Aerospace Adhesives And Sealants Market Report

Published Date: 03 February 2026 | Report Code: aerospace-adhesives-and-sealants

Aerospace Adhesives And Sealants Market Size, Share, Industry Trends and Forecast to 2033

This report offers comprehensive insights into the Aerospace Adhesives and Sealants market, covering industry analysis, market size, segmentation, and regional performance from 2023 to 2033.

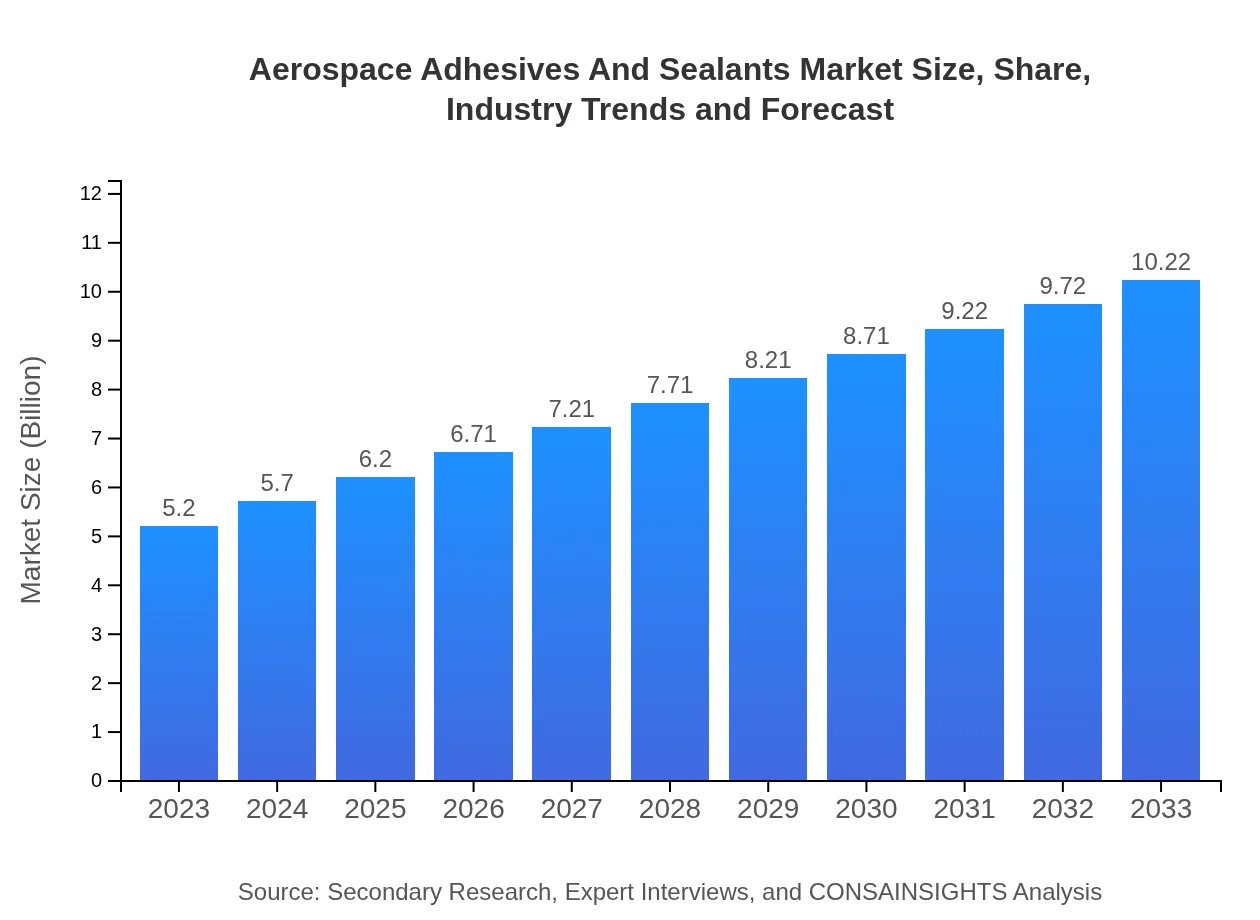

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Henkel AG & Co. KGaA, 3M Company, Lockheed Martin Corporation, Dow Chemical Company, BASF SE |

| Last Modified Date | 03 February 2026 |

Aerospace Adhesives And Sealants Market Overview

Customize Aerospace Adhesives And Sealants Market Report market research report

- ✔ Get in-depth analysis of Aerospace Adhesives And Sealants market size, growth, and forecasts.

- ✔ Understand Aerospace Adhesives And Sealants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Adhesives And Sealants

What is the Market Size & CAGR of Aerospace Adhesives And Sealants market in 2023?

Aerospace Adhesives And Sealants Industry Analysis

Aerospace Adhesives And Sealants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Adhesives And Sealants Market Analysis Report by Region

Europe Aerospace Adhesives And Sealants Market Report:

Europe's market is projected to increase from $1.40 billion in 2023 to $2.76 billion in 2033. Technological advancements and a strong focus on sustainability within EU regulations are primary drivers of this growth.Asia Pacific Aerospace Adhesives And Sealants Market Report:

In the Asia Pacific region, the market is projected to expand from $1.01 billion in 2023 to $1.99 billion in 2033. Key factors driving this growth include increased aircraft production in countries like China and India, and investments in military aerospace.North America Aerospace Adhesives And Sealants Market Report:

North America, leading the market, is forecasted to grow from $1.89 billion in 2023 to $3.71 billion by 2033. Strong demand from commercial aircraft manufacturing and a robust military sector are key growth drivers.South America Aerospace Adhesives And Sealants Market Report:

South America is expected to see modest growth, with market size increasing from $0.51 billion in 2023 to $0.99 billion in 2033. Factors such as a growing aviation sector and increasing regulatory standards in the region are expected to contribute to market growth.Middle East & Africa Aerospace Adhesives And Sealants Market Report:

The Middle East and Africa region is anticipated to witness growth from $0.39 billion in 2023 to $0.76 billion by 2033. Growth in air travel and increasing military spending are vital for the aerospace adhesives sector in this region.Tell us your focus area and get a customized research report.

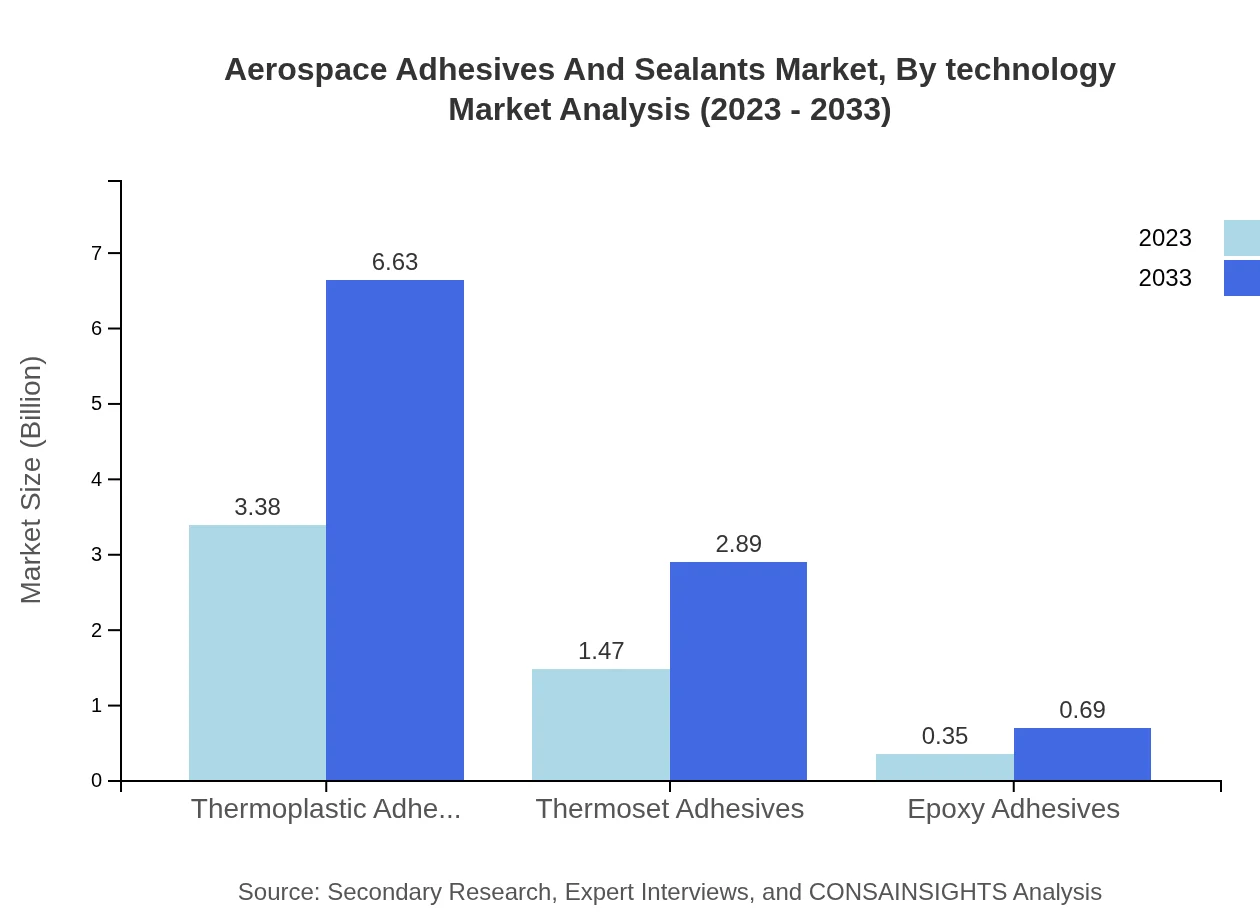

Aerospace Adhesives And Sealants Market Analysis By Product Type

The market segments into thermoplastic adhesives, thermoset adhesives, and epoxy adhesives. Thermoplastic adhesives hold a significant share due to their versatility and ease of application, expected to grow from $3.38 billion in 2023 to $6.63 billion by 2033. Thermoset adhesives cater well to high-stress applications, growing from $1.47 billion to $2.89 billion in the same period. Epoxy adhesives, due to their high durability, are projected to increase from $0.35 billion in 2023 to $0.69 billion by 2033.

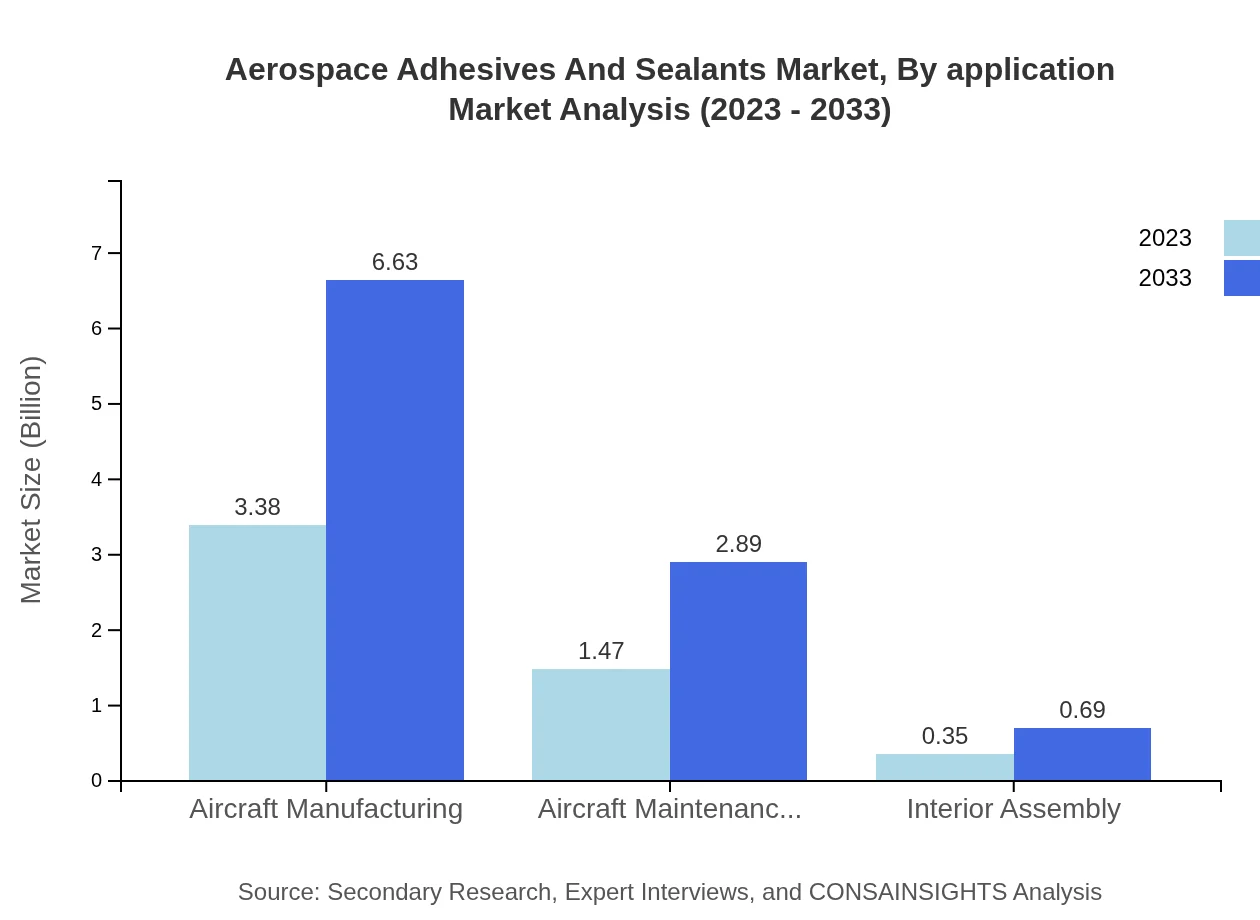

Aerospace Adhesives And Sealants Market Analysis By Application

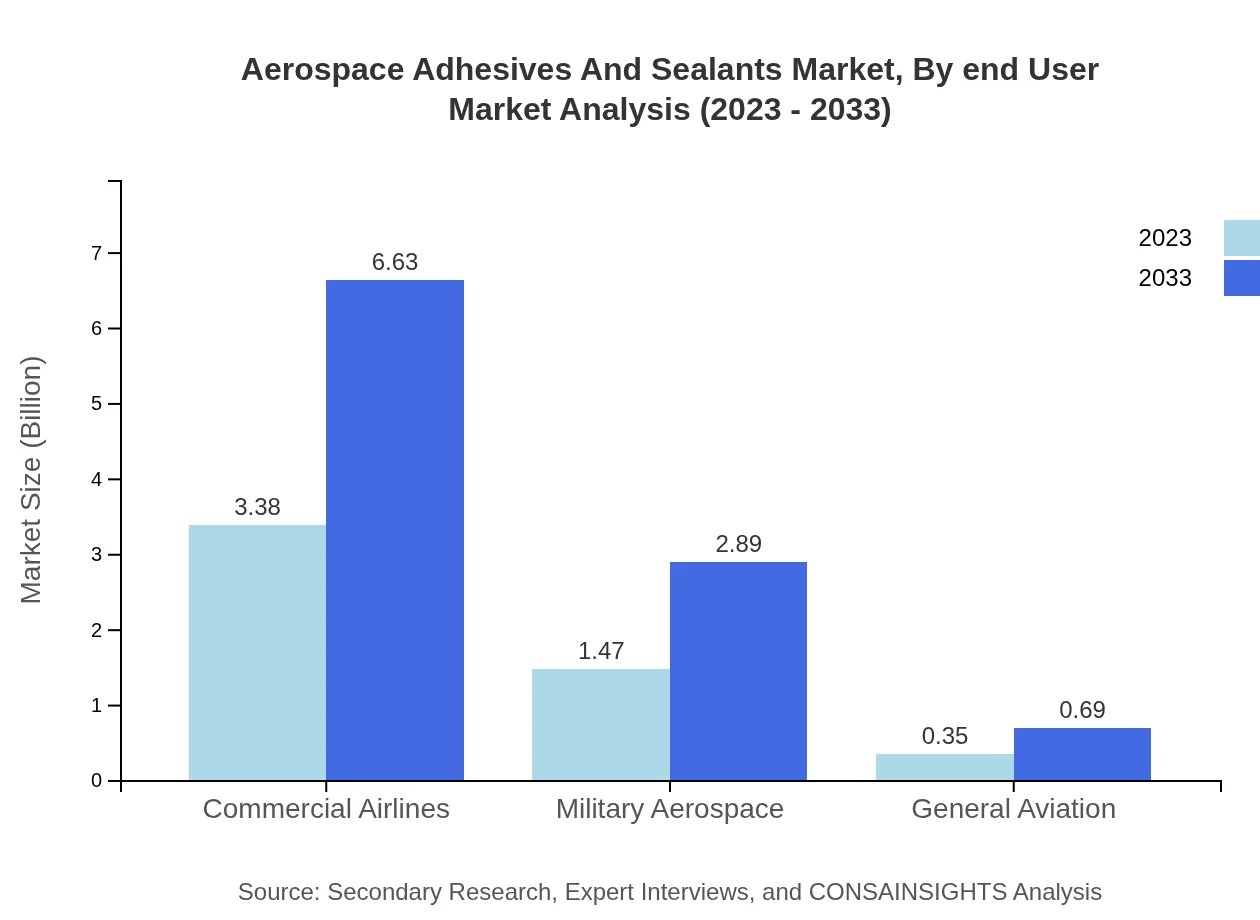

The primary applications include commercial airlines, military aerospace, and general aviation. The commercial airline segment is dominant, expected to grow from $3.38 billion in 2023 to $6.63 billion by 2033. Military aerospace follows, growing from $1.47 billion to $2.89 billion, while general aviation is projected to increase from $0.35 billion to $0.69 billion.

Aerospace Adhesives And Sealants Market Analysis By Technology

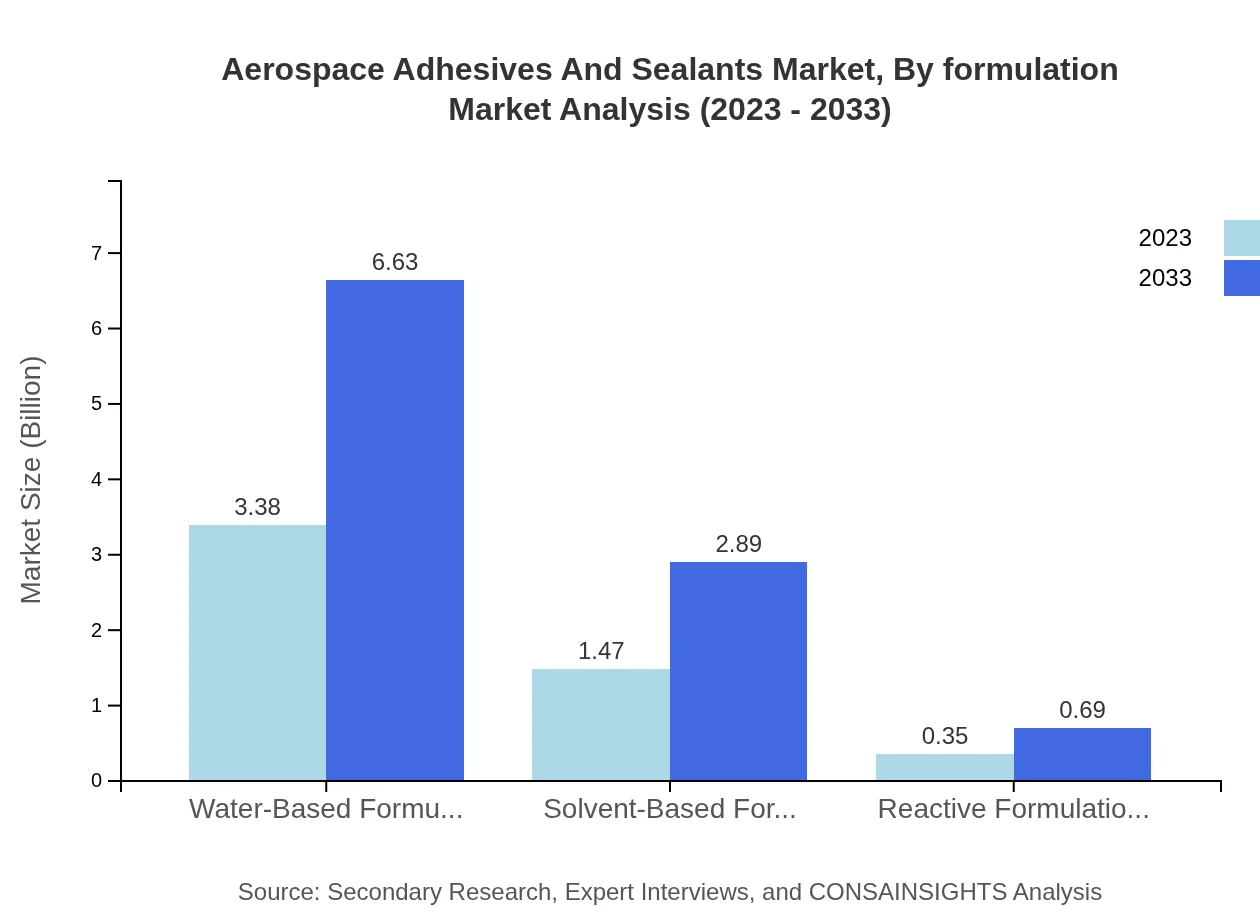

The technologies in use include water-based formulations, solvent-based formulations, and reactive formulations. Water-based formulations dominate, with a market size expected to grow from $3.38 billion to $6.63 billion from 2023 to 2033, representing a significant trend toward environmentally friendly products.

Aerospace Adhesives And Sealants Market Analysis By End User

End-user segments primarily include manufacturers of aircraft, maintenance and repair organizations, and interior assembly firms. The aircraft manufacturing segment is prominent, projected to grow from $3.38 billion to $6.63 billion over the forecast period, while the aircraft maintenance and repair segment is expected to rise from $1.47 billion to $2.89 billion.

Aerospace Adhesives And Sealants Market Analysis By Formulation

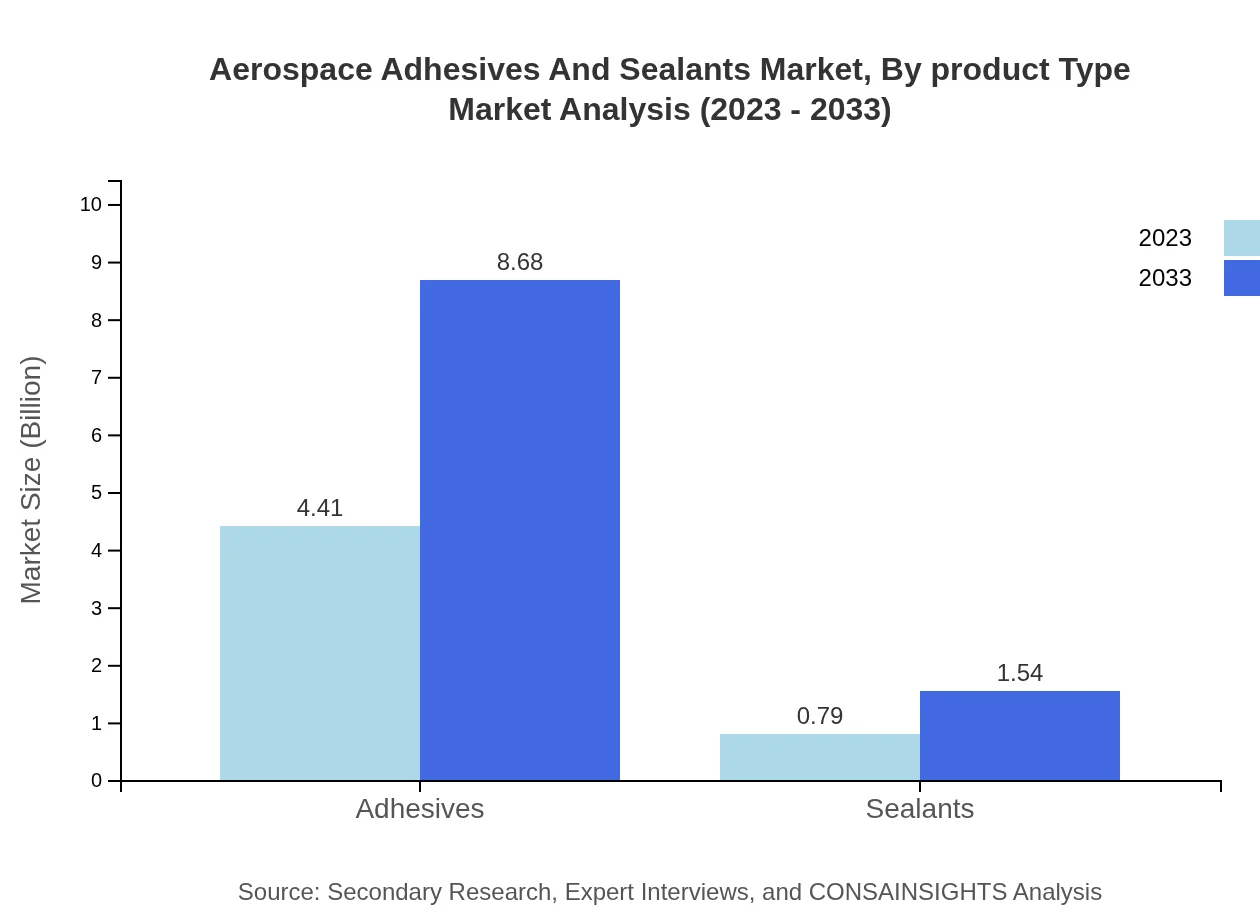

Key formulations include adhesives and sealants. Adhesives are forecast to take a leading market share of 84.89%, anticipated to reach $8.68 billion. Sealants, while smaller, are projected to grow from $0.79 billion to $1.54 billion, capturing a 15.11% market share.

Aerospace Adhesives And Sealants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Adhesives And Sealants Industry

Henkel AG & Co. KGaA:

A global leader in adhesives and sealants, Henkel provides advanced technologies and solutions for aerospace applications, enhancing durability and weight efficiency.3M Company:

Known for innovative adhesive solutions, 3M plays a significant role in the aerospace industry by offering a range of high-performance adhesives and sealants.Lockheed Martin Corporation:

A significant player in the aerospace sector, Lockheed Martin develops advanced materials and bonding solutions for military and commercial aerospace applications.Dow Chemical Company:

Dow is recognized for its extensive portfolio of high-tech adhesives and sealants used in aerospace manufacturing, focusing on performance and safety.BASF SE:

A leader in chemical solutions, BASF provides adhesive products that meet stringent aerospace standards and contribute to high-performance applications.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace Adhesives And Sealants?

The aerospace adhesives and sealants market is projected to reach a size of $5.2 billion in 2023, with a robust CAGR of 6.8%. This growth reflects increasing global aviation activities and advancements in adhesive technologies.

What are the key market players or companies in this aerospace Adhesives And Sealants industry?

Key players in the aerospace adhesives and sealants market include Henkel AG, 3M Company, Huntsman Corporation, Lord Corporation, and Sika AG. These companies lead innovations and maintain substantial market shares through strategic partnerships and acquisitions.

What are the primary factors driving the growth in the aerospace Adhesives And Sealants industry?

Growth in the aerospace adhesives and sealants industry is driven by rising aerospace production, technological advancements, increasing demand for lightweight materials, and stringent regulations on aircraft safety and fuel efficiency.

Which region is the fastest Growing in the aerospace Adhesives And Sealants?

North America is currently the fastest-growing region for aerospace adhesives and sealants, projected to grow from $1.89 billion in 2023 to $3.71 billion by 2033, fuelled by high aircraft manufacturing and maintenance activities.

Does ConsaInsights provide customized market report data for the aerospace Adhesives And Sealants industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the aerospace adhesives and sealants industry, providing insights on market trends, segmentation, and competitive analysis.

What deliverables can I expect from this aerospace Adhesives And Sealants market research project?

Deliverables from the aerospace adhesives and sealants market research include comprehensive reports, detailed market analysis, trend assessments, competitive landscapes, and segmented data relevant to various stakeholders.

What are the market trends of aerospace Adhesives And Sealants?

Current market trends in aerospace adhesives and sealants include an increased adoption of eco-friendly products, growth in the use of thermoplastic and thermoset adhesives, and innovations aimed at enhancing aircraft performance and durability.