respectively, emphasizing the mix required for balanced nutrition in livestock.

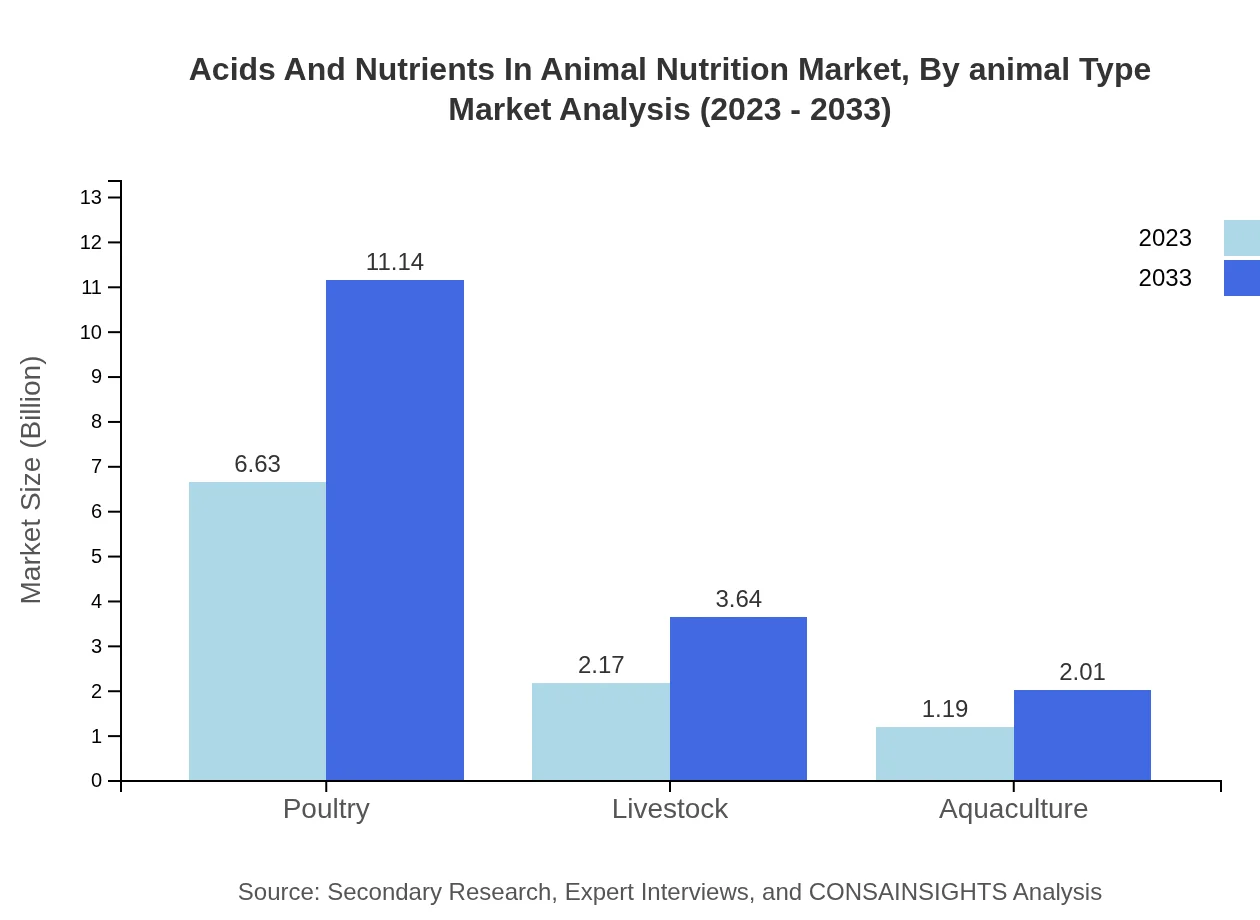

Acids And Nutrients In Animal Nutrition Market Analysis By Animal Type

Poultry remains the lead segment in the animal type market, valued at $6.63 billion in 2023. Livestock and aquaculture follow, indicating the varied application and significance of nutritional enhancements across different species.

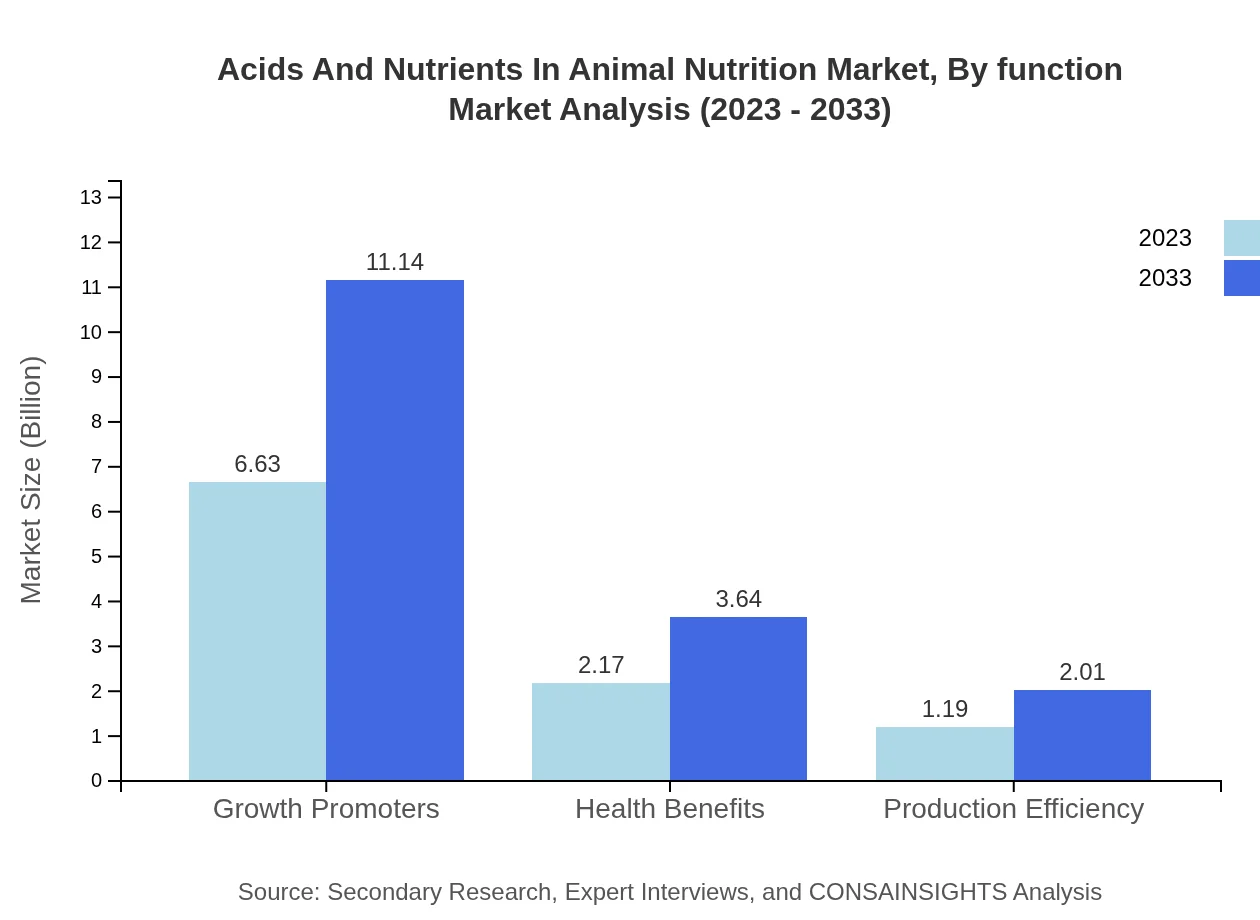

Acids And Nutrients In Animal Nutrition Market Analysis By Function

Growth promoters lead with substantial market size, valued at $6.63 billion in 2023 and expected to grow significantly. Health benefits and production efficiency also play critical roles as consumers demand higher productivity and healthier animal products.

Acids And Nutrients In Animal Nutrition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acids And Nutrients In Animal Nutrition Industry

Cargill, Inc.:

Cargill is a global leader in food and agriculture. They provide animal feed and nutritional products that enhance livestock productivity and health.DSM Nutritional Products:

DSM is a leader in the field of animal nutrition, providing an extensive range of vitamins, carotenoids, enzymes, and probiotics to improve animal health and production.BASF SE:

BASF is known for its diverse portfolio in the agricultural sector, including a variety of feed additives and animal feed to enhance nutritional quality.Nutreco N.V.:

Nutreco focuses on animal nutrition and aquafeed, leveraging on technology to produce feeds with superior nutritional profile and health-driven outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of acids And Nutrients In Animal Nutrition?

The global market for acids and nutrients in animal nutrition was estimated at $10 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 5.2%, projecting significant growth in the sector by 2033.

What are the key market players or companies in this acids And Nutrients In Animal Nutrition industry?

Key players in this market include major companies specializing in animal feed additives and nutrition solutions. These include prominent producers of amino acids, organic acids, and synthetic nutrient formulations leveraging technological advancements for market leadership.

What are the primary factors driving the growth in the acids And Nutrients In Animal Nutrition industry?

The growth is driven by rising demand for animal protein, increasing focus on animal health and productivity, and advancements in feed formulations. Additionally, regulatory pressures promoting sustainable practices bolster the adoption of specialized nutrient sources.

Which region is the fastest Growing in the acids And Nutrients In Animal Nutrition?

The fastest-growing region is projected to be Europe, with its market size expected to grow from $2.59 billion in 2023 to $4.35 billion by 2033, driven by stringent animal welfare regulations and a shift towards higher quality feed.

Does ConsaInsights provide customized market report data for the acids And Nutrients In Animal Nutrition industry?

Yes, ConsaInsights offers tailored market reports suited to specific research needs, providing in-depth analysis and insights that cater to individual business requirements and strategic planning in the acids and nutrients sector.

What deliverables can I expect from this acids And Nutrients In Animal Nutrition market research project?

Deliverables include comprehensive market analysis reports, segmented data insights, trend forecasts, competitive landscape evaluations, and strategic recommendations tailored to enhance decision-making for stakeholders in the industry.

What are the market trends of acids And Nutrients In Animal Nutrition?

Current trends include a shift towards plant-based nutrient sources, increasing demand for organic acids, and growth in amino acids utilization in feed. Innovations in feed efficiency and health benefits are also key components shaping market developments.