Adipic Acid Market Report

Published Date: 02 February 2026 | Report Code: adipic-acid

Adipic Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Adipic Acid market from 2023 to 2033, covering market trends, size and growth forecasts, industry insights, segmentation, and regional analysis to help stakeholders make informed decisions.

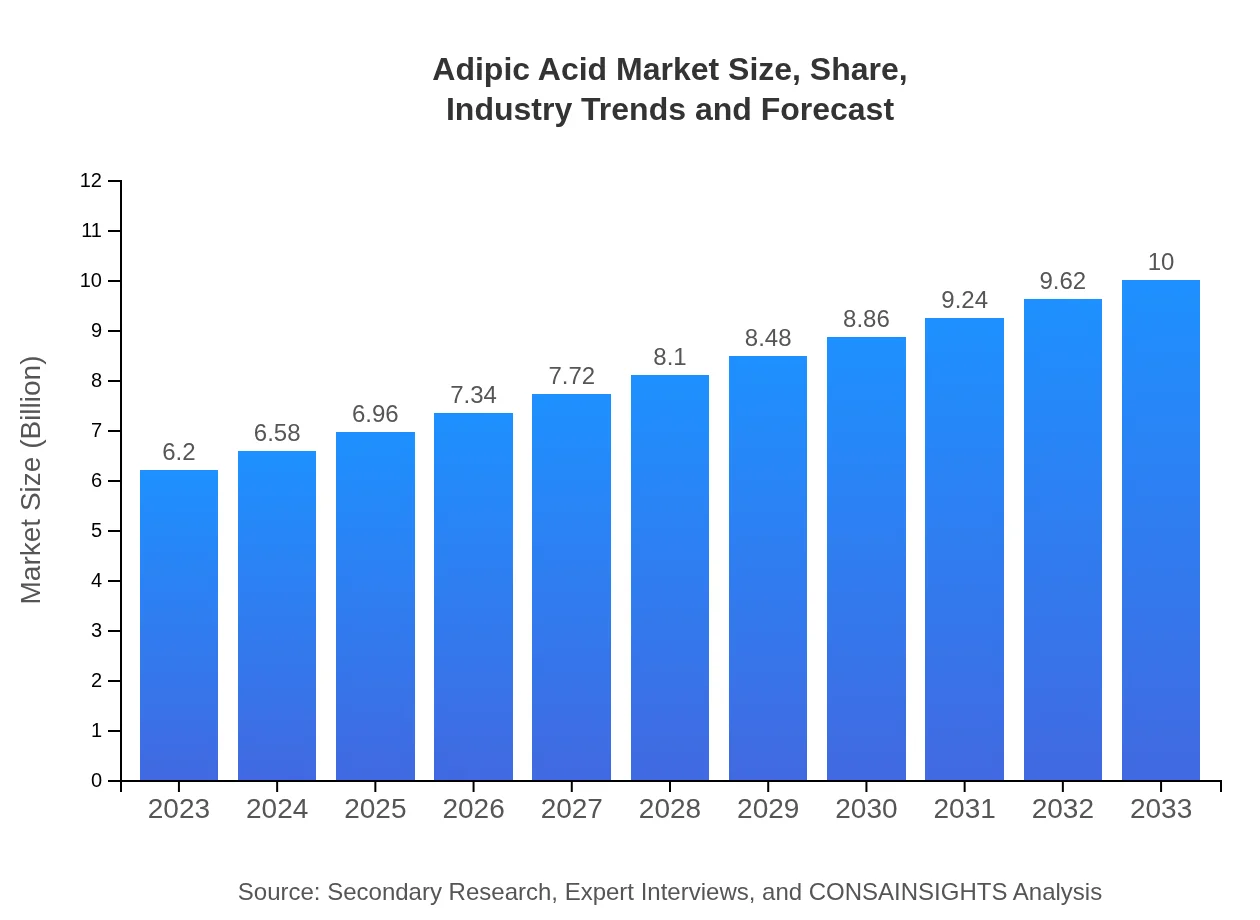

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.20 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $10.00 Billion |

| Top Companies | BASF SE, Invista, Hodogaya Chemical Co., Ltd., Nippon Shokubai Co., Ltd., Ube Industries, Ltd. |

| Last Modified Date | 02 February 2026 |

Adipic Acid Market Overview

Customize Adipic Acid Market Report market research report

- ✔ Get in-depth analysis of Adipic Acid market size, growth, and forecasts.

- ✔ Understand Adipic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Adipic Acid

What is the Market Size & CAGR of Adipic Acid market in 2023?

Adipic Acid Industry Analysis

Adipic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Adipic Acid Market Analysis Report by Region

Europe Adipic Acid Market Report:

Europe's Adipic Acid market is valued at $1.83 billion in 2023, anticipating growth to $2.95 billion by 2033. Regulatory policies promoting greener chemicals are leading to higher consumption of bio-based Adipic Acid, which is becoming more relevant in various applications.Asia Pacific Adipic Acid Market Report:

In 2023, the Asia Pacific region holds a market value of $1.16 billion, which is projected to grow to $1.87 billion by 2033. The growth is attributed to the rising demand for nylon in textiles and automotive applications, coupled with increased consumer electronics production.North America Adipic Acid Market Report:

North America shows a strong market value of $2.30 billion in 2023, projected to grow to $3.71 billion by 2033. This region is expected to experience significant growth due to a surge in automobile production and increasing investments in sustainable chemical manufacturing.South America Adipic Acid Market Report:

The South American Adipic Acid market is valued at $0.15 billion in 2023, expected to reach $0.25 billion by 2033. The market is driven by an increasing demand in the automotive and chemical sectors alongside expansion in food additives.Middle East & Africa Adipic Acid Market Report:

The Middle East and Africa market is estimated at $0.76 billion for 2023 and is expected to expand to $1.23 billion by 2033. Growth in this region is supported by an increase in construction activities and investment in the petrochemical industry.Tell us your focus area and get a customized research report.

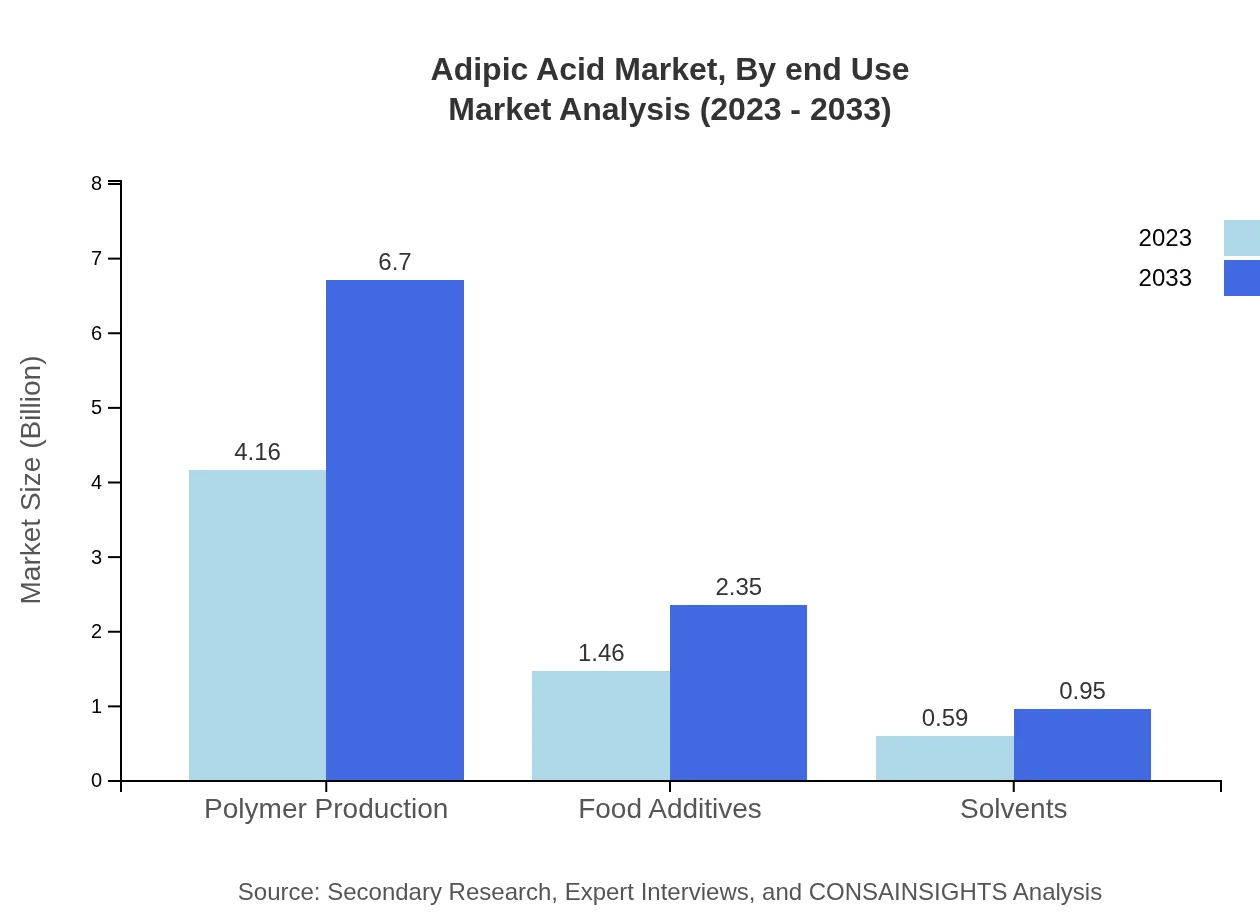

Adipic Acid Market Analysis By End Use

Adipic Acid is extensively used in various applications including automotive, textiles, food additives, and construction. The automotive segment leads the market, accounting for about 67.02% share in 2023. In terms of size, this segment values at $4.16 billion and is expected to grow to $6.70 billion by 2033. The food additives segment is also significant, valued at $1.46 billion in 2023, growing to $2.35 billion by 2033.

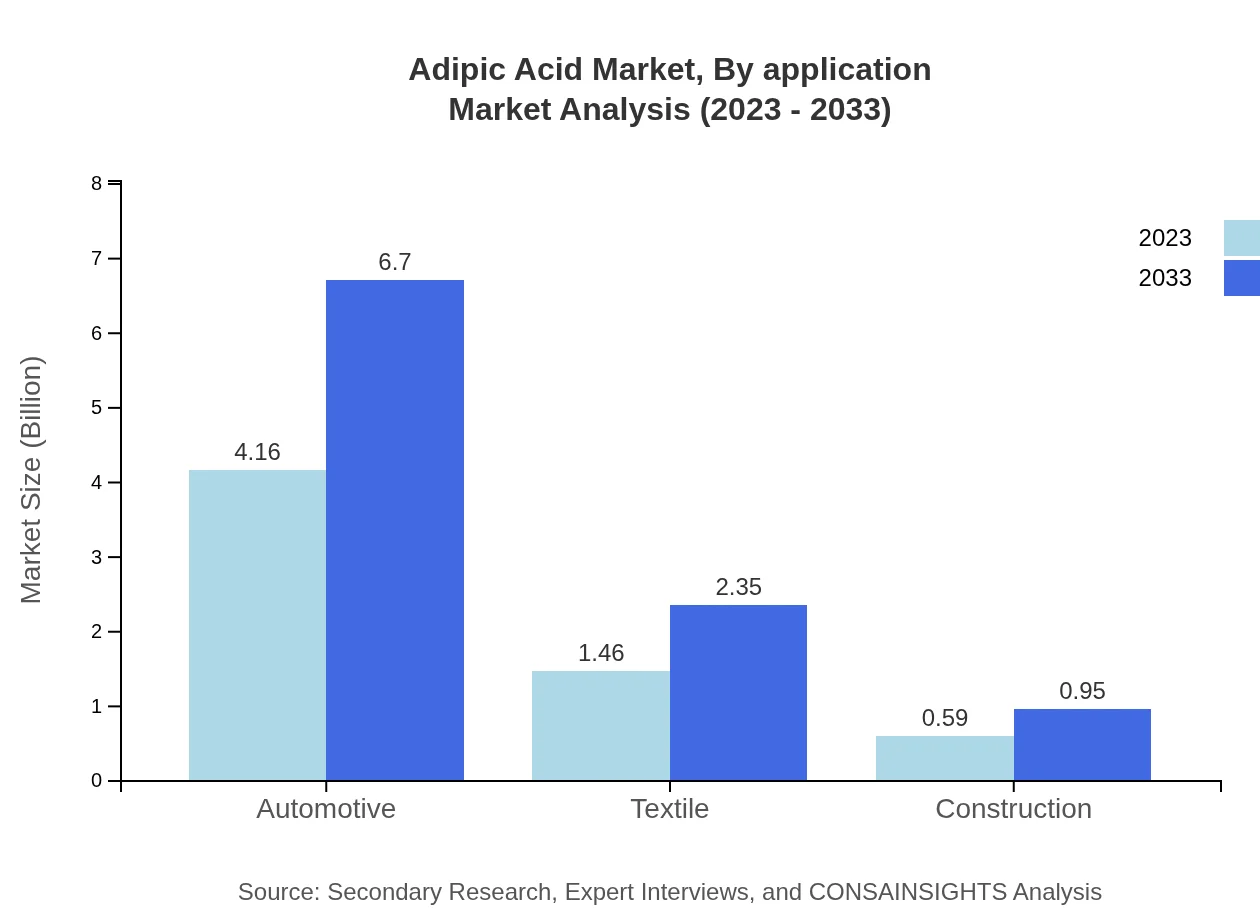

Adipic Acid Market Analysis By Application

Applications of Adipic Acid include its use in the production of polymers and food additives. The polymer production segment leads with a size of $4.16 billion in 2023 and is expected to reach $6.70 billion by 2033. Food additives have a current market size of $1.46 billion projected to grow to $2.35 billion during the same period, showing rising consumer interest in processed goods.

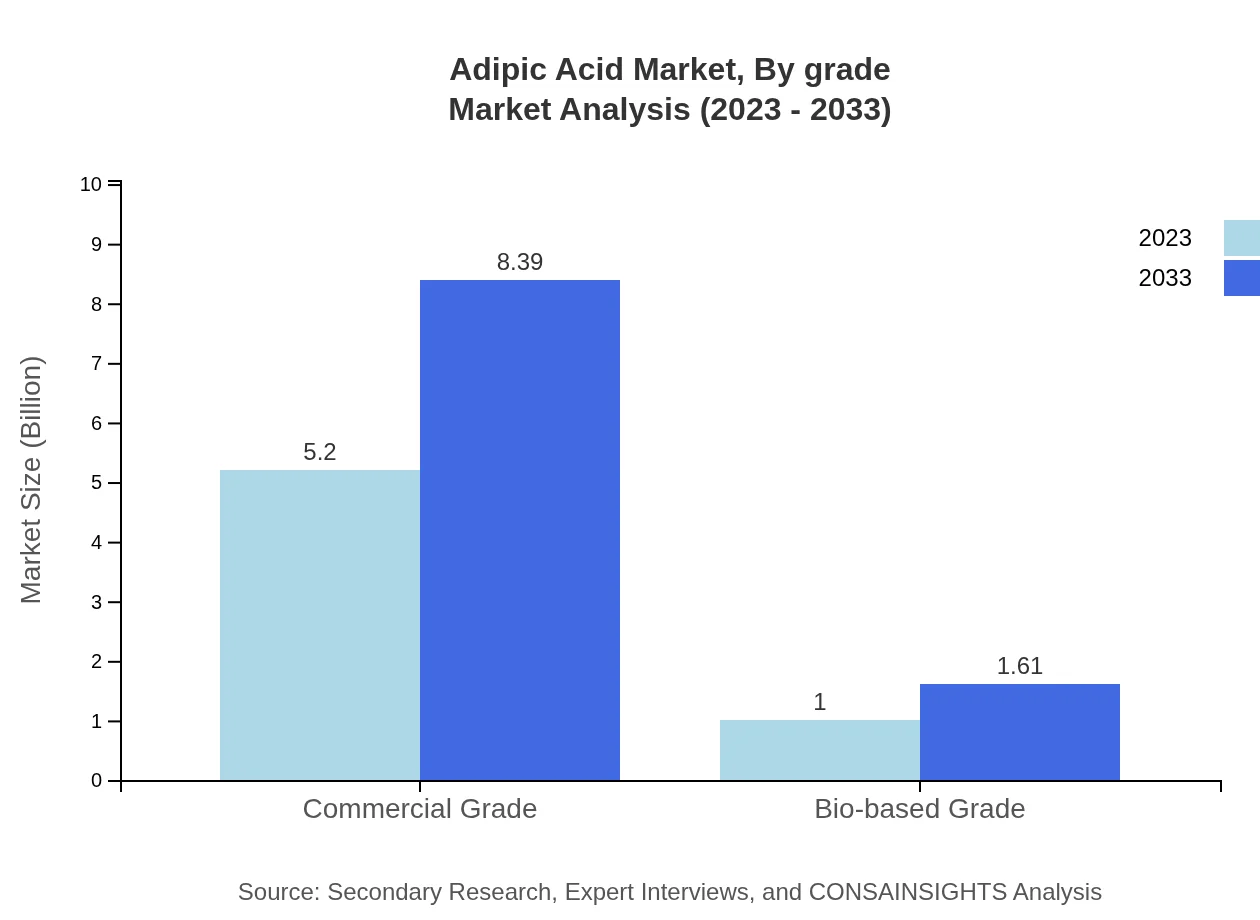

Adipic Acid Market Analysis By Grade

The Adipic Acid market is segmented into commercial grade and bio-based grade products. Commercial grade, representing 83.89% market share, is valued at $5.20 billion in 2023 and is expected to grow to $8.39 billion by 2033. Bio-based grade products reflect a more sustainable approach with a market value of $1.00 billion in 2023, projected to reach $1.61 billion by 2033.

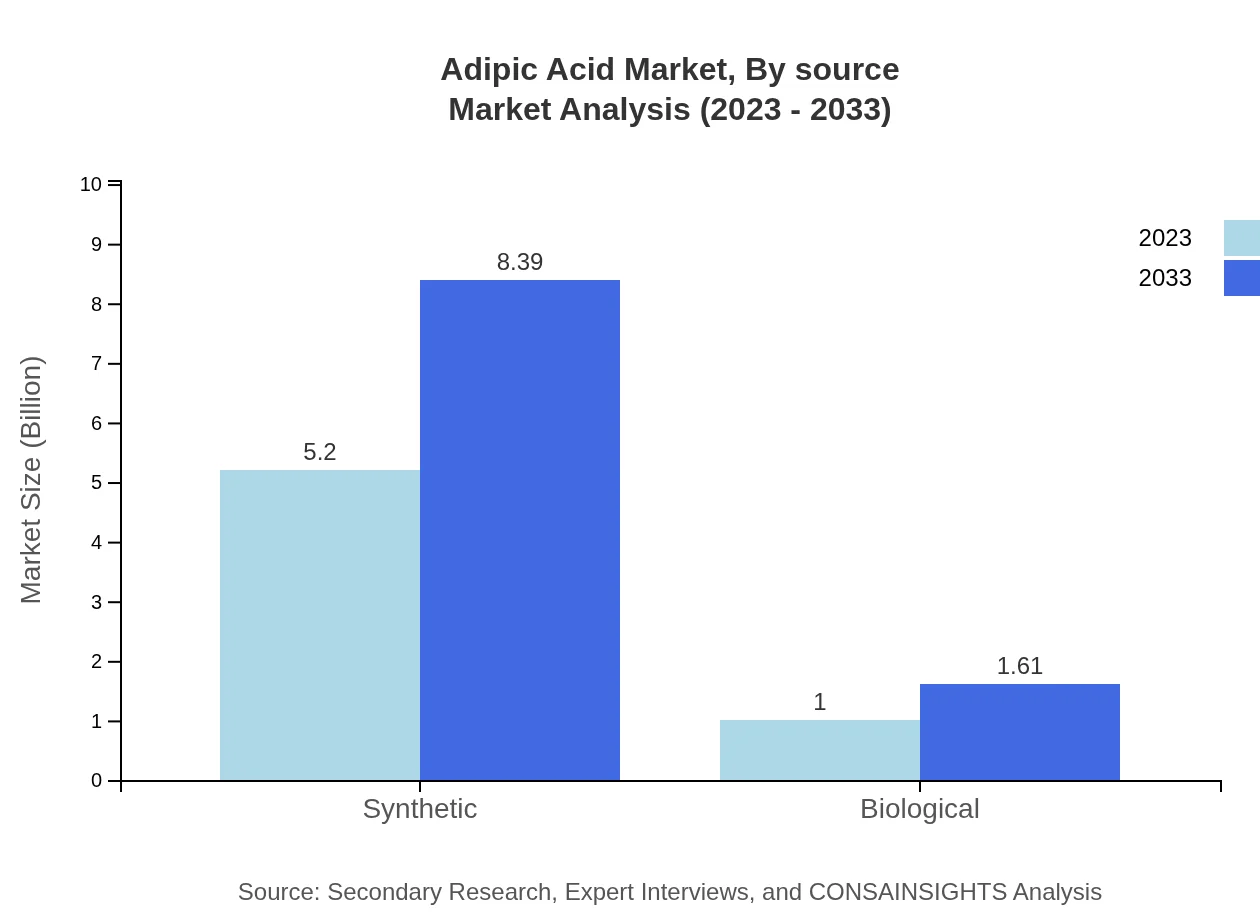

Adipic Acid Market Analysis By Source

The primary sources for Adipic Acid production include synthetic processes and biological sources. Currently, synthetic methods dominate the market. However, there is a noticeable increase in the adoption of biological methods driven by sustainability initiatives and eco-friendly chemical production requirements.

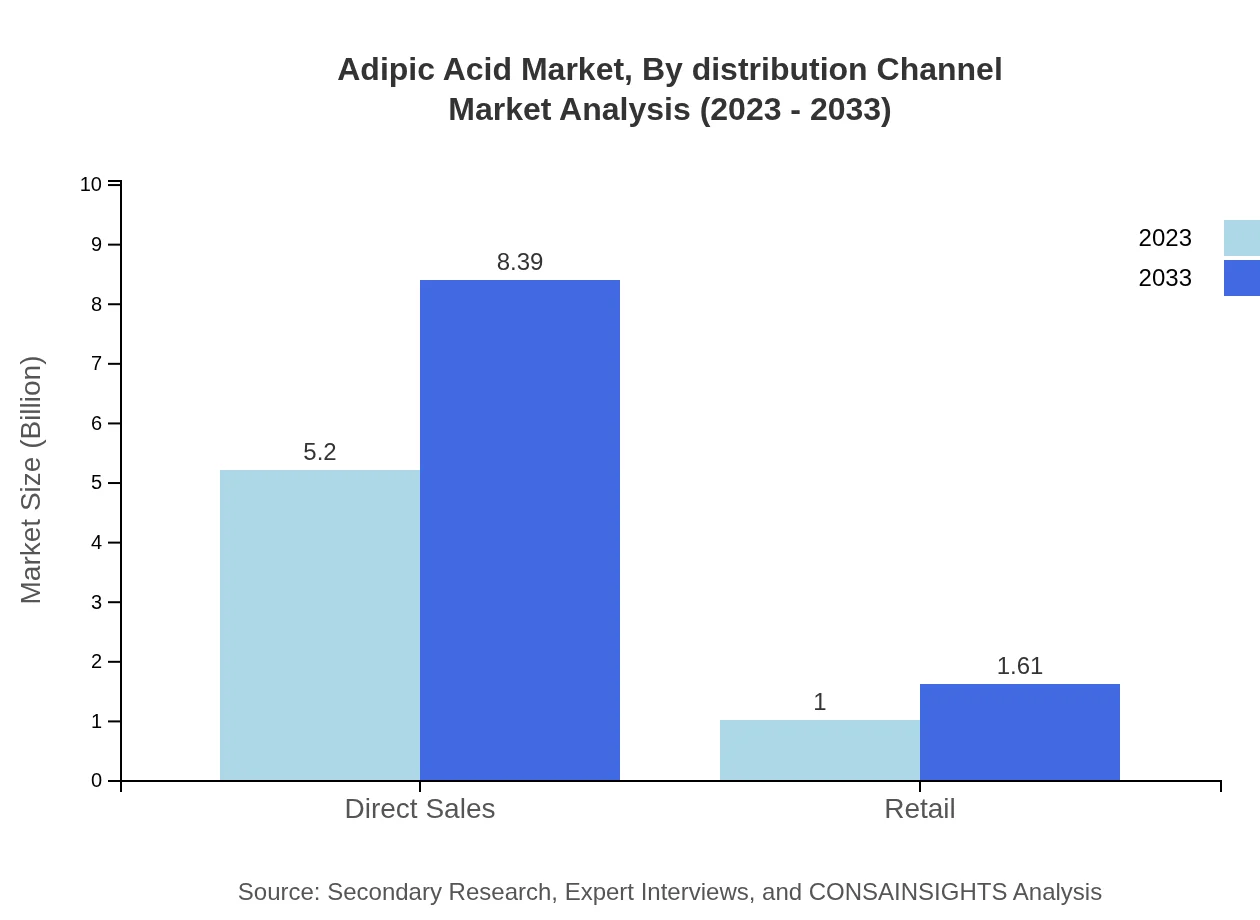

Adipic Acid Market Analysis By Distribution Channel

The distribution channels for Adipic Acid are focused on direct sales and retail. Direct sales hold a substantial market share of 83.89% valued at $5.20 billion in 2023, and projected to increase to $8.39 billion by 2033. Retail channels are also growing, essential for reaching end consumers.

Adipic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Adipic Acid Industry

BASF SE:

A leading chemical company, BASF SE produces a wide range of chemicals including Adipic Acid, focusing on sustainable production processes and innovative applications.Invista:

A significant player in the nylon industry, Invista manufactures Adipic Acid primarily for synthetic fibers and engineering plastics while emphasizing quality and technological improvement.Hodogaya Chemical Co., Ltd.:

Specializes in chemical manufacturing, including Adipic Acid, with a commitment to sustainable practices and enhancing its global presence.Nippon Shokubai Co., Ltd.:

Offers a range of chemical products, Nippon Shokubai focuses on innovation in producing Adipic Acid for various applications.Ube Industries, Ltd.:

A comprehensive supplier of chemicals, Ube Industries is involved in the production of Adipic Acid and other polymers, with a focus on advancements in chemical engineering.We're grateful to work with incredible clients.

FAQs

What is the market size of adipic acid?

The global adipic acid market was valued at approximately $6.2 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 4.8%, reaching around $9.95 billion by 2033.

What are the key market players or companies in the adipic acid industry?

Major players in the adipic acid market include BASF SE, DuPont, and […] among others, which significantly contribute to production and innovation within the industry.

What are the primary factors driving the growth in the adipic acid industry?

The growth in the adipic acid industry is driven by increasing demand in end-use sectors like automotive and textiles, along with rising applications in polymer production and food additives.

Which region is the fastest Growing in the adipic acid market?

The Asia Pacific region is the fastest-growing in the adipic acid market, expected to increase from $1.16 billion in 2023 to $1.87 billion by 2033, led by industrial expansion and demand.

Does ConsaInsights provide customized market report data for the adipic acid industry?

Yes, ConsaInsights offers customized market reports tailored to clients' specific needs in the adipic acid industry, addressing unique inquiries and strategic interests.

What deliverables can I expect from this adipic acid market research project?

From the adipic acid market research project, you can expect detailed reports, comprehensive data analysis, market forecasts, and insights into market trends and competitive landscapes.

What are the market trends of adipic acid?

Current market trends in adipic acid include a shift towards bio-based production methods, sustainability initiatives, and increased application in emerging sectors like renewable energy.