Aerial Smart Weapons Market Report

Published Date: 03 February 2026 | Report Code: aerial-smart-weapons

Aerial Smart Weapons Market Size, Share, Industry Trends and Forecast to 2033

This market report analyzes the aerial smart weapons industry, providing insights into market size, trends, segmentation, and regional dynamics from 2023 to 2033.

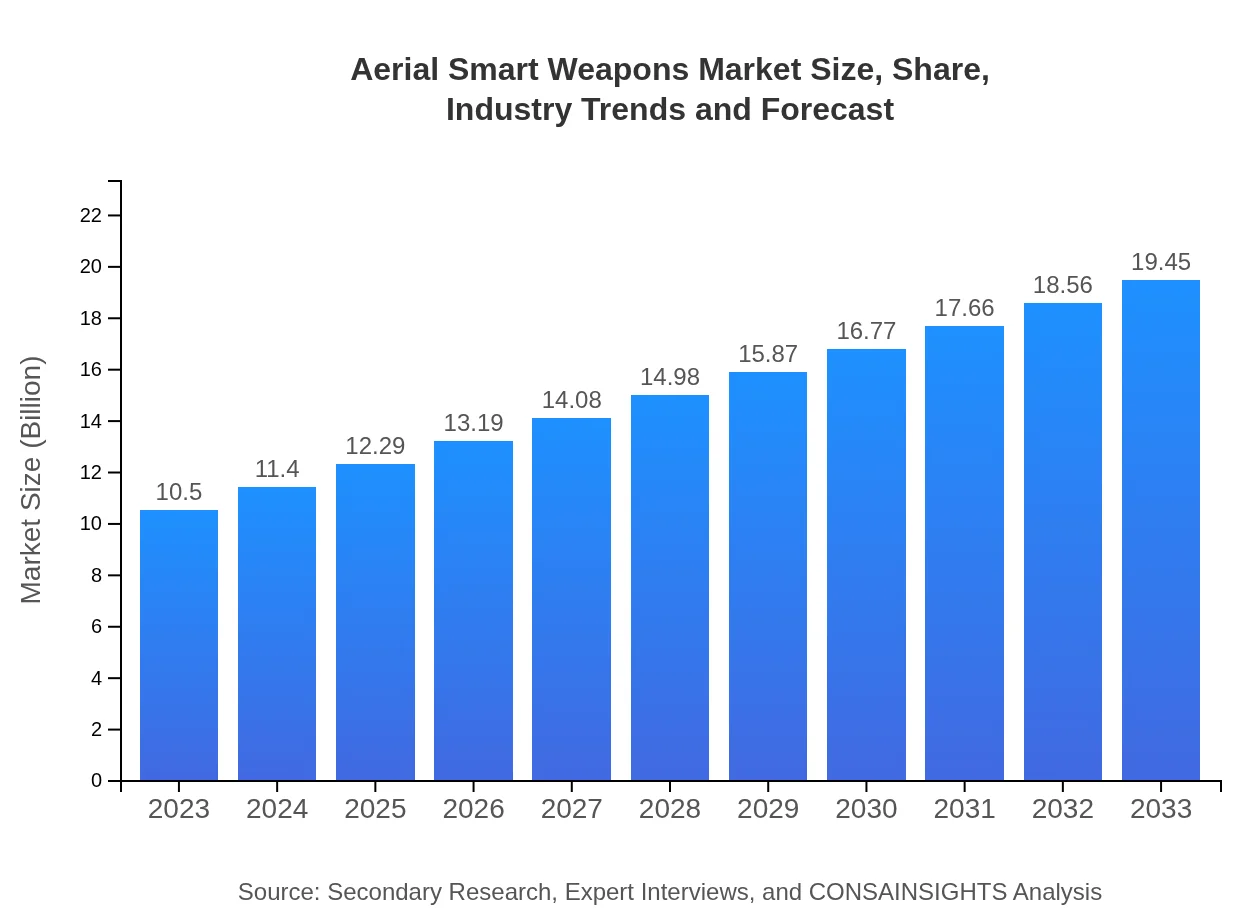

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | General Dynamics, Northrop Grumman, Raytheon Technologies, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Aerial Smart Weapons Market Overview

Customize Aerial Smart Weapons Market Report market research report

- ✔ Get in-depth analysis of Aerial Smart Weapons market size, growth, and forecasts.

- ✔ Understand Aerial Smart Weapons's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerial Smart Weapons

What is the Market Size & CAGR of Aerial Smart Weapons market in 2023?

Aerial Smart Weapons Industry Analysis

Aerial Smart Weapons Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerial Smart Weapons Market Analysis Report by Region

Europe Aerial Smart Weapons Market Report:

The European market is projected to expand from 2.98 billion USD in 2023 to 5.53 billion USD by 2033. Countries in Europe are increasingly recognizing the strategic importance of aerial smart weapons for homeland security, and NATO alliances are driving collaborative defense initiatives.Asia Pacific Aerial Smart Weapons Market Report:

In the Asia Pacific region, the aerial smart weapons market is currently valued at 1.93 billion USD in 2023 and is projected to reach 3.58 billion USD by 2033. Factors such as increasing defense expenditures, geopolitical tensions, and military modernization efforts contribute significantly to the market's growth trajectory.North America Aerial Smart Weapons Market Report:

North America holds a significant share of the aerial smart weapons market, with a valuation of 4.01 billion USD in 2023, expected to grow to 7.44 billion USD by 2033. The region is witnessing increased investments in defense technology advancements, and major defense contractors are continuously innovating in weapon systems.South America Aerial Smart Weapons Market Report:

The South American market for aerial smart weapons is anticipated to rise from 0.64 billion USD in 2023 to 1.18 billion USD by 2033. Emerging economies are gradually enhancing their defense capabilities, and the adoption of smart weapons is being prioritized to ensure national security amid various threats.Middle East & Africa Aerial Smart Weapons Market Report:

The aerial smart weapons market in the Middle East and Africa is expected to grow from 0.93 billion USD in 2023 to 1.72 billion USD by 2033. Ongoing regional conflicts and escalated defense budgets promote the procurement of advanced aerial weaponry to enhance combat readiness.Tell us your focus area and get a customized research report.

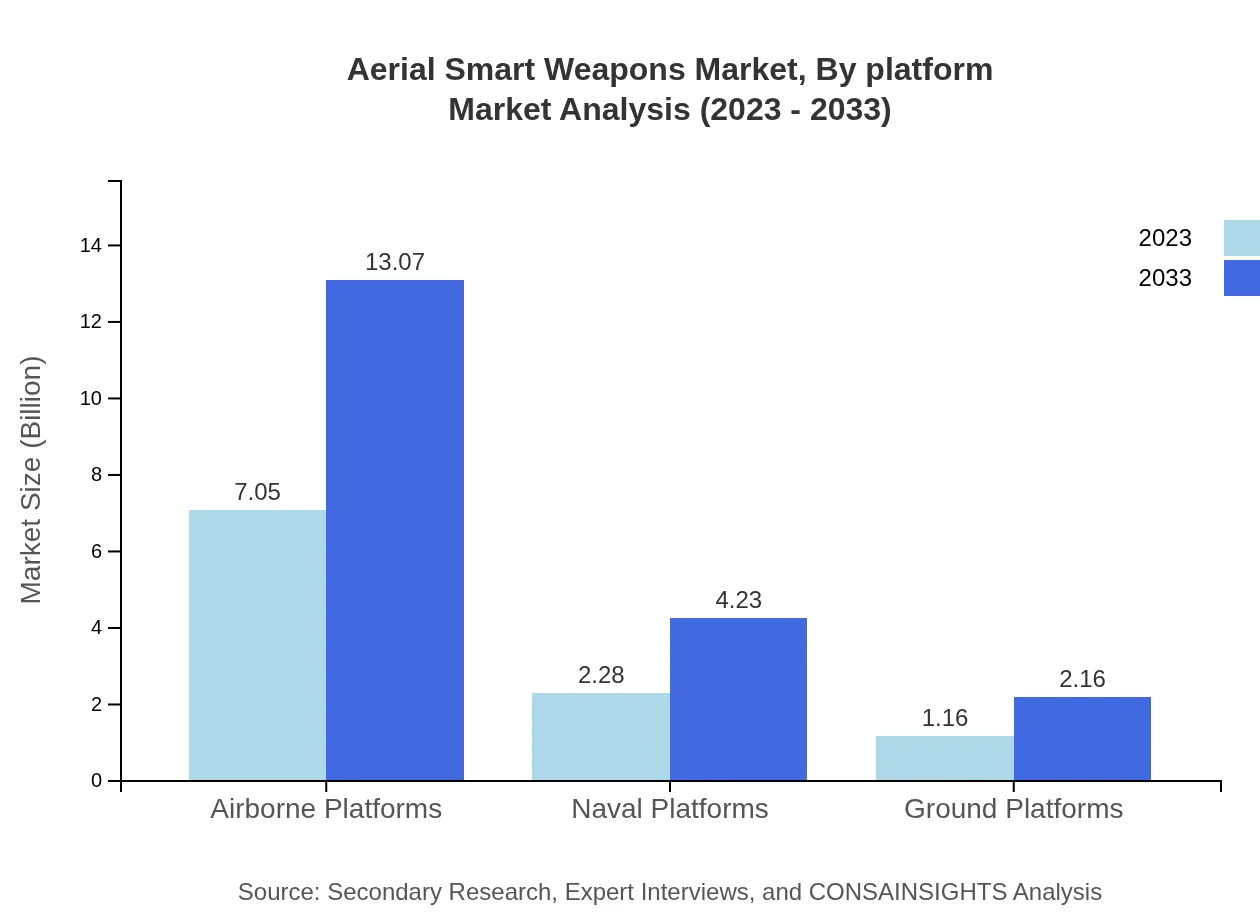

Aerial Smart Weapons Market Analysis By Platform

In 2023, the Airborne Platforms segment holds a substantial market size of 7.05 billion USD with an expected growth to 13.07 billion USD by 2033, reflecting the increasing utilization of drones and smart munitions in aerial combat. Naval Platforms and Ground Platforms follow, with sizes of 2.28 billion USD and 1.16 billion USD in 2023 respectively, signifying their roles in diverse operational contexts.

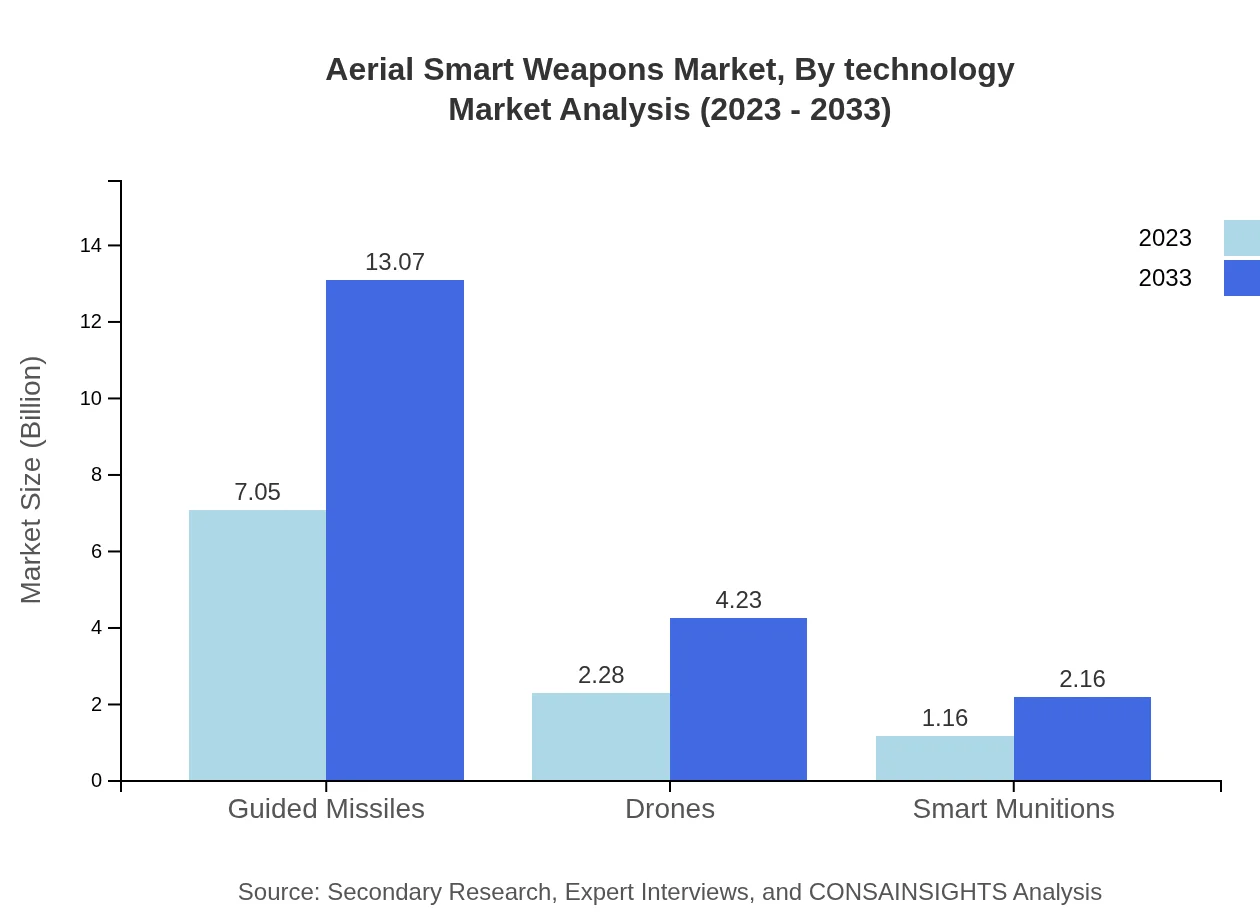

Aerial Smart Weapons Market Analysis By Technology

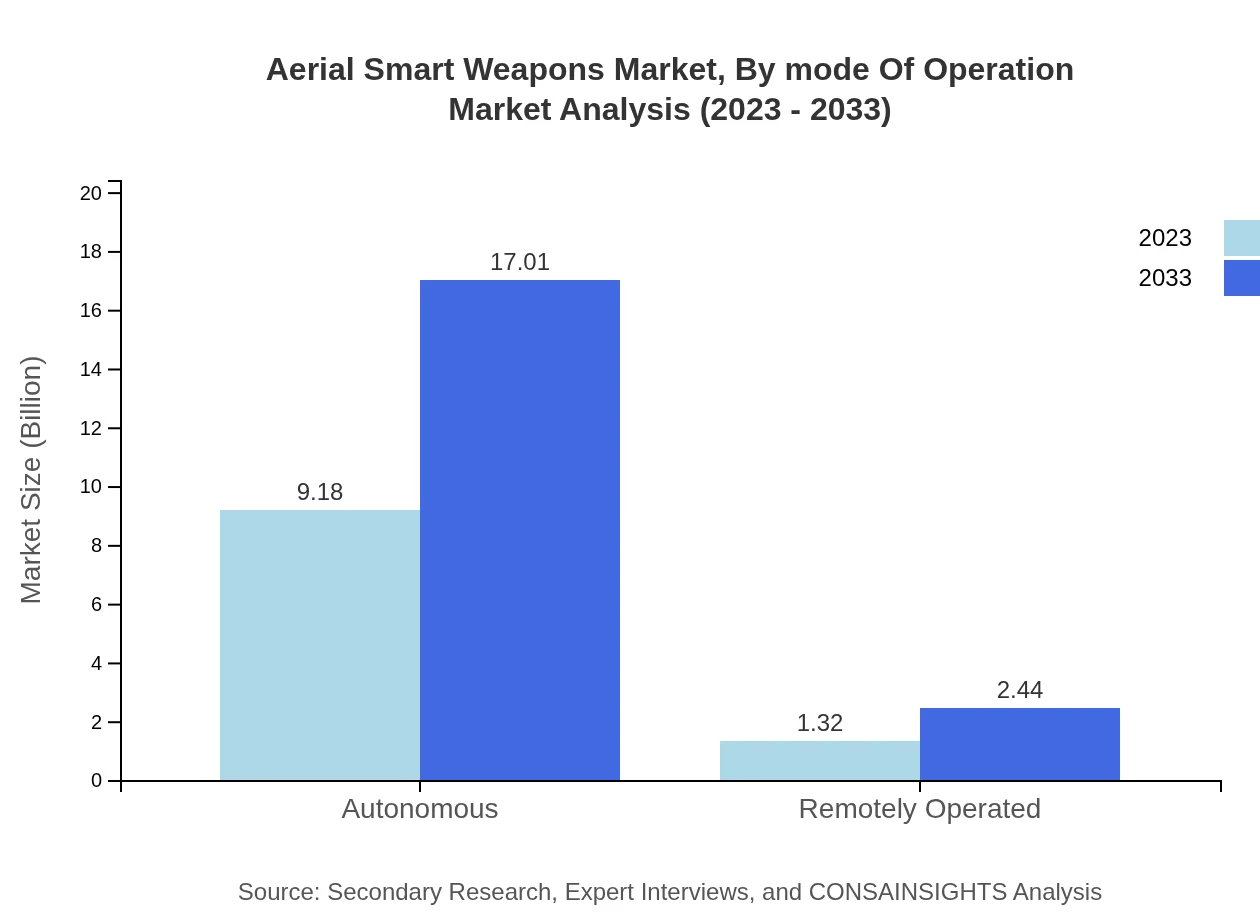

The landscape of aerial smart weapons technology is increasingly influenced by innovations in autonomous systems. In 2023, autonomous technologies dominate with a market size of 9.18 billion USD and are projected to reach 17.01 billion USD by 2033. This trend indicates a shift towards enhanced operational efficiencies and reduced human intervention in aerial operations.

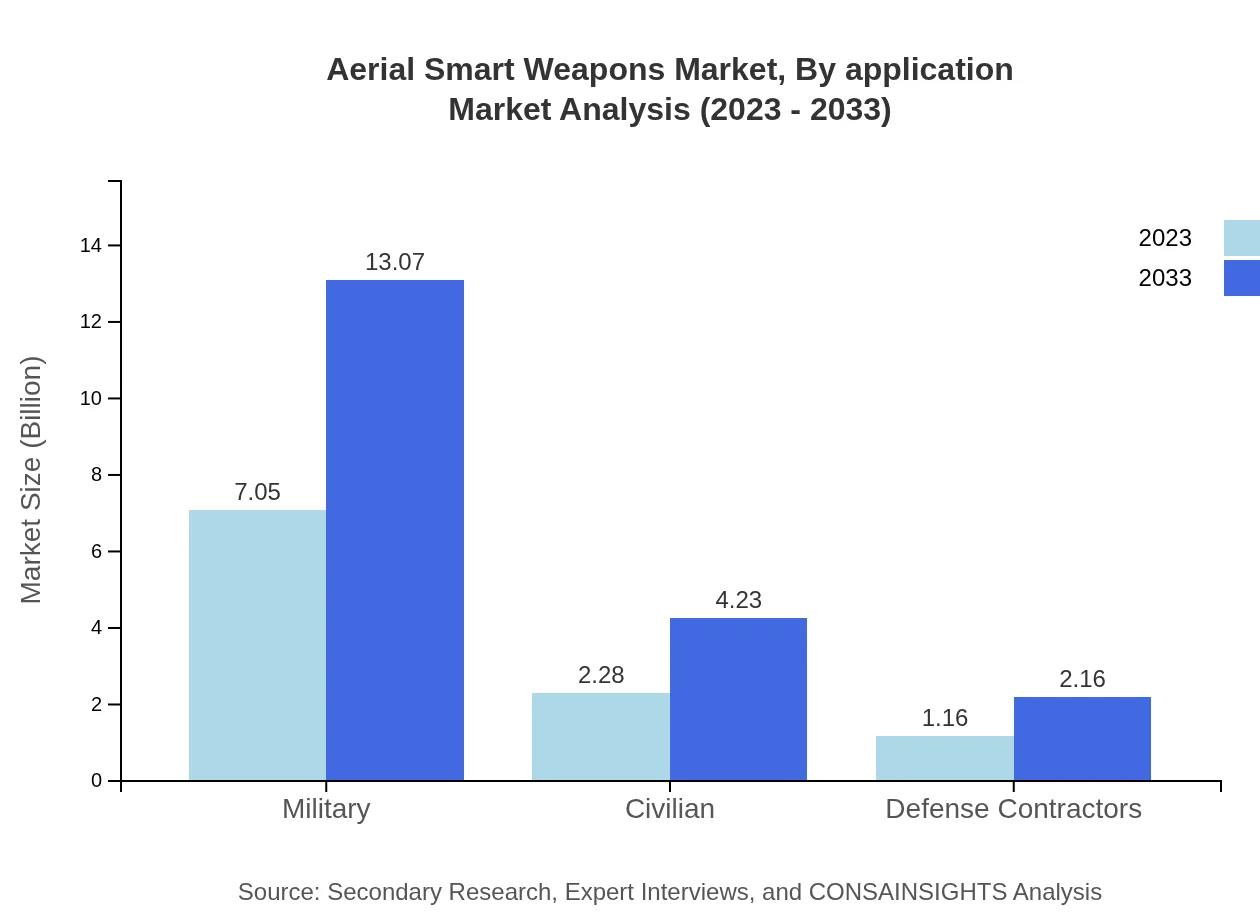

Aerial Smart Weapons Market Analysis By Application

The military application segment of aerial smart weapons significantly outweighs civilian applications. Military use accounts for a market size of 7.05 billion USD in 2023 and is expected to double by 2033, showcasing the continued emphasis on defense capabilities against evolving threats.

Aerial Smart Weapons Market Analysis By Mode Of Operation

The remotely operated aerial systems are gaining traction alongside autonomous systems. The market for remotely operated technologies valued at 1.32 billion USD in 2023 is anticipated to grow to 2.44 billion USD by 2033, representing a significant niche for tactical deployments in various operational settings.

Aerial Smart Weapons Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerial Smart Weapons Industry

General Dynamics:

A prominent aerospace and defense company providing advanced warfare technologies including aerial smart weapons, heavily invested in R&D for next-gen munitions.Northrop Grumman:

Specializes in unmanned systems and advanced weaponry, Northrop Grumman is a key player in developing smart munitions and aerial platforms to enhance military capabilities.Raytheon Technologies:

Involved in the design and manufacturing of weapon systems, including smart missiles and aerial drones, focused on maintaining technological supremacy in defense applications.Lockheed Martin:

A global leader in aeronautics and defense, known for its development of advanced aerial weapon systems and pushing forward innovation in UAV technology.We're grateful to work with incredible clients.

FAQs

What is the market size of aerial Smart Weapons?

The aerial smart weapons market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.2% from its current size in 2023. This growth reflects increasing investments in advanced military technologies globally.

What are the key market players or companies in this aerial Smart Weapons industry?

Key players in the aerial smart weapons market include major defense contractors and technology firms specializing in advanced weaponry. Leading companies often focus on innovation, partnerships, and expanding their portfolio to sustain market competitiveness.

What are the primary factors driving the growth in the aerial Smart Weapons industry?

Growth in the aerial smart weapons industry is driven by rising defense budgets, increasing geopolitical tensions, and advancements in technology. The demand for precision-targeting systems and autonomous capabilities also significantly boosts market expansion.

Which region is the fastest Growing in the aerial Smart Weapons?

The fastest-growing region for aerial smart weapons is Europe, with the market increasing from $2.98 billion in 2023 to $5.53 billion in 2033. Other regions like Asia Pacific and North America also show strong growth trends.

Does ConsaInsights provide customized market report data for the aerial Smart Weapons industry?

Yes, ConsaInsights offers customizable market report data tailored to specific requirements of clients in the aerial smart weapons industry, ensuring insightful and relevant information to support strategic decision-making.

What deliverables can I expect from this aerial Smart Weapons market research project?

Deliverables typically include a comprehensive market report, detailed analysis of market trends, segment insights, competitive landscape, and forecasts. Clients can also receive tailored insights based on their specific focus areas.

What are the market trends of aerial Smart Weapons?

Current market trends in aerial smart weapons include an increasing focus on autonomous systems, enhanced targeting technologies, and a shift toward multi-domain operations. The integration of AI and machine learning is also becoming prevalent in development strategies.