Advanced Wound Care Market Report

Published Date: 31 January 2026 | Report Code: advanced-wound-care

Advanced Wound Care Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Advanced Wound Care market, highlighting market trends, growth prospects, and comprehensive forecasts for the period 2023 to 2033. Insights cover market size, segmentation, regional dynamics, and key players in the industry.

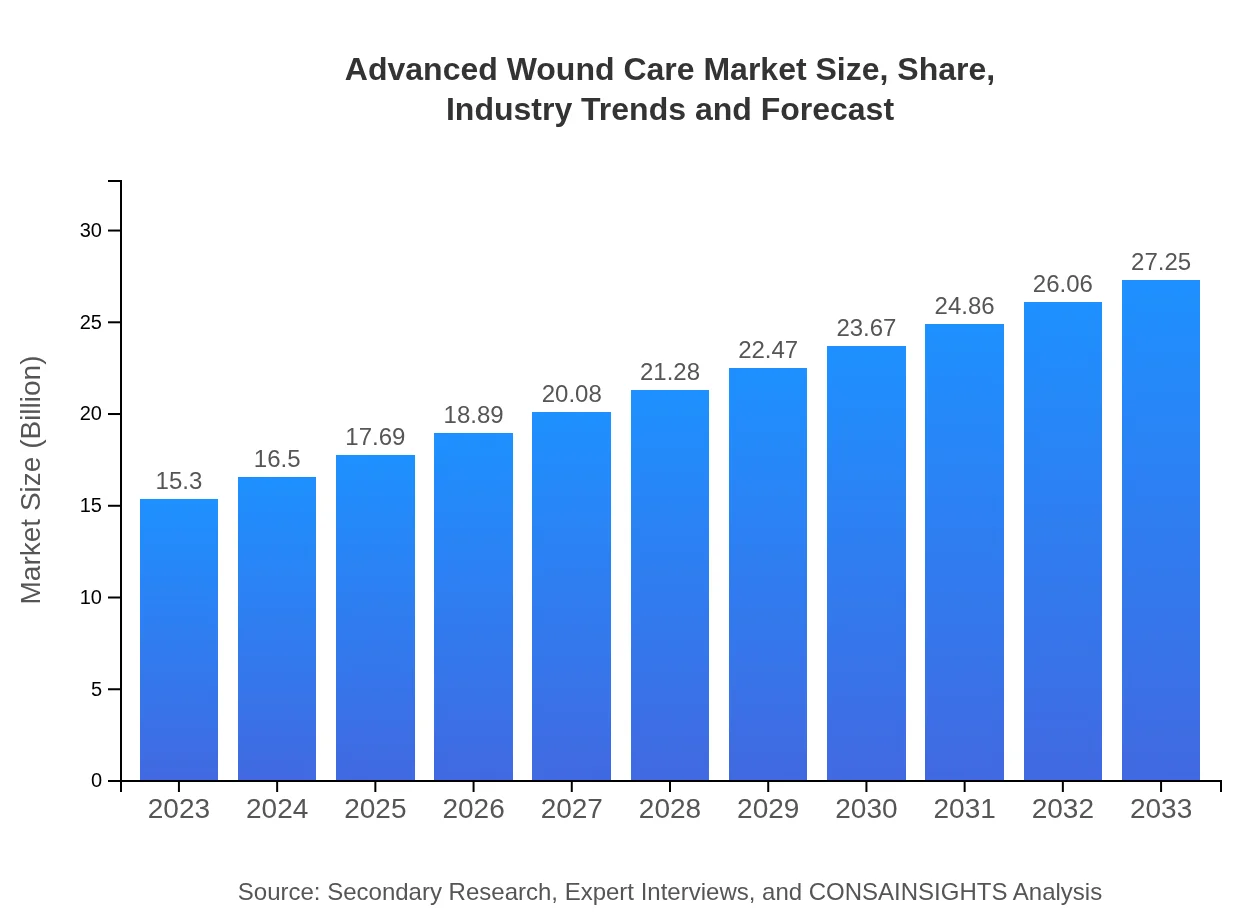

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.25 Billion |

| Top Companies | Smith & Nephew, Molnlycke Health Care, Acelity (now part of 3M), Convatec Group, Dermarite Industries, LLC |

| Last Modified Date | 31 January 2026 |

Advanced Wound Care Market Overview

Customize Advanced Wound Care Market Report market research report

- ✔ Get in-depth analysis of Advanced Wound Care market size, growth, and forecasts.

- ✔ Understand Advanced Wound Care's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Advanced Wound Care

What is the Market Size & CAGR of Advanced Wound Care market in 2023?

Advanced Wound Care Industry Analysis

Advanced Wound Care Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Advanced Wound Care Market Analysis Report by Region

Europe Advanced Wound Care Market Report:

The European Advanced Wound Care market is projected to increase from $4.34 billion in 2023 to $7.73 billion by 2033. Factors influencing this growth include rising patient awareness, advancements in wound care technologies, and favorable reimbursement policies.Asia Pacific Advanced Wound Care Market Report:

In 2023, the Advanced Wound Care market in Asia Pacific is estimated at $3.29 billion and expected to grow to $5.86 billion by 2033, driven by increasing healthcare investments and rising incidences of chronic wounds in rapidly aging populations.North America Advanced Wound Care Market Report:

In North America, the market is expected to grow from $5.28 billion in 2023 to $9.40 billion by 2033. High healthcare spending, a greater focus on quality care, and the prevalence of chronic conditions are key factors driving growth in this region.South America Advanced Wound Care Market Report:

The South American market is projected to expand from $0.57 billion in 2023 to $1.02 billion in 2033, propelled by improved access to healthcare and growing investments in advanced medical technologies.Middle East & Africa Advanced Wound Care Market Report:

The market in the Middle East and Africa is expected to rise from $1.82 billion in 2023 to $3.25 billion by 2033, with a surge in healthcare infrastructure and enhanced availability of advanced wound care products.Tell us your focus area and get a customized research report.

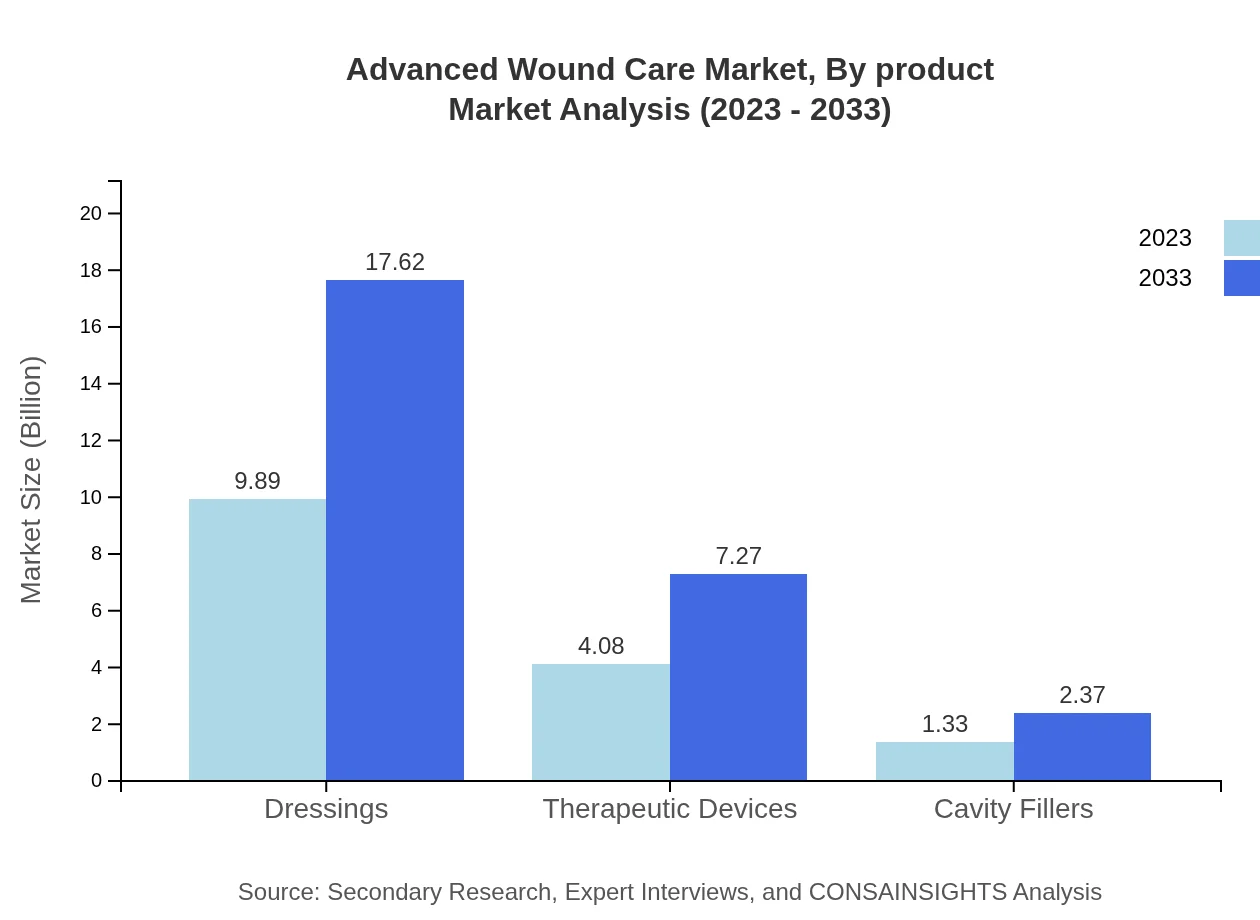

Advanced Wound Care Market Analysis By Product

The product segment dominates the Advanced Wound Care market; dressing types are expected to lead, growing from $9.89 billion in 2023 to $17.62 billion in 2033. Therapeutic devices, and cavity fillers also show significant growth, bolstered by innovations in healing technologies.

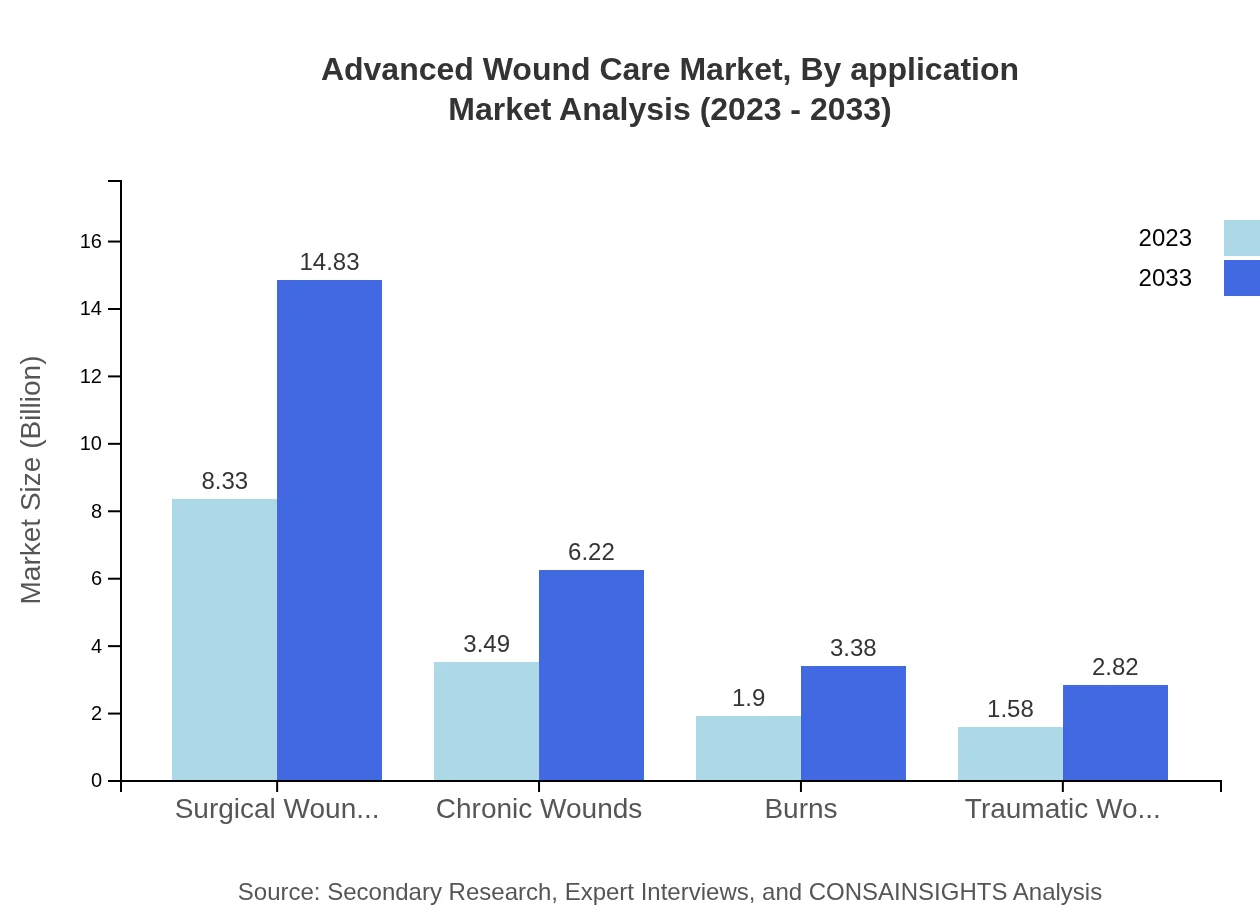

Advanced Wound Care Market Analysis By Application

Surgical wounds account for the largest share, expected to remain stable at 54.43% from 2023 through 2033. Chronic wounds show growth viability, increasing from $3.49 billion to $6.22 billion, as focus on long-term wound care escalates.

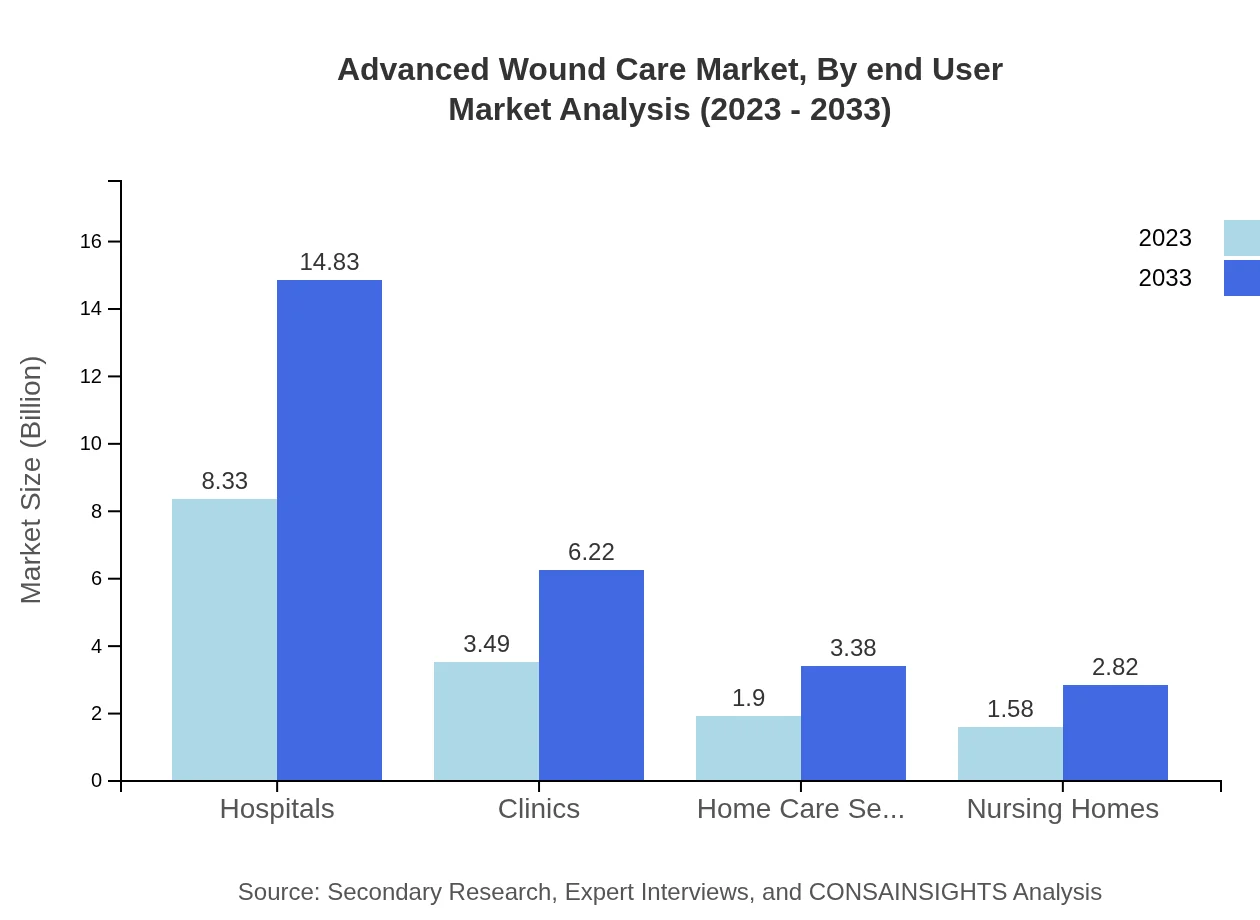

Advanced Wound Care Market Analysis By End User

Hospitals remain the primary end-user segment, representing 54.43% of the market share in 2023 and expected to remain consistent through 2033. Growth in home care settings is also notable, although smaller in size, it presents a growing market as community healthcare expands.

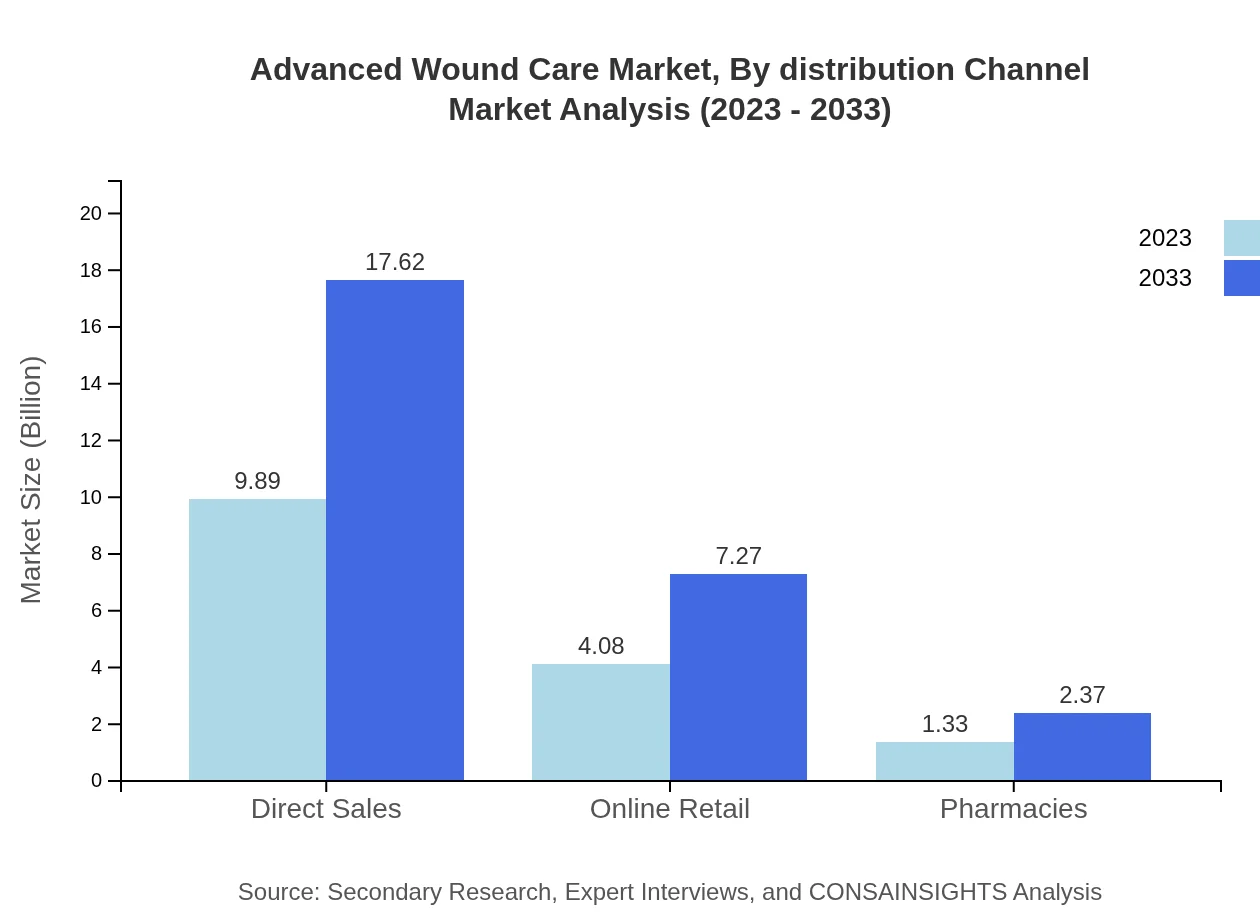

Advanced Wound Care Market Analysis By Distribution Channel

Direct sales continue to dominate, holding 64.65% share in 2023 and projected to retain this through 2033. Online retail is rapidly gaining, supported by e-commerce's growth, moving from $4.08 billion to $7.27 billion by 2033.

Advanced Wound Care Market Analysis By Region

Global Advanced Wound Care Market, By Region Market Analysis (2023 - 2033)

All regions show substantial growth potential with North America leading in market size, followed by Europe and Asia Pacific. Market dynamics vary by region, driven by healthcare expenditure, demographic factors, and technological availability.

Advanced Wound Care Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Advanced Wound Care Industry

Smith & Nephew:

A leading player in advanced wound management products, Smith & Nephew is recognized for its innovative solutions and extensive portfolio in wound care.Molnlycke Health Care:

Molnlycke is known for its high-quality dressings and wound care solutions, focusing on patient safety and clinically proven products.Acelity (now part of 3M):

Acelity offers a comprehensive range of wound care products and therapies, addressing the needs of chronic and complex wounds.Convatec Group:

Convatec specializes in advanced wound care and offers numerous products tailored to healthcare settings for effective wound management.Dermarite Industries, LLC:

Dermarite provides a variety of wound care solutions, focusing on improving healing outcomes and patient care across healthcare facilities.We're grateful to work with incredible clients.

FAQs

What is the market size of advanced Wound Care?

The global advanced wound care market is valued at approximately $15.3 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8%, aiming to reach significant growth by 2033.

What are the key market players or companies in this advanced Wound Care industry?

Key players in the advanced wound care industry include established companies such as Smith & Nephew, Mölnlycke Health Care, and Acelity, each contributing innovative solutions to advance wound healing processes.

What are the primary factors driving the growth in the advanced Wound Care industry?

Factors contributing to growth in this industry include an aging population, rising chronic disease prevalence, advancements in wound healing technologies, and increasing healthcare expenditures focused on chronic and surgical wound management.

Which region is the fastest Growing in the advanced Wound Care?

The Asia Pacific region is the fastest-growing market for advanced wound care, projected to expand from $3.29 billion in 2023 to $5.86 billion by 2033, reflecting a rapid uptake of advanced treatments and healthcare improvements.

Does ConsaInsights provide customized market report data for the advanced Wound Care industry?

Yes, ConsaInsights offers customized market report data for the advanced wound care industry, catering to specific client needs and providing tailored insights to aid strategic decision-making.

What deliverables can I expect from this advanced Wound Care market research project?

Clients can expect comprehensive deliverables including detailed market analysis, trend reports, competitive landscape insights, and segmented market forecasts, ensuring actionable intelligence for informed business strategies.

What are the market trends of advanced Wound Care?

Current trends in advanced wound care include a shift towards more advanced dressing technologies, increased focus on wound management personalization, and a growing market for telemedicine in wound care management.