Active Protection Systems Market Report

Published Date: 03 February 2026 | Report Code: active-protection-systems

Active Protection Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Active Protection Systems (APS) market from 2023 to 2033. It covers market size, growth trends, regional insights, technology advancements, and key players in the industry, equipping stakeholders with valuable data for decision-making.

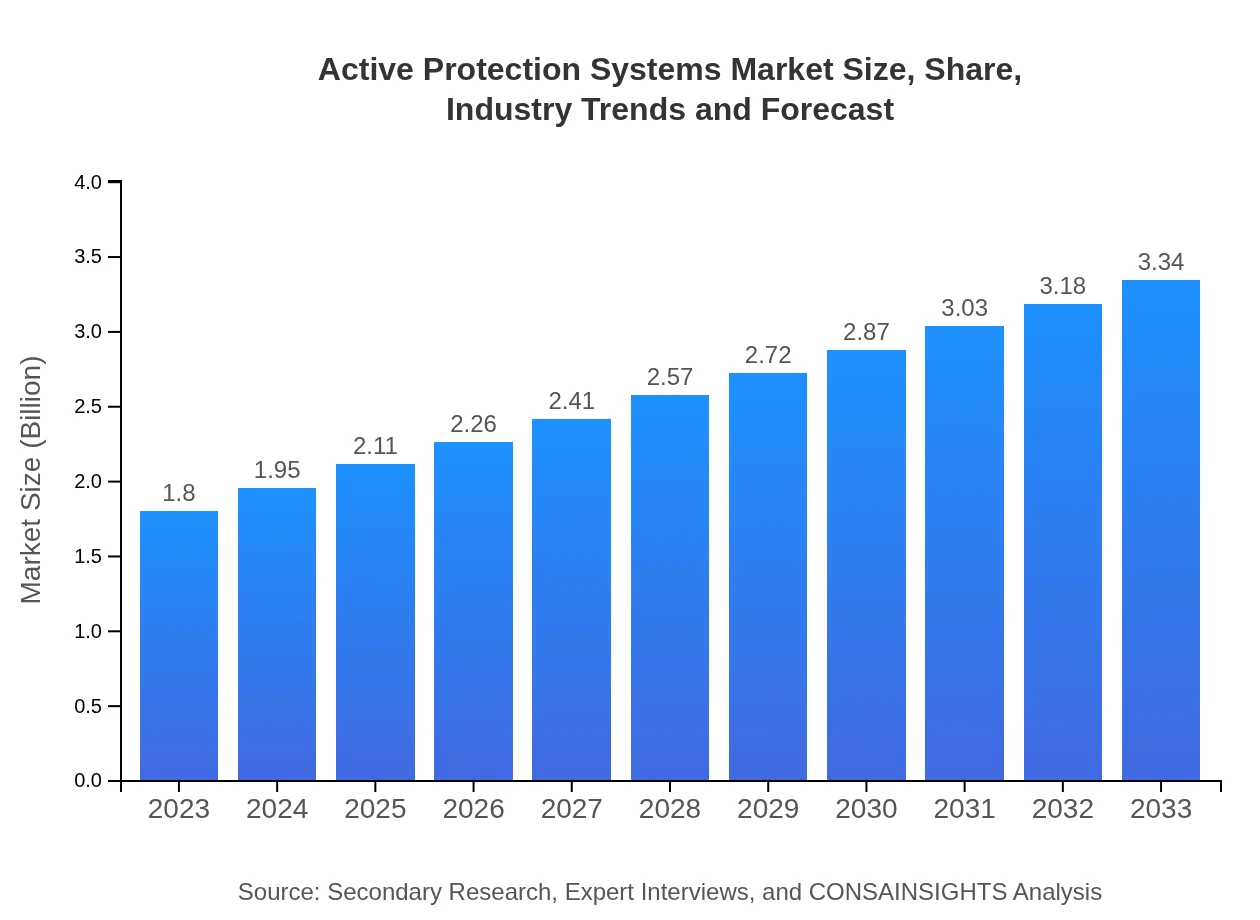

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Raytheon Technologies, Northrop Grumman, Thales Group, Leonardo S.p.A. |

| Last Modified Date | 03 February 2026 |

Active Protection Systems Market Overview

Customize Active Protection Systems Market Report market research report

- ✔ Get in-depth analysis of Active Protection Systems market size, growth, and forecasts.

- ✔ Understand Active Protection Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Protection Systems

What is the Market Size & CAGR of Active Protection Systems market in 2023?

Active Protection Systems Industry Analysis

Active Protection Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Protection Systems Market Analysis Report by Region

Europe Active Protection Systems Market Report:

The European APS market is anticipated to grow from $0.45 billion in 2023 to $0.83 billion by 2033. This growth is spurred by regional security threats and collaborative defense initiatives among EU nations. Advanced technology adoption in military uses and ongoing participation in international military operations further enhance market dynamics in Europe.Asia Pacific Active Protection Systems Market Report:

In 2023, the Asia Pacific Active Protection Systems market is valued at $0.38 billion and expected to grow to $0.70 billion by 2033. Rapid military modernization in countries like China and India drives this growth, along with increasing defense budgets and cross-border security concerns. The demand for APS solutions is further propelled by high population density, making urban areas more vulnerable to various threats.North America Active Protection Systems Market Report:

North America represents a pivotal region for the Active Protection Systems market, with a projected valuation of $0.63 billion in 2023 growing to $1.17 billion by 2033. The United States government’s commitment to advanced defense technologies and significant investments in military applications are key drivers in this region. The presence of leading defense contractors further reinforces market strength.South America Active Protection Systems Market Report:

The South American market for Active Protection Systems is valued at $0.12 billion in 2023 and is projected to grow to $0.23 billion by 2033. Though in a nascent stage compared to other regions, the increasing awareness of national security and the necessity to enhance defense capabilities in countries like Brazil and Argentina contribute to market growth.Middle East & Africa Active Protection Systems Market Report:

The Middle East and Africa market for Active Protection Systems is expected to increase from $0.22 billion in 2023 to $0.41 billion by 2033. The heightened security concerns due to regional instability, along with extensive military investments, propel growth in this region. Countries in the Middle East, particularly, are keen on acquiring sophisticated defense systems.Tell us your focus area and get a customized research report.

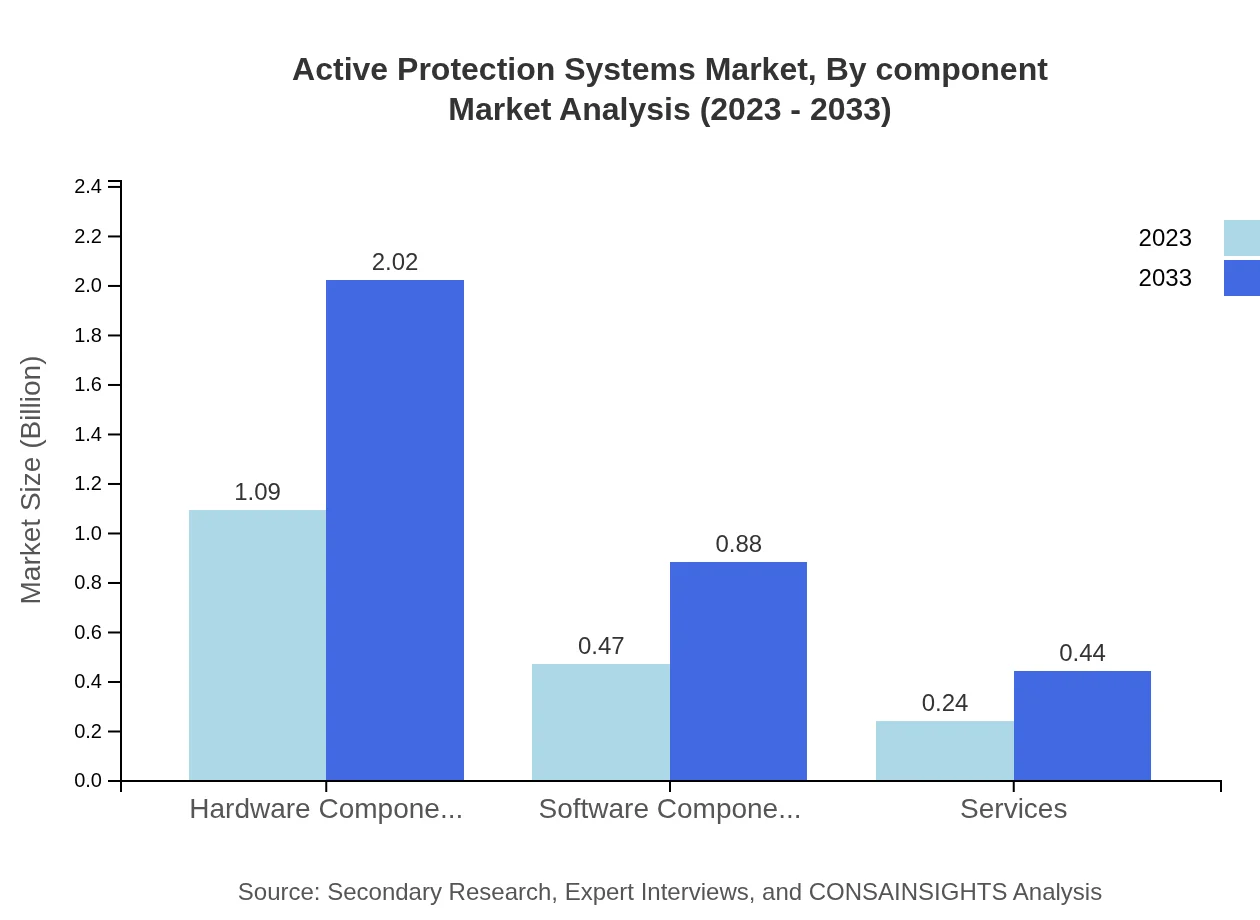

Active Protection Systems Market Analysis By Component

The Active Protection Systems market, segmented by components, comprises hardware and software systems, with hardware dominating the sector. In 2023, hardware components represent a market size of $1.09 billion, skyrocketing to $2.02 billion by 2033. Sensor technologies follow suit, valued at $1.55 billion in 2023, expected to elevate to $2.87 billion by the end of 2033.

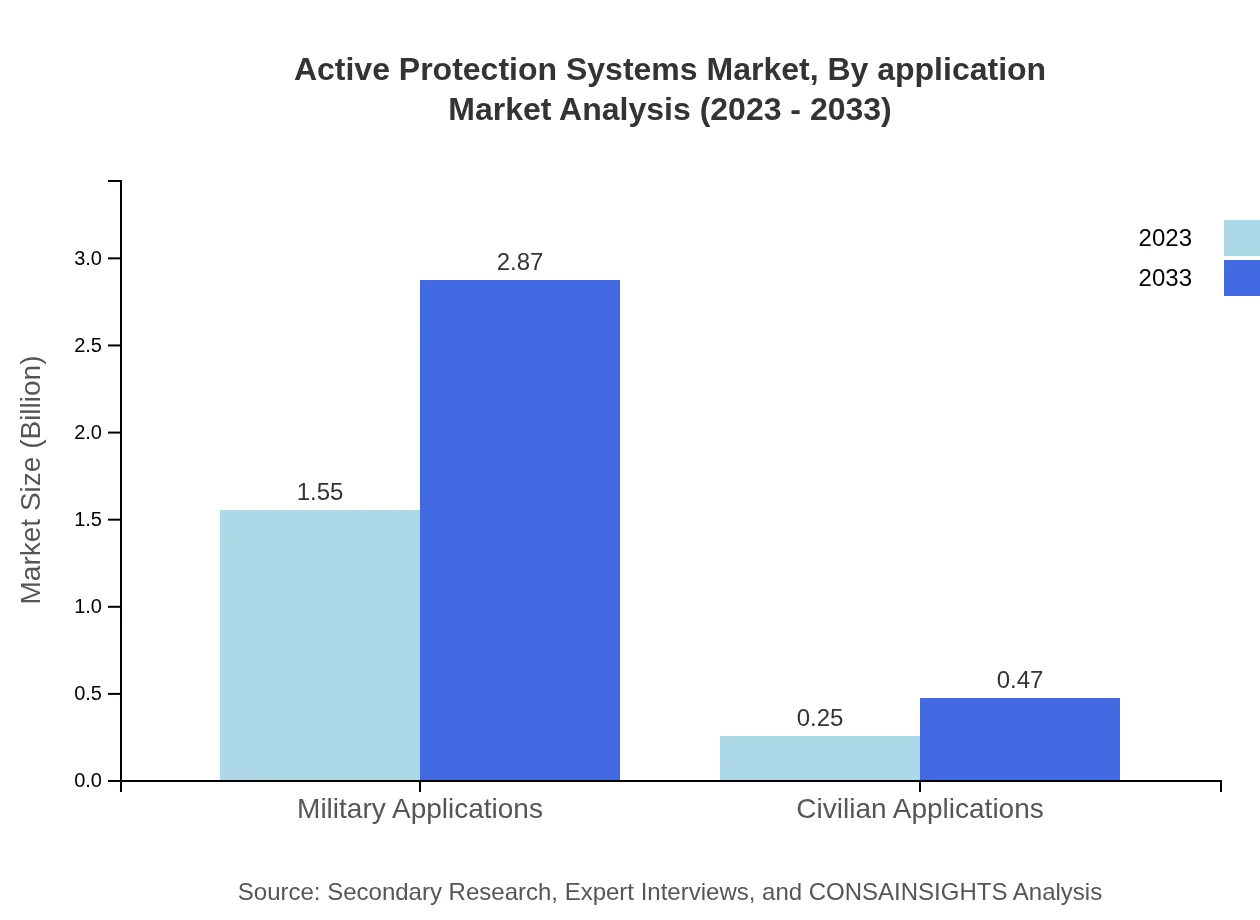

Active Protection Systems Market Analysis By Application

Market segmentation by application reflects a strong dual focus on military and civilian segments. Military applications, with a size of $1.55 billion in 2023, are projected to grow substantially to $2.87 billion by 2033. In parallel, civilian applications are gradually expanding, anticipated to grow from $0.25 billion to $0.47 billion during the same period.

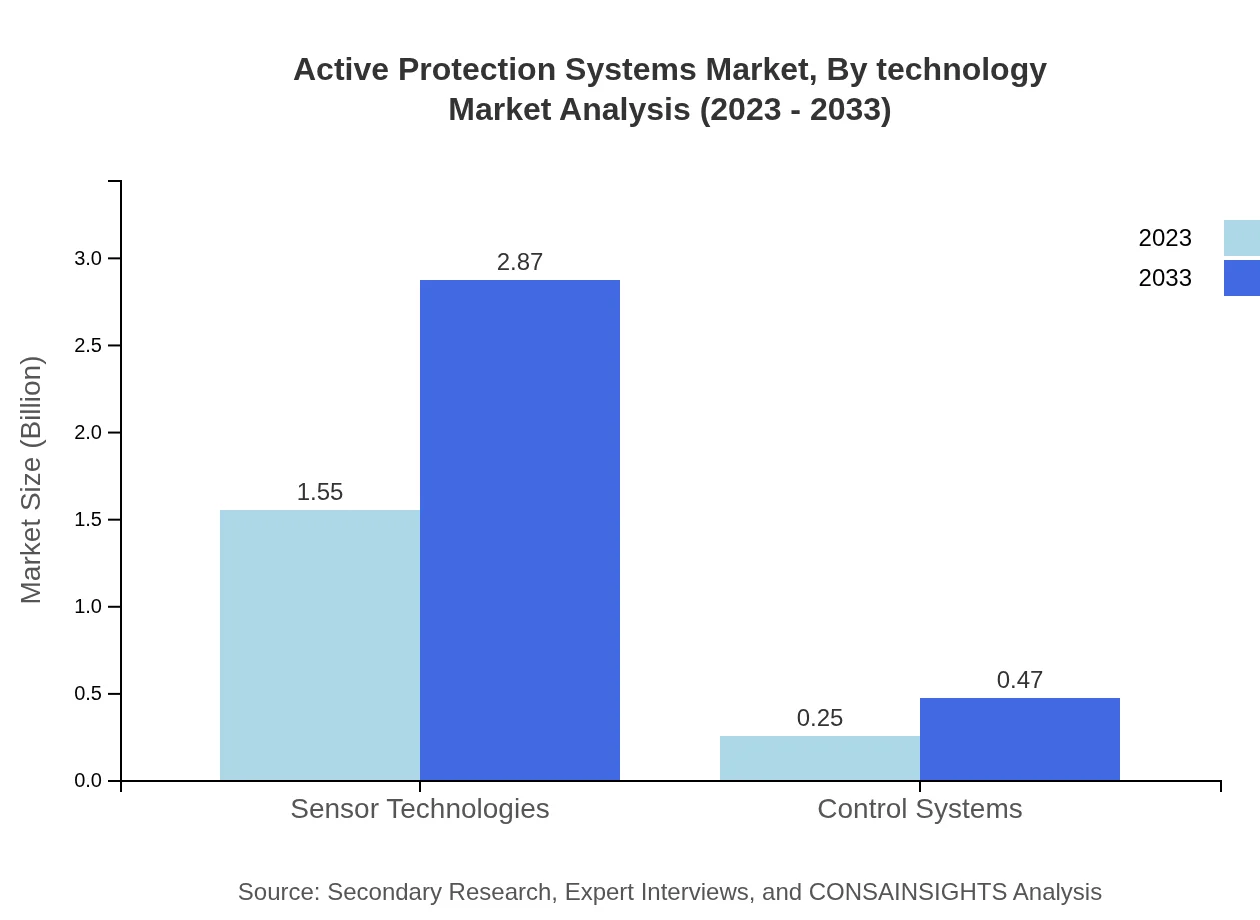

Active Protection Systems Market Analysis By Technology

The technology segment of the market indicates a strong inclination towards sensor technologies, which accounted for a significant portion of the market share. With growth from $1.55 billion in 2023 to $2.87 billion in 2033, sensor technology is the backbone of effective APS solutions. Meanwhile, control systems represent a smaller yet crucial segment, with an increase projected from $0.25 billion to $0.47 billion.

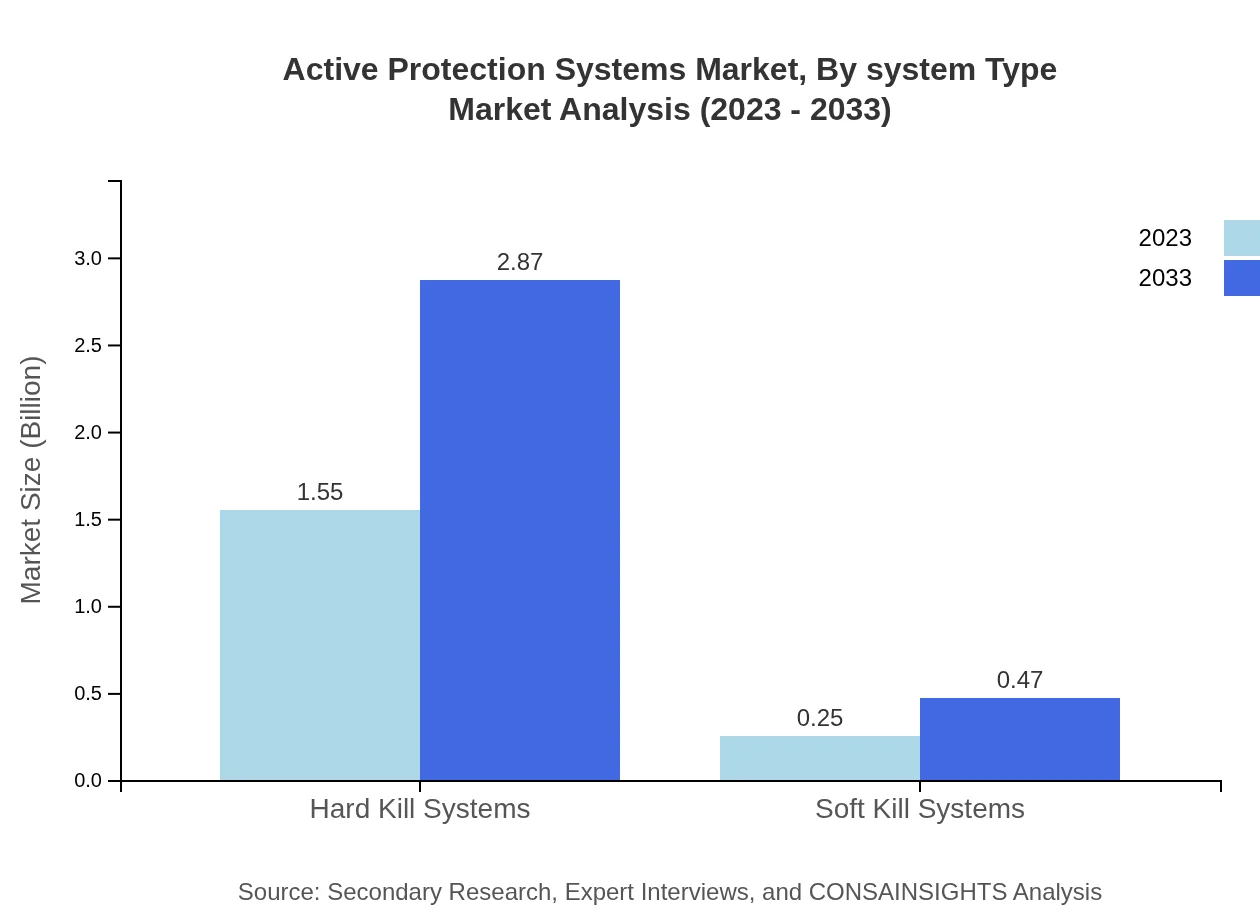

Active Protection Systems Market Analysis By System Type

The system type segment is predominantly represented by Hard Kill Systems, which hold a substantial market share and are poised for growth from $1.55 billion in 2023 to $2.87 billion by 2033. Soft Kill Systems may appear less significant with a market size of $0.25 billion in 2023, expected to grow modestly to $0.47 billion, reflecting a niche application in APS.

Active Protection Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Protection Systems Industry

Raytheon Technologies:

An American multinational company specializing in aerospace and defense, Raytheon Technologies is a leader in the development of innovative active protection systems, including advanced sensor solutions and missile defense technologies.Northrop Grumman:

Known for its wide range of defense products, Northrop Grumman excels in providing cutting-edge active protection solutions. The company focuses on both hardware and software systems designed to enhance military capabilities.Thales Group:

This multinational company specializes in advanced defense and aerospace technologies, including active protection systems that uphold security for military and civilian applications.Leonardo S.p.A.:

An Italian multinational company, Leonardo is a prominent player in the APS domain, focusing on innovative technologies including sensor systems and other integration possibilities for enhanced military effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of active Protection Systems?

The global market size for active protection systems in 2023 is approximately $1.8 billion, with a projected CAGR of 6.2% from 2023 to 2033. This growth indicates a rising demand for advanced security systems across various sectors.

What are the key market players or companies in this active Protection Systems industry?

Key players in the active protection systems industry include major defense contractors and technology firms that specialize in military and security solutions. These companies are vital in shaping market innovations and competitive dynamics.

What are the primary factors driving the growth in the active Protection Systems industry?

Growth factors include rising security threats, advancements in technology, government defense spending, and the increasing need for enhanced vehicle protection systems in military applications.

Which region is the fastest Growing in the active Protection Systems?

North America is the fastest-growing region for active protection systems, projected to increase from $0.63 billion in 2023 to $1.17 billion by 2033, driven by significant military investments and technological advancements.

Does ConsaInsights provide customized market report data for the active Protection Systems industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, allowing for in-depth insights and analysis relevant to particular interests within the active protection systems sector.

What deliverables can I expect from this active Protection Systems market research project?

Deliverables typically include comprehensive reports, market analysis, segment data, competitive landscape overviews, and actionable insights designed to inform strategic decision-making in the active protection systems market.

What are the market trends of active Protection Systems?

Key market trends include the integration of AI and machine learning, enhanced focus on sensor technologies, regulatory impacts on defense spending, and a shift towards both hard kill and soft kill systems in military applications.