Advanced Glass Market Report

Published Date: 22 January 2026 | Report Code: advanced-glass

Advanced Glass Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Advanced Glass market, including current trends, market size, and growth forecasts from 2023 to 2033. It offers insights into industry segmentation, regional performance, and the most influential market players.

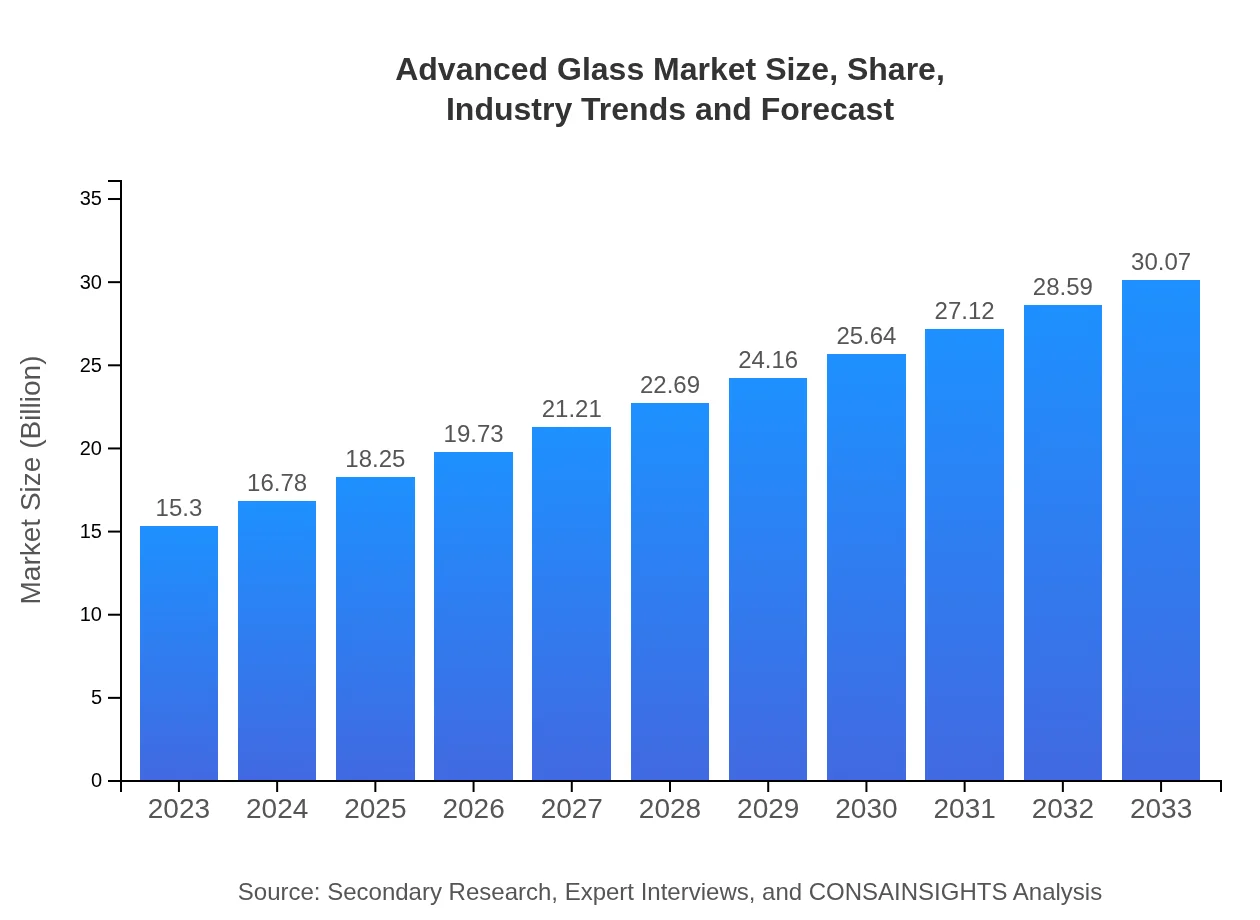

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.07 Billion |

| Top Companies | Saint-Gobain, AGC Inc., Guardian Glass, Nippon Sheet Glass Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Advanced Glass Market Overview

Customize Advanced Glass Market Report market research report

- ✔ Get in-depth analysis of Advanced Glass market size, growth, and forecasts.

- ✔ Understand Advanced Glass's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Glass

What is the Market Size & CAGR of Advanced Glass market in 2023?

Advanced Glass Industry Analysis

Advanced Glass Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Glass Market Analysis Report by Region

Europe Advanced Glass Market Report:

Europe represents a significant portion of the Advanced Glass market, with its value projected to grow from $4.73 billion in 2023 to $9.30 billion by 2033. Stringent regulations on energy efficiency and sustainability fuel growth, particularly in the construction of eco-friendly buildings and renewable energy applications.Asia Pacific Advanced Glass Market Report:

In 2023, the Advanced Glass market in the Asia Pacific region was valued at $2.70 billion, projected to reach $5.30 billion by 2033. Rapid urbanization and increasing disposable income, particularly in countries like China and India, are boosting demand. Moreover, investments in infrastructure development and renewable energy projects are driving market growth.North America Advanced Glass Market Report:

The North American market, valued at $5.88 billion in 2023, is expected to expand to $11.57 billion by 2033. Strong demand from the automotive and construction sectors, driven by innovation and regulatory requirements for energy-efficient products, is propelling growth. The presence of numerous manufacturing giants enhances competition and drives further growth.South America Advanced Glass Market Report:

South America's Advanced Glass market shows modest growth, with a valuation of approximately $0.00 billion in 2023, rising to $0.01 billion by 2033. The market is primarily influenced by construction growth and architectural innovations aimed at sustainability. However, economic challenges may slow its overall progress.Middle East & Africa Advanced Glass Market Report:

The Middle East and Africa's Advanced Glass market is expected to rise from $1.98 billion in 2023 to $3.90 billion by 2033, driven by infrastructural developments and rising investments in renewable energy initiatives. Opportunities lie in leveraging advanced glass technology for residential and commercial projects.Tell us your focus area and get a customized research report.

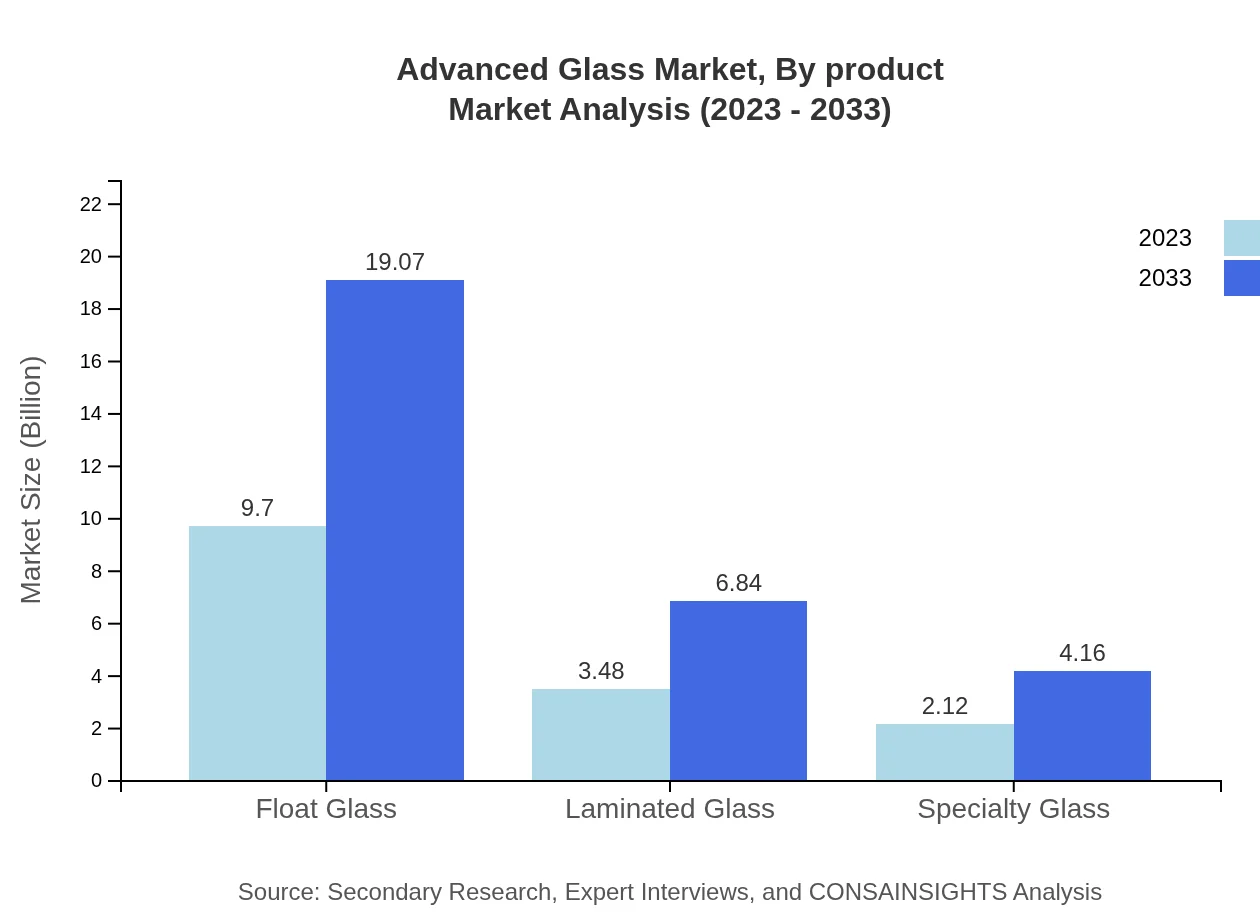

Advanced Glass Market Analysis By Product

The Advanced Glass market is majorly driven by three primary segments: Float Glass, Laminated Glass, and Specialty Glass. Float Glass is set to dominate, with a market size of $9.70 billion in 2023 and projected to double to $19.07 billion by 2033. Laminated Glass follows at $3.48 billion, expecting to see a rise to $6.84 billion. Specialty Glass, although smaller at a current valuation of $2.12 billion, is anticipated to grow to $4.16 billion, bolstered by unique applications in high-tech industries.

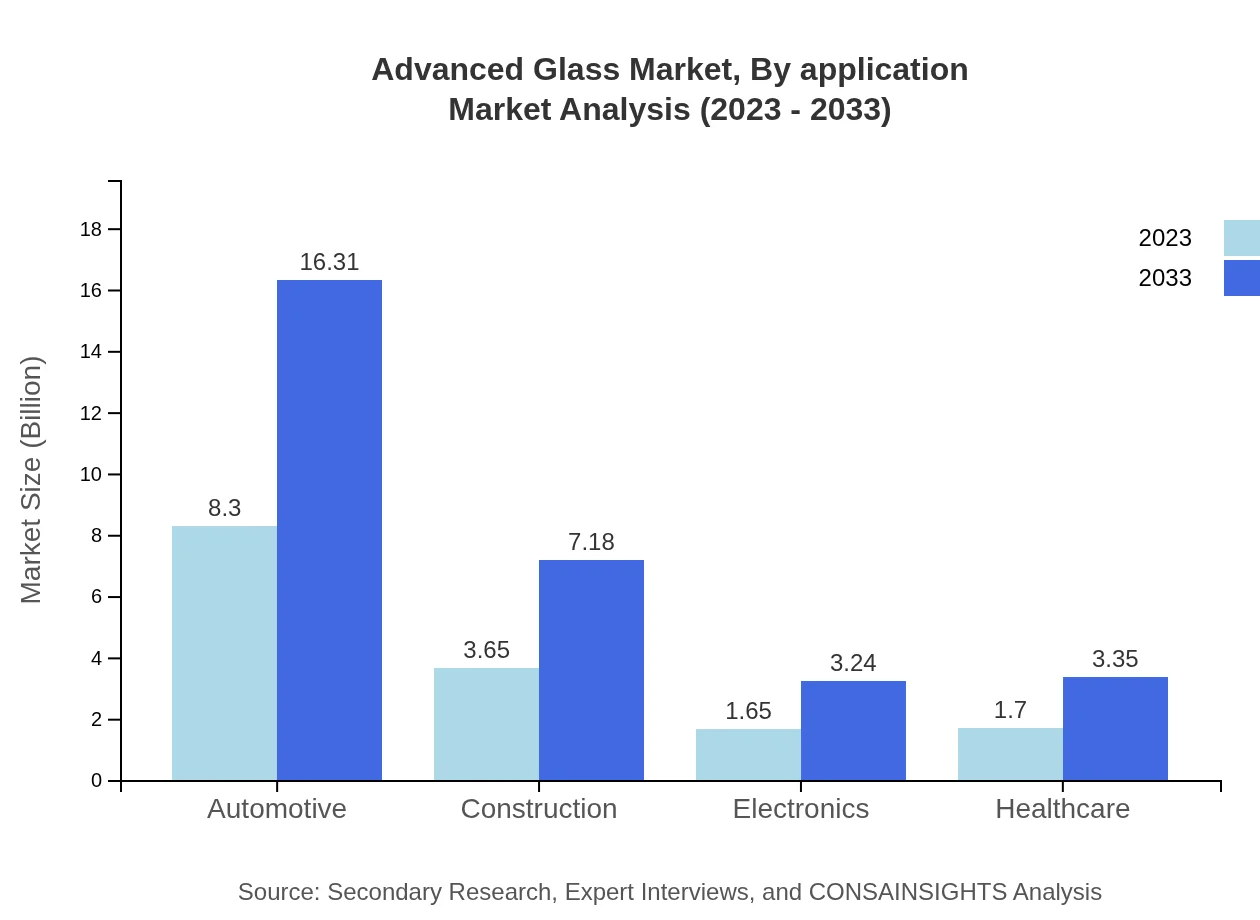

Advanced Glass Market Analysis By Application

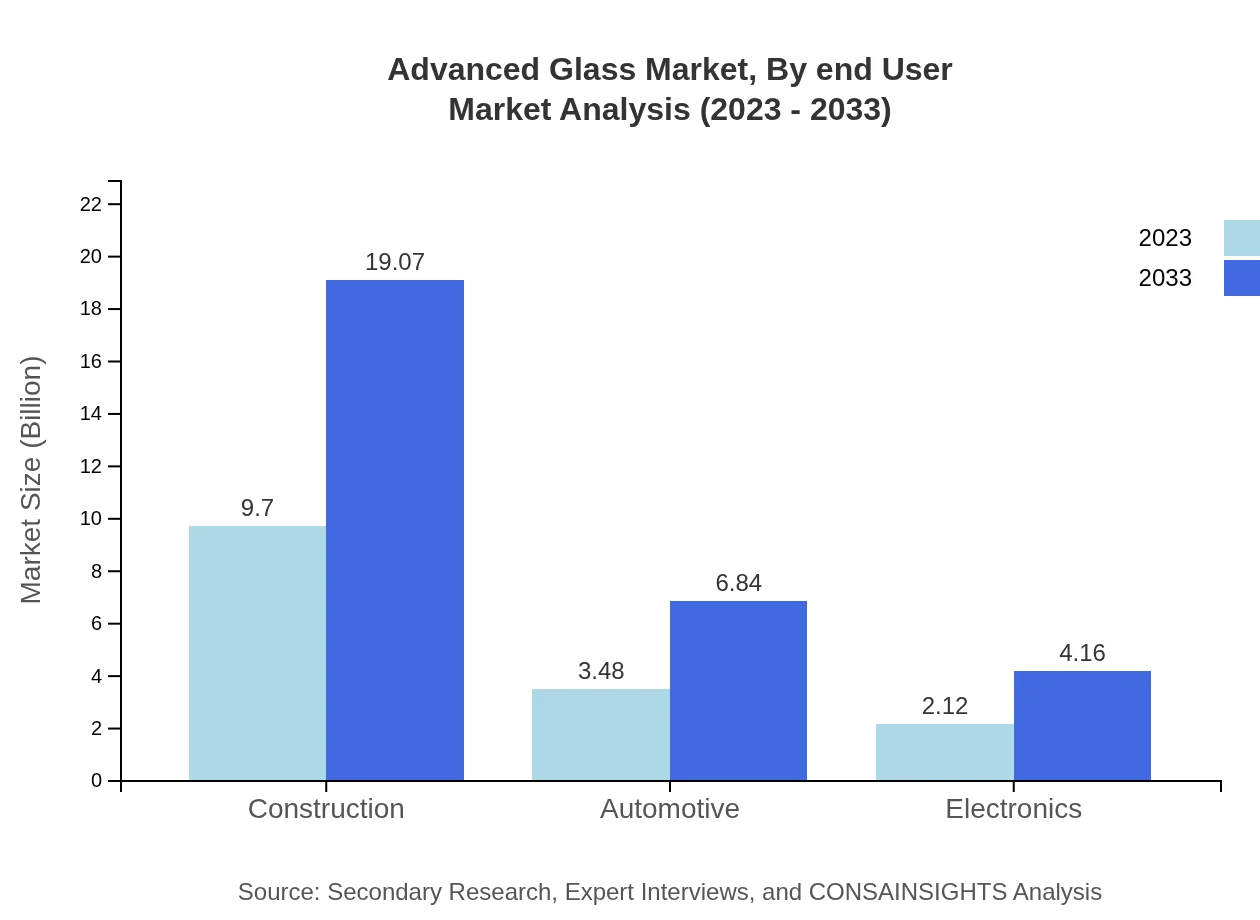

In terms of application, the construction industry stands out, leading the market share at 63.43%. The market for construction-related Advanced Glass is targeted to grow from $9.70 billion in 2023 to $19.07 billion by 2033. The automotive application market, valued at $3.48 billion, is projected to reach $6.84 billion, showcasing its importance within this sector. Electronics applications, although smaller at $2.12 billion, are also expected to see substantial growth, reaching $4.16 billion due to increasing demand for innovative electronic devices.

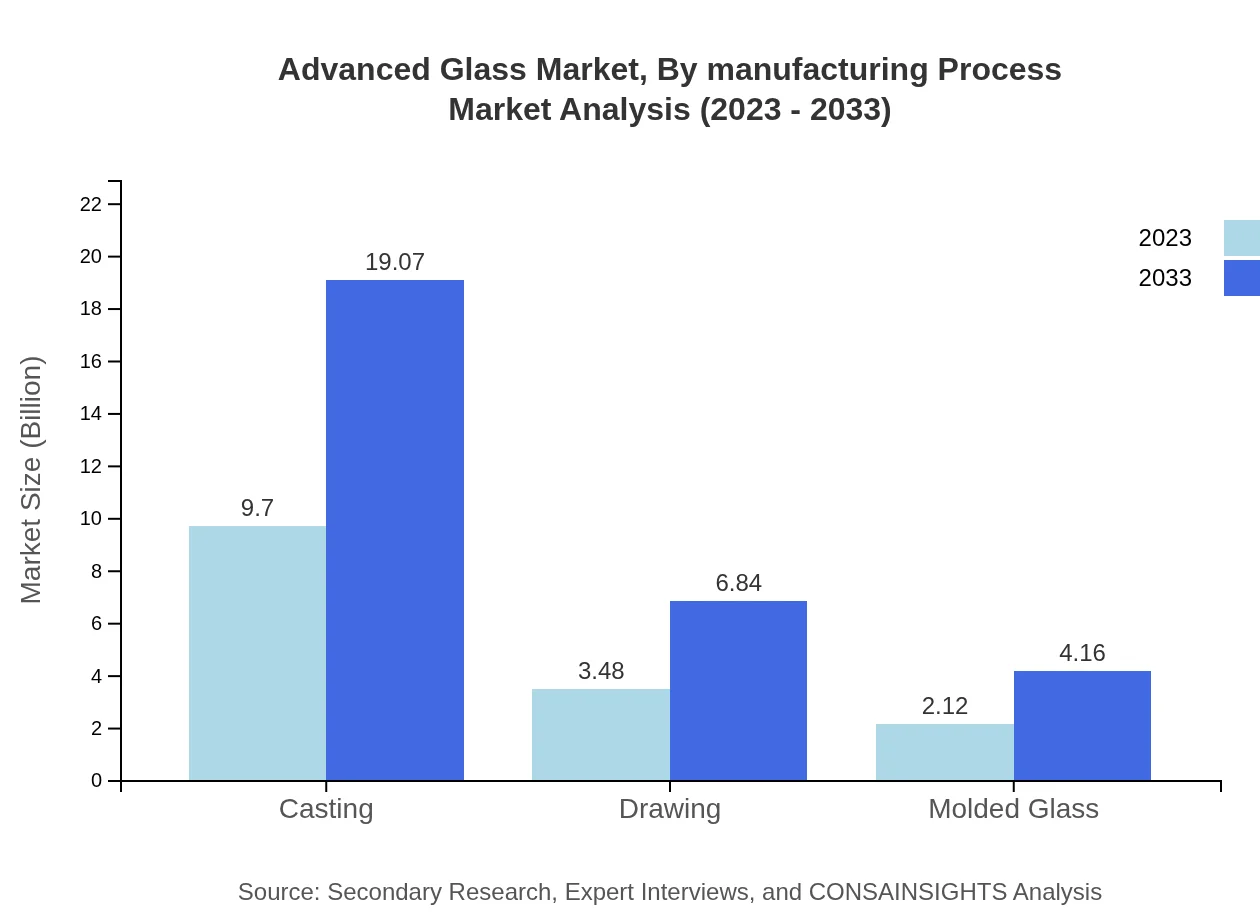

Advanced Glass Market Analysis By Manufacturing Process

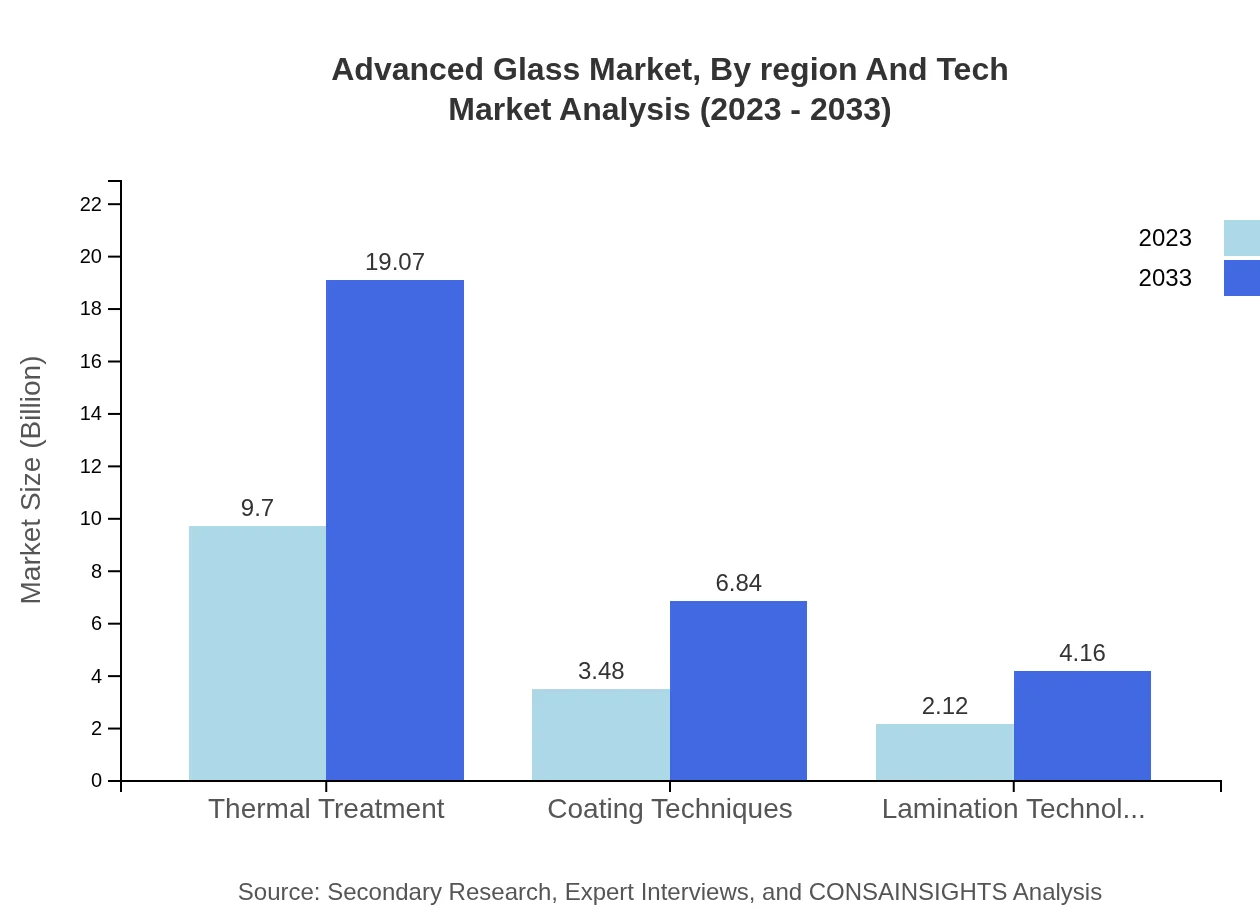

Manufacturing processes for Advanced Glass primarily include Thermal Treatment, Coating Techniques, and Lamination Technologies. Thermal Treatment is pivotal, dominating the market with a size of $9.70 billion and projected growth to $19.07 billion. Coating Techniques follow at $3.48 billion, expected to double to $6.84 billion, while Lamination Technologies account for $2.12 billion and are set to grow significantly to $4.16 billion, owing to advancements in protective coatings.

Advanced Glass Market Analysis By End User

The end-user industries for Advanced Glass significantly influence market dynamics. The construction sector leads with a substantial share of 63.43%, reflecting a market size of $9.70 billion in 2023, growing to $19.07 billion. Automotive, holding a 22.74% share, is essential at $3.48 billion, expected to expand to $6.84 billion. Electronics and Healthcare are smaller sectors but possess considerable growth trajectories, with valued projections indicating a steady climb through to 2033.

Advanced Glass Market Analysis By Region And Tech

Technological advancements have played a vital role in shaping the Advanced Glass market. Innovations, particularly in manufacturing processes like Casting and Drawing, are crucial for enhancing production efficiency and product quality. Casting, with a market share of 63.43%, retains significant dominance, while the Drawing process maintains a steady share at 22.74%. As manufacturers increasingly integrate smart glass technologies, the market is expected to see transformative changes leading to enhanced functionalities.

Advanced Glass Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Glass Industry

Saint-Gobain:

A global leader in building materials, Saint-Gobain specializes in high-performance glass products and sustainable building solutions, greatly contributing to the Advanced Glass market through innovation and eco-friendly practices.AGC Inc.:

AGC Inc. is one of the largest glass manufacturers globally, known for its advanced glass technologies used in construction, automotive, and electronics, driving industry advancements and setting quality standards.Guardian Glass:

Guardian Glass is a prominent manufacturer recognized for its wide range of glass products used in diverse applications, focusing on advanced solar control and energy-efficient glass solutions.Nippon Sheet Glass Co., Ltd.:

Nippon Sheet Glass is a key player known for its innovations in flat glass products and thermal treatment technologies, playing a significant role in enhancing the performance of Advanced Glass products.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced glass?

The advanced glass market is valued at $15.3 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, highlighting significant growth trends in various sectors involving advanced glass applications.

What are the key market players or companies in this advanced glass industry?

Key players in the advanced glass market include globally recognized companies specializing in glass manufacturing such as AGC Inc., Saint-Gobain, and Corning Inc., driving innovation and market presence in this evolving industry.

What are the primary factors driving the growth in the advanced glass industry?

Factors driving growth in the advanced glass industry include rising demand for energy-efficient solutions, technological advancements in glass production, and increasing applications in construction, automotive, and electronics sectors.

Which region is the fastest Growing in the advanced glass market?

Asia Pacific is the fastest-growing region in the advanced glass market, with market size expected to grow from $2.70 billion in 2023 to $5.30 billion by 2033, reflecting growing industrial and consumer demand for advanced glass solutions.

Does ConsaInsights provide customized market report data for the advanced glass industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the advanced glass industry, allowing businesses to gain insights relevant to their market positioning and strategic planning.

What deliverables can I expect from this advanced glass market research project?

Deliverables from the advanced glass market research project typically include comprehensive market analysis reports, growth forecasts, competitive landscape, and segment-wise performance data relevant to your business needs.

What are the market trends of advanced glass?

Current trends in the advanced glass market include increased adoption of smart glass technology, innovation in eco-friendly production processes, and the rising integration of advanced glass in construction and automotive applications.