Adhesive Composite And Coating Epoxy Market Report

Published Date: 02 February 2026 | Report Code: adhesive-composite-and-coating-epoxy

Adhesive Composite And Coating Epoxy Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Adhesive Composite and Coating Epoxy market from 2023 to 2033. It includes detailed insights on market trends, segmentation, regional analysis, and projections for growth, equipping stakeholders with the necessary data for strategic planning.

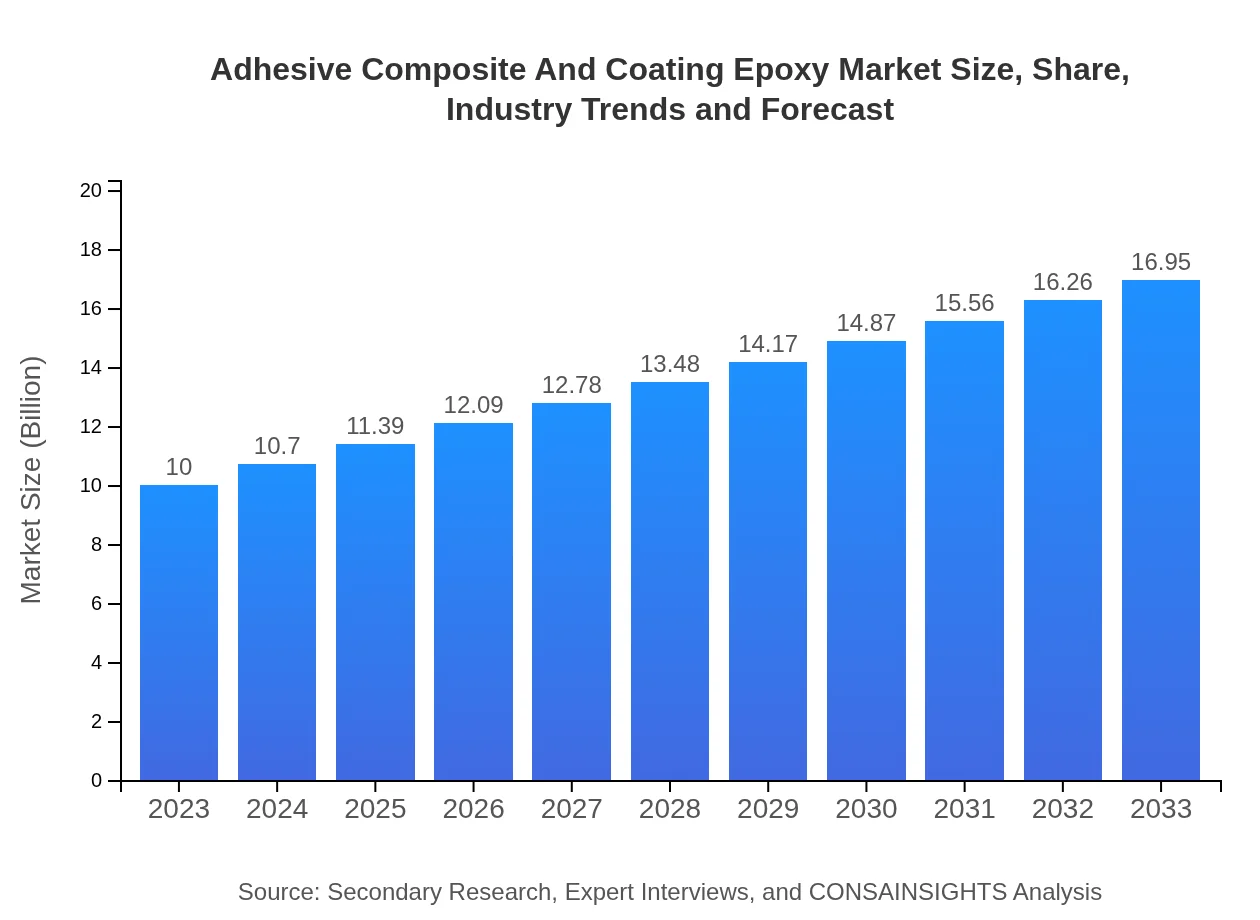

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $16.95 Billion |

| Top Companies | Henkel AG & Co. KGaA, Huntsman Corporation, 3M Company, BASF SE |

| Last Modified Date | 02 February 2026 |

Adhesive Composite And Coating Epoxy Market Overview

Customize Adhesive Composite And Coating Epoxy Market Report market research report

- ✔ Get in-depth analysis of Adhesive Composite And Coating Epoxy market size, growth, and forecasts.

- ✔ Understand Adhesive Composite And Coating Epoxy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Adhesive Composite And Coating Epoxy

What is the Market Size & CAGR of Adhesive Composite And Coating Epoxy market in 2023?

Adhesive Composite And Coating Epoxy Industry Analysis

Adhesive Composite And Coating Epoxy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Adhesive Composite And Coating Epoxy Market Analysis Report by Region

Europe Adhesive Composite And Coating Epoxy Market Report:

Europe is set to experience notable market growth from 3.00 billion USD in 2023 to 5.08 billion USD by 2033. The demand for advanced adhesive systems powered by high-performance properties caters to diverse industries including aerospace and automotive. Furthermore, the emphasis on sustainable practices across the continent fosters demand for eco-friendly products.Asia Pacific Adhesive Composite And Coating Epoxy Market Report:

The Asia Pacific region is projected to witness substantial growth, with the market anticipated to rise from 1.90 billion USD in 2023 to 3.22 billion USD by 2033. Rapid industrialization, increased construction activities, and burgeoning automotive production are key factors driving this growth. Countries such as China and India are leading the charge with expansion in infrastructure and manufacturing capabilities.North America Adhesive Composite And Coating Epoxy Market Report:

North America shows promising growth, with market size expected to rise from 3.90 billion USD in 2023 to 6.61 billion USD by 2033. The region is characterized by strong manufacturing sectors and high demand for advanced adhesive technologies in automotive, aerospace, and construction. Innovations in product offerings will further stimulate growth in this region.South America Adhesive Composite And Coating Epoxy Market Report:

In South America, the Adhesive Composite and Coating Epoxy market is set to grow from 0.35 billion USD in 2023 to 0.59 billion USD by 2033. Its growth is attributed to rising investment in infrastructure development and an increasing trend in eco-friendly adhesives due to environmental regulations, particularly in countries like Brazil and Argentina.Middle East & Africa Adhesive Composite And Coating Epoxy Market Report:

In the Middle East and Africa, the market for Adhesive Composite and Coating Epoxy is projected to increase from 0.86 billion USD in 2023 to 1.46 billion USD by 2033. This growth is powered by the expansion of construction and manufacturing industries, particularly in the UAE and South Africa, where initiatives are being taken to develop infrastructure.Tell us your focus area and get a customized research report.

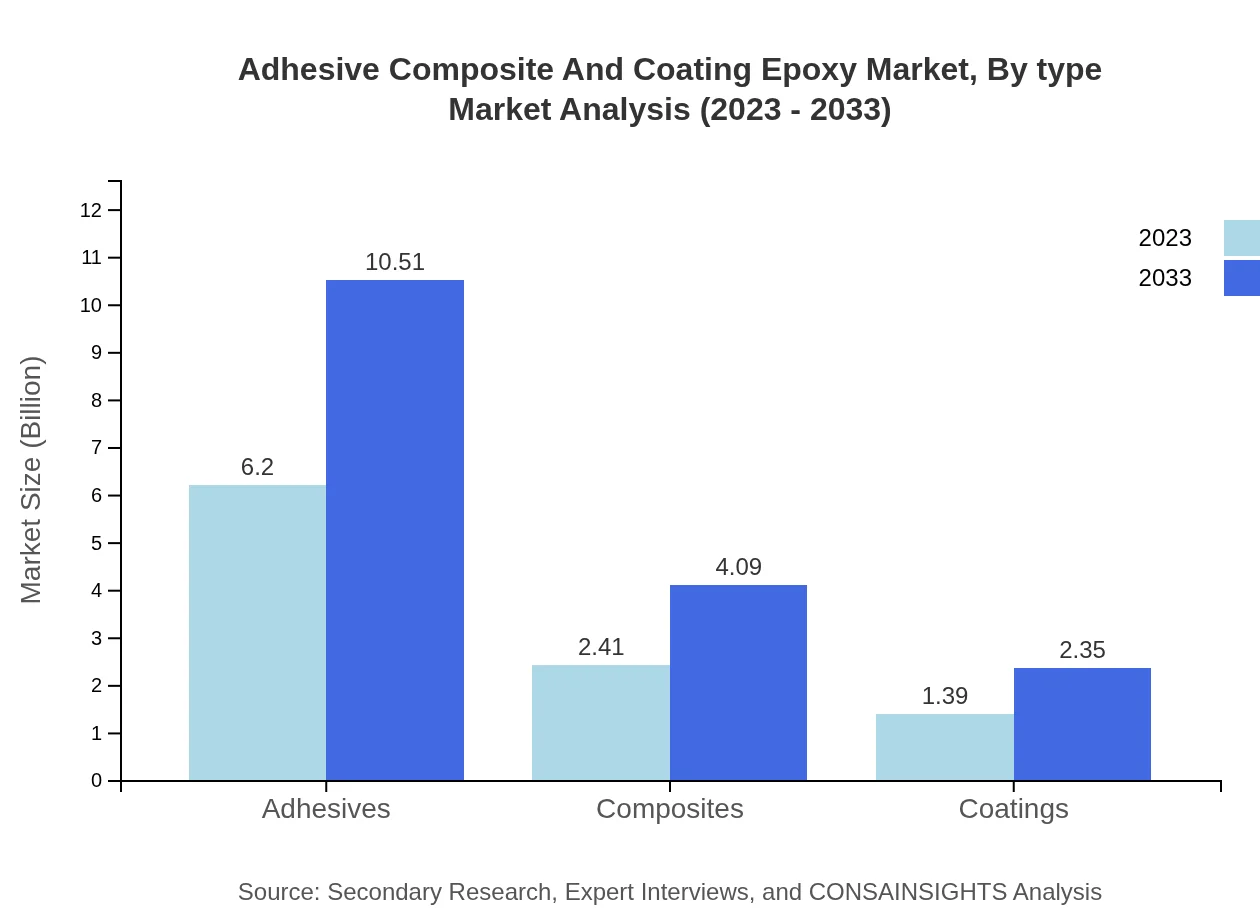

Adhesive Composite And Coating Epoxy Market Analysis By Type

The by-type segmentation shows a firm market share for Adhesives, contributing 6.20 billion USD in 2023, with projections to reach 10.51 billion USD by 2033, reflecting a stable market share of 62%. Composites are also on the rise, expanding from 2.41 billion USD in 2023 to 4.09 billion USD by 2033, maintaining a 24.14% market share. Coatings, while smaller, will grow from 1.39 billion USD to 2.35 billion USD, sustaining a 13.86% share through the forecast period.

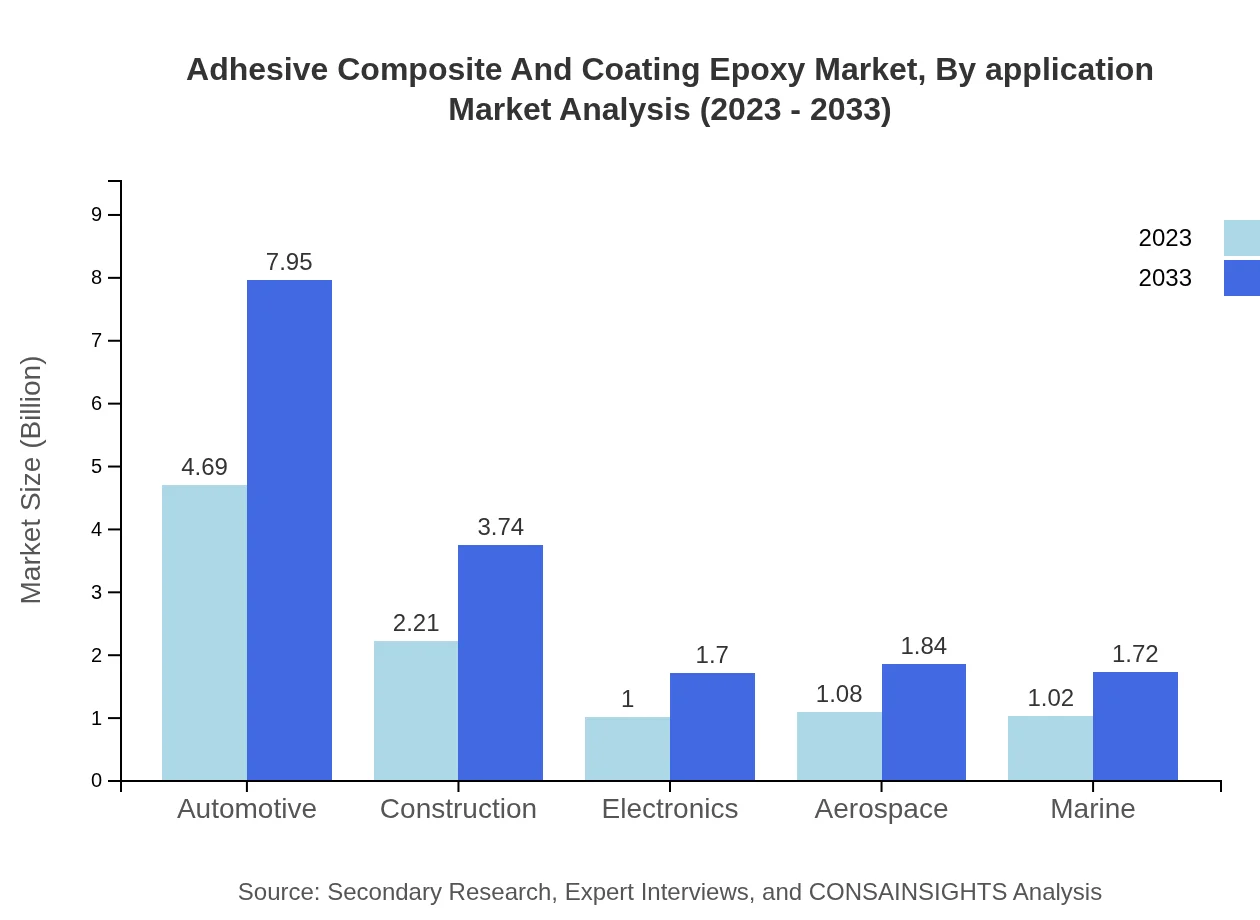

Adhesive Composite And Coating Epoxy Market Analysis By Application

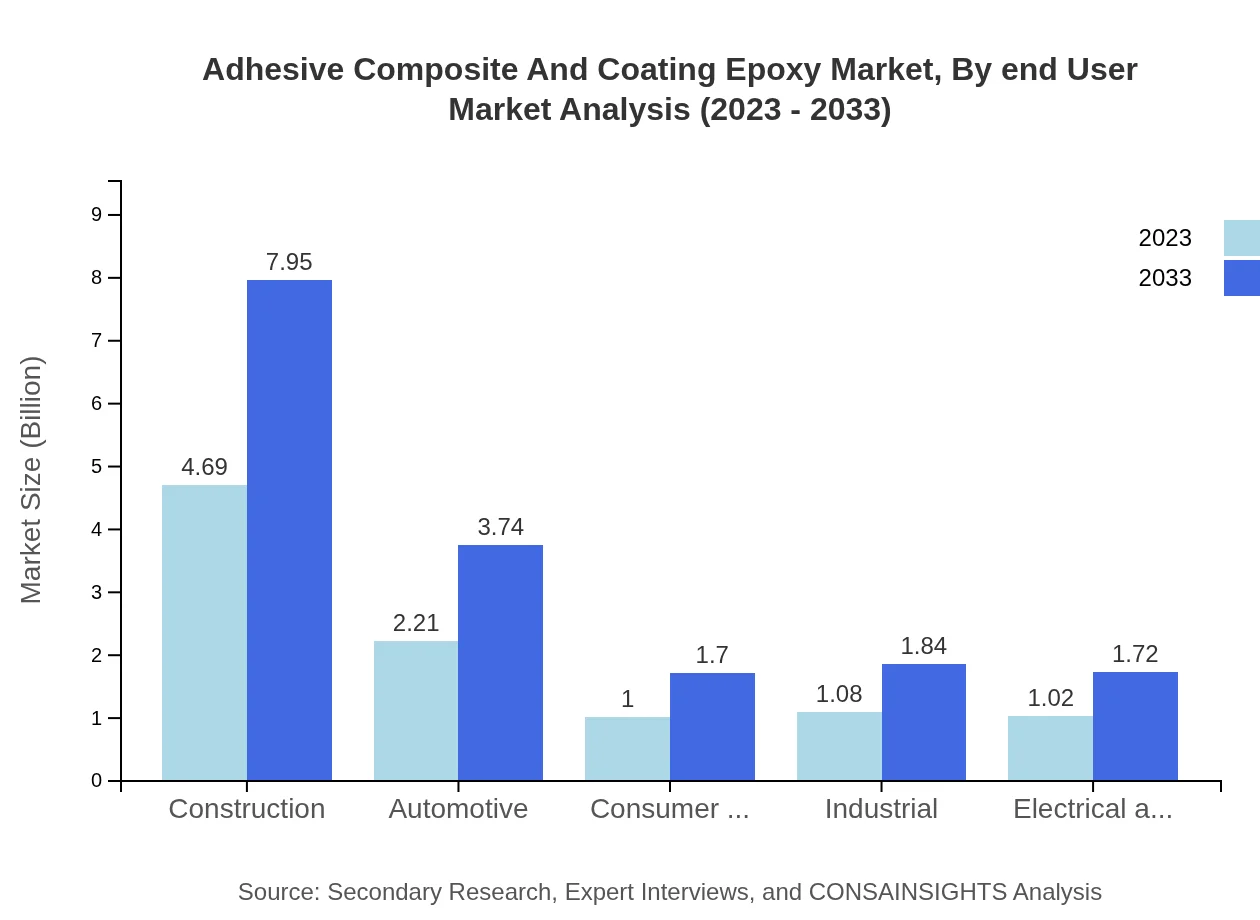

In terms of application, the construction sector dominates, valued at 4.69 billion USD in 2023 and expected to reach 7.95 billion USD by 2033, with a constant 46.88% market share. The automotive sector contributes significantly as well, projected to grow from 2.21 billion USD in 2023 to 3.74 billion USD by 2033, retaining 22.08% of the market share. Other key applications include consumer goods, electronics, and aerospace.

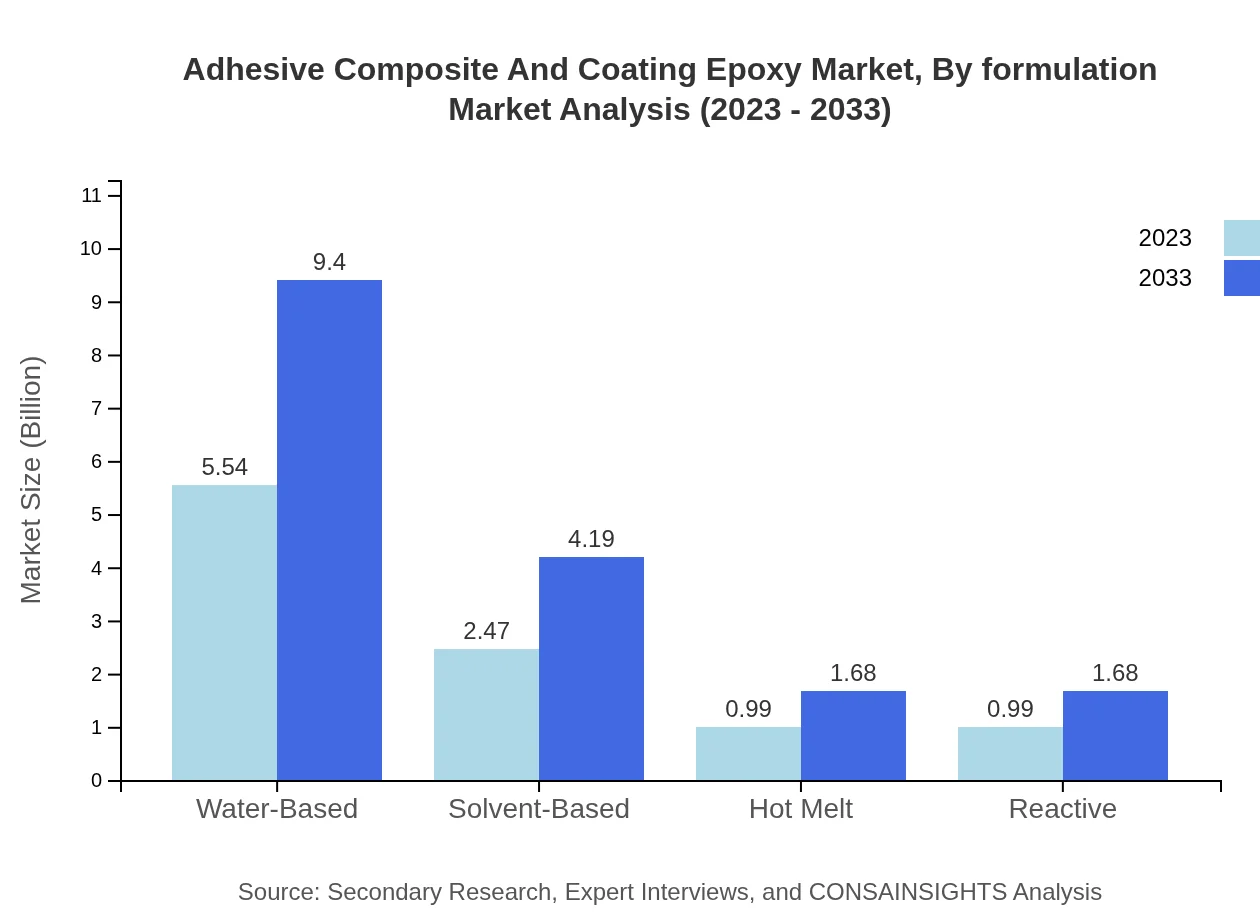

Adhesive Composite And Coating Epoxy Market Analysis By Formulation

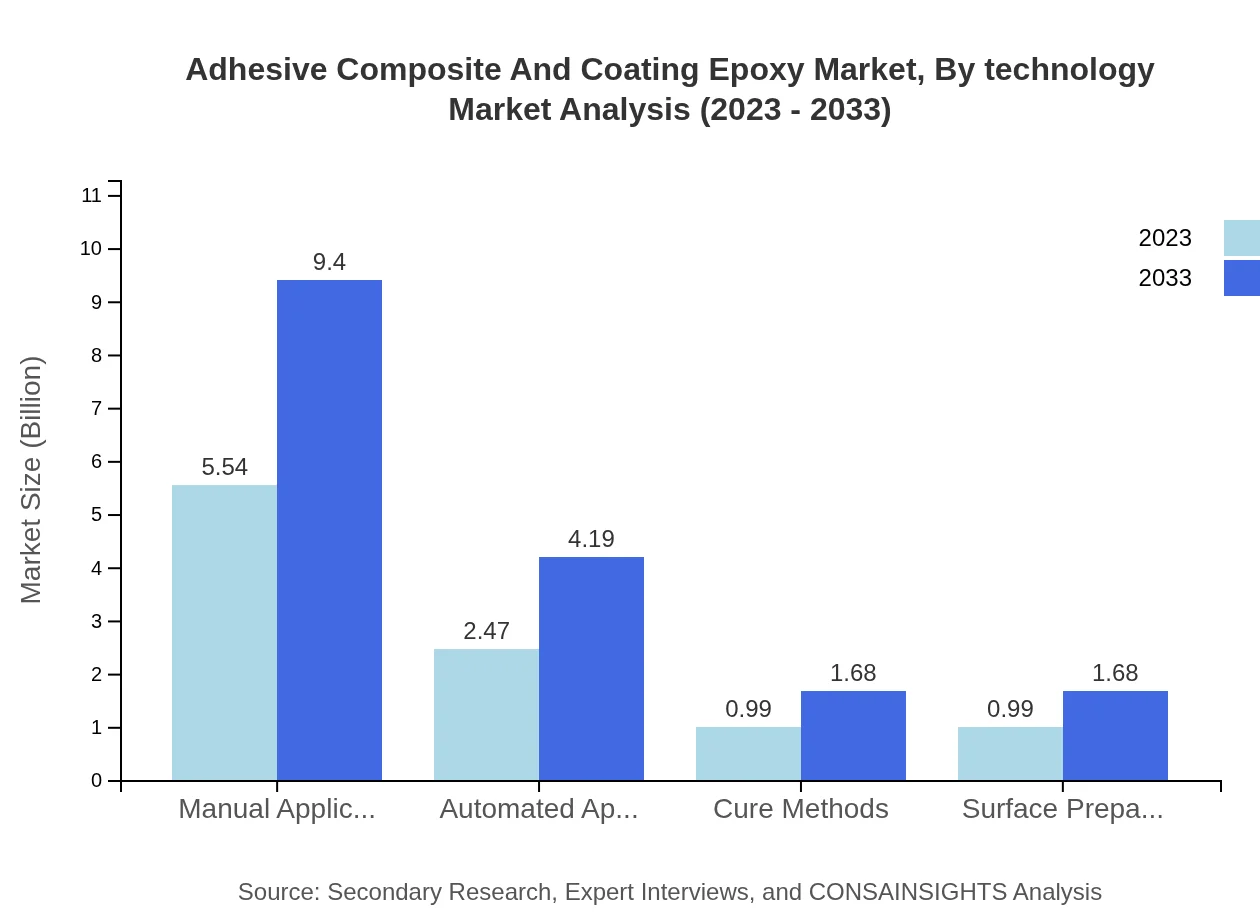

The formulation analysis indicates that Water-Based systems prominently lead the market with 55.42% share, growing from 5.54 billion USD in 2023 to 9.40 billion USD by 2033. Solvent-Based formulations are valued at 2.47 billion USD in 2023 and are expected to reach 4.19 billion USD by 2033, maintaining a 24.73% share, while Hot Melt formulations occupy 9.93% of the market, anticipated to grow steadily.

Adhesive Composite And Coating Epoxy Market Analysis By End User

Within the end-user industries, the construction sector holds the largest market share at 46.88%, valued at 4.69 billion USD in 2023 and expected to grow to 7.95 billion USD by 2033. Automotive and industrial applications also contribute significantly, with shares of 22.08% and 10.85% respectively, driven by demand for lightweight and high-strength materials.

Adhesive Composite And Coating Epoxy Market Analysis By Technology

Advancements in application technologies—specifically Manual and Automated Applications—show a significant inclination for Manual with a 55.42% market share, progressing from 5.54 billion USD to 9.40 billion USD by 2033. Automated Applications are similarly growing, currently valued at 2.47 billion USD and expected to rise to 4.19 billion USD by the end of the forecast period.

Adhesive Composite And Coating Epoxy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Adhesive Composite And Coating Epoxy Industry

Henkel AG & Co. KGaA:

A multinational company specializing in adhesives and sealants, Henkel is known for its commitment to innovation and sustainability in epoxy technologies.Huntsman Corporation:

A global leader in differentiated chemicals, Huntsman specializes in advanced epoxy composites, focusing on high-performance applications in automotive and aerospace.3M Company:

3M engages in developing a wide range of adhesive technologies, including epoxy solutions tailored for diverse industrial applications.BASF SE:

As one of the largest chemical producers globally, BASF offers a comprehensive portfolio of epoxy products that cater to the demanding needs across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of adhesive Composite And Coating Epoxy?

The global adhesive-composite-and-coating-epoxy market is valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of 5.3%, potentially reaching new heights by 2033.

What are the key market players or companies in this adhesive Composite And Coating Epoxy industry?

Key players in the adhesive-composite-and-coating-epoxy industry include major manufacturers known for their innovation and product offerings, catering to sectors like automotive, construction, and consumer goods. Their contributions are pivotal to market dynamics.

What are the primary factors driving the growth in the adhesive Composite And Coating Epoxy industry?

The growth in the adhesive-composite-and-coating-epoxy industry is driven by rising demand for advanced materials in construction and automotive sectors, increased focus on durability, and advancements in adhesive technologies enhancing performance and sustainability.

Which region is the fastest Growing in the adhesive Composite And Coating Epoxy?

The fastest-growing region in the adhesive-composite-and-coating-epoxy market is projected to be North America, with a market size increasing from $3.90 billion in 2023 to $6.61 billion by 2033, reflecting robust growth and demand.

Does ConsaInsights provide customized market report data for the adhesive Composite And Coating Epoxy industry?

Yes, ConsaInsights offers customized market report data for the adhesive-composite-and-coating-epoxy industry, allowing clients to gain tailored insights based on specific needs and regional analyses.

What deliverables can I expect from this adhesive Composite And Coating Epoxy market research project?

Deliverables from the adhesive-composite-and-coating-epoxy market research project include comprehensive market analysis reports, segment data, growth forecasts, and strategic insights tailored to industry trends and market dynamics.

What are the market trends of adhesive Composite And Coating Epoxy?

Market trends in the adhesive-composite-and-coating-epoxy sector include increasing adoption of eco-friendly products, innovations in epoxy formulations, and widening applications across industries such as automotive and aerospace, aligning with sustainability goals.