Acoustic Emission Testing Market Report

Published Date: 22 January 2026 | Report Code: acoustic-emission-testing

Acoustic Emission Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Acoustic Emission Testing market from 2023 to 2033, covering market size, trends, segmentation, regional insights, and forecasts. Key market players and their contributions are also examined to provide a comprehensive view of the industry landscape.

| Metric | Value |

|---|---|

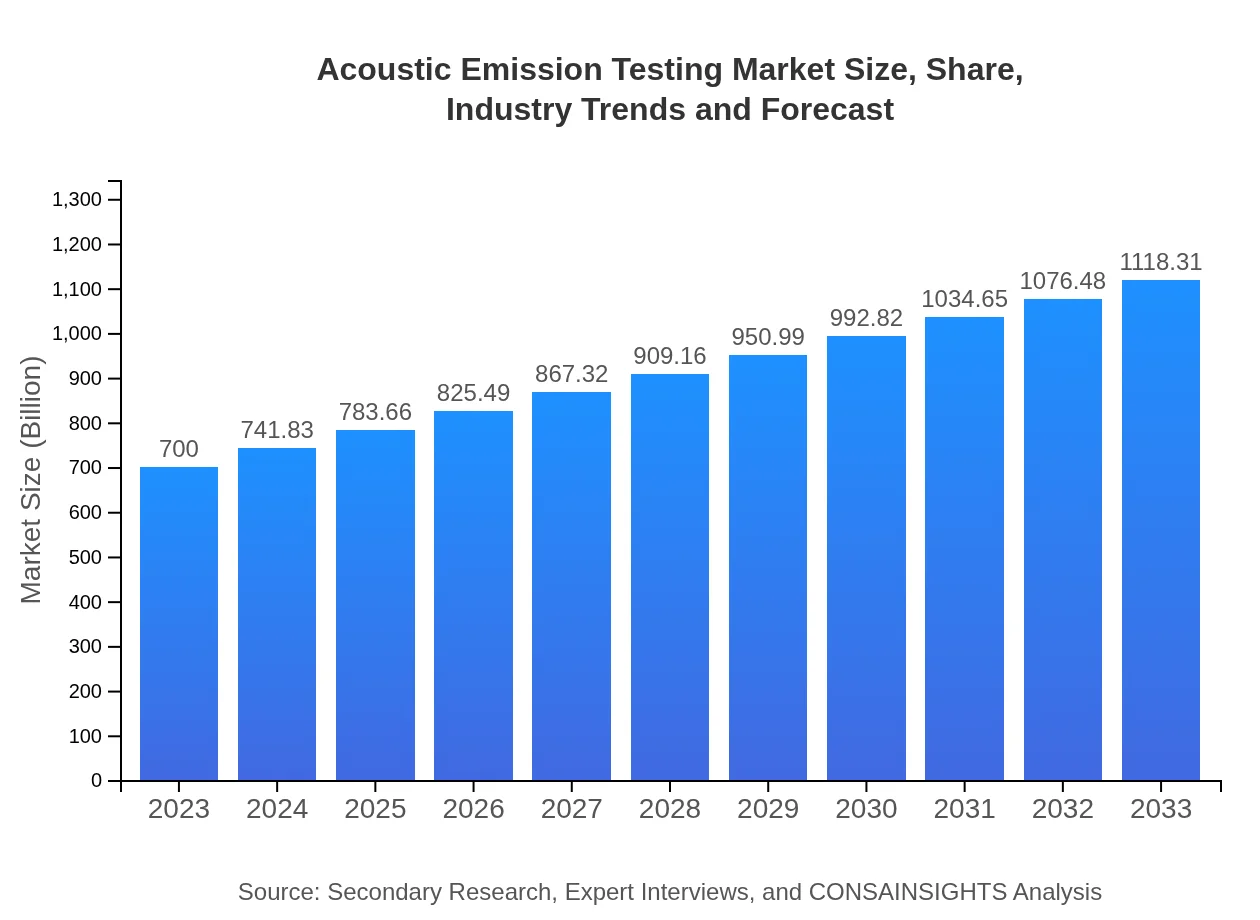

| Study Period | 2023 - 2033 |

| 2023 Market Size | $700.00 Million |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $1118.31 Million |

| Top Companies | Vallen Systeme GmbH, Mistras Group, Inc., Krautkramer, Olympus Corporation |

| Last Modified Date | 22 January 2026 |

Acoustic Emission Testing Market Overview

Customize Acoustic Emission Testing Market Report market research report

- ✔ Get in-depth analysis of Acoustic Emission Testing market size, growth, and forecasts.

- ✔ Understand Acoustic Emission Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acoustic Emission Testing

What is the Market Size & CAGR of Acoustic Emission Testing market in 2023?

Acoustic Emission Testing Industry Analysis

Acoustic Emission Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acoustic Emission Testing Market Analysis Report by Region

Europe Acoustic Emission Testing Market Report:

The European Acoustic Emission Testing market is expected to grow from $175.42 million in 2023 to $280.25 million by 2033. Increased awareness about operational safety, coupled with strict European Union regulations regarding industrial processes, drives continuous demand for AET.Asia Pacific Acoustic Emission Testing Market Report:

In Asia Pacific, the Acoustic Emission Testing market is expected to grow from $149.17 million in 2023 to $238.31 million by 2033. Rapid industrialization, infrastructure development projects, and increasing investment in safety measures fuel the market's growth in this region. Additionally, countries like China and India are witnessing escalating demands for non-destructive testing methods across various industries.North America Acoustic Emission Testing Market Report:

North America's Acoustic Emission Testing market is forecasted to rise from $251.02 million in 2023 to $401.03 million by 2033. The region leads the market due to robust industrial infrastructure, stringent safety regulations, and high adoption rates of advanced testing technologies. The presence of major oil and gas companies further propels market demand.South America Acoustic Emission Testing Market Report:

The South American market for Acoustic Emission Testing is projected to increase from $63.42 million in 2023 to $101.32 million by 2033. This growth is driven primarily by the expansion of the oil and gas sector, which is experiencing increased investments in safety protocols and maintenance practices.Middle East & Africa Acoustic Emission Testing Market Report:

In the Middle East and Africa, the market is anticipated to expand from $60.97 million in 2023 to $97.40 million by 2033. Increased focus on energy sector advancements and infrastructural development projects are key drivers in this region, supported by governmental initiatives promoting safety and sustainability.Tell us your focus area and get a customized research report.

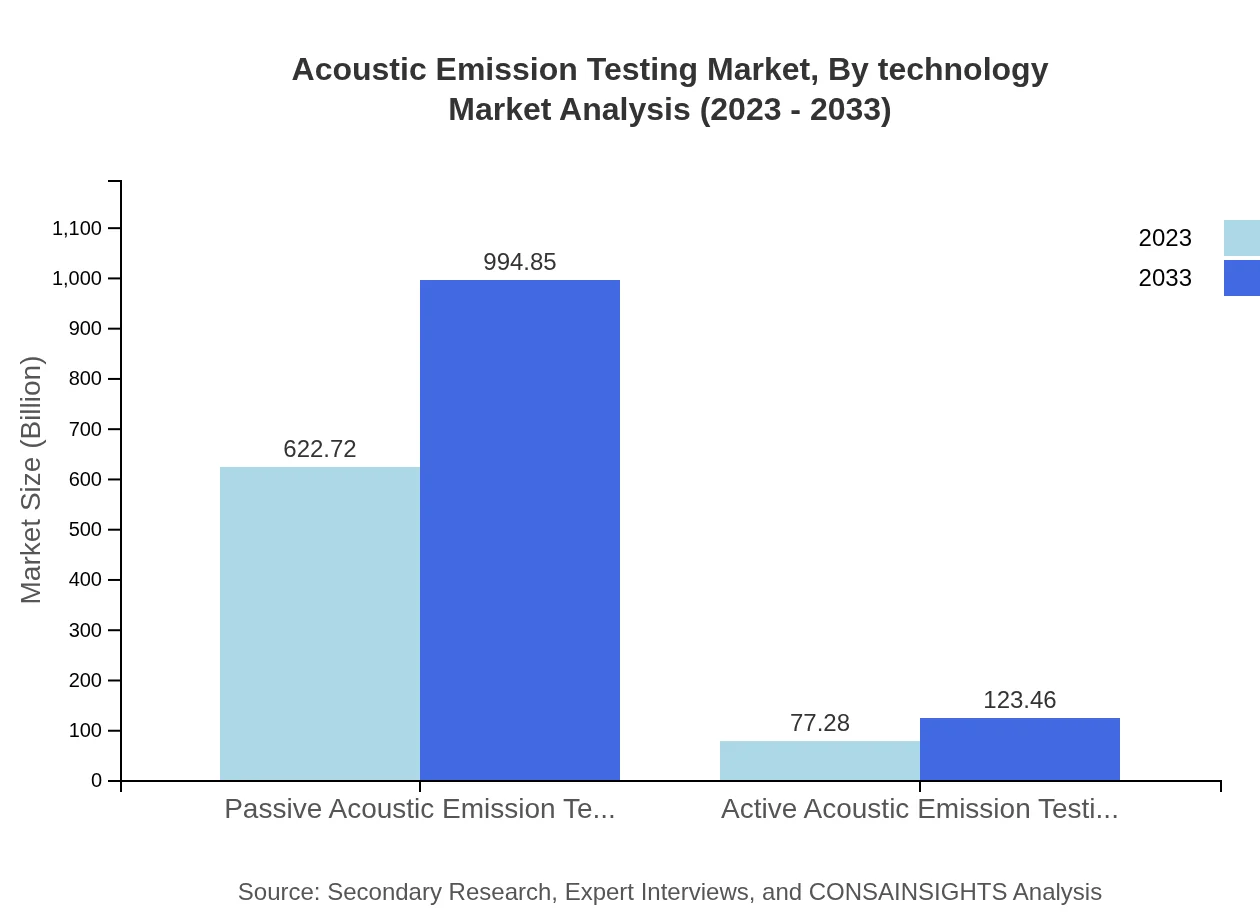

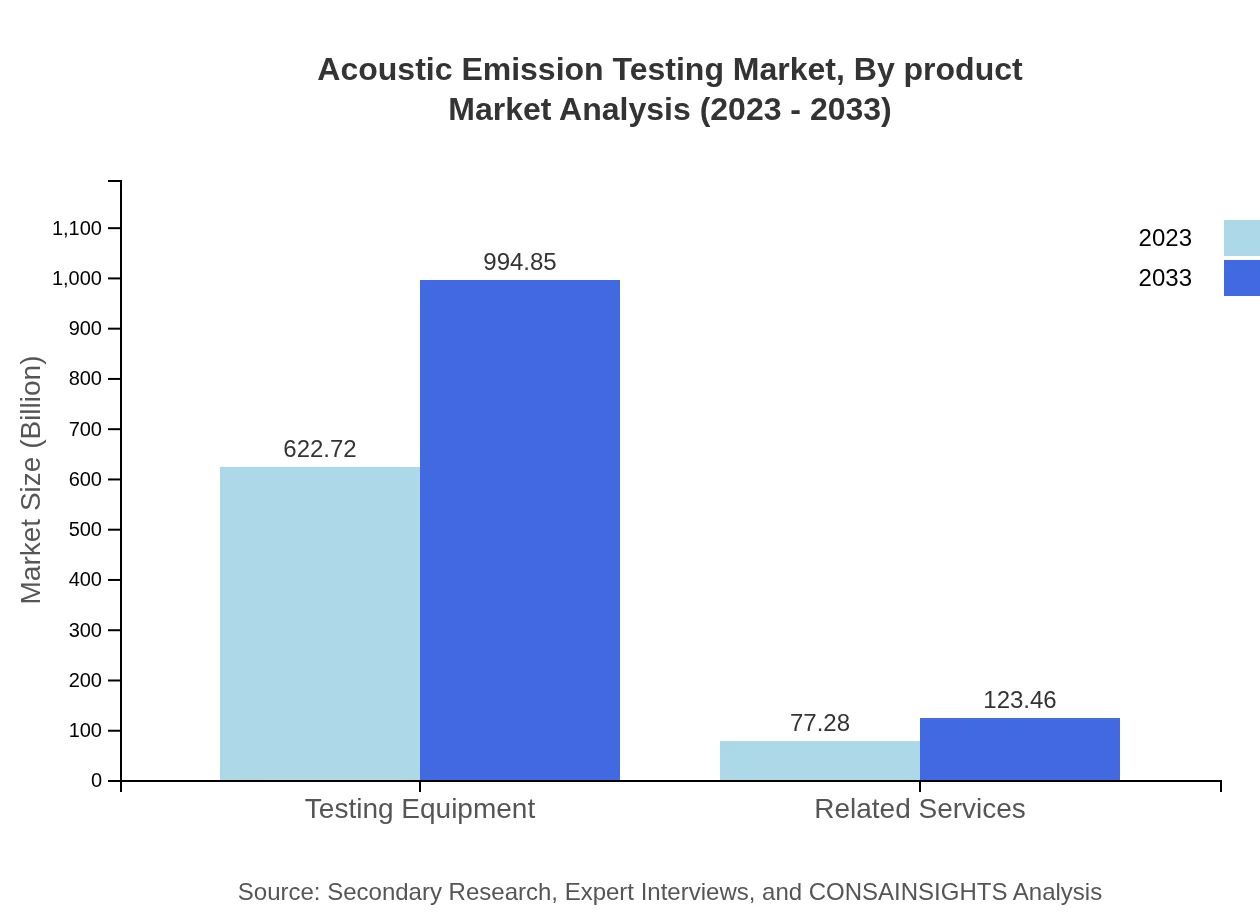

Acoustic Emission Testing Market Analysis By Technology

The market is divided into two main technologies: Passive Acoustic Emission Testing and Active Acoustic Emission Testing. In 2023, Passive Acoustic Emission Testing holds a substantial market size of $622.72 million, representing approximately 88.96% of the total market share. This segment is anticipated to grow significantly, reaching $994.85 million by 2033. Active Acoustic Emission Testing, while smaller in market size at $77.28 million in 2023, is expected to grow to $123.46 million during the same period, holding an 11.04% share. Both technologies are crucial for different applications based on the specific requirements of the industry.

Acoustic Emission Testing Market Analysis By Application

This market focuses on applications within structural health monitoring and leak detection. The demand for structural health monitoring is particularly high as industries seek to prolong equipment life and maintain safety. The increasing incidents of structural failures have led to more companies investing in acoustic emission technologies. The anticipated growth for these applications is expected to parallel overall market trends over the forecast period.

Acoustic Emission Testing Market Analysis By End User

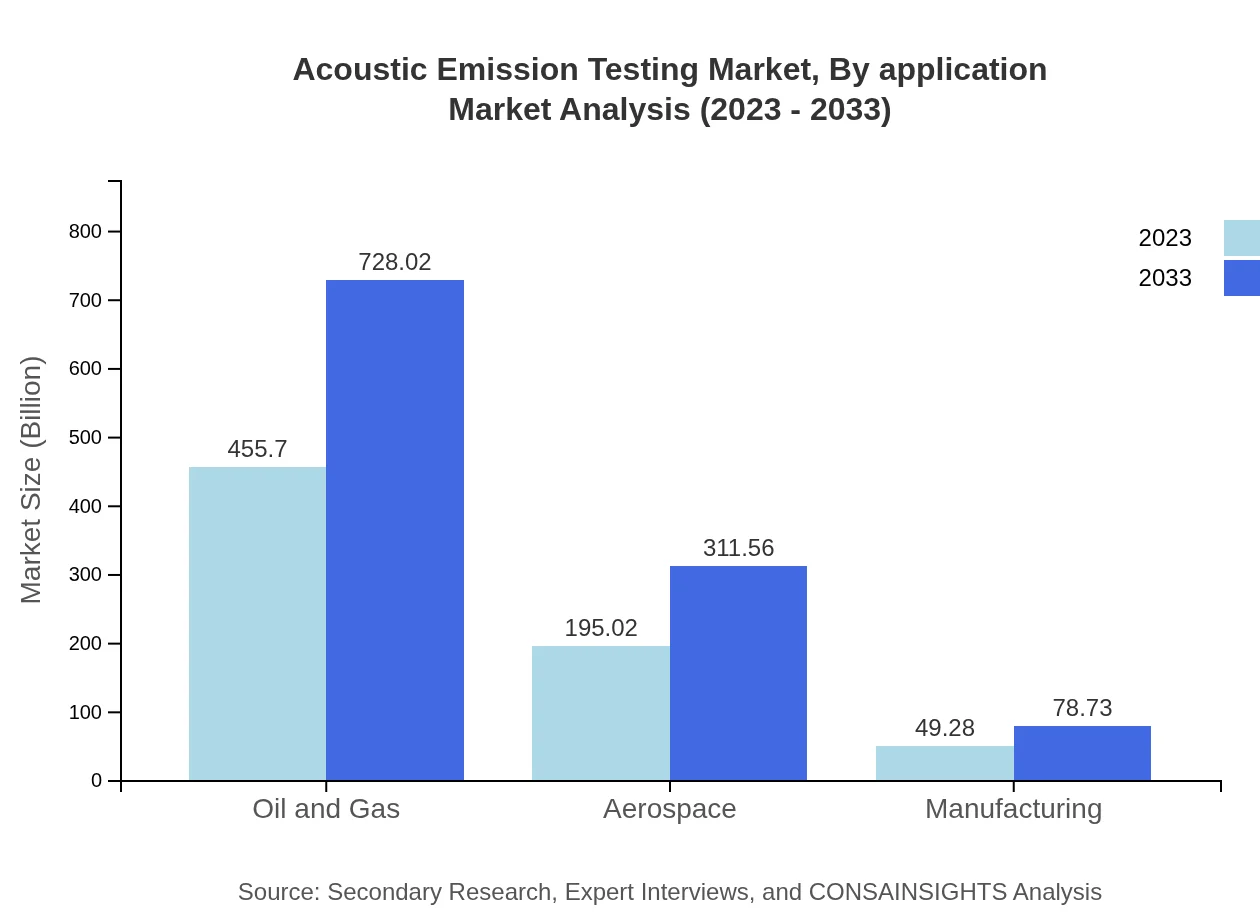

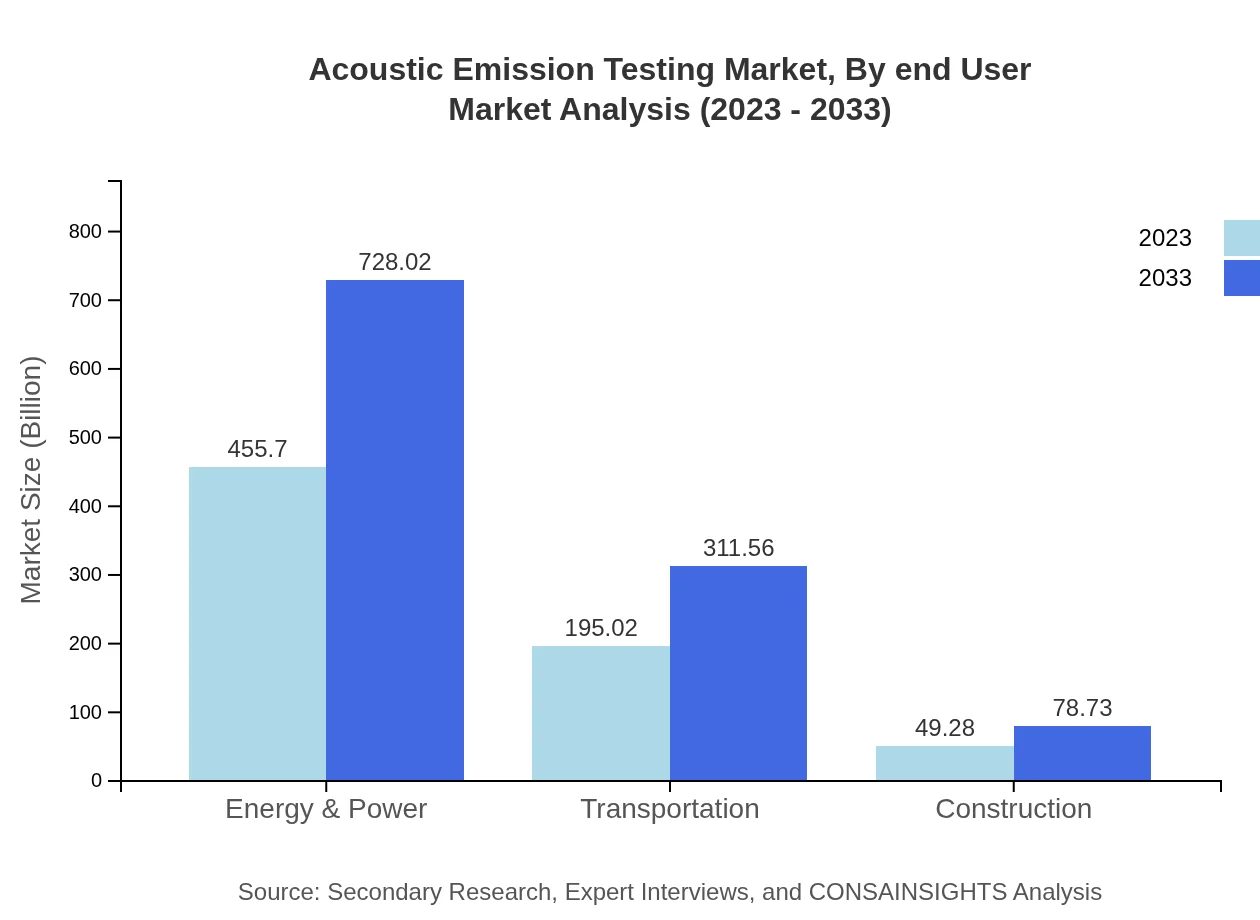

Segmented by end-users, the oil and gas sector dominates the market due to high safety standards and inspection regulations, estimated at approximately $455.70 million in 2023, with a growth projection to $728.02 million by 2033. Other important segments include aerospace, with $195.02 million in 2023 projected to rise to $311.56 million, and manufacturing, which is forecasted to increase from $49.28 million to $78.73 million in the same period.

Acoustic Emission Testing Market Analysis By Product

The product analysis indicates reliance on testing equipment and related services as critical elements for market growth. The testing equipment segment is valued at $622.72 million in 2023, expanding to $994.85 million by 2033, while related services are anticipated to grow from $77.28 million to $123.46 million in the same timeframe. These segments enhance the efficacy and precision of acoustic emission testing, making them indispensable to industry standards.

Acoustic Emission Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acoustic Emission Testing Industry

Vallen Systeme GmbH:

A leading provider of non-destructive testing technologies, Vallen specializes in acoustic emission testing equipment and services, offering innovative solutions for structural health monitoring.Mistras Group, Inc.:

Mistras is a global leader in asset protection solutions, providing advanced acoustic emission testing along with a comprehensive suite of non-destructive testing services.Krautkramer:

Part of the Baker Hughes Company, Krautkramer offers state-of-the-art testing equipment and services, focusing on innovative acoustic emission technologies for various industries.Olympus Corporation:

Olympus Corporation is renowned for its advanced imaging and measurement technologies, including acoustic emission testing systems, providing high-quality solutions for integrity assessment.We're grateful to work with incredible clients.

FAQs

What is the market size of Acoustic Emission Testing?

The global Acoustic Emission Testing market is valued at approximately $700 million in 2023, with a projected CAGR of 4.7% over the next decade, reaching significant growth and diversification in applications and technologies.

What are the key market players or companies in the Acoustic Emission Testing industry?

Leading companies in the Acoustic Emission Testing market include Mistras Group, Inc., KRSolutions, and Siemens AG. These companies contribute significantly to technological advancements and the development of innovative testing solutions across various sectors.

What are the primary factors driving the growth in the Acoustic Emission Testing industry?

Growth in the Acoustic Emission Testing market is largely driven by increasing demand for safety and quality assurance in industries such as oil and gas, construction, and aerospace, alongside advancements in technology that enhance testing accuracy and reliability.

Which region is the fastest Growing in the Acoustic Emission Testing market?

The Asia Pacific region is poised to be the fastest-growing market for Acoustic Emission Testing, expected to increase from $149.17 million in 2023 to $238.31 million by 2033, driven by rapid industrialization and infrastructure development.

Does ConsaInsights provide customized market report data for the Acoustic Emission Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the Acoustic Emission Testing industry, allowing businesses to gain insights relevant to their strategic decision-making processes.

What deliverables can I expect from this Acoustic Emission Testing market research project?

Deliverables from the Acoustic Emission Testing market research project may include comprehensive market analysis reports, detailed insights on market trends, competitive landscape evaluations, and forecasts segmented by region and application.

What are the market trends of Acoustic Emission Testing?

Current trends in the Acoustic Emission Testing market include a focus on integration with IoT technologies for real-time monitoring, increasing demand in the oil and gas sector, and the push towards automation in testing processes to enhance efficiency.