Active Intelligent Packaging In Pharmaceutical Market Report

Published Date: 01 February 2026 | Report Code: active-intelligent-packaging-in-pharmaceutical

Active Intelligent Packaging In Pharmaceutical Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Active Intelligent Packaging in Pharmaceutical market, including market trends, growth forecasts, regional insights, and detailed assessments by segments between 2023 and 2033.

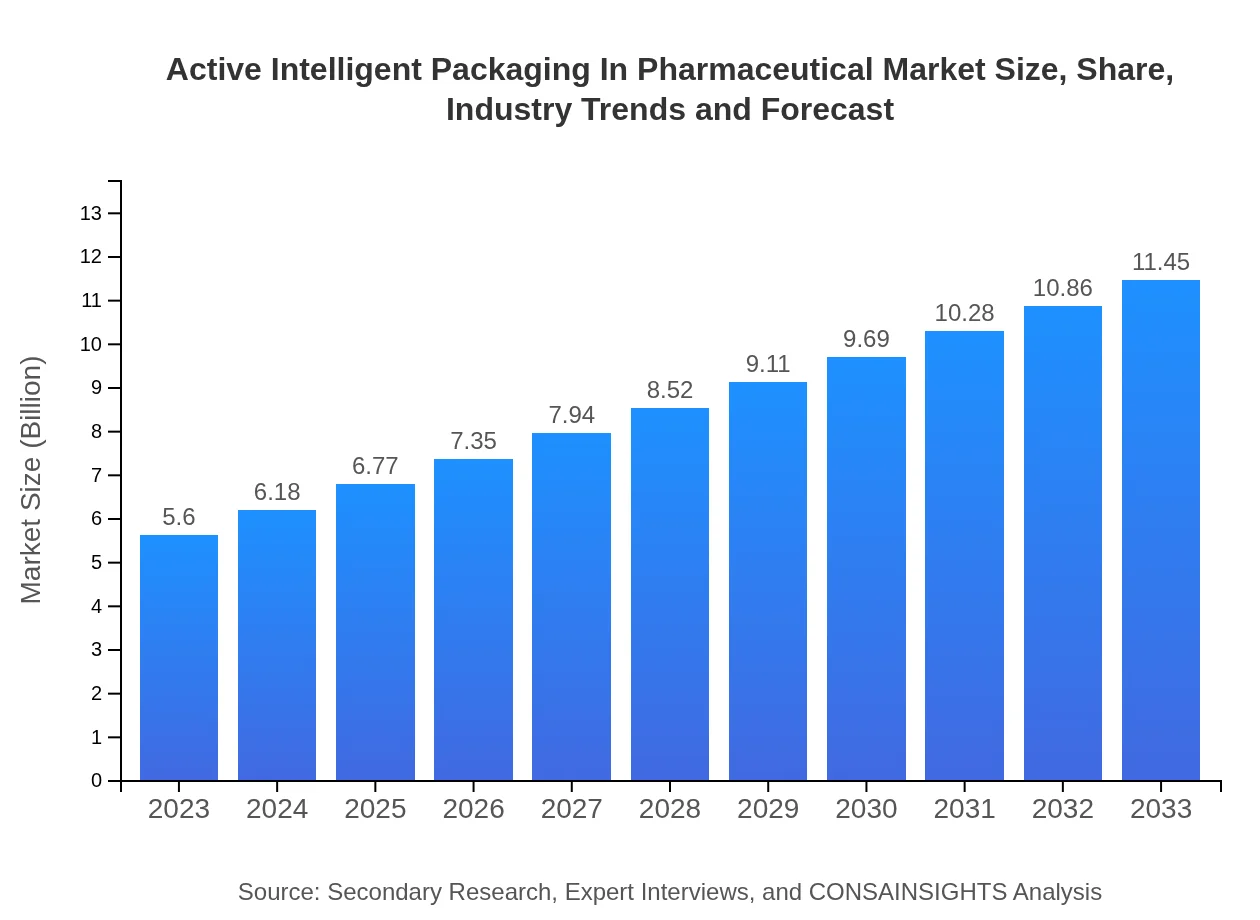

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Amcor plc, Avery Dennison Corporation, Mondi Group, Schott AG |

| Last Modified Date | 01 February 2026 |

Active Intelligent Packaging In Pharmaceutical Market Overview

Customize Active Intelligent Packaging In Pharmaceutical Market Report market research report

- ✔ Get in-depth analysis of Active Intelligent Packaging In Pharmaceutical market size, growth, and forecasts.

- ✔ Understand Active Intelligent Packaging In Pharmaceutical's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Intelligent Packaging In Pharmaceutical

What is the Market Size & CAGR of Active Intelligent Packaging In Pharmaceutical market in 2023?

Active Intelligent Packaging In Pharmaceutical Industry Analysis

Active Intelligent Packaging In Pharmaceutical Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Intelligent Packaging In Pharmaceutical Market Analysis Report by Region

Europe Active Intelligent Packaging In Pharmaceutical Market Report:

Europe is another key market, expected to grow from $1.48 billion in 2023 to $3.03 billion by 2033. The stringent European Union regulations regarding pharmaceutical packaging and a growing focus on patient safety are critical factors driving this market.Asia Pacific Active Intelligent Packaging In Pharmaceutical Market Report:

The Asia Pacific region is witnessing a significant surge in the Active Intelligent Packaging market, with an expected growth from $1.19 billion in 2023 to approximately $2.44 billion by 2033. This growth is fueled by increasing pharmaceutical manufacturing activities, rising health awareness, and expanding healthcare infrastructure across countries like China and India.North America Active Intelligent Packaging In Pharmaceutical Market Report:

North America holds a significant share of the market, valued at $1.81 billion in 2023, projected to expand to $3.69 billion by 2033. The region's robust pharmaceutical industry, stringent regulatory requirements, and emphasis on drug safety are primary factors behind this growth.South America Active Intelligent Packaging In Pharmaceutical Market Report:

In South America, the market size is projected to grow from $0.42 billion in 2023 to around $0.85 billion by 2033. This growth is driven by a rise in healthcare access and a gradual shift towards advanced packaging solutions, particularly in Brazil and Argentina.Middle East & Africa Active Intelligent Packaging In Pharmaceutical Market Report:

The Middle East and Africa region is projected to see growth from $0.71 billion in 2023 to around $1.44 billion by 2033. The increase of pharmaceutical production and investments in healthcare infrastructure are pivotal in driving demand for intelligent packaging solutions in this region.Tell us your focus area and get a customized research report.

Active Intelligent Packaging In Pharmaceutical Market Analysis By Product Type

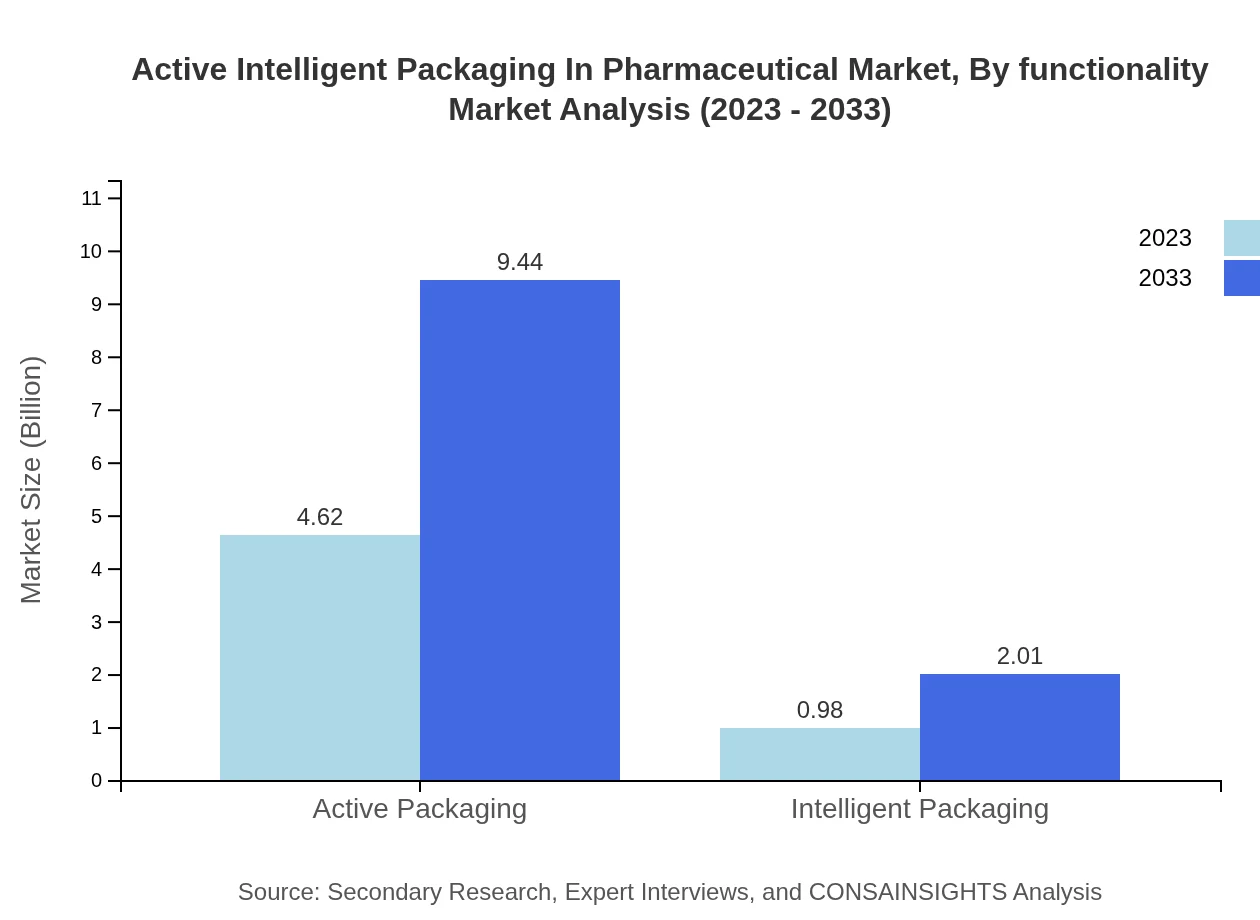

The Active Intelligent Packaging Market segmented by product type is driven predominantly by active packaging solutions, which accounted for approximately 82.44% of the total market in 2023, valued at $4.62 billion. Intelligent packaging, worth $0.98 billion, represents the remaining market share. By 2033, both segments are expected to see significant growth, with active packaging reaching $9.44 billion and intelligent packaging growing to $2.01 billion.

Active Intelligent Packaging In Pharmaceutical Market Analysis By Functionality

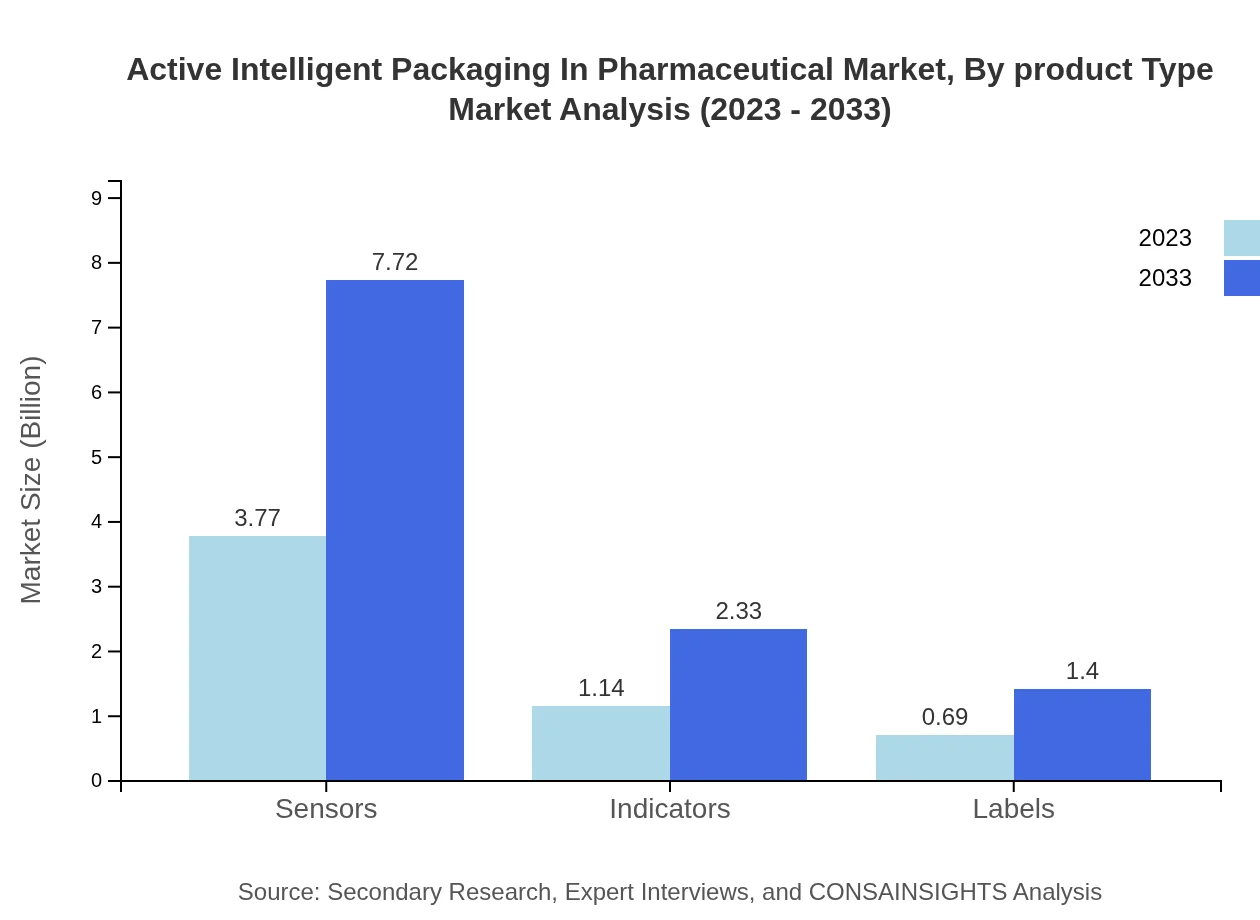

Functionality-wise, sensors and indicators are pivotal, encompassing 67.4% market share in 2023, valued at $3.77 billion. These functionalities are essential for monitoring environmental conditions and ensuring product safety throughout the supply chain. As the market evolves, the demand for multifunctional packaging solutions is expected to grow significantly.

Active Intelligent Packaging In Pharmaceutical Market Analysis By Application

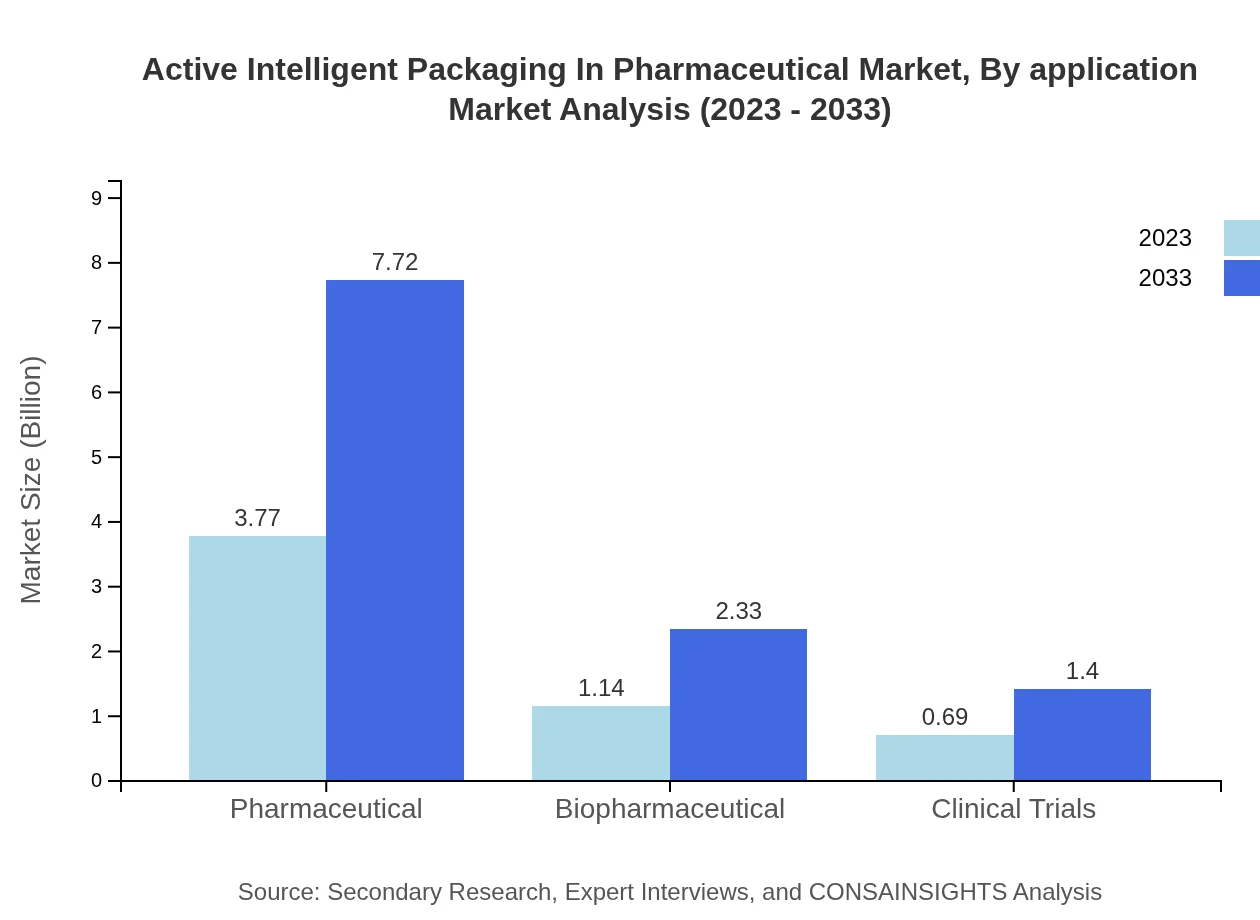

The applications of active intelligent packaging span pharmaceuticals, biopharmaceuticals, and clinical trials. Pharmaceutical applications dominate the market, accounting for approximately 67.4% share in 2023. The increasing complexities in drug delivery methods and rising regulatory requirements are expected to bolster demand across all application segments, reaching $7.72 billion by 2033.

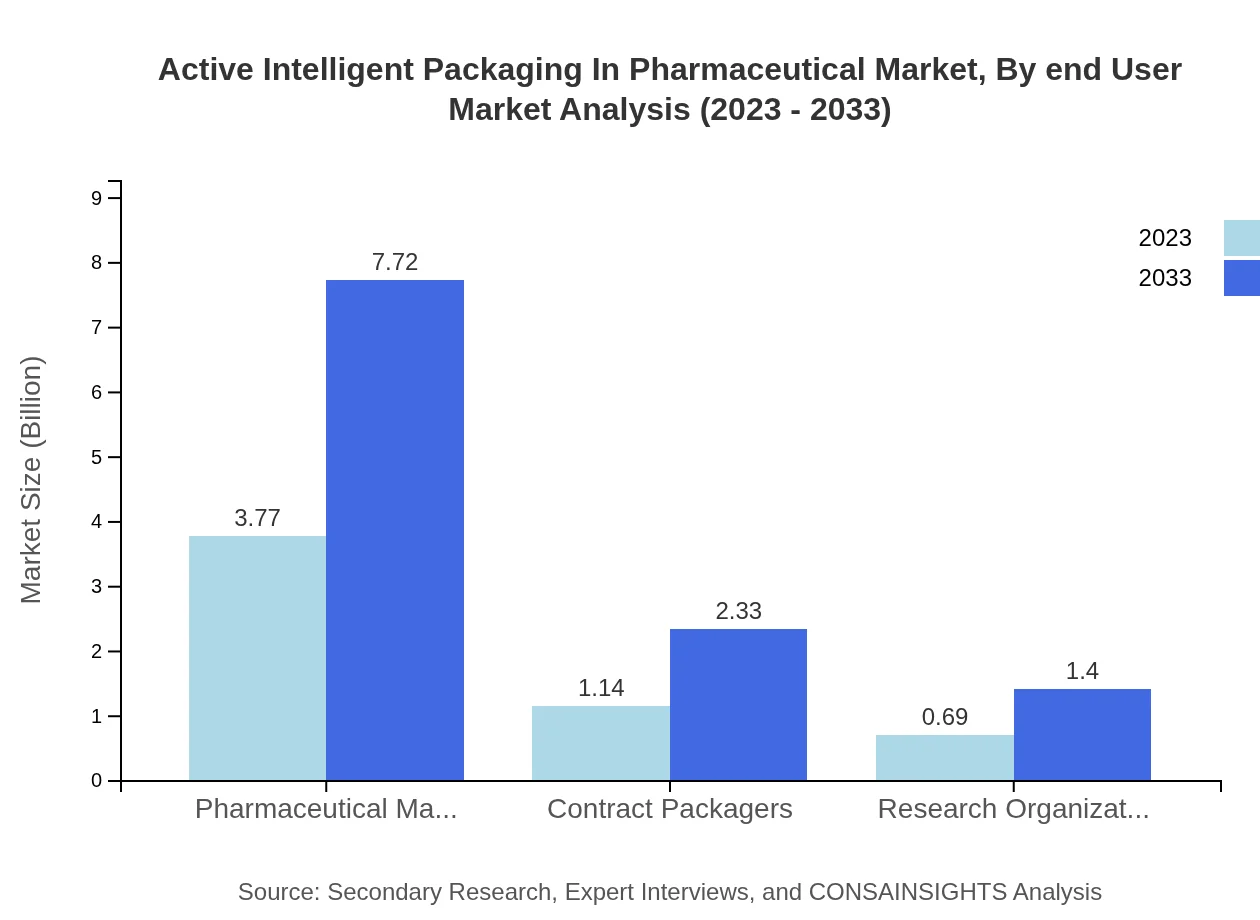

Active Intelligent Packaging In Pharmaceutical Market Analysis By End User

End-user analysis reveals pharmaceutical manufacturers as the leading segment, holding a significant market share of 67.4% in 2023. The demand for active intelligent packaging from contract packagers and research organizations is also noteworthy, with expected growth due to the ongoing trends towards collaboration within the pharmaceutical industry.

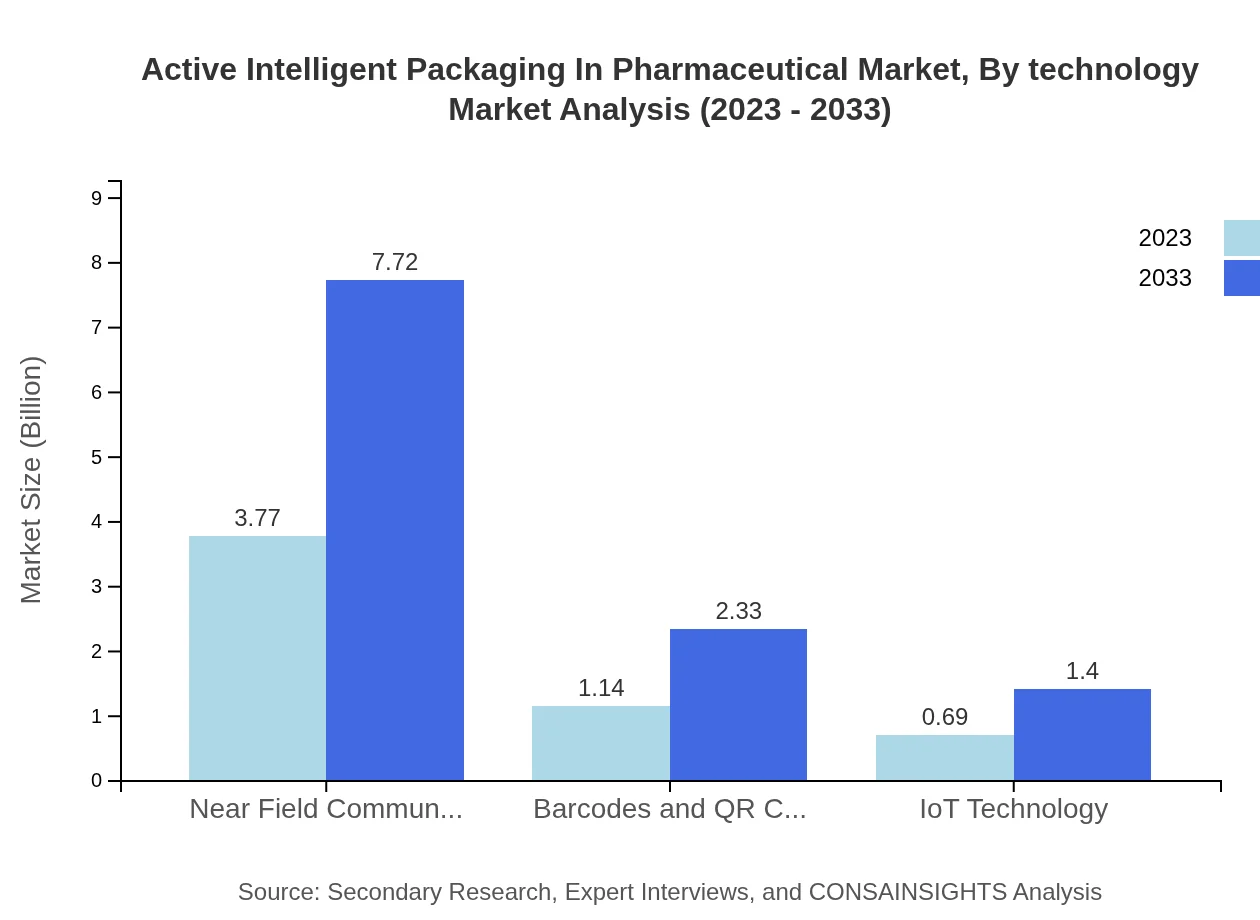

Active Intelligent Packaging In Pharmaceutical Market Analysis By Technology

From a technology perspective, Near Field Communication (NFC) leads the market, constituting around 67.4% of the share. The growth of IoT technology is also noteworthy, expected to increase its contribution from $0.69 billion in 2023 to $1.40 billion by 2033, driven by advancements in smart packaging and connectivity solutions.

Active Intelligent Packaging In Pharmaceutical Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Intelligent Packaging In Pharmaceutical Industry

Amcor plc:

Amcor is a global leader in packaging solutions, known for its innovative active and intelligent packaging technologies that meet the needs of the pharmaceutical industry.Avery Dennison Corporation:

Avery Dennison specializes in labeling and packaging materials and is making strides in active intelligent packaging through innovative solutions designed for temperature-sensitive pharmaceutical products.Mondi Group:

Mondi is recognized for its sustainable packaging solutions, offering a range of active packaging options that enhance product lifespan and safety in pharmaceuticals.Schott AG:

Schott AG develops and produces innovative packaging systems including active intelligent packaging, catering specifically to the pharmaceutical sector to ensure product integrity.We're grateful to work with incredible clients.

FAQs

What is the market size of active Intelligent Packaging In Pharmaceutical?

The active intelligent packaging in the pharmaceutical market is valued at approximately $5.6 billion in 2023. It is projected to grow at a CAGR of 7.2%, reaching significant expansion by 2033, showcasing its increasing adoption across the industry.

What are the key market players or companies in this active Intelligent Packaging In Pharmaceutical industry?

Key players in the active intelligent packaging market include major pharmaceutical manufacturers, contract packaging companies, and innovative technology firms. Their alliances and advancements in packaging solutions drive the evolution of packaging technologies in the pharmaceutical space.

What are the primary factors driving the growth in the active Intelligent Packaging In Pharmaceutical industry?

The growth in the active intelligent packaging market is primarily fueled by rising demand for drug safety, improved supply chain transparency, and increased technological innovations such as sensors and IoT integration, enhancing patient compliance and monitoring.

Which region is the fastest Growing in the active Intelligent Packaging In Pharmaceutical?

Asia Pacific is the fastest-growing region, with the market size expected to increase from $1.19 billion in 2023 to $2.44 billion by 2033. North America and Europe also show significant growth potential as demand rises for advanced packaging solutions.

Does ConsaInsights provide customized market report data for the active Intelligent Packaging In Pharmaceutical industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the active intelligent packaging sector. Businesses can request detailed analyses suited to their strategic planning and operational needs.

What deliverables can I expect from this active Intelligent Packaging In Pharmaceutical market research project?

Deliverables include comprehensive reports, market forecasts, segment analyses, and insights on competitive landscapes. Clients will receive strategic recommendations to leverage insights for enhancing operational efficiency and market positioning.

What are the market trends of active Intelligent Packaging In Pharmaceutical?

Current trends in active intelligent packaging include increased utilization of NFC technology, advancements in smart labels, and the integration of IoT. These innovations aim to enhance patient engagement and streamline manufacturing processes.