Advanced Ic Substrates Market Report

Published Date: 31 January 2026 | Report Code: advanced-ic-substrates

Advanced Ic Substrates Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced IC Substrates market from 2023 to 2033, focusing on market size, growth trends, segmentation, regional insights, and key players. Key insights into technological advancements and market challenges are also highlighted.

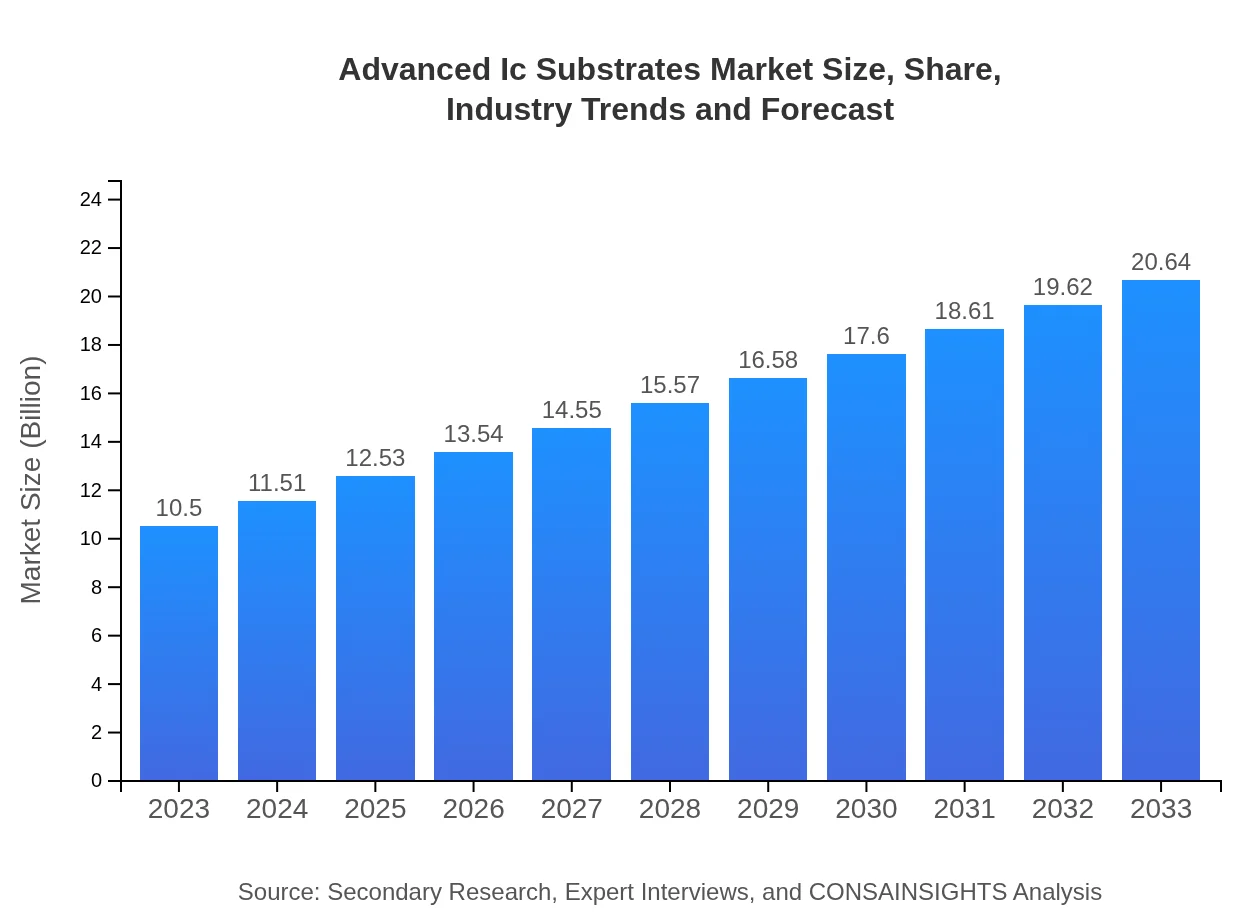

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Key Tronic Corporation, Nihon Superior Co., Ltd., AGC Electronics, Shinko Electric Industries |

| Last Modified Date | 31 January 2026 |

Advanced Ic Substrates Market Overview

Customize Advanced Ic Substrates Market Report market research report

- ✔ Get in-depth analysis of Advanced Ic Substrates market size, growth, and forecasts.

- ✔ Understand Advanced Ic Substrates's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Ic Substrates

What is the Market Size & CAGR of Advanced Ic Substrates market in 2023?

Advanced Ic Substrates Industry Analysis

Advanced Ic Substrates Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Ic Substrates Market Analysis Report by Region

Europe Advanced Ic Substrates Market Report:

Europe's Advanced IC Substrates market is projected to expand from $3.05 billion in 2023 to $6.00 billion by 2033. The region's emphasis on high-tech industries, coupled with stricter environmental regulations, fuels demand for innovative and eco-friendly substrate solutions.Asia Pacific Advanced Ic Substrates Market Report:

In the Asia Pacific region, the Advanced IC Substrates market size is projected to grow from $1.98 billion in 2023 to $3.88 billion by 2033. This growth is primarily driven by significant investments in semiconductor manufacturing, particularly in countries like China, Taiwan, and Japan, which are at the forefront of technology adoption and innovation.North America Advanced Ic Substrates Market Report:

The North American market is a significant contributor, with revenue expected to rise from $3.99 billion in 2023 to $7.84 billion by 2033. This market's growth is supported by a strong focus on R&D, along with the presence of several leading technology firms that prioritize advanced electronic systems and components.South America Advanced Ic Substrates Market Report:

South America currently represents a small segment of the Advanced IC Substrates market, with revenues expected to grow from $0.03 billion in 2023 to $0.06 billion by 2033. The growth is slow but steady, as local manufacturers begin to explore advanced manufacturing techniques to meet increasing electronics demand.Middle East & Africa Advanced Ic Substrates Market Report:

In the Middle East and Africa, the market is expected to grow from $1.45 billion in 2023 to $2.85 billion by 2033. While the growth is gradual, there is increasing interest in smart technologies and IoT applications, offering a promising landscape for market expansion.Tell us your focus area and get a customized research report.

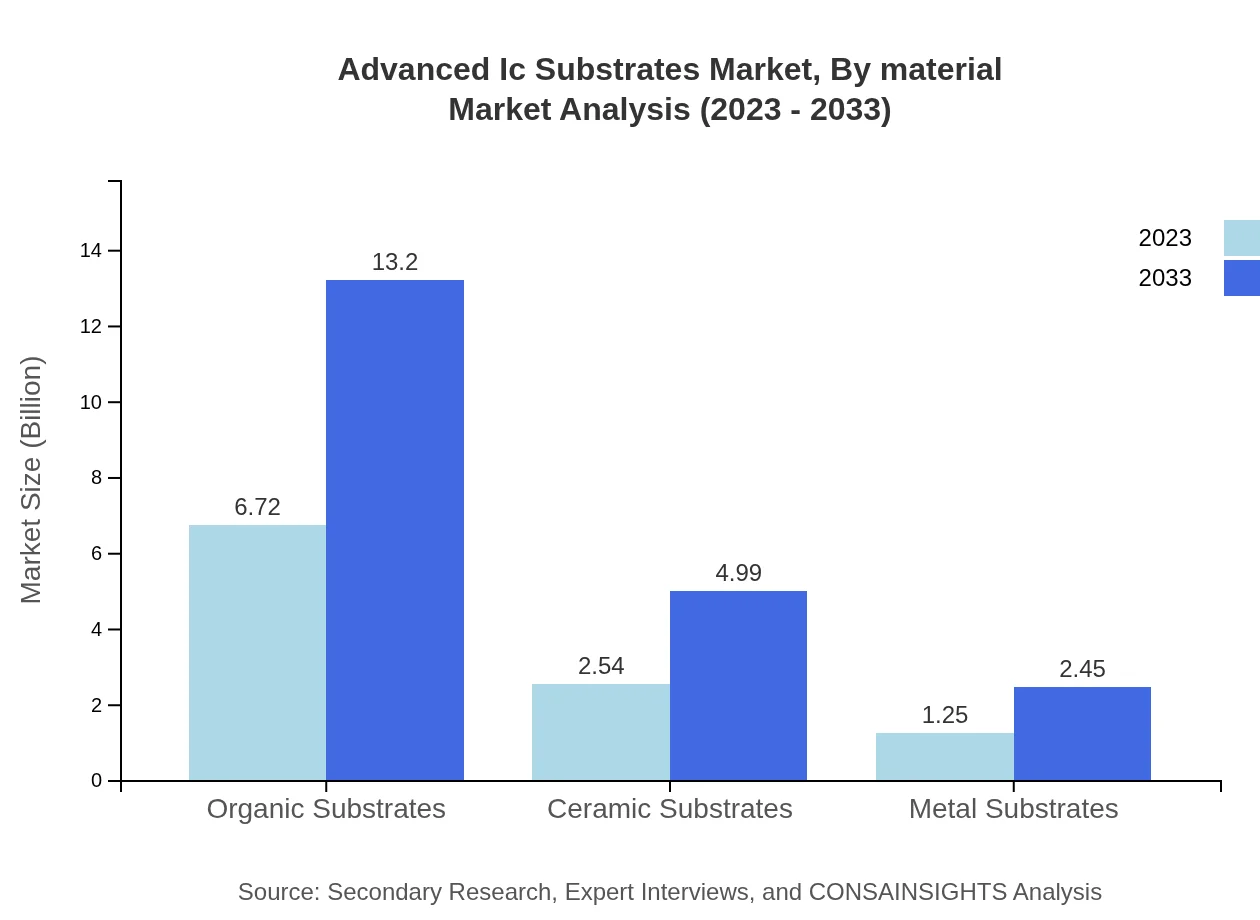

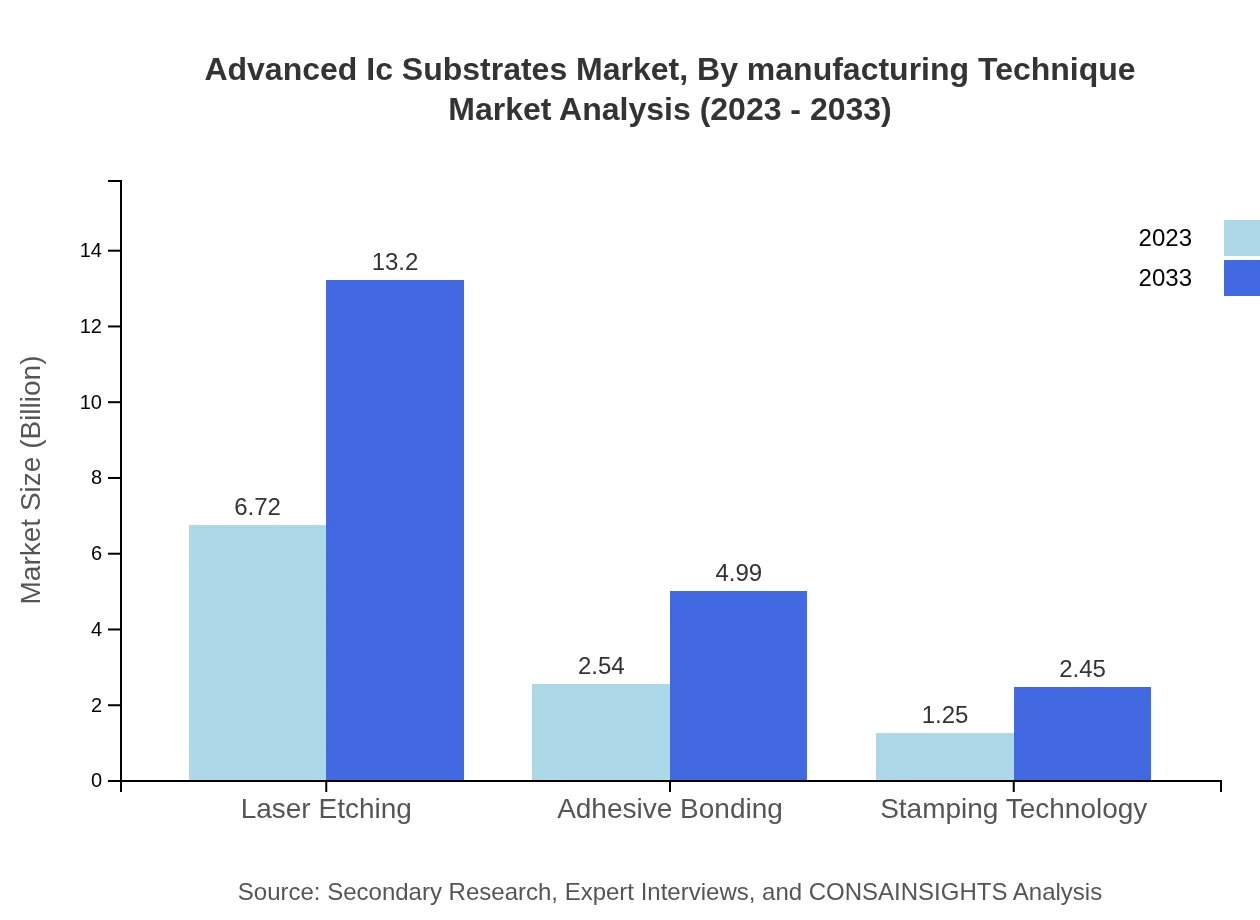

Advanced Ic Substrates Market Analysis By Material

The Advanced IC Substrates market, segmented by material, includes organic, ceramic, and metal substrates. Organic substrates dominate the market, with a size projected to grow from $6.72 billion in 2023 to $13.20 billion by 2033, contributing significantly due to their superior performance in high-frequency applications. Ceramic substrates are also important, expected to rise from $2.54 billion to $4.99 billion, favored for their thermal stability and durability.

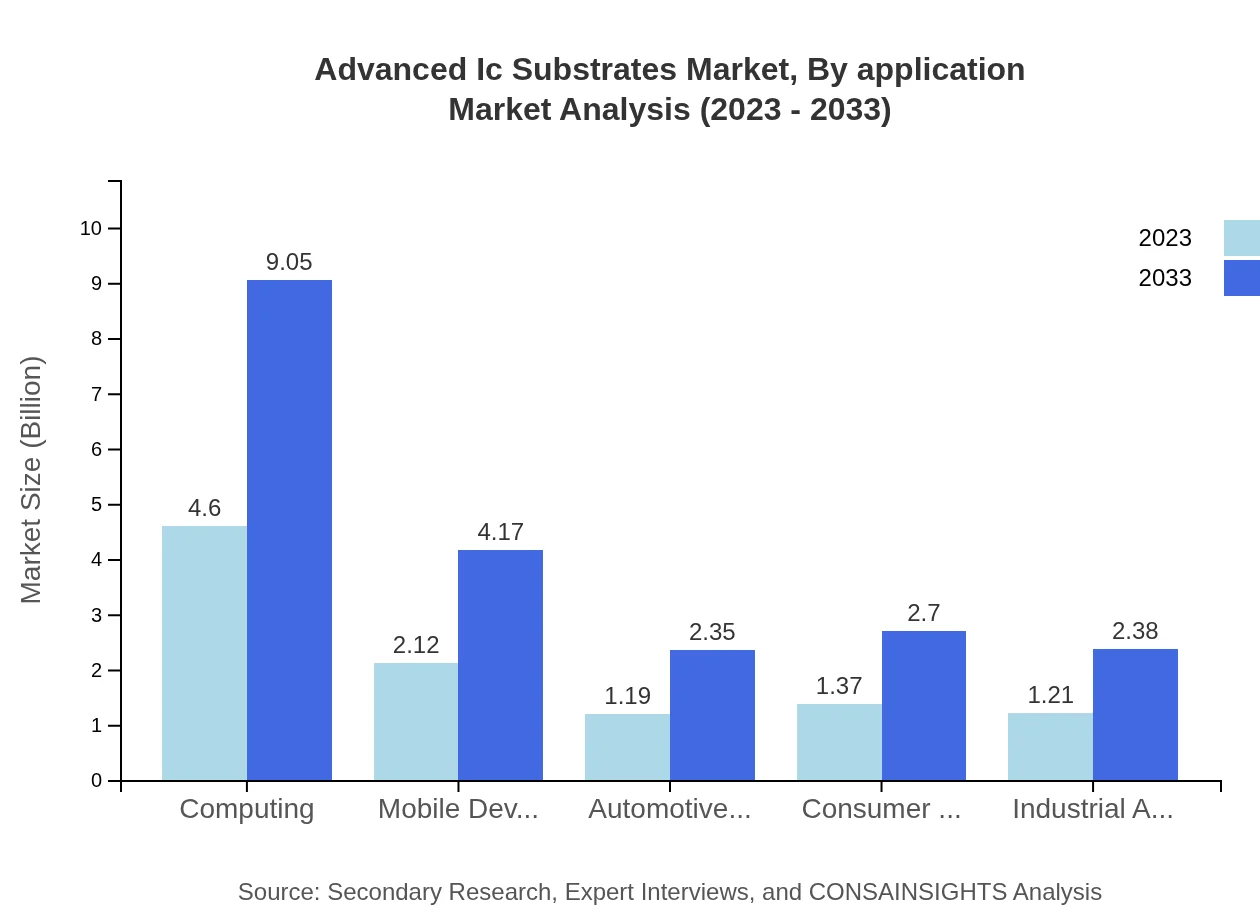

Advanced Ic Substrates Market Analysis By Application

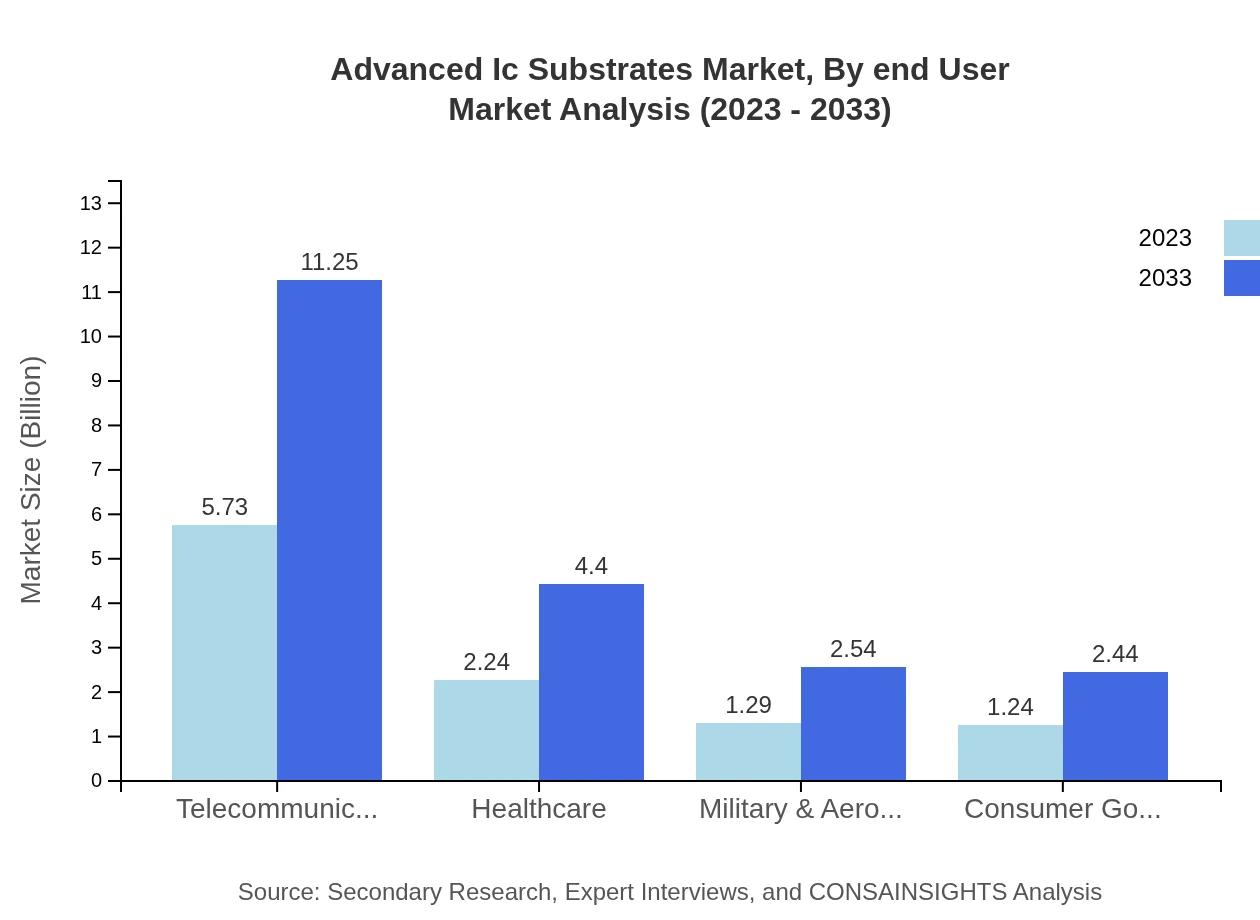

Telecommunications applications are the largest segment, forecasted to maintain a size of $5.73 billion in 2023, growing to $11.25 billion by 2033, driven by data consumption growth. Computing applications follow, expected to see a rise from $4.60 billion to $9.05 billion, driven by the expanding need for computing power in various technologies, including AI and machine learning.

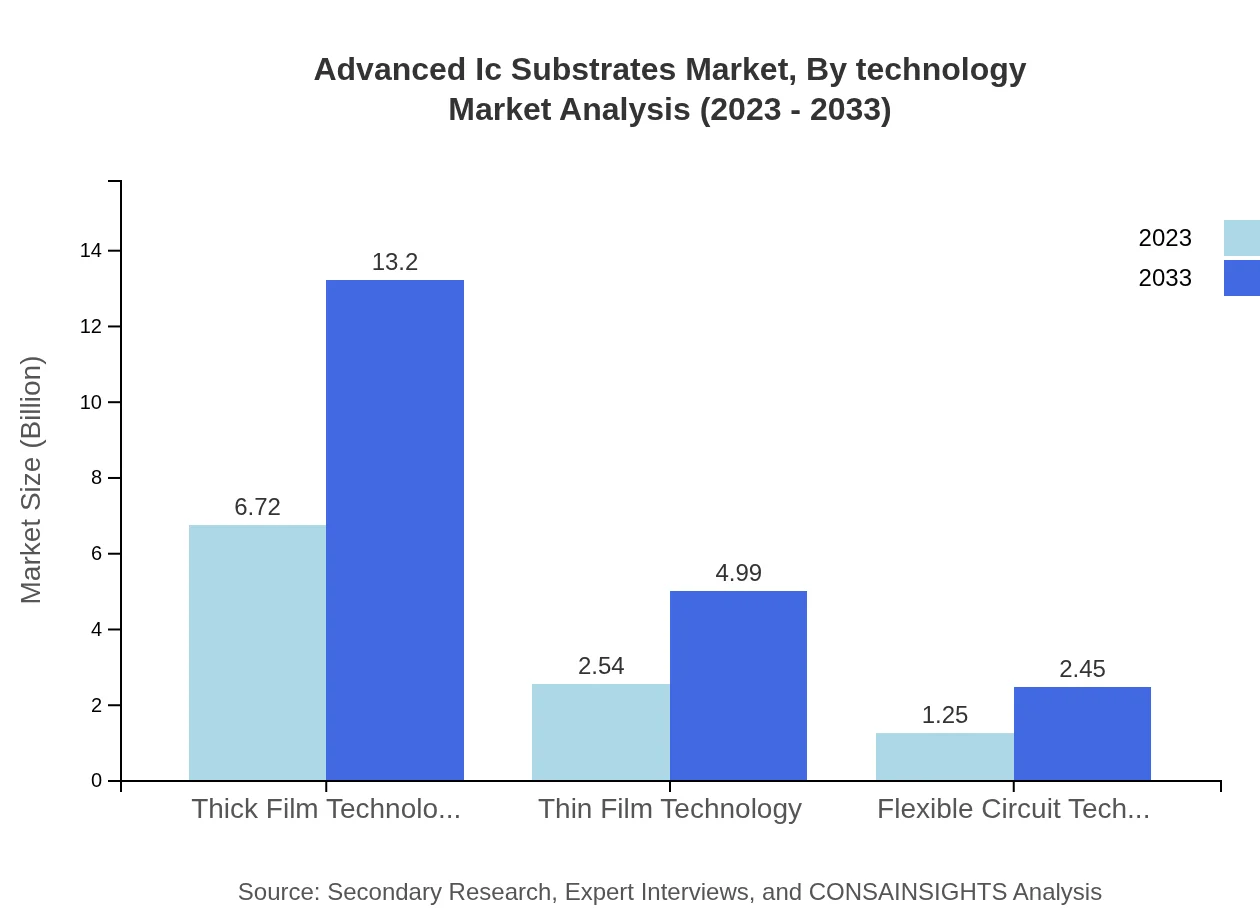

Advanced Ic Substrates Market Analysis By Technology

Thin Film and Thick Film technologies dominate the Advanced IC Substrates market, with Thin Film technology expected to grow from $2.54 billion in 2023 to $4.99 billion by 2033, while Thick Film technology remains dominant with projections of $6.72 billion to $13.20 billion. Innovations in manufacturing techniques and materials are central to the growth of these segments.

Advanced Ic Substrates Market Analysis By End User

The consumer electronics segment is witnessing steady growth, estimated to increase from $1.37 billion in 2023 to $2.70 billion by 2033. Automotive electronics also present significant opportunities, with growth from $1.19 billion to $2.35 billion as smart automotive systems become more prevalent.

Advanced Ic Substrates Market Analysis By Manufacturing Technique

Key manufacturing techniques include adhesive bonding and stamping technology, each expected to witness growth aligned with overall market expansion. Adhesive bonding is set to grow from $2.54 billion in 2023 to $4.99 billion, while stamping technology is projected to expand from $1.25 billion to $2.45 billion, reflecting the demand for innovative and efficient production methods.

Advanced Ic Substrates Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Ic Substrates Industry

Key Tronic Corporation:

A key player in the manufacturing of electronic one-stop solutions, known for producing advanced substrates used in high-quality semiconductor applications.Nihon Superior Co., Ltd.:

Renowned for its advanced bonding technologies and materials that enhance the performance and reliability of industrial products.AGC Electronics:

A leader in advanced glass substrates known for its innovations in high-performance materials for the semiconductor market.Shinko Electric Industries:

Specializes in semiconductor packages and substrates, delivering high-quality solutions for the global electronics market.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Ic Substrates?

The market size of advanced-ic-substrates is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.8% from 2023 to 2033, indicating robust demand and expansion in various sectors.

What are the key market players or companies in this advanced Ic Substrates industry?

Key players in the advanced-ic-substrates industry include major semiconductor manufacturers and technology firms that specialize in integrated circuit development, contributing to innovation and competitive dynamics across the sector.

What are the primary factors driving the growth in the advanced Ic Substrates industry?

Growth in the advanced-ic-substrates industry is driven by increasing demand for faster, more efficient semiconductors, rapid technological advances, and the expansion of applications in telecommunications, healthcare, and automotive sectors.

Which region is the fastest Growing in the advanced Ic Substrates?

The fastest-growing region for advanced-ic-substrates is North America, with the market projected to grow from $3.99 billion in 2023 to $7.84 billion in 2033. Europe also shows significant growth potential, increasing from $3.05 billion to $6.00 billion.

Does ConsaInsights provide customized market report data for the advanced Ic Substrates industry?

Yes, ConsaInsights offers customized market report data tailored to the advanced-ic-substrates industry, allowing clients to gain insights specific to their needs, including trends, forecasts, and competitive analysis.

What deliverables can I expect from this advanced Ic Substrates market research project?

Deliverables from the advanced-ic-substrates market research project include comprehensive reports, detailed market analysis, forecasts, trends, and insights into competitive landscapes and specific regional markets.

What are the market trends of advanced Ic Substrates?

Current market trends in advanced-ic-substrates indicate a shift towards organic substrates, with a market size projected to increase from $6.72 billion in 2023 to $13.20 billion by 2033, reflecting growing applications in electronics.