Actuators Valves Market Report

Published Date: 31 January 2026 | Report Code: actuators-valves

Actuators Valves Market Size, Share, Industry Trends and Forecast to 2033

This report offers insights into the Actuators Valves market from 2023 to 2033, detailing market trends, size, segmentation, and forecasts. It provides an in-depth analysis of market dynamics and the competitive landscape shaping the industry.

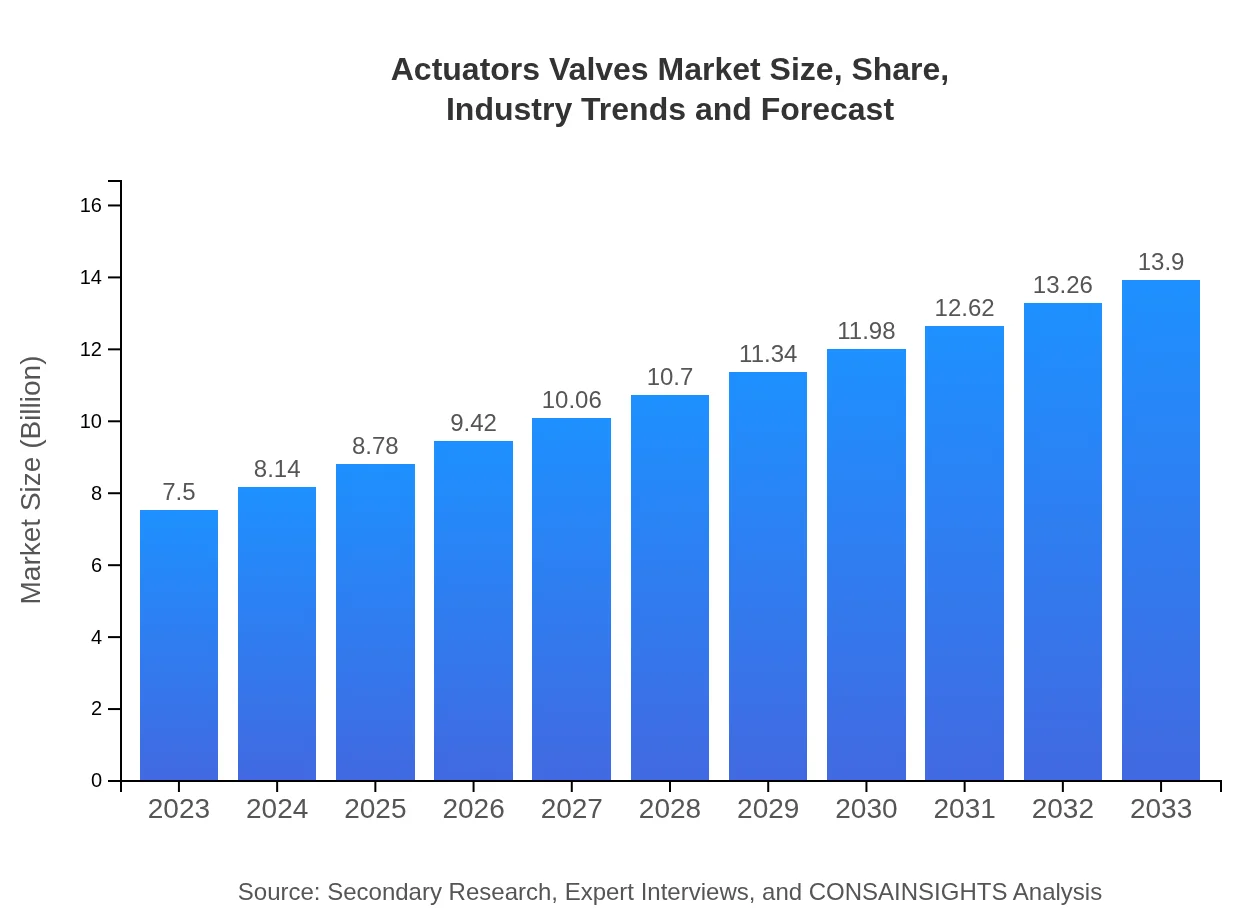

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Parker Hannifin Corporation, Emerson Electric Co., Honeywell International Inc., Siemens AG, Schneider Electric |

| Last Modified Date | 31 January 2026 |

Actuators Valves Market Overview

Customize Actuators Valves Market Report market research report

- ✔ Get in-depth analysis of Actuators Valves market size, growth, and forecasts.

- ✔ Understand Actuators Valves's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Actuators Valves

What is the Market Size & CAGR of Actuators Valves market in 2023?

Actuators Valves Industry Analysis

Actuators Valves Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Actuators Valves Market Analysis Report by Region

Europe Actuators Valves Market Report:

Europe's market is presently valued at $2.33 billion, with expectations to grow to $4.32 billion by 2033. The region's strong environmental regulations and commitment to reducing carbon emissions are driving the adoption of advanced actuators and optimized control systems.Asia Pacific Actuators Valves Market Report:

In 2023, the Asia Pacific Actuators Valves market is valued at $1.39 billion and is expected to grow to $2.57 billion by 2033. This growth is primarily driven by the region's rapid industrialization and infrastructural developments, coupled with a strong shift towards automation in various industries.North America Actuators Valves Market Report:

North America remains a key player, currently valued at $2.66 billion in 2023, projected to reach $4.92 billion by 2033. The growth stems from advancements in energy efficiency and sustainability efforts across industries such as oil and gas, automotive, and chemical processing.South America Actuators Valves Market Report:

The South American market for Actuators Valves is valued at $0.38 billion in 2023, with a forecasted growth to $0.71 billion by 2033. The region is witnessing increased investments in oil and gas exploration, which is fueling demand for actuators and valves.Middle East & Africa Actuators Valves Market Report:

In 2023, the Middle East and Africa market for Actuators Valves is valued at $0.74 billion, with projections of reaching $1.37 billion by 2033. This growth is supported by increasing investments in water and wastewater treatment plants and oil & gas infrastructure upgrades.Tell us your focus area and get a customized research report.

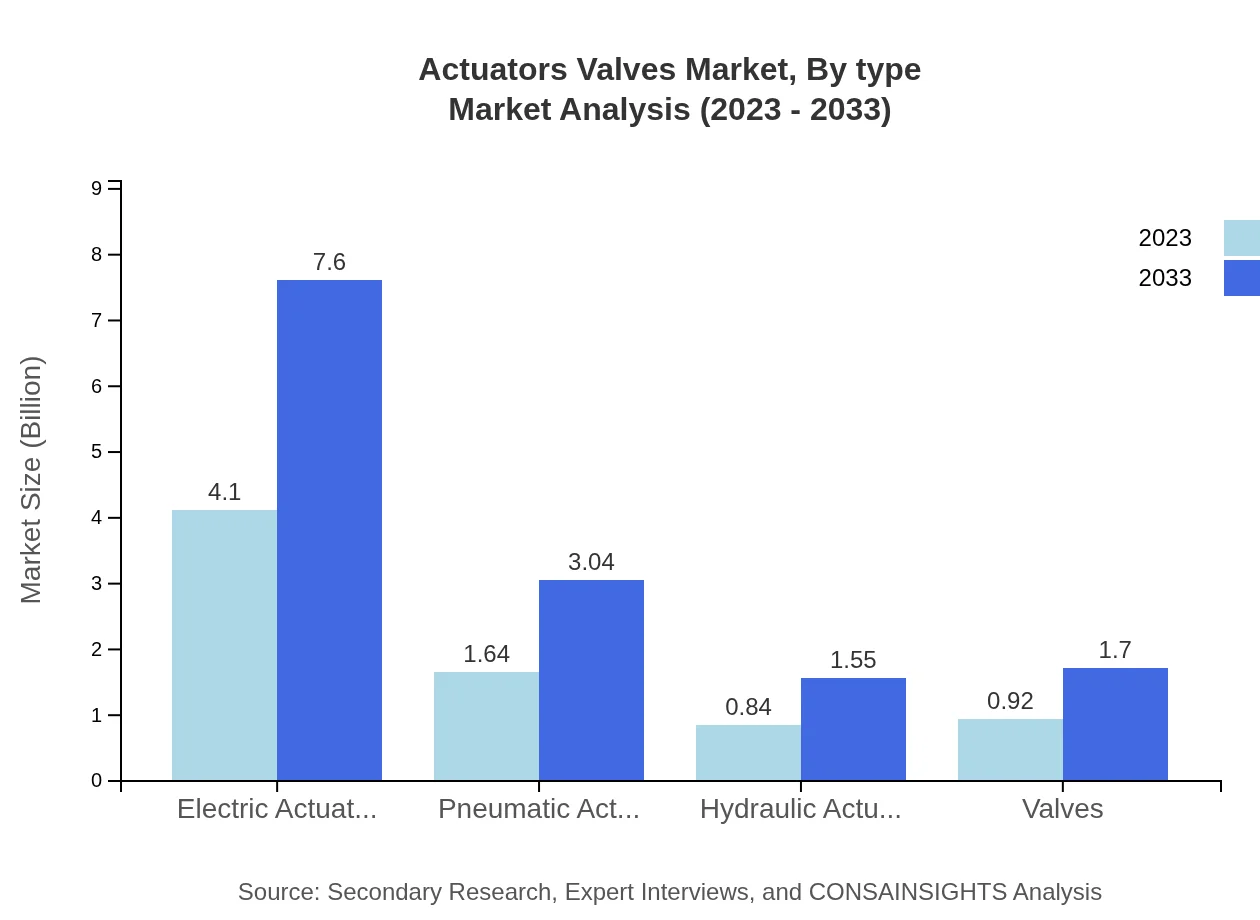

Actuators Valves Market Analysis By Type

Electric Actuators dominate the market with a size of $4.10 billion in 2023, projected to grow to $7.60 billion by 2033, representing a significant share of 54.72%. Pneumatic Actuators are growing steadily from $1.64 billion to $3.04 billion, holding 21.87% of the market. Hydraulic Actuators follow with a market projection from $0.84 billion to $1.55 billion, contributing 11.19%. Valves are also a significant segment from $0.92 billion to $1.70 billion, holding 12.22% of the overall market.

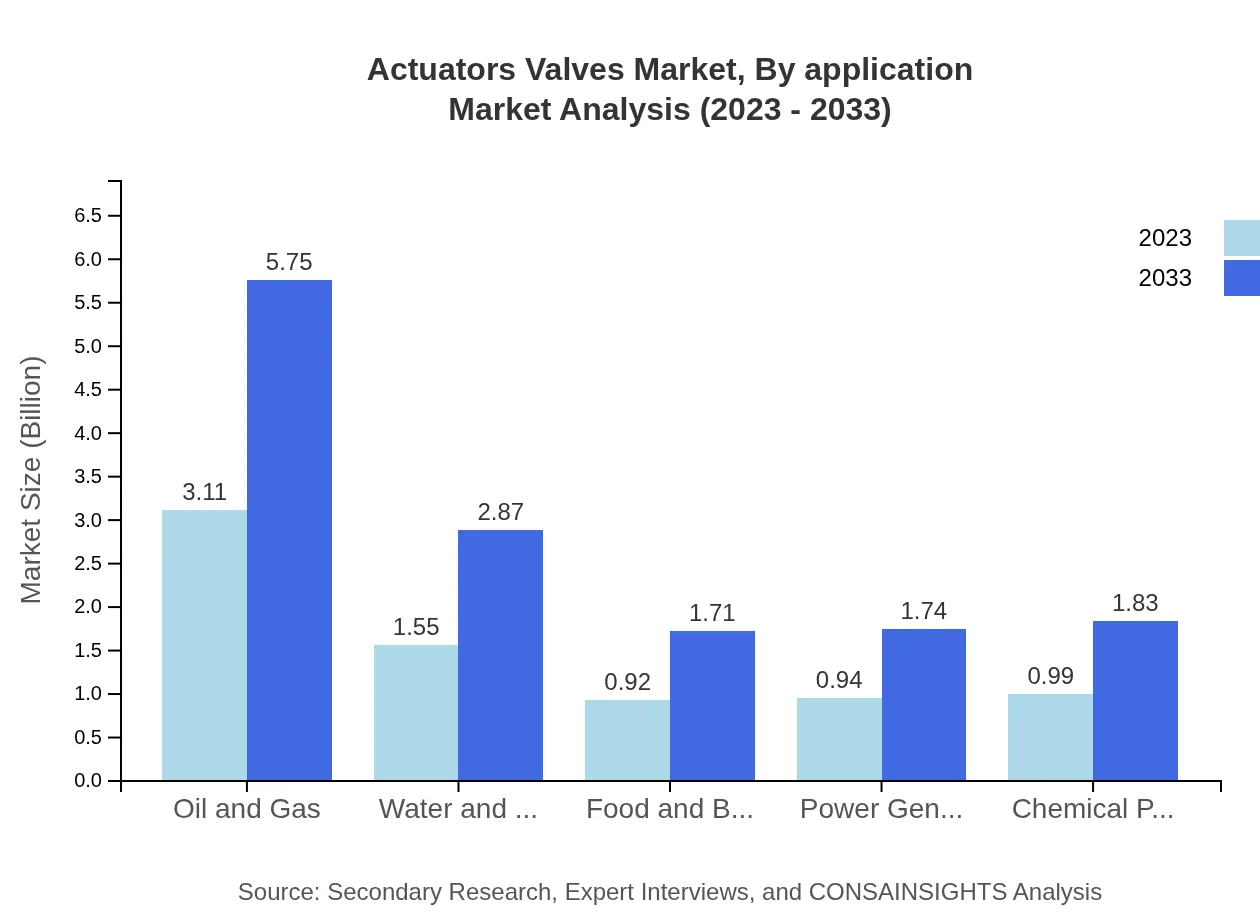

Actuators Valves Market Analysis By Application

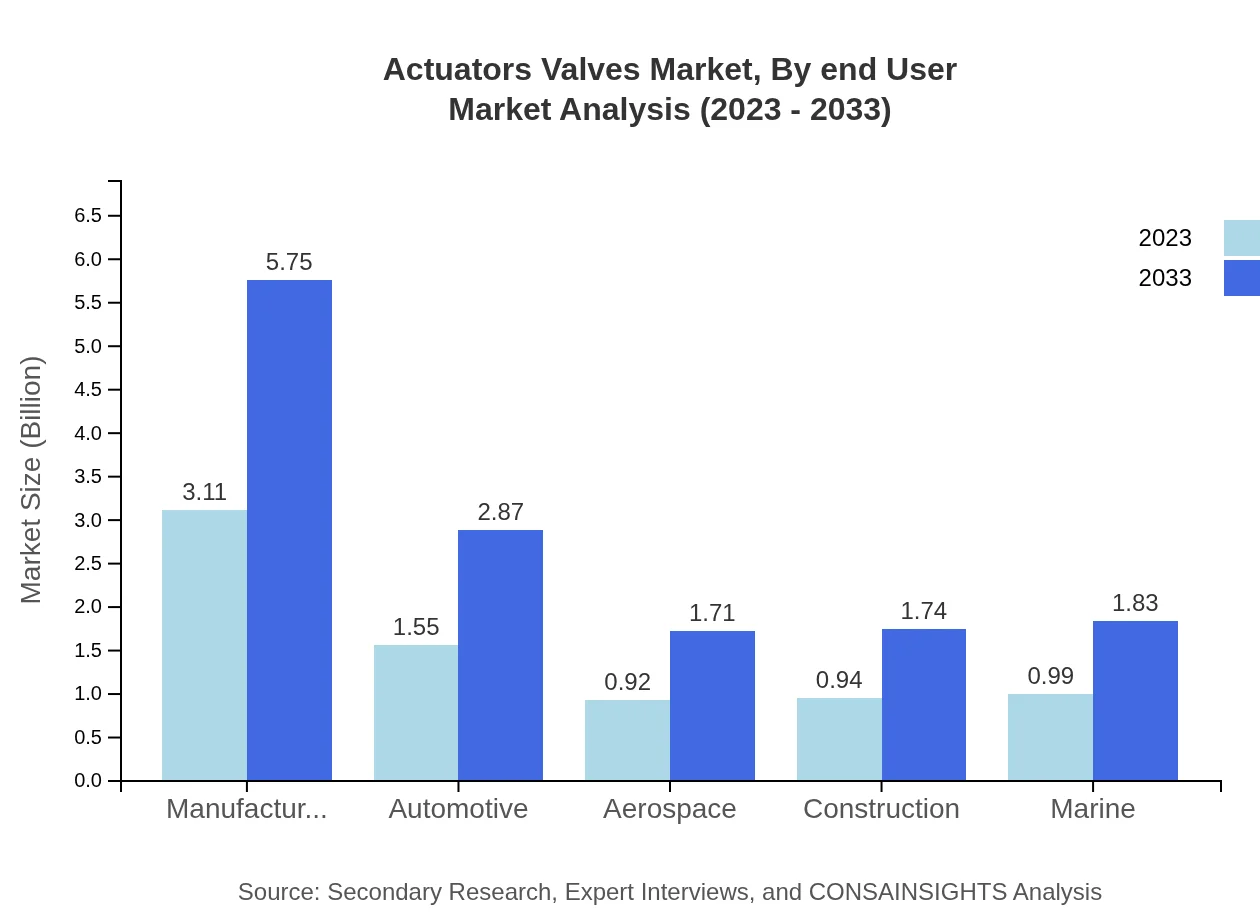

The manufacturing sector is a leading application area, with a market size of $3.11 billion in 2023, expected to rise to $5.75 billion by 2033, capturing 41.41% market share. The automotive industry holds $1.55 billion with a projected increase to $2.87 billion. Other significant applications include aerospace, water and wastewater, food and beverage, and power generation, with forecasts indicating steady growth across these sectors.

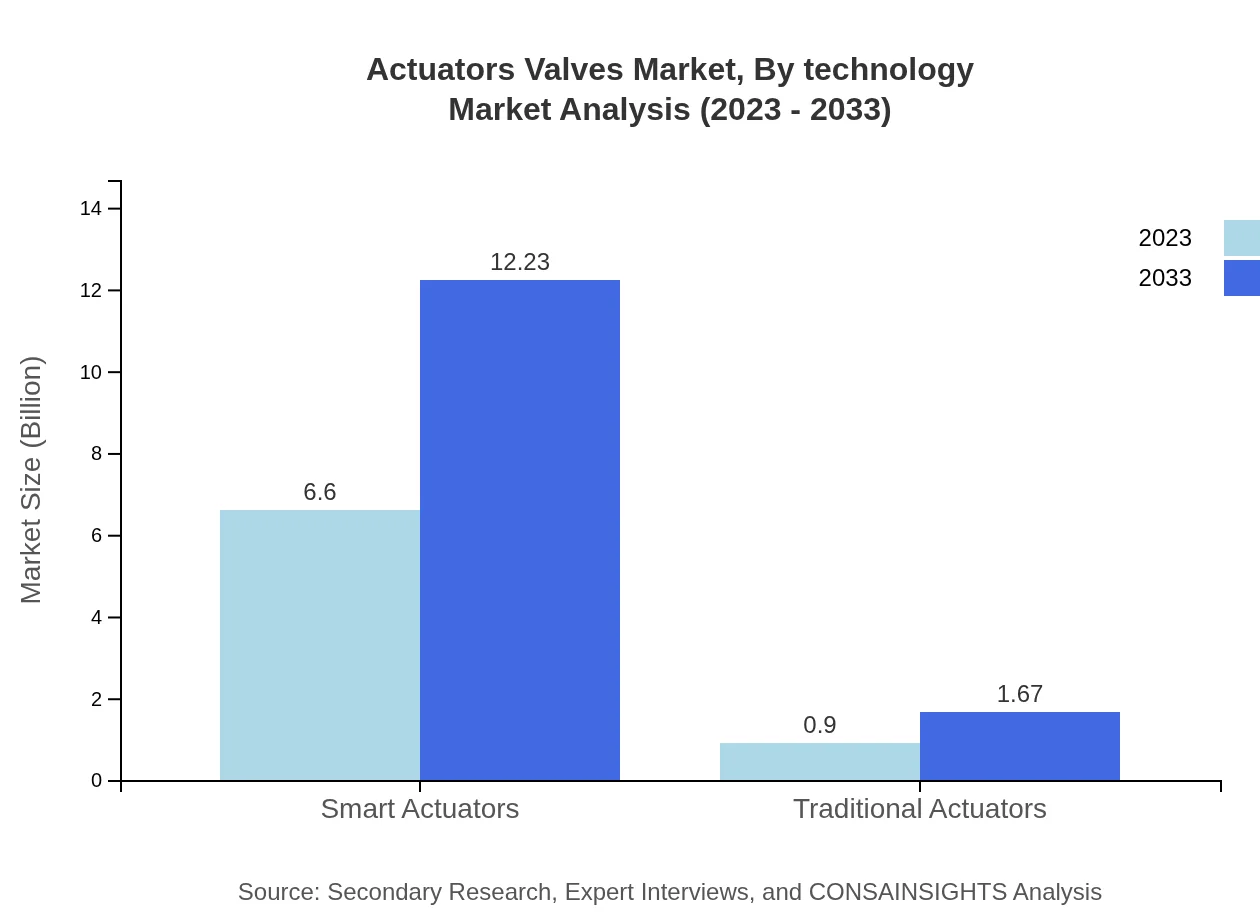

Actuators Valves Market Analysis By Technology

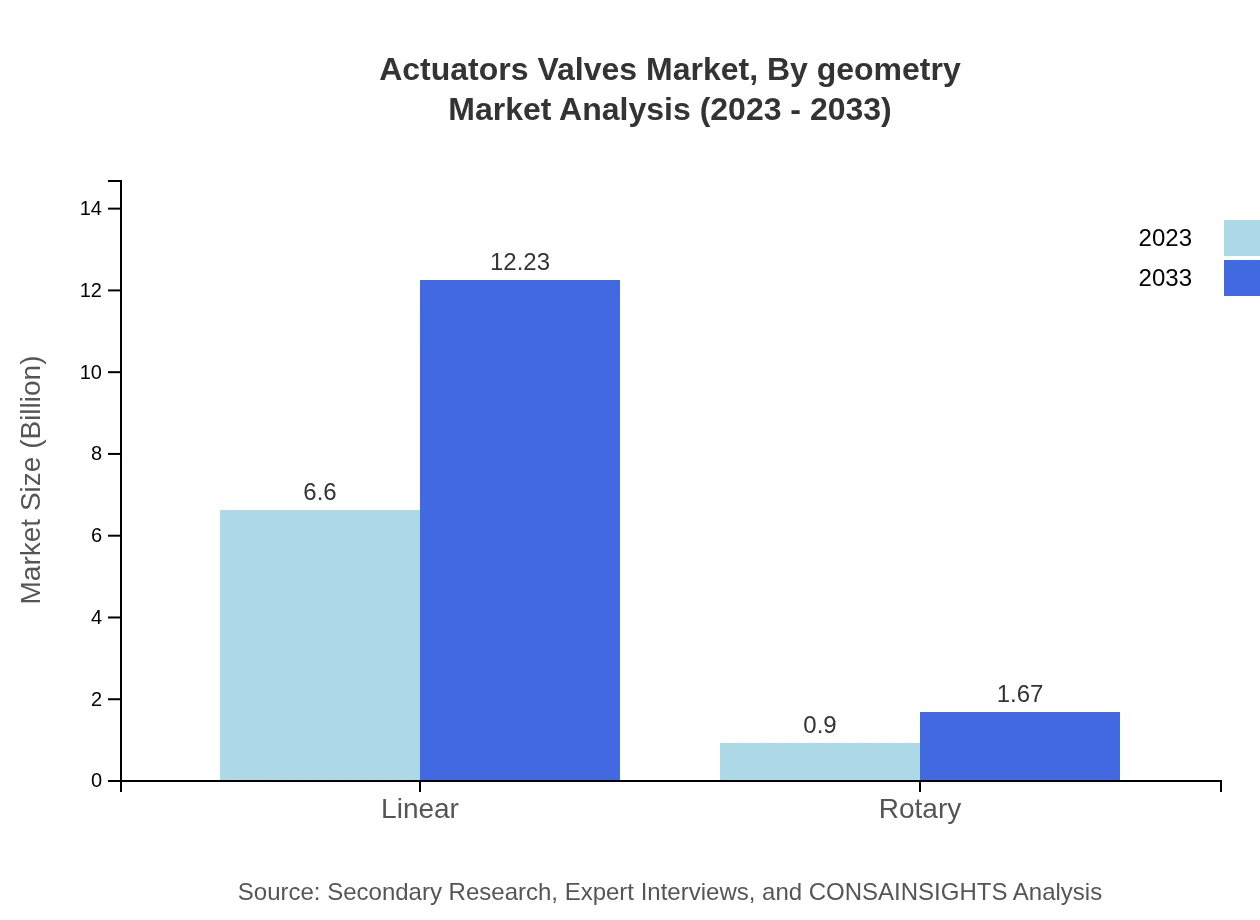

Smart and linear actuator technologies dominate the market with sizes of $6.60 billion and a share of 88.01% in 2023. These technologies are increasingly favored for their precision and efficiency in industrial applications. Traditional technologies account for a smaller segment but are still significant, with current projections showing linear actuators growing from $6.60 billion to $12.23 billion by 2033.

Actuators Valves Market Analysis By End User

The oil and gas sector leads the market with a share of $3.11 billion (41.41%) in 2023, projected to grow to $5.75 billion by 2033. Other industries such as chemical processing, construction, and marine applications also contribute significantly, with steady growth anticipated across these sectors due to increasing automation and efficiency demands.

Actuators Valves Market Analysis By Geometry

The market is characterized by two primary geometries: linear, which holds a dominant position with a size of $6.60 billion and a share of 88.01%, and rotary actuators, which currently account for $0.90 billion with an anticipated growth to $1.67 billion by 2033, capturing 11.99% market share.

Actuators Valves Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Actuators Valves Industry

Parker Hannifin Corporation:

A leader in motion and control technologies, Parker Hannifin offers a wide range of actuator solutions that improve efficiency and performance across various industrial applications.Emerson Electric Co.:

Emerson provides innovative and high-value automation solutions, including actuators and valves, geared towards enhancing operational efficiency and safety.Honeywell International Inc.:

Honeywell is a multinational conglomerate known for its advanced automation technologies, offering a broad range of actuators and valves for diverse applications.Siemens AG:

Siemens is a global powerhouse in electronics and electrical engineering, providing high-quality actuators and control technologies tailored to meet industry needs.Schneider Electric:

Specializing in digital transformation in energy management and automation, Schneider Electric delivers smart actuator solutions that optimize industrial controls.We're grateful to work with incredible clients.

FAQs

What is the market size of actuators Valves?

The global actuators-valves market was valued at approximately $7.5 billion in 2023 and is projected to grow at a CAGR of 6.2% through 2033, reaching a robust size that reflects increasing automation across industries.

What are the key market players or companies in this actuators Valves industry?

Key players in the actuators-valves industry include major manufacturers like Emerson Electric Co., Honeywell International Inc., and Metso Corporation, which significantly influence market dynamics and innovations.

What are the primary factors driving the growth in the actuators Valves industry?

Growth in the actuators-valves industry is primarily driven by advancements in automation technology, increasing demand for smart manufacturing, and the need for energy efficiency across various sectors.

Which region is the fastest Growing in the actuators Valves market?

The Asia-Pacific region is the fastest-growing market for actuators-valves, projected to expand from $1.39 billion in 2023 to $2.57 billion by 2033, indicating strong industrial growth and modernization efforts.

Does ConsaInsights provide customized market report data for the actuators Valves industry?

Yes, ConsaInsights offers customized market report data for the actuators-valves industry, catering to specific client needs and providing tailored insights for strategic decision-making.

What deliverables can I expect from this actuators Valves market research project?

Deliverables from the actuators-valves market research project typically include detailed market analysis reports, segmentation insights, growth forecasts, and competitive landscape assessments for strategic planning.

What are the market trends of actuators Valves?

Key market trends include the rising adoption of electric actuators, an emphasis on smart actuator technology, and the integration of IoT in automation processes, enhancing overall operational efficiency.