Advanced Driver Assistance System Adas Market Report

Published Date: 31 January 2026 | Report Code: advanced-driver-assistance-system-adas

Advanced Driver Assistance System Adas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced Driver Assistance System (ADAS) market from 2023 to 2033, focusing on market size, trends, and growth opportunities across various segments and regions.

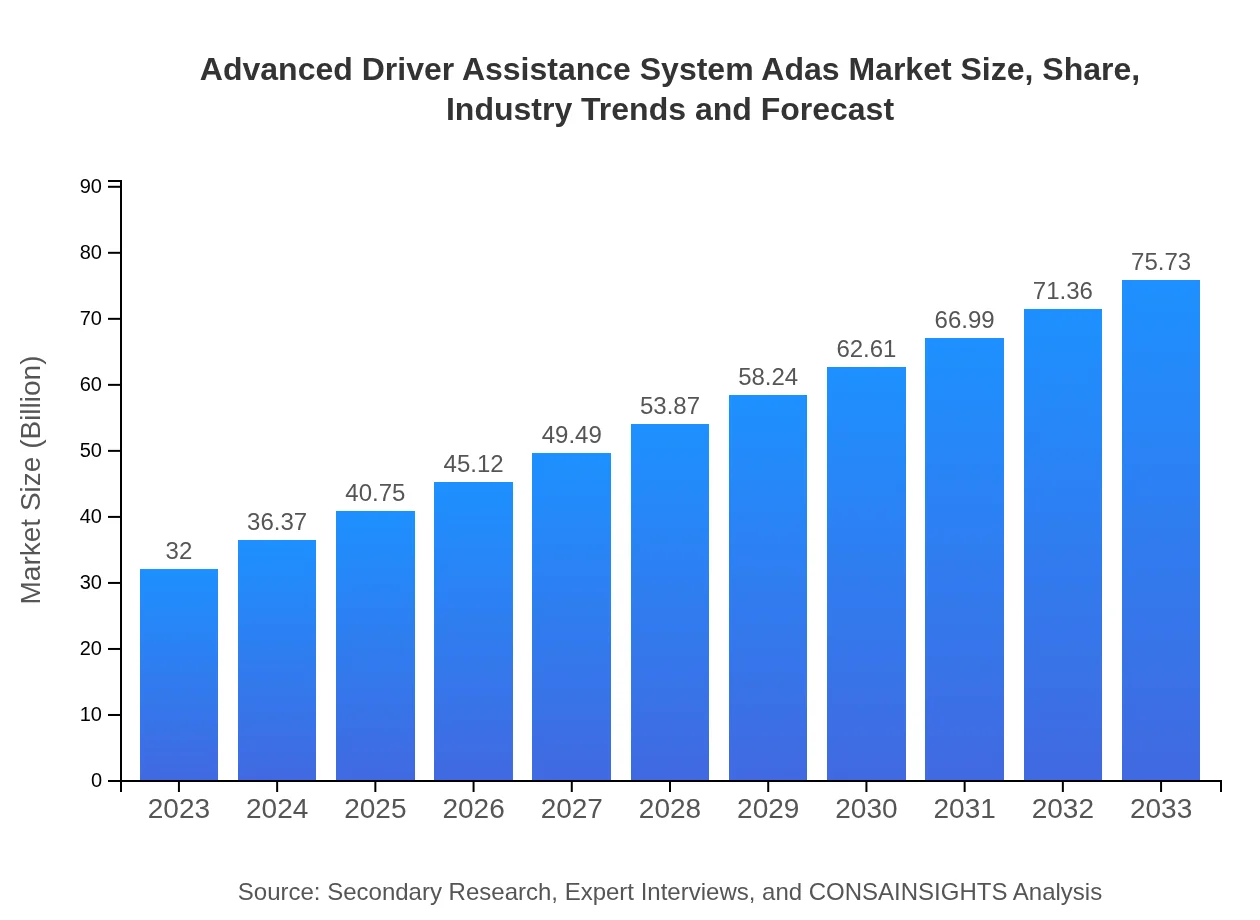

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.00 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $75.73 Billion |

| Top Companies | Bosch, Denso Corporation, Mobileye, Continental AG |

| Last Modified Date | 31 January 2026 |

Advanced Driver Assistance System Adas Market Overview

Customize Advanced Driver Assistance System Adas Market Report market research report

- ✔ Get in-depth analysis of Advanced Driver Assistance System Adas market size, growth, and forecasts.

- ✔ Understand Advanced Driver Assistance System Adas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Driver Assistance System Adas

What is the Market Size & CAGR of Advanced Driver Assistance System Adas market in 2033?

Advanced Driver Assistance System Adas Industry Analysis

Advanced Driver Assistance System Adas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Driver Assistance System Adas Market Analysis Report by Region

Europe Advanced Driver Assistance System Adas Market Report:

Europe represents one of the largest markets globally, with a projected increase from $10.52 billion in 2023 to $24.90 billion by 2033. Key factors include stringent safety regulations and a high demand for premium vehicles equipped with advanced technologies.Asia Pacific Advanced Driver Assistance System Adas Market Report:

The Asia Pacific region is set to witness substantial growth, with a market size projected to expand from $6.22 billion in 2023 to $14.72 billion by 2033. This growth is fueled by the increasing vehicle production in countries like China and Japan, alongside rising demand for advanced safety features amongst consumers.North America Advanced Driver Assistance System Adas Market Report:

North America shows a steady growth trajectory, with the market projected to grow from $10.29 billion in 2023 to $24.36 billion by 2033. The region’s robust regulatory framework regarding vehicle safety features contributes significantly to this growth, alongside the presence of major automotive players.South America Advanced Driver Assistance System Adas Market Report:

In South America, the ADAS market is expected to grow from $2.99 billion in 2023 to $7.07 billion by 2033, driven by growing awareness of vehicle safety and government regulations. Brazil and Argentina are likely to dominate this market due to their large automotive industries.Middle East & Africa Advanced Driver Assistance System Adas Market Report:

The Middle East and Africa market is expected to see growth from $1.98 billion in 2023 to $4.68 billion by 2033, influenced by increasing investments in vehicle safety technologies and a growing consumer base in the region.Tell us your focus area and get a customized research report.

Advanced Driver Assistance System Adas Market Analysis By Technology

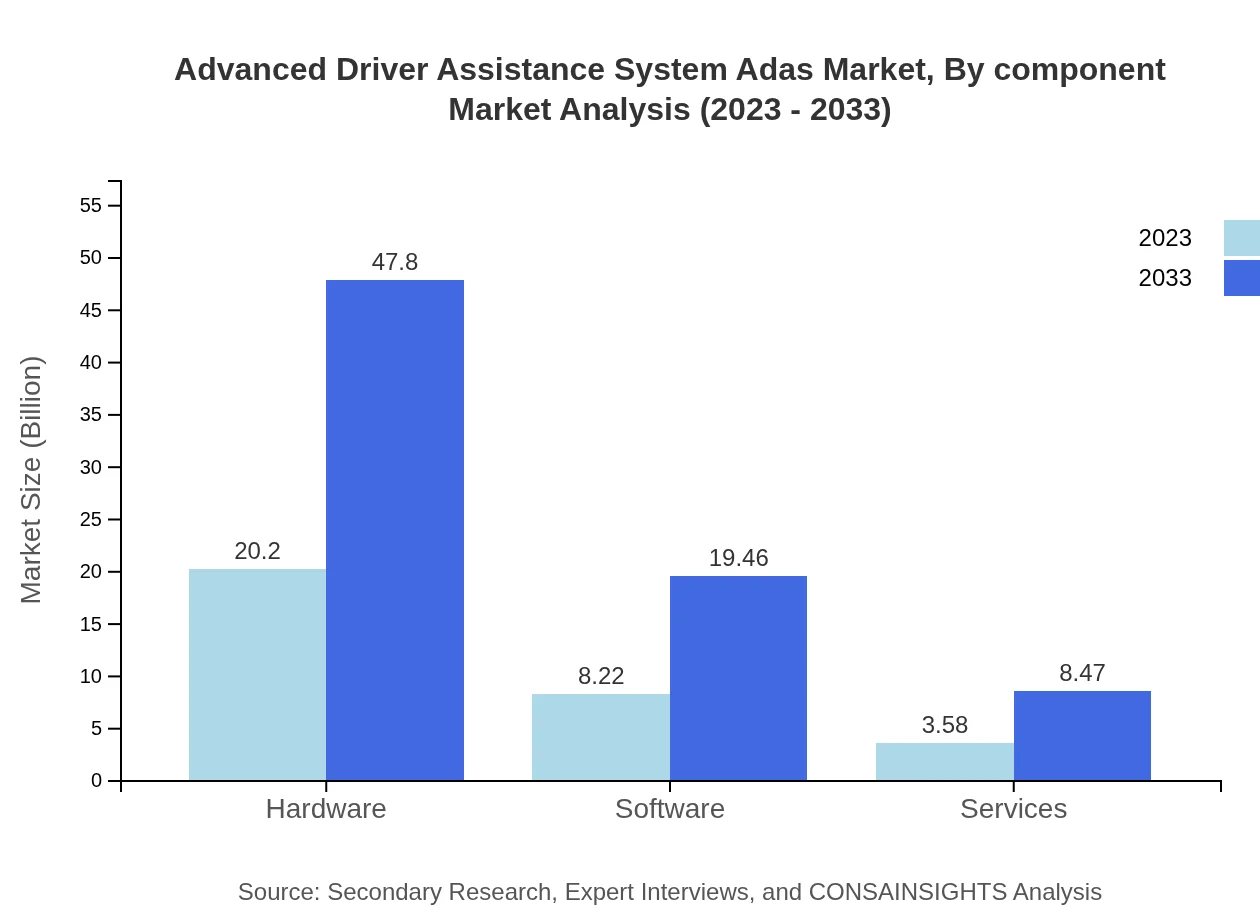

The hardware segment dominates the ADAS market, expected to grow from $20.20 billion in 2023 to $47.80 billion in 2033, holding a market share of 63.12%. Software solutions will see growth from $8.22 billion to $19.46 billion, representing a 25.69% share, while services expand from $3.58 billion to $8.47 billion, maintaining an 11.19% market share over the same period.

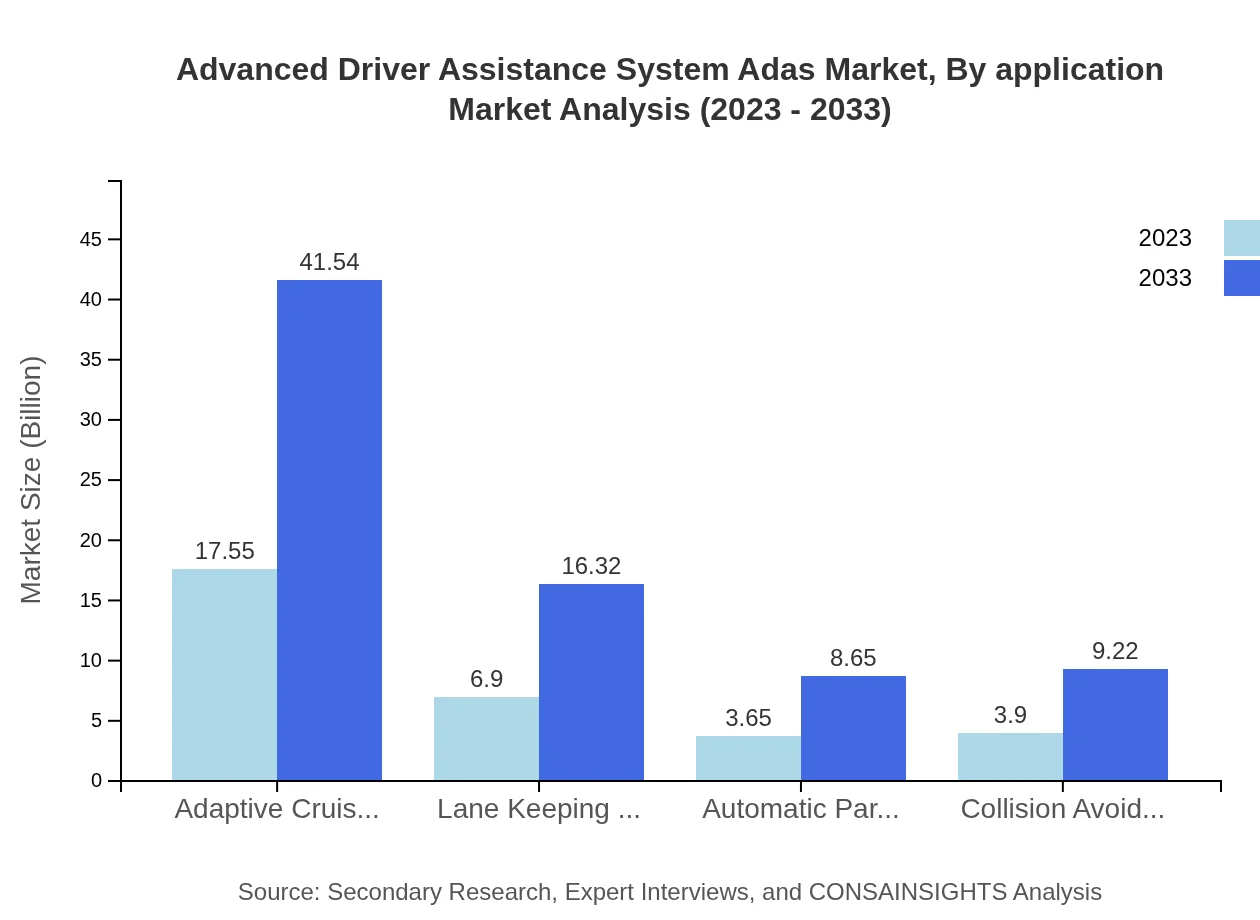

Advanced Driver Assistance System Adas Market Analysis By Application

Passenger vehicles represent the largest application segment, with a size increase from $20.20 billion in 2023 to $47.80 billion by 2033 and a market share of 63.12%. Commercial vehicles also show promising growth, set to rise from $8.22 billion to $19.46 billion, maintaining a share of 25.69%. Electric vehicles, whilst currently smaller, are projected to grow from $3.58 billion to $8.47 billion, showing an increasing penetration of ADAS in this sector.

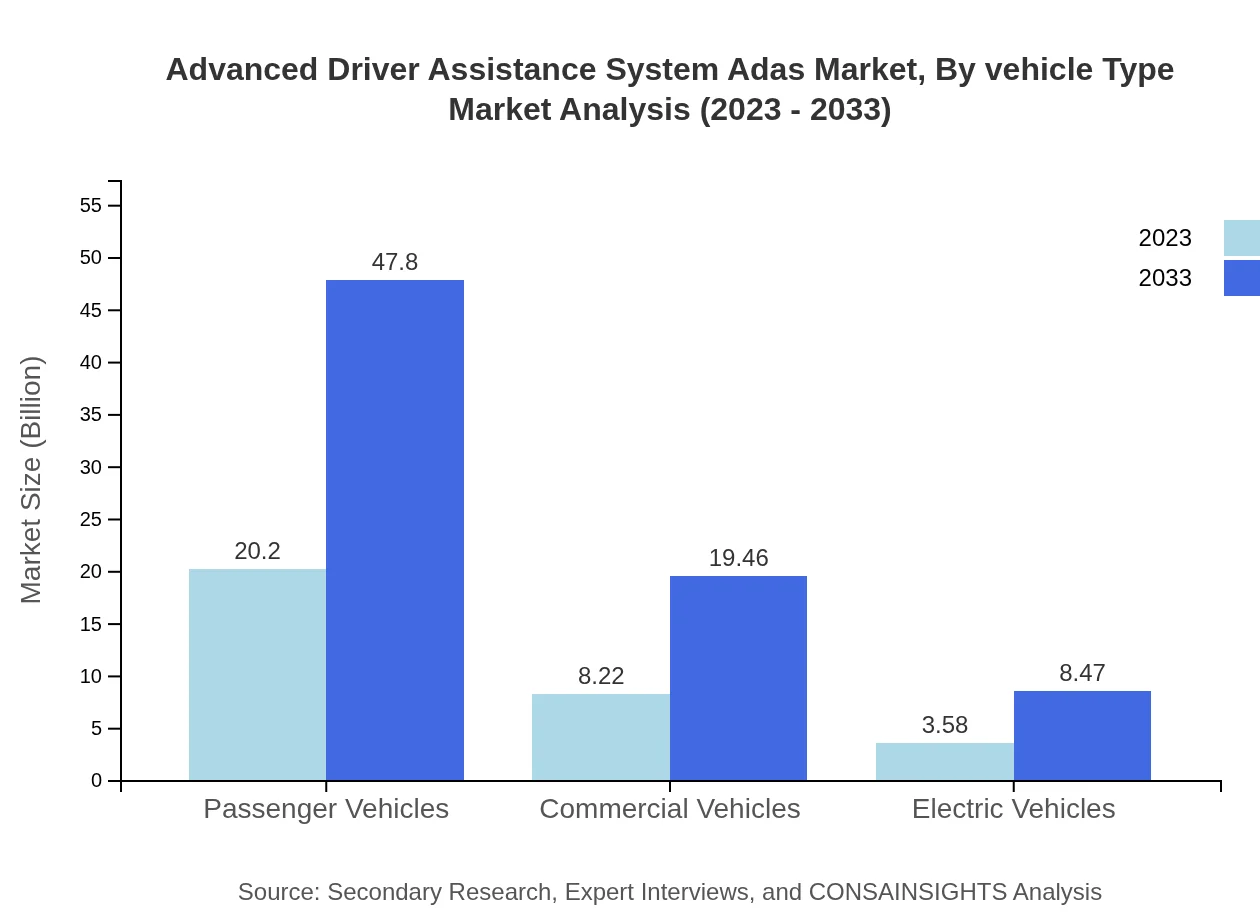

Advanced Driver Assistance System Adas Market Analysis By Vehicle Type

In terms of vehicle types, the market shows a strong preference for passenger vehicles, with historical growth illustrated from $20.20 billion in 2023 to $47.80 billion by 2033. This segment leverages consumer demand for enhanced safety features. Meanwhile, commercial vehicles are expanding steadily, reflecting the growing trend of fleet management integration with ADAS technologies.

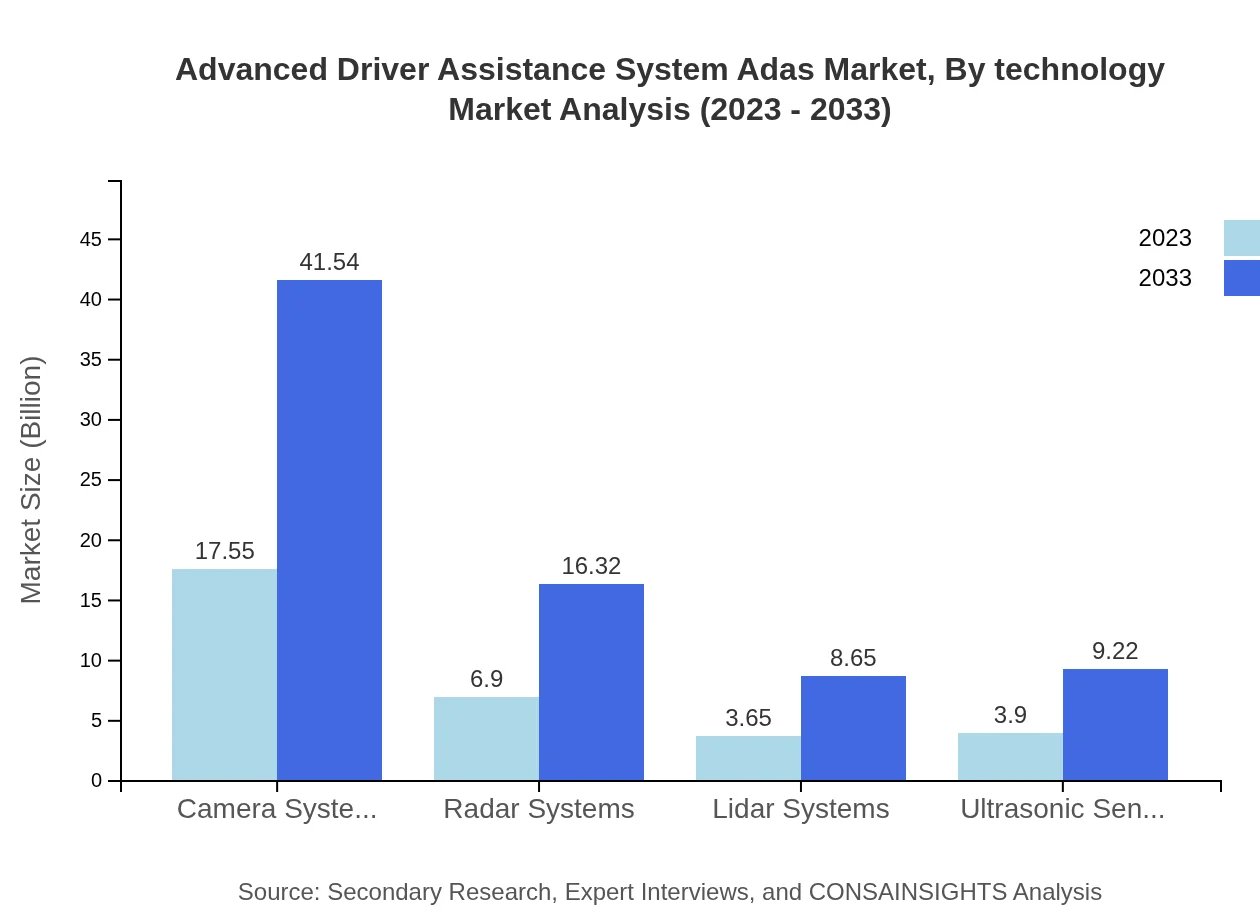

Advanced Driver Assistance System Adas Market Analysis By Component

The market consists primarily of individual components such as camera systems, radar systems, and Lidar systems. Camera systems lead with a size forecast from $17.55 billion in 2023 to $41.54 billion in 2033, followed by radar systems from $6.90 billion to $16.32 billion. Lidar systems and ultrasonic sensors also exhibit growth, affirming their essential roles in ADAS technology.

Advanced Driver Assistance System Adas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Driver Assistance System Adas Industry

Bosch:

Bosch is a leading global supplier of technology and services, actively involved in developing innovative ADAS technologies, enhancing vehicle safety and efficiency.Denso Corporation:

Denso Corporation is a vital player in the automotive sector, focusing on advanced safety and comfort technologies, including ADAS solutions that align with evolving mobility needs.Mobileye:

Mobileye is renowned for its pioneering computer vision technologies for advanced driver assistance, significantly contributing to safety enhancements in vehicles around the globe.Continental AG:

Continental AG develops major automotive technologies and products, including cutting-edge ADAS features, ensuring vehicles meet safety regulations while advancing towards autonomous driving.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced driver assistance system (ADAS)?

The global market size of Advanced Driver Assistance Systems (ADAS) is projected to reach approximately $32 billion by 2033, with a CAGR of 8.7% from 2023 to 2033.

What are the key market players or companies in the advanced driver assistance system (ADAS) industry?

Key players in the ADAS industry include major automotive manufacturers and technology companies such as Bosch, Continental, Delphi Technologies, Denso, and Mobileye, driving innovation and competition in the market.

What are the primary factors driving the growth in the advanced driver assistance system (ADAS) industry?

The growth of the ADAS industry is primarily driven by increasing demand for vehicle safety features, advancements in sensor technology, regulatory mandates for safety standards, and the rising popularity of electric and autonomous vehicles.

Which region is the fastest Growing in the advanced driver assistance system (ADAS)?

Among the regions, Europe is the fastest-growing market for ADAS, projected to grow from $10.52 billion in 2023 to $24.90 billion by 2033, thanks to stringent safety regulations and advanced automotive technologies.

Does ConsaInsights provide customized market report data for the advanced driver assistance system (ADAS) industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the ADAS industry, allowing clients to obtain insights and analyses based on particular interests and market segments.

What deliverables can I expect from this advanced driver assistance system (ADAS) market research project?

Deliverables from the ADAS market research project typically include detailed reports on market size, competitive analysis, regional insights, trends, forecasts, and specific segment data to aid strategic decision making.

What are the market trends of advanced driver assistance system (ADAS)?

Current market trends in the ADAS industry include the increased integration of artificial intelligence, the shift towards fully automated driving, growing consumer awareness about safety features, and an uptick in collaborations between auto manufacturers and tech companies.