Acyclovir Market Report

Published Date: 31 January 2026 | Report Code: acyclovir

Acyclovir Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Acyclovir market, detailing insights related to market size, growth trends, segmentation, and forecasts over the period from 2023 to 2033.

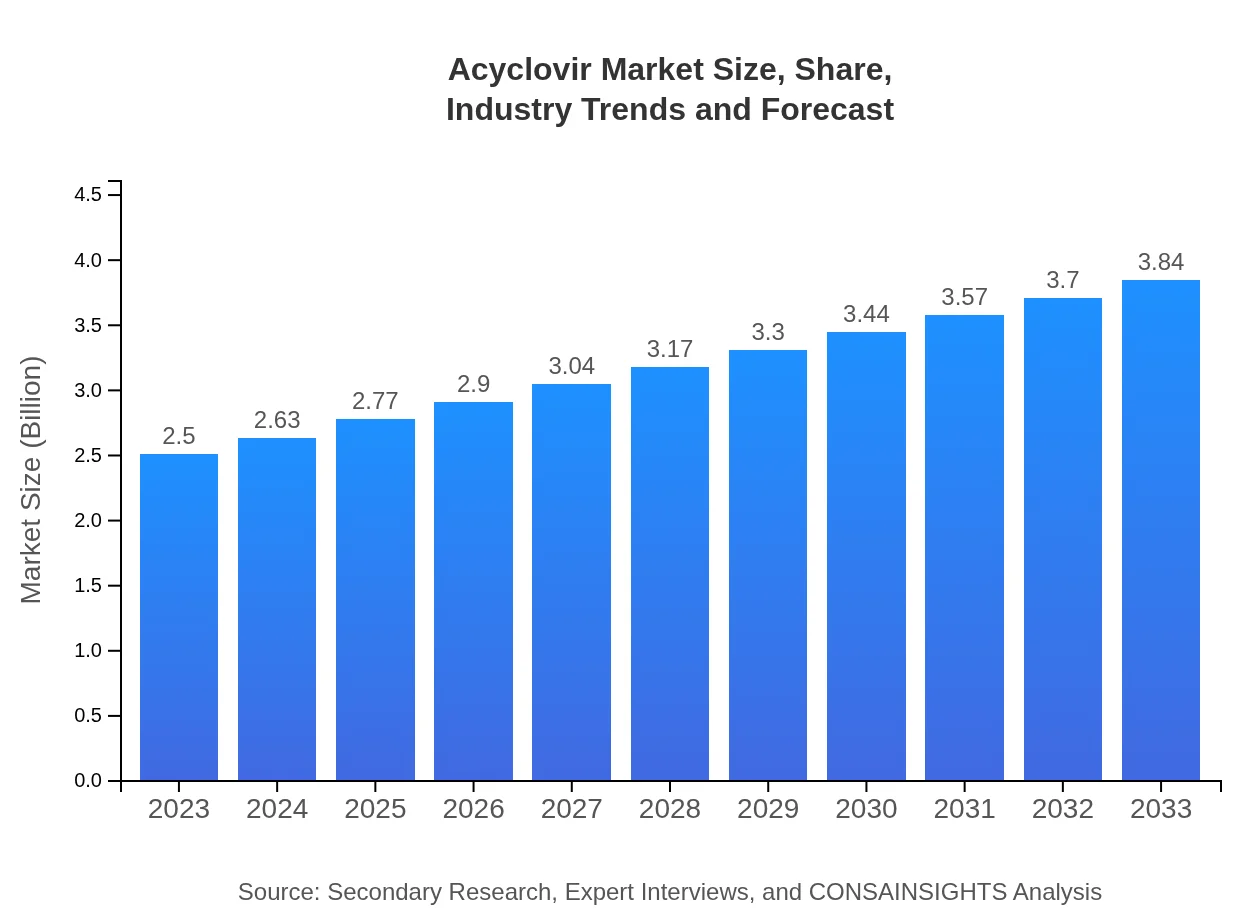

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $3.84 Billion |

| Top Companies | GSK, Teva Pharmaceuticals, Mylan N.V., Fresenius Kabi, Bristol Myers Squibb |

| Last Modified Date | 31 January 2026 |

Acyclovir Market Overview

Customize Acyclovir Market Report market research report

- ✔ Get in-depth analysis of Acyclovir market size, growth, and forecasts.

- ✔ Understand Acyclovir's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Acyclovir

What is the Market Size & CAGR of Acyclovir market in 2023?

Acyclovir Industry Analysis

Acyclovir Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Acyclovir Market Analysis Report by Region

Europe Acyclovir Market Report:

Europe's Acyclovir market is anticipated to expand from $0.77 billion in 2023 to $1.19 billion in 2033, supported by significant healthcare investments and ongoing R&D in antiviral therapies.Asia Pacific Acyclovir Market Report:

In the Asia Pacific region, the Acyclovir market is projected to grow from $0.47 billion in 2023 to $0.72 billion by 2033, reflecting a growing awareness of viral infections and improved healthcare access.North America Acyclovir Market Report:

North America is a leading market with a size of $0.91 billion in 2023 projected to grow to $1.40 billion by 2033, spurred by advanced healthcare systems and high awareness regarding virus-related diseases.South America Acyclovir Market Report:

The South American market is expected to increase from $0.09 billion in 2023 to $0.14 billion by 2033, driven by expanding healthcare services and rising antiviral drug consumption.Middle East & Africa Acyclovir Market Report:

The Middle East and Africa market is likely to grow from $0.25 billion in 2023 to $0.38 billion by 2033, reflecting increasing healthcare initiatives and access to drug therapies.Tell us your focus area and get a customized research report.

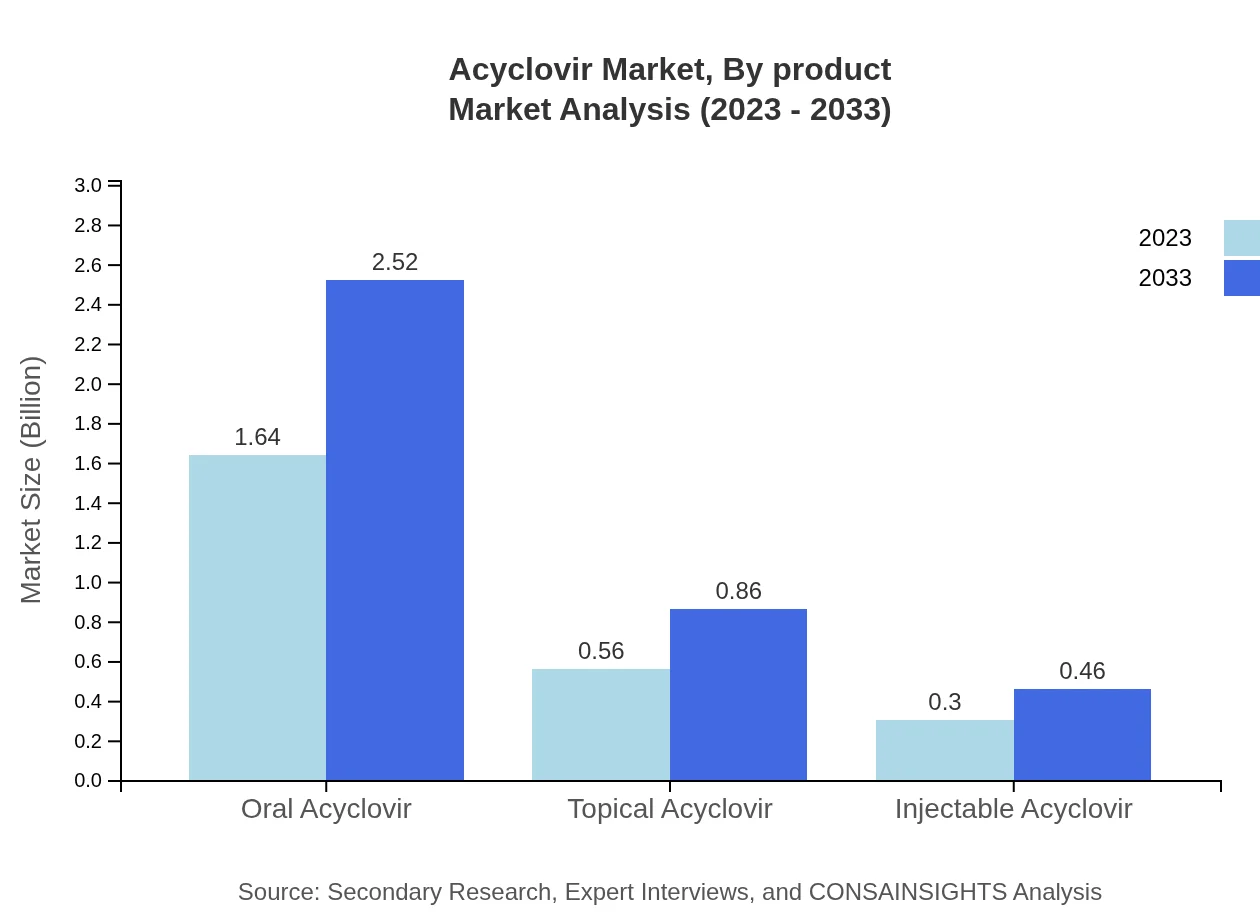

Acyclovir Market Analysis By Product

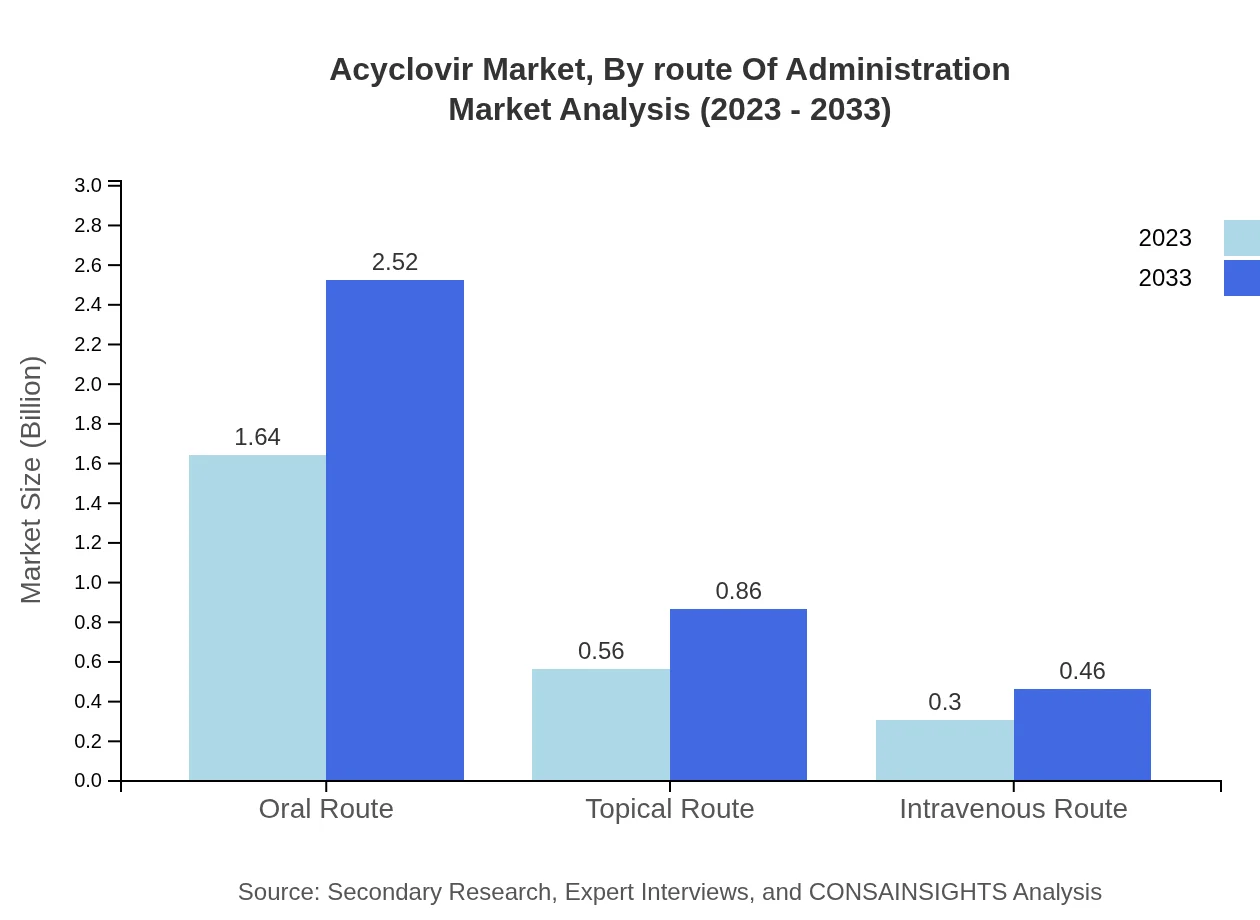

The oral Acyclovir segment leads the market, projected to account for $1.64 billion in 2023 and reaching $2.52 billion by 2033. The topical segment is expected to grow from $0.56 billion to $0.86 billion, while the injectable segment is projected to expand from $0.30 billion to $0.46 billion over the same period.

Acyclovir Market Analysis By Application

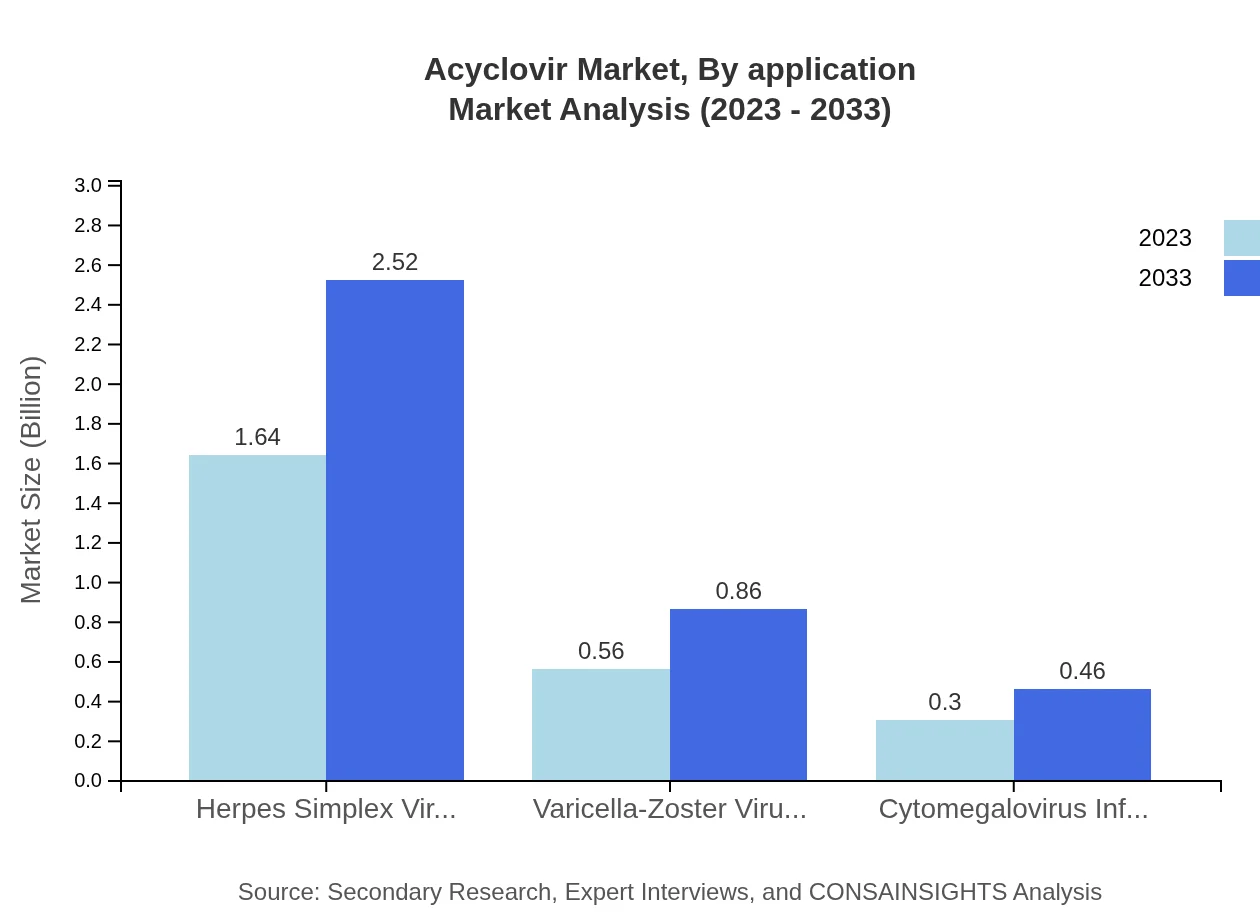

By application, the herpes simplex virus infections segment commands the market, expected to grow from $1.64 billion in 2023 to $2.52 billion by 2033. Similarly, varicella-zoster virus infections will expand from $0.56 billion to $0.86 billion, with cytomegalovirus infections growing from $0.30 billion to $0.46 billion.

Acyclovir Market Analysis By End User

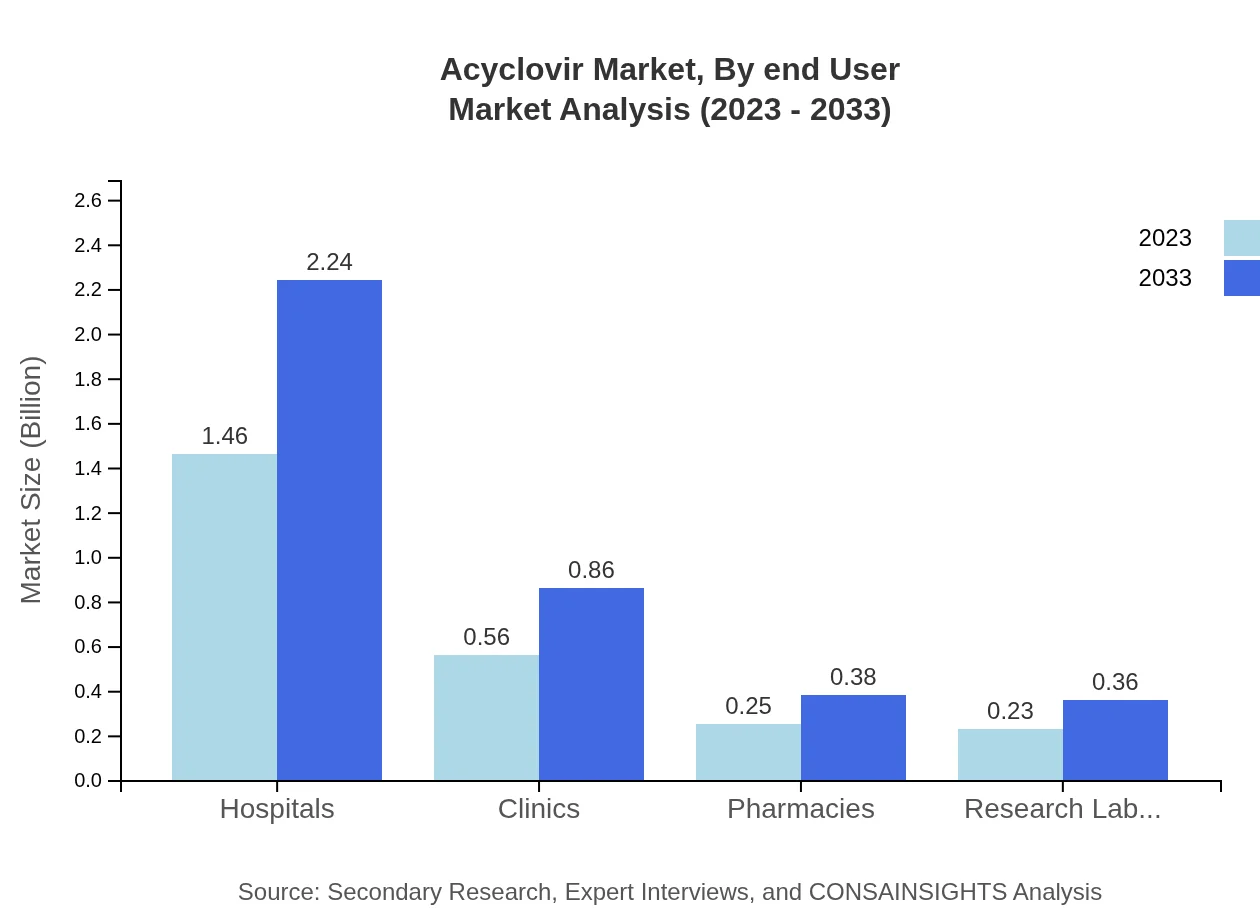

Hospitals dominate the end-user market, anticipated to increase from $1.46 billion in 2023 to $2.24 billion by 2033. Clinics and pharmacies will also see growth, increasing from $0.56 billion to $0.86 billion and $0.25 billion to $0.38 billion, respectively.

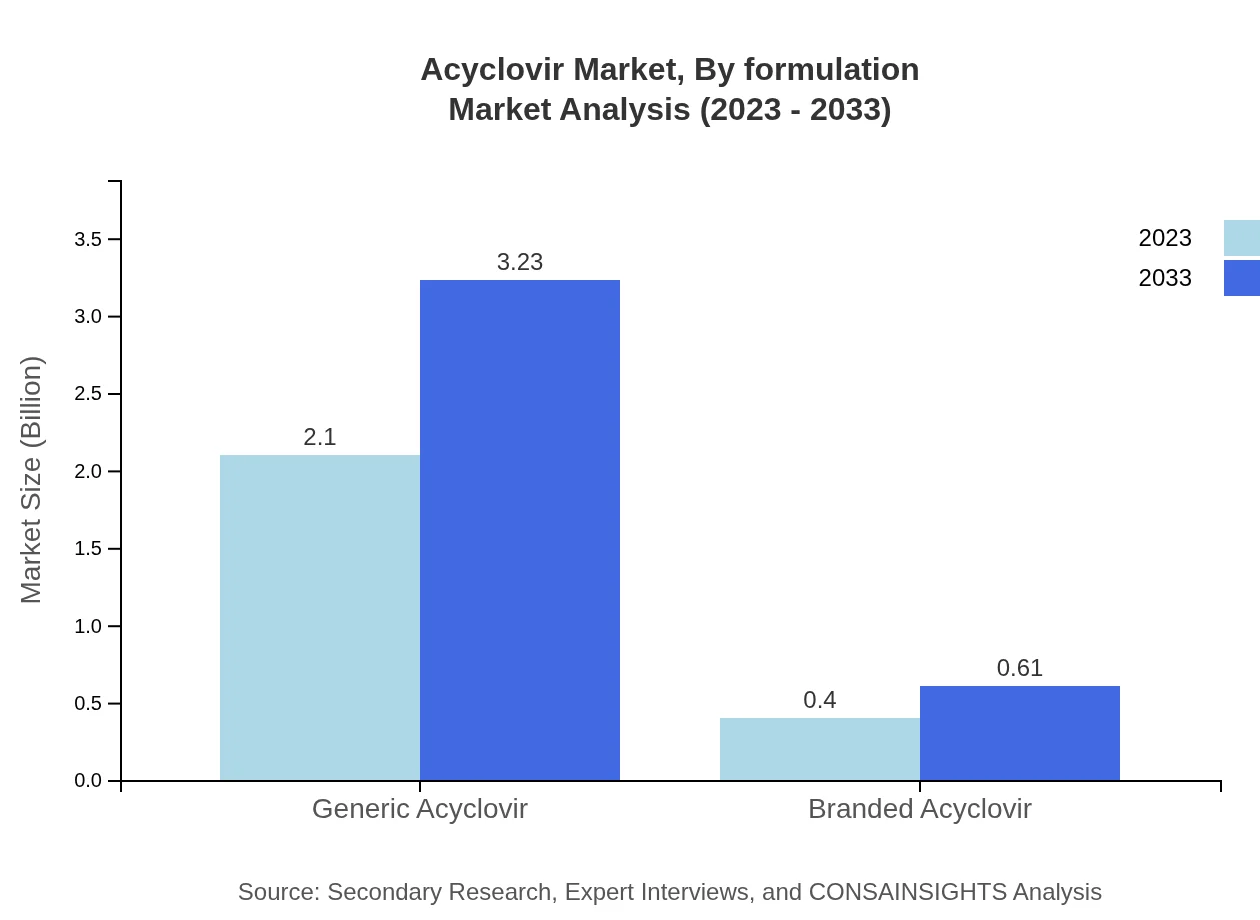

Acyclovir Market Analysis By Formulation

Generic Acyclovir overwhelmingly leads the market share at 84.02% and is projected to enjoy substantial growth from $2.10 billion in 2023 to $3.23 billion by 2033. Branded Acyclovir remains a smaller segment, increasing from $0.40 billion to $0.61 billion over the same period.

Acyclovir Market Analysis By Route Of Administration

The oral route is projected to maintain the largest market size, expanding from $1.64 billion in 2023 to $2.52 billion by 2033, representing a significant market share of 65.64%. This is followed by the topical and intravenous routes, growing from $0.56 to $0.86 billion and $0.30 to $0.46 billion, respectively.

Acyclovir Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Acyclovir Industry

GSK:

GlaxoSmithKline is a global healthcare company involved in researching and developing Acyclovir formulations, focusing on making treatments more accessible.Teva Pharmaceuticals:

Teva is a leading provider of generic drugs and actively competes in the Acyclovir market, often at lower price points.Mylan N.V.:

Mylan provides both generic and branded Acyclovir, ensuring a wide range of access for patients, especially in North America.Fresenius Kabi:

Fresenius Kabi manufactures injectable Acyclovir, emphasizing delivery in hospital settings.Bristol Myers Squibb:

A leading biopharmaceutical company that produces licensed branded Acyclovir aimed at specialized treatment protocols.We're grateful to work with incredible clients.

FAQs

What is the market size of acyclovir?

The global Acyclovir market is valued at approximately $2.5 billion in 2023 and is projected to grow with a CAGR of 4.3%. This growth reflects increasing usage and demand for treatments related to viral infections.

What are the key market players or companies in the acyclovir industry?

Key players in the Acyclovir industry include GSK, Teva Pharmaceuticals, and Mylan. These companies focus on developing, manufacturing, and marketing Acyclovir in various formulations, contributing to market growth.

What are the primary factors driving the growth in the acyclovir industry?

Key drivers for the Acyclovir market include a rise in herpes virus infections, increased awareness about viral diseases, and the development of generic drug options, making treatments more accessible to patients.

Which region is the fastest Growing in the acyclovir market?

North America is the fastest-growing region in the Acyclovir market, projected to increase from $0.91 billion in 2023 to $1.40 billion by 2033, driven by high infection rates and access to advanced healthcare.

Does ConsaInsights provide customized market report data for the acyclovir industry?

Yes, ConsaInsights provides customized market reports for the Acyclovir industry. Clients can access tailored data and insights to meet specific research requirements and strategic planning.

What deliverables can I expect from this acyclovir market research project?

Deliverables from the Acyclovir market research include detailed market analysis reports, regional insights, segment analysis, and future forecasts, equipping clients with critical data for strategic decision-making.

What are the market trends of acyclovir?

Current trends in the Acyclovir market include a shift toward generic formulations, increased adoption of intravenous treatments, and a growing emphasis on research and development for more effective antiviral therapies.