Active Implantable Medical Devices Market Report

Published Date: 31 January 2026 | Report Code: active-implantable-medical-devices

Active Implantable Medical Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Active Implantable Medical Devices market, including market size estimates, growth projections, industry dynamics, and segmentation insights from 2023 to 2033.

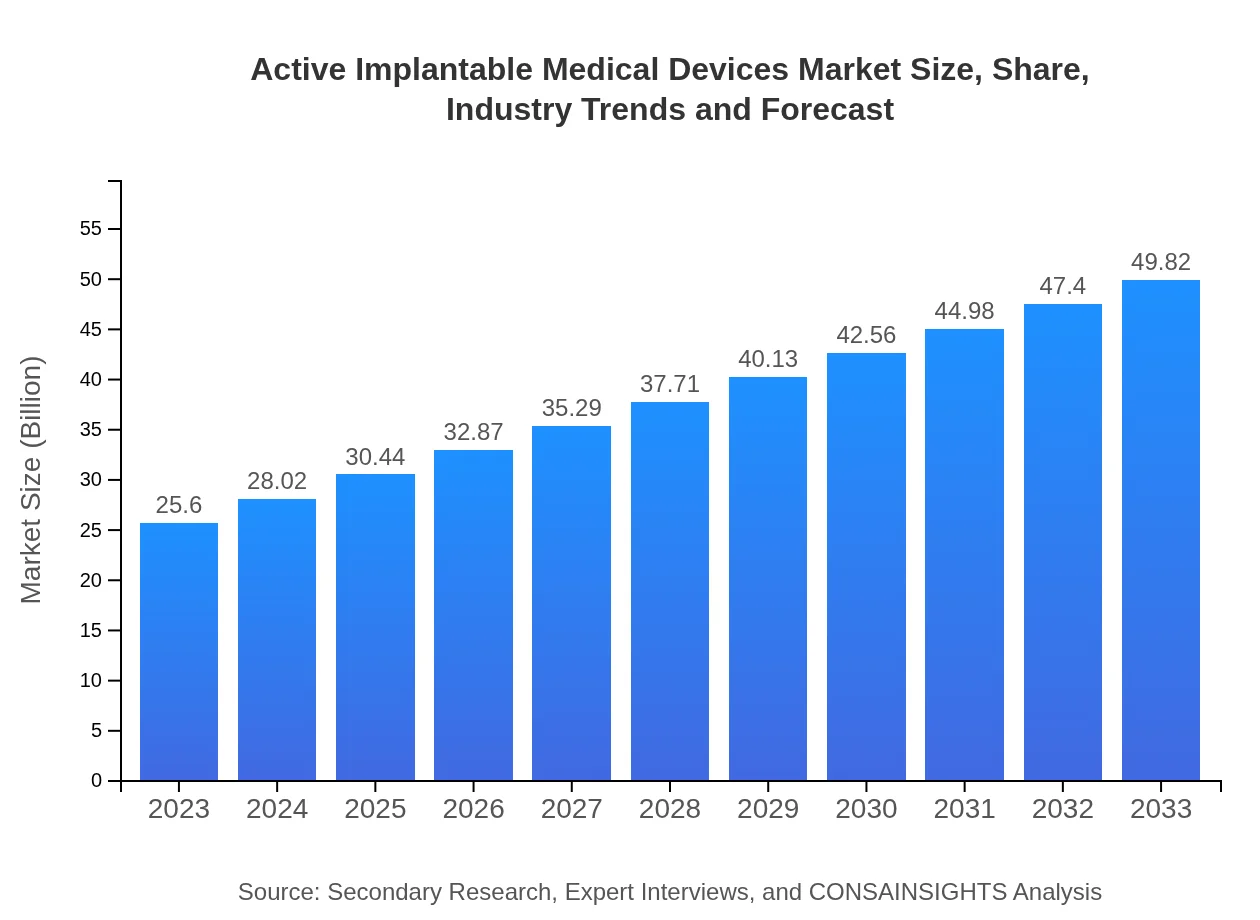

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $49.82 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Boston Scientific, Cardinal Health, Biotronik |

| Last Modified Date | 31 January 2026 |

Active Implantable Medical Devices Market Overview

Customize Active Implantable Medical Devices Market Report market research report

- ✔ Get in-depth analysis of Active Implantable Medical Devices market size, growth, and forecasts.

- ✔ Understand Active Implantable Medical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Implantable Medical Devices

What is the Market Size & CAGR of Active Implantable Medical Devices market in 2023 and 2033?

Active Implantable Medical Devices Industry Analysis

Active Implantable Medical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Implantable Medical Devices Market Analysis Report by Region

Europe Active Implantable Medical Devices Market Report:

The European Active Implantable Medical Devices market stands at $7.18 billion in 2023, expected to grow to $13.98 billion by 2033. Stringent regulations and a focus on innovative healthcare solutions drive the market.Asia Pacific Active Implantable Medical Devices Market Report:

The Asia Pacific region is projected to experience significant growth, from $4.81 billion in 2023 to $9.36 billion by 2033, driven by increased healthcare expenditures and rising geriatric population. Demand for advanced medical technology and growing healthcare infrastructure contribute positively.North America Active Implantable Medical Devices Market Report:

North America leads the market with a size of $9.96 billion in 2023, anticipated to reach $19.39 billion by 2033. The high prevalence of chronic diseases and technological advancements are significant growth drivers.South America Active Implantable Medical Devices Market Report:

In South America, the market is expected to grow from $1.17 billion in 2023 to $2.27 billion by 2033. Factors include improving access to healthcare services and rising awareness about advanced medical devices.Middle East & Africa Active Implantable Medical Devices Market Report:

The Middle East and Africa market is anticipated to expand from $2.48 billion in 2023 to $4.83 billion by 2033. This growth is supported by an increase in healthcare investments and technology adoption.Tell us your focus area and get a customized research report.

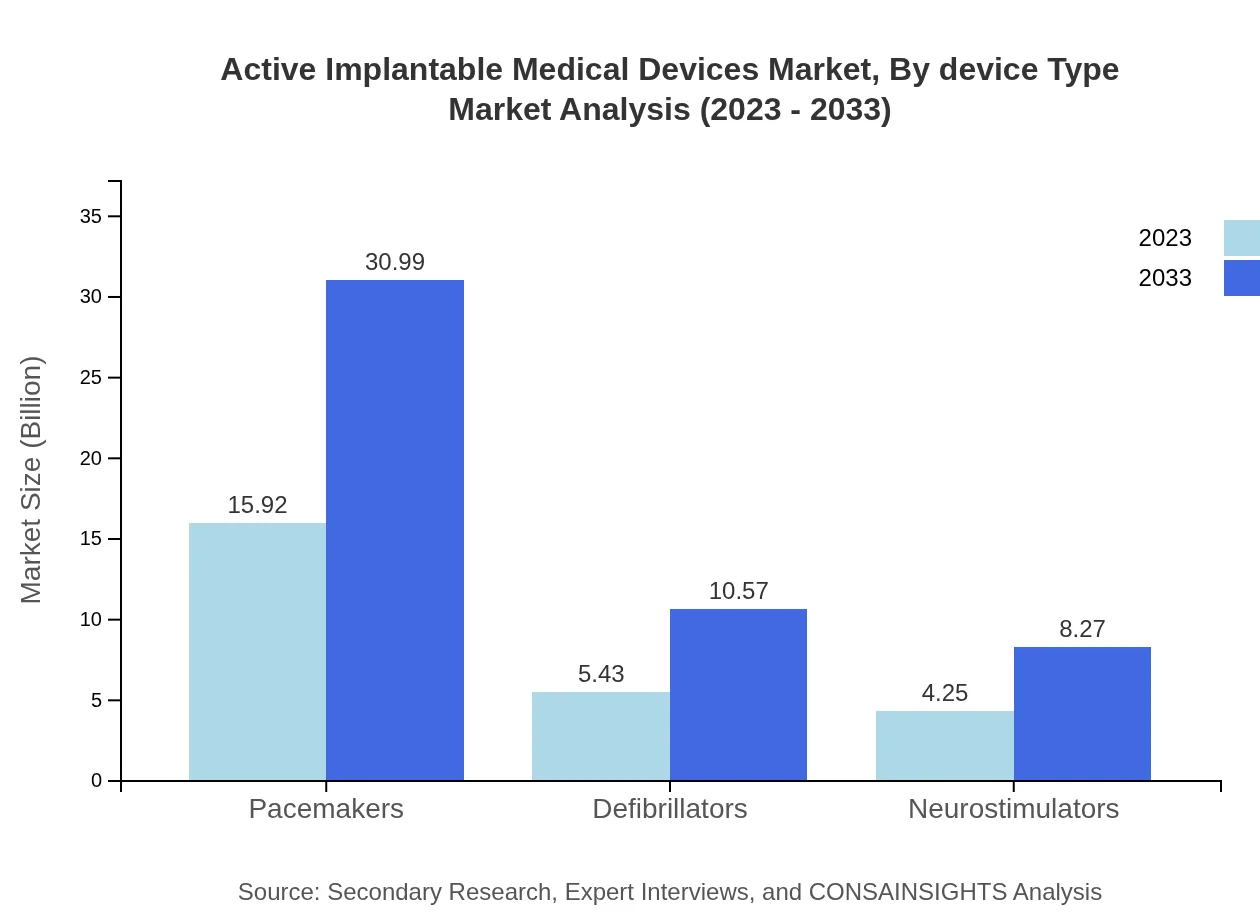

Active Implantable Medical Devices Market Analysis By Device Type

The device types are pivotal in understanding market dynamics: Pacemakers lead the segment with a market size of $15.92 billion in 2023, expected to grow to $30.99 billion by 2033. Defibrillators and neurostimulators also show significant growth prospects. Other segments include telemetry and biological sensors, with rising applications in healthcare.

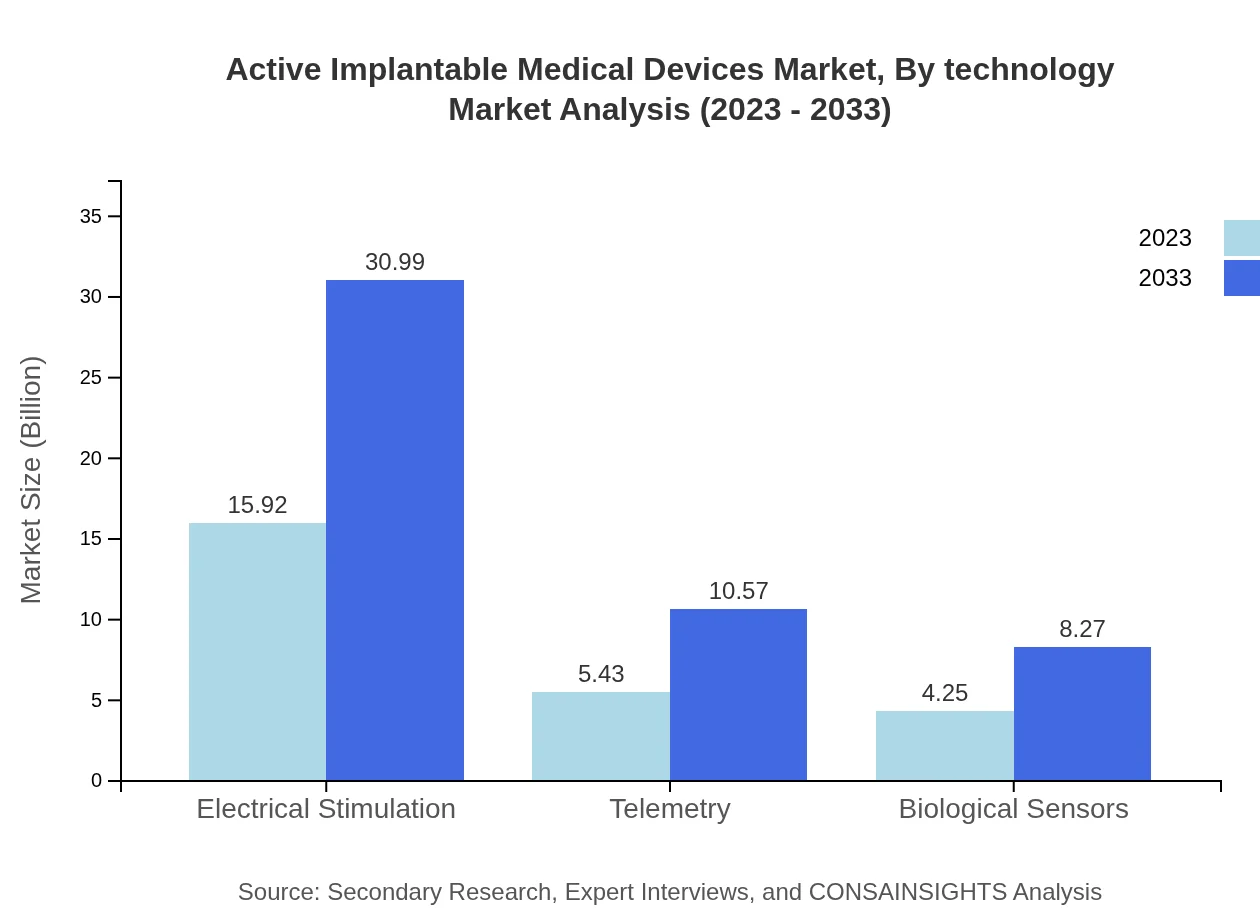

Active Implantable Medical Devices Market Analysis By Technology

Technological innovations such as miniaturization, connectivity features for remote monitoring, and AI integration in devices are shaping the market landscape. Advanced telemetry systems and biological sensors are gaining popularity, enhancing patient management and satisfaction.

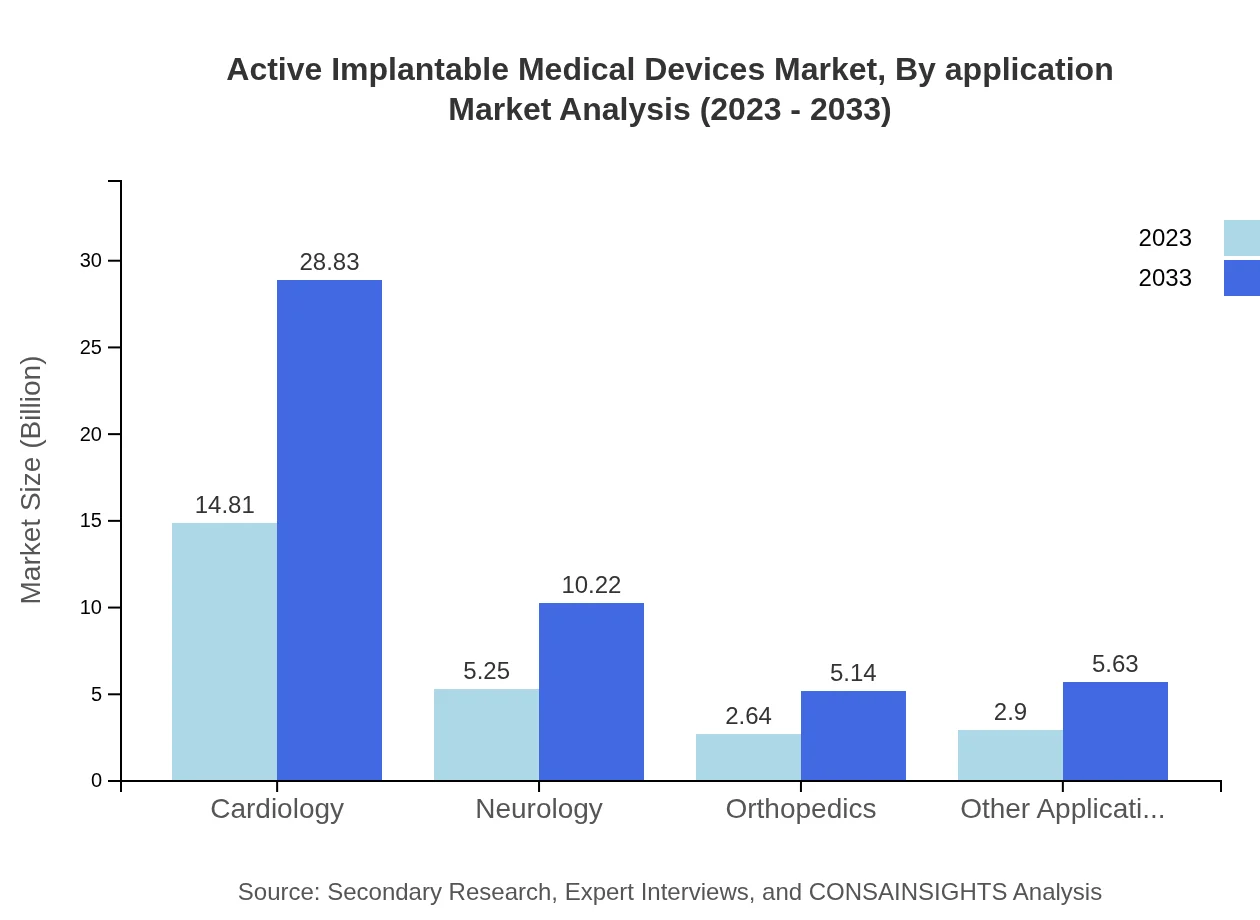

Active Implantable Medical Devices Market Analysis By Application

The cardiovascular application segment dominates the market, accounting for a significant share due to therapeutic and preventive roles of devices like pacemakers and defibrillators. Neurology and orthopedics are emerging segments, with increasing adoption of implantable neurostimulators and orthopedic devices.

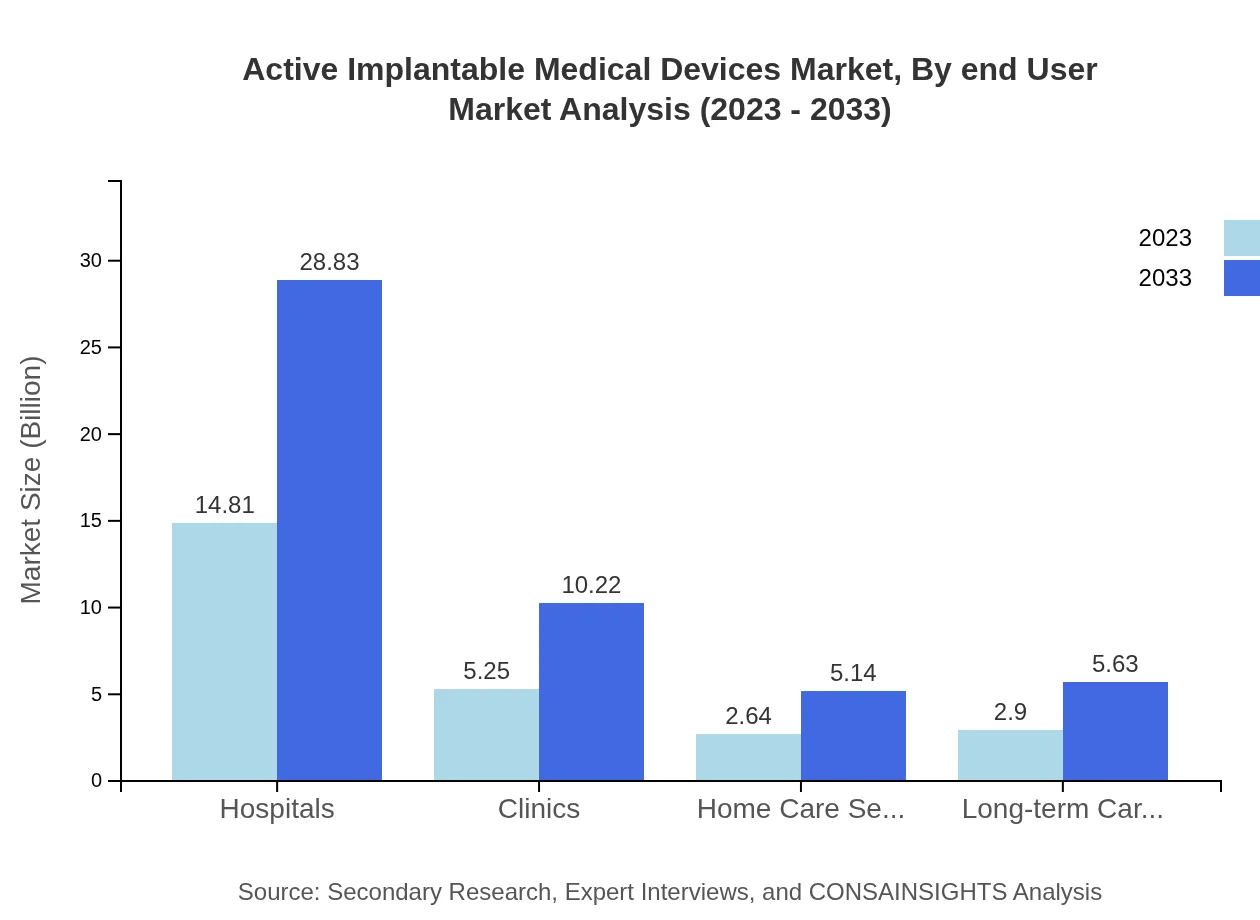

Active Implantable Medical Devices Market Analysis By End User

Hospitals play a major role in the deployment of these devices, holding a market share of 57.86% in 2023. Other significant end-user segments include clinics, home care settings, and long-term care facilities, reflecting the diverse settings where these devices are utilized.

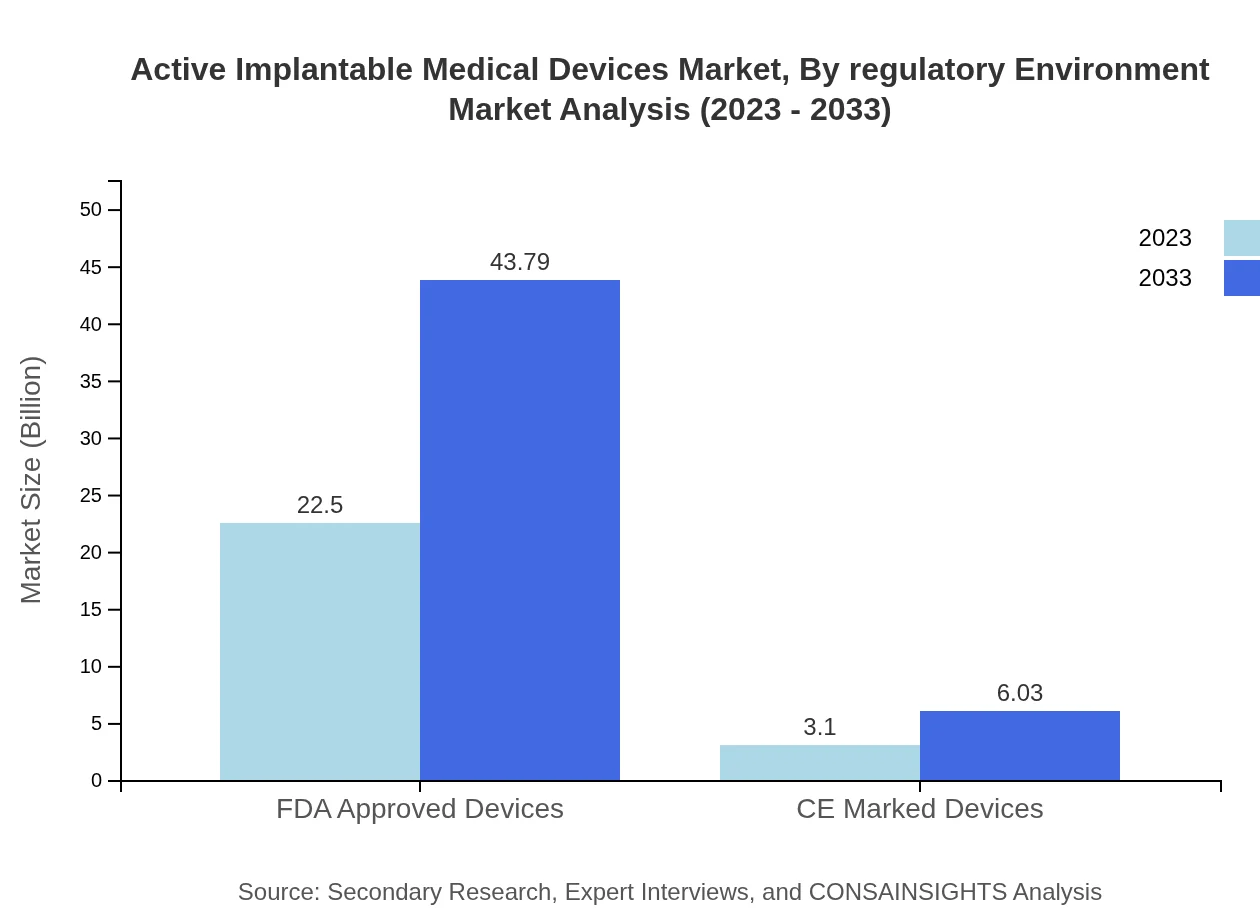

Active Implantable Medical Devices Market Analysis By Regulatory Environment

The market is influenced significantly by regulatory approvals, notably FDA approvals in the U.S. and CE marking in Europe. These regulatory frameworks ensure that products meet safety and efficacy standards, impacting market entry and availability.

Active Implantable Medical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Implantable Medical Devices Industry

Medtronic :

Medtronic is a global leader in medical technology, specifically medicines, and devices related to pacemakers and defibrillators.Abbott Laboratories:

Abbott specializes in a diverse array of medical devices with a focus on cardiovascular and neurostimulation technologies.Boston Scientific:

Boston Scientific develops innovative medical solutions that advance patient care, particularly in cardiovascular and implantable devices.Cardinal Health:

Cardinal Health provides essential supply chain services to the healthcare sector, enhancing distribution for active implantable devices.Biotronik:

Biotronik is known for its pioneering cardiac rhythm management and vascular interventions technology.We're grateful to work with incredible clients.

FAQs

What is the market size of active Implantable Medical Devices?

The active implantable medical devices market is projected to reach approximately $25.6 billion by 2033, growing at a CAGR of 6.7% from its current valuation. This substantial growth indicates a rising demand for innovative medical solutions.

What are the key market players or companies in this active Implantable Medical Devices industry?

Key players in the active implantable medical devices market include major companies like Medtronic, Boston Scientific, Abbott Laboratories, St. Jude Medical, and other prominent medical device manufacturers recognized for their technological advancements and robust portfolios.

What are the primary factors driving the growth in the active Implantable Medical Devices industry?

The primary factors fueling growth in the active implantable medical devices industry include an aging global population, advancements in medical technology, increased prevalence of chronic diseases, and rising healthcare expenditures, driving demand for innovative medical solutions.

Which region is the fastest Growing in the active Implantable Medical Devices?

The fastest-growing region in the active implantable medical devices market is North America, expected to grow from $9.96 billion in 2023 to $19.39 billion by 2033, reflecting advancements in healthcare technology and significant investments in R&D.

Does ConsaInsights provide customized market report data for the active Implantable Medical Devices industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the active implantable medical devices industry, providing clients with detailed insights and analysis to support strategic decision-making.

What deliverables can I expect from this active Implantable Medical Devices market research project?

From the market research project on active implantable medical devices, you can expect comprehensive reports detailing market size, trends, growth forecasts, competitive analysis, and segmented market insights for various applications and regions.

What are the market trends of active Implantable Medical Devices?

Current trends in the active implantable medical devices market include increasing adoption of advanced telemetry systems, the integration of smart technologies, and a focus on patient-centric healthcare solutions, indicative of ongoing innovation in this sector.