Advanced Metering Infrastructure Market Report

Published Date: 22 January 2026 | Report Code: advanced-metering-infrastructure

Advanced Metering Infrastructure Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Advanced Metering Infrastructure (AMI) market, covering key insights and data trends from 2023 to 2033. It highlights market size, growth forecasts, segmentation, regional dynamics, and significant industry trends.

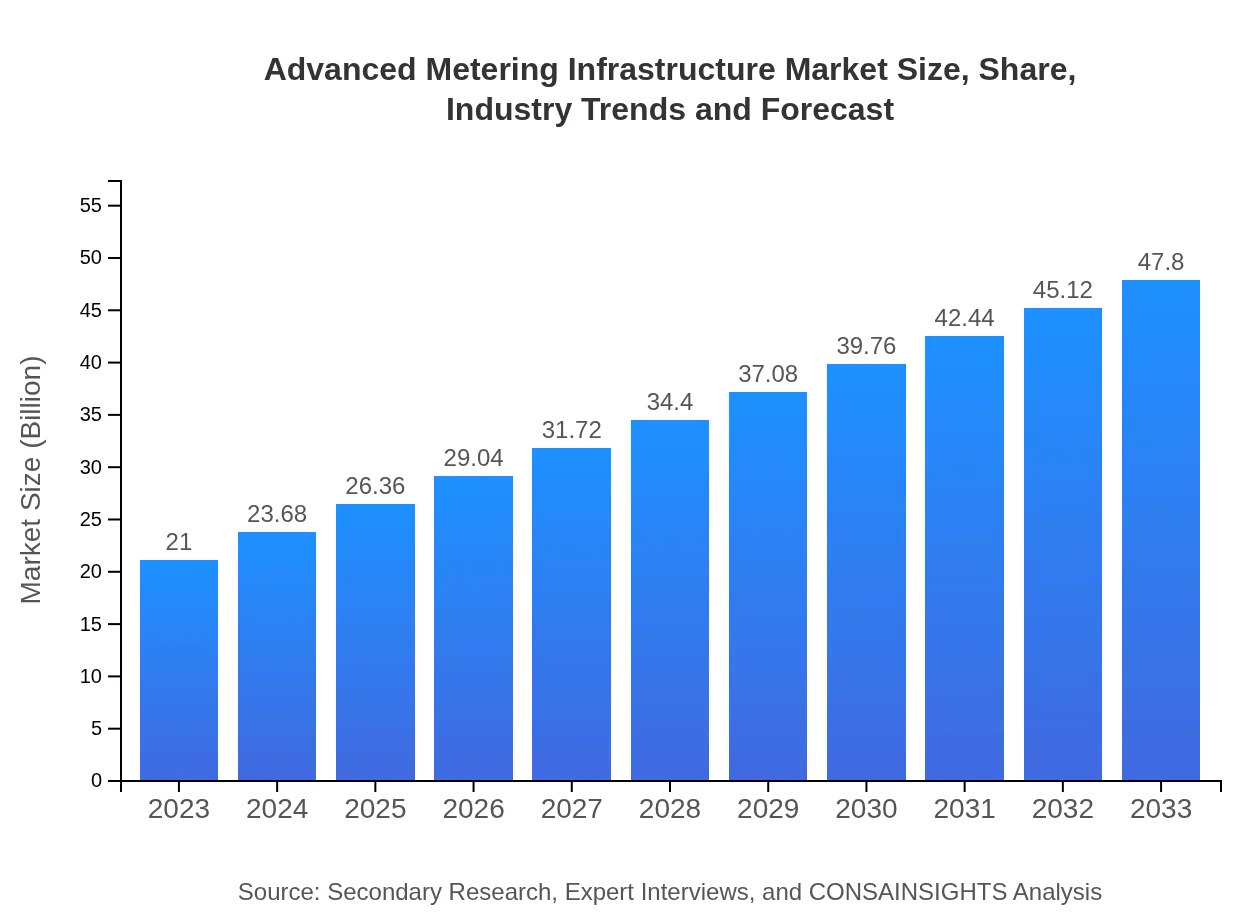

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $47.80 Billion |

| Top Companies | Siemens , Itron, Schneider Electric, Honeywell , Landis+Gyr |

| Last Modified Date | 22 January 2026 |

Advanced Metering Infrastructure Market Overview

Customize Advanced Metering Infrastructure Market Report market research report

- ✔ Get in-depth analysis of Advanced Metering Infrastructure market size, growth, and forecasts.

- ✔ Understand Advanced Metering Infrastructure's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Metering Infrastructure

What is the Market Size & CAGR of Advanced Metering Infrastructure market in 2023?

Advanced Metering Infrastructure Industry Analysis

Advanced Metering Infrastructure Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Metering Infrastructure Market Analysis Report by Region

Europe Advanced Metering Infrastructure Market Report:

Europe's AMI market stood at $5.64 billion in 2023 and is projected to reach $12.84 billion by 2033. The region is focusing on climate goals, leading to extensive investment in smart meter infrastructure and digitalization of energy services.Asia Pacific Advanced Metering Infrastructure Market Report:

The Asia Pacific region, valued at $4.18 billion in 2023, is expected to expand to $9.52 billion by 2033. The growing urbanization, rising energy consumption, and government initiatives towards sustainable energy practices are propelling the market in countries like China and India.North America Advanced Metering Infrastructure Market Report:

North America holds a significant market share, with a valuation of $7.52 billion in 2023 anticipated to reach $17.11 billion by 2033. The regions' focus on innovative energy management solutions, coupled with favorable regulatory dynamics, creates a robust market environment.South America Advanced Metering Infrastructure Market Report:

In South America, the AMI market is projected to grow from $1.60 billion in 2023 to $3.65 billion in 2033, driven by the need for energy efficiency and smart grid development. Countries such as Brazil are leading investments in AMI technology.Middle East & Africa Advanced Metering Infrastructure Market Report:

The Middle East and Africa market is expected to grow from $2.06 billion in 2023 to $4.69 billion by 2033. Investment in modern infrastructure and the need for efficient utility management are key driving factors in the region.Tell us your focus area and get a customized research report.

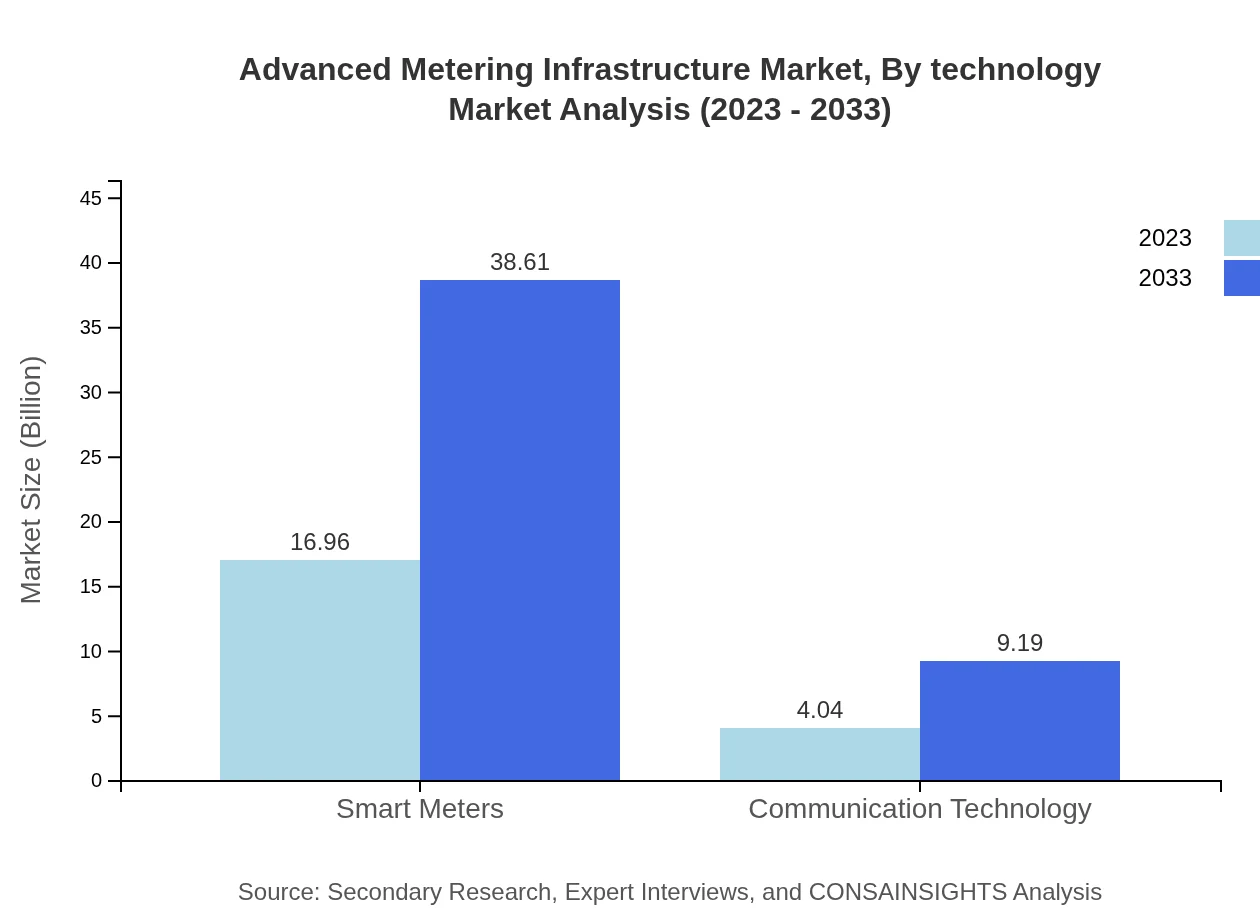

Advanced Metering Infrastructure Market Analysis By Technology

The advanced metering infrastructure market is segmented by technology into smart meters, communication technology, and data management systems. Smart meters dominate the segment, accounting for 80.78% of the market share in 2023, valued at $16.96 billion, which is expected to increase to $38.61 billion by 2033. Communication technology is also showing robust growth, projected to rise from $4.04 billion to $9.19 billion by 2033.

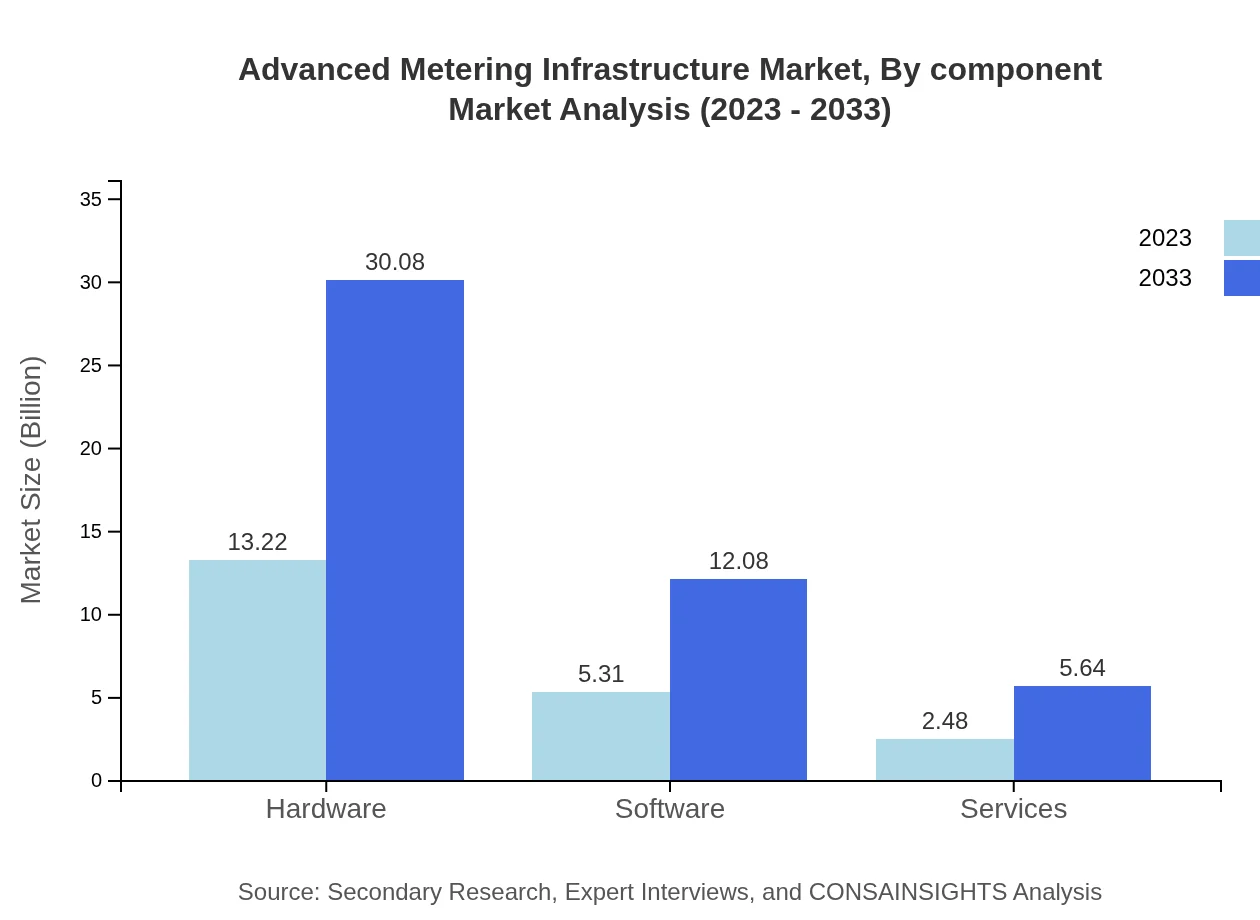

Advanced Metering Infrastructure Market Analysis By Component

AMI comprises various components, including hardware, software, and services. Hardware leads with a market share of 62.93% in 2023, valued at $13.22 billion, and is projected to grow to $30.08 billion by 2033. Software solutions are also crucial, with expectations for growth from $5.31 billion to $12.08 billion over the same period.

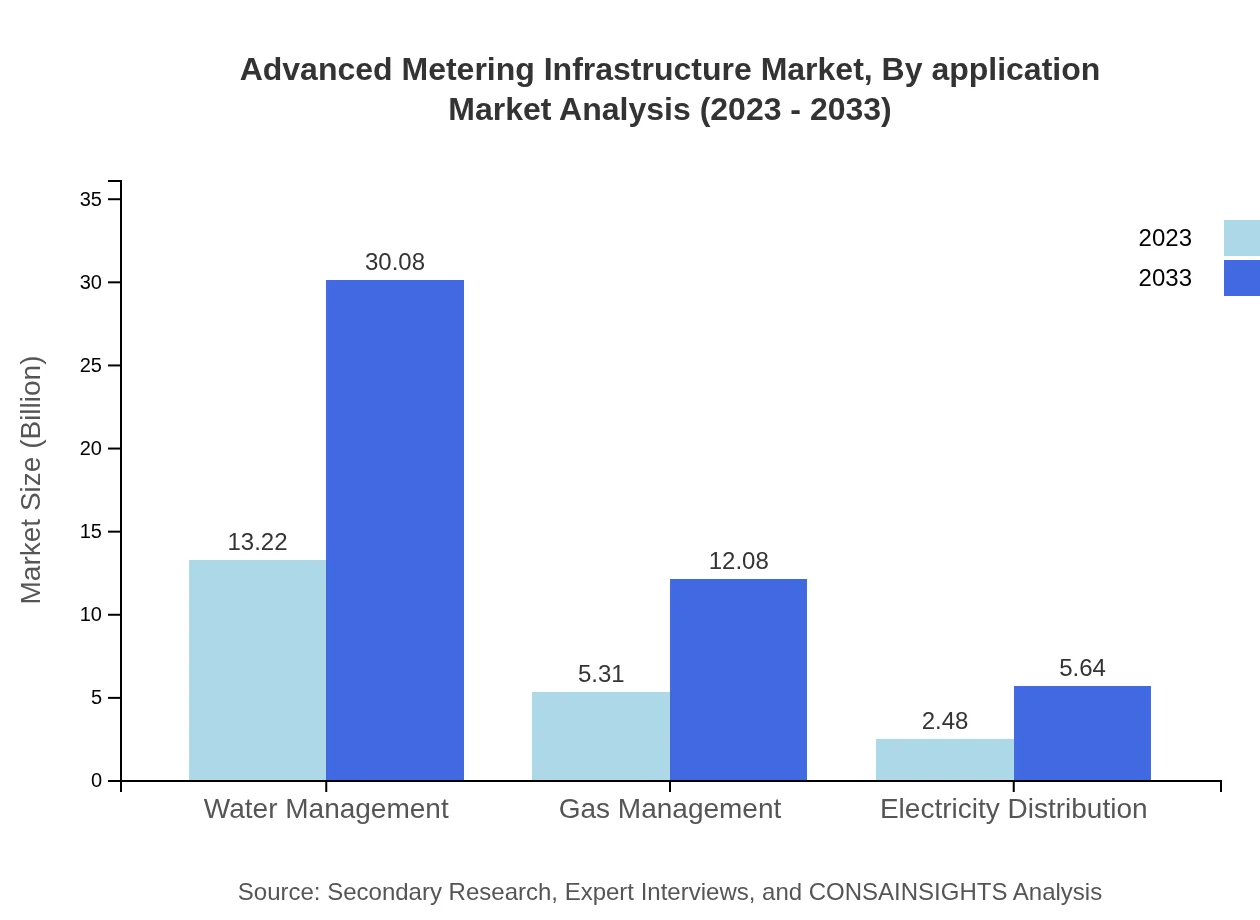

Advanced Metering Infrastructure Market Analysis By Application

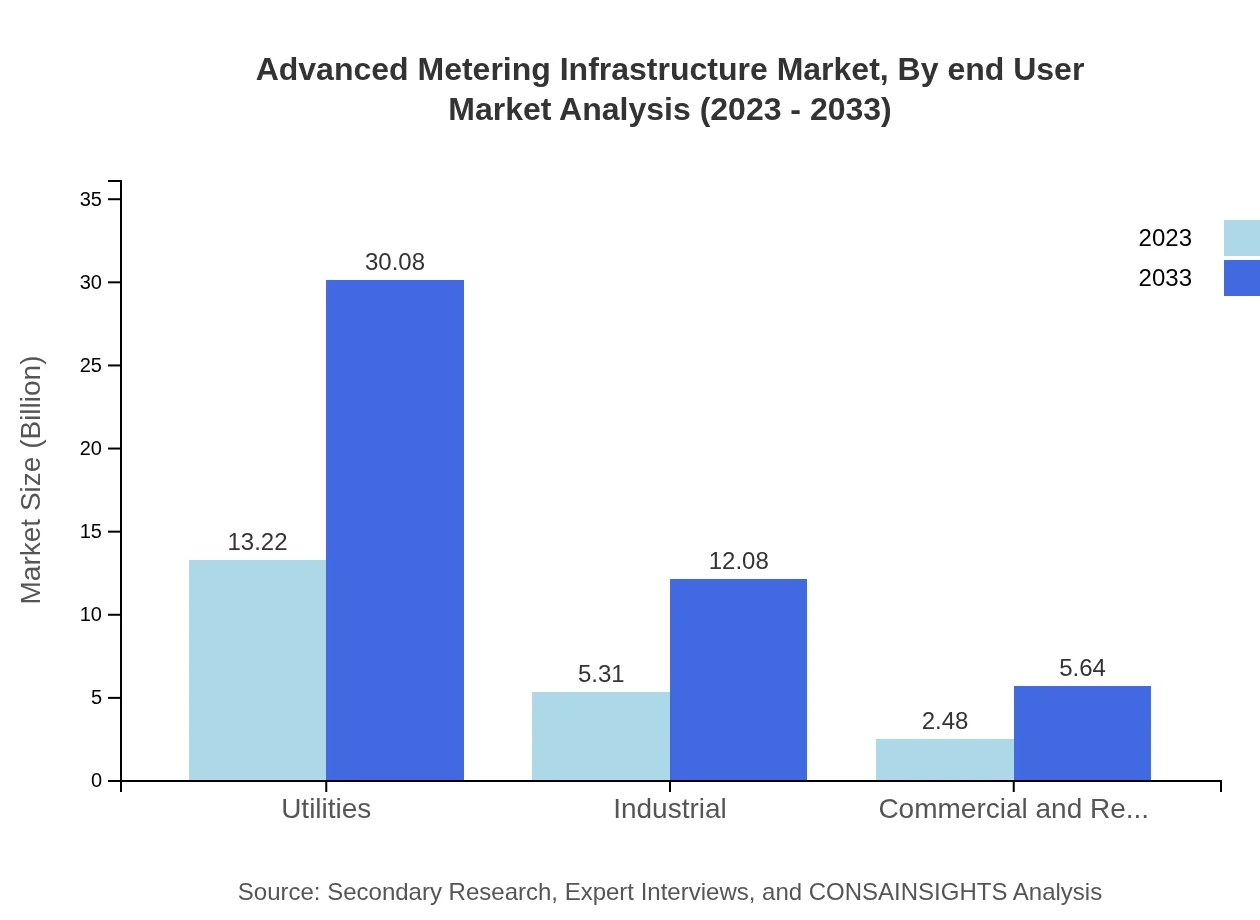

The applications of AMI are classified into utilities, commercial, and residential end-users. Utilities dominate the application segment, with a market size of $13.22 billion in 2023, expected to reach $30.08 billion by 2033, driven by the expansion of smart grid initiatives.

Advanced Metering Infrastructure Market Analysis By End User

The end-user segment includes utilities, commercial, residential, and industrial consumers. Utilities account for a significant share of the market, with projected market size growth aligning with the increasing focus on smart energy solutions and sustainable practices.

Advanced Metering Infrastructure Market Analysis By Region

Global Advanced Metering Infrastructure Market, By Region Market Analysis (2023 - 2033)

Regional analysis reveals the diverse growth trajectories within the AMI market, driven by factors such as regulation, energy demands, and infrastructure needs. North America and Europe currently lead the market with substantial investments, while Asia-Pacific is emerging as a high-growth region.

Advanced Metering Infrastructure Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Metering Infrastructure Industry

Siemens :

A leader in automation and digitalization in industrial sectors, Siemens provides comprehensive AMI solutions that enhance resource management and energy efficiency.Itron:

Itron specializes in advanced metering technologies and is committed to shaping the future of energy and water management with IoT-enabled AMI solutions.Schneider Electric:

Schneider Electric offers integrated solutions for efficient energy management, contributing significantly to advancing AMI technology across various regions.Honeywell :

Honeywell focuses on providing smart energy solutions and has developed state-of-the-art metering technologies to assist utilities in optimizing their operations.Landis+Gyr:

Landis+Gyr is a global leader in AMI, offering a range of products and services tailored for smarter grid management and enhanced utility customer engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Metering Infrastructure?

The global market size for Advanced Metering Infrastructure is projected to reach approximately $21 billion by 2033, growing at a CAGR of 8.3% from its current valuation.

What are the key market players or companies in this advanced Metering Infrastructure industry?

Key players in the advanced metering infrastructure industry include major companies specializing in smart metering technologies and software solutions, which play a critical role in driving innovation and market growth.

What are the primary factors driving the growth in the advanced Metering Infrastructure industry?

Driving factors include the increasing demand for energy efficiency, technological advancements in smart metering, and government initiatives promoting sustainable practices, which collectively enhance infrastructure development and usage.

Which region is the fastest Growing in the advanced Metering Infrastructure?

North America is the fastest-growing region in the Advanced Metering Infrastructure market, expected to increase from $7.52 billion in 2023 to $17.11 billion in 2033.

Does ConsaInsights provide customized market report data for the advanced Metering Infrastructure industry?

Yes, ConsaInsights offers customizable market report data tailored to specific needs within the advanced metering infrastructure sector, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this advanced Metering Infrastructure market research project?

Deliverables include comprehensive market analysis reports, segmentation details, regional insights, competitive landscapes, and growth forecasts to guide decisions in the advanced metering infrastructure market.

What are the market trends of advanced Metering Infrastructure?

Key market trends include the rise of IoT integration, the adoption of smart grid technologies, and increasing investments in renewable energy sources, shaping the future of advanced metering infrastructure.