Active Data Warehousing Market Report

Published Date: 31 January 2026 | Report Code: active-data-warehousing

Active Data Warehousing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Active Data Warehousing market. It covers market trends, industry insights, and regional breakdowns, forecasting growth from 2023 to 2033 to offer a clear understanding of future prospects.

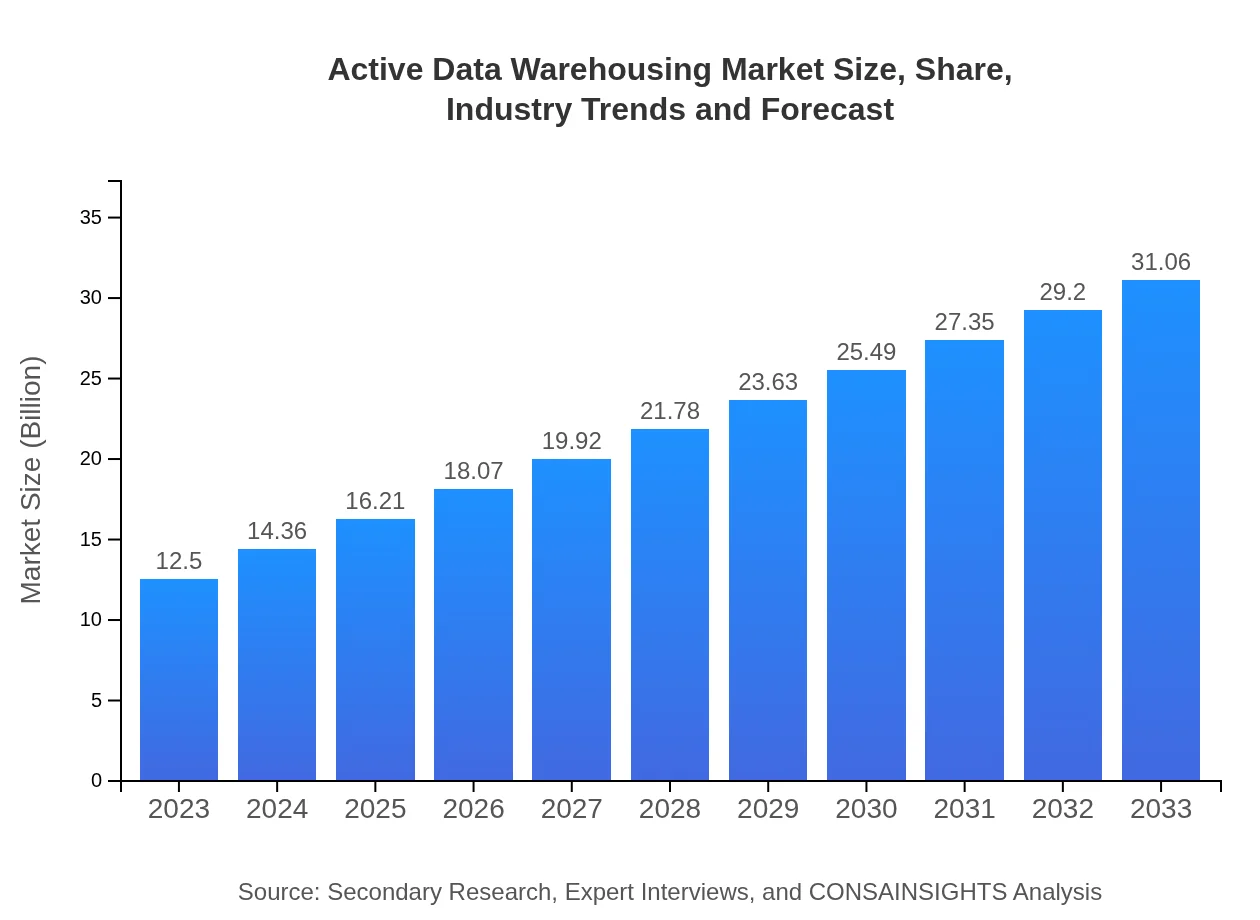

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $31.06 Billion |

| Top Companies | Oracle Corporation, IBM Corporation, Microsoft Corporation, SAP SE, Snowflake Inc. |

| Last Modified Date | 31 January 2026 |

Active Data Warehousing Market Overview

Customize Active Data Warehousing Market Report market research report

- ✔ Get in-depth analysis of Active Data Warehousing market size, growth, and forecasts.

- ✔ Understand Active Data Warehousing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Data Warehousing

What is the Market Size & CAGR of Active Data Warehousing market in 2023?

Active Data Warehousing Industry Analysis

Active Data Warehousing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Data Warehousing Market Analysis Report by Region

Europe Active Data Warehousing Market Report:

The European Active Data Warehousing market is anticipated to rise from $4.40 billion in 2023 to $10.93 billion by 2033, driven by stringent data regulation policies and a strong emphasis on data governance.Asia Pacific Active Data Warehousing Market Report:

The Asia Pacific region is projected to grow significantly, with market size increasing from $2.05 billion in 2023 to $5.09 billion by 2033. Factors driving this growth include rapidly digitizing economies, increasing investments in big data analytics, and a burgeoning technology startup ecosystem.North America Active Data Warehousing Market Report:

North America leads the market, with the market size expected to grow from $4.23 billion in 2023 to $10.50 billion by 2033. The presence of key players and widespread adoption of advanced technologies are major contributing factors to this robust growth.South America Active Data Warehousing Market Report:

In South America, the market is estimated to increase from $0.75 billion in 2023 to approximately $1.86 billion by 2033. The growth in cloud adoption and an increasing focus on data analytics are primary drivers in this region.Middle East & Africa Active Data Warehousing Market Report:

In the Middle East and Africa, the market is projected to grow from $1.07 billion in 2023 to $2.66 billion by 2033, supported by increasing investments in IT infrastructure and a growing need for efficient data management solutions.Tell us your focus area and get a customized research report.

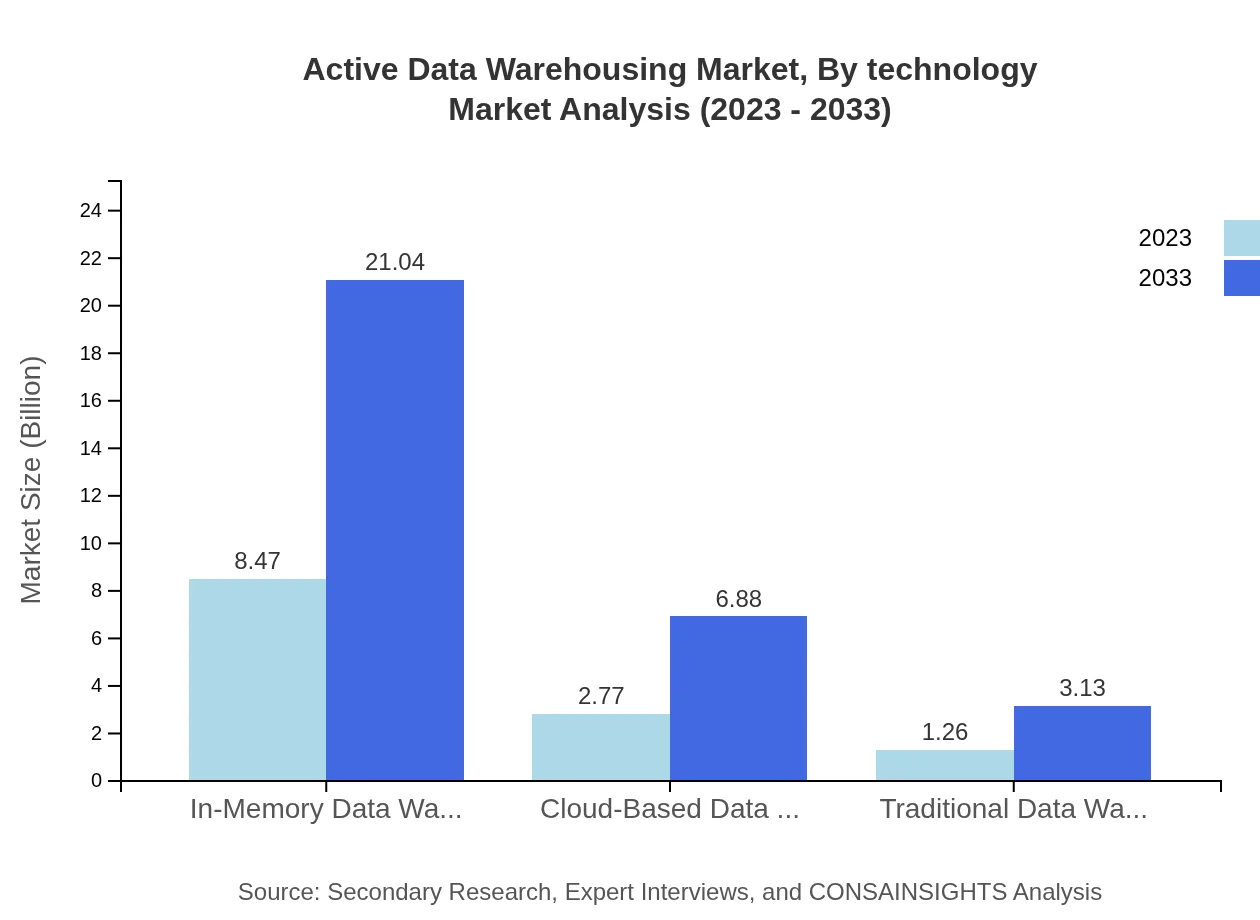

Active Data Warehousing Market Analysis By Technology

The technology segment displays significant diversity, with In-Memory Data Warehousing leading the way, projected to grow from $8.47 billion in 2023 to $21.04 billion by 2033. This segment is predominant due to its fast processing capabilities. Cloud-Based Data Warehousing is also witnessing increased adoption, with estimated growth from $2.77 billion to $6.88 billion in the same period.

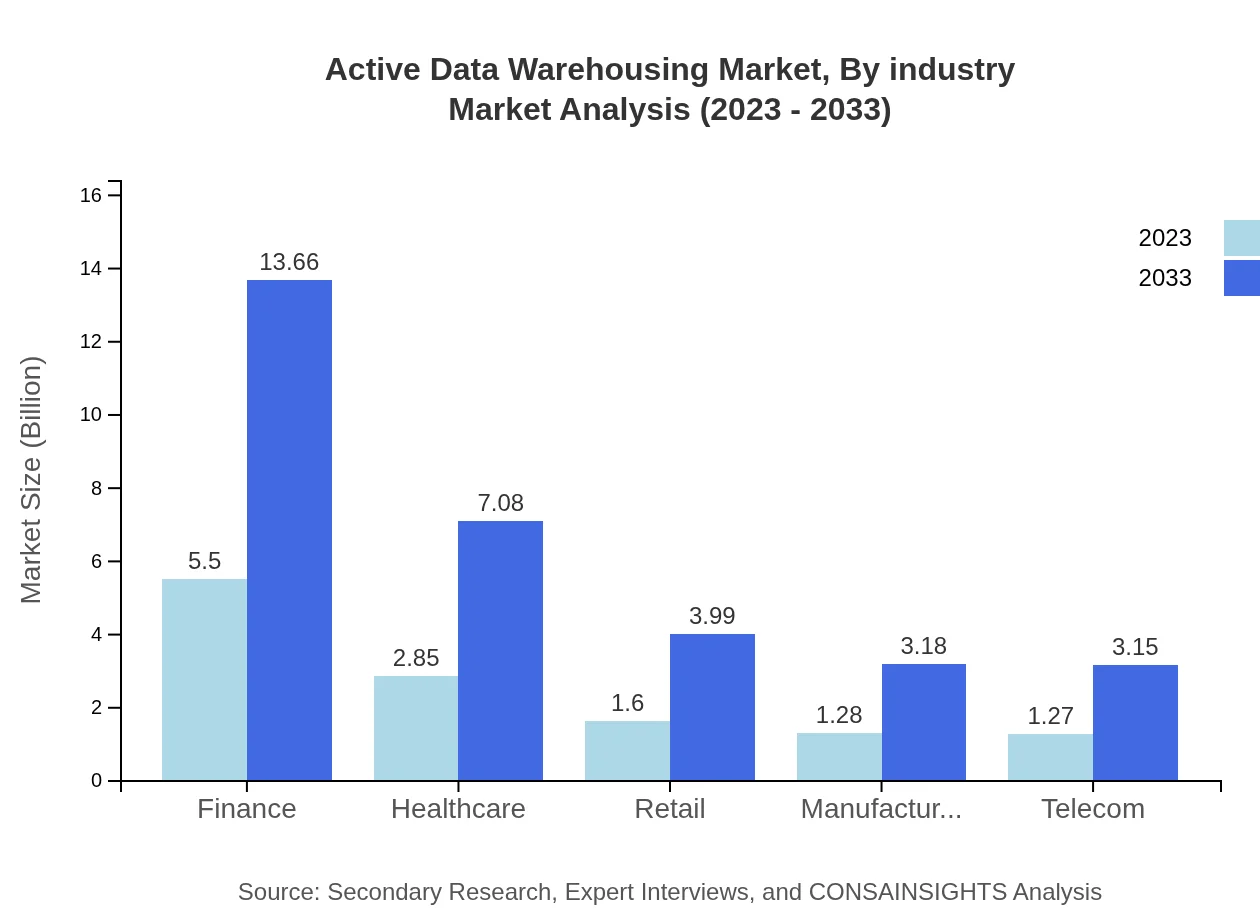

Active Data Warehousing Market Analysis By Industry

The finance sector remains a key segment, currently comprising 43.99% of the market share in 2023 with a size of $5.50 billion, projected to reach $13.66 billion by 2033. Other sectors, such as healthcare and retail, are also significant, with healthcare's share at 22.81% and expected growth reflective of increasing compliance and data management needs.

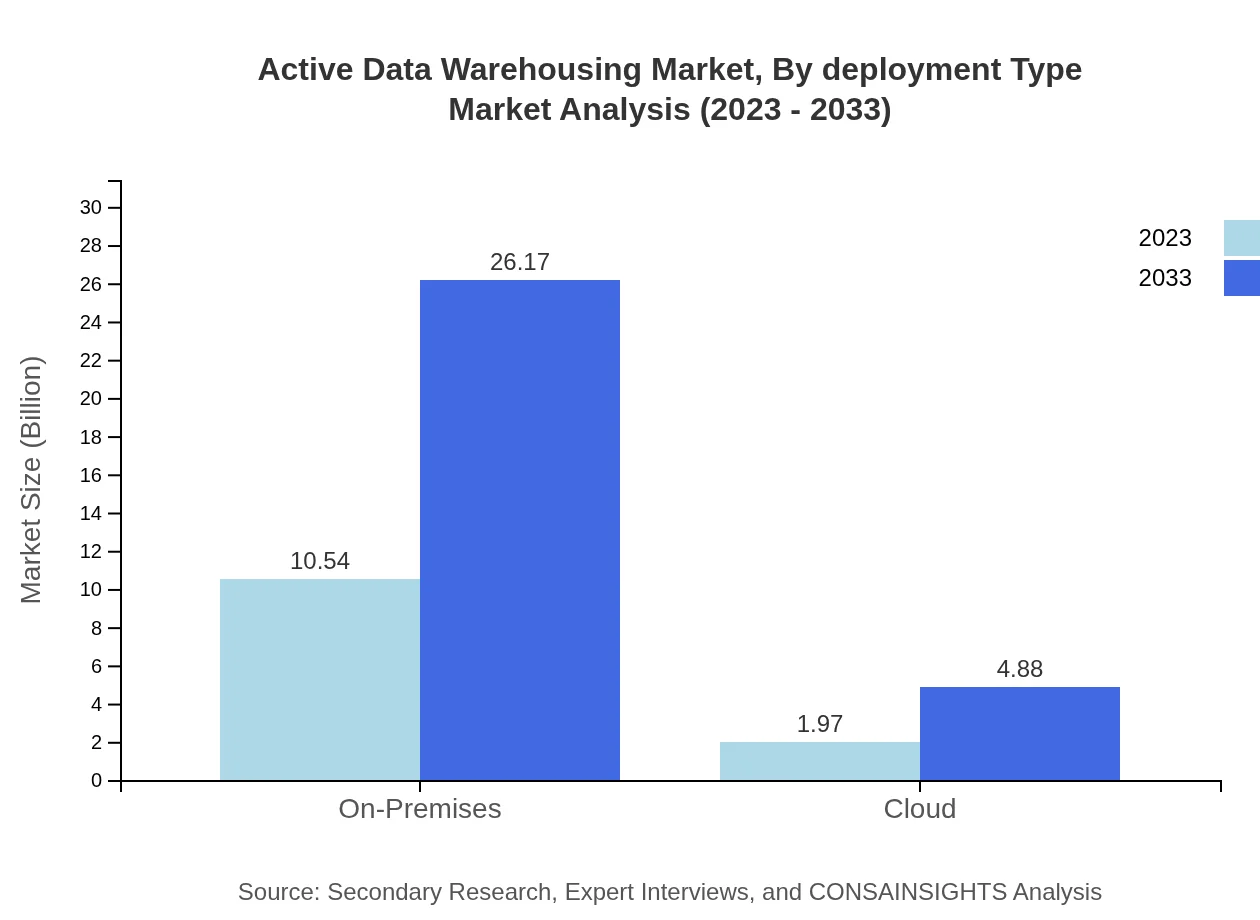

Active Data Warehousing Market Analysis By Deployment Type

The On-Premises deployment type dominates with a market size of $10.54 billion in 2023, expected to expand to $26.17 billion by 2033, driven by enterprises seeking control over their data. In contrast, Cloud deployment is gaining traction, anticipated to grow from $1.97 billion to $4.88 billion, attributed to flexibility and lower costs.

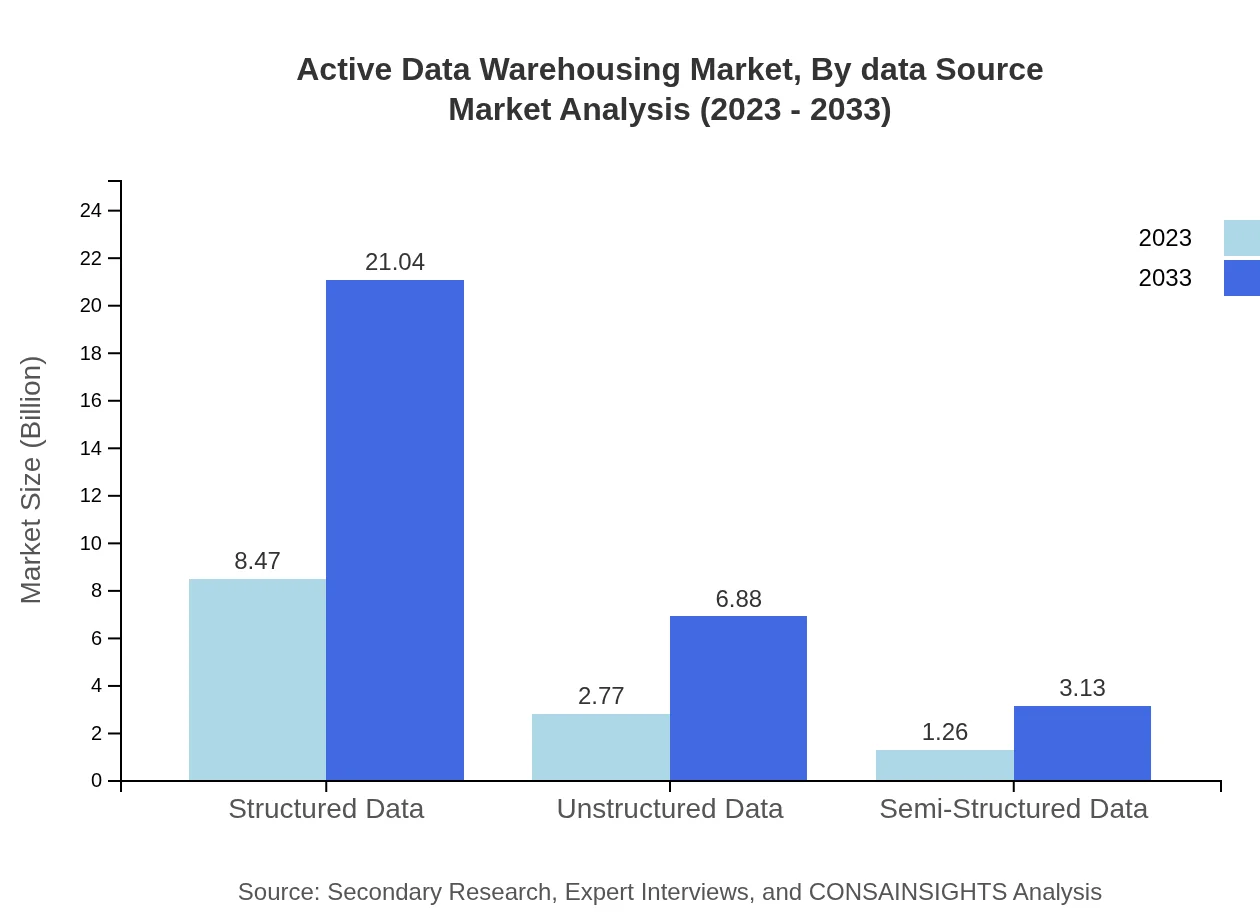

Active Data Warehousing Market Analysis By Data Source

Structured data continues to be the leading source for Active Data Warehousing, projected to grow from $8.47 billion to $21.04 billion due to its critical role in standard business analytics. Unstructured and semi-structured data are also gaining prominence amid evolving data landscapes.

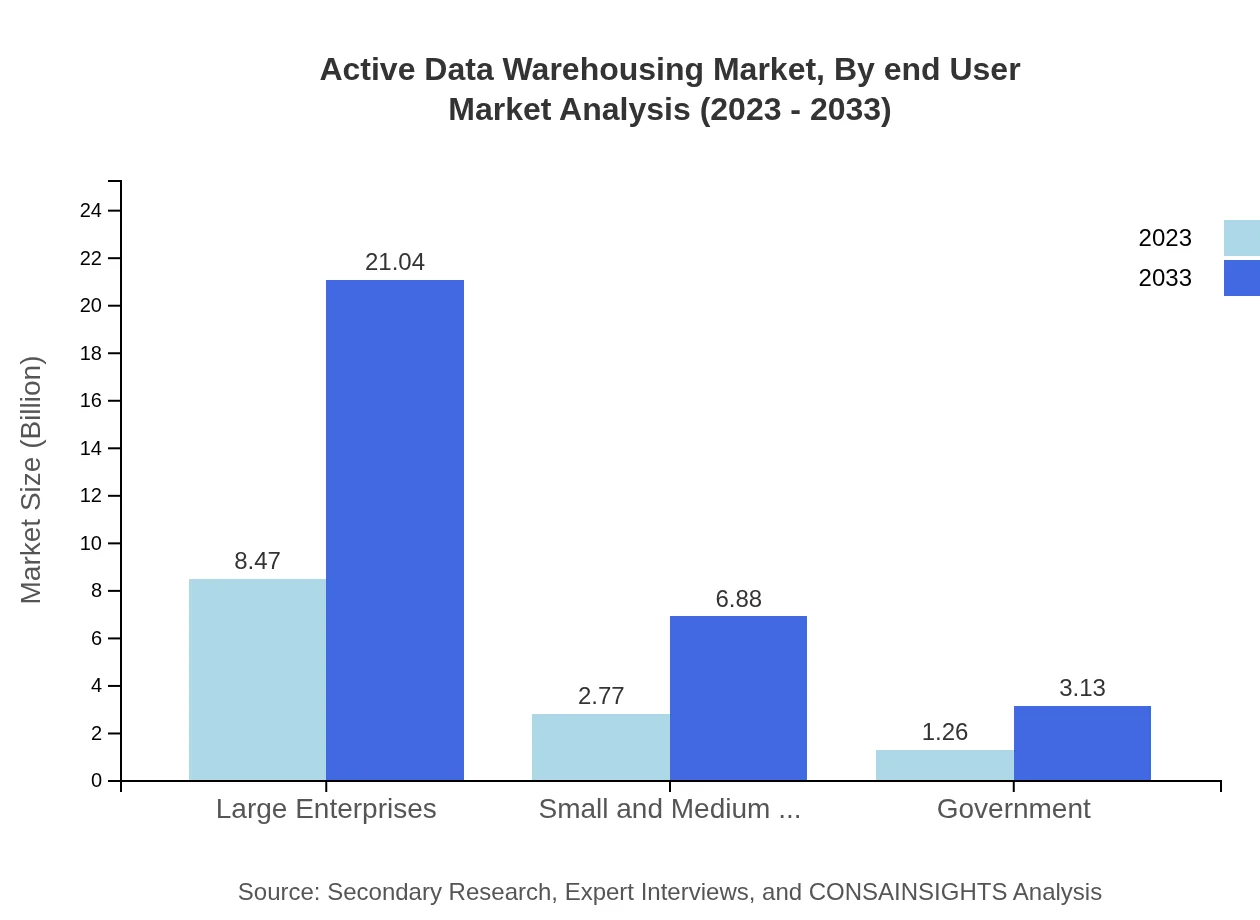

Active Data Warehousing Market Analysis By End User

Large enterprises account for a substantial market share at 67.75%, with growth from $8.47 billion in 2023 to $21.04 billion by 2033. In contrast, small and medium businesses are expected to show robust growth, increasing from $2.77 billion to $6.88 billion, as they increasingly leverage data analytics for competitive advantage.

Active Data Warehousing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Data Warehousing Industry

Oracle Corporation:

Oracle is a pioneer in data warehousing technology and continues to innovate with cloud solutions, enhancing real-time data accessibility for businesses.IBM Corporation:

IBM offers comprehensive data warehousing solutions, leveraging AI and cloud capabilities to provide analytics and data management services.Microsoft Corporation:

Microsoft's Azure database solutions incorporate powerful analytical tools, catering to diverse industries with innovative data warehousing capabilities.SAP SE:

SAP is renowned for its enterprise resource planning solutions, integrating data warehousing technology to support large-scale data analytics.Snowflake Inc.:

Snowflake has transformed the data warehousing landscape with its cloud-native architecture, offering unparalleled scalability and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of active Data Warehousing?

The active data warehousing market is projected to reach a significant size of $12.5 billion by 2033, growing at a CAGR of 9.2%. This growth indicates a strong demand for enhanced data management solutions in various sectors.

What are the key market players or companies in the active Data Warehousing industry?

Key players in the active data warehousing industry include major technology firms specializing in data management solutions, analytics, and cloud computing, which leverage innovative technologies to enhance their offerings and market presence.

What are the primary factors driving the growth in the active data warehousing industry?

Factors driving growth include the increasing need for real-time data analytics, the rise of big data, advancements in cloud technologies, and the growing demand for data-driven decision-making across industries.

Which region is the fastest Growing in active data warehousing?

The fastest-growing region for active data warehousing is Europe, expected to grow from $4.40 billion in 2023 to $10.93 billion by 2033, reflecting increased investment in data management solutions.

Does ConsaInsights provide customized market report data for the active data warehousing industry?

Yes, ConsaInsights offers customized market reports that cater to specific industry needs, providing tailored insights and data analysis for the active data warehousing market to support strategic decision-making.

What deliverables can I expect from this active data warehousing market research project?

Deliverables include comprehensive reports, market size analysis, growth forecasts, competitive landscape evaluations, and tailored recommendations to help stakeholders make informed decisions in the active data warehousing market.

What are the market trends of active data warehousing?

Market trends in active data warehousing include the shift towards cloud-based solutions, the growing importance of real-time analytics, integration of AI and machine learning technologies, and increasing focus on data security and compliance.