Advanced Distribution Management System Market Report

Published Date: 22 January 2026 | Report Code: advanced-distribution-management-system

Advanced Distribution Management System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Advanced Distribution Management System (ADMS) market, focusing on market trends, size projections, regional insights, and competitive landscape. The forecast period spans from 2023 to 2033.

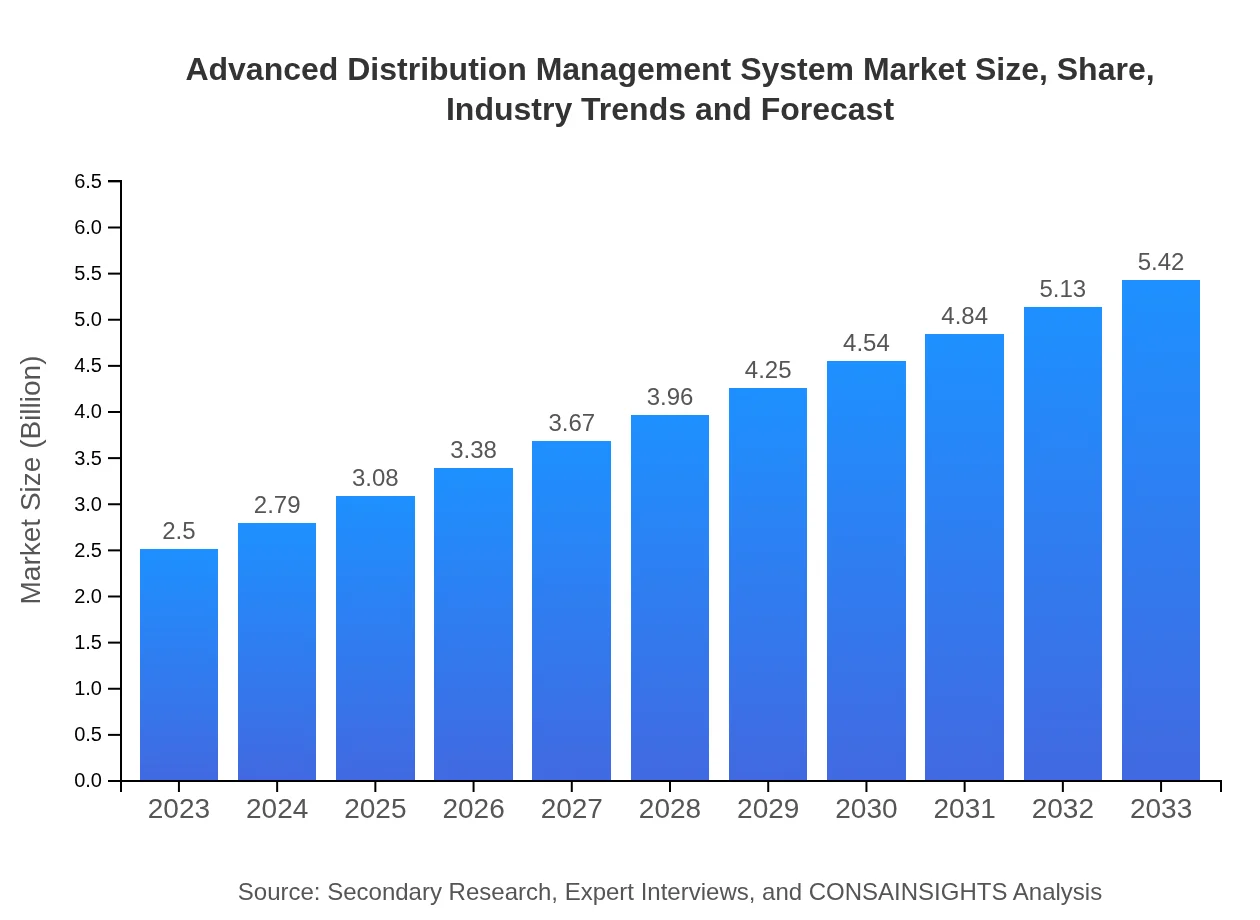

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Siemens AG, Schneider Electric, GE Digital, Oracle Corporation |

| Last Modified Date | 22 January 2026 |

Advanced Distribution Management System Market Overview

Customize Advanced Distribution Management System Market Report market research report

- ✔ Get in-depth analysis of Advanced Distribution Management System market size, growth, and forecasts.

- ✔ Understand Advanced Distribution Management System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Distribution Management System

What is the Market Size & CAGR of Advanced Distribution Management System market in 2023?

Advanced Distribution Management System Industry Analysis

Advanced Distribution Management System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Distribution Management System Market Analysis Report by Region

Europe Advanced Distribution Management System Market Report:

In Europe, the market is projected to increase from $0.67 billion in 2023 to $1.45 billion by 2033. The European Union's strong emphasis on achieving carbon neutrality and enhancing energy efficiency is likely to propel the demand for advanced distribution management systems.Asia Pacific Advanced Distribution Management System Market Report:

In the Asia Pacific region, the ADMS market is expected to grow from $0.49 billion in 2023 to $1.07 billion by 2033. Factors contributing to this growth include increasing electricity consumption, mandatory modernization of electricity infrastructure in developing nations, and governmental policies aimed at enhancing sustainability through the integration of renewable energies.North America Advanced Distribution Management System Market Report:

North America dominates the ADMS market, growing from $0.83 billion in 2023 to $1.81 billion by 2033. The region's advanced electric grid infrastructure, substantial investments in smart grid technologies, and regulatory incentives for renewable energy adoption will drive this growth.South America Advanced Distribution Management System Market Report:

The South American market is forecasted to expand from $0.16 billion in 2023 to $0.34 billion by 2033. This growth is primarily driven by infrastructure development projects and the increasing demand for reliable energy solutions in countries with growing urban populations.Middle East & Africa Advanced Distribution Management System Market Report:

The Middle East and Africa region is expected to see growth from $0.34 billion in 2023 to $0.75 billion by 2033. This growth can be attributed to escalating energy demands, diversification of energy sources, and substantial investments in electrical infrastructure to support economic growth.Tell us your focus area and get a customized research report.

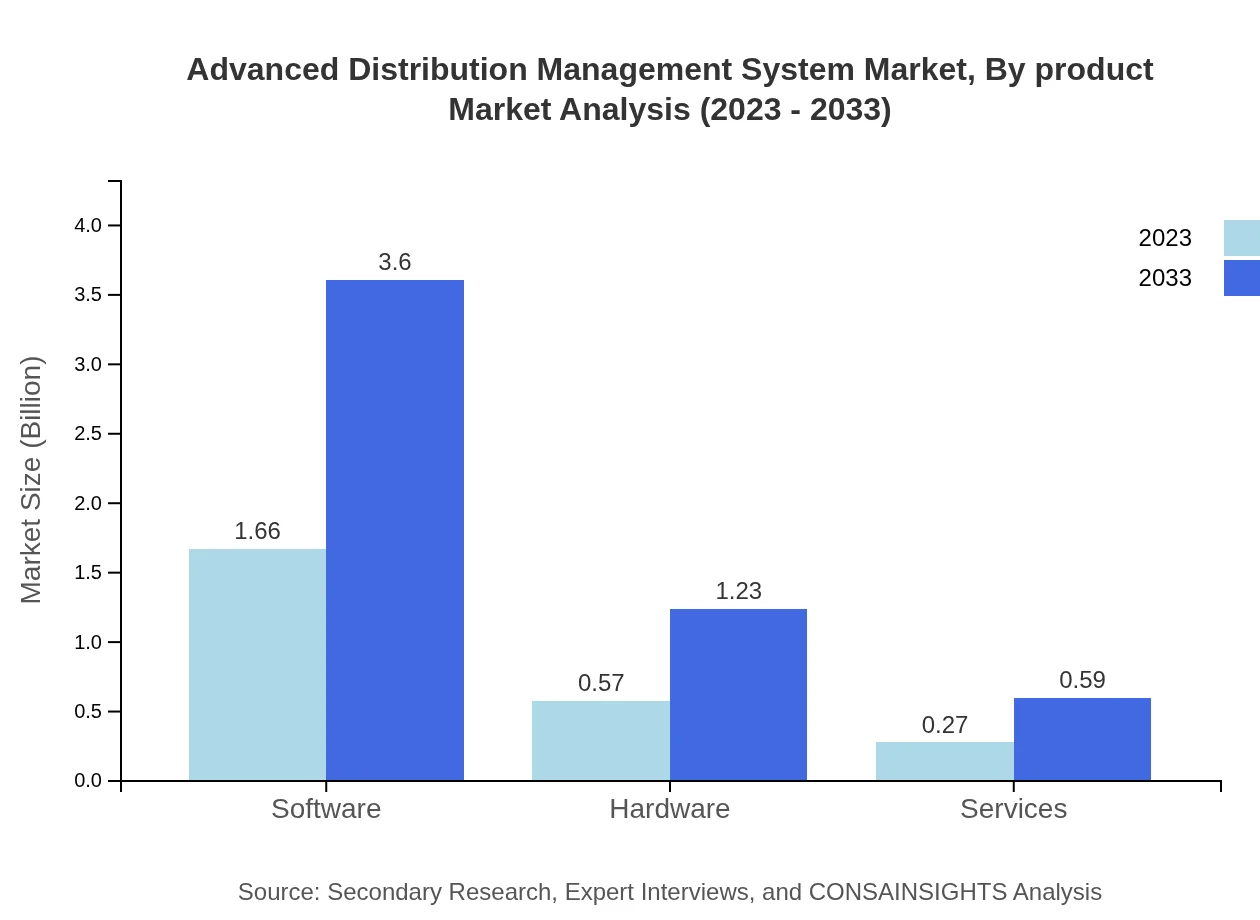

Advanced Distribution Management System Market Analysis By Product

The ADMS market can be divided into software, hardware, and services. The software segment holds the largest market share at 66.42% in 2023 and continues to dominate due to its essential role in real-time data processing and analytics. Hardware components, although accounting for a smaller share of 22.65%, are crucial for the physical implementation of distribution management systems. The services segment makes up 10.93%, providing essential support and maintenance for effective system operation.

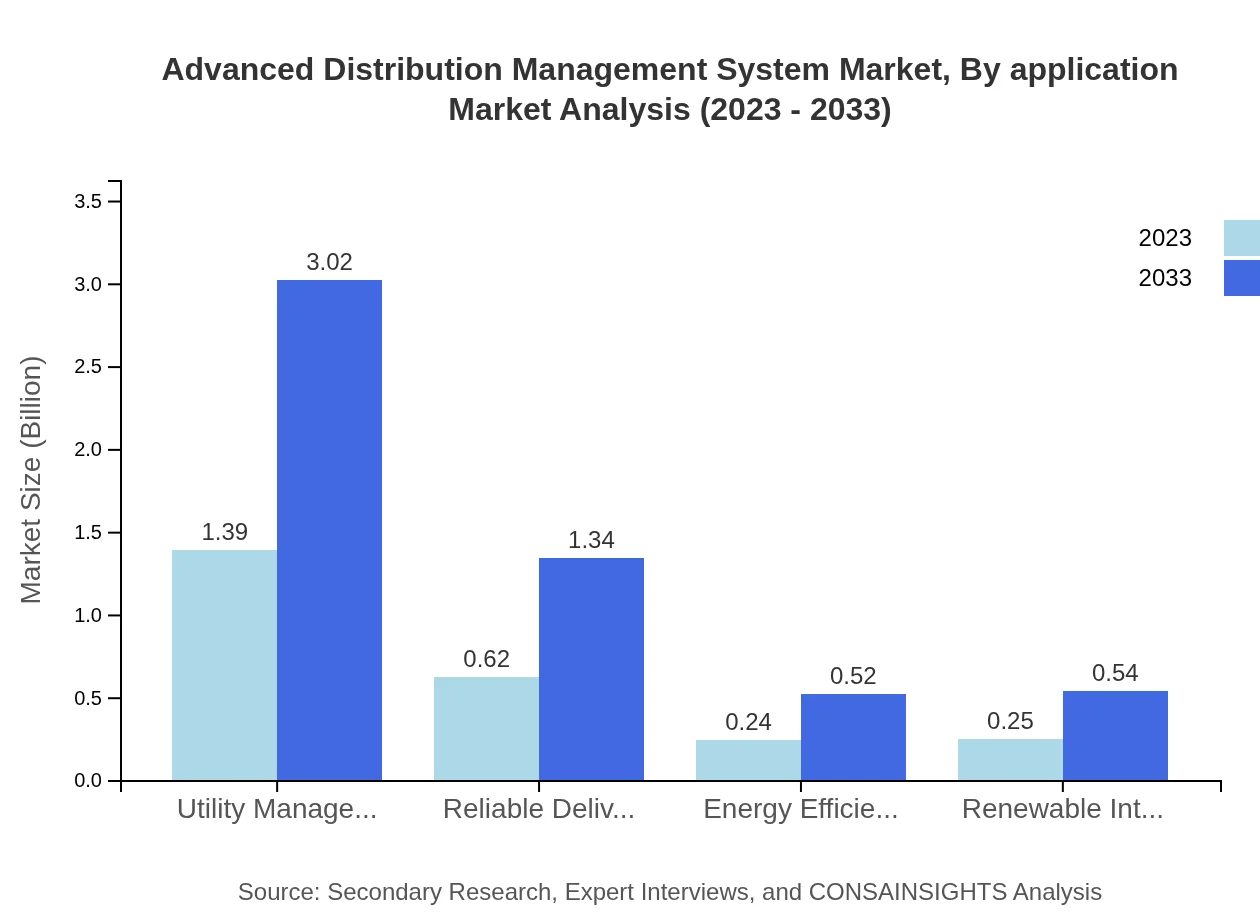

Advanced Distribution Management System Market Analysis By Application

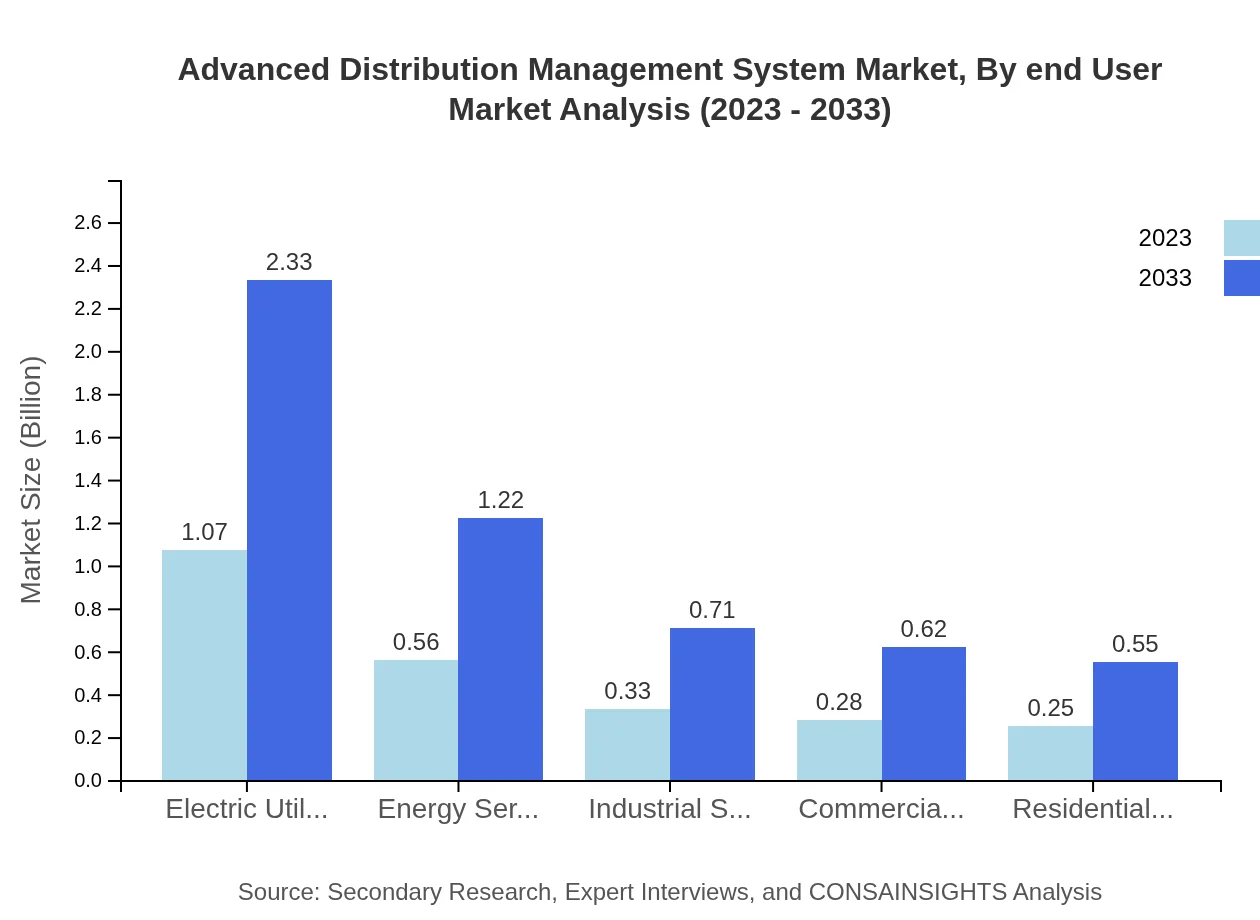

The range of applications within the ADMS market includes electric utilities, energy service companies, industrial, commercial, and residential sectors. Electric utilities emerge as the largest segment with a 42.96% share, reflecting their significant reliance on ADMS to enhance grid management. Energy service companies capture 22.42%, while industrial and commercial sectors hold 13.08% and 11.38% respectively, indicating a growing trend of ADMS adoption across diverse market sectors.

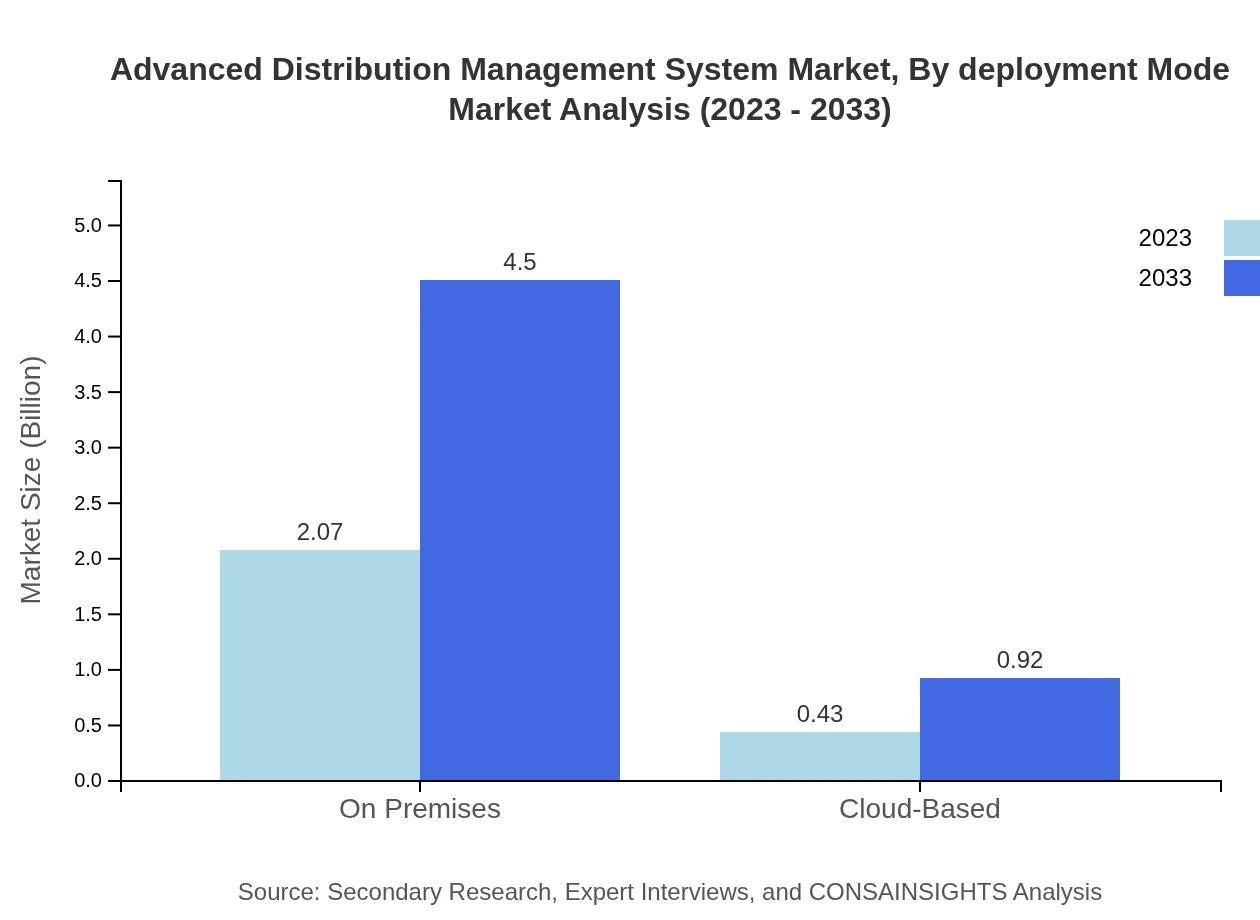

Advanced Distribution Management System Market Analysis By Deployment Mode

ADMS solutions are typically deployed in two modes: On-Premises and Cloud-Based. The On-Premises segment leads the market with an 82.95% share in 2023, favored for its control and customization capabilities. However, Cloud-Based solutions are gaining traction, expected to grow from $0.43 billion to $0.92 billion by 2033, due to their cost-effectiveness and flexibility.

Advanced Distribution Management System Market Analysis By End User

End-user industries for ADMS include utility management, renewable integration, energy efficiency, and reliable delivery. The Utility Management sector leads the market with a 55.67% share in 2023, emphasizing the critical need for ADMS solutions in optimizing utility operations. The focus on renewable energy sources is expected to drive the growth of the renewable integration segment, as utilities strive to accommodate diverse energy inputs and enhance grid stability.

Advanced Distribution Management System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Distribution Management System Industry

Siemens AG:

Siemens is a global leader in electrification, automation, and digitalization, providing cutting-edge ADMS solutions that optimize distribution networks for utility companies.Schneider Electric:

Schneider Electric offers innovative software solutions for energy management and automation, empowering utilities to enhance operational efficiency using ADMS technology.GE Digital:

GE Digital provides advanced digital solutions to enable utilities to manage complex distribution systems through enhanced analytics and operational insight.Oracle Corporation:

Oracle provides comprehensive cloud-based solutions for utilities, including ADMS functionalities that promote efficiency and reliability in energy distribution.We're grateful to work with incredible clients.

FAQs

What is the market size of Advanced Distribution Management System?

The Advanced Distribution Management System market is valued at approximately $2.5 billion in 2023 and is projected to reach $5.52 billion by 2033, growing at a CAGR of 7.8%.

What are the key market players or companies in the Advanced Distribution Management System industry?

Key players in the Advanced Distribution Management System market include Siemens, Schneider Electric, ABB, Oracle, and GE Digital, among others. These companies lead in innovation, technology advancements, and market share.

What are the primary factors driving the growth in the Advanced Distribution Management System industry?

The growth in the Advanced Distribution Management System industry is primarily driven by the increasing demand for electricity, the need for efficient energy management, advancements in smart grid technologies, and regulatory mandates for renewable integration.

Which region is the fastest Growing in the Advanced Distribution Management System market?

The Asia Pacific region is currently the fastest-growing in the Advanced Distribution Management System market, expected to grow from $0.49 billion in 2023 to $1.07 billion by 2033.

Does ConsaInsights provide customized market report data for the Advanced Distribution Management System industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Advanced Distribution Management System industry, ensuring valuable insights and competitive analysis.

What deliverables can I expect from this Advanced Distribution Management System market research project?

Expect comprehensive deliverables including detailed market size analysis, growth forecasts, competitive landscape assessments, key trends, and segment-wise analysis covering software, hardware, and services.

What are the market trends of Advanced Distribution Management System?

Key market trends include the rise of cloud-based solutions, the increasing focus on energy efficiency, advancements in AI for predictive maintenance, and the integration of renewable energy sources into distribution systems.