Acrylic Processing Aid Market Report

Published Date: 02 February 2026 | Report Code: acrylic-processing-aid

Acrylic Processing Aid Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Acrylic Processing Aid market, including insights into market size, growth trends, and segment performance from 2023 to 2033. It covers regional analyses, technological advancements, and forecasts for the coming decade.

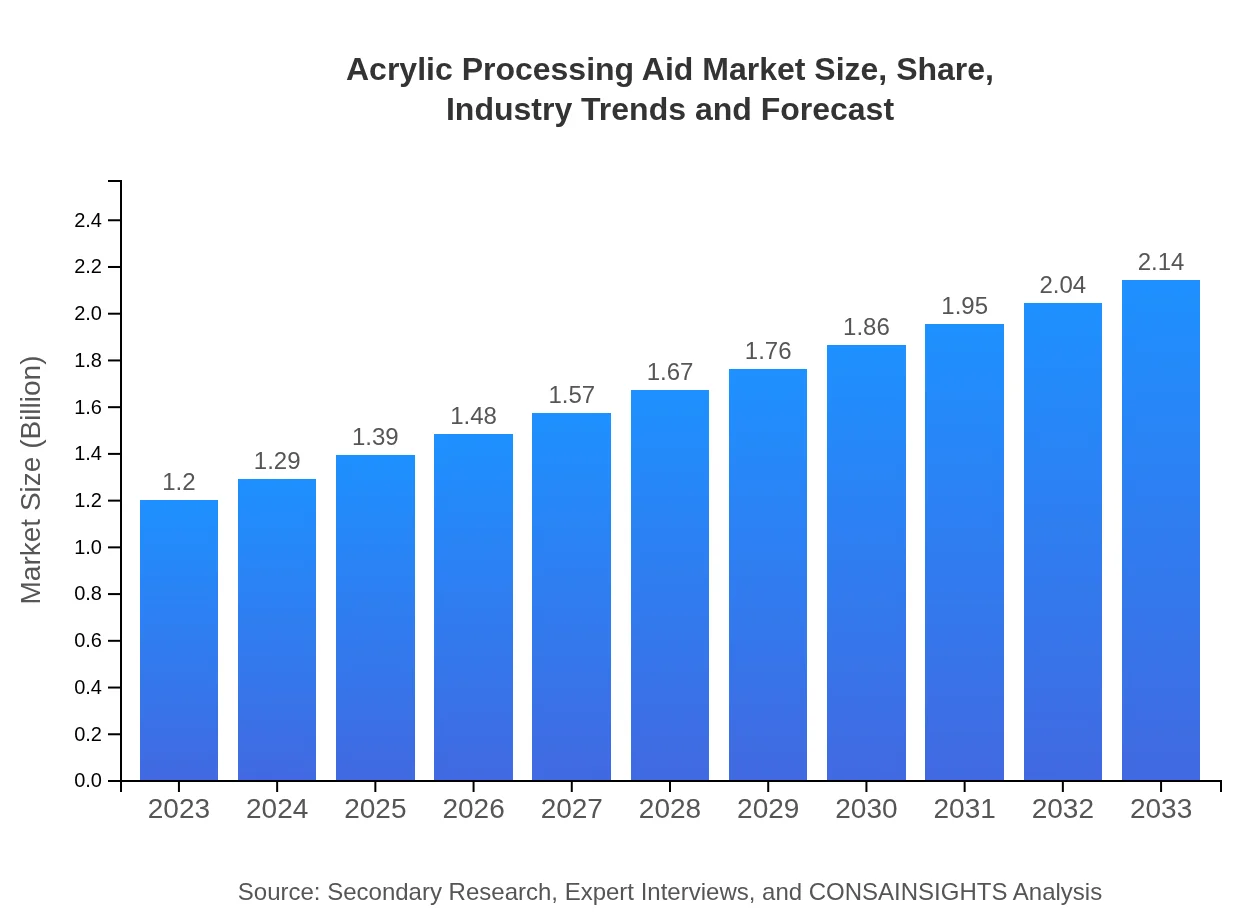

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.14 Billion |

| Top Companies | BASF SE, Dow Inc., Additives International, Evonik Industries AG, SABIC |

| Last Modified Date | 02 February 2026 |

Acrylic Processing Aid Market Overview

Customize Acrylic Processing Aid Market Report market research report

- ✔ Get in-depth analysis of Acrylic Processing Aid market size, growth, and forecasts.

- ✔ Understand Acrylic Processing Aid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acrylic Processing Aid

What is the Market Size & CAGR of the Acrylic Processing Aid market in 2023?

Acrylic Processing Aid Industry Analysis

Acrylic Processing Aid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acrylic Processing Aid Market Analysis Report by Region

Europe Acrylic Processing Aid Market Report:

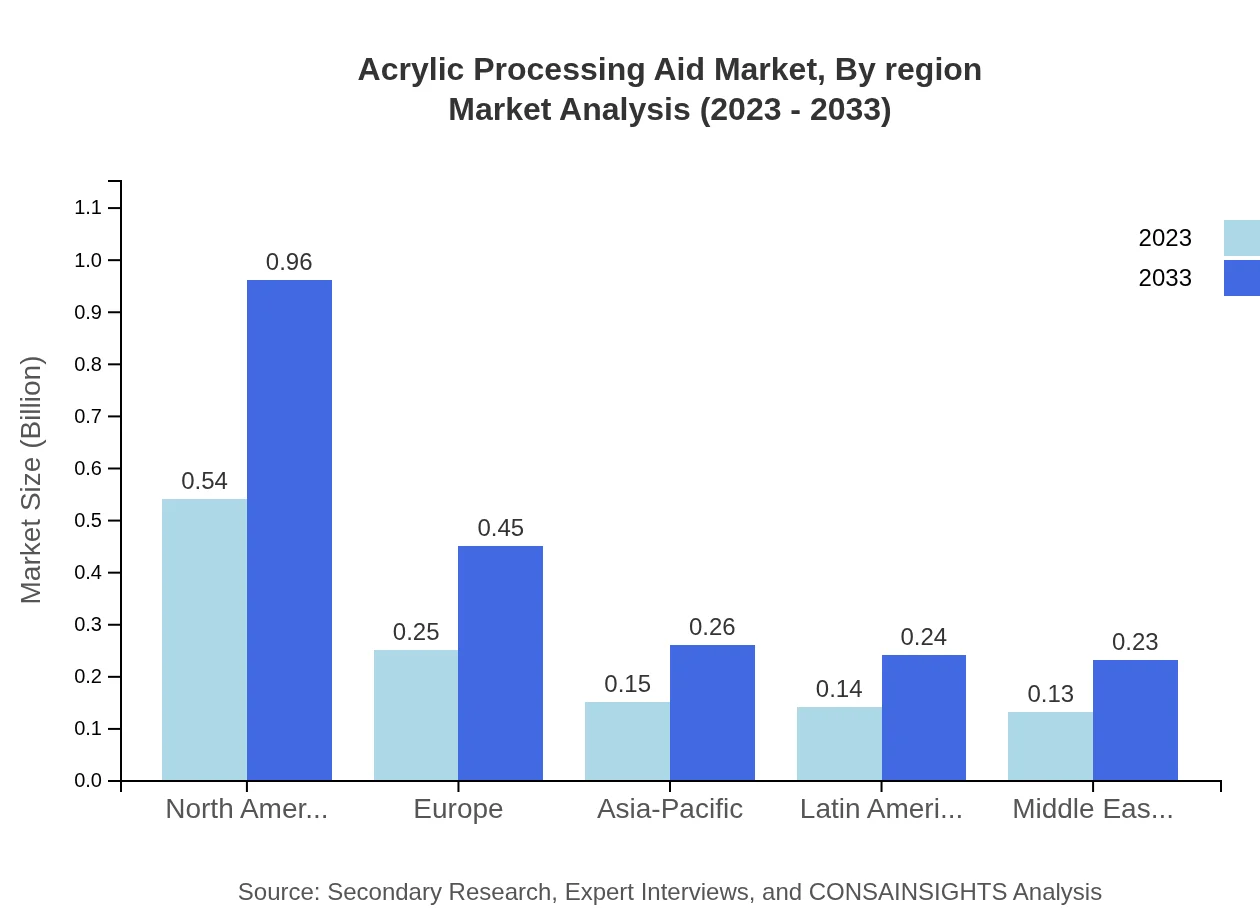

The European market for Acrylic Processing Aid is projected to grow from USD 0.37 billion in 2023 to approximately USD 0.66 billion by 2033. The region's strong regulatory framework on material safety and sustainability drives the adoption of advanced acrylic solutions, boosting market growth.Asia Pacific Acrylic Processing Aid Market Report:

The Asia Pacific region accounts for a significant share of the Acrylic Processing Aid market, with a market size of approximately USD 0.23 billion in 2023, projected to grow to USD 0.41 billion by 2033. The growth is driven by rapid industrialization, high demand for acrylic solutions in packaging, and a growing automotive sector in countries like China and India.North America Acrylic Processing Aid Market Report:

North America displays a robust market presence with an estimated size of USD 0.41 billion in 2023, anticipated to expand to USD 0.72 billion by 2033. The region's growth can be attributed to the high demand for acrylic processing aids in diverse applications such as automotive and construction.South America Acrylic Processing Aid Market Report:

In South America, the Acrylic Processing Aid market is relatively smaller, with a size of USD 0.03 billion in 2023, expected to reach USD 0.05 billion by 2033. The market growth here is supported by the increasing use of acrylics in the construction and consumer goods sectors.Middle East & Africa Acrylic Processing Aid Market Report:

The Middle East and Africa market, currently valued at USD 0.16 billion in 2023, is expected to reach USD 0.29 billion by 2033. Growing construction activities and a rising trend towards urbanization are key factors driving demand in this region.Tell us your focus area and get a customized research report.

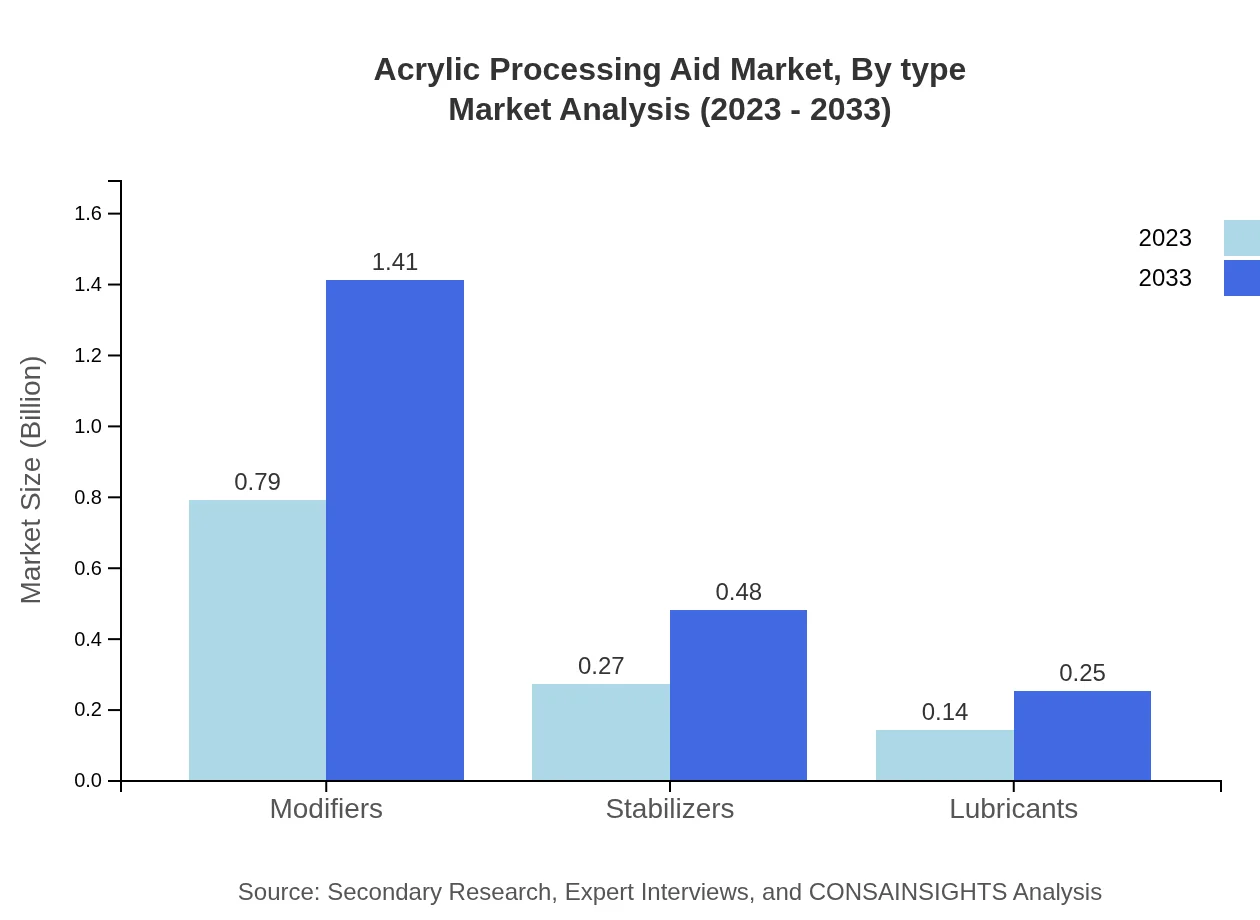

Acrylic Processing Aid Market Analysis By Type

In 2023, the market for **Modifiers** is valued at USD 0.79 billion and is projected to enhance to USD 1.41 billion by 2033, capturing a dominant share of 65.79% in the overall market. **Stabilizers** account for about USD 0.27 billion, expected to grow to USD 0.48 billion, representing 22.42% of the market. Lastly, **Lubricants** currently hold a position with a market size of USD 0.14 billion, forecasted to reach USD 0.25 billion, maintaining an 11.79% industry share.

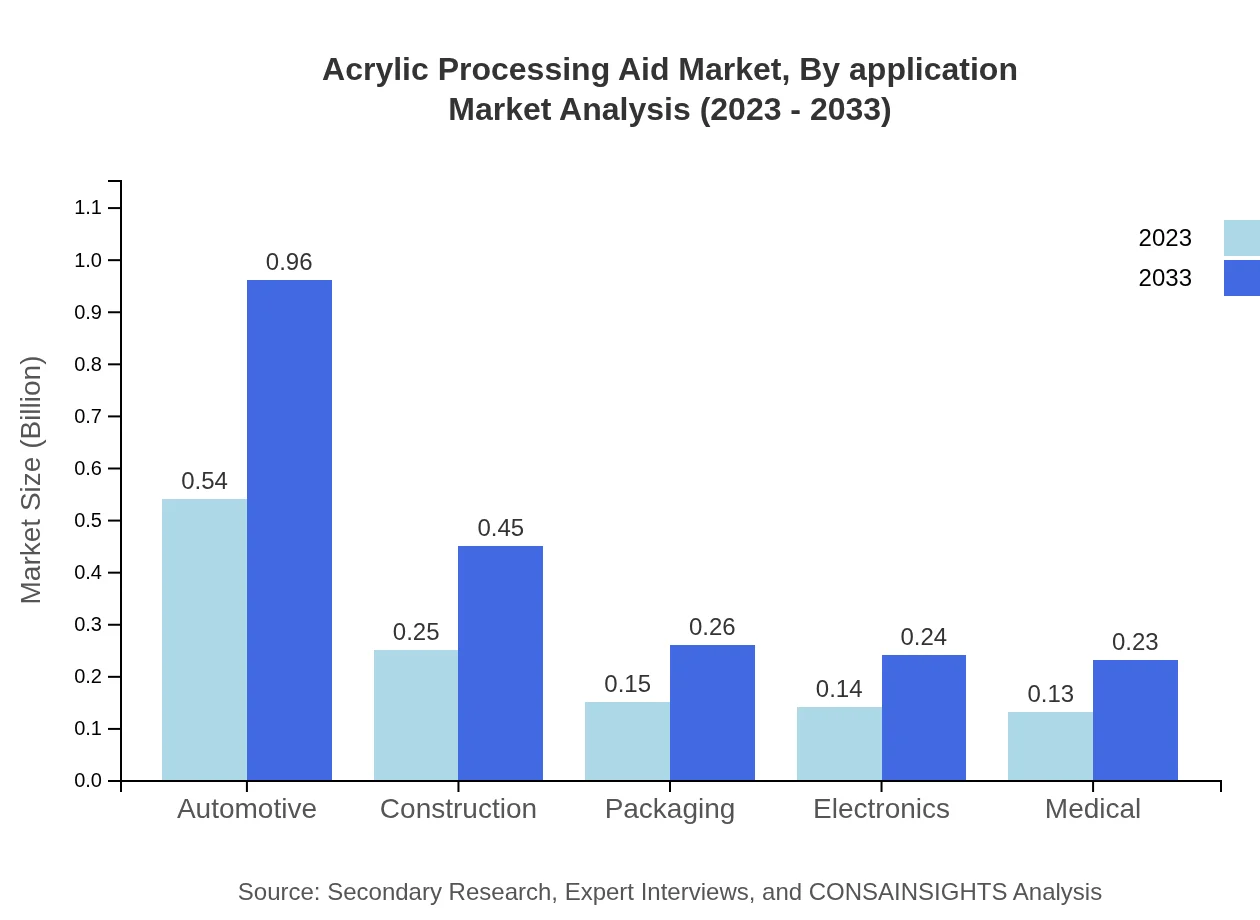

Acrylic Processing Aid Market Analysis By Application

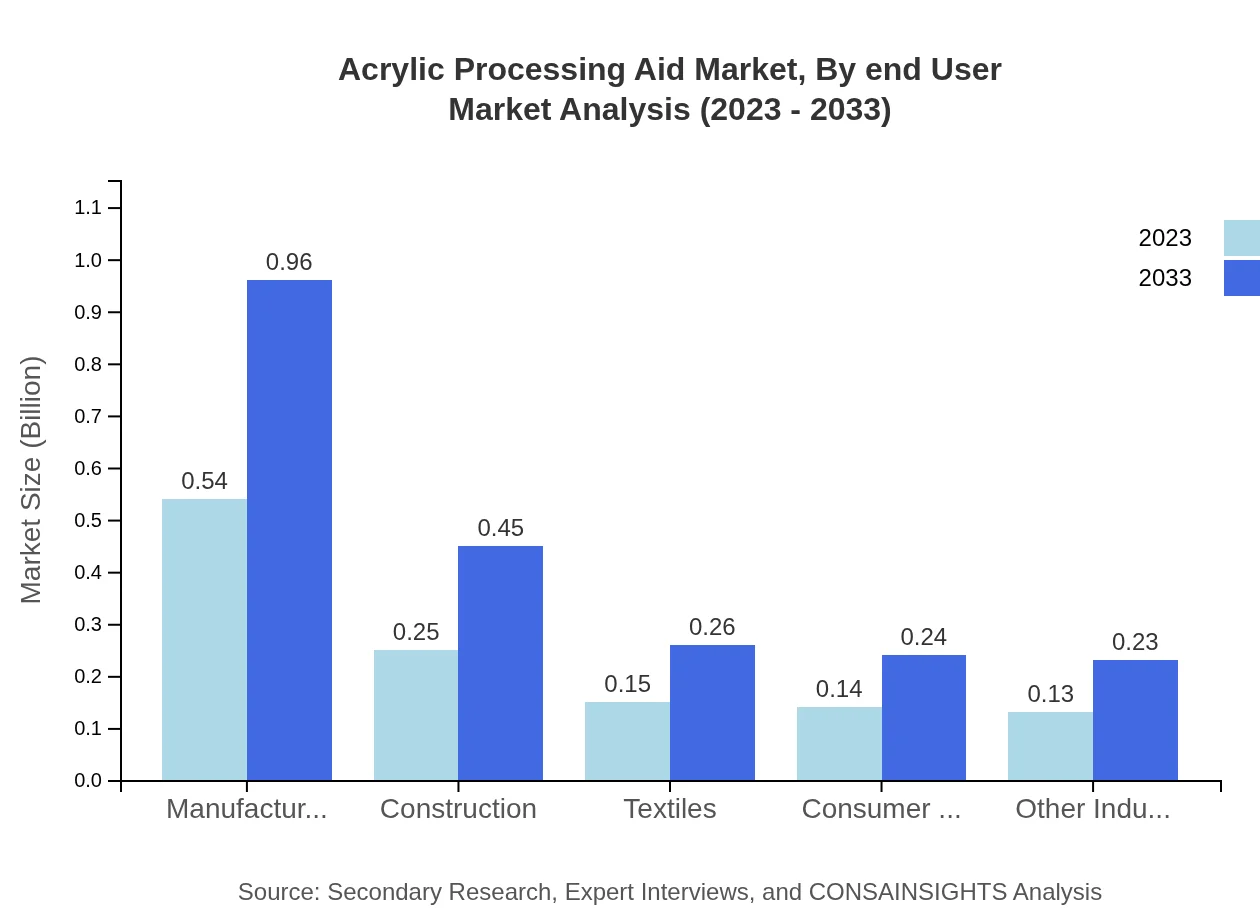

The **Manufacturing** sector is the largest consumer, with a market size of USD 0.54 billion in 2023, anticipated to grow to USD 0.96 billion. This segment holds a 44.95% share. **Construction**, as another key user, has a size of USD 0.25 billion, growing to USD 0.45 billion, representing a 20.82% share. Other applications include **Textiles**, **Packaging**, and **Automotive**, all of which are vital for sustaining market growth.

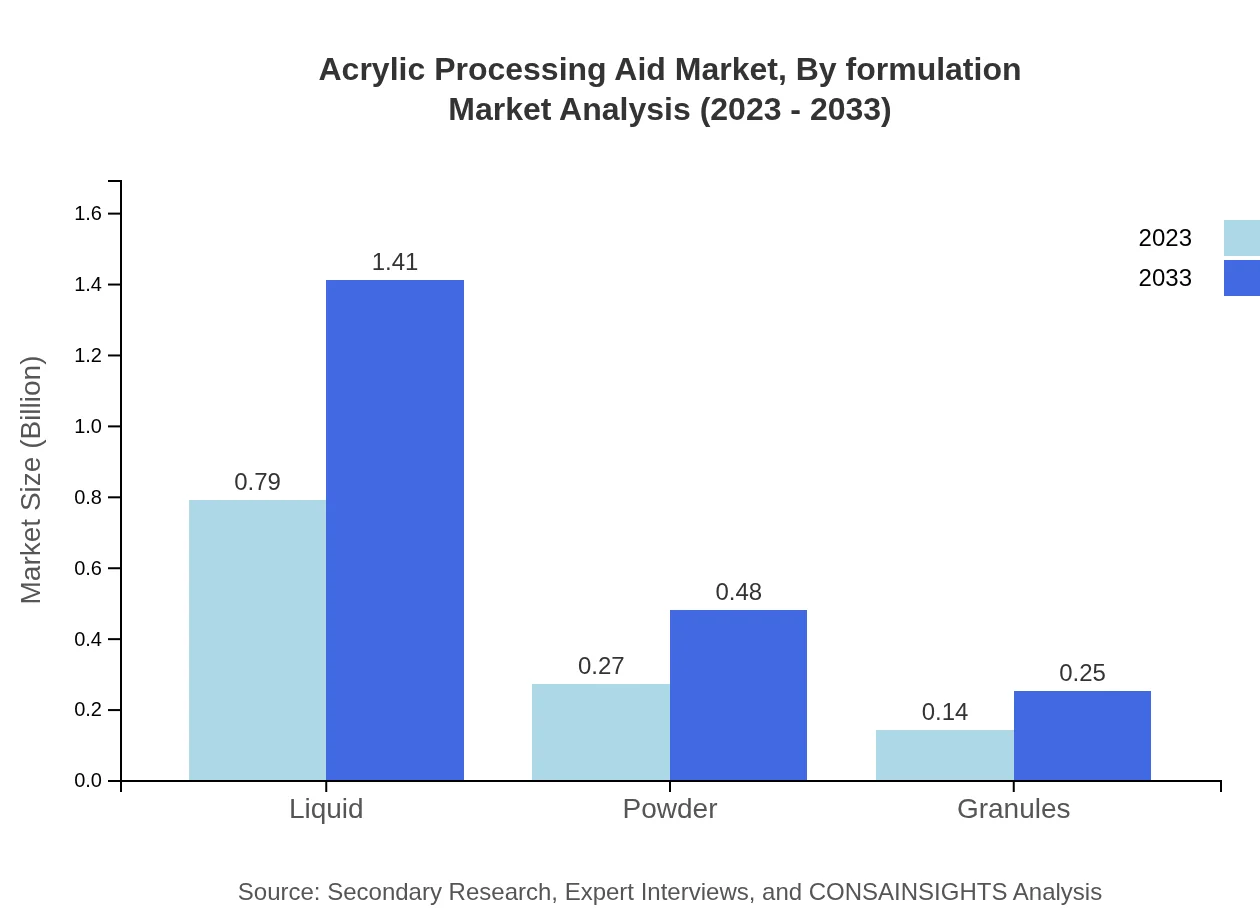

Acrylic Processing Aid Market Analysis By Formulation

The **Liquid** formulation is the most preferred type with a market value of USD 0.79 billion, projected to rise to USD 1.41 billion by 2033, representing a 65.79% market share. Meanwhile, **Powder** and **Granules** formulations make up smaller segments, valued at USD 0.27 billion and USD 0.14 billion respectively.

Acrylic Processing Aid Market Analysis By End User

Key end-user industries include **Automotive**, the largest segment at USD 0.54 billion in 2023, expected to reach USD 0.96 billion. **Construction** and **Consumer Goods** also play significant roles, contributing substantially to the growth of the acrylic processing aids market.

Acrylic Processing Aid Market Analysis By Region

Geographic segmentation reveals North America and Europe as leaders in market share, while substantial growth is projected across Asia-Pacific and Latin America as these regions advance industrially and technologically.

Acrylic Processing Aid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Acrylic Processing Aid Industry

BASF SE:

A leading chemical company that integrates sustainability into its acrylic processing aids, ensuring compatibility with environmental regulations and enhancing performance during manufacturing.Dow Inc.:

A key player in the polymer industry, Dow provides innovative acrylic processing aids that improve product quality in various applications, focusing on customer needs.Additives International:

Specializes in providing high-quality acrylic additives that enhance processing functionality and optimize operational efficiency in end-user applications.Evonik Industries AG:

Evonik offers a broad portfolio of acrylic processing aids known for their high-performance characteristics, helping customers meet stringent production requirements.SABIC:

A global leader in chemicals, SABIC's acrylic processing aids are designed for versatility, catering to a wide range of industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of acrylic Processing Aid?

The acrylic processing aid market is valued at approximately $1.2 billion in 2023. It is projected to grow at a CAGR of 5.8% over the next decade, reaching significant expansion by 2033.

What are the key market players or companies in this acrylic Processing Aid industry?

Key players in the acrylic processing aid market include major chemical manufacturers and suppliers who provide additives for plastic processing. Their innovations and diverse product ranges significantly influence market dynamics.

What are the primary factors driving the growth in the acrylic Processing Aid industry?

Key drivers include rising demand from the construction and automotive sectors, advancements in polymer technology, and increasing applications in the packaging industry, contributing to market expansion.

Which region is the fastest Growing in the acrylic Processing Aid?

The fastest-growing region for acrylic processing aids is projected to be North America, with market growth from $0.41 billion in 2023 to $0.72 billion by 2033, reflecting increasing industrial activities.

Does ConsaInsights provide customized market report data for the acrylic Processing Aid industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs in the acrylic processing aid industry, ensuring comprehensive data aligns with their strategic interests.

What deliverables can I expect from this acrylic Processing Aid market research project?

Expect detailed market analysis, segmentation data, competitive landscape, and regional insights, along with trends and forecasts for the acrylic processing aid industry to guide strategic decisions.

What are the market trends of acrylic Processing Aid?

Current trends in the acrylic processing aid market include increased adoption of bio-based additives, diversification of product forms, and an emphasis on sustainability, shaping future market trajectories.