Aerospace-3d Printing Market Report

Published Date: 22 January 2026 | Report Code: aerospace-3d-printing

Aerospace-3d Printing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aerospace-3D Printing market, covering key trends, market sizes, regional insights, and forecasts from 2023 to 2033, along with industry challenges and growth opportunities.

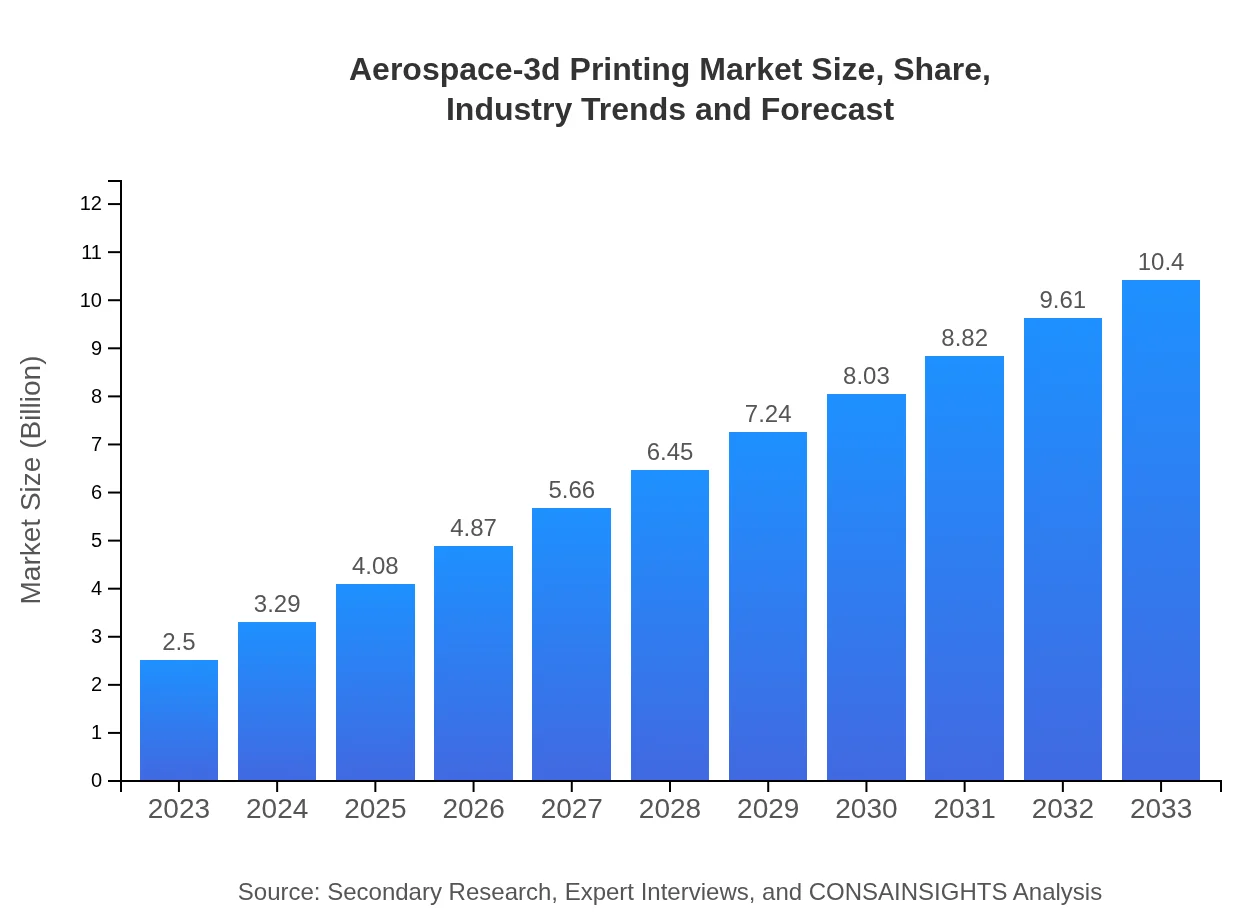

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 14.6% |

| 2033 Market Size | $10.40 Billion |

| Top Companies | Stratasys Ltd., GE Additive, Materialise NV, 3D Systems Corporation, EOS GmbH |

| Last Modified Date | 22 January 2026 |

Aerospace-3d Printing Market Overview

Customize Aerospace-3d Printing Market Report market research report

- ✔ Get in-depth analysis of Aerospace-3d Printing market size, growth, and forecasts.

- ✔ Understand Aerospace-3d Printing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace-3d Printing

What is the Market Size & CAGR of Aerospace-3d Printing market in 2023 and 2033?

Aerospace-3d Printing Industry Analysis

Aerospace-3d Printing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace-3d Printing Market Analysis Report by Region

Europe Aerospace-3d Printing Market Report:

The European market is expected to grow from $0.80 billion in 2023 to $3.34 billion by 2033, supported by stringent regulations favoring advanced manufacturing techniques like 3D printing in aerospace.Asia Pacific Aerospace-3d Printing Market Report:

In the Asia-Pacific region, the Aerospace-3D Printing market is projected to grow from $0.47 billion in 2023 to $1.95 billion by 2033, reflecting a strong CAGR fueled by rising demand for lightweight components and a growing aerospace sector.North America Aerospace-3d Printing Market Report:

North America remains a key player, expanding from $0.86 billion in 2023 to $3.59 billion in 2033. The presence of major aerospace manufacturers in the USA supports significant growth driven by technological innovations.South America Aerospace-3d Printing Market Report:

The South American market is smaller, with a projected growth from $0.09 billion in 2023 to $0.38 billion in 2033. Increasing investments in aerospace infrastructure and development programs are likely to drive this growth.Middle East & Africa Aerospace-3d Printing Market Report:

In the Middle East and Africa, the market is set to increase from $0.27 billion in 2023 to $1.13 billion by 2033, due to growing interest in aerospace capabilities and infrastructure development.Tell us your focus area and get a customized research report.

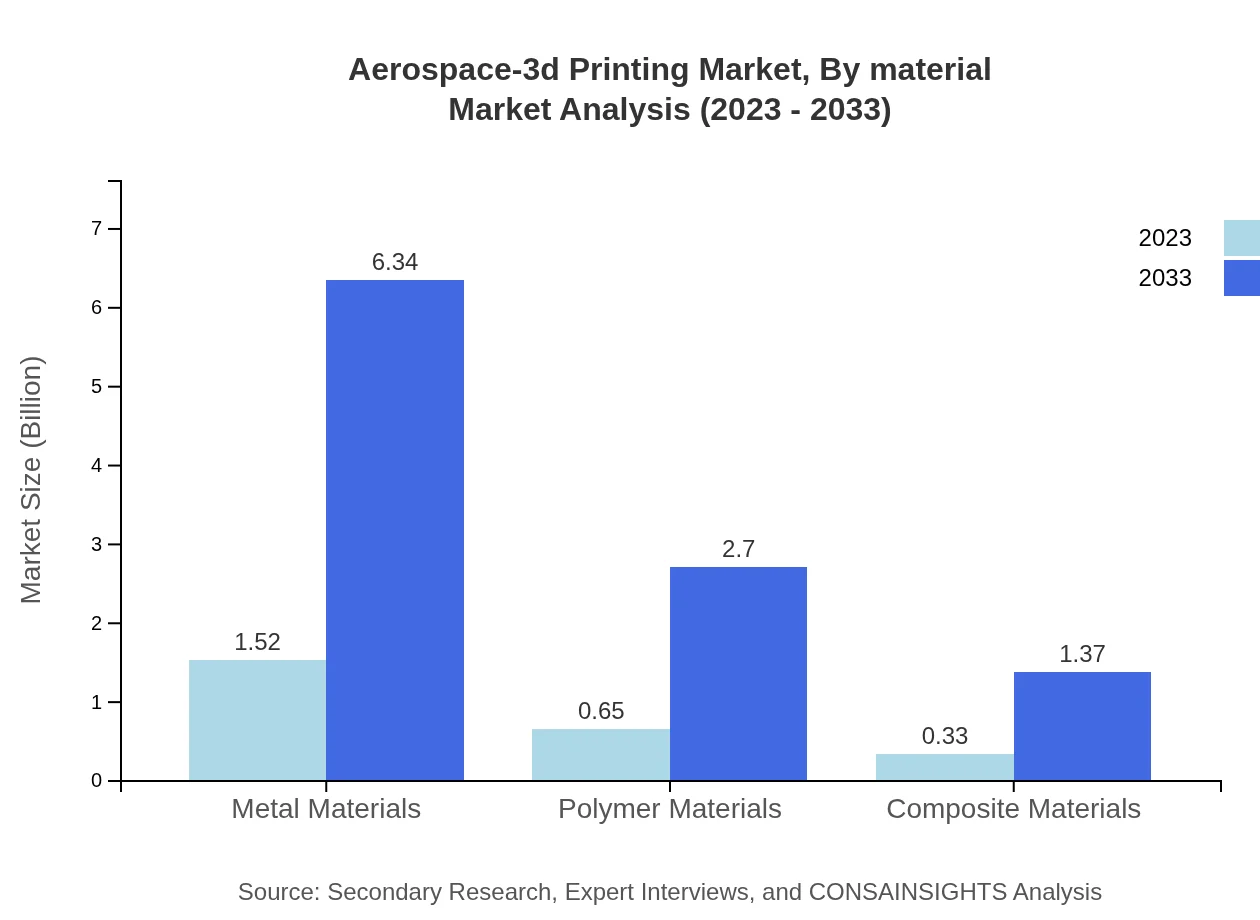

Aerospace-3d Printing Market Analysis By Material

The material segment of the Aerospace-3D Printing market is dominated by metal materials in 2023, valued at $1.52 billion, projected to reach $6.34 billion by 2033. Polymer materials, valued at $0.65 billion in 2023, will grow to $2.70 billion. Composite materials, while smaller at $0.33 billion in 2023, will reach $1.37 billion by 2033.

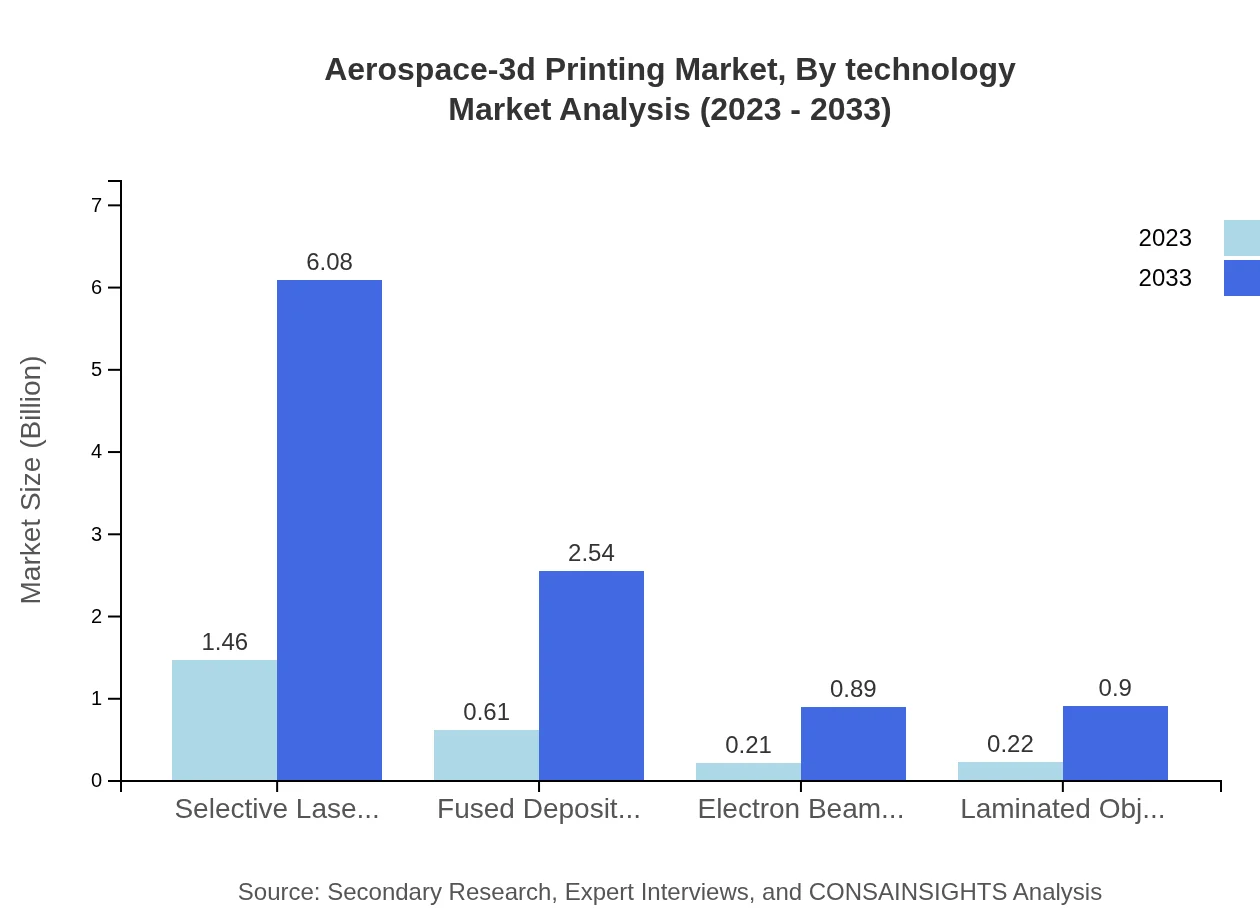

Aerospace-3d Printing Market Analysis By Technology

Selective Laser Melting (SLM) serves as the leading technology segment, projected to grow from $1.46 billion in 2023 to $6.08 billion by 2033. Fused Deposition Modeling (FDM) is expected to incrementally increase from $0.61 billion to $2.54 billion during the same period, while Electron Beam Melting (EBM) and other technologies also contribute to market diversity.

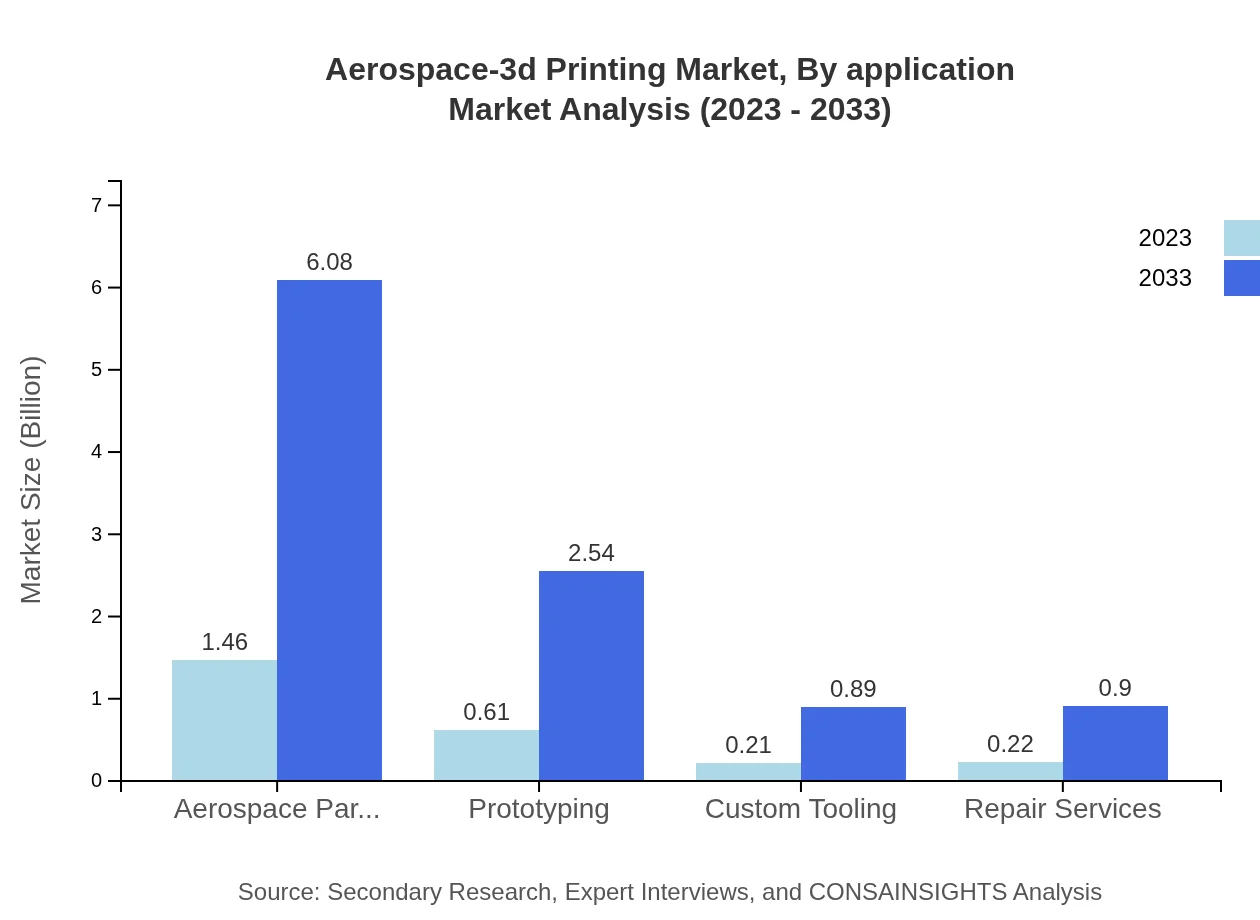

Aerospace-3d Printing Market Analysis By Application

In application segmentation, aerospace parts manufacturing is the largest sector, with a value of $1.46 billion in 2023, expected to rise to $6.08 billion by 2033. Prototyping is also significant, growing from $0.61 billion to $2.54 billion, while segments like custom tooling and repair services play supportive yet growing roles.

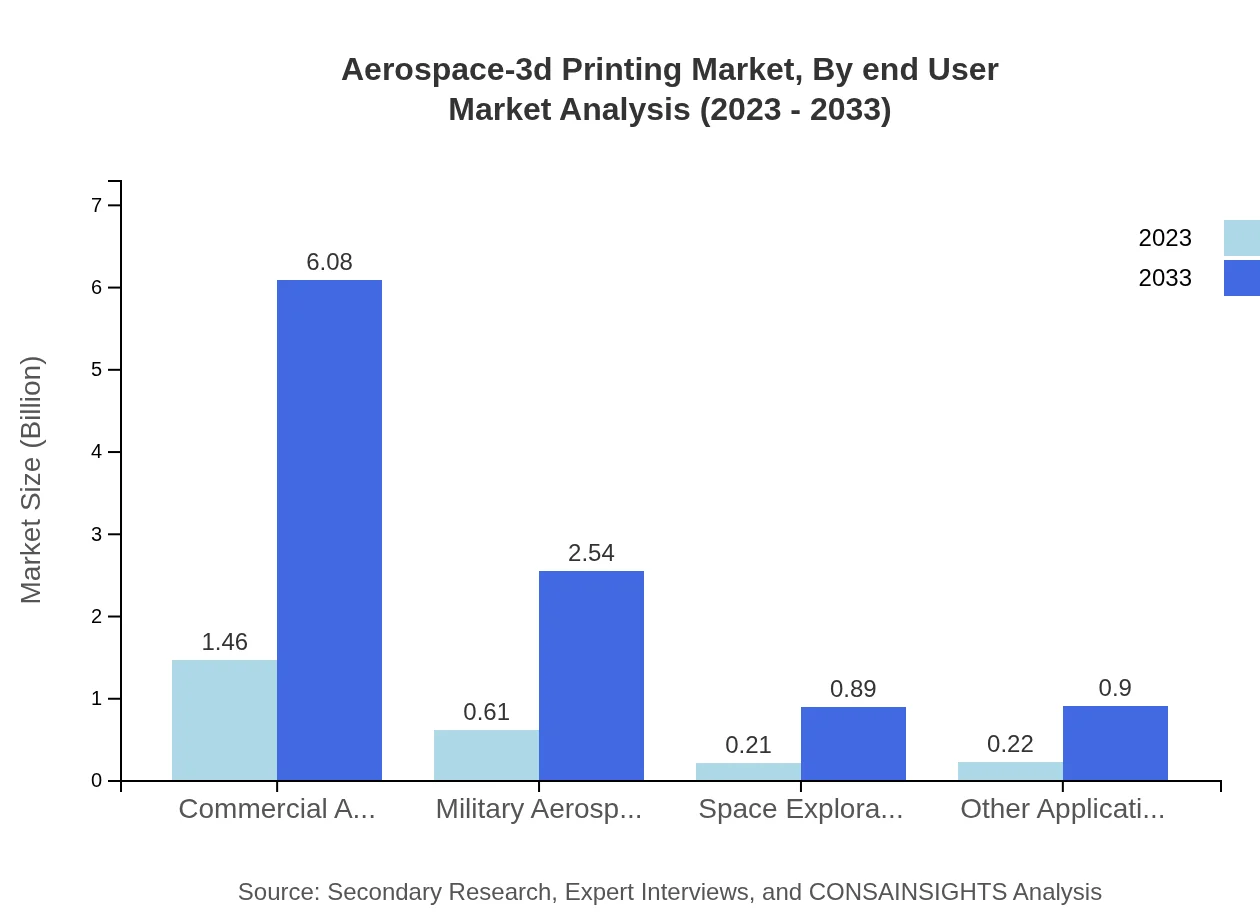

Aerospace-3d Printing Market Analysis By End User

The end-user industry analysis indicates that the commercial aerospace sector accounts for about 58.46% of the market share in 2023, stabilizing through 2033. Military aerospace follows, representing 24.39%, with increasing investment in aerospace technologies driving growth.

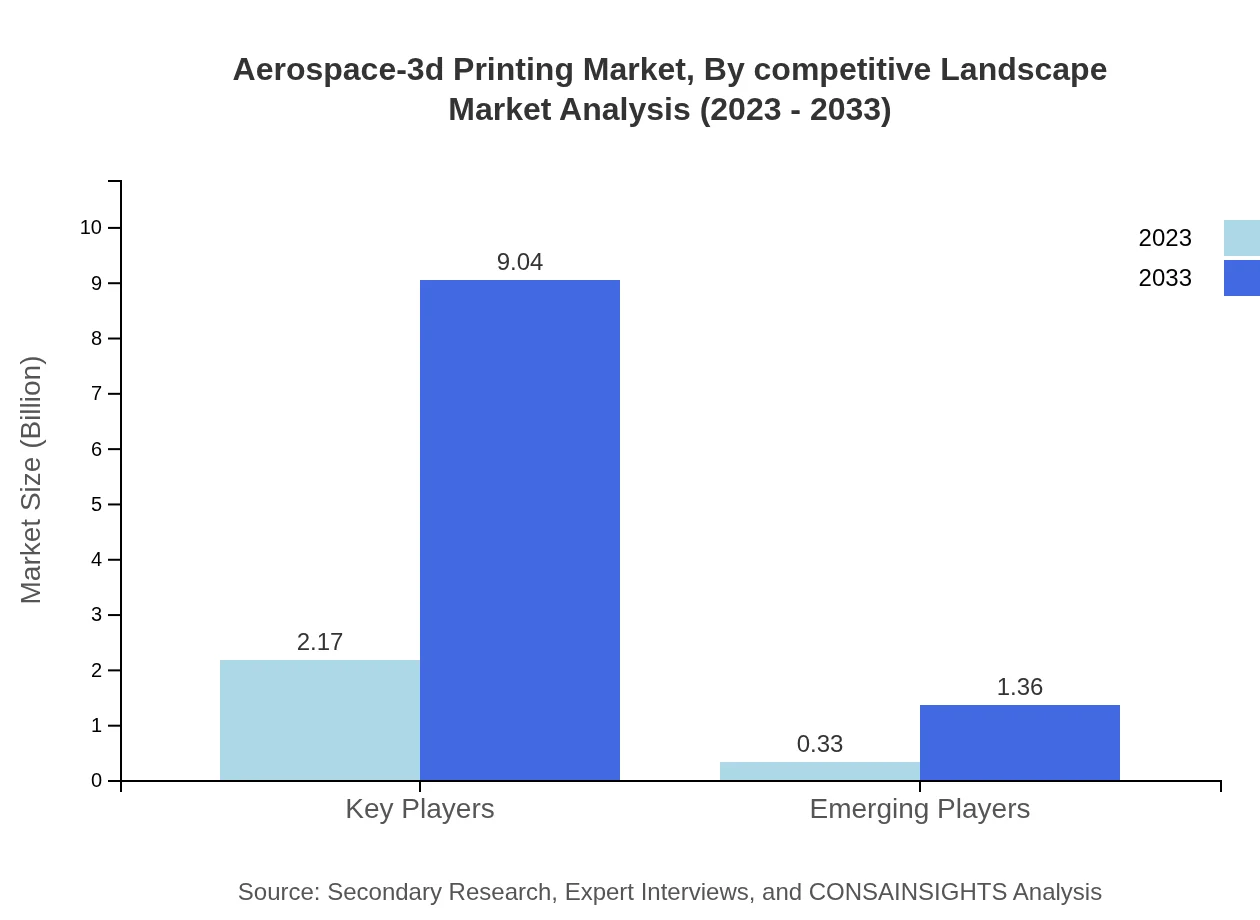

Aerospace-3d Printing Market Analysis By Competitive Landscape

The competitive landscape of the Aerospace-3D Printing market includes major companies and emerging players. The market leaders are focused on strategic partnerships and continuous innovation to maintain their competitive advantage.

Aerospace-3d Printing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace-3d Printing Industry

Stratasys Ltd.:

Stratasys is a pioneer in 3D printing and additive manufacturing solutions, focusing on delivering innovations that enhance product development cycles for the aerospace industry.GE Additive:

GE Additive specializes in advanced digital manufacturing solutions, prioritizing 3D printing technologies that improve aircraft engine components and structural parts.Materialise NV:

Materialise offers innovative software and advanced manufacturing solutions, particularly in the aerospace sector for optimizing designs and facilitating production processes.3D Systems Corporation:

3D Systems provides comprehensive 3D printing solutions including hardware, software, and materials, serving the aerospace industry with end-to-end solutions.EOS GmbH:

EOS is a leading technology provider for industrial 3D printing of metals and polymers, dedicated to introducing customized solutions for aerospace applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace-3d Printing?

The aerospace 3D printing market is projected to reach $2.5 billion by 2033, growing at a CAGR of 14.6% from 2023. This growth reflects the increasing adoption of advanced manufacturing techniques in the aerospace sector.

What are the key market players or companies in this aerospace-3d Printing industry?

Key players in the aerospace 3D printing industry include major companies like Boeing, Airbus, and GE Aviation, which dominate the market, accounting for approximately 86.91% of market share in 2023, projected to remain stable through 2033.

What are the primary factors driving the growth in the aerospace-3d Printing industry?

Growth in the aerospace 3D printing market is driven by factors such as technological advancements, increasing demand for lightweight components, and the need for cost-effective manufacturing processes that reduce waste and lead times.

Which region is the fastest Growing in the aerospace-3d Printing?

North America, valued at $0.86 billion in 2023 and projected to reach $3.59 billion by 2033, is the fastest-growing region for aerospace 3D printing, driven by significant investments and innovation in aerospace technology.

Does Consainsights provide customized market report data for the aerospace-3d Printing industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the aerospace 3D printing landscape, ensuring clients receive relevant insights tailored to their strategic goals.

What deliverables can I expect from this aerospace-3d Printing market research project?

Deliverables from this market research project include detailed reports, market forecasts, competitive analysis, and insights into regional trends, helping stakeholders make informed decisions within the aerospace 3D printing industry.

What are the market trends of aerospace-3d Printing?

Key trends in the aerospace 3D printing market include increasing adoption of metal and polymer materials, expansion of applications in commercial and military sectors, and innovations in technologies like Selective Laser Melting and Fused Deposition Modeling.