Adulticide Market Report

Published Date: 02 February 2026 | Report Code: adulticide

Adulticide Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Adulticide market, covering market size, trends, forecasts (2023-2033), segmentation, regional insights, and key market players. It aims to offer valuable insights for stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

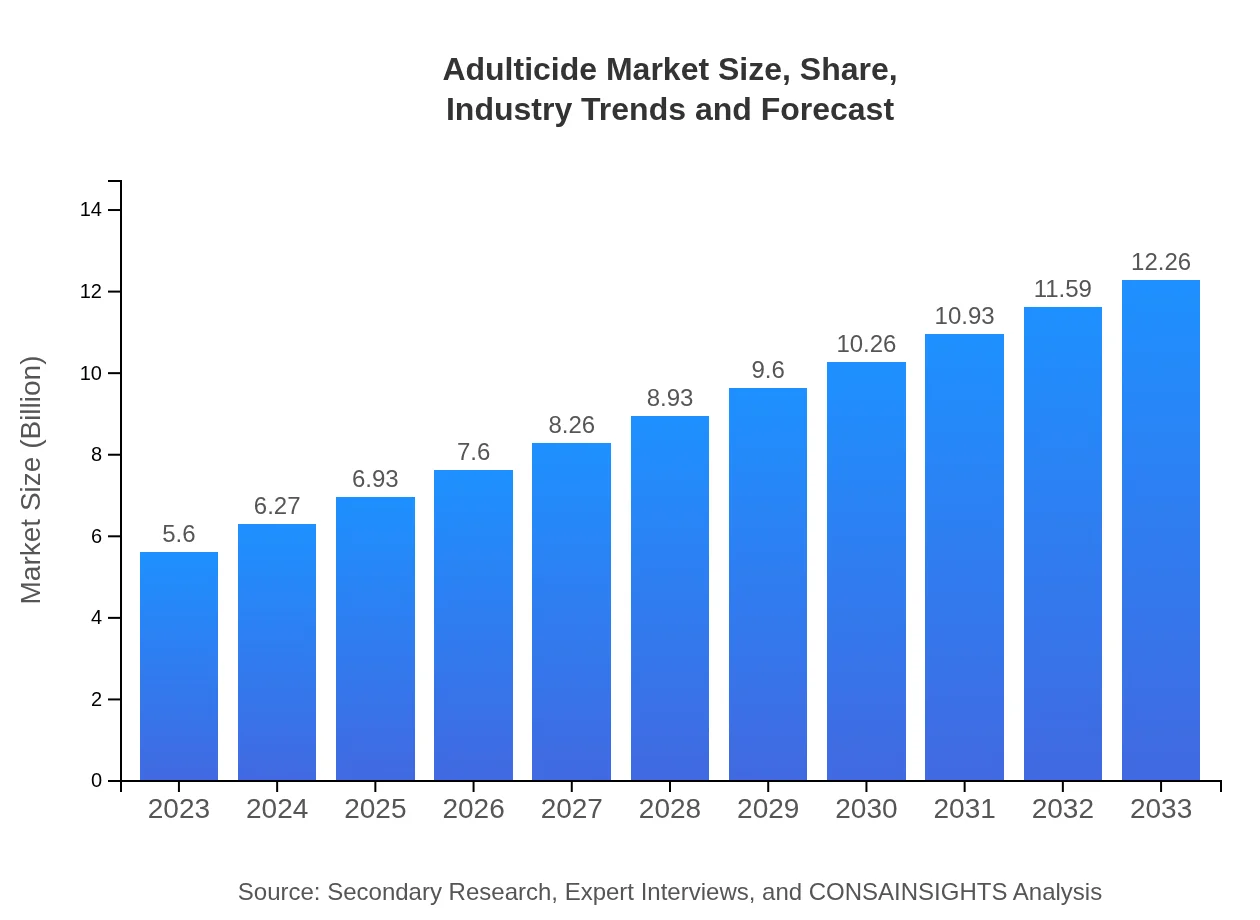

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.9% |

| 2033 Market Size | $12.26 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Dow AgroSciences |

| Last Modified Date | 02 February 2026 |

Adulticide Market Overview

Customize Adulticide Market Report market research report

- ✔ Get in-depth analysis of Adulticide market size, growth, and forecasts.

- ✔ Understand Adulticide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Adulticide

What is the Market Size & CAGR of Adulticide market in 2023 and 2033?

Adulticide Industry Analysis

Adulticide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Adulticide Market Analysis Report by Region

Europe Adulticide Market Report:

Europe's Adulticide market size stood at $1.42 billion in 2023, projected to grow to $3.11 billion by 2033. The region's focus on environmentally sustainable solutions and innovations in pest management technologies drives new market opportunities.Asia Pacific Adulticide Market Report:

In 2023, the Adulticide market in Asia Pacific was valued at $1.12 billion and is projected to grow to $2.45 billion by 2033. Rapid urbanization and increased agricultural activities are driving demand in this region. Governments are actively implementing pest control measures, which further enhance market growth.North America Adulticide Market Report:

North America, holding a market size of $1.94 billion in 2023, is expected to reach $4.25 billion by 2033. The high prevalence of pest-related issues, combined with stringent regulatory standards for pest control, has fostered a robust market environment.South America Adulticide Market Report:

The South American Adulticide market was valued at $0.48 billion in 2023, with forecasts indicating growth to $1.04 billion by 2033. The region's focus on agricultural productivity and pest control in both rural and urban settings contributes to this growth.Middle East & Africa Adulticide Market Report:

The Middle East and Africa market was valued at $0.65 billion in 2023, with expectations of growth to $1.42 billion by 2033. Increasing urbanization and public health initiatives aimed at combating disease vectors are major factors influencing this region's market.Tell us your focus area and get a customized research report.

Adulticide Market Analysis By Type

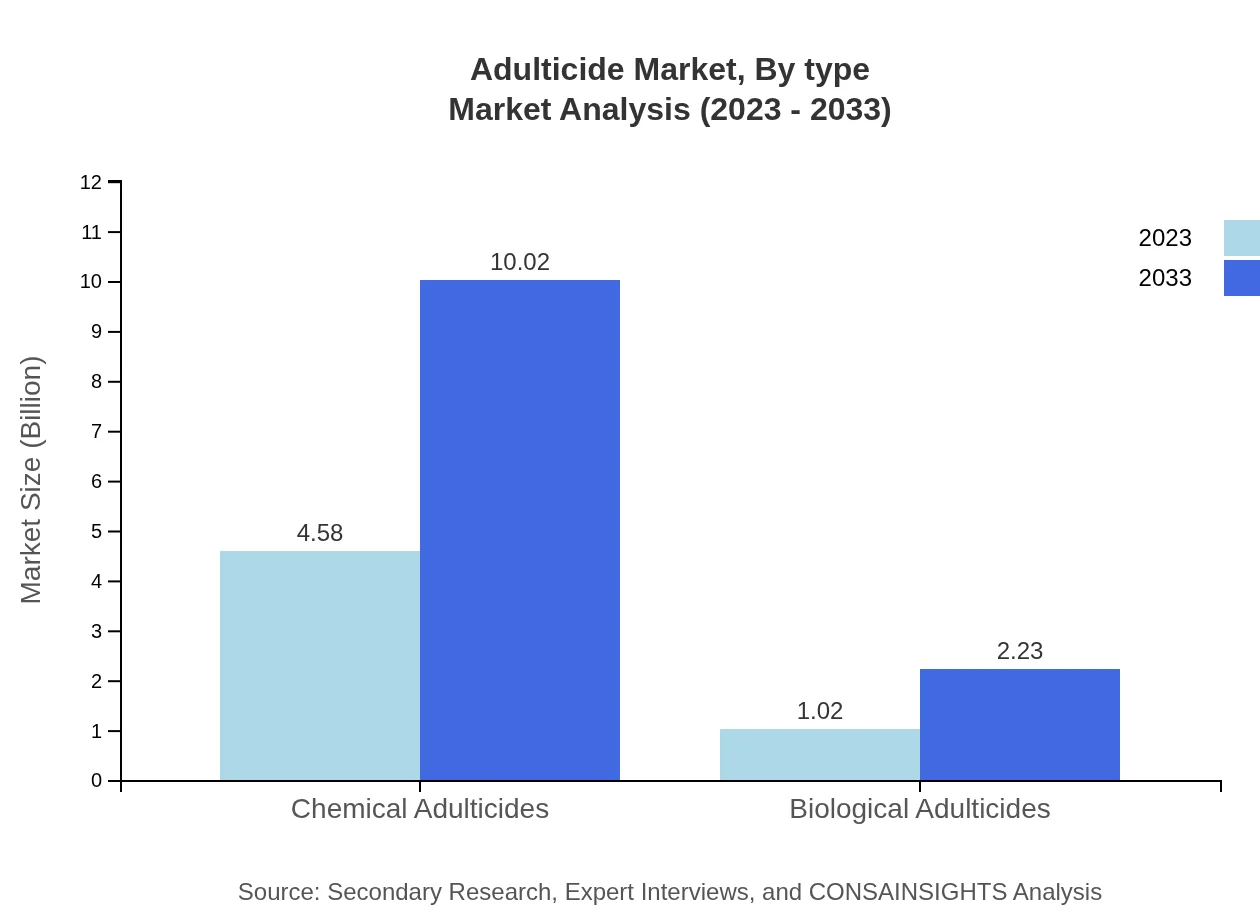

The Adulticide market is predominantly divided into Chemical and Biological Adulticides. In 2023, Chemical Adulticides accounted for a market size of $4.58 billion (81.77% share) and are projected to increase to $10.02 billion by 2033. On the other hand, Biological Adulticides represented a smaller segment with a size of $1.02 billion (18.23% share) in 2023, expected to reach $2.23 billion by 2033.

Adulticide Market Analysis By Application

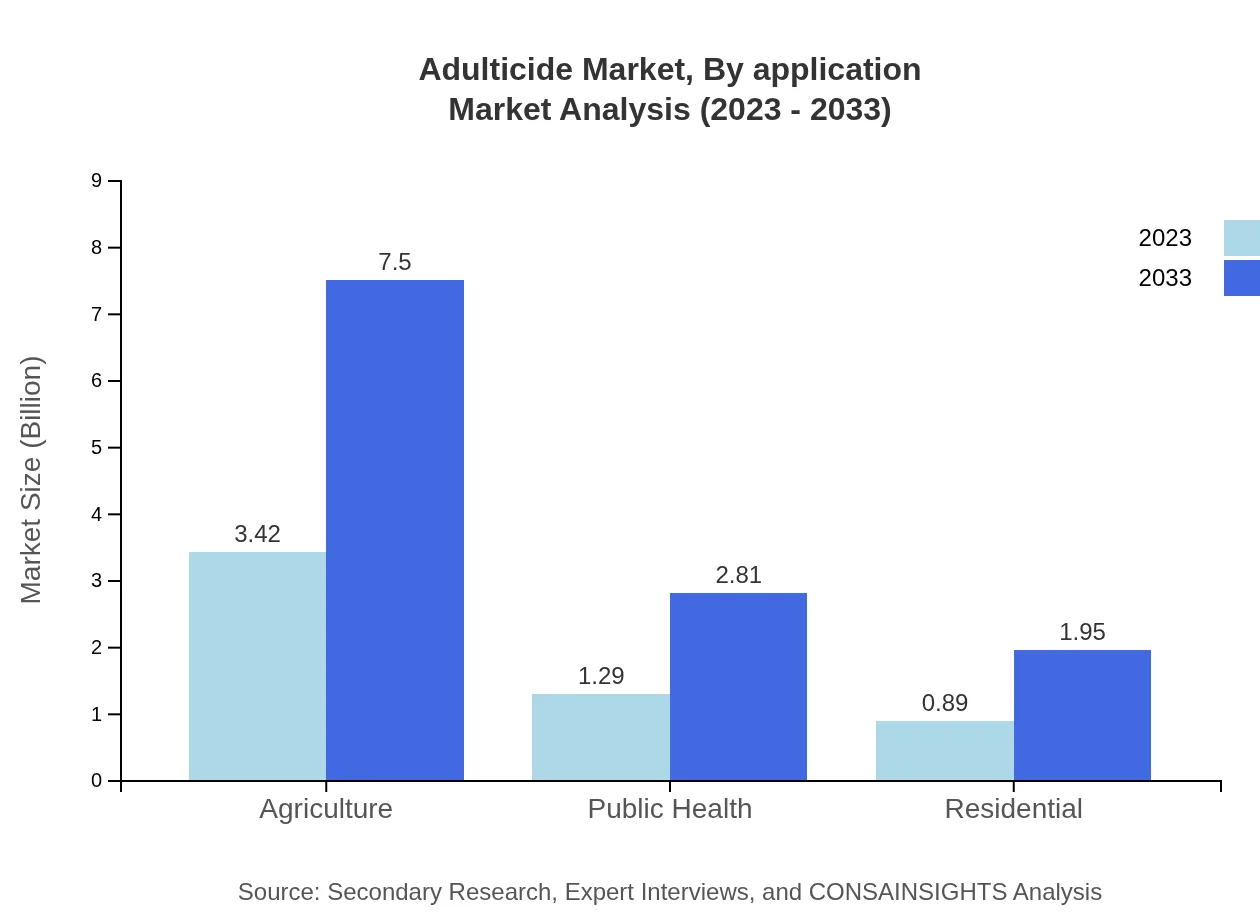

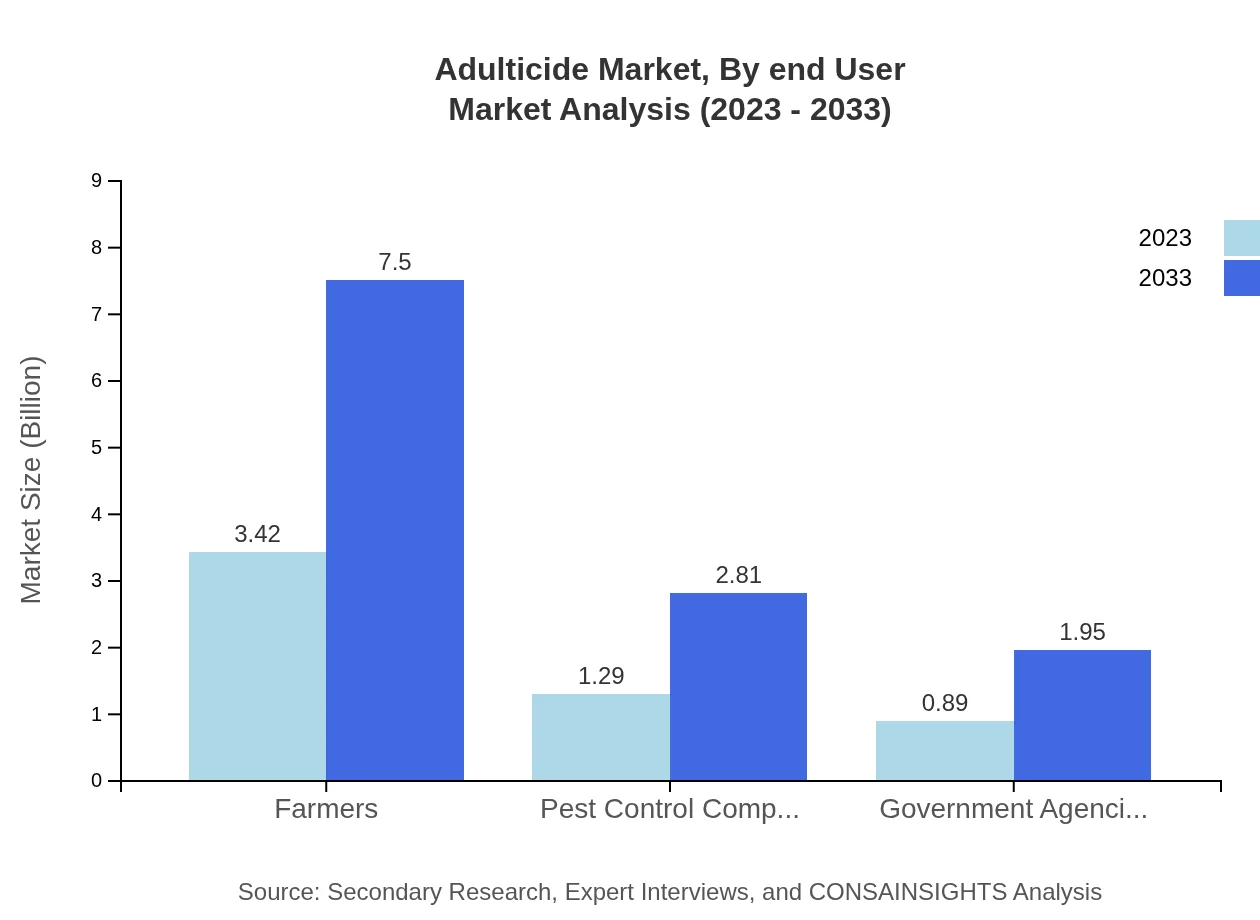

In terms of application, the major categories include Agriculture, Pest Control Companies, Government Agencies, Public Health, and Residential sectors. Agriculture dominated the segment, generating $3.42 billion in 2023 (61.15% share), and expected to rise to $7.50 billion by 2033. Pest control companies also hold significant weight, projected from $1.29 billion (22.96% share) in 2023 to $2.81 billion by 2033.

Adulticide Market Analysis By Formulation

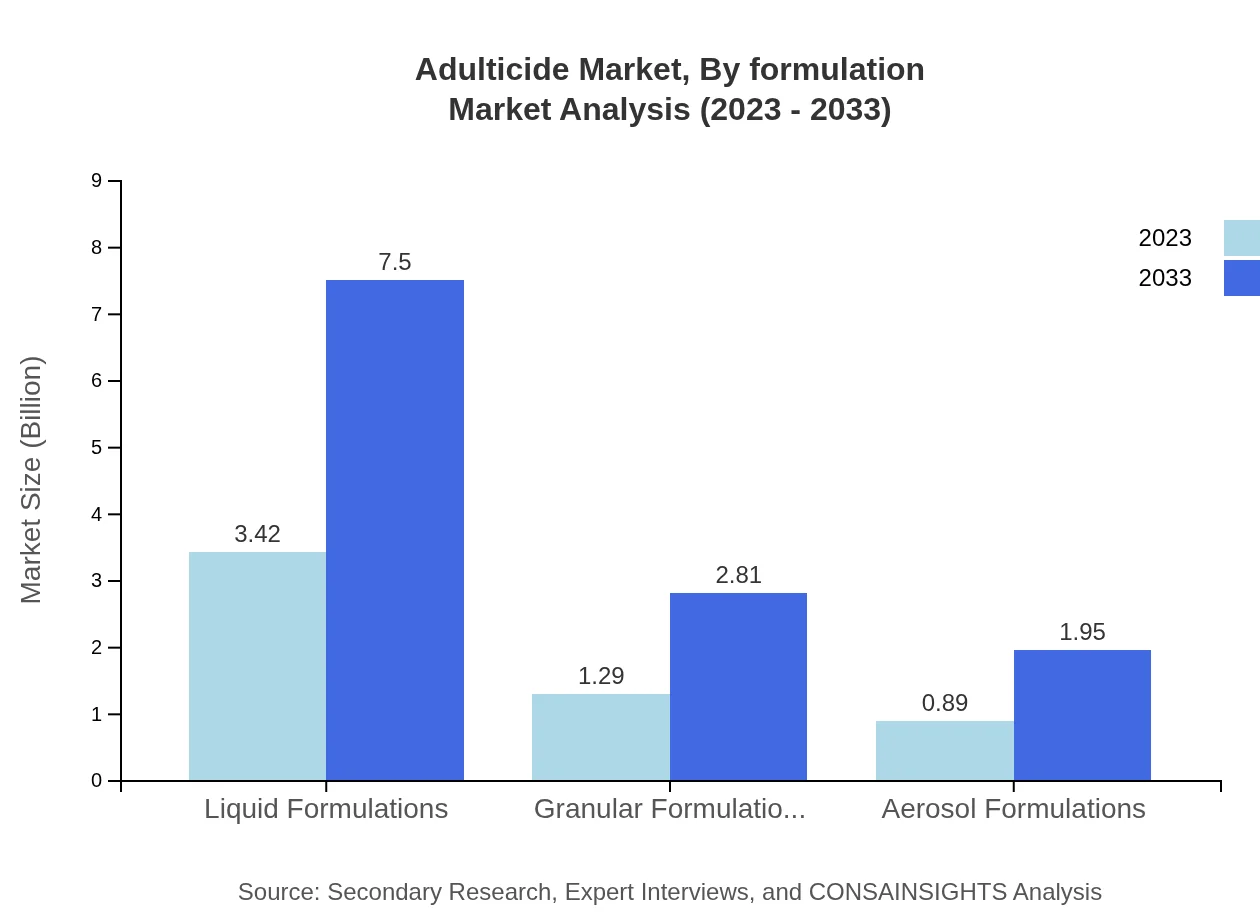

In terms of formulations, Liquid formulations led the segment with a market size of $3.42 billion (61.15% share) in 2023, projected to reach $7.50 billion by 2033. Granular formulations followed with a market size of $1.29 billion (22.96% share), anticipated to grow to $2.81 billion by 2033, while aerosol formulations accounted for $0.89 billion (15.89% share).

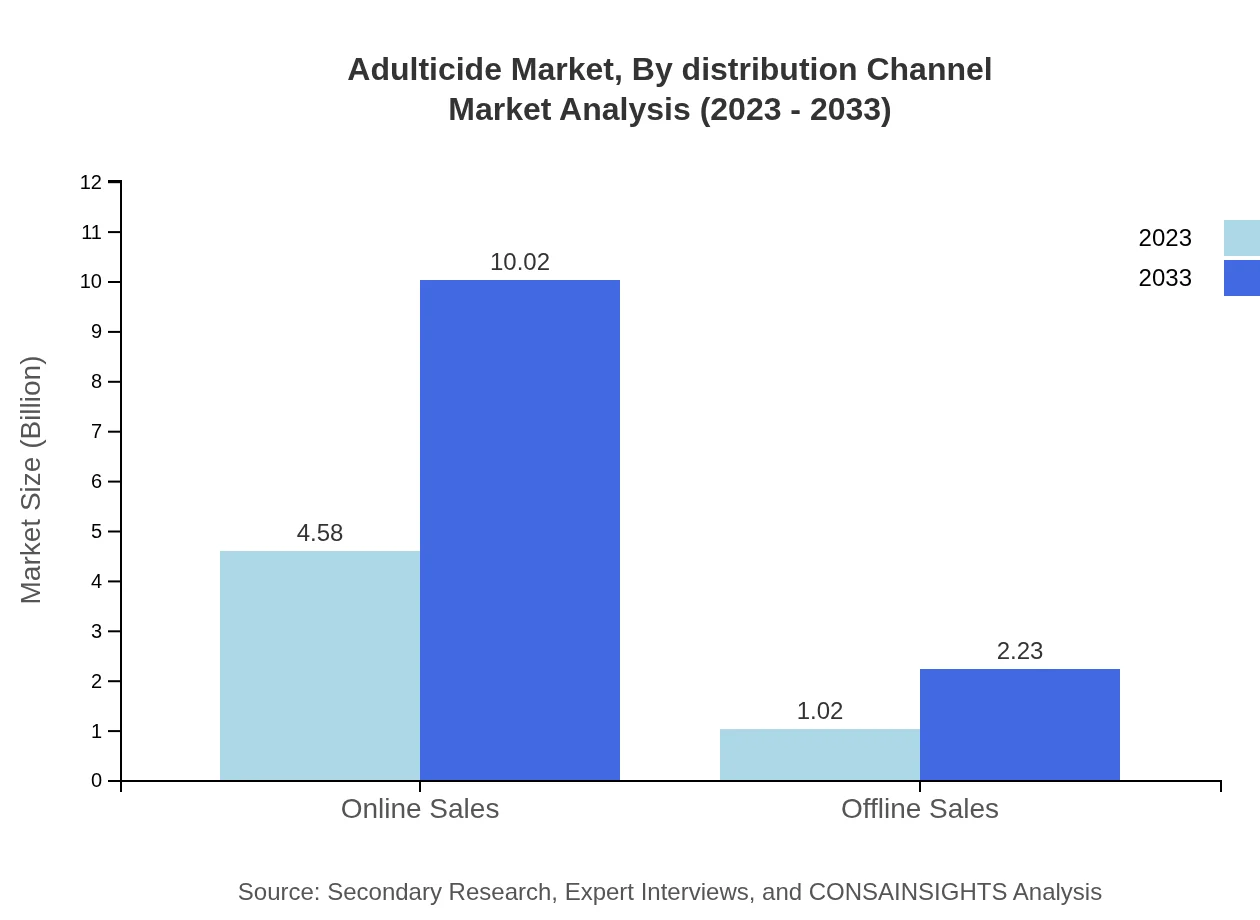

Adulticide Market Analysis By Distribution Channel

Distribution channels are segmented into Online and Offline sales. The online sales channel is rapidly growing, with a value of $4.58 billion (81.77% share) in 2023, forecasted to reach $10.02 billion by 2033. Conversely, offline sales exhibited a significantly smaller market size of $1.02 billion (18.23% share), expected to grow to $2.23 billion by 2033.

Adulticide Market Analysis By End User

The Adulticide market end-users include Farmers, government agencies, and residential customers. Farmers represent the most significant share with $3.42 billion (61.15% share) in 2023 and projected to grow to $7.50 billion by 2033. The public health sector is also pivotal with $1.29 billion (22.96% share) in 2023, forecasted to reach $2.81 billion by 2033.

Adulticide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Adulticide Industry

BASF SE:

BASF SE is a leading global player in the chemical industry, offering a variety of Adulticides known for their efficacy and safety. The company invests significantly in research and development to create environmentally friendly formulations.Syngenta AG:

Syngenta AG specializes in crop protection and offers innovative Adulticide solutions. They focus on sustainable practices and have introduced several products to combat pest resistance, securing a strong market position.FMC Corporation:

FMC Corporation is a key competitor in the Adulticide market, providing advanced formulations that cater to various applications including agriculture and public health.Dow AgroSciences:

Dow AgroSciences, part of the Dow Chemical Company, offers a wide array of pest control solutions including Adulticides focused on improving agricultural efficiency and public safety.We're grateful to work with incredible clients.

FAQs

What is the market size of adulticide?

The adulticide market is valued at approximately $5.6 billion in 2023 with a projected CAGR of 7.9% through 2033. This growth signifies an expanding demand for mosquito and pest control solutions globally.

What are the key market players or companies in the adulticide industry?

Key players in the adulticide industry include major companies like Bayer AG, Bell Labs, and Syngenta. These firms are known for their innovative pest control solutions that meet agricultural and public health needs.

What are the primary factors driving the growth in the adulticide industry?

The growth of the adulticide market is driven by rising pest populations, increased awareness of pest-related diseases, and advancements in chemical formulations. Environmental concerns also push for efficient pest control solutions.

Which region is the fastest Growing in the adulticide market?

North America is the fastest-growing region in the adulticide market with expected market growth from $1.94 billion in 2023 to $4.25 billion by 2033, fueled by innovation in pest control practices.

Does ConsaInsights provide customized market report data for the adulticide industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the adulticide industry. This includes in-depth analysis and projections based on unique client requirements.

What deliverables can I expect from this adulticide market research project?

From the adulticide market research project, expect comprehensive reports including market sizing, segment analyses, competitive landscape, growth forecasts, and regional insights to strategize better.

What are the market trends of adulticide?

Current trends in the adulticide market include a shift towards biological products, increased online sales avenues, and the development of user-friendly formulations, reflecting eco-conscious consumer preferences.