Adhesives And Sealants Distribution Market Report

Published Date: 02 February 2026 | Report Code: adhesives-and-sealants-distribution

Adhesives And Sealants Distribution Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the Adhesives and Sealants Distribution market, offering insights into market trends, growth forecasts from 2023 to 2033, and a detailed analysis of regional and segment-specific performance.

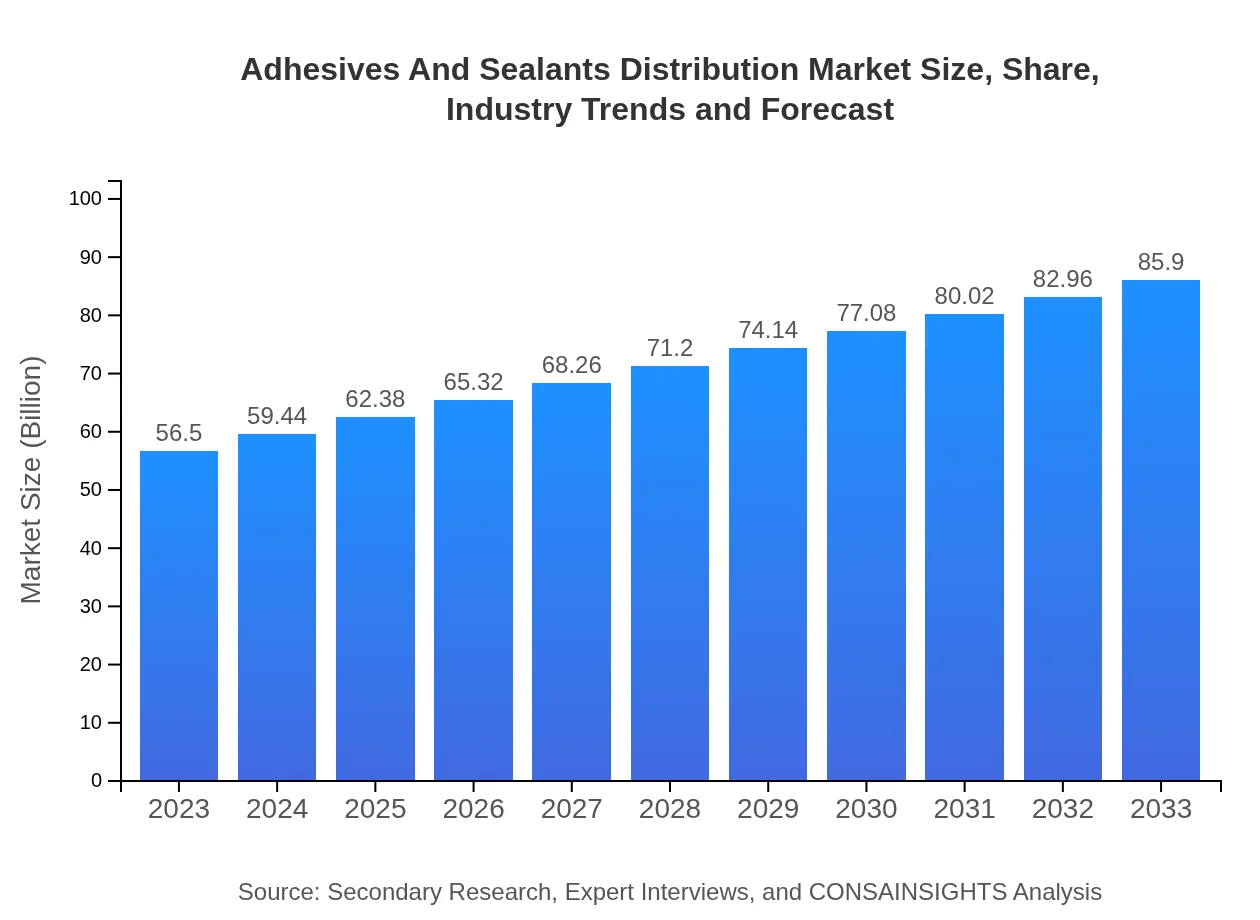

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $56.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $85.90 Billion |

| Top Companies | Henkel AG, 3M Company, BASF SE, Dow Inc. |

| Last Modified Date | 02 February 2026 |

Adhesives And Sealants Distribution Market Overview

Customize Adhesives And Sealants Distribution Market Report market research report

- ✔ Get in-depth analysis of Adhesives And Sealants Distribution market size, growth, and forecasts.

- ✔ Understand Adhesives And Sealants Distribution's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Adhesives And Sealants Distribution

What is the Market Size & CAGR of Adhesives And Sealants Distribution market in 2023?

Adhesives And Sealants Distribution Industry Analysis

Adhesives And Sealants Distribution Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Adhesives And Sealants Distribution Market Analysis Report by Region

Europe Adhesives And Sealants Distribution Market Report:

Europe's market, valued at $19.66 billion in 2023, is expected to grow to $29.89 billion by 2033. The presence of key industries and stringent regulations on VOC emissions are likely to increase the demand for water-based adhesives, positively impacting market growth.Asia Pacific Adhesives And Sealants Distribution Market Report:

In 2023, the Adhesives and Sealants Distribution market in the Asia Pacific is estimated at $10.42 billion, projected to grow to $15.84 billion by 2033. Factors driving this growth include rising urbanization, infrastructural developments, and a robust manufacturing sector fueling demand for adhesives in various applications.North America Adhesives And Sealants Distribution Market Report:

North America, estimated at $18.91 billion in 2023 and projected to grow to $28.75 billion by 2033, benefits from high demand in the automotive and construction sectors. Innovations in product formulations and a growing emphasis on sustainability are also shaping market evolution in this region.South America Adhesives And Sealants Distribution Market Report:

The market in South America is initially valued at $2.01 billion in 2023, expected to reach $3.06 billion by 2033. Growth is supported by increasing construction activities and a growing automotive industry, which are anticipated to drive adhesive consumption across various sectors.Middle East & Africa Adhesives And Sealants Distribution Market Report:

The Middle East and Africa market is anticipated to grow from $5.50 billion in 2023 to $8.36 billion by 2033, reflecting the rising construction sector and infrastructural projects, particularly in the GCC countries.Tell us your focus area and get a customized research report.

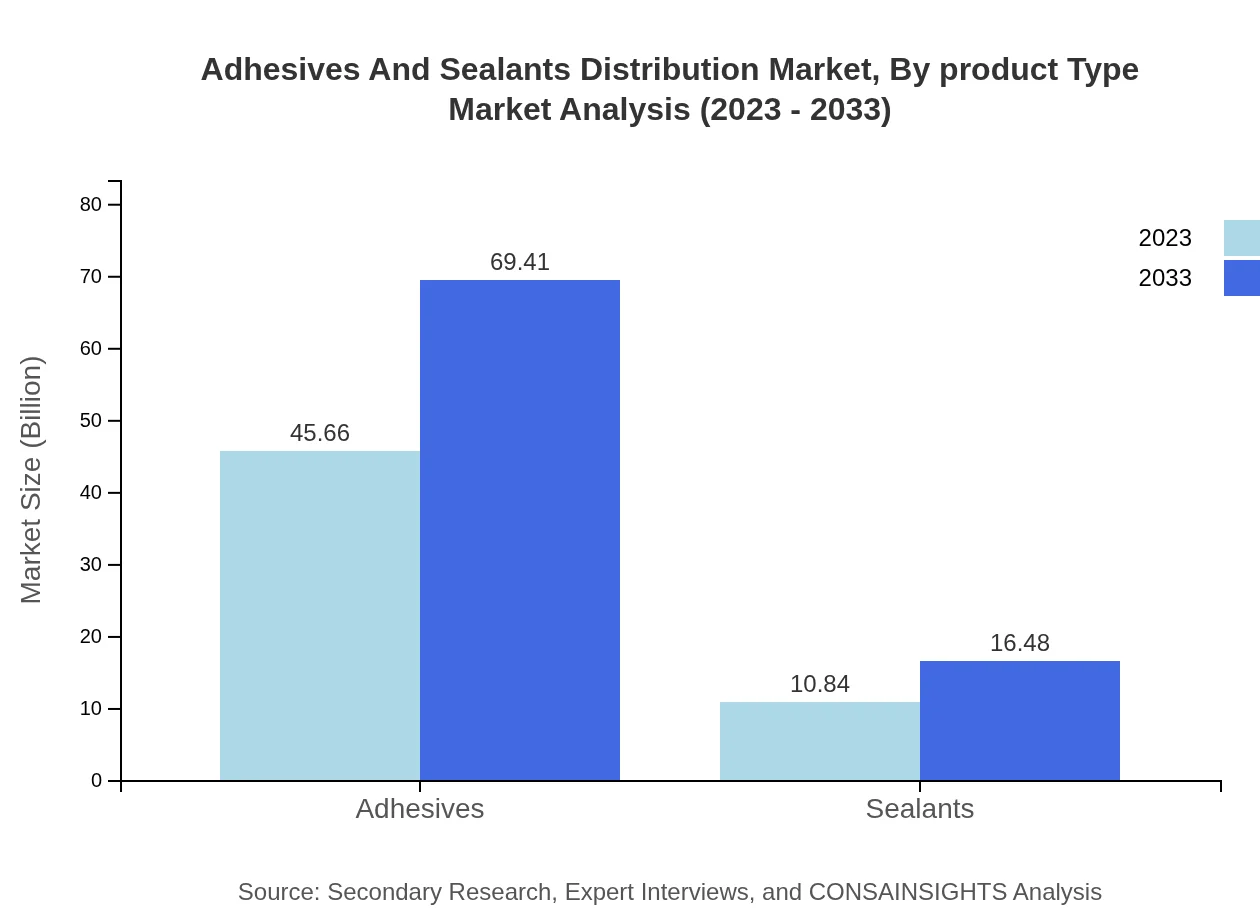

Adhesives And Sealants Distribution Market Analysis By Product Type

The adhesives market is dominated by adhesives, captured at $45.66 billion in 2023 and projected to grow to $69.41 billion by 2033. Sealants represent a smaller share, projected to grow from $10.84 billion to $16.48 billion over the same period. This indicates a strong preference for adhesive products, which are critical for various applications across industries.

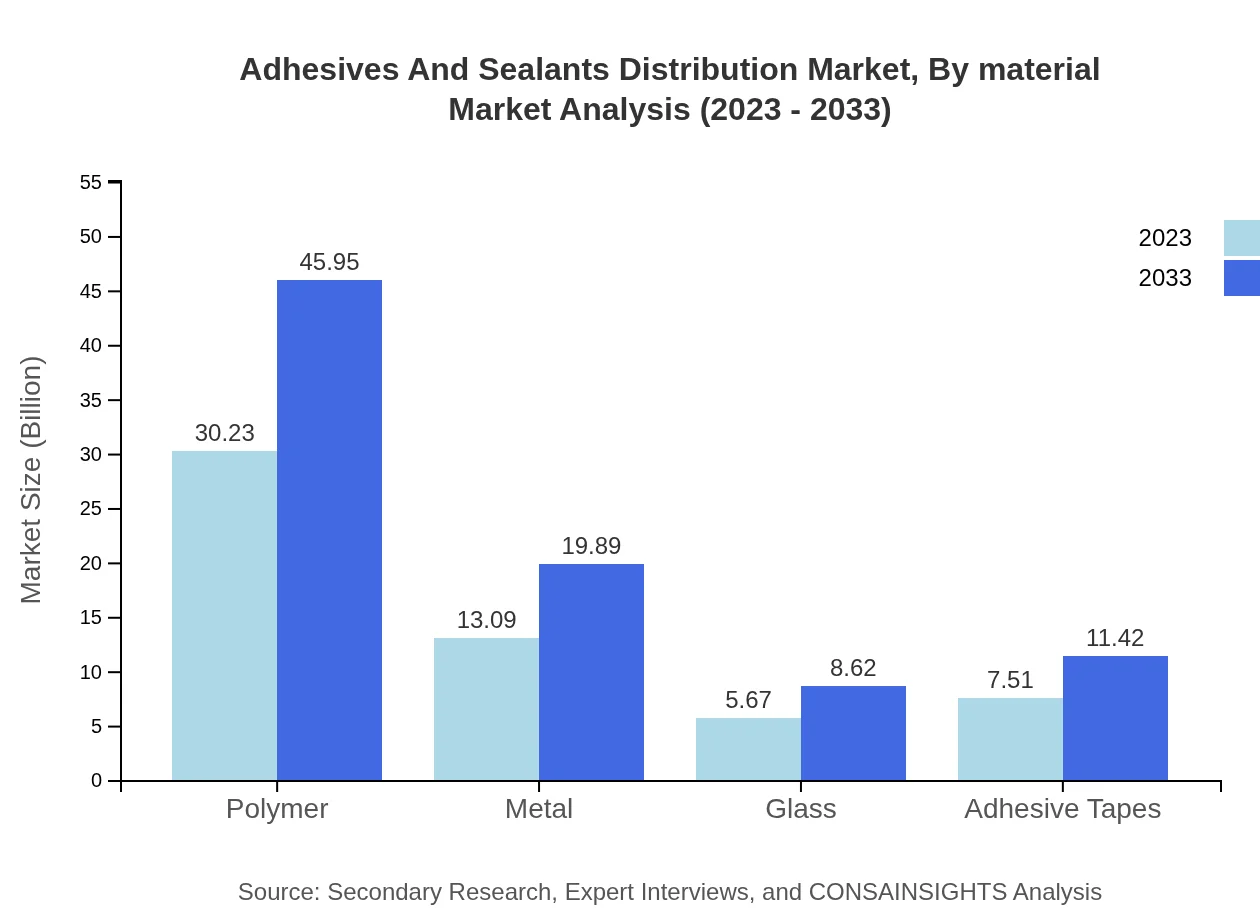

Adhesives And Sealants Distribution Market Analysis By Material

Polymer materials dominate the adhesives and sealants industry due to their versatility and performance characteristics. In 2023, the polymer market is estimated at $30.23 billion and is projected to reach $45.95 billion by 2033. This market segment also reflects the trend toward the development of high-performance polymer adhesives that meet industry-specific requirements.

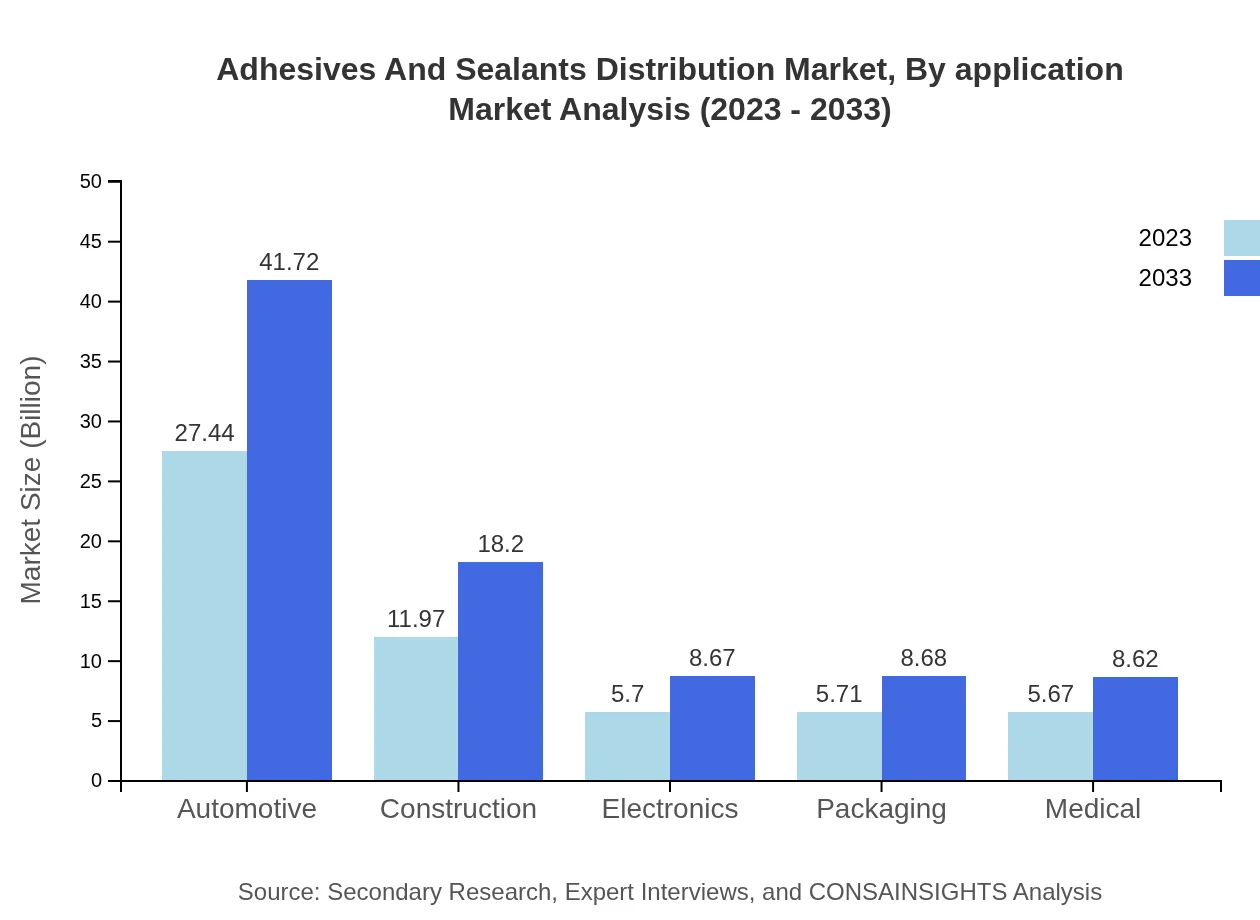

Adhesives And Sealants Distribution Market Analysis By Application

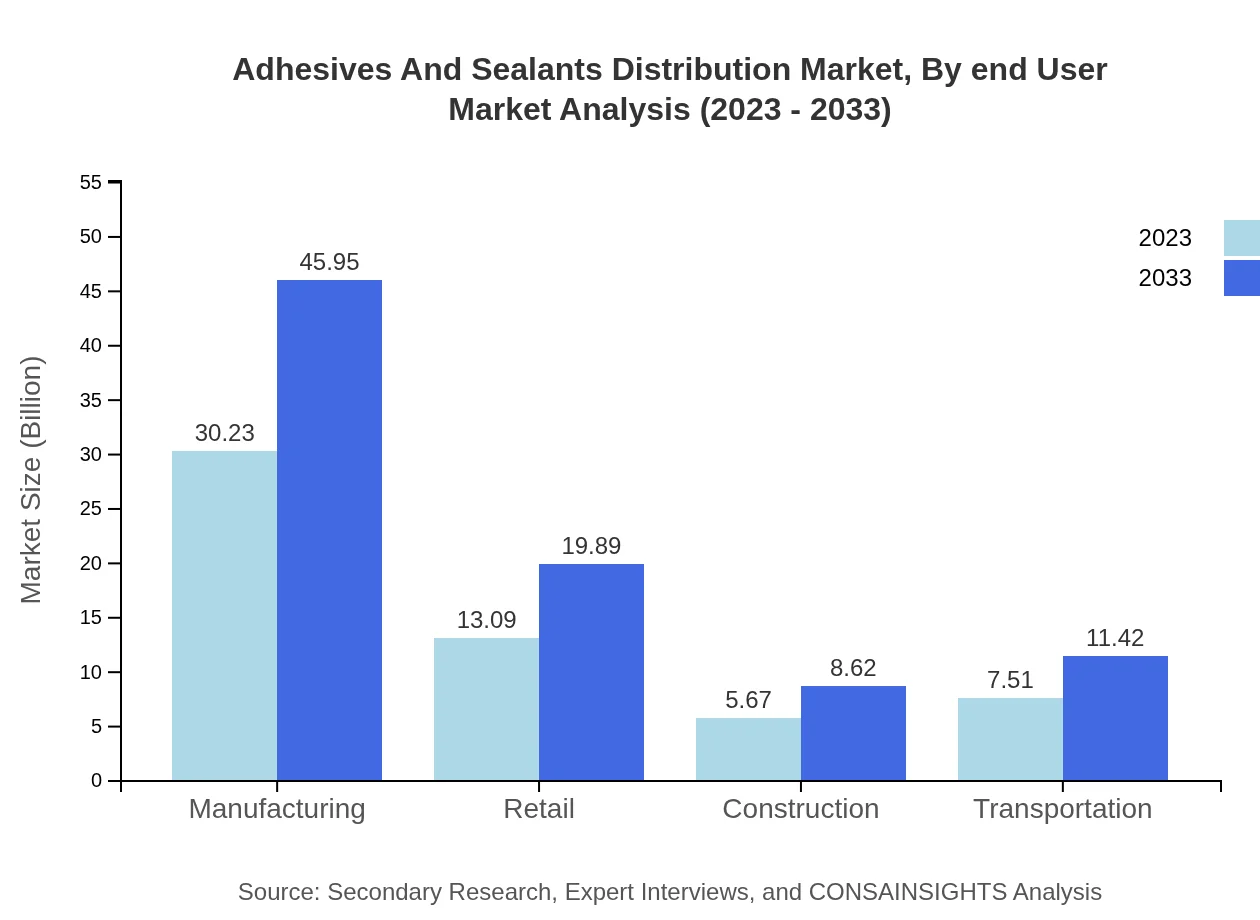

The manufacturing sector significantly influences demand, with a market size of $30.23 billion in 2023, expected to grow to $45.95 billion by 2033. This is followed by sectors like transportation and construction, which have considerable growth potential within the adhesives and sealants distribution framework.

Adhesives And Sealants Distribution Market Analysis By End User

The automotive sector leads the market with a significant share, valued at $27.44 billion in 2023, projected to increase to $41.72 billion by 2033. Other notable end-user segments include construction, electronics, and medical applications which are steadily rising in demand due to innovations and increasing application areas.

Adhesives And Sealants Distribution Market Analysis By Formulation

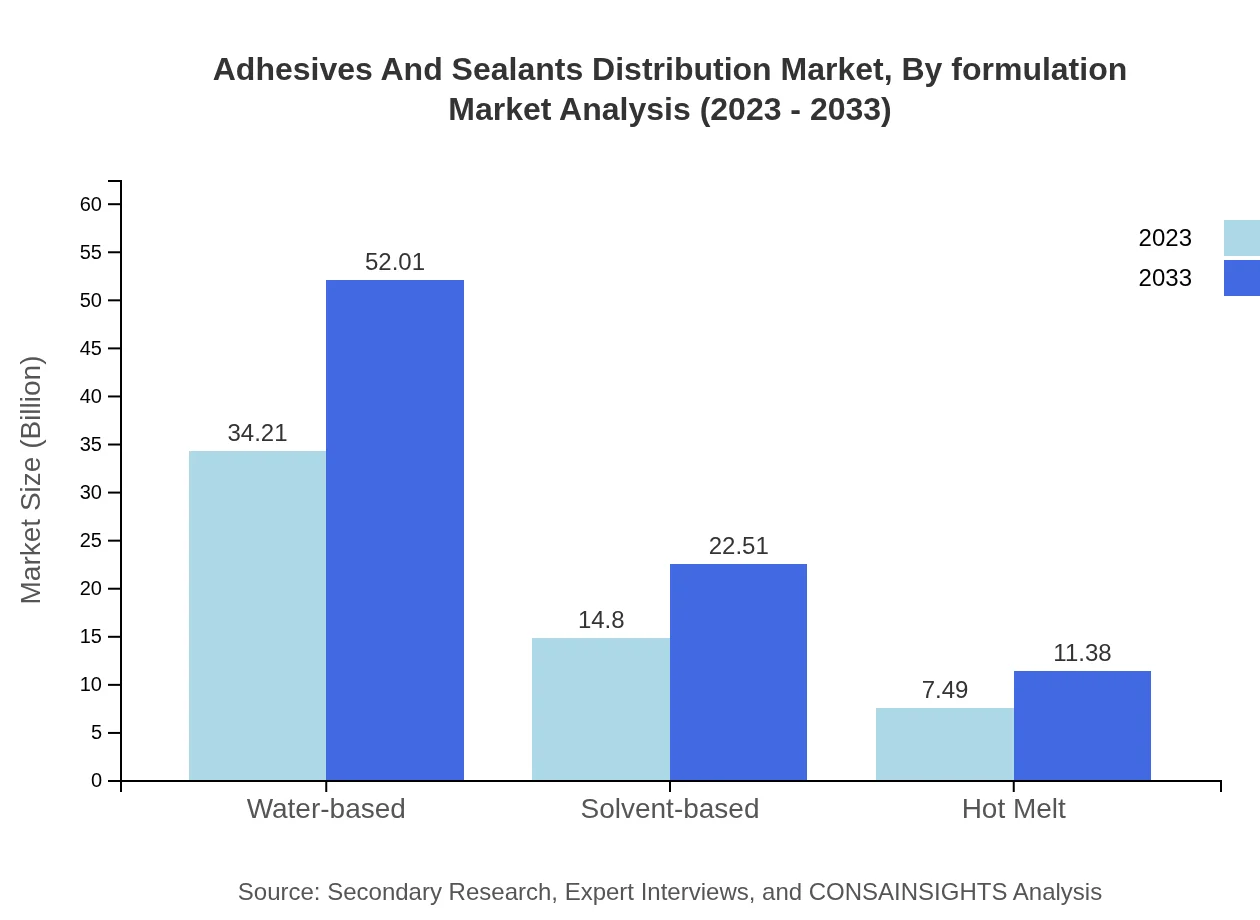

Water-based adhesives are leading with a market size of $34.21 billion in 2023, expected to grow to $52.01 billion by 2033, owing to rising environmental concerns and regulations. Solvent-based and hot melt adhesives also exhibit considerable market sizes but are seeing relatively slower growth due to the shift towards greener options.

Adhesives And Sealants Distribution Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Adhesives And Sealants Distribution Industry

Henkel AG:

A global leader in adhesives, Henkel develops innovative solutions that enhance bonding performance across diverse applications, characterized by sustainable and efficient formulations.3M Company:

3M is renowned for its advanced adhesive technologies, offering a broad range of products suited for both industrial and consumer applications while focusing on sustainability in its manufacturing processes.BASF SE:

As one of the largest chemical producers globally, BASF provides high-performance adhesives and sealants that are essential in key industries like automotive, construction, and packaging.Dow Inc.:

Dow specializes in specialty materials that include robust adhesives and sealants, focusing on enhancing product performance while implementing sustainable practices in production.We're grateful to work with incredible clients.

FAQs

What is the market size of adhesives And Sealants Distribution?

The global adhesives and sealants distribution market is valued at approximately $56.5 billion in 2023 and is projected to reach significant growth by 2033, with a CAGR of 4.2% over the period.

What are the key market players or companies in this adhesives And Sealants Distribution industry?

Key players in the adhesives and sealants distribution market include global manufacturers and distributors like Henkel AG, 3M Company, Sika AG, H.B. Fuller Company, and PPG Industries, which significantly influence market dynamics.

What are the primary factors driving the growth in the adhesives And Sealants Distribution industry?

Growth in the adhesives and sealants market is driven by increasing construction activities, demand for durable goods in manufacturing, innovations in adhesive technologies, and the rising automotive sector promoting the use of advanced bonding solutions.

Which region is the fastest Growing in the adhesives And Sealants Distribution?

Asia Pacific is the fastest-growing region in the adhesives and sealants distribution market, projected to grow from $10.42 billion in 2023 to $15.84 billion by 2033, raising its significance in global trade.

Does ConsaInsights provide customized market report data for the adhesives And Sealants Distribution industry?

Yes, ConsaInsights offers customized market report data tailored to the adhesives and sealants distribution industry, allowing clients to gain precise insights and forecasts based on specific market needs.

What deliverables can I expect from this adhesives And Sealants Distribution market research project?

Deliverables from the adhesives and sealants distribution market research project include detailed market analysis reports, segmentation data, trend forecasts, insights on regional growth, and comprehensive competitive landscapes.

What are the market trends of adhesives And Sealants Distribution?

Trends in the adhesives and sealants distribution market include increased adoption of eco-friendly products, technological advancements in adhesive formulations, and a shift towards automation in manufacturing processes to enhance efficiency.