Advanced Combat Helmet Market Report

Published Date: 03 February 2026 | Report Code: advanced-combat-helmet

Advanced Combat Helmet Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Advanced Combat Helmet market, covering key insights and forecasts from 2023 to 2033. It analyzes market size, segmentation, regional insights, industry trends, and competitive landscape, providing a comprehensive overview for stakeholders and decision-makers.

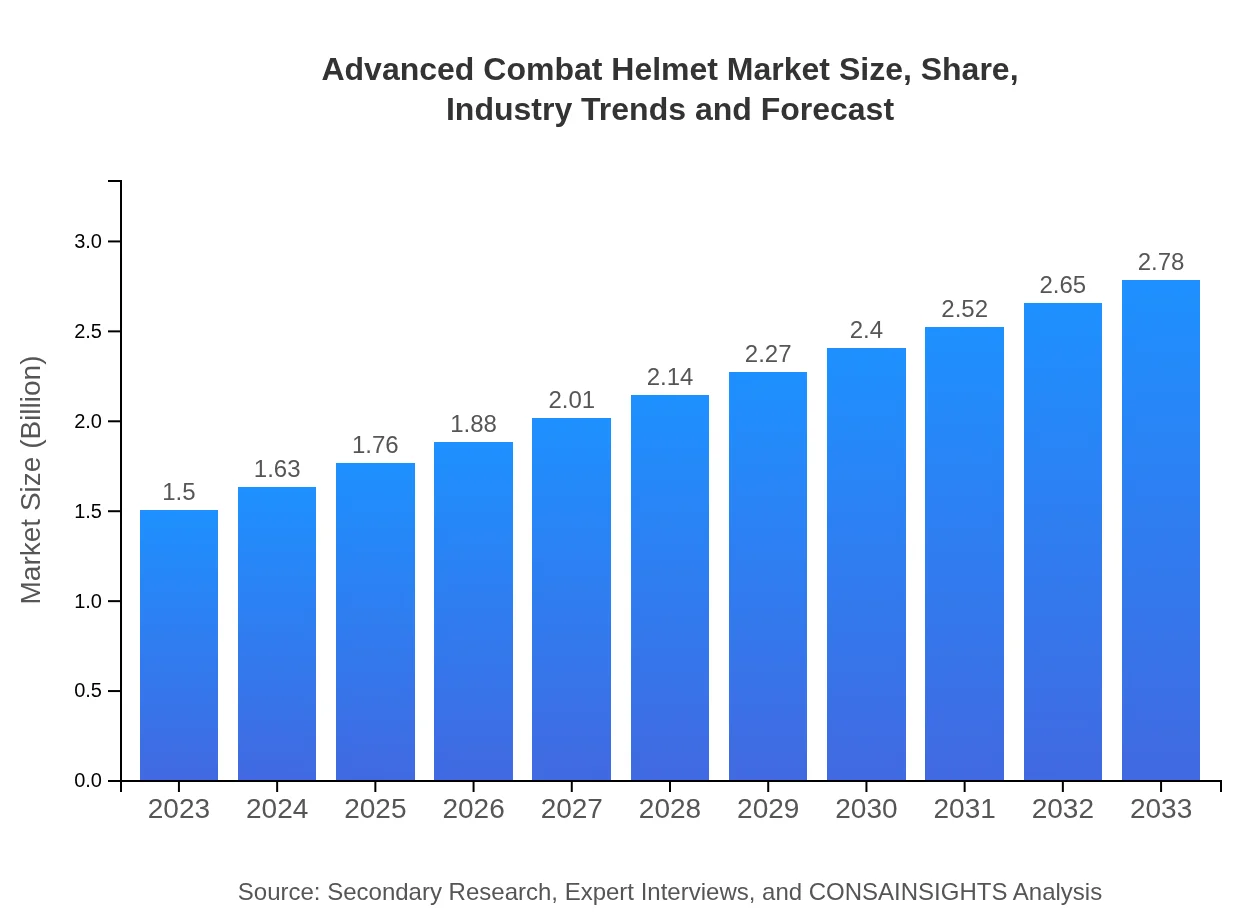

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Gentex Corporation, 3M Company, Honeywell International Inc., MSA Safety Incorporated, Avon Protection PLC |

| Last Modified Date | 03 February 2026 |

Advanced Combat Helmet Market Overview

Customize Advanced Combat Helmet Market Report market research report

- ✔ Get in-depth analysis of Advanced Combat Helmet market size, growth, and forecasts.

- ✔ Understand Advanced Combat Helmet's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Combat Helmet

What is the Market Size & CAGR of Advanced Combat Helmet market in 2023?

Advanced Combat Helmet Industry Analysis

Advanced Combat Helmet Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Combat Helmet Market Analysis Report by Region

Europe Advanced Combat Helmet Market Report:

Europe's market is estimated to rise from $0.46 billion in 2023 to $0.85 billion by 2033. European countries are investing in next-generation protective gear to maintain operational readiness in response to emerging security threats.Asia Pacific Advanced Combat Helmet Market Report:

The Asia Pacific region is projected to grow from $0.31 billion in 2023 to $0.57 billion by 2033, driven by increased military modernization initiatives among countries such as India, China, and Japan, where defense spending has seen a notable uptick.North America Advanced Combat Helmet Market Report:

The North American market, dominated by the United States, is anticipated to grow from $0.49 billion in 2023 to $0.91 billion by 2033. The U.S. military's ongoing investments in advanced gear, paired with increased defense budgets, significantly contributes to this growth.South America Advanced Combat Helmet Market Report:

In South America, the Advanced Combat Helmet market is expected to expand from $0.11 billion in 2023 to $0.21 billion by 2033. Rising security concerns and investments in law enforcement agencies are propelling this growth, as countries seek to enhance public safety.Middle East & Africa Advanced Combat Helmet Market Report:

The Middle East and Africa region are expected to experience growth from $0.13 billion in 2023 to $0.24 billion by 2033. Increased military expenditures driven by regional conflicts and terrorism threats are incentivizing nations to invest in advanced combat helmets.Tell us your focus area and get a customized research report.

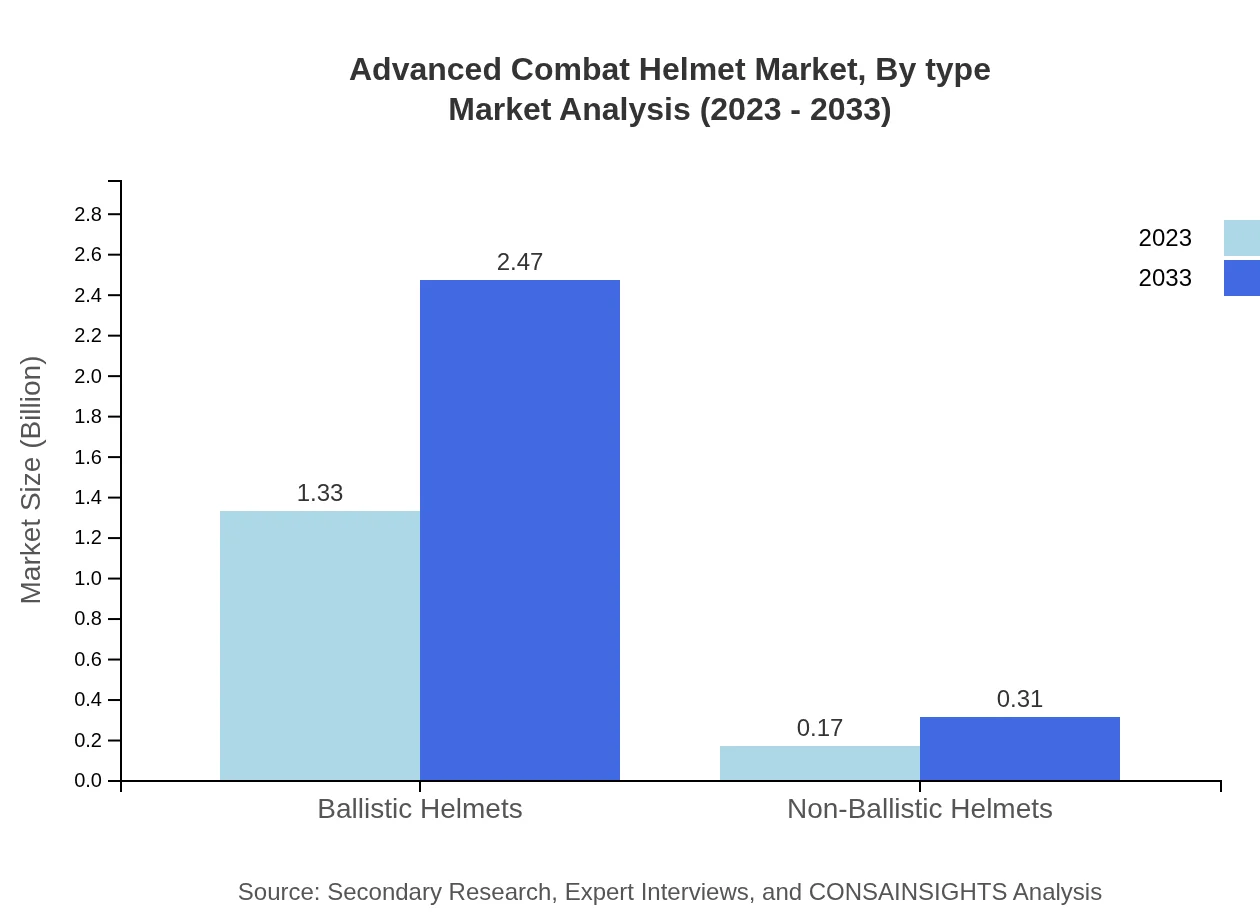

Advanced Combat Helmet Market Analysis By Type

Ballistic helmets dominate the market, expected to grow from $1.33 billion in 2023 to $2.47 billion by 2033, capturing approximately 88.72% of the market share. Conversely, non-ballistic helmets are anticipated to grow from $0.17 billion to $0.31 billion, holding a market share of 11.28%. This segment reflects military preferences for robust yet lightweight helmet options.

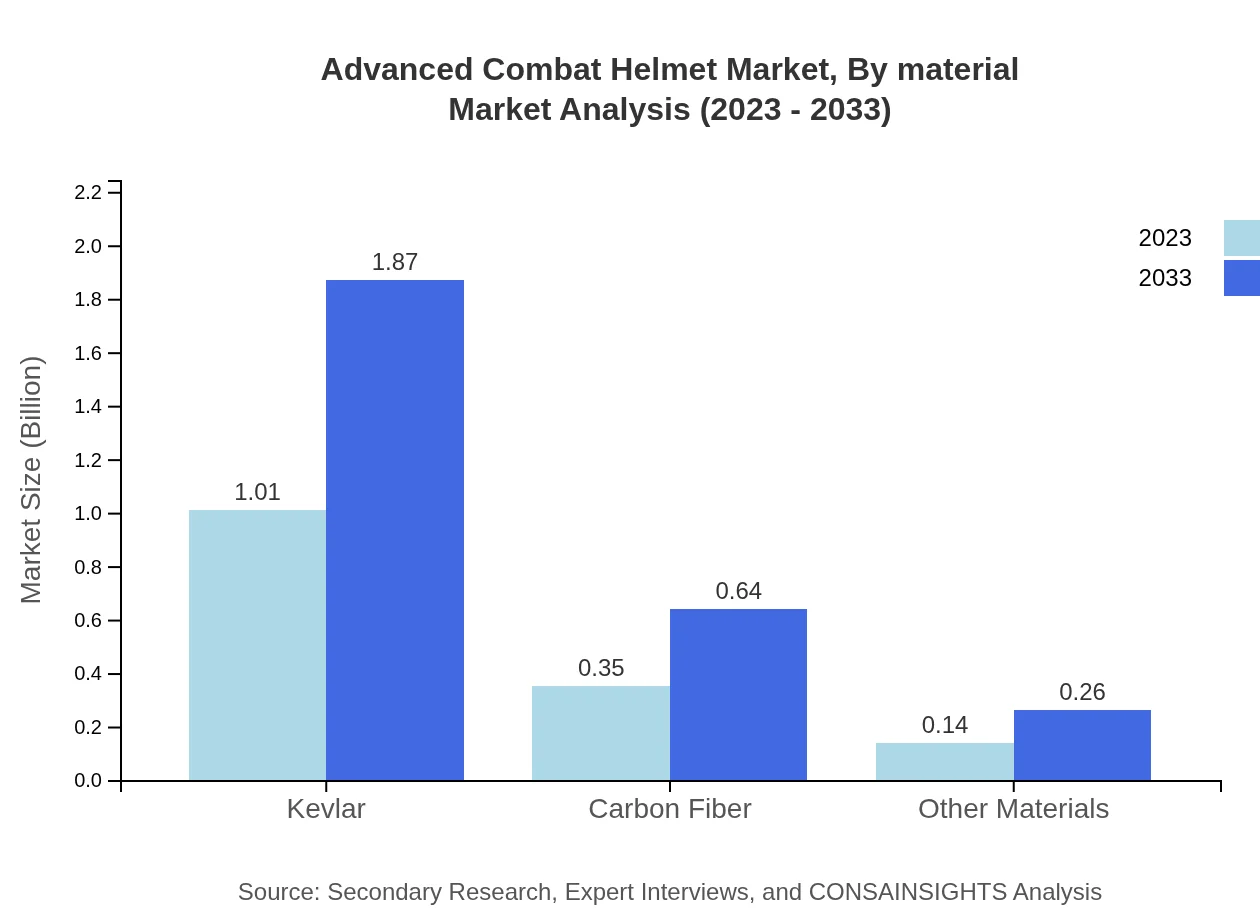

Advanced Combat Helmet Market Analysis By Material

The material segment showcases Kevlar leading with a market size of $1.01 billion in 2023, projected to reach $1.87 billion by 2033, representing a market share of 67.46%. Carbon fiber's market is expected to grow from $0.35 billion to $0.64 billion, while other materials will experience modest growth from $0.14 billion to $0.26 billion, reflecting a diverse material preference in helmet manufacturing.

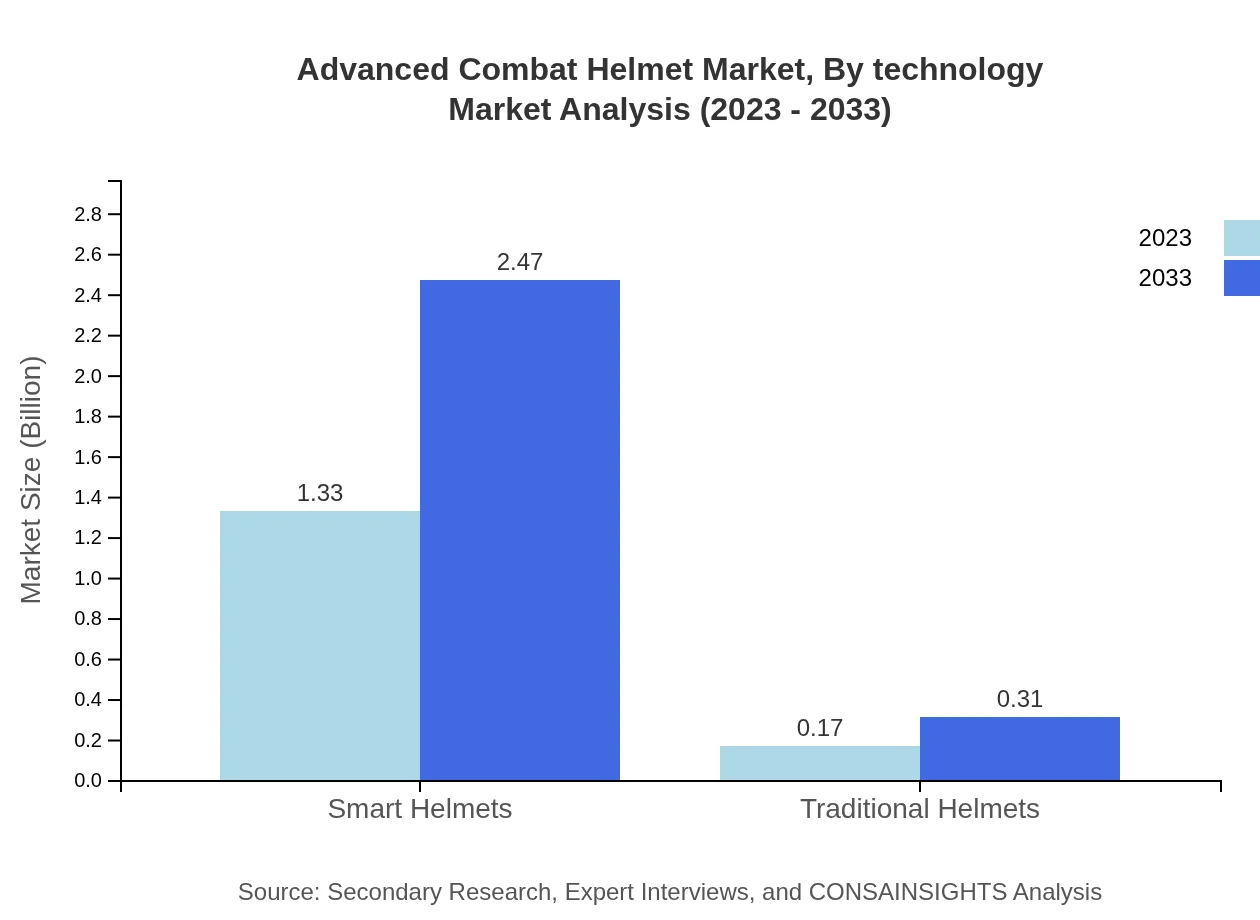

Advanced Combat Helmet Market Analysis By Technology

Smart helmets, equipped with enhanced technology and communication systems, comprise a significant and growing segment, projected to double from $1.33 billion in 2023 to $2.47 billion by 2033, while traditional helmets are expected to reach $0.31 billion by 2033.

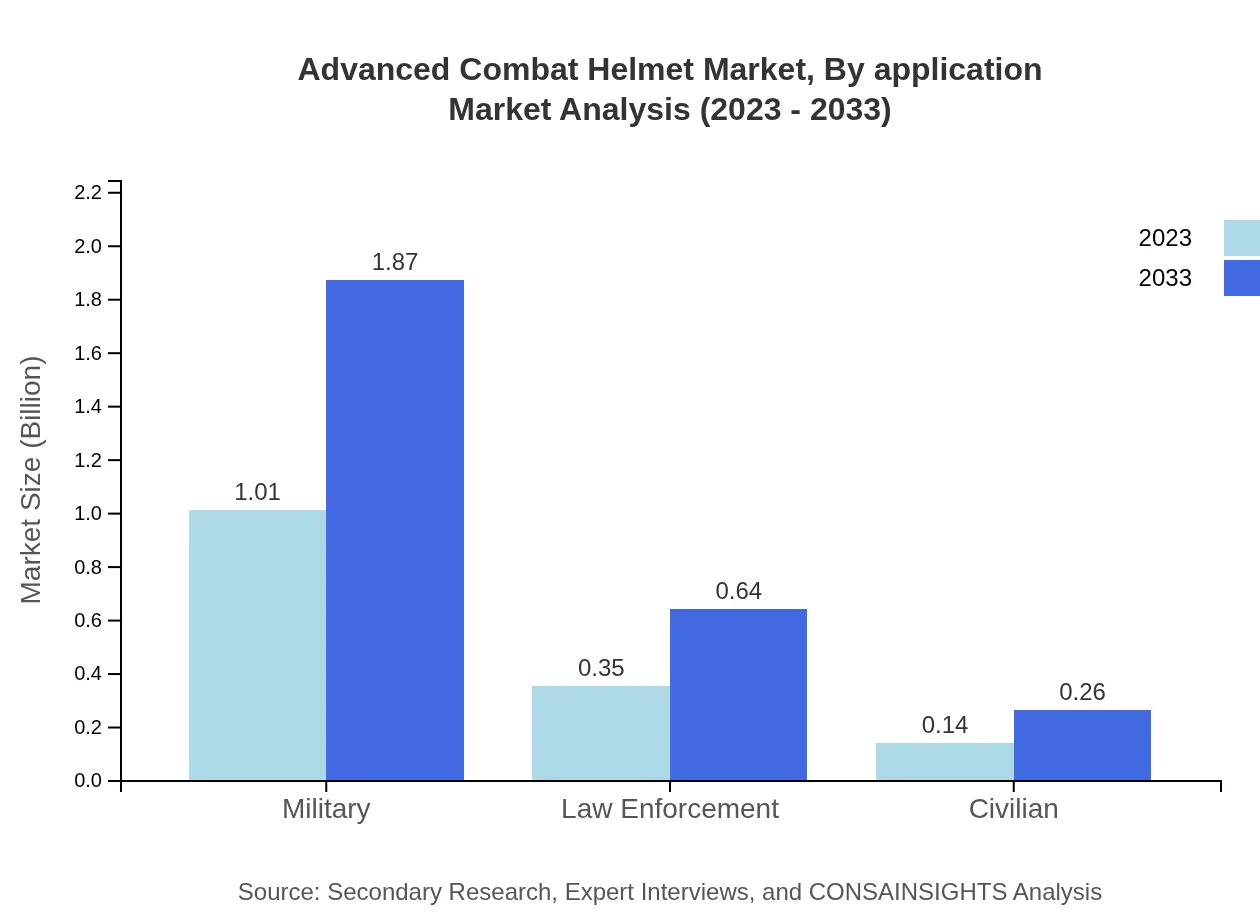

Advanced Combat Helmet Market Analysis By Application

Military applications dominate the Advanced Combat Helmet market, expected to grow from $1.01 billion in 2023 to $1.87 billion by 2033, representing a market share of 67.46%. Law enforcement is also a crucial sector with a projected growth from $0.35 billion to $0.64 billion, while the civilian segment will rise from $0.14 billion to $0.26 billion.

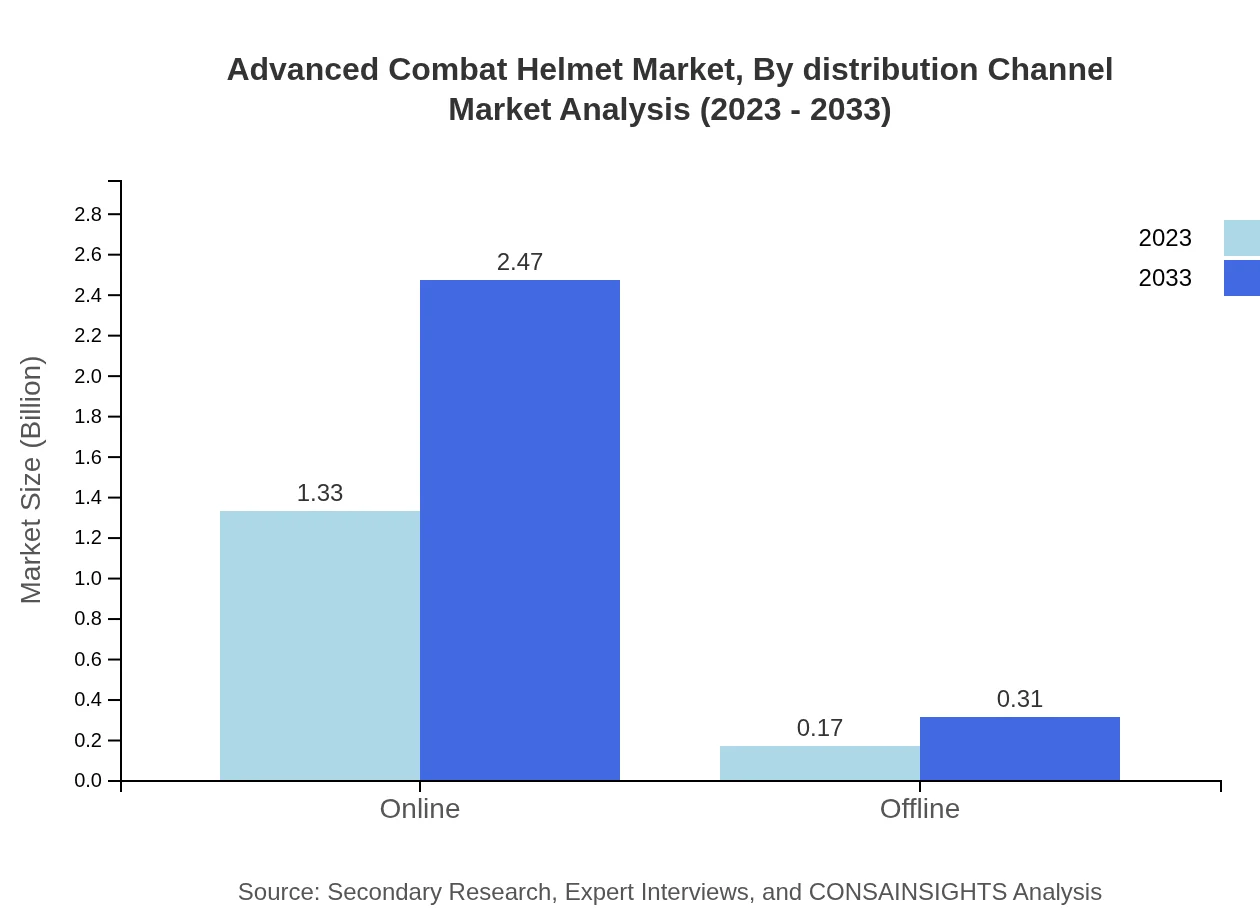

Advanced Combat Helmet Market Analysis By Distribution Channel

The online distribution channel leads with a projected growth from $1.33 billion in 2023 to $2.47 billion by 2033, capturing 88.72% of the market share. Offline channels will see modest growth from $0.17 billion to $0.31 billion, indicating a shift towards digital purchasing preferences.

Advanced Combat Helmet Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Combat Helmet Industry

Gentex Corporation:

A leader in the design and manufacture of advanced head protection systems, Gentex specializes in innovative helmet technology for military and law enforcement applications.3M Company:

3M is renowned for safety products, including advanced protective helmets, utilizing cutting-edge materials and technology for various applications.Honeywell International Inc.:

Honeywell excels in providing advanced military equipment and helmets, emphasizing durability and adaptability in high-threat environments.MSA Safety Incorporated:

MSA is recognized for its protective equipment, including combat helmets, focusing on safety and compliance with military standards.Avon Protection PLC:

Specializing in respiratory and ballistic protection, Avon Protection leads in developing advanced helmets integrated with communication systems.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Combat Helmet?

The advanced combat helmet market is currently valued at $1.5 billion with an impressive CAGR of 6.2%. By 2033, significant growth is anticipated, underscoring the growing importance of advanced protective gear in military and law enforcement sectors.

What are the key market players or companies in this advanced Combat Helmet industry?

Key players in the advanced combat helmet market include leading defense contractors and armor manufacturers who specialize in personal protection equipment. These companies drive innovation, focusing on materials and technology enhancements, thus contributing to market competitive dynamics.

What are the primary factors driving the growth in the advanced combat helmet industry?

The advanced combat helmet market growth is driven by increasing defense budgets, rising global conflicts, and demands for enhanced soldier protection. Additionally, advancements in materials technology and smart helmet functionalities are crucial to sustaining momentum in this sector.

Which region is the fastest Growing in the advanced combat helmet market?

North America is currently the fastest-growing region in the advanced combat helmet market, projected to grow from $0.49 billion in 2023 to $0.91 billion by 2033. Its concentration of defense operations boosts the demand for advanced protective gear.

Does ConsaInsights provide customized market report data for the advanced Combat Helmet industry?

Yes, ConsaInsights offers customized market report data for the advanced combat helmet industry. Clients can request tailored analyses to meet specific research needs, ensuring they gain the most relevant and insightful data for decision-making.

What deliverables can I expect from this advanced Combat Helmet market research project?

From the advanced combat helmet market research project, clients can expect comprehensive reports detailing market size, growth projections, segment analysis, and regional insights, along with strategic recommendations to navigate the competitive landscape.

What are the market trends of advanced combat helmet?

Current trends in the advanced combat helmet market include a shift towards smart helmets integrating technology for enhanced situational awareness and situational safety, along with an increasing emphasis on lightweight materials like carbon fiber and kevlar for improved mobility.