Advanced Infusion Systems Market Report

Published Date: 31 January 2026 | Report Code: advanced-infusion-systems

Advanced Infusion Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced Infusion Systems market, exploring current trends, future forecasts, and regional insights from 2023 to 2033.

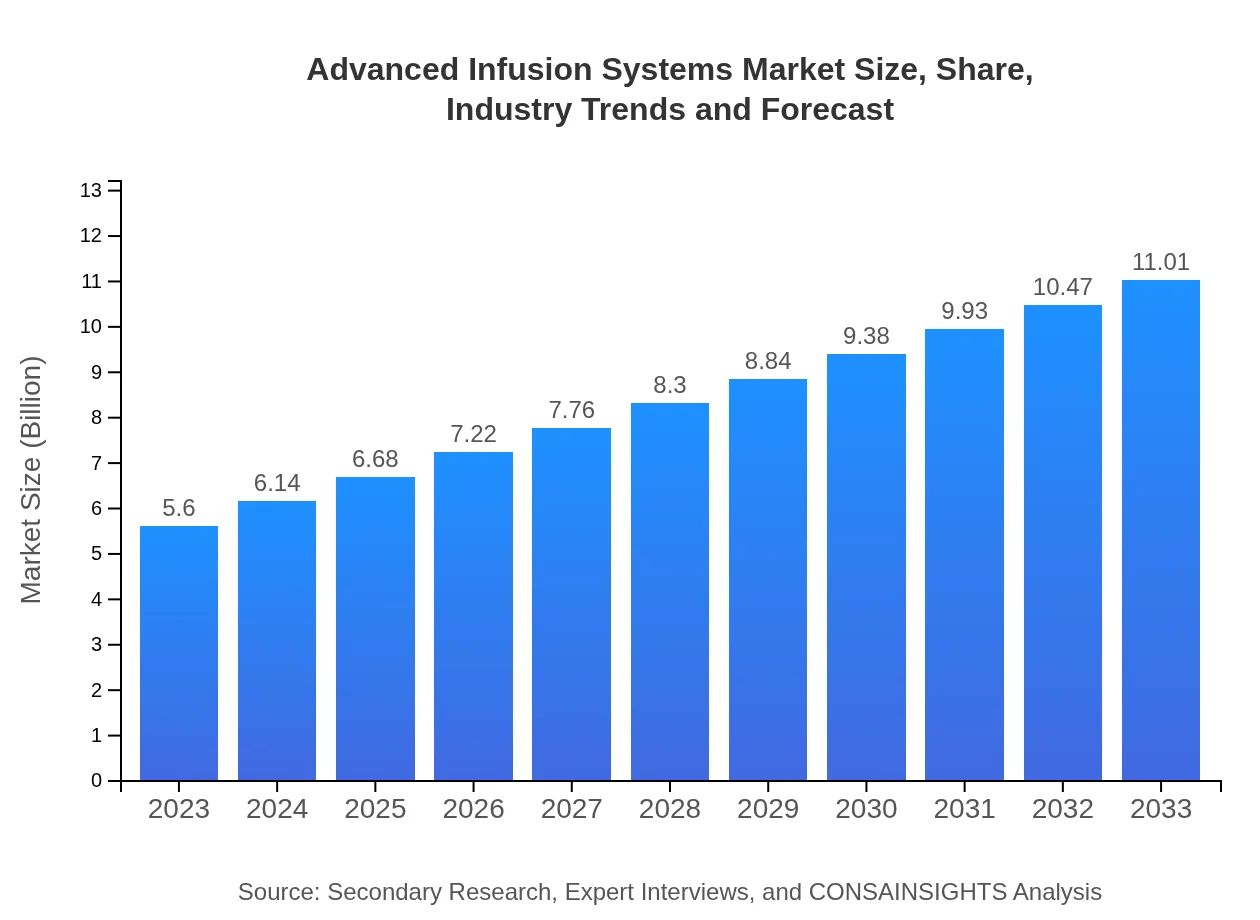

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | B. Braun Melsungen AG, Medtronic plc, Fresenius Kabi AG, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Advanced Infusion Systems Market Overview

Customize Advanced Infusion Systems Market Report market research report

- ✔ Get in-depth analysis of Advanced Infusion Systems market size, growth, and forecasts.

- ✔ Understand Advanced Infusion Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Infusion Systems

What is the Market Size & CAGR of Advanced Infusion Systems market in 2023?

Advanced Infusion Systems Industry Analysis

Advanced Infusion Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Infusion Systems Market Analysis Report by Region

Europe Advanced Infusion Systems Market Report:

In Europe, the Advanced Infusion Systems market was evaluated at $1.81 billion in 2023, projected to grow to $3.55 billion by 2033. The region is at the forefront of medical technology advancements, with regulatory frameworks supporting innovation in healthcare. Additionally, the aging population is expected to drive demand for infusion therapies.Asia Pacific Advanced Infusion Systems Market Report:

The Asia Pacific Advanced Infusion Systems market was valued at $0.98 billion in 2023 and is expected to reach $1.93 billion by 2033. Key factors include the growing healthcare infrastructure and increasing awareness of advanced medical technologies in countries like India and China. The region is also witnessing a rise in chronic illnesses, leading to a higher demand for effective infusion therapies.North America Advanced Infusion Systems Market Report:

North America accounted for a market size of $2.09 billion in 2023, with estimates reaching $4.11 billion by 2033. The region benefits from established healthcare systems, high spending on healthcare technologies, and a strong focus on innovation. The U.S. is a primary market due to its advanced medical infrastructure and increasing prevalence of chronic diseases.South America Advanced Infusion Systems Market Report:

The South America market for Advanced Infusion Systems generated $0.29 billion in 2023, projected to reach $0.58 billion by 2033. The market's growth is primarily driven by improvements in healthcare facilities and increased adoption of advanced medical technologies, although economic challenges might hinder overall expansion.Middle East & Africa Advanced Infusion Systems Market Report:

The Middle East and Africa market size was $0.43 billion in 2023, anticipated to reach $0.84 billion by 2033. Growing investments in healthcare and improving healthcare access in countries like UAE and South Africa are key growth drivers, although disparities in healthcare access may pose challenges for market penetration.Tell us your focus area and get a customized research report.

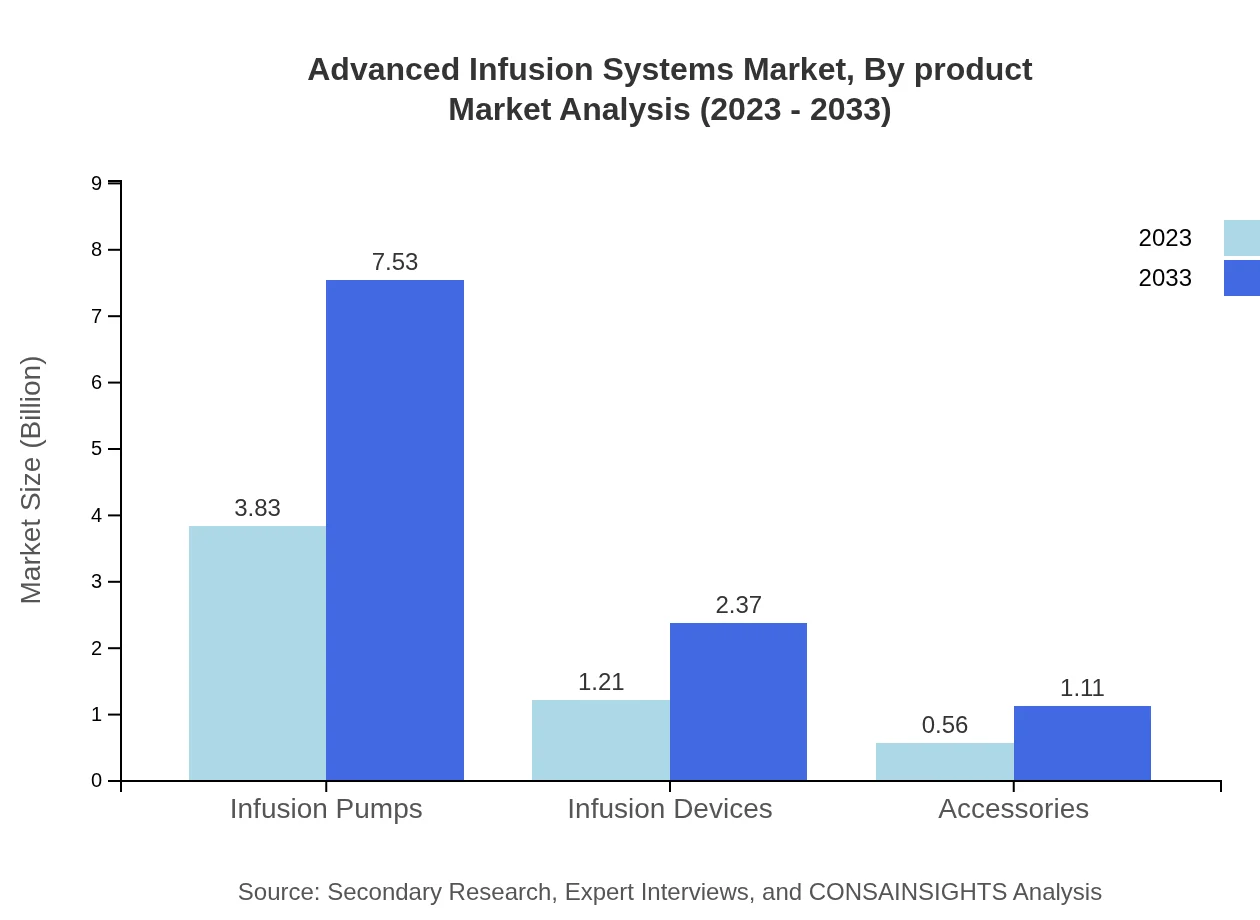

Advanced Infusion Systems Market Analysis By Product

Infusion pumps dominate the product segment with an estimated market value of $3.83 billion in 2023, expected to rise to $7.53 billion by 2033. This substantial growth is attributed to their essential role in delivering precise medication dosages. Infusion devices and accessories are also contributing significantly, valued at $1.21 billion and $0.56 billion in 2023, respectively.

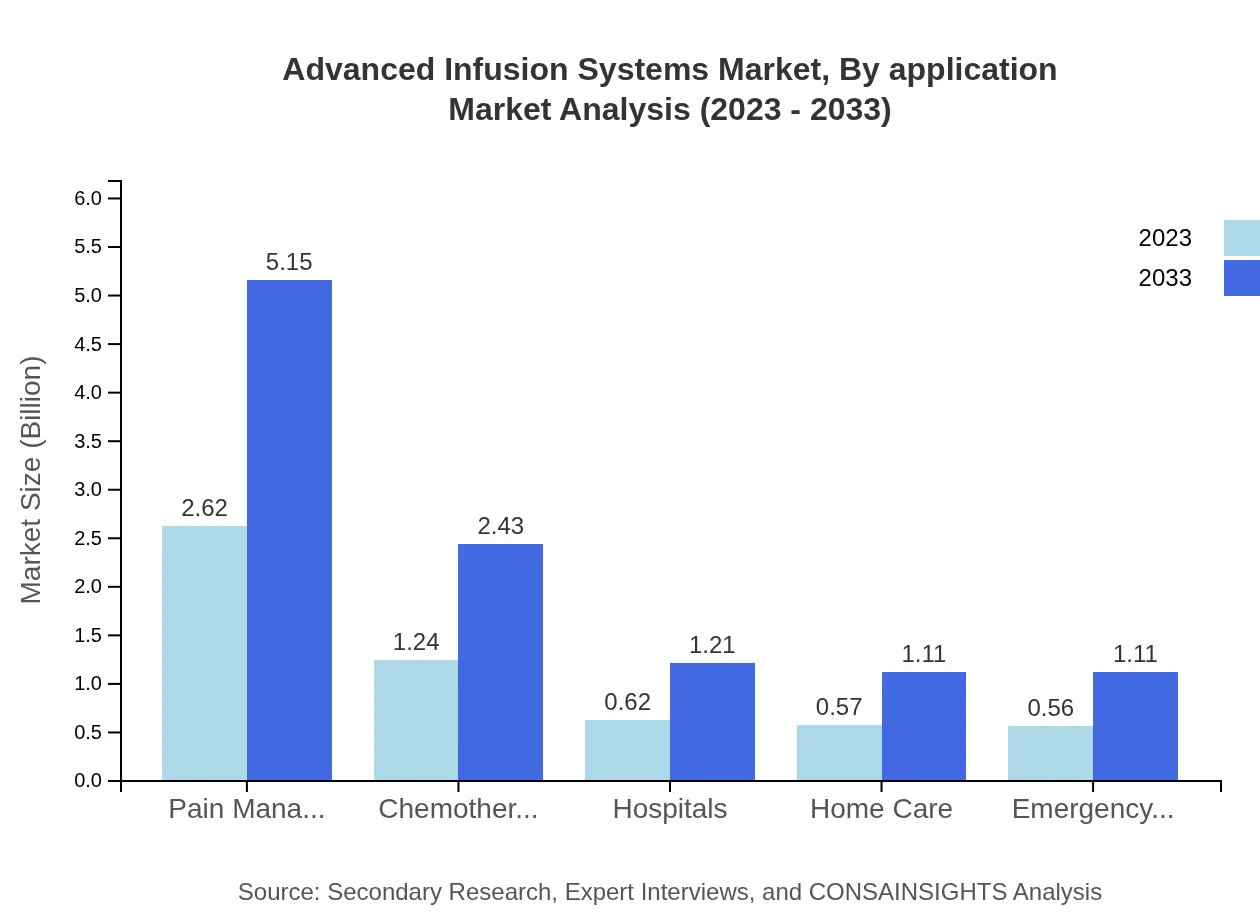

Advanced Infusion Systems Market Analysis By Application

Pain management and chemotherapy applications lead the market, collectively dominating with a size of $3.86 billion in 2023. Pain management holds a significant share, valued at $2.62 billion, while chemotherapy accounts for $1.24 billion. This preference stems from the growing prevalence of cancer and pain-related disorders demanding effective therapeutic solutions.

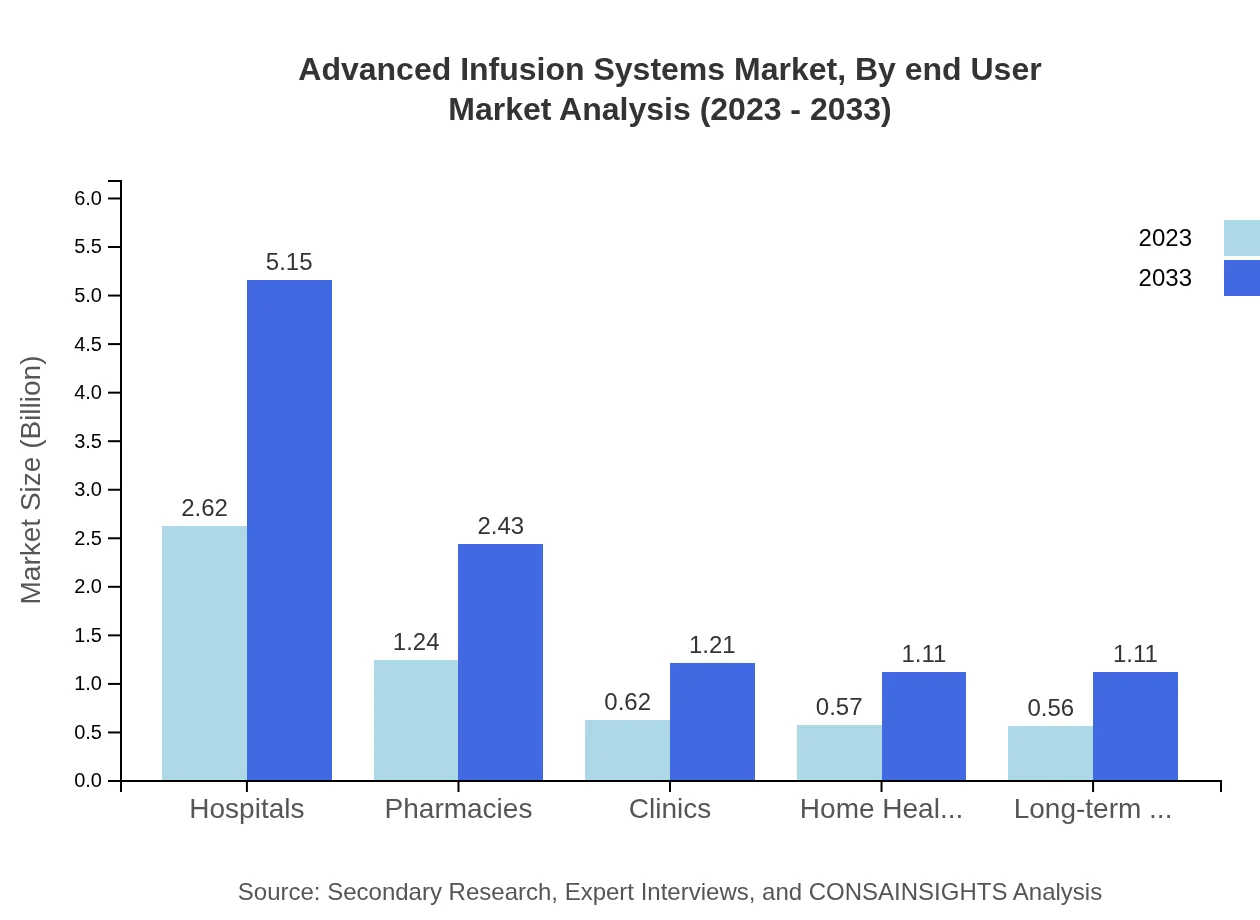

Advanced Infusion Systems Market Analysis By End User

Hospitals are the largest end-user segment, generating a market size of $2.62 billion in 2023. Other notable segments include pharmacies and clinics, valued at $1.24 billion and $0.62 billion, respectively. The increasing patient volume and the trend towards outpatient care significantly bolster adoption rates in these facilities.

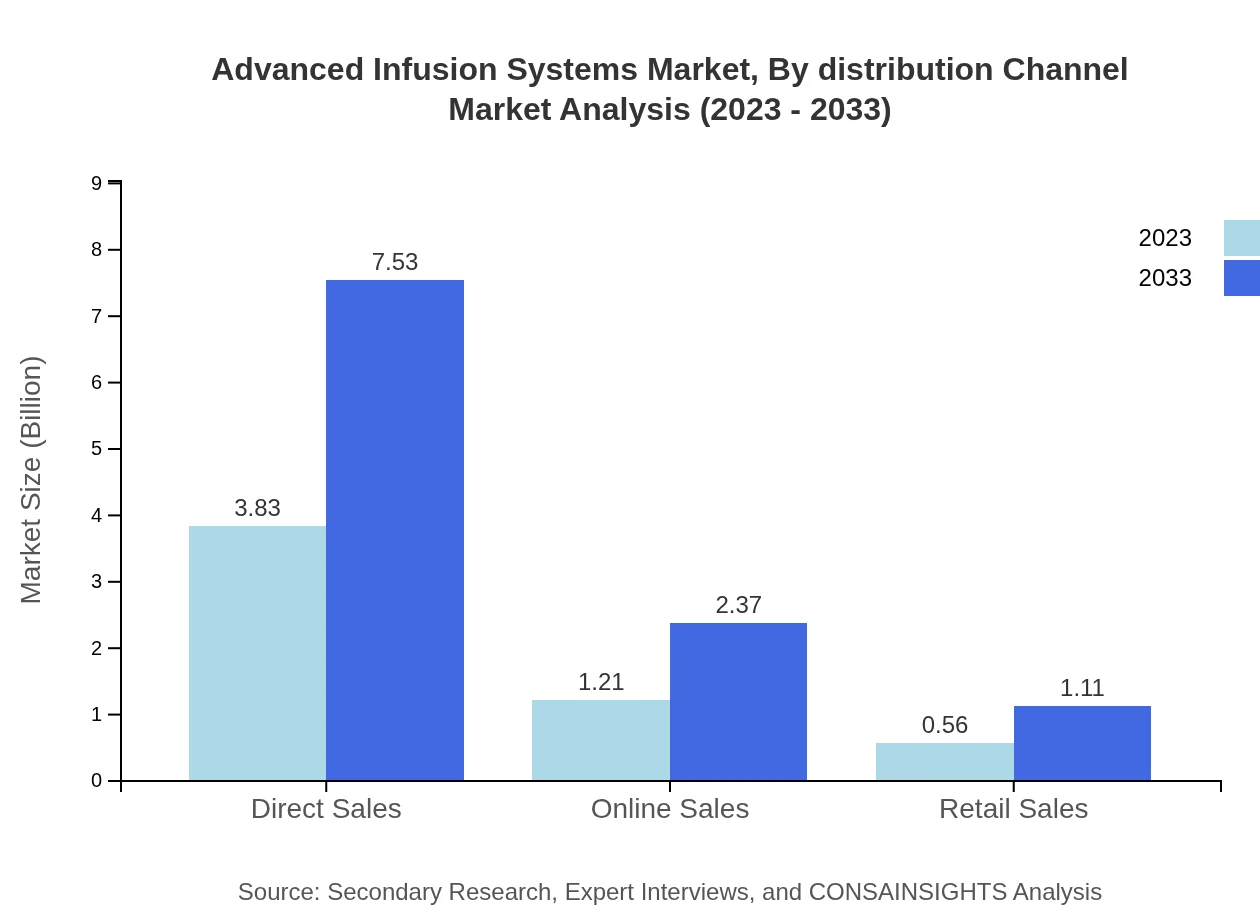

Advanced Infusion Systems Market Analysis By Distribution Channel

The distribution channel analysis indicates that direct sales dominate with a market size of $3.83 billion in 2023, reflecting effective supplier relationships and established networks in healthcare. Online sales and retail sales follow, valued at $1.21 billion and $0.56 billion, showcasing diversification in distribution strategies to reach various end-users.

Advanced Infusion Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Infusion Systems Industry

B. Braun Melsungen AG:

B. Braun is a leading global manufacturer of infusion systems, providing comprehensive solutions and innovative products to enhance patient care. The company is recognized for its commitment to quality and technology-driven solutions.Medtronic plc:

Medtronic is a prominent player in the infusion systems market, known for its advanced pump technologies. The company continually invests in research and development to improve product efficacy and patient safety.Fresenius Kabi AG:

Fresenius Kabi focuses on high-quality infusion therapies, providing a variety of infusion systems and clinical services that emphasize patient-centric care and safety.Terumo Corporation:

Terumo is a key innovator in infusion systems, known for its extensive product range and dedicated research efforts aimed at improving infusion technology for diverse medical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of Advanced Infusion Systems?

The Advanced Infusion Systems market is projected to grow from a size of 5.6 billion in 2023, with a CAGR of 6.8%, potentially reaching significant levels by 2033, marking its rising importance in healthcare.

What are the key market players or companies in the Advanced Infusion Systems industry?

Key players in the Advanced Infusion Systems market include major medical technology companies such as Abbott Laboratories, Becton, Dickinson and Company, and Baxter International, among others, who significantly contribute to the market's innovation and growth.

What are the primary factors driving the growth in the Advanced Infusion Systems industry?

The growth of Advanced Infusion Systems is driven by increasing chronic diseases, technological advancements, and the rise in home healthcare services, highlighting the shift toward patient-centric care in modern medical practices.

Which region is the fastest Growing in the Advanced Infusion Systems?

The fastest-growing region in the Advanced Infusion Systems market is North America, projected to expand from a market size of 2.09 billion in 2023 to 4.11 billion by 2033, reflecting increased healthcare investments.

Does ConsaInsights provide customized market report data for the Advanced Infusion Systems industry?

Yes, ConsaInsights offers tailored market report data for the Advanced Infusion Systems industry, accommodating specific client requirements for comprehensive insights into market trends, forecasts, and competitive landscapes.

What deliverables can I expect from this Advanced Infusion Systems market research project?

Deliverables from this market research project may include detailed market analysis reports, segmentation data, competitive landscape overviews, and actionable insights to guide strategic decision-making.

What are the market trends of Advanced Infusion Systems?

Market trends in Advanced Infusion Systems indicate a growing preference for smart infusion pumps, increased integration of IT solutions, and rising demand for infusions in home healthcare settings, driving future growth.