Advanced Process Control Market Report

Published Date: 22 January 2026 | Report Code: advanced-process-control

Advanced Process Control Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced Process Control (APC) market from 2023 to 2033. It covers market size, growth trends, regional dynamics, industry segmentation, and leading companies, giving valuable insights for stakeholders.

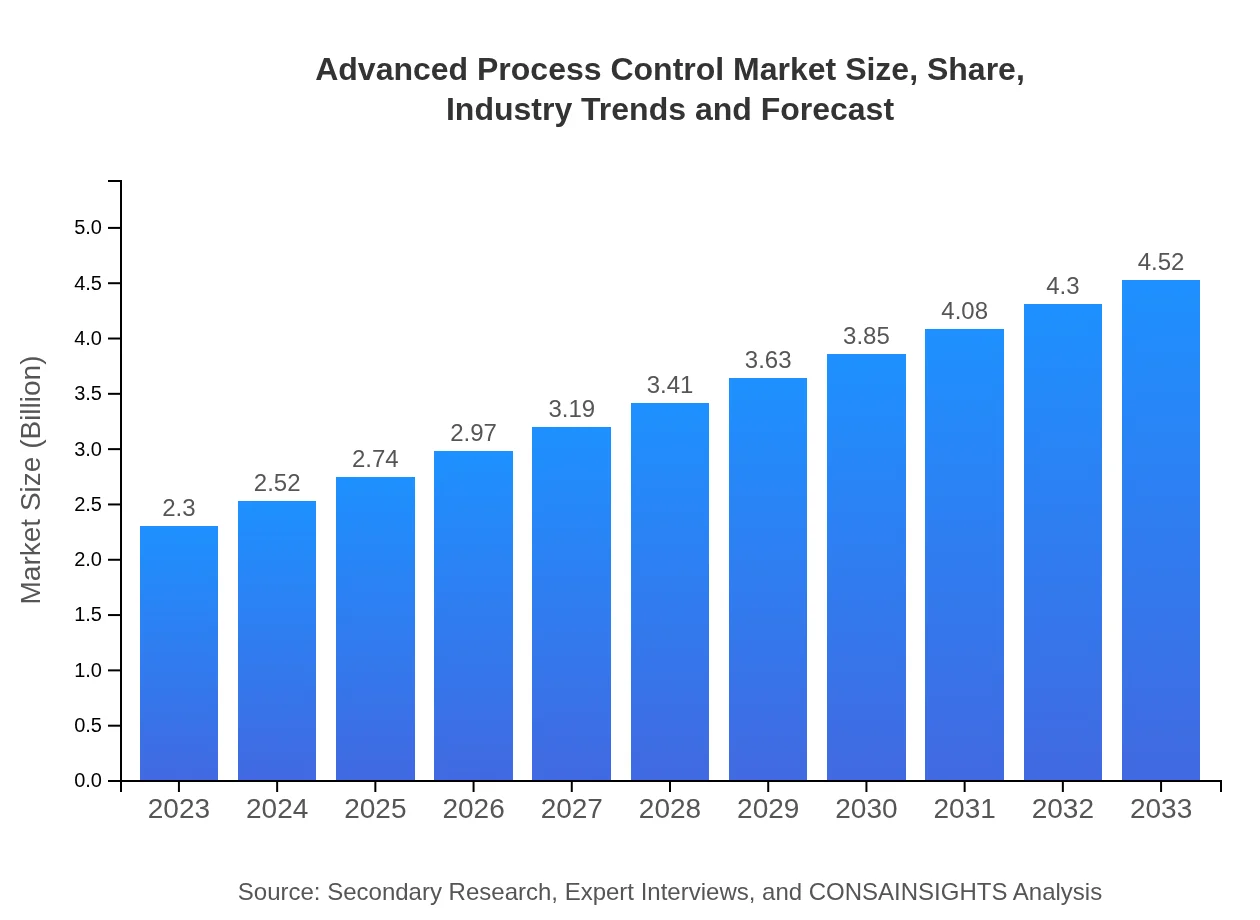

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Honeywell International Inc., Emerson Electric Co., Siemens AG, Rockwell Automation, Inc., Schneider Electric |

| Last Modified Date | 22 January 2026 |

Advanced Process Control Market Overview

Customize Advanced Process Control Market Report market research report

- ✔ Get in-depth analysis of Advanced Process Control market size, growth, and forecasts.

- ✔ Understand Advanced Process Control's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Process Control

What is the Market Size & CAGR of Advanced Process Control market in 2023?

Advanced Process Control Industry Analysis

Advanced Process Control Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Process Control Market Analysis Report by Region

Europe Advanced Process Control Market Report:

The European Advanced Process Control market is estimated at $0.67 billion in 2023, with an expected reach of $1.31 billion by 2033. Innovations in technology and a robust regulatory framework regarding industrial operations drive adoption in this region. Countries such as Germany, the UK, and France stand out for their advanced manufacturing capabilities and smart factories.Asia Pacific Advanced Process Control Market Report:

In 2023, the Advanced Process Control market in the Asia Pacific region is valued at approximately $0.45 billion, and it is projected to grow to $0.88 billion by 2033. The increasing industrialization and adoption of advanced technologies in countries like China and India are significant contributors to this growth. Additionally, the focus on optimizing manufacturing processes and energy consumption aligns with governmental policies promoting sustainability.North America Advanced Process Control Market Report:

North America holds a significant share of the Advanced Process Control market, valued at $0.83 billion in 2023, projected to grow to $1.64 billion by 2033. The region’s strong focus on automation, especially in manufacturing and food processing industries, along with stringent regulations regarding efficiency and safety, fuel this market's growth. Major players in the industry are investing heavily in R&D to maintain their competitive edge.South America Advanced Process Control Market Report:

The South American Advanced Process Control market is relatively smaller, valued at $0.08 billion in 2023, with projections of reaching $0.16 billion by 2033. Challenges such as infrastructural limitations are prevalent, but increasing investments in the chemical and oil & gas industries are expected to drive growth in this region. Countries like Brazil and Argentina are emerging as key markets.Middle East & Africa Advanced Process Control Market Report:

In the Middle East and Africa, the market is valued at $0.27 billion in 2023 and is anticipated to double to $0.54 billion by 2033. The oil and gas sector significantly influences this market, with significant investments in automation technologies to enhance operational efficiency and reduce costs.Tell us your focus area and get a customized research report.

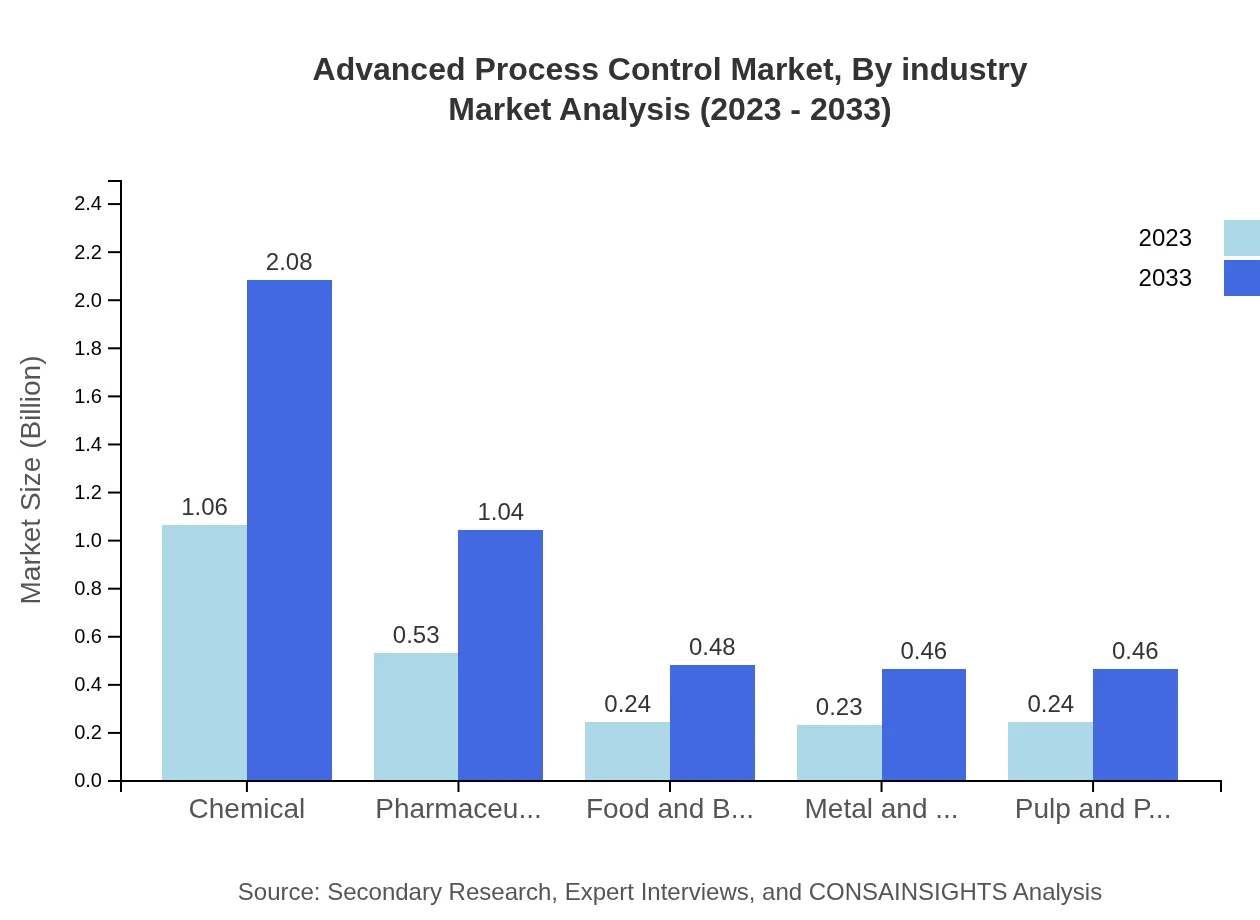

Advanced Process Control Market Analysis By Industry

The Advanced Process Control market is predominantly driven by the chemicals and pharmaceuticals industries, which accounted for significant market shares in both size and value. The chemical industry is projected to grow from $1.06 billion in 2023 to $2.08 billion by 2033, maintaining a 46.05% share. Similarly, the pharmaceutical sector is anticipated to grow from $0.53 billion to $1.04 billion over the same period, retaining a 23.05% market share. Other segments like food and beverage, metal and mining also show favorable growth prospects, contributing to the overall expansion of the prominent market sectors.

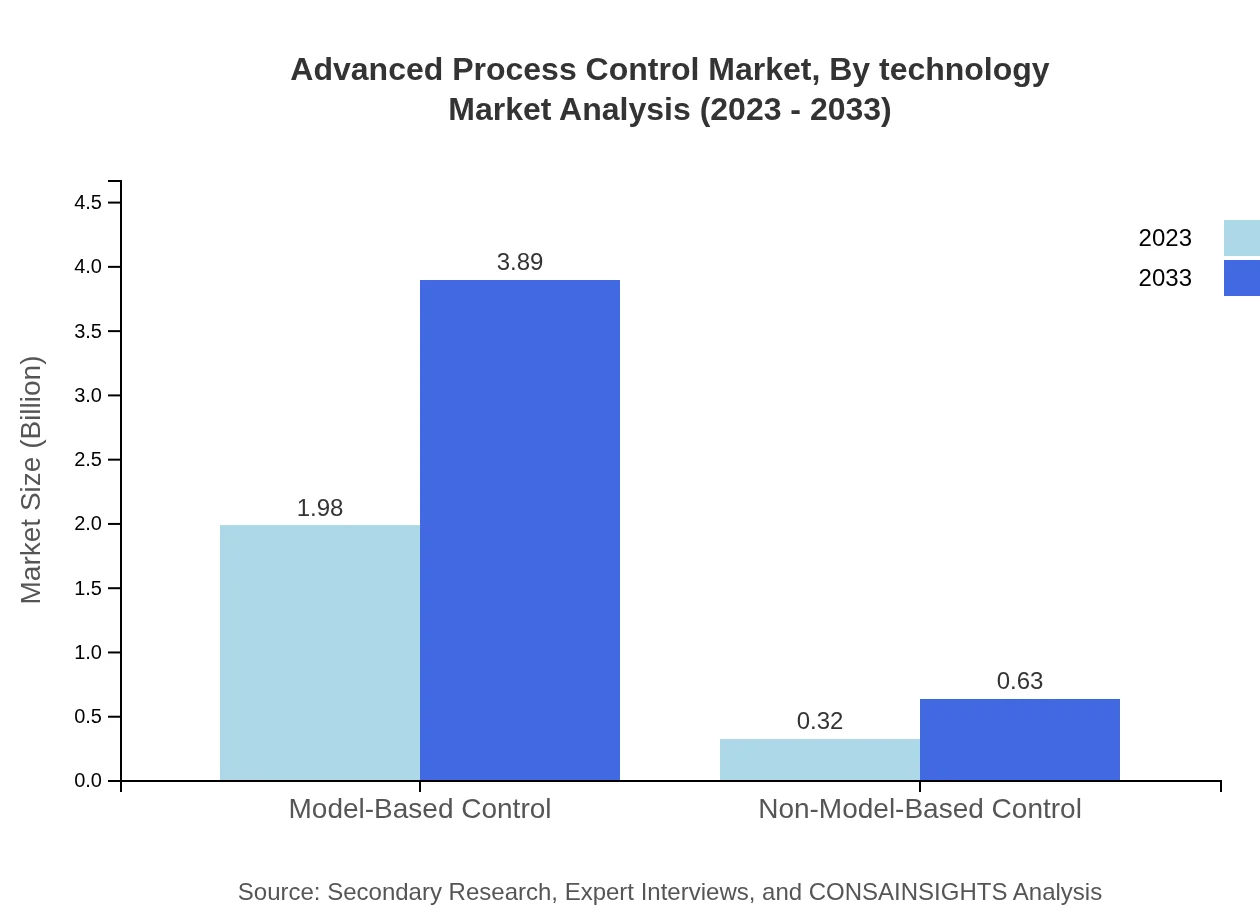

Advanced Process Control Market Analysis By Technology

The primary technologies in the Advanced Process Control market comprise Model-Based Control and Non-Model-Based Control systems. Model-Based Control accounts for a large majority, projected to grow from $1.98 billion in 2023 to $3.89 billion by 2033, maintaining an 86% market share. Non-Model-Based Control, while smaller, is experiencing steady growth, increasing from $0.32 billion to $0.63 billion, reflecting the diversity in operational control needs among different industries.

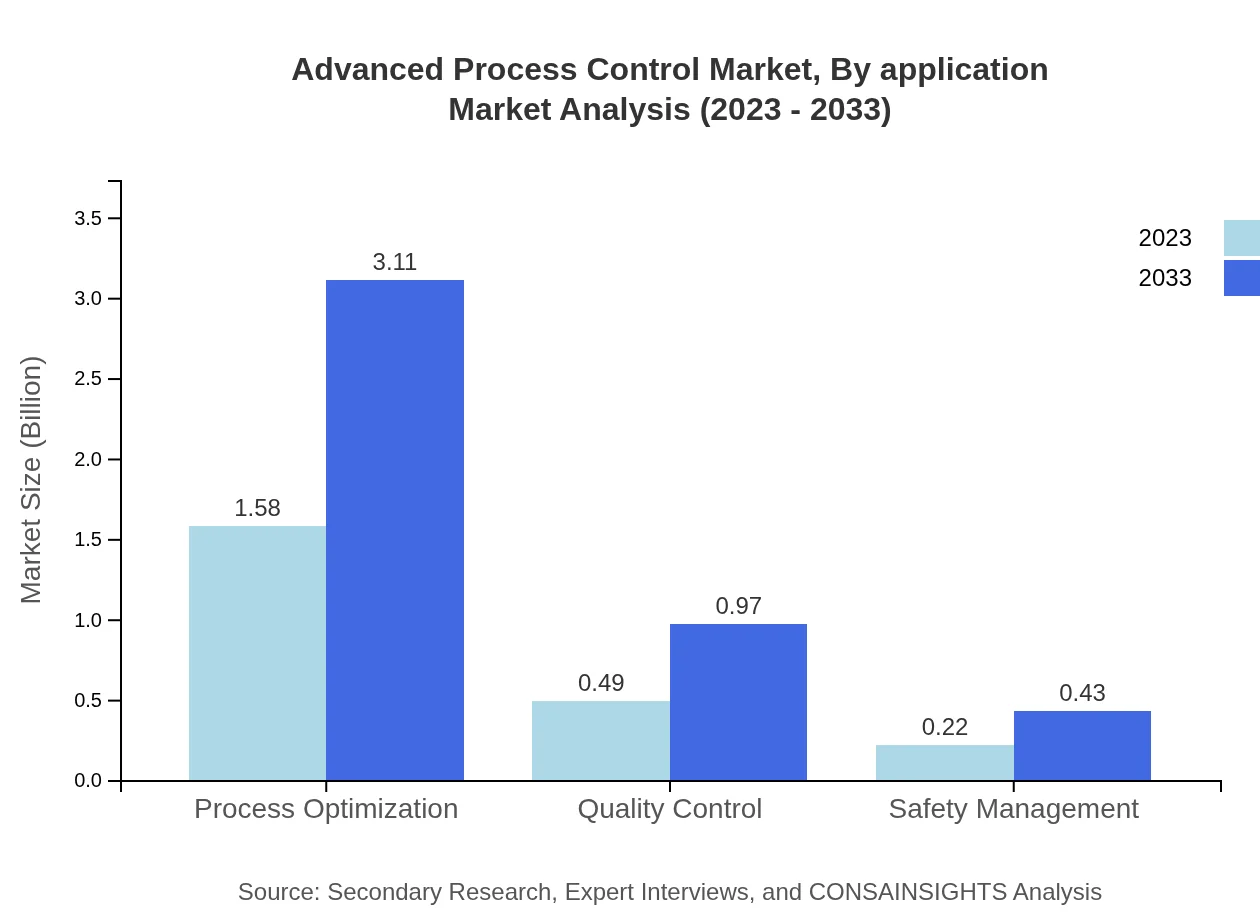

Advanced Process Control Market Analysis By Application

Key applications of Advanced Process Control systems include process optimization, quality control, safety management, and distributed control systems (DCS). The process optimization segment is leading, with a market size of $1.58 billion in 2023, expected to double to $3.11 billion by 2033, reflecting a share of 68.89%. Quality control and safety management segments also show promising growth, emphasizing the importance of maintaining production standards and safety protocols across industries.

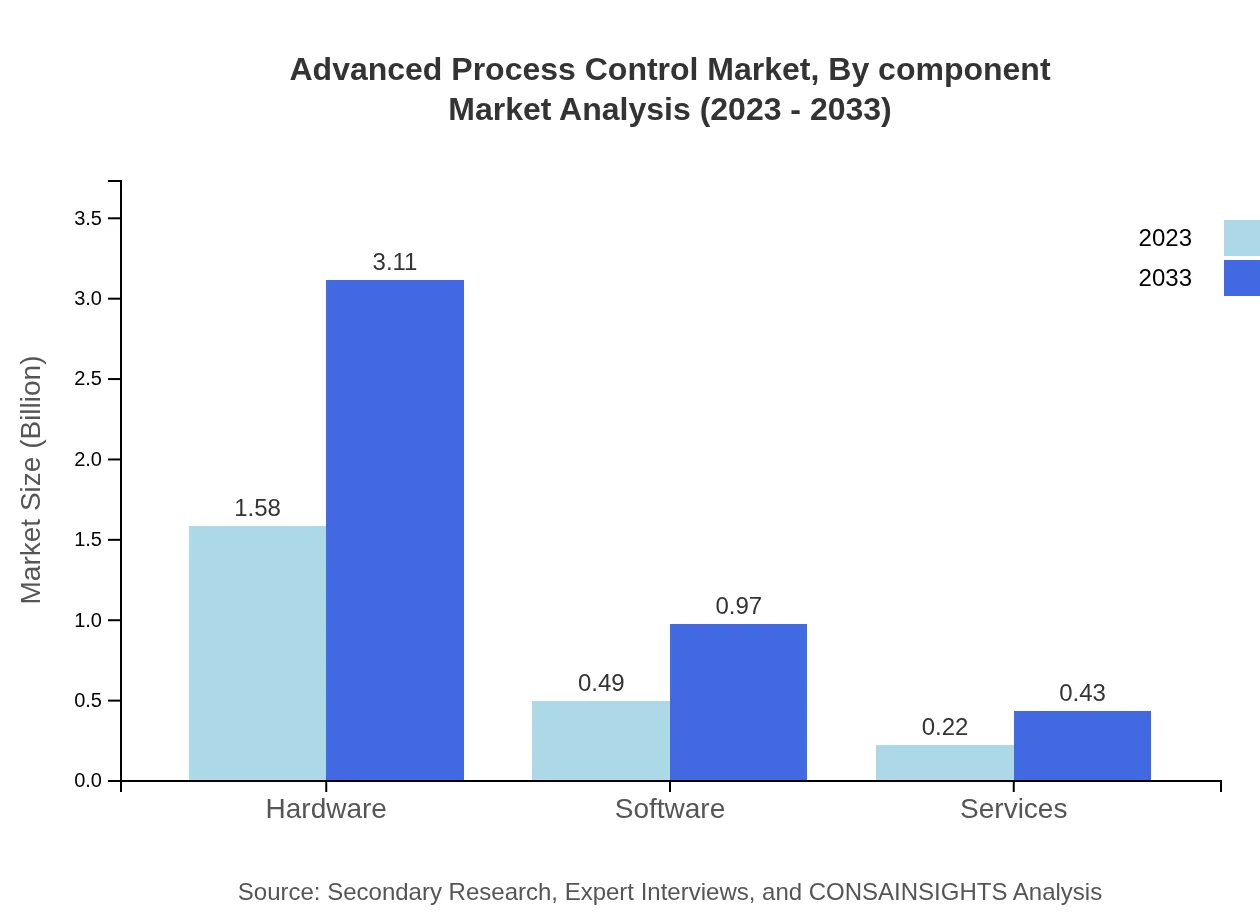

Advanced Process Control Market Analysis By Component

The Advanced Process Control market is divided into hardware and software components. Hardware systems are the backbone of APC solutions, currently valued at $1.58 billion, forecasted to reach $3.11 billion by 2033 with a 68.89% market share. Software components, though smaller, are crucial in complementing hardware capabilities, projected to witness substantial growth from $0.49 billion to $0.97 billion over the same period.

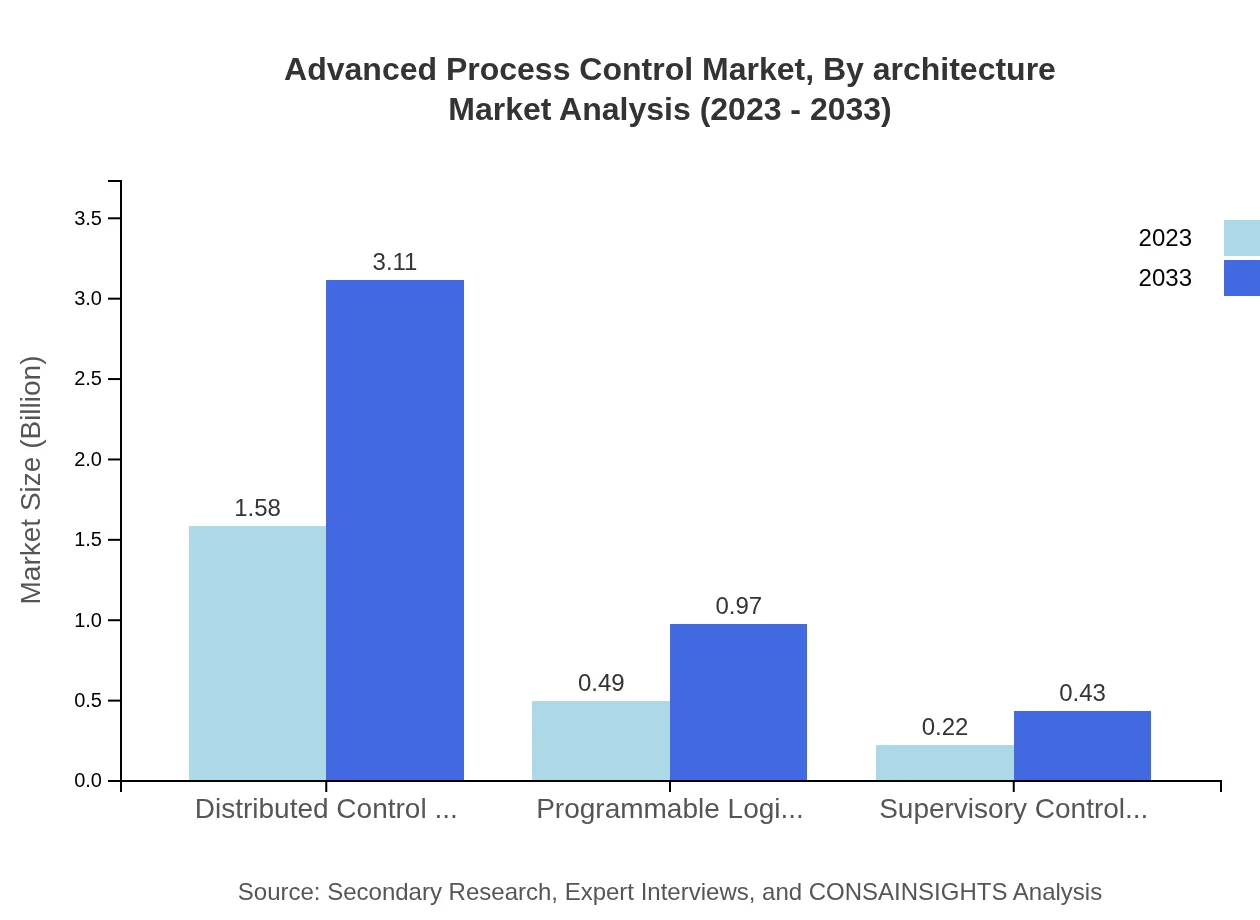

Advanced Process Control Market Analysis By Architecture

Architectural frameworks in Advanced Process Control, including Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), and Supervisory Control and Data Acquisition (SCADA), play vital roles in the efficient execution of procedures. DCS systems dominate the segment, with an estimated market size of $1.58 billion in 2023, expected to reach $3.11 billion by 2033 due to their effectiveness in complex industrial environments. PLCs and SCADA systems also contribute significantly, with projections of growth reflecting the necessity of integrating different processing controls.

Advanced Process Control Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Process Control Industry

Honeywell International Inc.:

A leader in automation control systems, Honeywell provides advanced APC solutions to various sectors, focusing on safety and efficiency enhancements.Emerson Electric Co.:

Emerson is known for its process control technologies and automation solutions that enhance production techniques and efficiency across multiple industries.Siemens AG:

Siemens is at the forefront of digital industries, providing software and automation technologies that improve productivity and cut operational losses.Rockwell Automation, Inc.:

Rockwell specializes in industrial automation and information technology, offering a range of advanced process control products to enhance operational efficiency.Schneider Electric:

As an energy management and automation company, Schneider Electric offers innovative CAN solutions that integrate advanced process controls for better industrial operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Advanced Process Control?

The Advanced Process Control market is valued at approximately $2.3 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching substantial growth by 2033.

What are the key market players or companies in the Advanced Process Control industry?

Key players in the Advanced Process Control industry include top technology providers that specialize in automation systems, software solutions, and services, driving innovation in various sectors such as chemicals, pharmaceuticals, and food and beverage.

What are the primary factors driving the growth in the Advanced Process Control industry?

The growth of the Advanced Process Control market is driven by increasing demand for process optimization, enhanced efficiency in manufacturing, and the integration of advanced technologies like AI and IoT for improved operational performance.

Which region is the fastest Growing in the Advanced Process Control market?

The fastest-growing region in the Advanced Process Control market is North America, with projected growth from $0.83 billion in 2023 to $1.64 billion by 2033, showcasing significant demand in this sector.

Does ConsaInsights provide customized market report data for the Advanced Process Control industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring comprehensive insights and analysis specific to the Advanced Process Control industry and its unique requirements.

What deliverables can I expect from this Advanced Process Control market research project?

Deliverables from the Advanced Process Control market research project include detailed reports, market analysis, growth forecasts, regional insights, and segmentation data to guide strategic business decisions.

What are the market trends of Advanced Process Control?

Current trends in the Advanced Process Control market include a shift towards digital transformation, increased automation, and the adoption of smart technologies, influencing operational efficiencies across multiple industrial sectors.