Additive Manufacturing And Materials Market Report

Published Date: 31 January 2026 | Report Code: additive-manufacturing-and-materials

Additive Manufacturing And Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Additive Manufacturing and Materials market, focusing on trends, opportunities, and forecasts from 2023 to 2033. It offers insights into market size, segmentation, regional analysis, and key players in the industry.

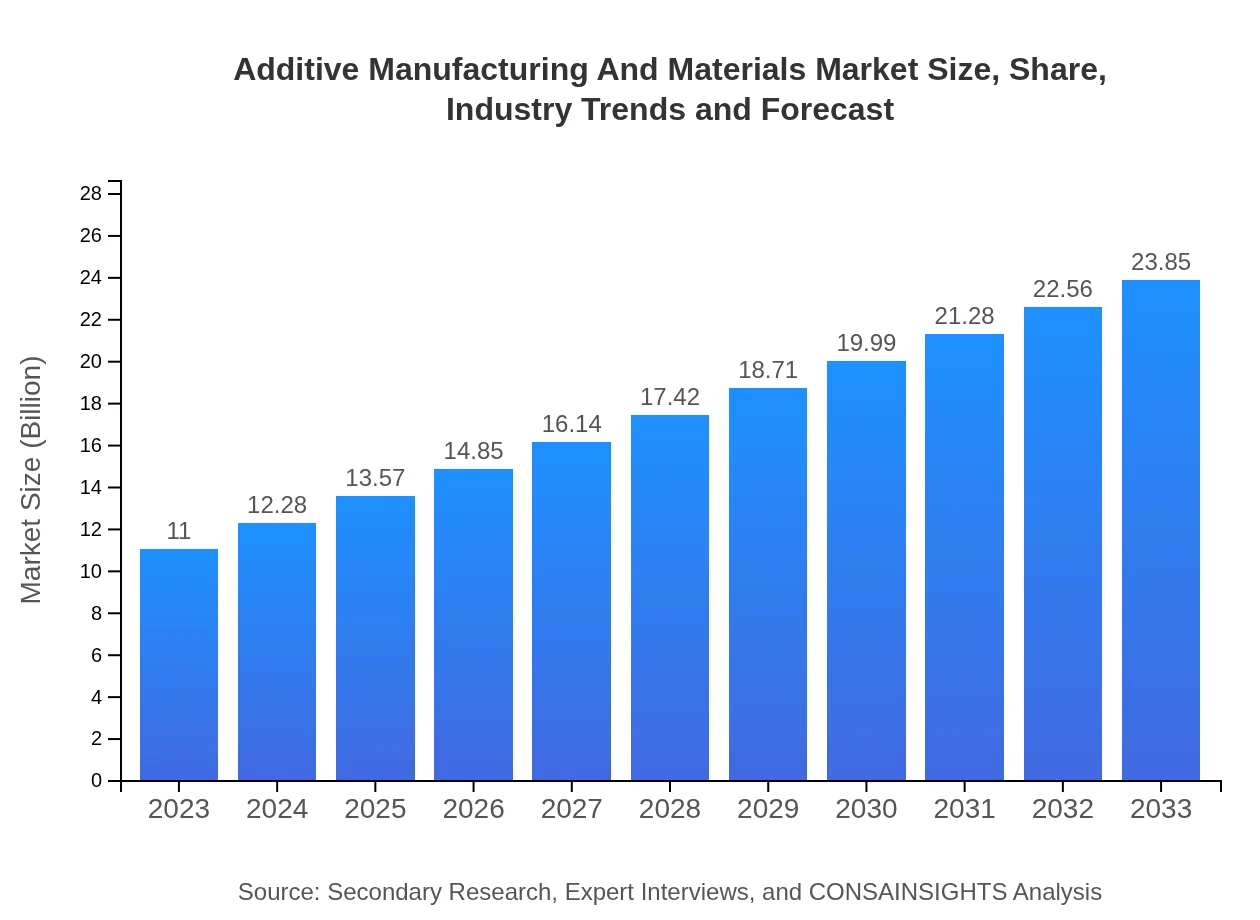

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.00 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $23.85 Billion |

| Top Companies | Stratasys Ltd., 3D Systems Corporation, Materialise NV, HP Inc., EOS GmbH |

| Last Modified Date | 31 January 2026 |

Additive Manufacturing And Materials Market Overview

Customize Additive Manufacturing And Materials Market Report market research report

- ✔ Get in-depth analysis of Additive Manufacturing And Materials market size, growth, and forecasts.

- ✔ Understand Additive Manufacturing And Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Additive Manufacturing And Materials

What is the Market Size & CAGR of Additive Manufacturing And Materials market in 2023 and 2033?

Additive Manufacturing And Materials Industry Analysis

Additive Manufacturing And Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Additive Manufacturing And Materials Market Analysis Report by Region

Europe Additive Manufacturing And Materials Market Report:

Europe's market will expand from $3.41 billion in 2023 to $7.39 billion by 2033. The region is noted for strict regulations in industries such as aerospace and healthcare, where AM applications are increasingly utilized to meet compliance and customization needs, fostering a competitive landscape.Asia Pacific Additive Manufacturing And Materials Market Report:

In the Asia-Pacific region, the market is expected to grow from approximately $1.85 billion in 2023 to $4.01 billion by 2033. Countries like China and Japan are spearheading advancements in additive technologies, largely driven by the automotive and electronics industries, promoting significant investments in R&D.North America Additive Manufacturing And Materials Market Report:

North America remains a dominant force, with market growth from $4.12 billion in 2023 to $8.93 billion in 2033. The U.S. is at the forefront of AM innovation, with significant investments in healthcare, aerospace, and automotive industries driving demand for advanced manufacturing solutions.South America Additive Manufacturing And Materials Market Report:

The South American market is projected to rise from $0.94 billion in 2023 to $2.04 billion by 2033. Brazil is the primary market player, with a focus on industrial applications. A growing interest in sustainable practices is propelling the adoption of AM technologies across various sectors.Middle East & Africa Additive Manufacturing And Materials Market Report:

In the Middle East and Africa, the market is expected to see growth from $0.68 billion in 2023 to $1.48 billion by 2033. Emerging markets in the region are gradually embracing additive manufacturing, particularly within the construction and medical sectors, while facing challenges related to infrastructure and skilled labor.Tell us your focus area and get a customized research report.

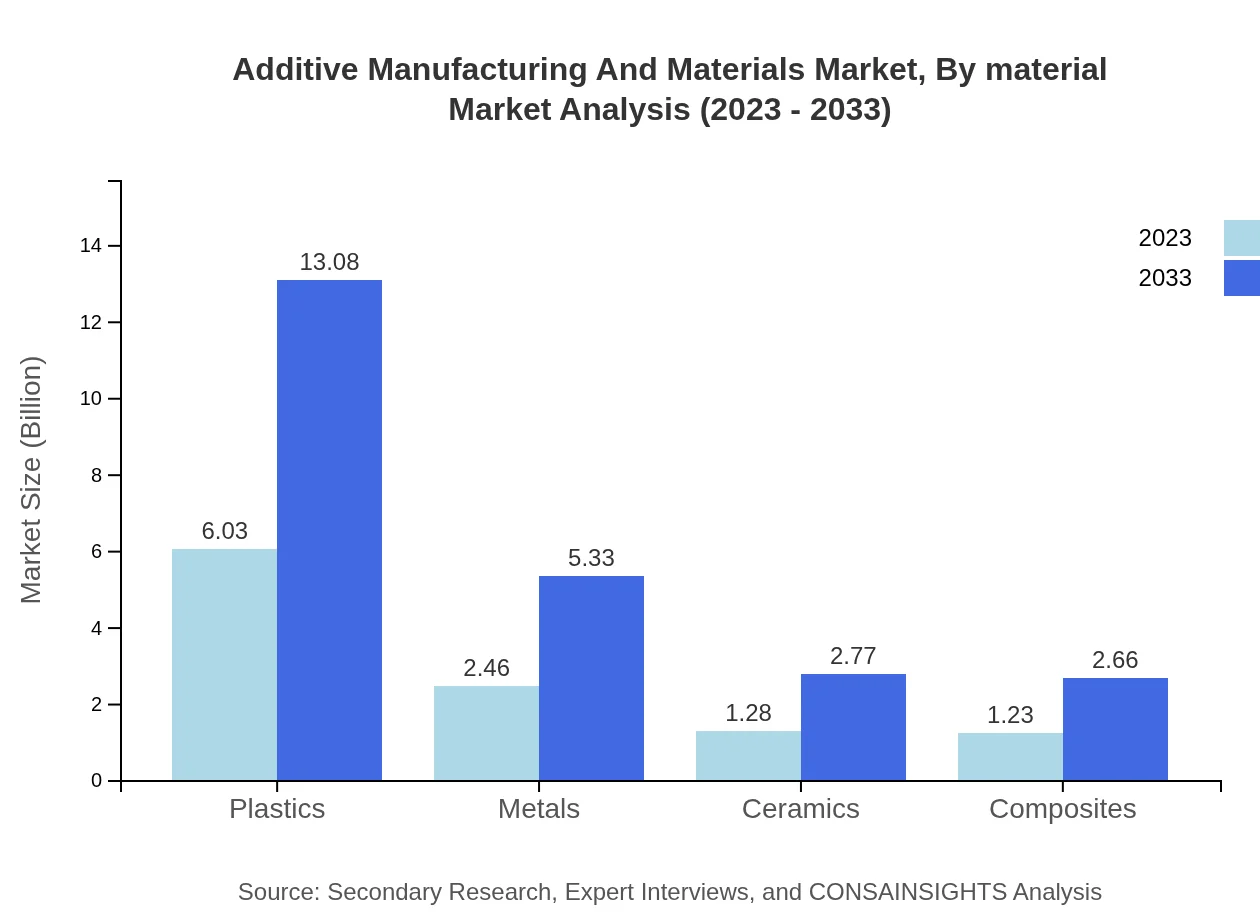

Additive Manufacturing And Materials Market Analysis By Material

The material segment of the Additive Manufacturing market is characterized by a predominant share of plastics, holding approximately 54.85% of the market in 2023, growing to 54.85% by 2033. Metals constitute 22.36% in 2023 and are expected to maintain this share as applications in aerospace and automotive sectors expand. Other materials like ceramics and composites play smaller yet significant roles, providing unique properties suited for specialized applications.

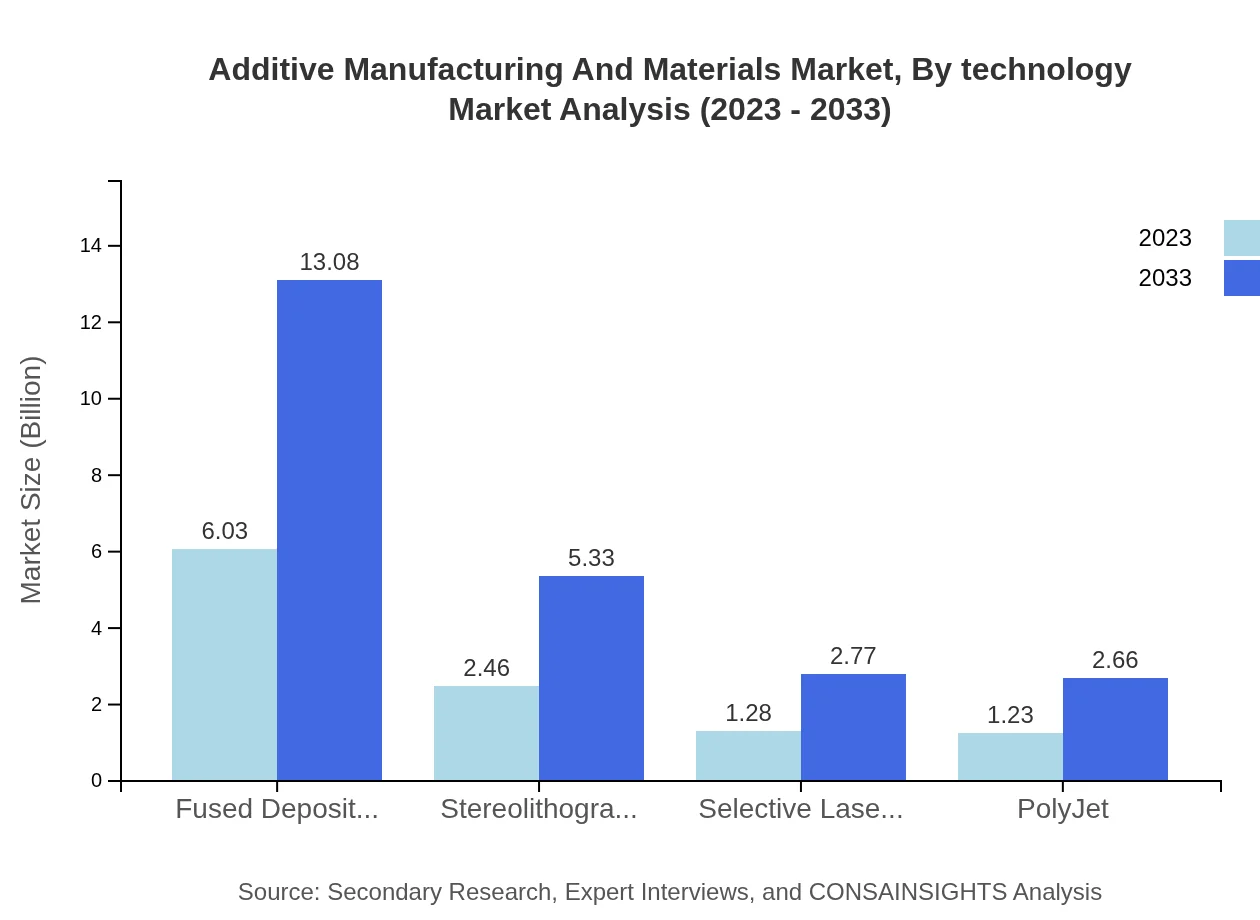

Additive Manufacturing And Materials Market Analysis By Technology

Fused Deposition Modeling (FDM) currently dominates the technology segment, accounting for 54.85% of the market share. This technology's versatility and cost-effectiveness favor its adoption across various industries. Stereolithography (SLA) holds 22.36%, preferred for higher precision needs, particularly in the healthcare sector. Selective Laser Sintering (SLS) and other emerging technologies are also gaining traction as the demand for complex geometries increases.

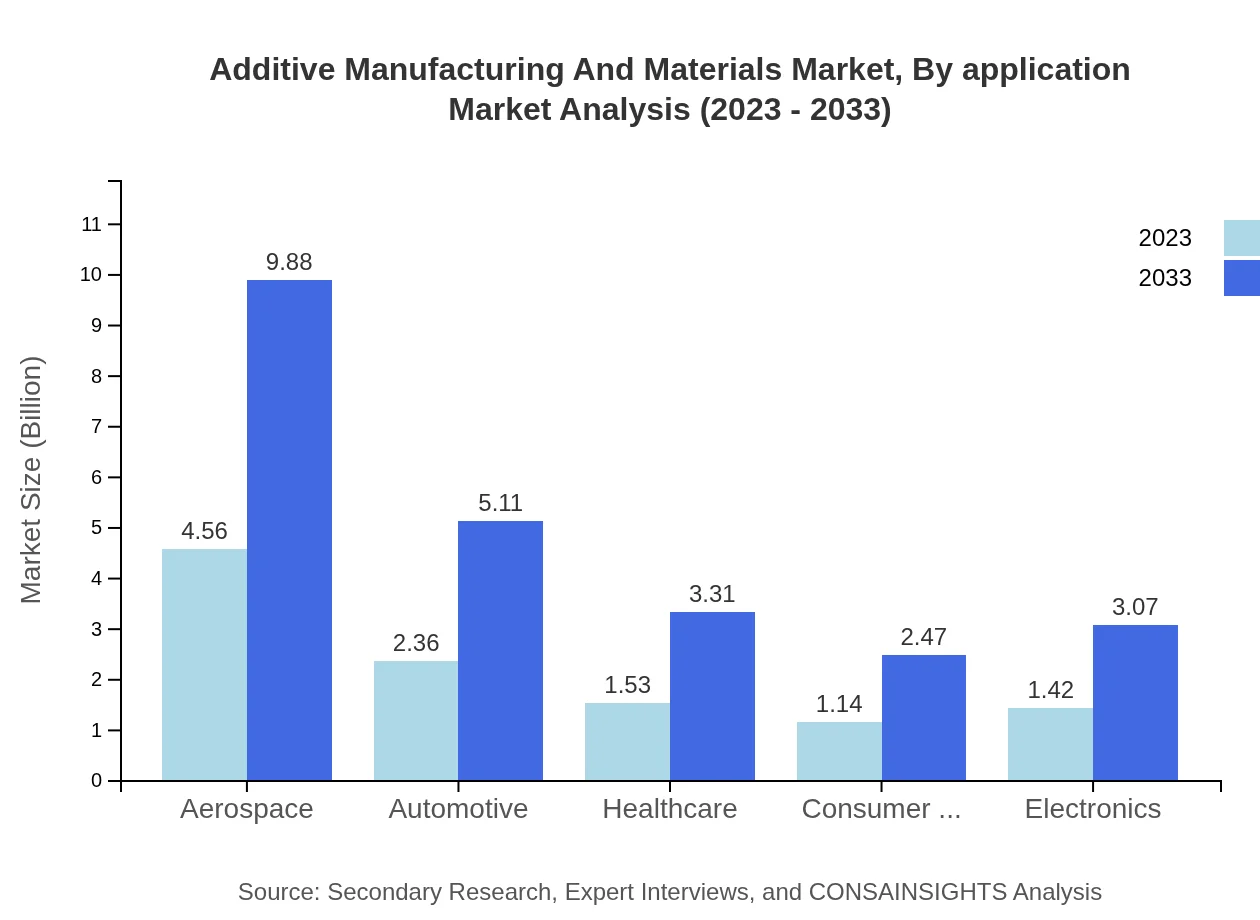

Additive Manufacturing And Materials Market Analysis By Application

Aerospace and automotive applications lead the sector, with shares of 41.42% and 21.44% respectively in 2023, driven by the need for lightweight components and rapid prototyping. The healthcare sector, providing critical growth with 13.90% share, is also witnessing a surge in personalized medical devices made via additive manufacturing, which are tailored to individual patient needs.

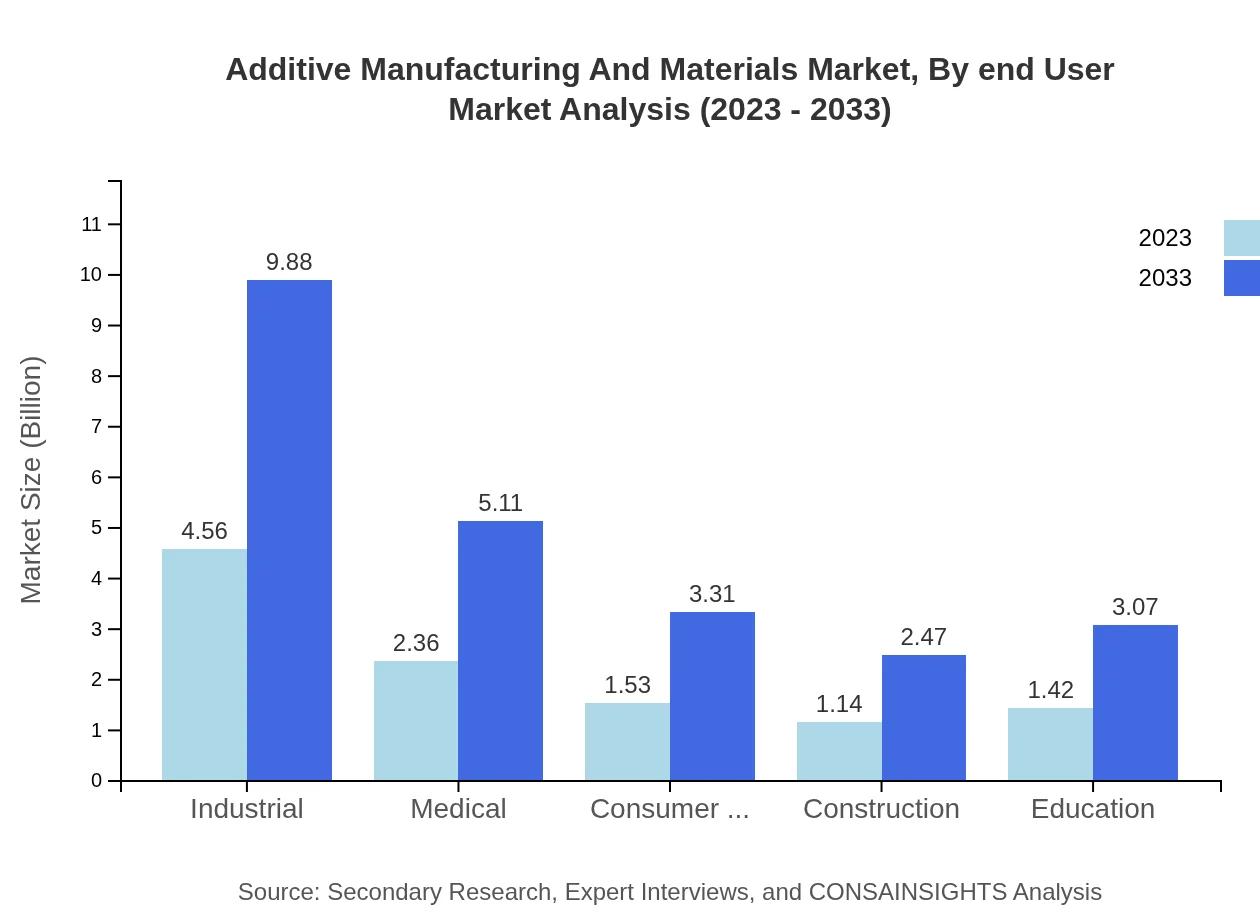

Additive Manufacturing And Materials Market Analysis By End User

End-user sectors such as aerospace, automotive, healthcare, and consumer products showcase varied adoption rates, with aerospace leading at 41.42% in 2023. Increasing investments in R&D by various industries to explore the potential of additive manufacturing further leverage the market's growth dynamics.

Additive Manufacturing And Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Additive Manufacturing And Materials Industry

Stratasys Ltd.:

A leader in 3D printing technology, Stratasys specializes in FDM and PolyJet technologies, offering solutions for rapid prototyping and manufacturing across industries.3D Systems Corporation:

Pioneers in the AM space, 3D Systems provides a broad portfolio of 3D printing solutions, ranging from software to material systems, enhancing production capabilities in various sectors.Materialise NV:

With a focus on medical applications, Materialise offers software solutions and services that facilitate the integration of additive manufacturing into healthcare.HP Inc.:

HP has made significant inroads into the additive space, notably with its Multi Jet Fusion technology, aimed at high-speed production for industrial sectors.EOS GmbH:

Specializing in industrial 3D printing systems and materials, EOS focuses on metal and polymer additive manufacturing, contributing to rapid production and mass customization.We're grateful to work with incredible clients.

FAQs

What is the market size of additive Manufacturing And Materials?

The additive manufacturing and materials market is projected to reach $11 billion by 2033, with a compound annual growth rate (CAGR) of 7.8% from 2023 to 2033.

What are the key market players or companies in this additive Manufacturing And Materials industry?

Key players in the additive manufacturing industry include companies like Stratasys, 3D Systems, Materialise, and HP, which lead the market in technology innovations and solutions for various applications.

What are the primary factors driving the growth in the additive Manufacturing And Materials industry?

Growth in the additive manufacturing sector is driven by increased demand for custom products, technological advancements, cost efficiency, and sustainability efforts that prioritize reduced material waste and enhanced production methods.

Which region is the fastest Growing in the additive Manufacturing And Materials?

The fastest-growing region for additive manufacturing from 2023 to 2033 is Europe, projected to expand from $3.41 billion to $7.39 billion, followed closely by North America, attributed to high adoption rates and innovation.

Does ConsaInsights provide customized market report data for the additive Manufacturing And Materials industry?

Yes, ConsaInsights offers customized market reports to cater to specific needs, ensuring a detailed analysis tailored to the additive manufacturing sector's unique challenges and opportunities.

What deliverables can I expect from this additive Manufacturing And Materials market research project?

Expect detailed reports, market analysis, trend forecasts, competitive landscape assessments, and actionable insights tailored for strategic decision-making in additive manufacturing.

What are the market trends of additive Manufacturing And Materials?

Current market trends include increased use of metals and plastics in production, advancements in 3D printing technologies, applications in healthcare, and growing interest in eco-friendly materials and methods.