Acrylate Market Report

Published Date: 02 February 2026 | Report Code: acrylate

Acrylate Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Acrylate market, highlighting key insights, growth trends, and forecasts spanning from 2023 to 2033, including market segmentation by regions and applications.

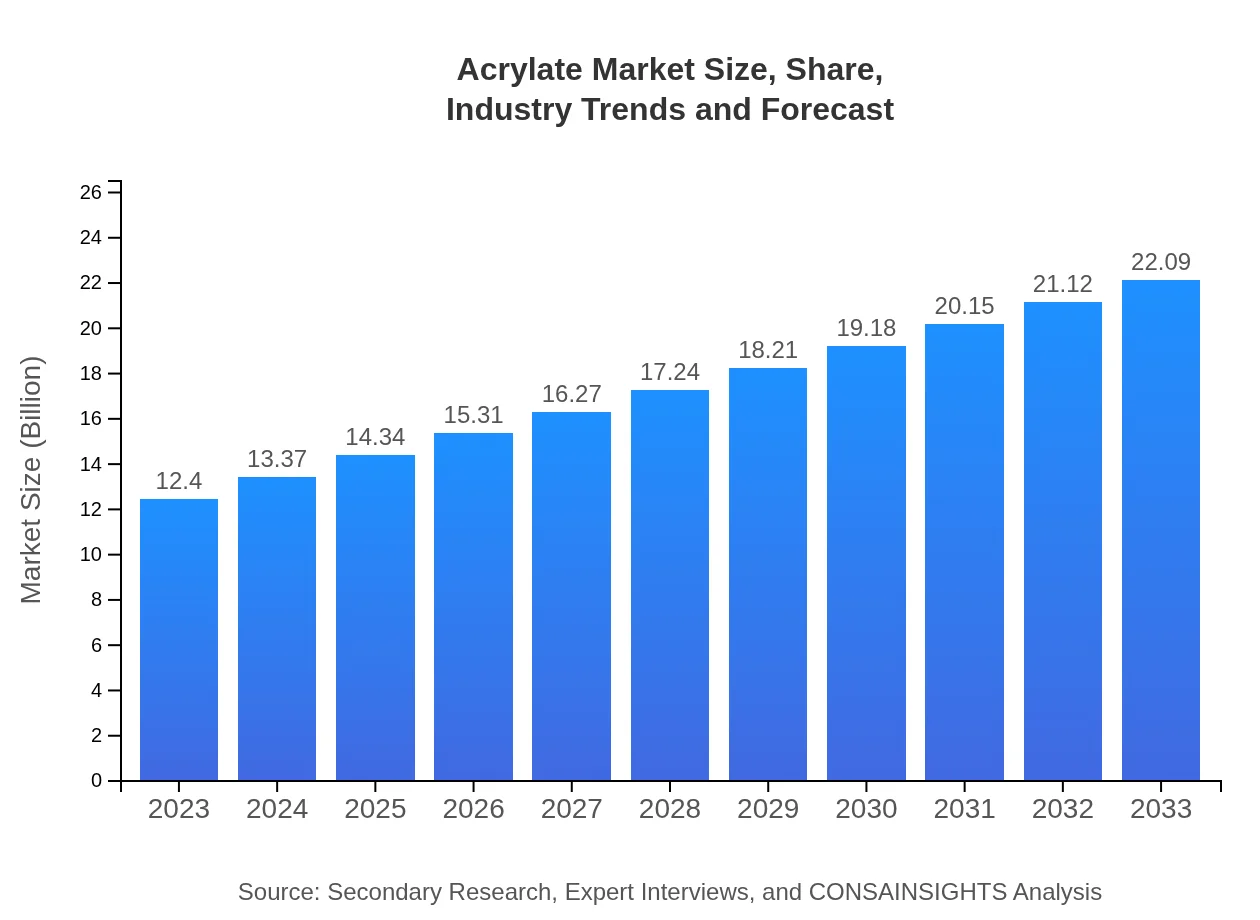

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.40 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.09 Billion |

| Top Companies | BASF SE, Dow Chemical Company, Mitsubishi Chemical Corporation, Evonik Industries AG |

| Last Modified Date | 02 February 2026 |

Acrylate Market Overview

Customize Acrylate Market Report market research report

- ✔ Get in-depth analysis of Acrylate market size, growth, and forecasts.

- ✔ Understand Acrylate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acrylate

What is the Market Size & CAGR of Acrylate market in 2033?

Acrylate Industry Analysis

Acrylate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

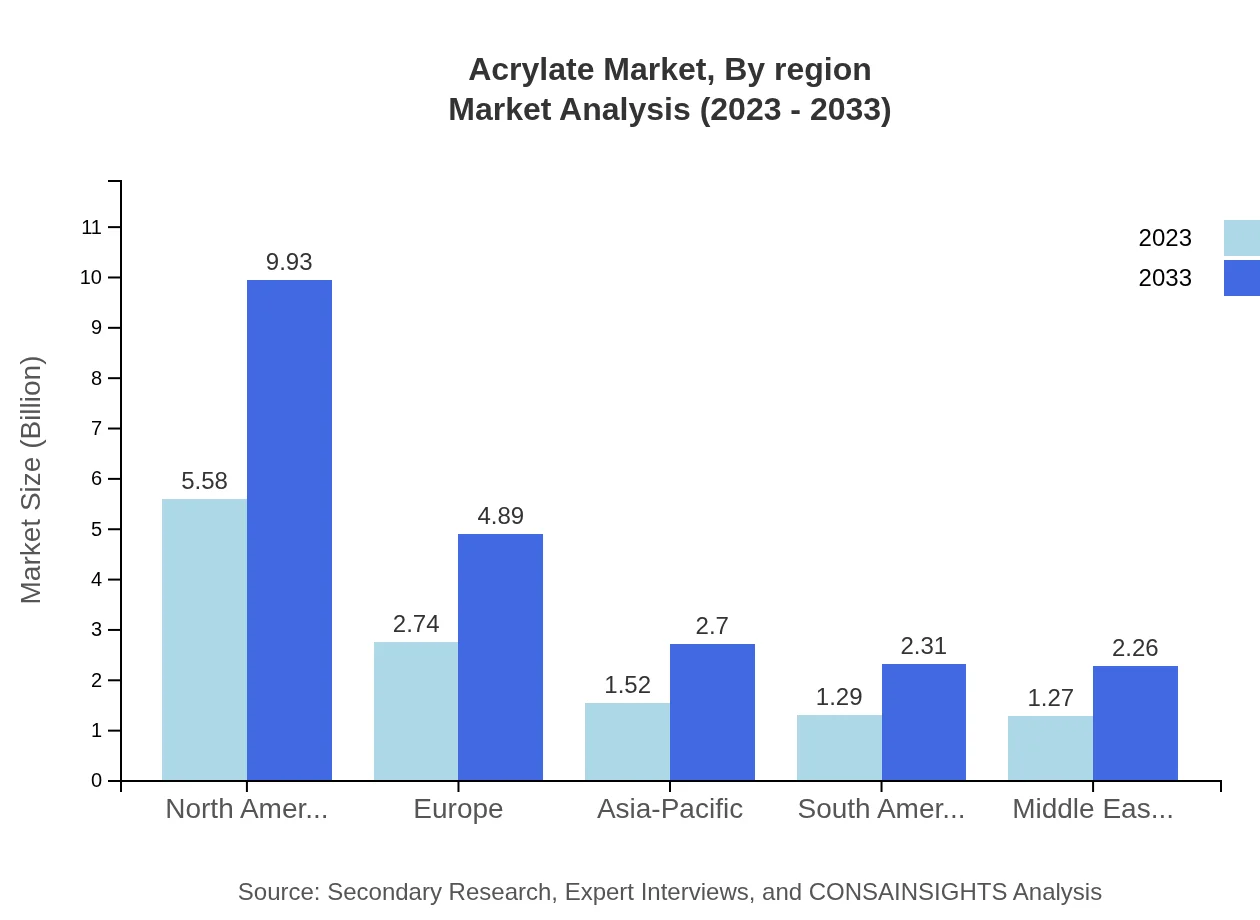

Acrylate Market Analysis Report by Region

Europe Acrylate Market Report:

The European market for Acrylate is anticipated to grow from $3.17 billion in 2023 to $5.64 billion in 2033. Investment in innovative production technologies and increasing demand for high-performance coatings are pivotal factors in this growth.Asia Pacific Acrylate Market Report:

The Asia Pacific region is expected to witness significant growth in the Acrylate market, projected to expand from $2.40 billion in 2023 to $4.28 billion by 2033. The growth is driven by rapid industrialization, infrastructural developments, and increasing consumer demand for sustainable products.North America Acrylate Market Report:

North America is expected to maintain a strong market presence, with the Acrylate market predicted to rise from $4.22 billion in 2023 to $7.51 billion in 2033. Stringent regulations promoting environmentally friendly products and innovations in the healthcare and cosmetic industries are significant drivers.South America Acrylate Market Report:

In South America, the market for Acrylate is projected to grow from $1.17 billion in 2023 to $2.08 billion by 2033. This growth is attributed to rising construction activities and an expanding automotive industry within the region.Middle East & Africa Acrylate Market Report:

In the Middle East and Africa, the Acrylate market is expected to increase from $1.44 billion in 2023 to $2.57 billion by 2033. Key drivers include economic diversification efforts and rising consumer awareness regarding the benefits of Acrylate-based products.Tell us your focus area and get a customized research report.

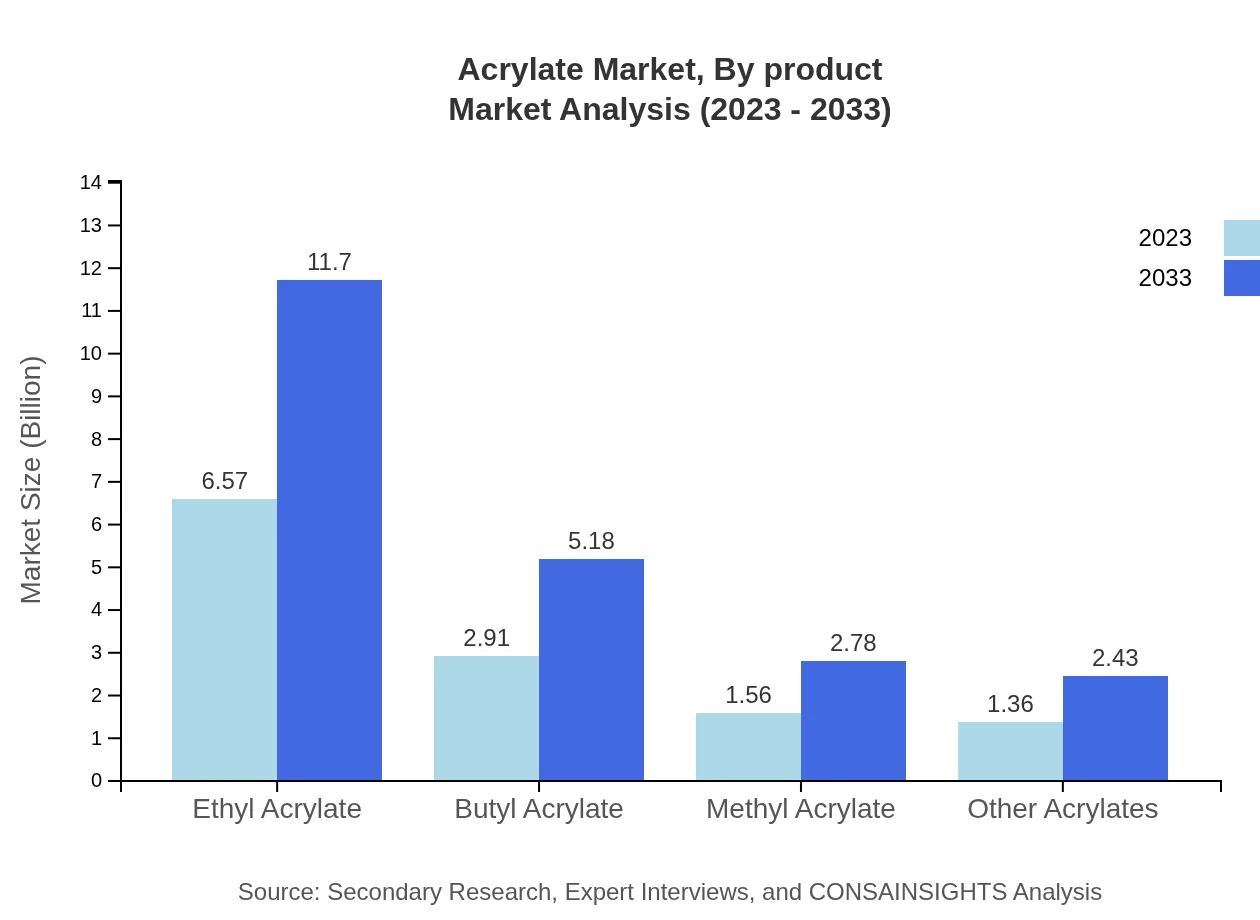

Acrylate Market Analysis By Product

The Acrylate market is dominated by Ethyl Acrylate, which contributes to 52.98% of the market share and is expected to grow from $6.57 billion in 2023 to $11.70 billion in 2033. Butyl Acrylate follows, capturing a significant 23.45% market share, expected to increase from $2.91 billion to $5.18 billion by 2033. Methyl Acrylate and Other Acrylates, though smaller, are also experiencing steady demand.

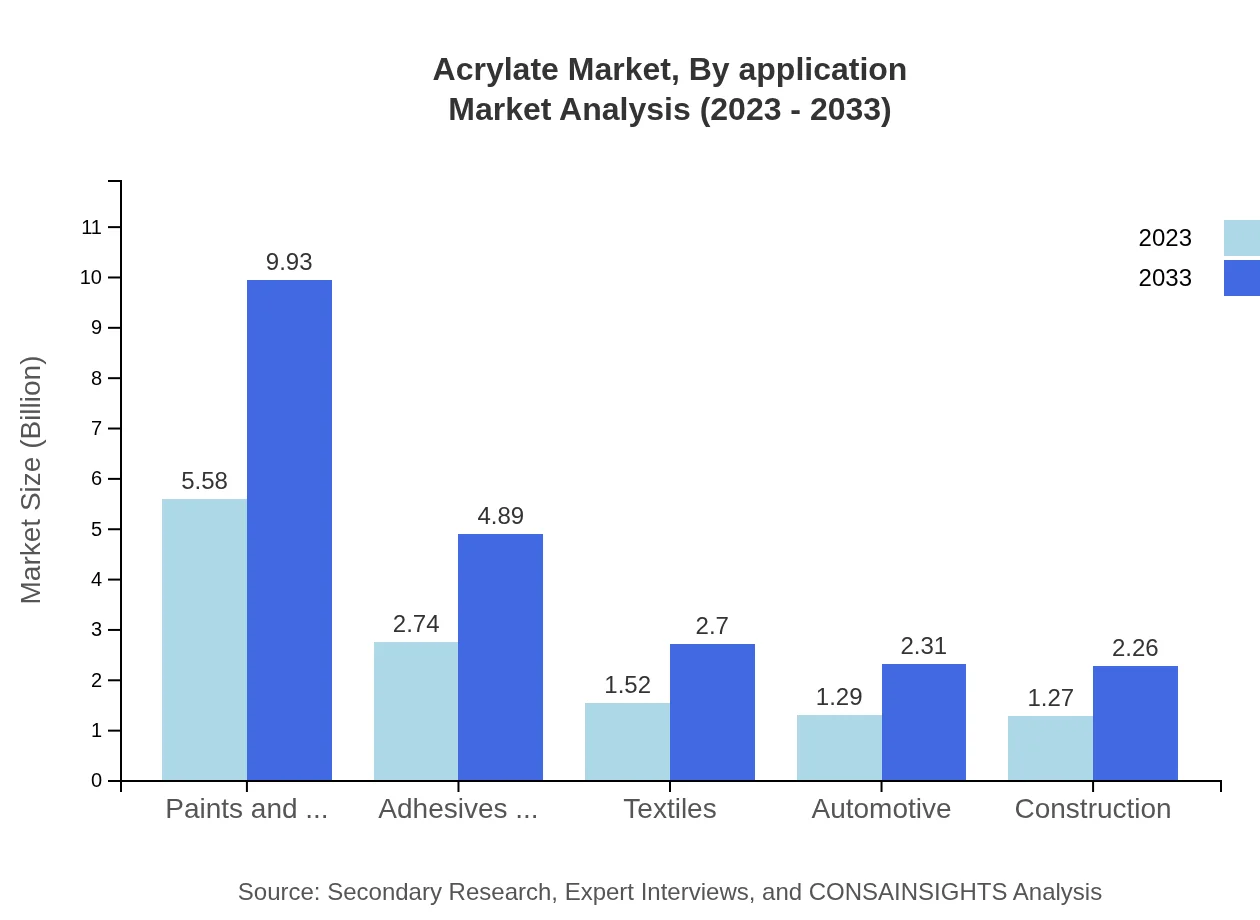

Acrylate Market Analysis By Application

Key applications for Acrylate products include paints and coatings, which represent approximately 44.98% of the market share, projected to grow from $5.58 billion in 2023 to $9.93 billion by 2033. The adhesives and sealants segment follows at 22.13%, expected to increase from $2.74 billion to $4.89 billion by 2033, driven by increasing demand across various industries.

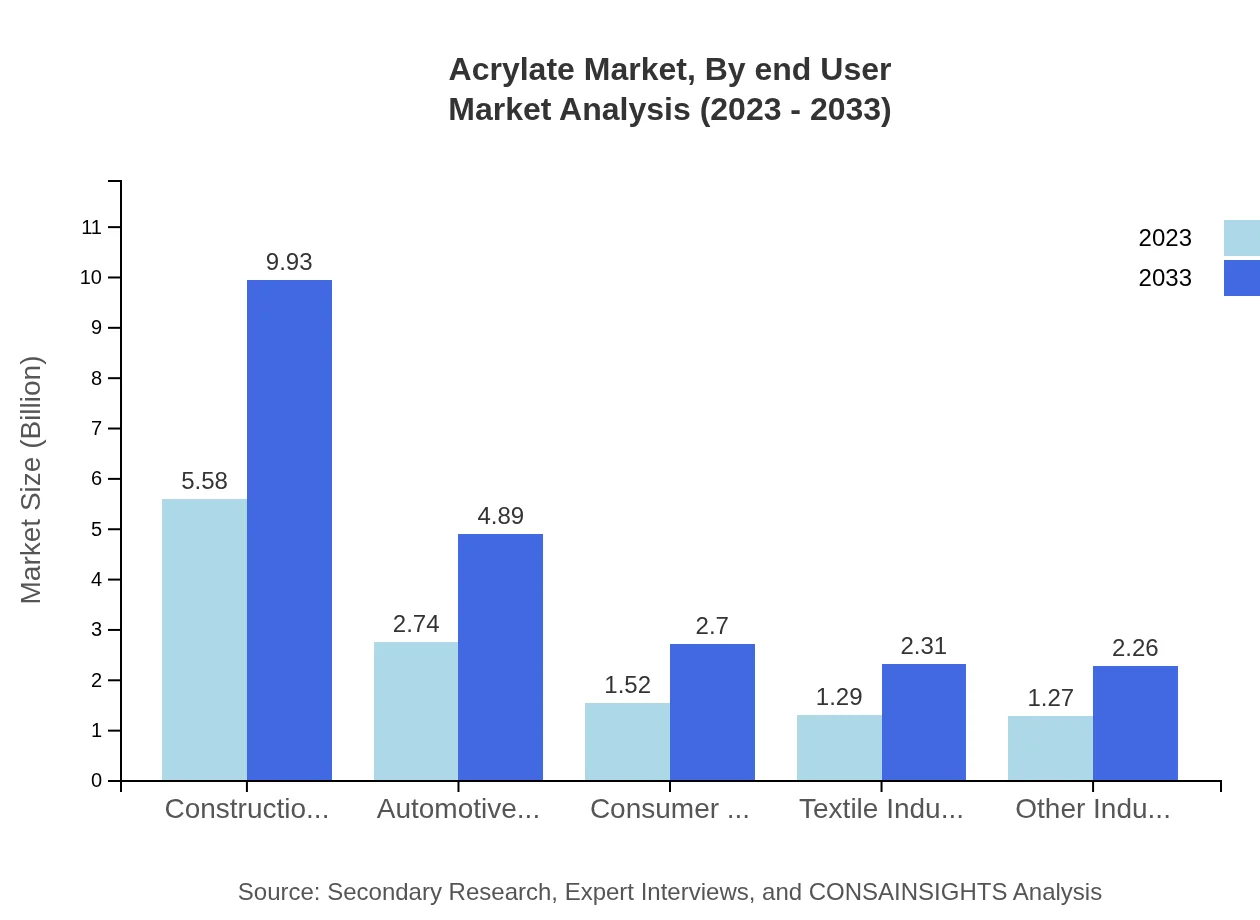

Acrylate Market Analysis By End User

In terms of end-users, the construction industry holds a prominent share of approximately 44.98%, anticipated to grow from $5.58 billion to $9.93 billion by 2033. Other significant industries include automotive, textiles, and consumer goods, with projected growth outcomes that reflect ongoing trends in each sector towards using advanced materials, including Acrylates.

Acrylate Market Analysis By Region

Regional dynamics highlight that North America leads in market share (44.98%), followed by Europe (22.13%) and Asia-Pacific (12.23%), indicating distinct consumer preferences and regulatory influences across regions. The continuous product exploration in regions like Asia-Pacific is driving innovation, while the established markets in North America and Europe are focusing on environmentally sustainable practices.

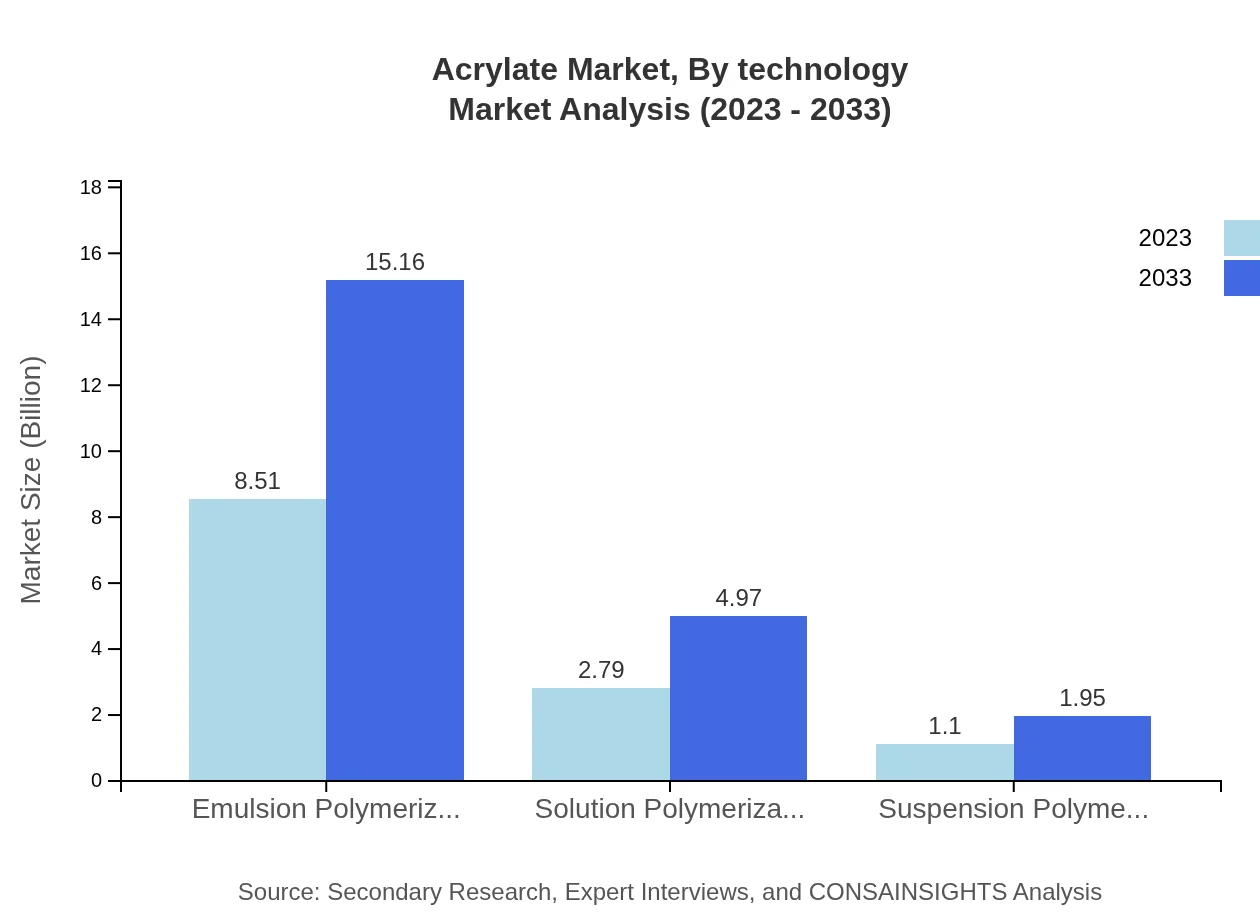

Acrylate Market Analysis By Technology

Emulsion polymerization is the leading technology in the Acrylate market, accounting for 68.63% market share, with growth projected from $8.51 billion in 2023 to $15.16 billion by 2033. Solution polymerization and suspension polymerization show potential growth at 22.52% and 8.85%, respectively, reflecting diversified manufacturing methods and applications in various industries.

Acrylate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acrylate Industry

BASF SE:

BASF SE is a leading global chemical company known for its innovative chemical solutions across various sectors, including Acrylates. Their extensive research and focus on sustainability drive market growth.Dow Chemical Company:

The Dow Chemical Company is a major player in the Acrylate market, offering a wide range of products that cater to industries such as automotive, construction, and consumer products, with a strong focus on technological advancements.Mitsubishi Chemical Corporation:

Mitsubishi Chemical Corporation specializes in chemical solutions and has a significant presence in the Acrylate market, known for its quality products and innovative applications driving industry growth.Evonik Industries AG:

Evonik Industries AG is a leading specialty chemicals company involved in the Acrylate sector, providing advanced solutions to meet diverse customer needs with an emphasis on sustainability and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of acrylate?

The global Acrylate market size is projected to reach $12.4 billion by 2033, with a CAGR of 5.8% from 2023. This growth reflects increasing applications across diverse industries and strong demand for innovative products.

What are the key market players or companies in the acrylate industry?

Key players in the Acrylate market include BASF, Dow, Arkema, Mitsubishi Chemical, and NIPPON SHOKUBAI. These companies lead by embracing advanced production technologies and detailed market strategies to sustain their competitive edge.

What are the primary factors driving the growth in the acrylate industry?

Driving factors in the Acrylate industry encompass rising demand from construction and automotive sectors, increased investments in infrastructure, and the growing trend of eco-friendly products that enhance sustainability in various applications.

Which region is the fastest Growing in the acrylate market?

North America is the fastest-growing region in the Acrylate market, projected to expand from $4.22 billion in 2023 to $7.51 billion by 2033. This growth is fueled by robust industrialization and substantial investments in sustainable technologies.

Does ConsaInsights provide customized market report data for the acrylate industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Acrylate industry. This includes market size, growth trends, and competitive analysis focused on various segments.

What deliverables can I expect from this acrylate market research project?

From the Acrylate market research project, expect comprehensive reports, market size analysis, regional insights, and detailed segmentation data. These deliverables aim to inform strategic decisions and enhance market understanding.

What are the market trends of acrylate?

Current market trends for Acrylate include a shift towards eco-friendly applications, innovations in emulsion polymerization, and increased focus on high-performance coatings. Such trends indicate a positive outlook for industry growth.