Advanced Process Control Software Market Report

Published Date: 31 January 2026 | Report Code: advanced-process-control-software

Advanced Process Control Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Advanced Process Control Software market, focusing on current trends, forecasts from 2023 to 2033, and insights into regional dynamics and market segments that drive growth in the industry.

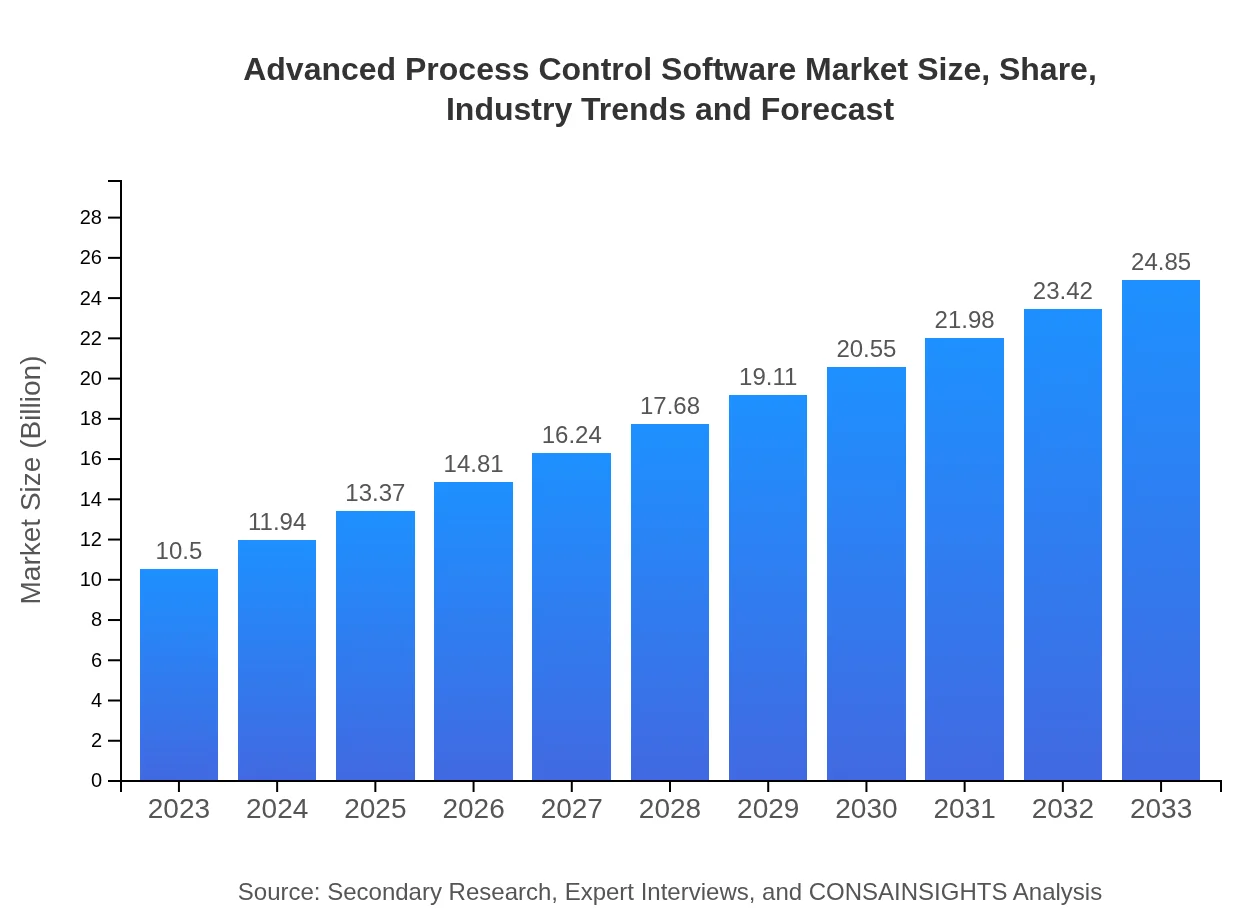

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $24.85 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Emerson Electric Co., Rockwell Automation, Schneider Electric |

| Last Modified Date | 31 January 2026 |

Advanced Process Control Software Market Overview

Customize Advanced Process Control Software Market Report market research report

- ✔ Get in-depth analysis of Advanced Process Control Software market size, growth, and forecasts.

- ✔ Understand Advanced Process Control Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Process Control Software

What is the Market Size & CAGR of Advanced Process Control Software market in 2023?

Advanced Process Control Software Industry Analysis

Advanced Process Control Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Process Control Software Market Analysis Report by Region

Europe Advanced Process Control Software Market Report:

The European Advanced Process Control Software market is expected to increase from $2.66 billion in 2023 to $6.29 billion by 2033. Factors such as stringent regulations on operational efficiency and sustainability focus encourage the adoption of advanced software solutions across various industries.Asia Pacific Advanced Process Control Software Market Report:

In Asia Pacific, the market is anticipated to grow from $2.08 billion in 2023 to $4.93 billion by 2033. The region's rapid industrialization and the push towards smart manufacturing are primary growth drivers, alongside government initiatives to enhance industrial productivity.North America Advanced Process Control Software Market Report:

North America dominates the market with an estimated size of $3.50 billion in 2023, projected to reach $8.28 billion by 2033. Major investments in oil and gas, pharmaceuticals, and chemicals enhance the demand for APC solutions in this region. Additionally, the presence of key market players contributes to the established infrastructure for advanced technological adoption.South America Advanced Process Control Software Market Report:

The South American market is expected to rise from $0.87 billion in 2023 to $2.07 billion by 2033. Increased investments in the food and beverage sector and the need for reliable supply chain management are fueling this growth, despite broader economic challenges in the region.Middle East & Africa Advanced Process Control Software Market Report:

The Middle East and Africa market is projected to see growth from $1.39 billion in 2023 to $3.28 billion by 2033. This growth is driven primarily by investments in the oil and gas sector, along with an increasing emphasis on enhancing infrastructural capabilities in countries across the region.Tell us your focus area and get a customized research report.

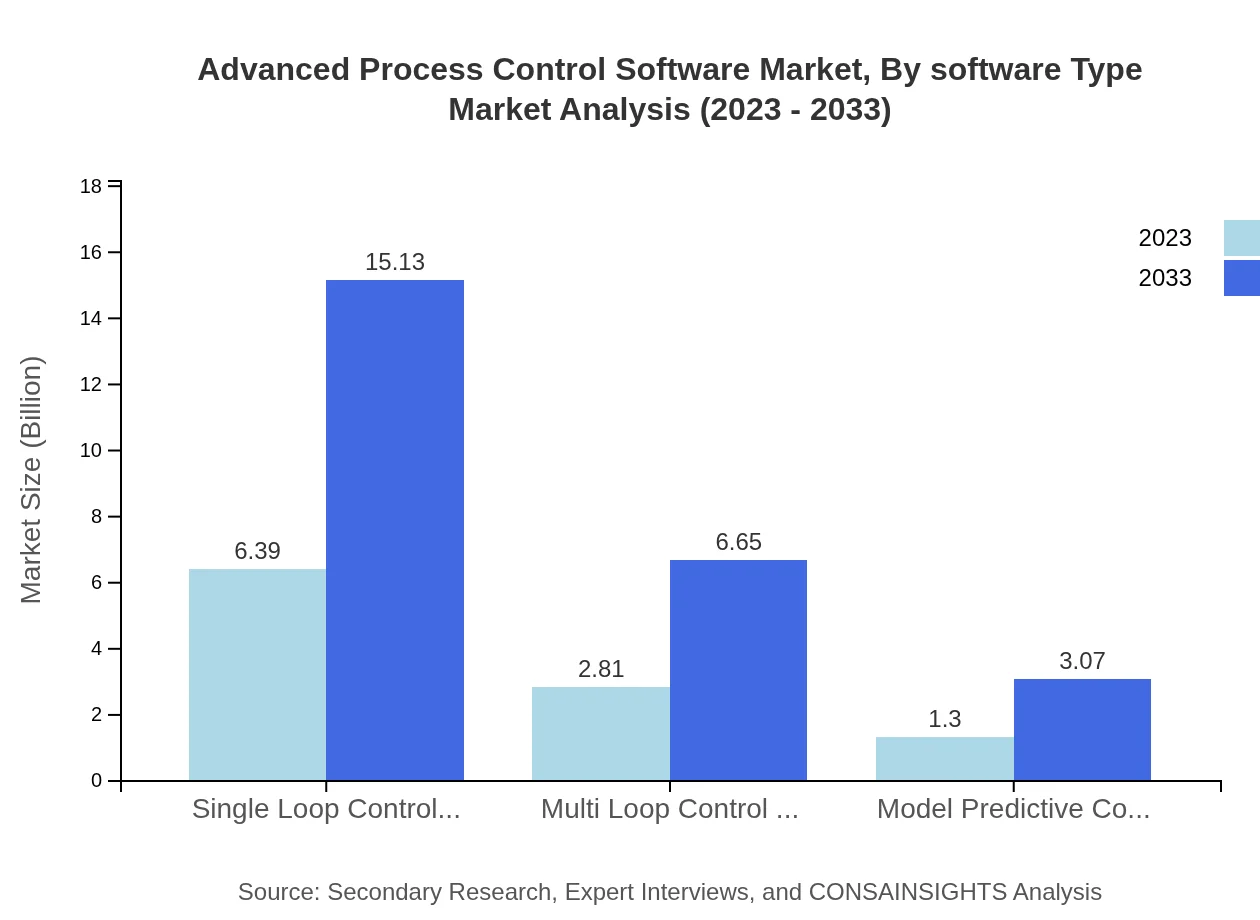

Advanced Process Control Software Market Analysis By Software Type

In the Advanced Process Control Software market, single loop control software holds a significant share, valued at $6.39 billion in 2023 and expected to grow to $15.13 billion by 2033. Other software types, such as multi-loop control software and model predictive control software, are also experiencing growth, reflecting the industry's shift towards more sophisticated solutions.

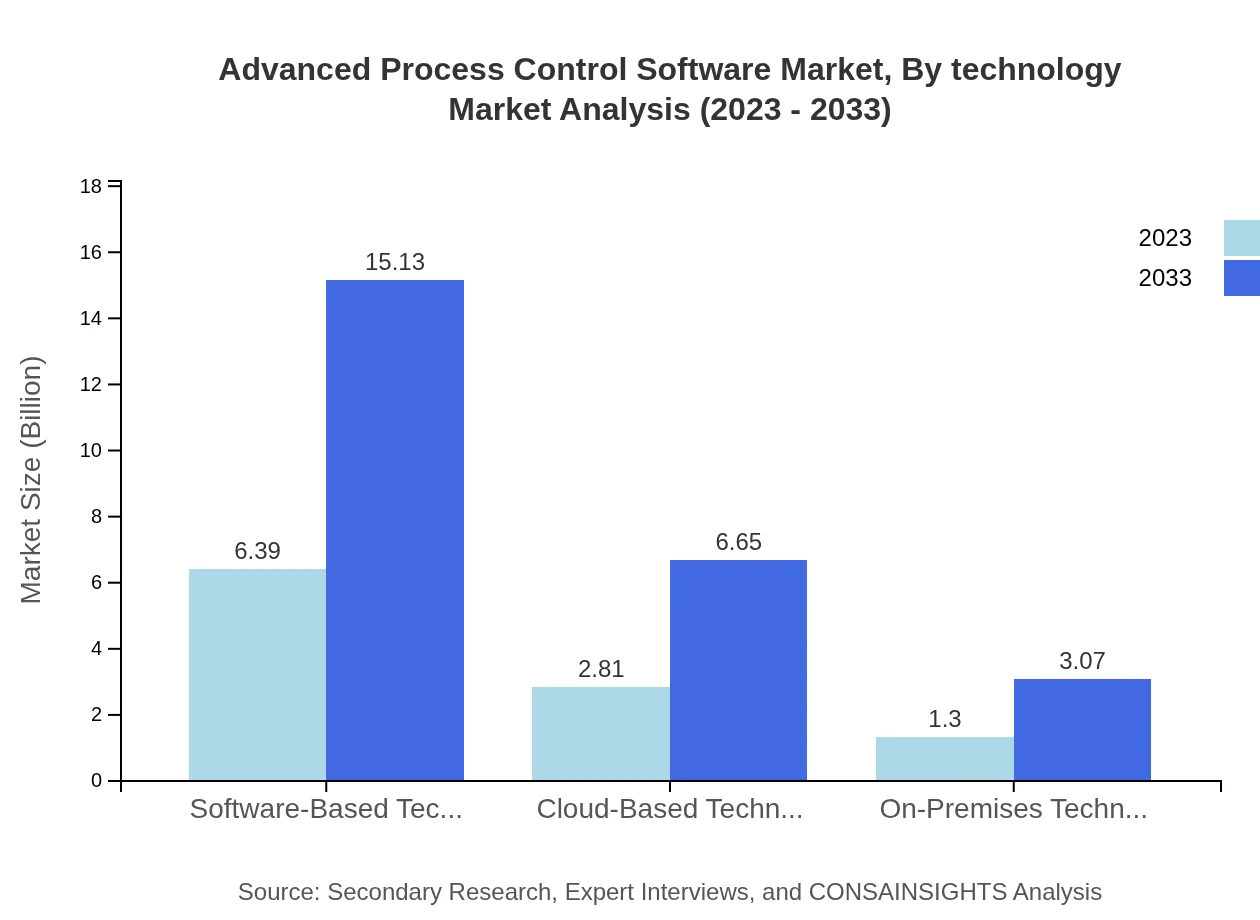

Advanced Process Control Software Market Analysis By Technology

The market reveals that software-based technology leads with a size of $6.39 billion in 2023 and is on track to reach $15.13 billion by 2033. Cloud-based technology and on-premises technology contribute significantly as well, each catering to unique operational needs and deployment strategies.

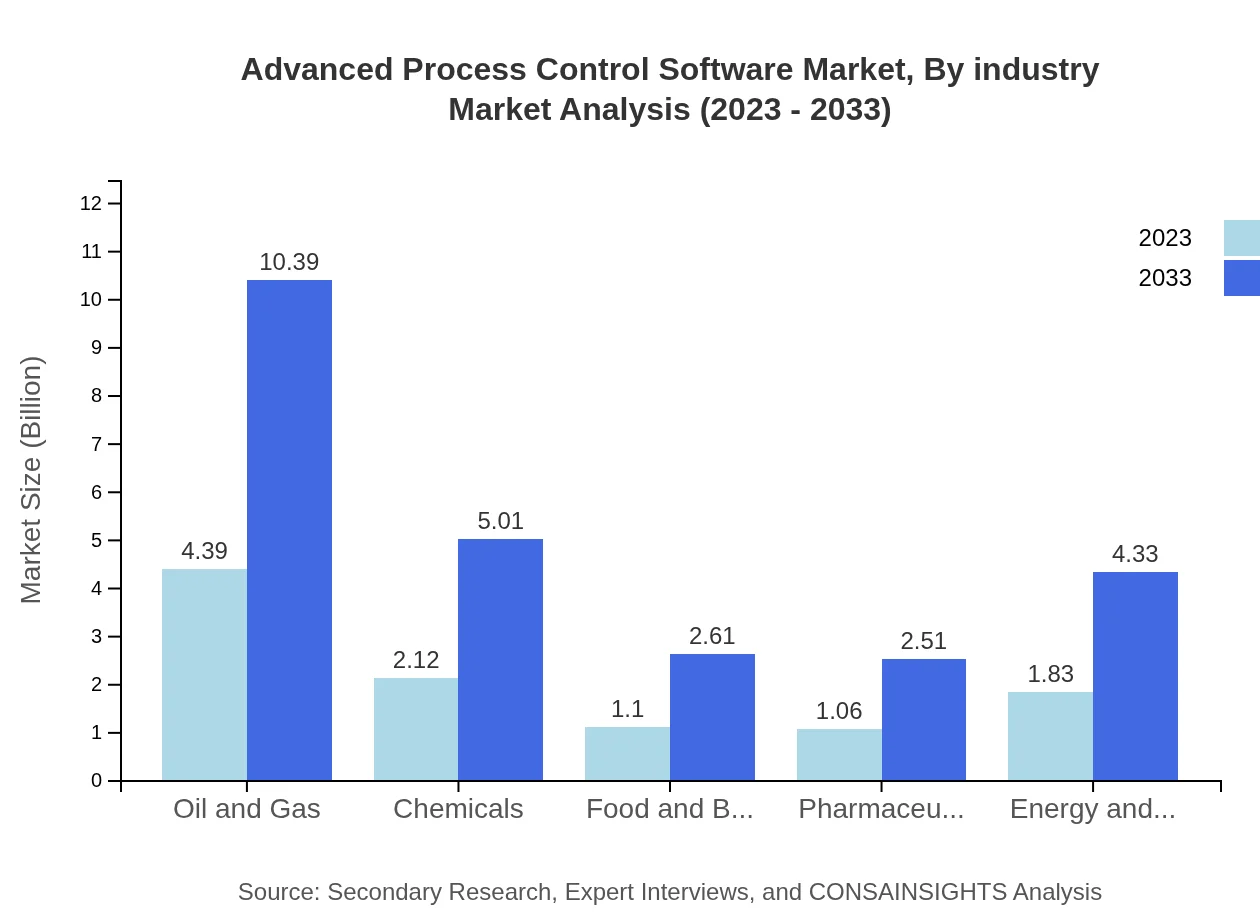

Advanced Process Control Software Market Analysis By Industry

The oil and gas industry is the largest segment within the Advanced Process Control Software market, valued at $4.39 billion in 2023 and projected to grow to $10.39 billion by 2033. Other sectors like chemicals and pharmaceuticals also demonstrate considerable engagement with APC solutions, reflecting their importance in maintaining efficiency and compliance.

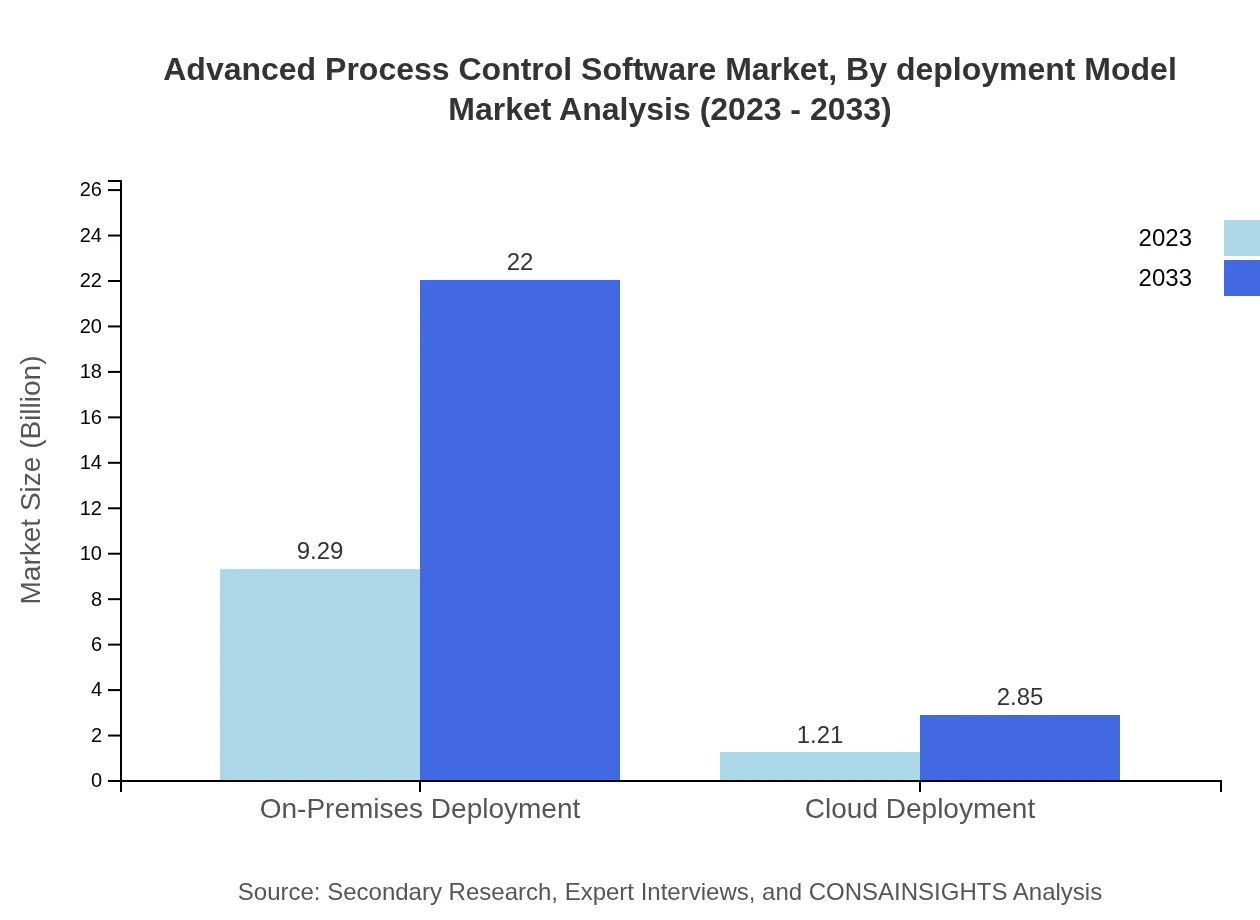

Advanced Process Control Software Market Analysis By Deployment Model

On-premises deployment continues to dominate the Advanced Process Control market, valued at $9.29 billion in 2023. However, cloud deployment is gaining traction, expected to increase from $1.21 billion in 2023 to $2.85 billion by 2033 due to its flexibility and scalability.

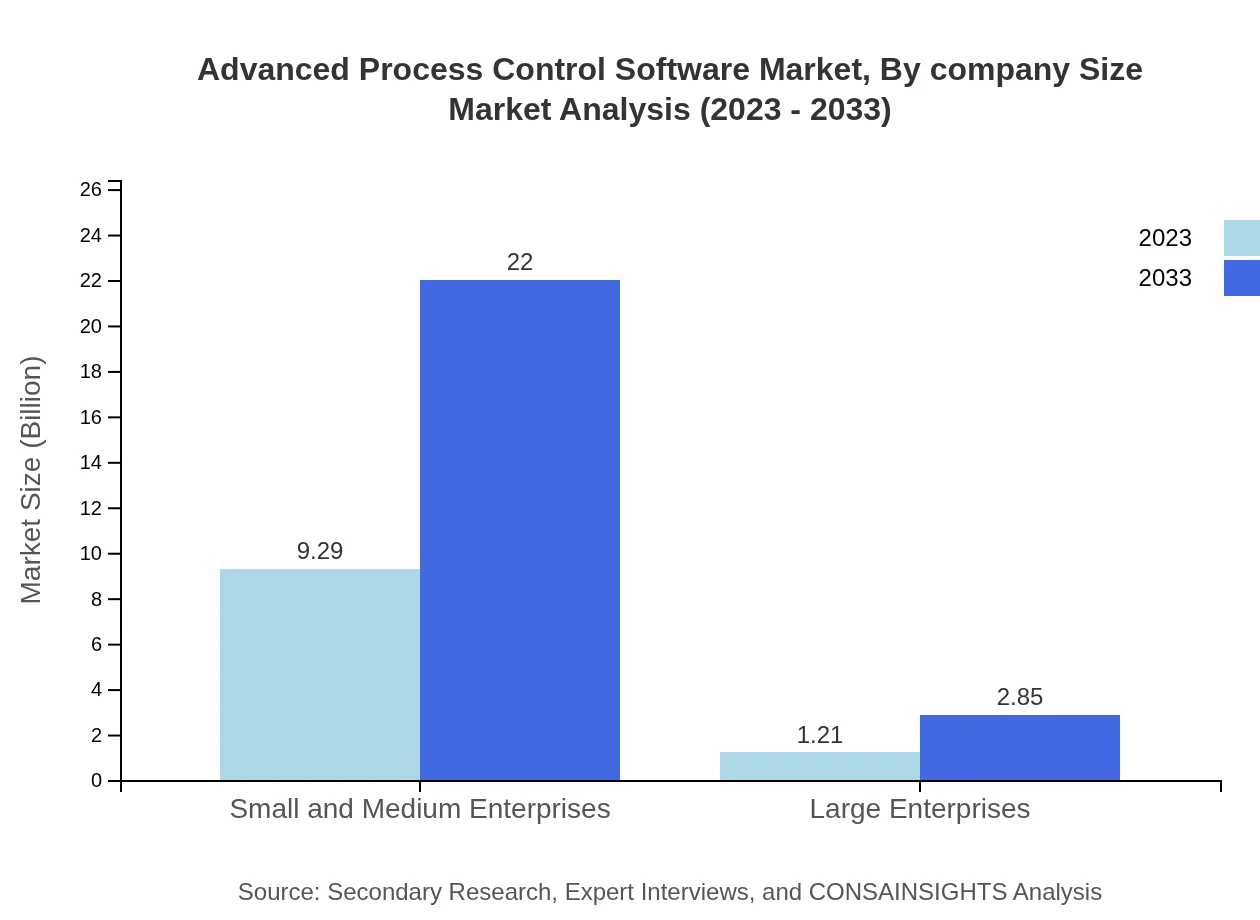

Advanced Process Control Software Market Analysis By Company Size

The market shows significant participation from small and medium enterprises, with a projected growth from $9.29 billion in 2023 to $22.00 billion by 2033, illustrating how APC solutions are essential even for smaller operational scales.

Advanced Process Control Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Process Control Software Industry

Honeywell International Inc.:

A leading provider of industrial automation and control systems, Honeywell offers advanced APC solutions that optimize operations and improve safety across multiple sectors.Siemens AG:

Siemens provides diverse automation solutions, with a strong emphasis on advancing digital industries through its innovative APC software solutions.Emerson Electric Co.:

Emerson is renowned for its automation technologies, delivering high-performance APC software critical for enhancing operational efficiency in heavy industries.Rockwell Automation:

As a key player in the field, Rockwell delivers software and automation solutions that help manufacturers enhance productivity and performance through smart manufacturing.Schneider Electric:

Schneider Electric specializes in energy management and automation, providing APC solutions that enable businesses to achieve sustainable and efficient operations.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Process Control Software?

The advanced process control software market is valued at approximately $10.5 billion in 2023, with an expected CAGR of 8.7% through 2033, reflecting robust growth driven by increasing automation and demand for operational efficiency.

What are the key market players or companies in this advanced Process Control Software industry?

Key players in the advanced process control software industry include global leaders like Honeywell, Siemens, Emerson Electric, Rockwell Automation, and ABB. These companies compete on delivering innovative solutions that enhance production efficiency and reliability.

What are the primary factors driving the growth in the advanced Process Control Software industry?

Growth in the advanced process control software industry is propelled by the increasing need for industrial automation, adoption of IoT technologies, and the push towards smarter manufacturing processes, resulting in enhanced operational efficiencies and reduced downtime.

Which region is the fastest Growing in the advanced Process Control Software?

Currently, North America leads the growth trajectory, projected to increase from $3.50 billion in 2023 to $8.28 billion in 2033. Europe and Asia Pacific also exhibit strong growth, indicating significant regional opportunities in process control.

Does ConsaInsights provide customized market report data for the advanced Process Control Software industry?

Yes, ConsaInsights specializes in delivering customized market report data tailored to specific needs within the advanced process control software industry, offering insights into unique segments or regions of interest.

What deliverables can I expect from this advanced Process Control Software market research project?

Deliverables from this market research project will include comprehensive reports detailing market size, growth projections, competitive landscape, regional analysis, and trending technologies within the advanced process control software sector.

What are the market trends of advanced Process Control Software?

Key market trends for advanced process control software include increasing adoption of cloud-based solutions, integration of AI and machine learning for predictive analytics, and a shift towards eco-friendly practices in manufacturing processes.