Additive Masterbatch Market Report

Published Date: 02 February 2026 | Report Code: additive-masterbatch

Additive Masterbatch Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Additive Masterbatch market, covering key insights and trends from 2023 to 2033. It highlights market size, growth rates, industry dynamics, and projections, helping stakeholders make informed decisions in this evolving landscape.

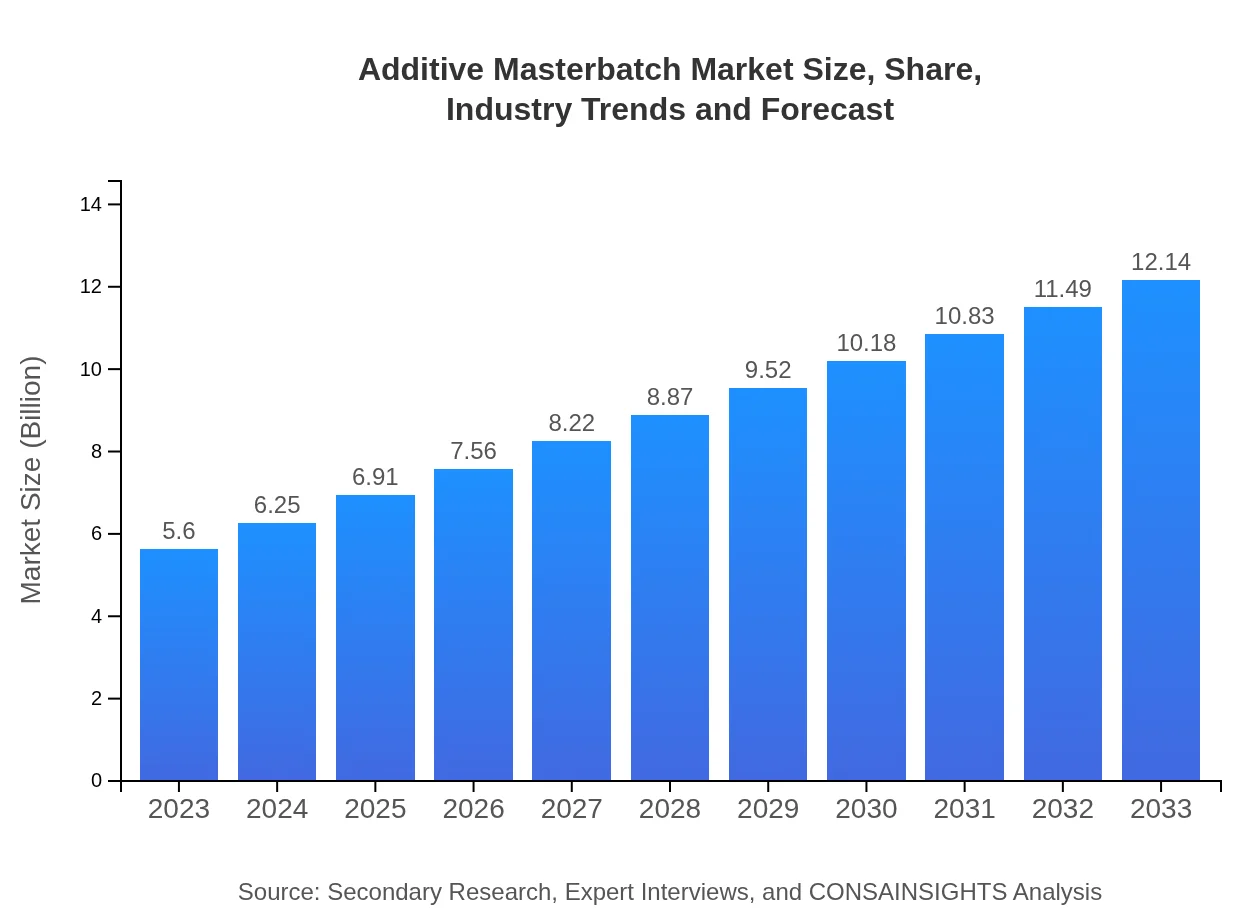

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | BASF, Clariant, AMPACET Corporation, LyondellBasell, PolyOne Corporation |

| Last Modified Date | 02 February 2026 |

Additive Masterbatch Market Overview

Customize Additive Masterbatch Market Report market research report

- ✔ Get in-depth analysis of Additive Masterbatch market size, growth, and forecasts.

- ✔ Understand Additive Masterbatch's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Additive Masterbatch

What is the Market Size & CAGR of Additive Masterbatch market in 2023?

Additive Masterbatch Industry Analysis

Additive Masterbatch Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Additive Masterbatch Market Analysis Report by Region

Europe Additive Masterbatch Market Report:

The European market is set to grow from $1.78 billion in 2023 to $3.85 billion by 2033. Sustainable solutions and regulatory measures promoting eco-friendly materials are driving the demand for additive masterbatches in various industries including packaging, automotive, and construction.Asia Pacific Additive Masterbatch Market Report:

The Asia Pacific region is anticipated to dominate the Additive Masterbatch market, valued at $0.90 billion in 2023 and projected to grow to $1.95 billion by 2033. The growth is fueled by increasing industrial production in countries like China and India and rising consumer demand for coated materials in packaging and automotive applications.North America Additive Masterbatch Market Report:

North America is expected to witness significant growth, with the market size projected to rise from $2.12 billion in 2023 to $4.60 billion by 2033. The region benefits from a robust manufacturing sector and increased adoption of advanced materials in applications such as consumer goods and electronics.South America Additive Masterbatch Market Report:

In South America, the market is projected to increase from $0.12 billion in 2023 to $0.26 billion by 2033, buoyed by enhancements in manufacturing and rising compliance with international quality standards, creating opportunities for growth in the Additive Masterbatch sector.Middle East & Africa Additive Masterbatch Market Report:

The Middle East and Africa region is projected to grow from $0.68 billion in 2023 to $1.48 billion by 2033. Factors such as increasing investment in the production of plastics and growing demand for performance materials are expected to boost market growth.Tell us your focus area and get a customized research report.

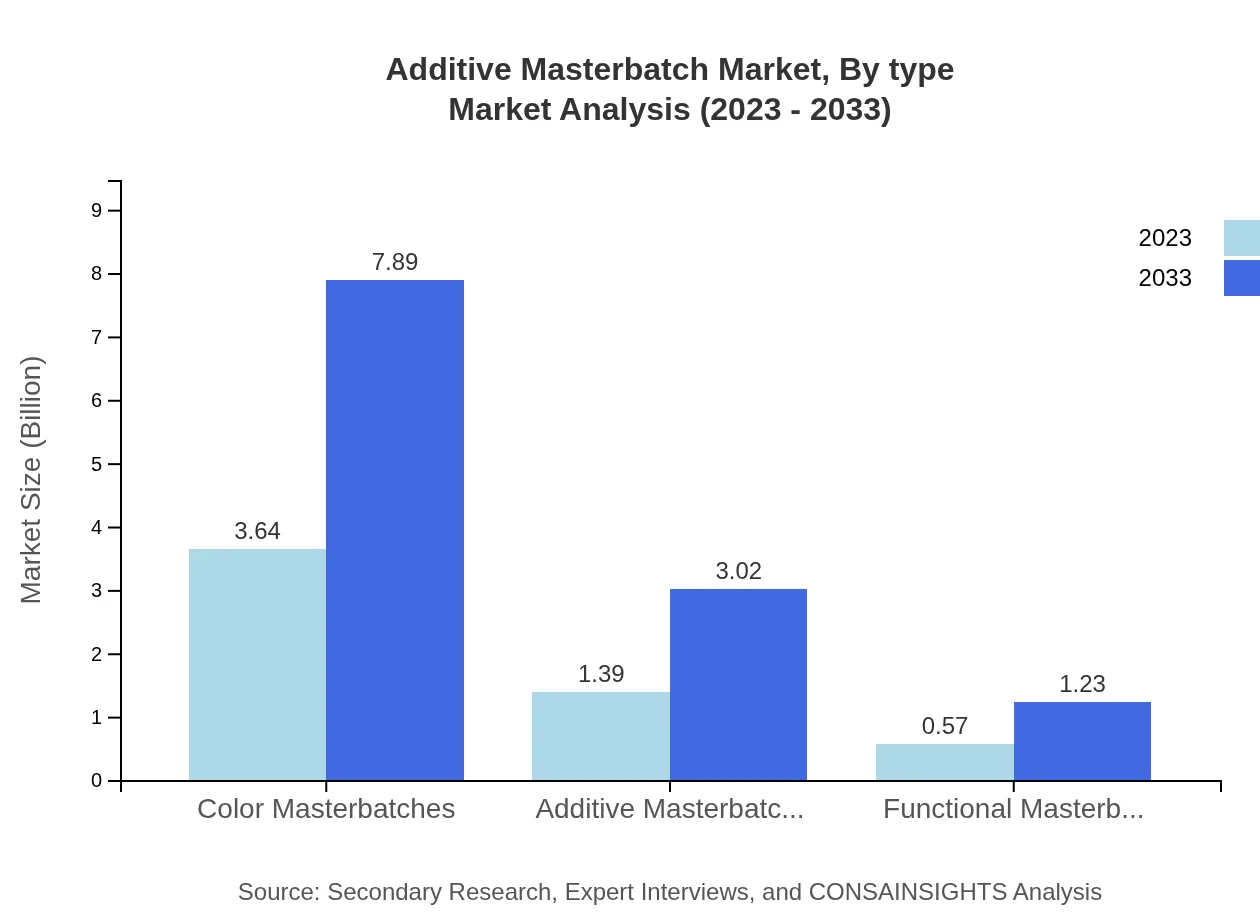

Additive Masterbatch Market Analysis By Type

The Additive Masterbatch market is primarily categorized into Color Masterbatches and Functional Masterbatches. Color Masterbatches have a significant market size of $3.64 billion in 2023, expected to grow to $7.89 billion by 2033, maintaining 65% market share. Functional Masterbatches account for approximately $0.57 billion in 2023, growing to $1.23 billion by 2033, holding a 10.11% market share.

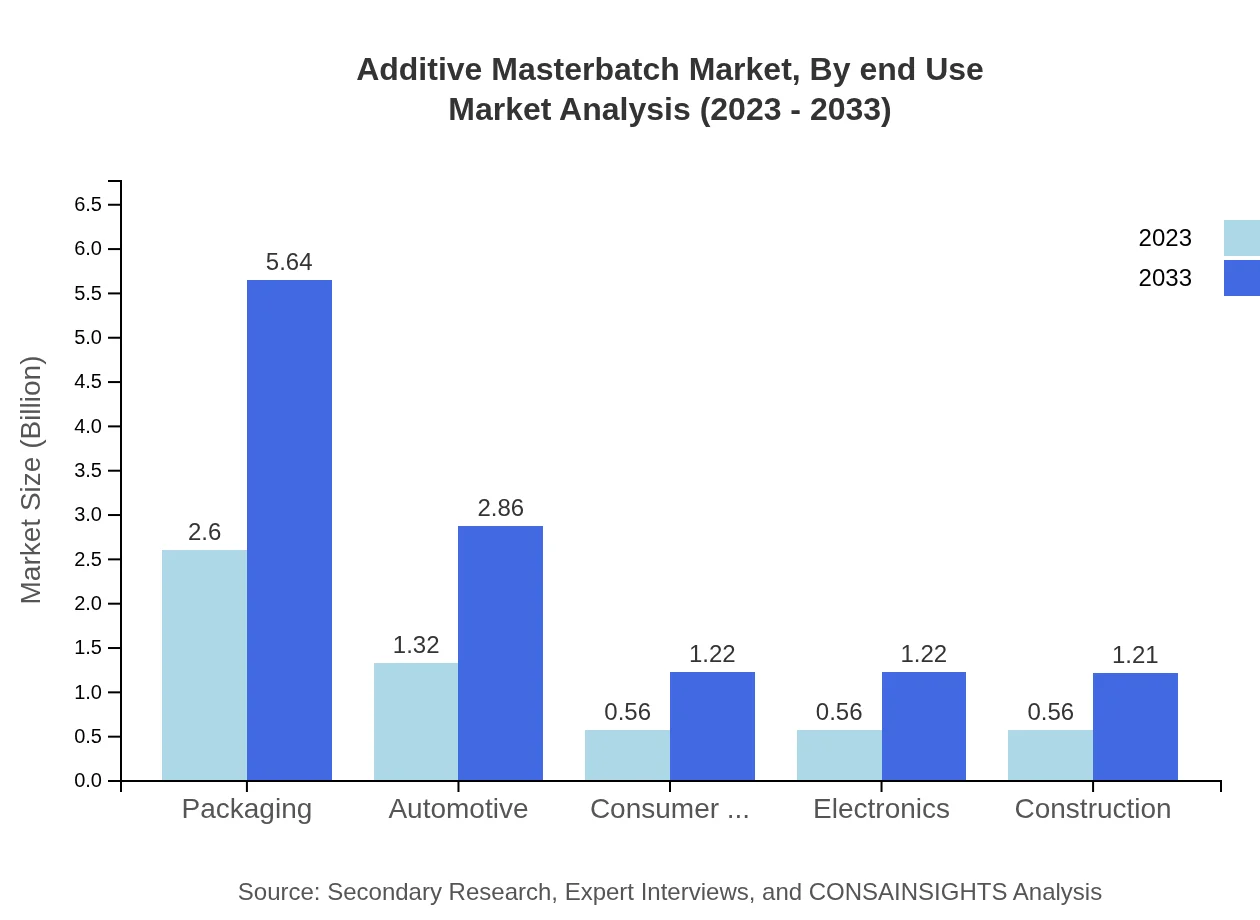

Additive Masterbatch Market Analysis By End Use

Key end-use industries for Additive Masterbatces include Packaging, Automotive, Consumer Goods, and Electronics. Packaging leads with a market size of $2.60 billion in 2023 and growing to $5.64 billion by 2033, accounting for approximately 46.43% of the market share. The automotive sector represents a market of $1.32 billion in 2023, projected to grow to $2.86 billion by 2033, with a consistent market share of 23.53%.

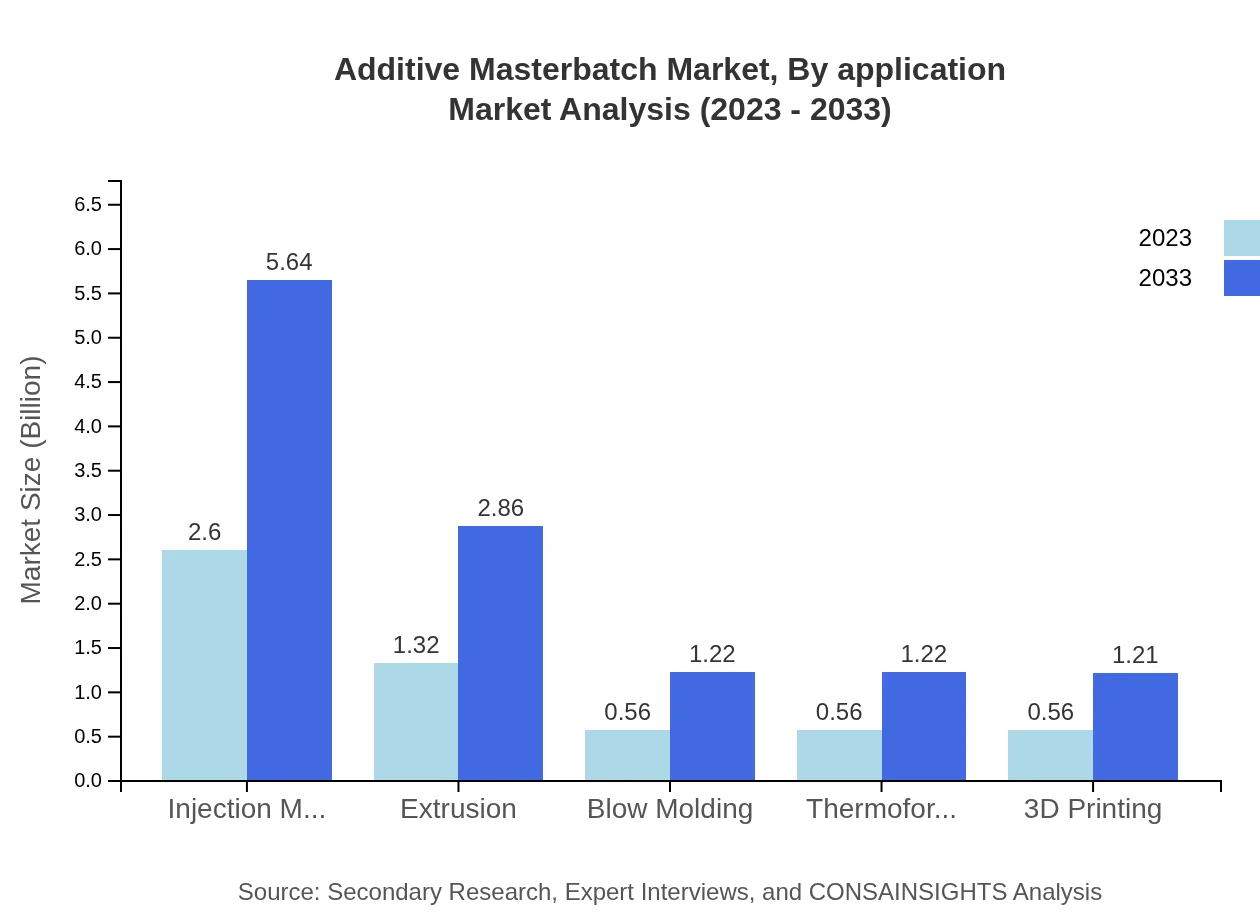

Additive Masterbatch Market Analysis By Application

The most significant applications for Additive Masterbatches include Injection Molding, Extrusion, and Blow Molding. Injection Molding, with a share of 46.43%, is valued at $2.60 billion in 2023, projected to grow to $5.64 billion by 2033. Extrusion is expected to grow from $1.32 billion in 2023 to $2.86 billion by 2033, maintaining a market share of 23.53%.

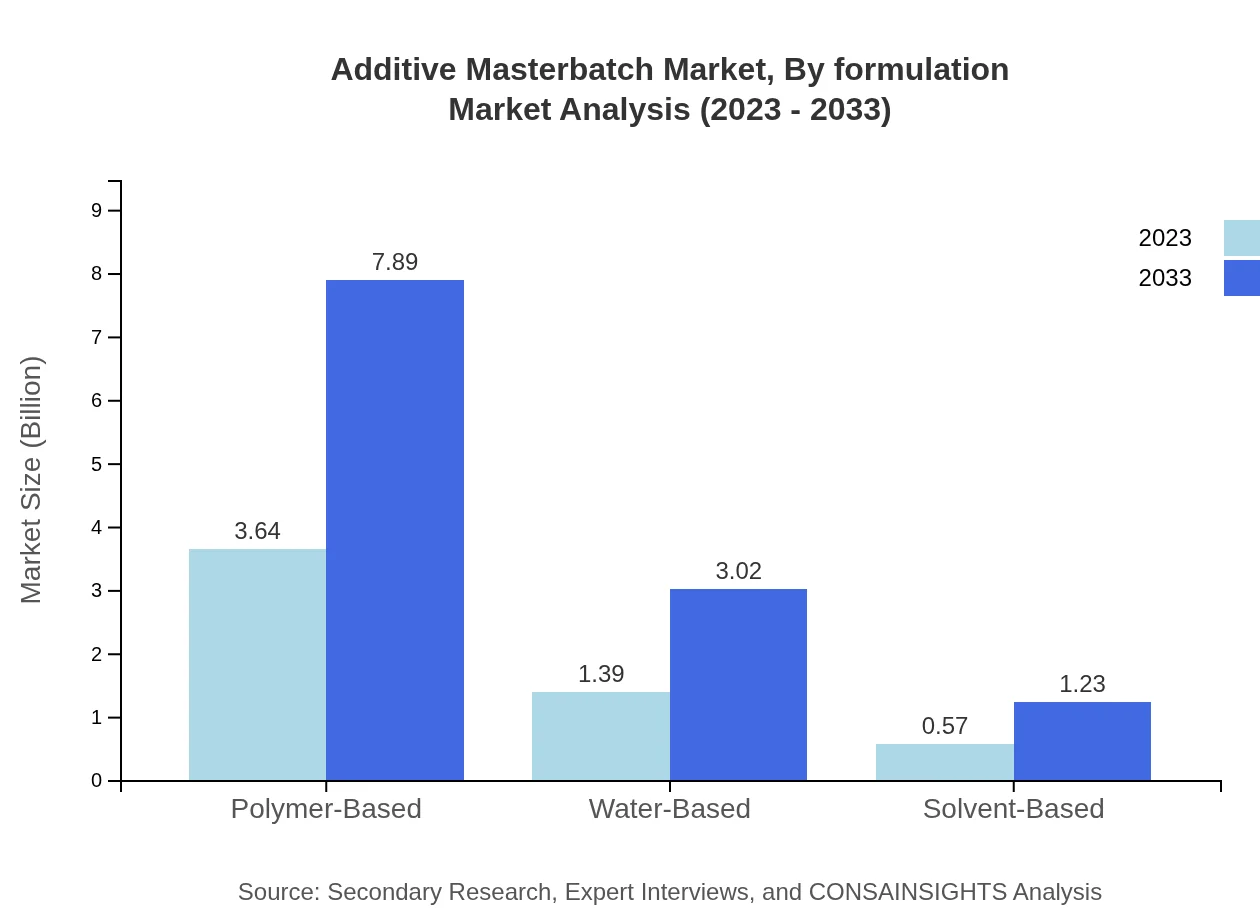

Additive Masterbatch Market Analysis By Formulation

The market is segmented into Polymer-Based, Water-Based, and Solvent-Based formulations. Polymer-based masterbatches dominate the market with $3.64 billion in 2023, and they are expected to grow to $7.89 billion by 2033, representing 65% of the market. Water-Based formulations contribute $1.39 billion, forecasting an increase to $3.02 billion by 2033.

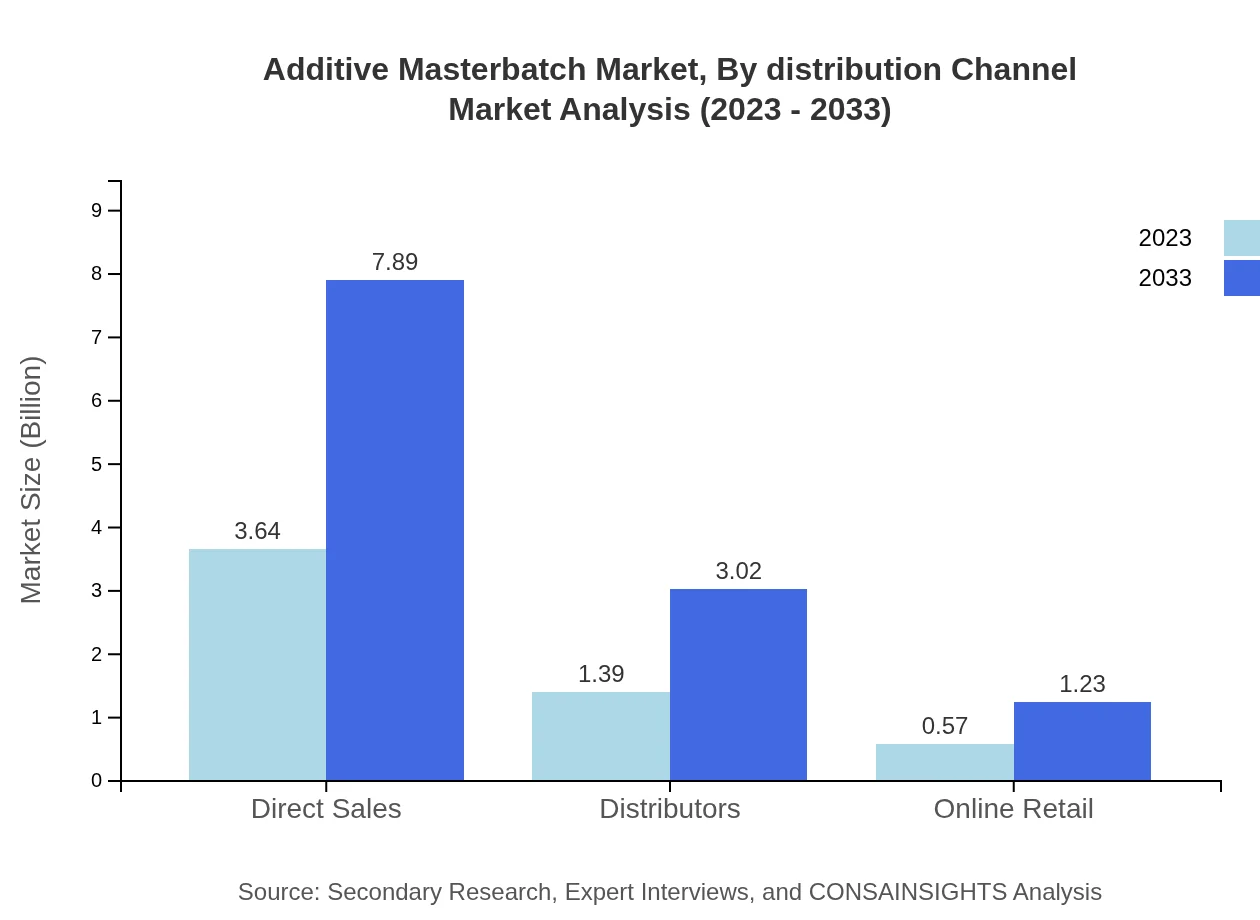

Additive Masterbatch Market Analysis By Distribution Channel

Distribution channels are categorized into Direct Sales, Distributors, and Online Retail. Direct Sales lead with $3.64 billion in 2023, expected to double by 2033, while Distributors account for $1.39 billion currently, projected to reach $3.02 billion. Online Retail contributes a smaller segment of the market, valued at $0.57 billion but showing promising growth.

Additive Masterbatch Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Additive Masterbatch Industry

BASF:

BASF is a leading global chemical producer with a robust portfolio in masterbatch solutions, focusing on innovation and sustainability in the polymer industry.Clariant:

Clariant specializes in specialty chemicals and offers a wide range of additive masterbatches that cater to various sectors with high-performance solutions.AMPACET Corporation:

AMPACET is a recognized leader in the manufacture of color and additive masterbatches, renowned for its strong commitment to customer service and quality.LyondellBasell:

LyondellBasell is a prominent player recognized for its high-quality plastic resins and advanced additive masterbatch solutions tailored to diverse industrial applications.PolyOne Corporation:

PolyOne provides a wide array of advanced polymer solutions, including tailor-made masterbatch products designed to enhance the properties of plastics.We're grateful to work with incredible clients.

FAQs

What is the market size of additive Masterbatch?

The global additive masterbatch market is projected to grow from a size of $5.6 billion in 2023, with a notable CAGR of 7.8% throughout the forecast period, expected to reach approximately $10.10 billion by 2033.

What are the key market players or companies in this additive Masterbatch industry?

Key players in the additive masterbatch industry include industry leaders such as A. Schulman, Clariant, and Ampacet, which dominate the market with innovative product offerings and extensive distribution networks.

What are the primary factors driving the growth in the additive Masterbatch industry?

The growth in the additive masterbatch industry is driven by the increasing demand for high-quality plastics in the packaging, automotive, and consumer goods sectors, alongside technological advancements in manufacturing processes.

Which region is the fastest Growing in the additive Masterbatch?

The Asia-Pacific region is the fastest-growing market for additive masterbatches, anticipated to expand from $0.90 billion in 2023 to $1.95 billion by 2033, influenced by rapid industrialization and rising plastic consumption.

Does ConsaInsights provide customized market report data for the additive Masterbatch industry?

Yes, ConsaInsights offers customized market report data specific to the additive masterbatch industry, catering to unique client needs by providing detailed insights and analysis tailored to different market segments.

What deliverables can I expect from this additive Masterbatch market research project?

From the additive masterbatch market research project, clients can expect comprehensive deliverables including market size analysis, competitive landscape insights, buyer personas, trend analysis, and tailored strategic recommendations.

What are the market trends of additive Masterbatch?

Current trends in the additive masterbatch market include a growing focus on eco-friendly materials, increased investment in R&D for innovative formulations, and rising demand for color and functional masterbatches across various industries.