Advanced Ceramics Market Report

Published Date: 02 February 2026 | Report Code: advanced-ceramics

Advanced Ceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced Ceramics market, offering insights into market trends, sizes, and forecasts from 2023 to 2033. It covers key segments, regional variations, industry dynamics, and identifies market leaders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

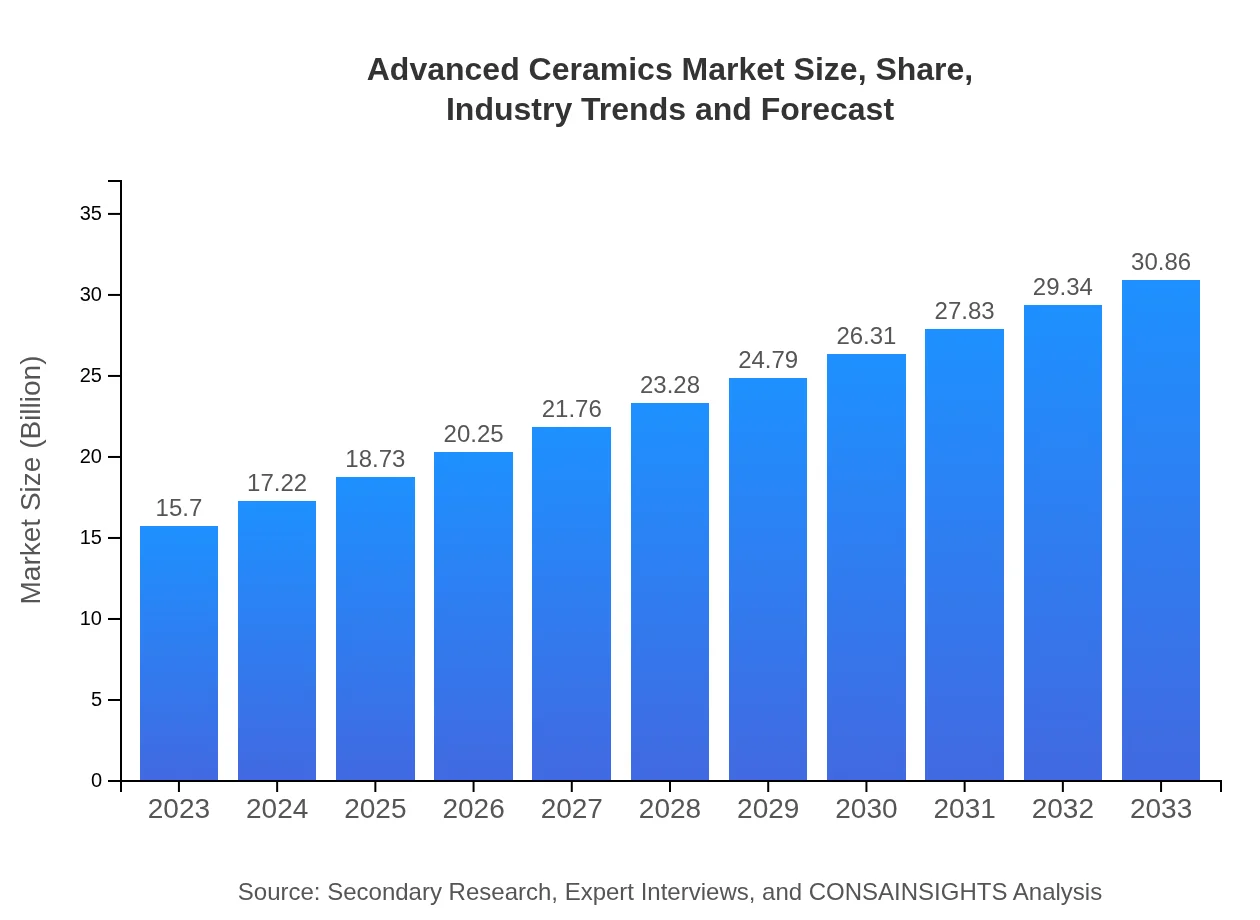

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.86 Billion |

| Top Companies | Ceramtec, Kyocera Corporation, CoorsTek |

| Last Modified Date | 02 February 2026 |

Advanced Ceramics Market Overview

Customize Advanced Ceramics Market Report market research report

- ✔ Get in-depth analysis of Advanced Ceramics market size, growth, and forecasts.

- ✔ Understand Advanced Ceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Ceramics

What is the Market Size & CAGR of Advanced Ceramics market in 2023?

Advanced Ceramics Industry Analysis

Advanced Ceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Ceramics Market Analysis Report by Region

Europe Advanced Ceramics Market Report:

Europe's Advanced Ceramics market is projected to inflate from $4.94 billion in 2023 to $9.70 billion by 2033. The region is characterized by robust research and development initiatives, particularly in Germany and the UK, contributing to advancements in the electronics and automotive sectors.Asia Pacific Advanced Ceramics Market Report:

The Asia Pacific region is projected to show substantial growth, estimated to reach $6.00 billion by 2033 from $3.05 billion in 2023. The rapid industrialization and technological advancements in countries like China and Japan are key factors driving demand. Additionally, the focus on automotive and electronics manufacturing plays a significant role in boosting the market.North America Advanced Ceramics Market Report:

North America is expected to witness a strong increase, with the market size projected to grow from $5.21 billion in 2023 to $10.23 billion by 2033. The United States is a leader in technological innovations within the ceramics industry, significantly benefiting from increased defense and aerospace applications.South America Advanced Ceramics Market Report:

In South America, the Advanced Ceramics market is anticipated to grow from $0.42 billion in 2023 to $0.82 billion by 2033. Brazil and Argentina lead the region in both production and usage due to growing investments in infrastructure and technology. However, the market remains small compared to other global regions.Middle East & Africa Advanced Ceramics Market Report:

The Middle East and Africa region is expected to grow from $2.09 billion in 2023 to $4.11 billion by 2033. With increasing investments in renewable energy and manufacturing, countries like UAE and South Africa are emerging as key markets for advanced ceramics. The region's economic diversification also supports market growth.Tell us your focus area and get a customized research report.

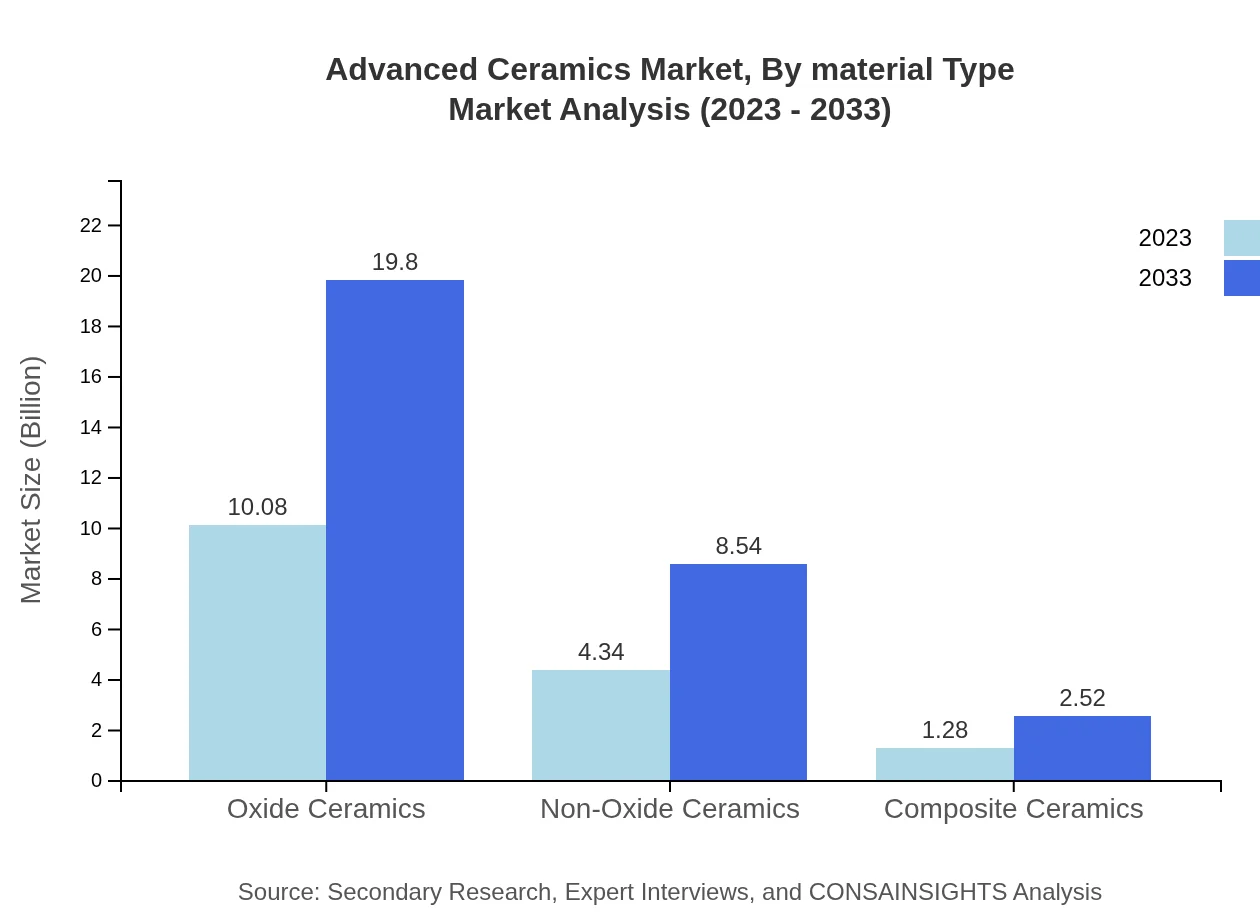

Advanced Ceramics Market Analysis By Material Type

In terms of material type, oxide ceramics dominate the market with a size reaching $10.08 billion in 2023 and expected to increase to $19.80 billion by 2033, accounting for 64.18% market share. Non-oxide ceramics are also projected to grow considerably, from $4.34 billion to $8.54 billion, capturing 27.66%. Composite ceramics remain a smaller segment, expected to rise from $1.28 to $2.52 billion with 8.16% share.

Advanced Ceramics Market Analysis By Application

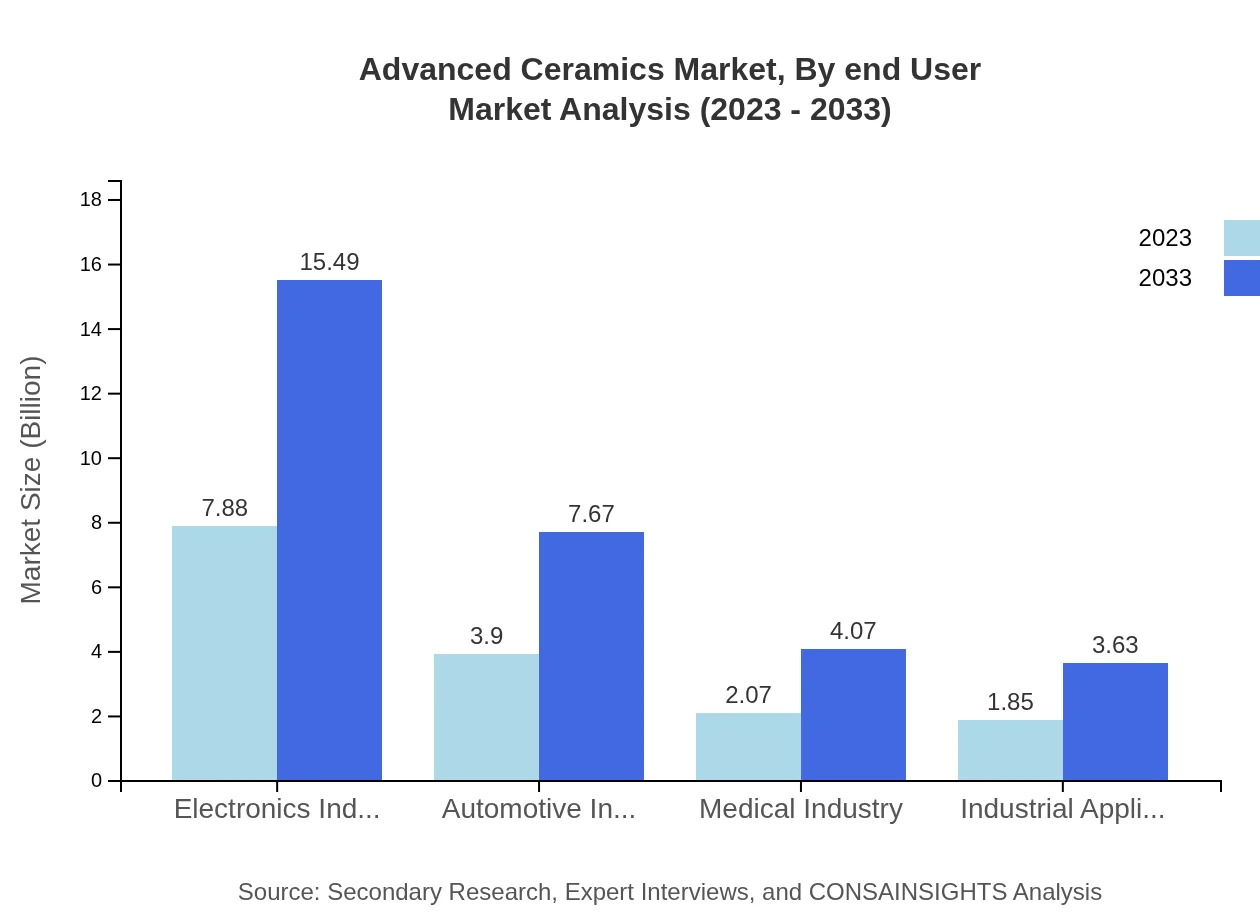

The largest application segment is electronics, estimated to reach $7.88 billion by 2023 and projecting $15.49 billion by 2033, holding a consistent share. The automotive industry will also see significant growth, expected to grow from $3.90 billion to $7.67 billion. The medical industry is projected to increase from $2.07 billion to $4.07 billion, whereas industrial applications will expand from $1.85 billion to $3.63 billion.

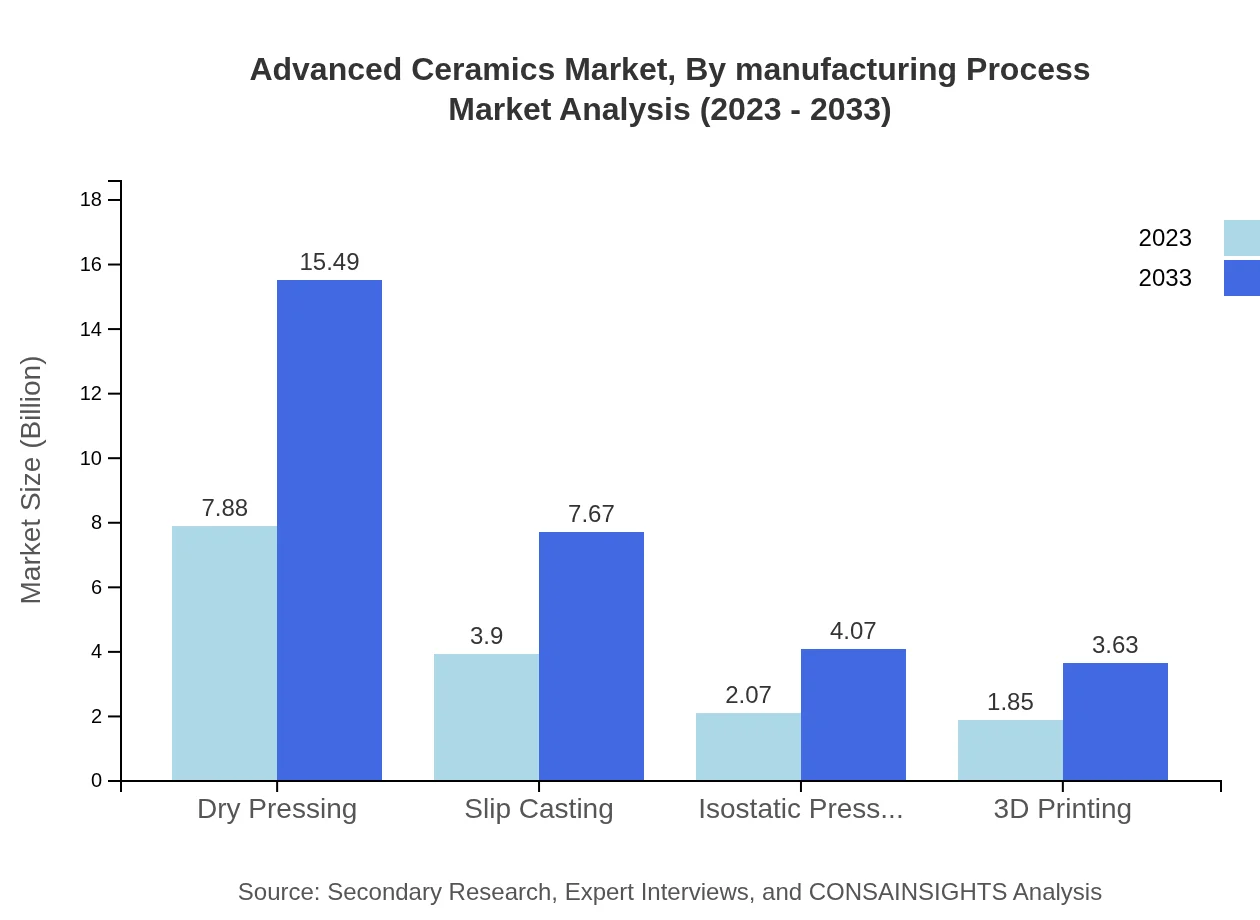

Advanced Ceramics Market Analysis By Manufacturing Process

By manufacturing process, dry pressing remains the leading method with a market size of $7.88 billion in 2023, projected to double by 2033. The slip casting method will also see growth, increasing from $3.90 billion to $7.67 billion. Isostatic pressing is forecasted to grow from $2.07 billion to $4.07 billion, while 3D printing is expected to rise from $1.85 billion to $3.63 billion.

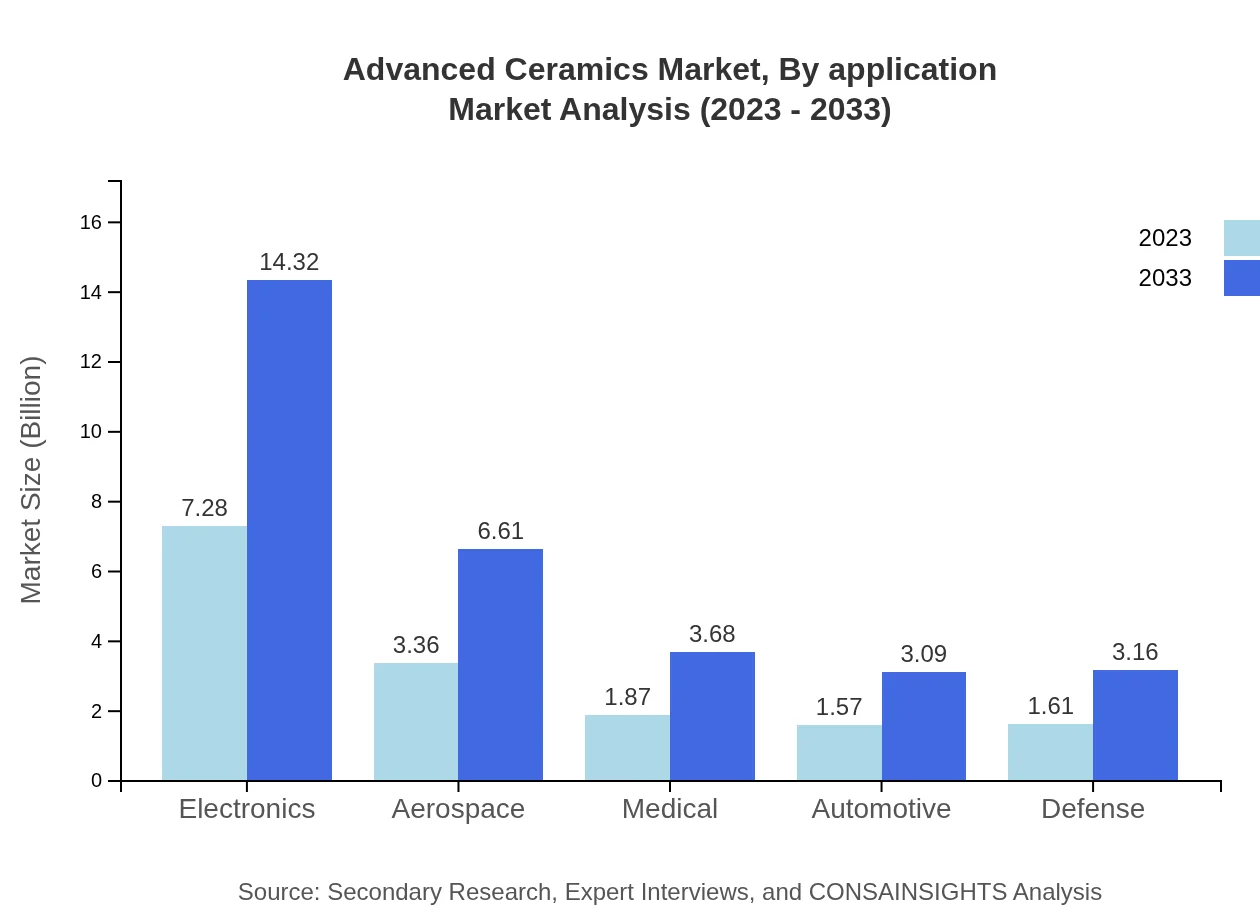

Advanced Ceramics Market Analysis By End User

An analysis of end-user segments shows aerospace and defense contributing significantly, with aerospace projected to grow from $3.36 billion to $6.61 billion. The defense sector's size will advance from $1.61 billion to $3.16 billion. Medical end-users will exhibit growth from $1.87 billion to $3.68 billion, while automotive applications will experience growth from $1.57 billion to $3.09 billion.

Advanced Ceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Ceramics Industry

Ceramtec:

Ceramtec is a leading global manufacturer of advanced ceramics, specializing in innovative material solutions for the technology, aerospace, automotive, and medical sectors. They focus on R&D to develop products that meet stringent industry standards.Kyocera Corporation:

Kyocera is a multinational corporation known for its advanced ceramics technology, producing a wide range of ceramic products with significant applications in electronics and telecommunications.CoorsTek:

CoorsTek produces advanced ceramic solutions that cater to diverse industries, including aerospace and defense, providing high-durability materials for critical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Ceramics?

The advanced ceramics market is valued at approximately $15.7 billion in 2023 with a projected compound annual growth rate (CAGR) of 6.8%. By 2033, the market is expected to continue expanding significantly, driven by various industrial applications.

What are the key market players in the advanced Ceramics industry?

Key players in the advanced ceramics market include established companies like CeramTec, Kyocera, and Morgan Advanced Materials, alongside emerging firms focused on innovation in ceramic materials and production processes their contributions shape market dynamics.

What are the primary factors driving growth in the advanced Ceramics industry?

Growth is driven by increased demand in electronics, automotive, and medical sectors, innovations in manufacturing processes, and advancements in material properties that enhance performance and durability in complex applications.

Which region is the fastest Growing in the advanced Ceramics market?

The Asia Pacific region shows rapid growth in the advanced ceramics market, with a market size projected to rise from $3.05 billion in 2023 to $6.00 billion in 2033, reflecting a booming demand for technological applications.

Does ConsaInsights provide customized market report data for the advanced Ceramics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the advanced ceramics sector, including detailed analyses, strategic insights, and forecasts based on client requirements.

What deliverables can I expect from the advanced Ceramics market research project?

Deliverables typically include detailed market reports, regional and segment analyses, growth projections, competitive landscape evaluations, and tailored strategic recommendations for stakeholders in the advanced ceramics industry.

What are the market trends of advanced Ceramics?

Current trends include increasing use of advanced ceramics in the aerospace sector, advancements in 3D printing and manufacturing techniques, and growing applications in smart materials and electronics, which drive innovation.