Active Ingredients Market Report

Published Date: 01 February 2026 | Report Code: active-ingredients

Active Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Active Ingredients market from 2023 to 2033, covering market trends, size, segment analysis, regional insights, and forecasts. It aims to offer valuable data and insights for stakeholders navigating this evolving industry.

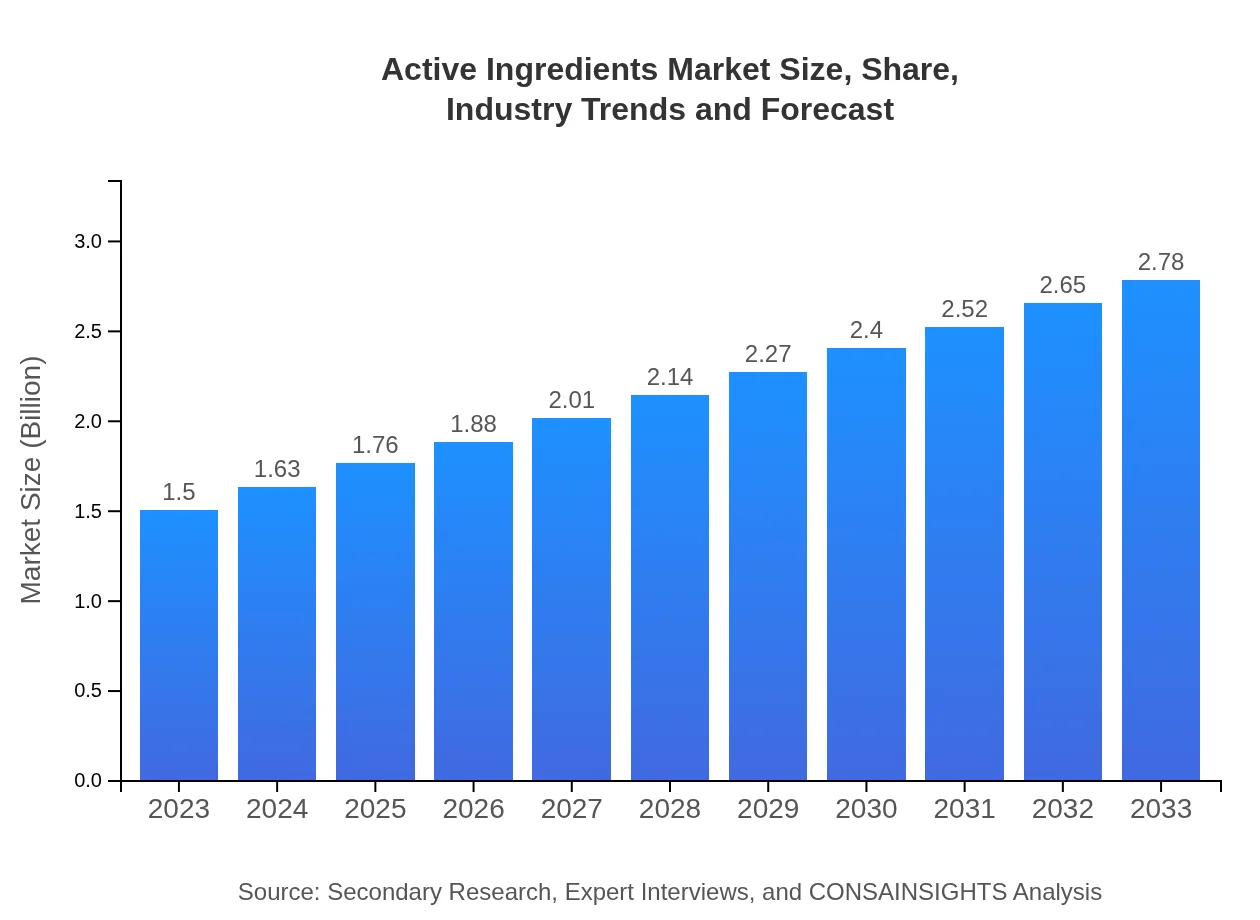

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | BASF SE, Dow Inc., Evonik Industries AG, Syngenta AG, Givaudan SA |

| Last Modified Date | 01 February 2026 |

Active Ingredients Market Overview

Customize Active Ingredients Market Report market research report

- ✔ Get in-depth analysis of Active Ingredients market size, growth, and forecasts.

- ✔ Understand Active Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Ingredients

What is the Market Size & CAGR of Active Ingredients market in 2023?

Active Ingredients Industry Analysis

Active Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Ingredients Market Analysis Report by Region

Europe Active Ingredients Market Report:

Europe's market is expected to grow from $0.43 billion in 2023 to $0.79 billion in 2033, propelled by stringent regulations favoring sustainability and the growing demand for clean label products in the cosmetics and pharmaceutical sectors.Asia Pacific Active Ingredients Market Report:

In the Asia-Pacific region, the Active Ingredients market size was approximately $0.33 billion in 2023 and is projected to reach $0.61 billion by 2033. This growth can be attributed to increasing industrialization, rising health consciousness, and expanding pharmaceutical sectors in nations like China and India.North America Active Ingredients Market Report:

North America, holding a market size of $0.52 billion in 2023, is anticipated to grow to $0.96 billion by 2033. The region's focus on research and development, along with strong regulatory frameworks, supports innovation in active ingredients, particularly in healthcare applications.South America Active Ingredients Market Report:

South America represented a market size of $0.14 billion in 2023, with expectations of growth to $0.27 billion by 2033. The region is seeing increased investments in agriculture and cosmetics, largely driven by the demand for high-quality and organic products.Middle East & Africa Active Ingredients Market Report:

The Middle East and Africa region's active ingredients market is projected to grow from $0.08 billion in 2023 to $0.15 billion by 2033. The increasing focus on agriculture and health in many African nations presents new opportunities for market penetration and product development.Tell us your focus area and get a customized research report.

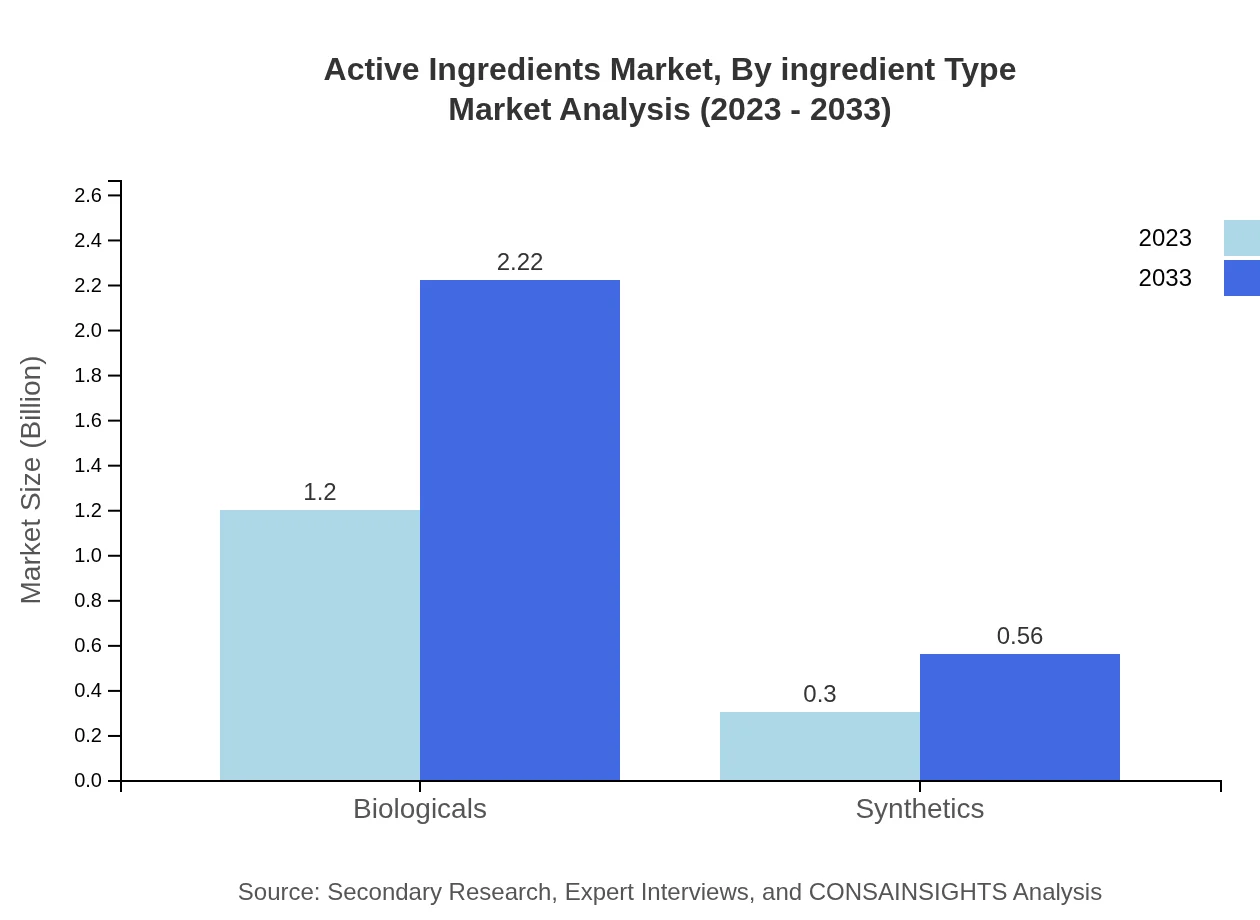

Active Ingredients Market Analysis By Ingredient Type

The leading segment of the Active Ingredients market is Biologicals, anticipated to grow from $1.20 billion in 2023 to $2.22 billion by 2033, accounting for over 80% of the market share. Synthetics hold a minor position, expected to reach $0.56 billion by 2033. This trend highlights the growing preference for biological ingredients due to their efficacy and safety.

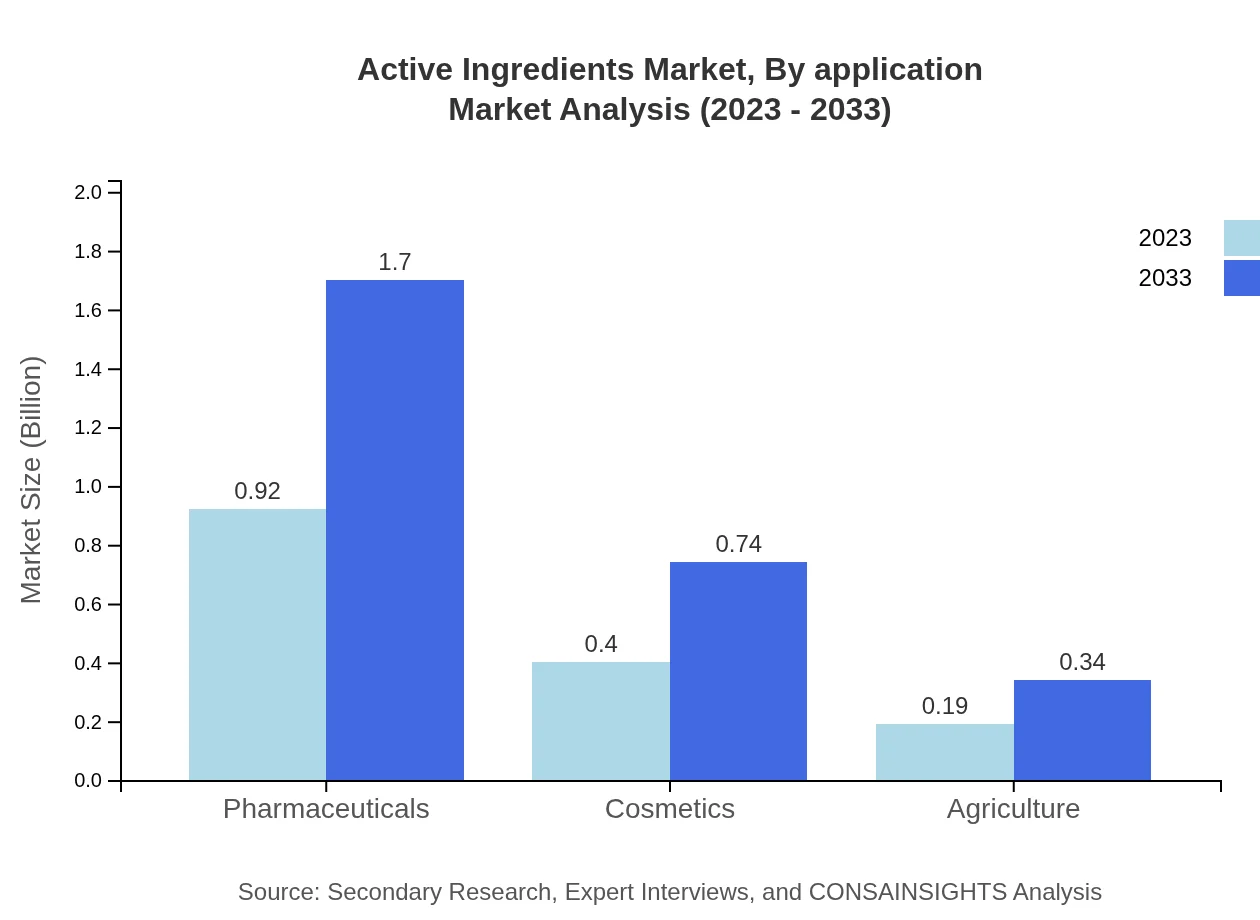

Active Ingredients Market Analysis By Application

Pharmaceuticals dominate the Active Ingredients market with a size of $0.92 billion in 2023 and projected growth to $1.70 billion by 2033. Cosmetics follow, expected to increase from $0.40 billion to $0.74 billion. This reflects a wider trend toward personal health and appearance management among consumers.

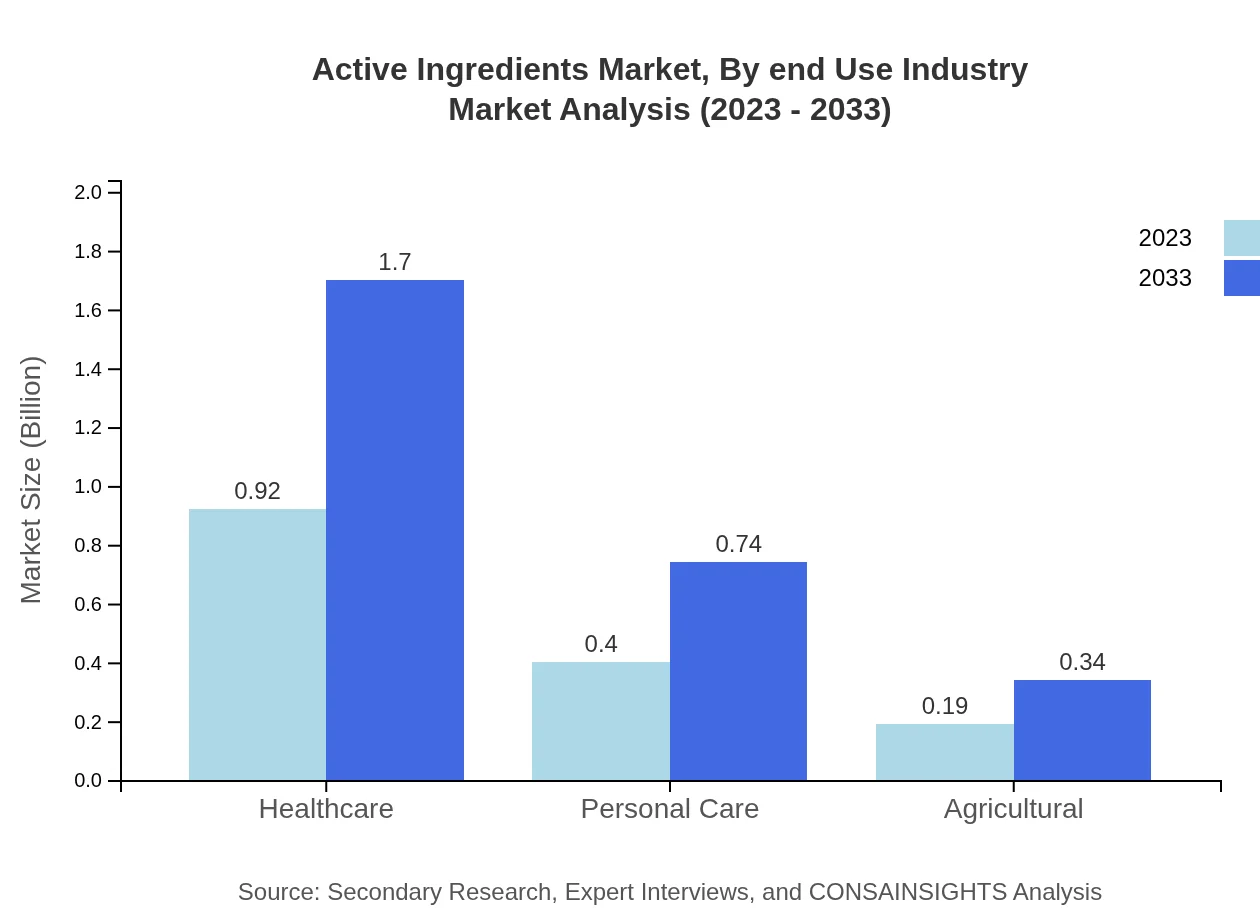

Active Ingredients Market Analysis By End Use Industry

In the end-use segment, healthcare takes the lead, poised to retain a 61% market share as it grows alongside the expanding pharmaceutical industry, particularly in terms of active ingredient utilization for drugs and therapies aimed at boosting health outcomes.

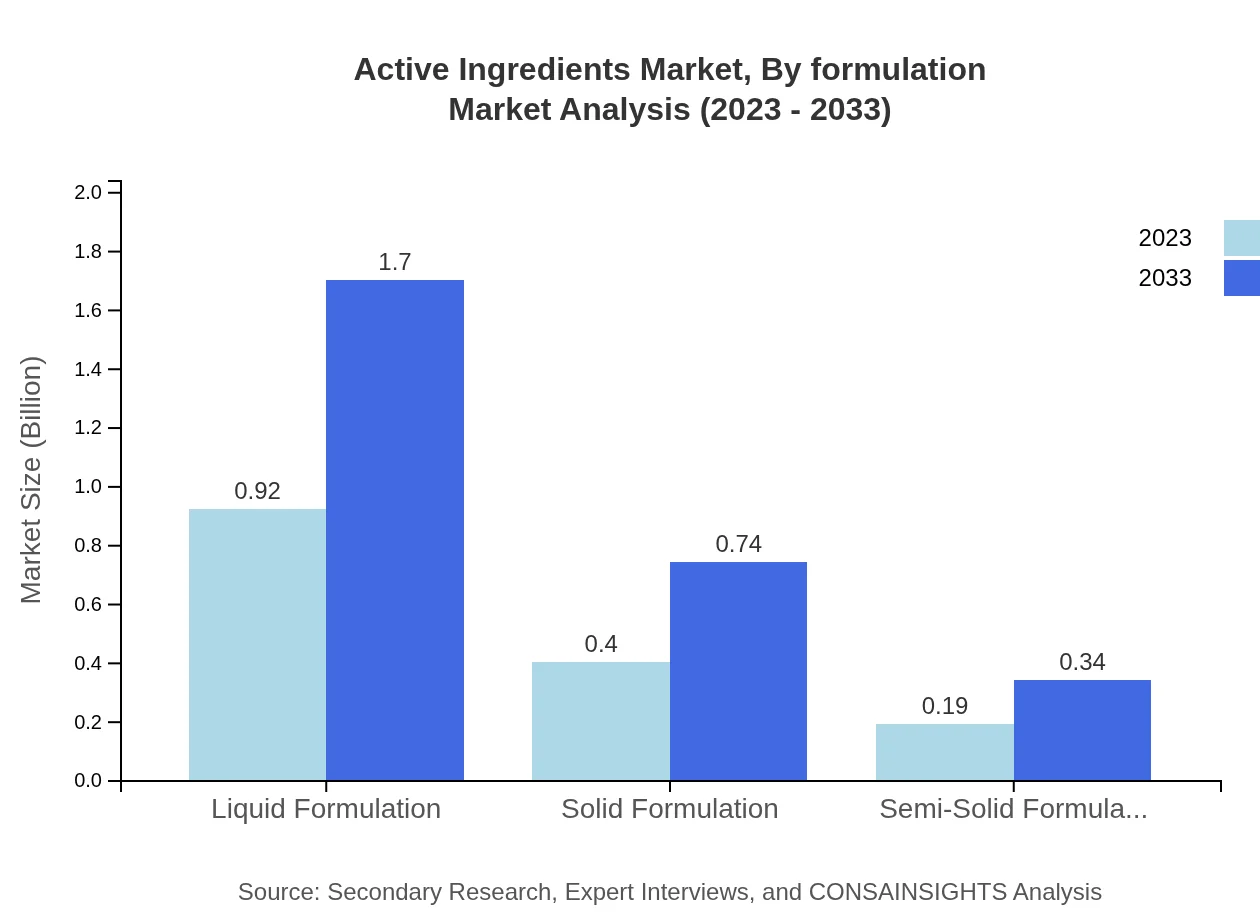

Active Ingredients Market Analysis By Formulation

Liquid formulations are significant, expected to grow from $0.92 billion in 2023 to $1.70 billion. Solid formulations follow closely, given their widespread use in both pharmaceuticals and cosmetics, reflecting consumer demands for effective and easily applicable products.

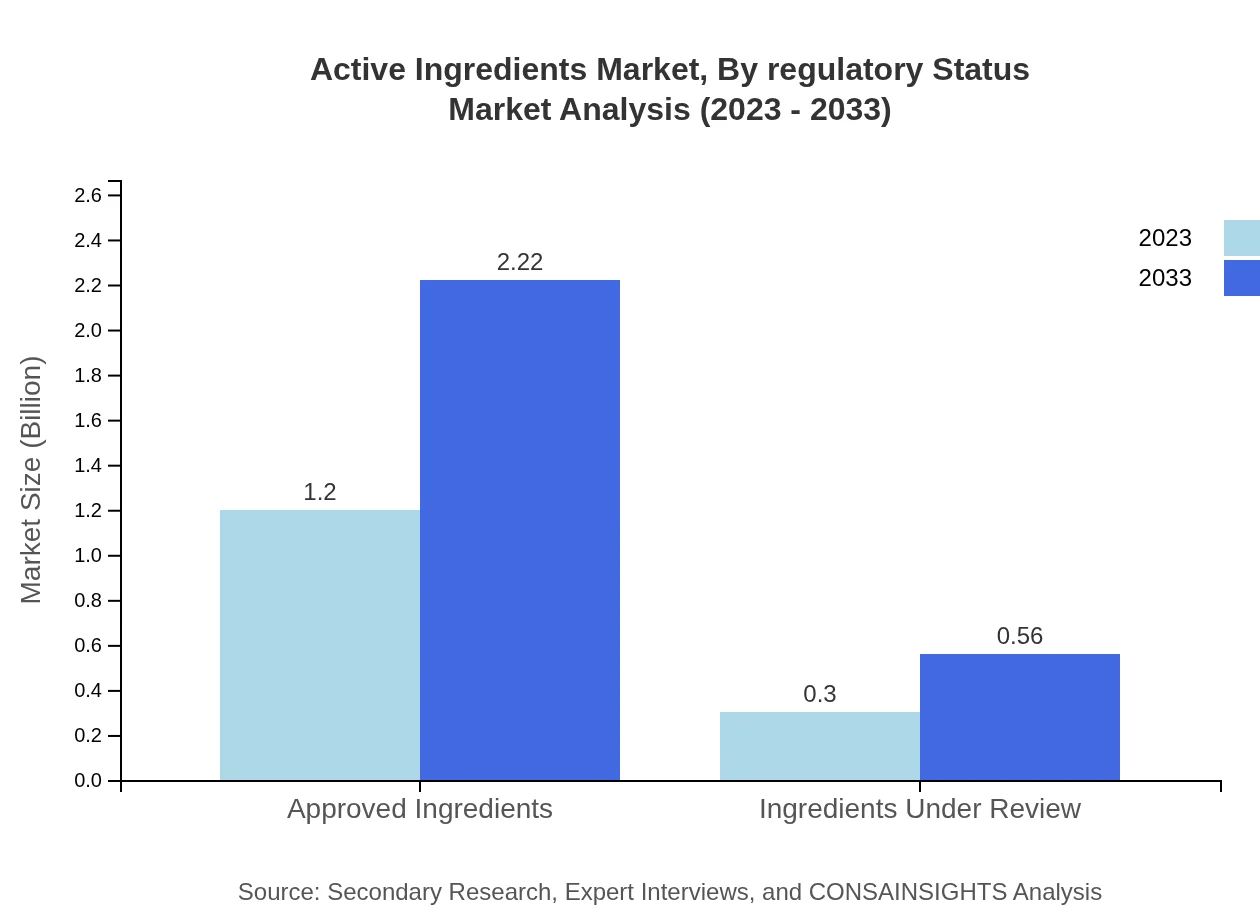

Active Ingredients Market Analysis By Regulatory Status

Approved Ingredients dominate, comprising 80% of the market, with expected growth from $1.20 billion to $2.22 billion. Ingredients Under Review present future opportunities as companies seek certification and market entry, growing from $0.30 billion to $0.56 billion.

Active Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Ingredients Industry

BASF SE:

BASF SE is a leading chemical company focusing on sustainable agricultural solutions, actively participating in the development of innovative active ingredients for various applications in the agriculture and cosmetic sectors.Dow Inc.:

Dow Inc. is a prominent player in the materials science sector with a diverse portfolio that includes advanced active ingredient solutions focusing on sustainability and environmental impact.Evonik Industries AG:

Evonik Industries specializes in specialty chemicals and is a key contributor to developing innovative active substances and formulations for pharmaceuticals and personal care.Syngenta AG:

Syngenta is a global leader in agriculture, focusing on developing crop protection products and active ingredients that improve yield and productivity for farmers globally.Givaudan SA:

Givaudan is a world leader in flavor and fragrance production, significantly involved in developing innovative active ingredients that enhance cosmetic formulations.We're grateful to work with incredible clients.

FAQs

What is the market size of active Ingredients?

The active ingredients market is valued at $1.5 billion in 2023, with a projected CAGR of 6.2%. By 2033, the market is expected to expand significantly, reflecting the increasing demand for effective formulations across sectors.

What are the key market players or companies in this active Ingredients industry?

Key players in the active ingredients market include global pharmaceutical companies and local manufacturers. They drive innovation, regulatory compliance, and sustainability, establishing strong supply chains to meet the rising demand for active ingredients.

What are the primary factors driving the growth in the active ingredients industry?

Key growth drivers include increased demand for pharmaceuticals and personal care products, regulatory advancements, and growing awareness of health and wellness. The rising trend in organic and natural products also fuels market expansion.

Which region is the fastest Growing in the active ingredients market?

The Asia Pacific region is the fastest-growing market, with a significant increase expected from $0.33 billion in 2023 to $0.61 billion by 2033. This growth is attributed to expanding manufacturing capabilities and rising consumer demand.

Does ConsaInsights provide customized market report data for the active ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the active ingredients industry. Whether for niche segments or geographical focus, personalized reports can provide detailed insights.

What deliverables can I expect from this active ingredients market research project?

Deliverables include comprehensive reports featuring market analysis, regional insights, trends, forecasts, and competitive landscape assessments. Additional data on segments will be provided for a nuanced market understanding.

What are the market trends of active ingredients?

Current trends involve a shift towards biological and sustainable ingredients, increased investment in research and development, and a focus on personalization in formulations. Adoption of new technologies also drives innovation in product development.