Aerospace And Defense Telemetry Market Report

Published Date: 03 February 2026 | Report Code: aerospace-and-defense-telemetry

Aerospace And Defense Telemetry Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aerospace and Defense Telemetry market, covering current market conditions, future growth forecasts, and competitive landscape insights from 2023 to 2033.

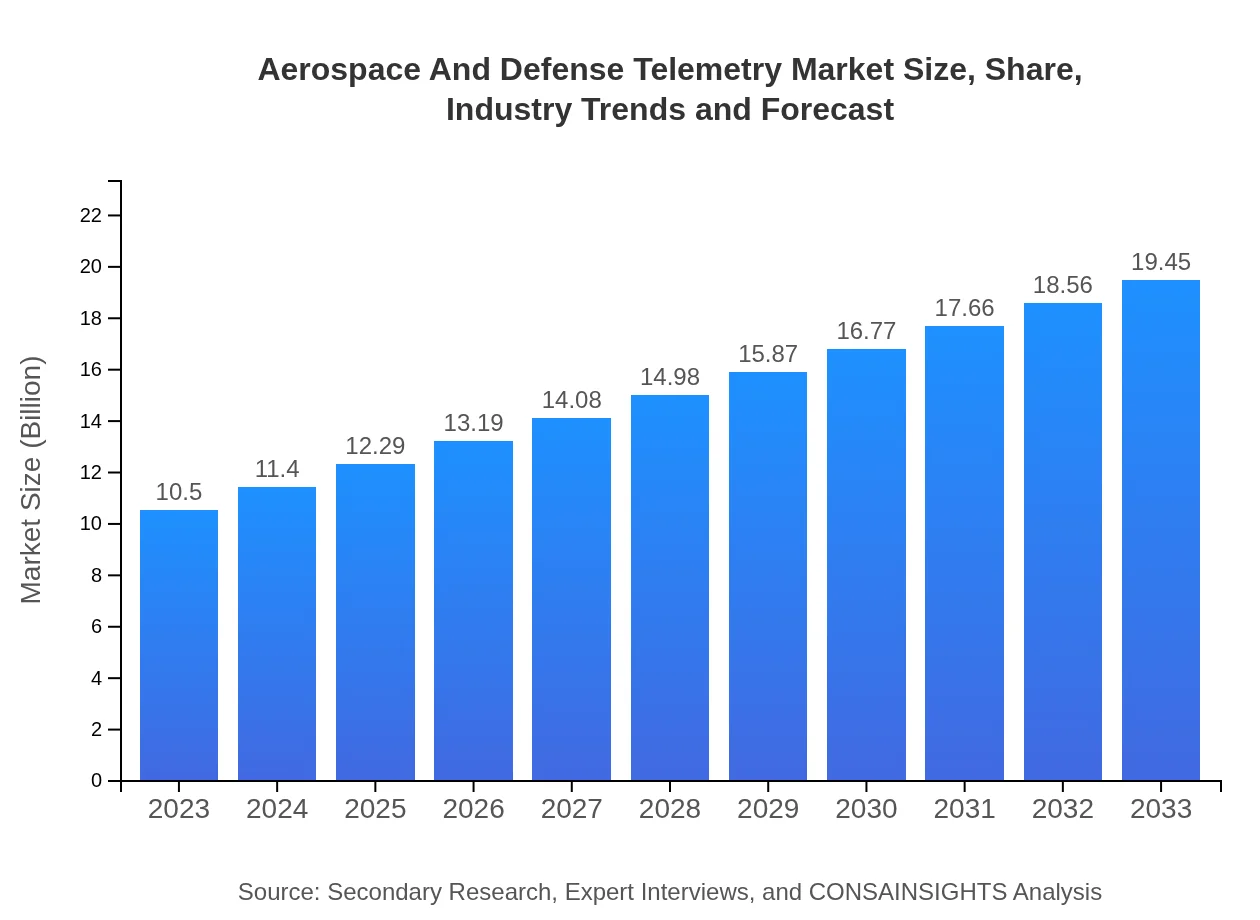

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Rockwell Collins, Hawker Beechcraft Corporation, Northrop Grumman Corporation, Boeing , Thales Group |

| Last Modified Date | 03 February 2026 |

Aerospace And Defense Telemetry Market Overview

Customize Aerospace And Defense Telemetry Market Report market research report

- ✔ Get in-depth analysis of Aerospace And Defense Telemetry market size, growth, and forecasts.

- ✔ Understand Aerospace And Defense Telemetry's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace And Defense Telemetry

What is the Market Size & CAGR of Aerospace And Defense Telemetry market in 2023?

Aerospace And Defense Telemetry Industry Analysis

Aerospace And Defense Telemetry Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace And Defense Telemetry Market Analysis Report by Region

Europe Aerospace And Defense Telemetry Market Report:

The European market is estimated to grow from $2.76 billion in 2023 to $5.11 billion in 2033. The presence of key players, along with joint projects and defense partnerships among nations, fuels the demand for innovative telemetry solutions.Asia Pacific Aerospace And Defense Telemetry Market Report:

The Asia Pacific region is projected to grow from $2.22 billion in 2023 to $4.12 billion in 2033, driven by increasing investment in defense modernization and growing aerospace activities in countries like India and China. The rising presence of UAVs and surveillance systems further boosts the need for advanced telemetry solutions.North America Aerospace And Defense Telemetry Market Report:

North America remains the largest market with a valuation of $3.56 billion in 2023, expected to reach $6.60 billion by 2033. The robust defense budget of the United States and advancements in space exploration initiatives contribute to continuous growth in this region.South America Aerospace And Defense Telemetry Market Report:

In South America, the market is anticipated to grow from $0.64 billion in 2023 to $1.18 billion in 2033. Countries such as Brazil are ramping up their defense spending, enhancing the need for sophisticated telemetry in both military and civilian aviation sectors.Middle East & Africa Aerospace And Defense Telemetry Market Report:

The Middle East and Africa market is set to increase from $1.32 billion in 2023 to $2.44 billion in 2033. The region's heightened military focus and the need for surveillance technologies contribute to the upward trend in telemetry demand.Tell us your focus area and get a customized research report.

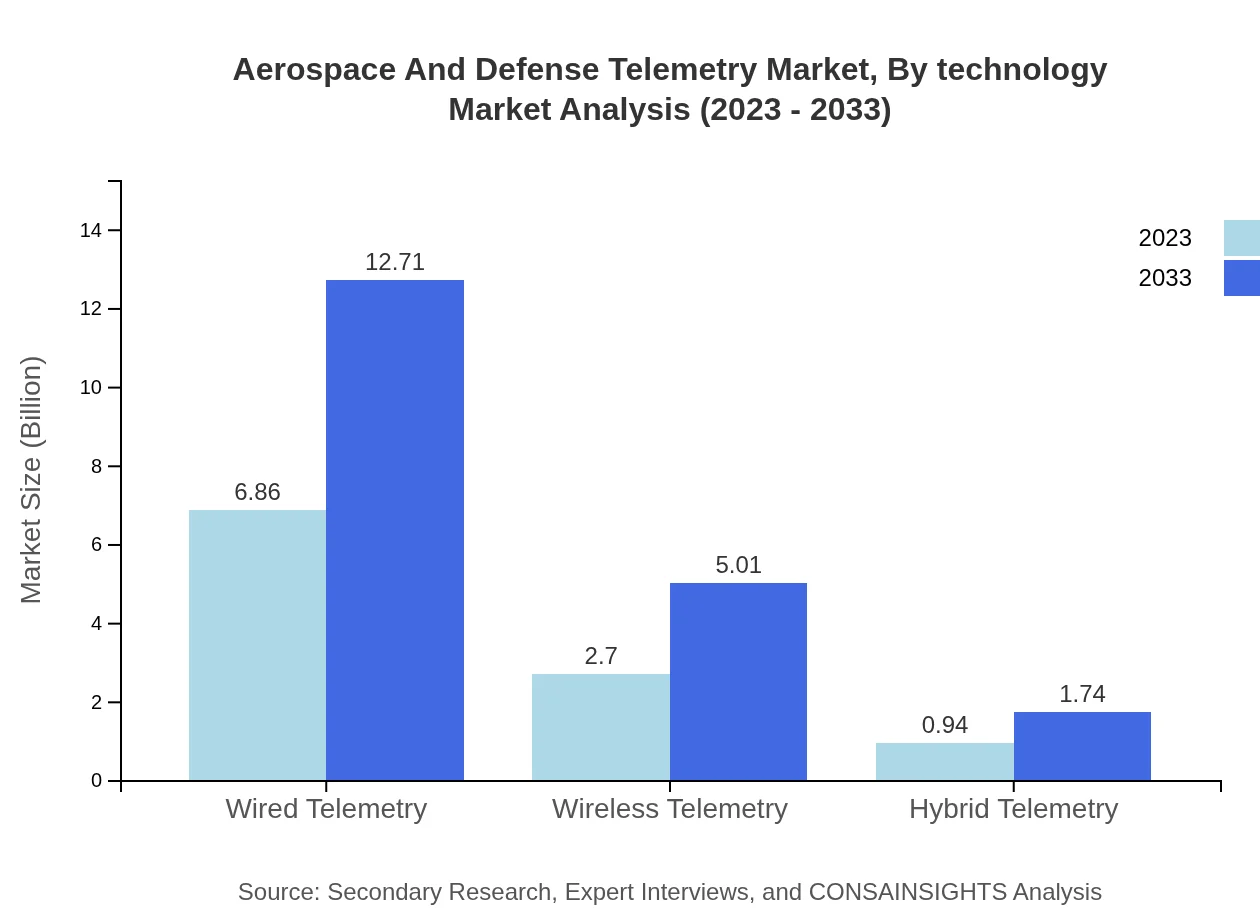

Aerospace And Defense Telemetry Market Analysis By Technology

The technology segment shows a clear inclination towards wired telemetry (65.32% market share) and wireless telemetry (25.75% market share) in 2023. With the expected market values of $6.86 billion and $2.70 billion in respective segments, the evolving technology landscape continues to integrate hybrid telemetry solutions, which are gaining traction due to their flexibility installed across varied operational environments.

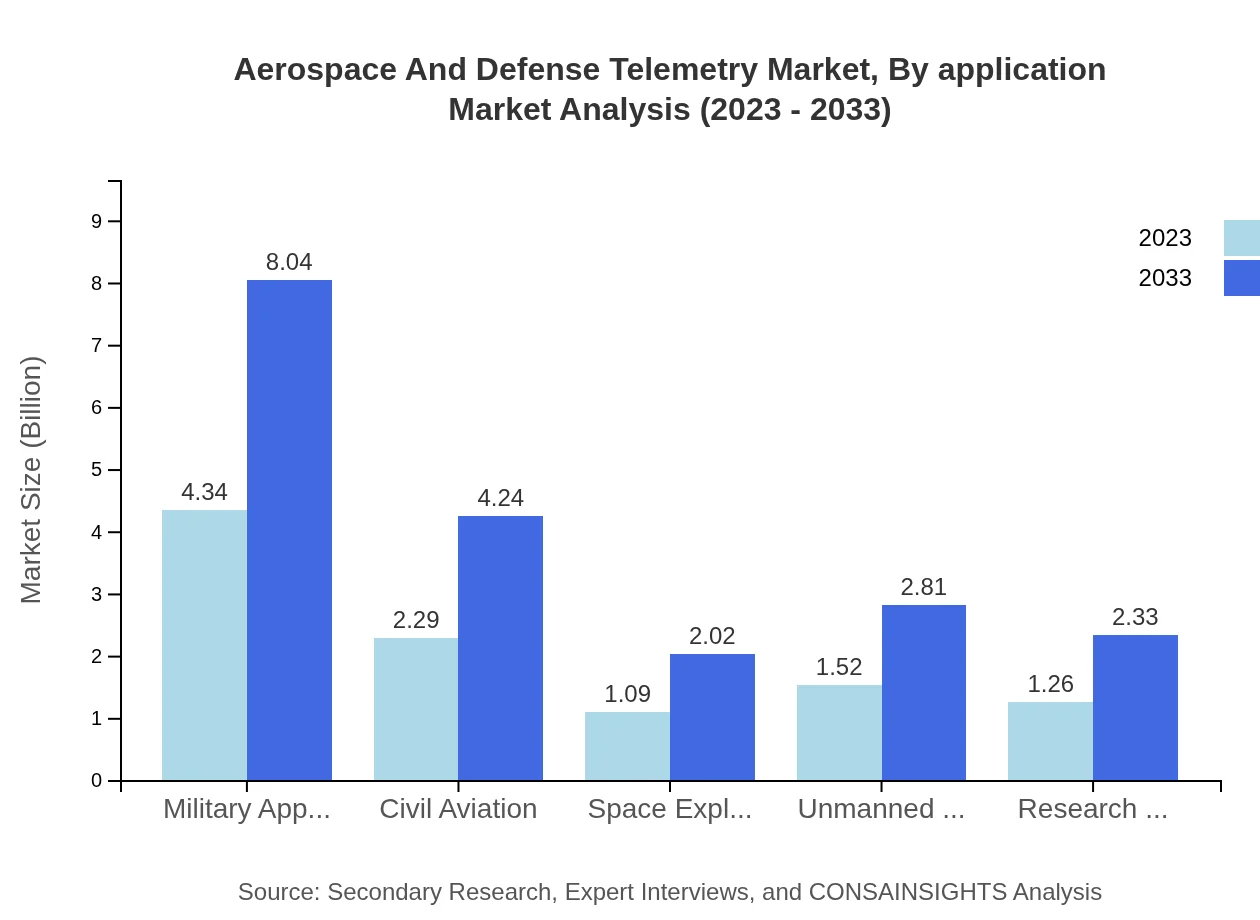

Aerospace And Defense Telemetry Market Analysis By Application

The application segments reveal that military applications command the largest market share (41.34%) in 2023, valued at $4.34 billion, indicative of the essential role telemetry plays in defense systems. The civil aviation segment stands equally crucial, reflecting a robust demand for telemetry solutions in commercial aircraft operations and space agencies, reflecting values of $1.21 billion in 2023.

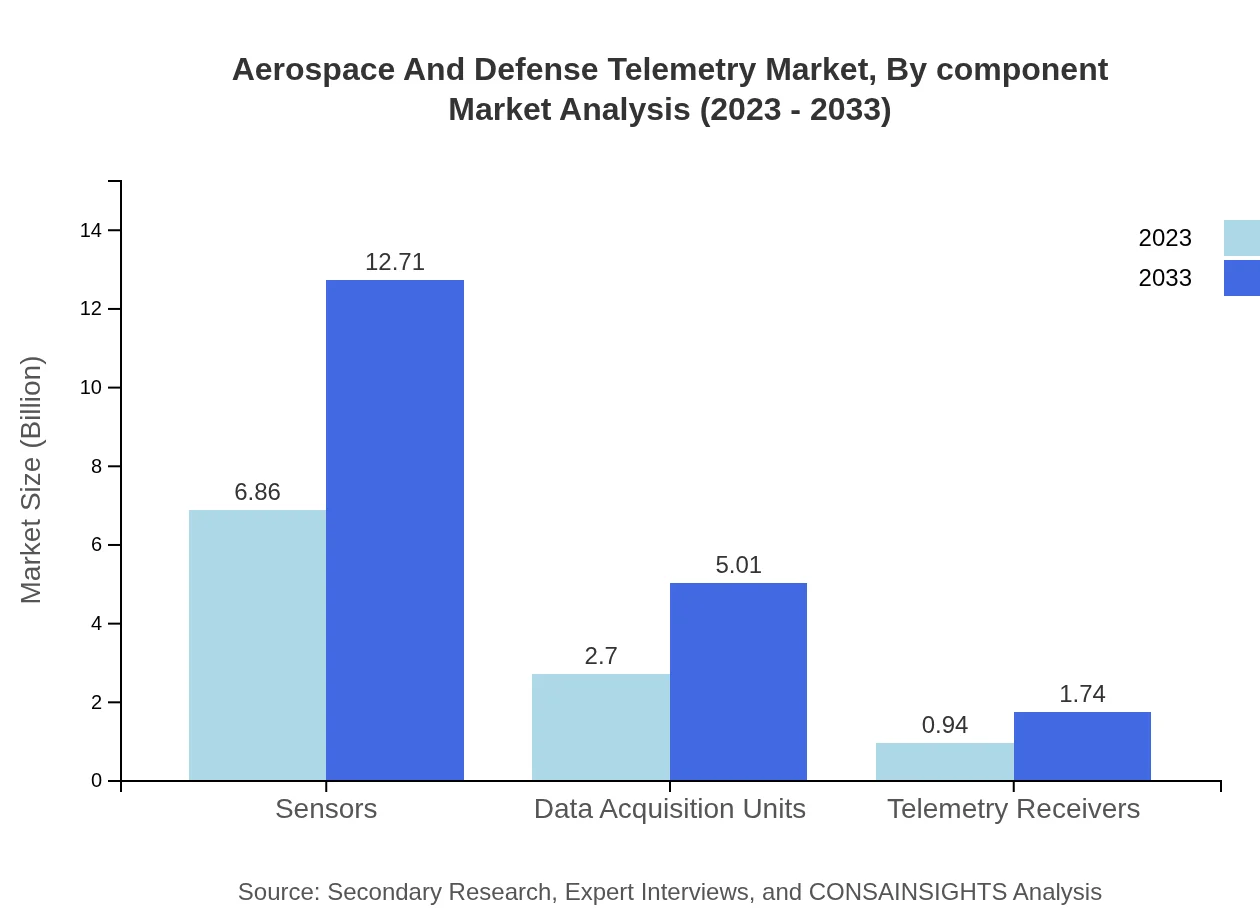

Aerospace And Defense Telemetry Market Analysis By Component

When broken down by components, sensors hold the largest market share (65.32%) in maximizing the effectiveness of telemetry systems, projected to reach $12.71 billion by 2033. Data acquisition units followed closely, growing from $2.70 billion in 2023 to $5.01 billion by 2033, leading to greater overall data collection capabilities across aerospace and defense applications.

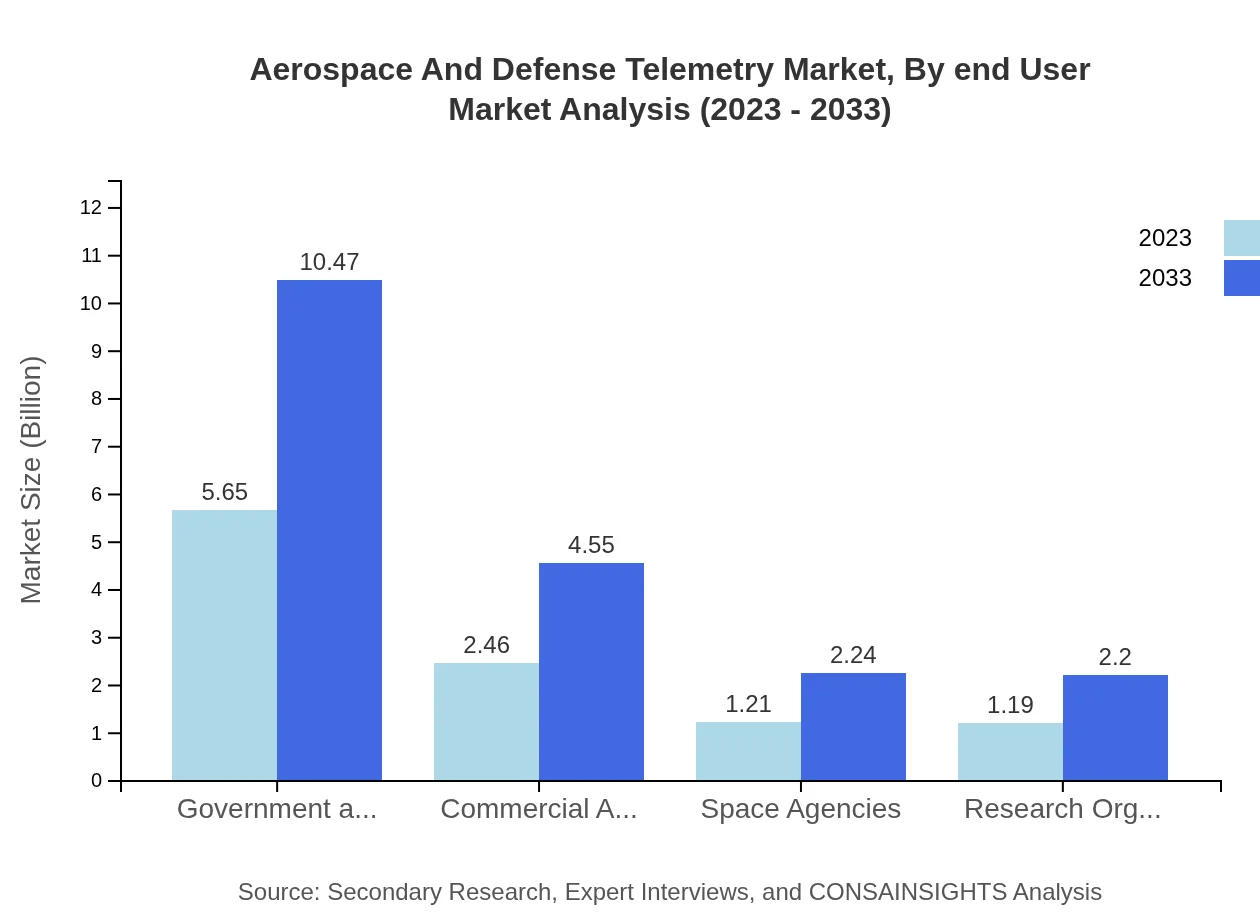

Aerospace And Defense Telemetry Market Analysis By End User

Within the end-user analysis, the government and defense sectors represent a significant market share (53.8%) due to rising security concerns and increased defense budgets. The commercial sector also displays positive growth trends, particularly in civil aviation and space exploration applications, showcasing telemetry's essential role in connecting data systems across varying operations.

Aerospace And Defense Telemetry Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace And Defense Telemetry Industry

Rockwell Collins:

A leading global provider of avionics systems and software, Rockwell Collins specializes in telemetry solutions for aerospace and military applications, enhancing operational capabilities.Hawker Beechcraft Corporation:

Recognized for its advanced aircraft technologies, Hawker Beechcraft offers telemetry solutions to streamline data processing and reliability for diverse aviation services.Northrop Grumman Corporation:

A key player in defense technologies, Northrop Grumman develops robust telemetry systems essential for military applications, leveraging advanced technologies in data collection and transmission.Boeing :

As one of the largest aerospace companies globally, Boeing integrates advanced telemetry systems into its aerospace technology, positioning itself as a leader in innovative solutions for commercial and military aviation.Thales Group:

Thales specializes in high-performance telemetry systems, providing end-to-end solutions for defense and aerospace applications, ensuring secure and efficient data management.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace And Defense Telemetry?

The aerospace-and-defense-telemetry market is projected to reach a size of approximately $10.5 billion by 2033, growing at a CAGR of 6.2% from 2023. This growth reflects increasing investments in aerospace technologies and defense systems globally.

What are the key market players or companies in the aerospace And Defense Telemetry industry?

Key market players in the aerospace-and-defense-telemetry industry include major corporations like Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These companies are pivotal in advancing telemetry solutions for both defense and commercial aviation sectors.

What are the primary factors driving the growth in the aerospace And Defense Telemetry industry?

The growth of the aerospace-and-defense-telemetry industry is driven by factors such as increasing military expenditure, advancements in aerial technologies, and the rising need for accurate data acquisition systems in military and civilian applications.

Which region is the fastest Growing in the aerospace And Defense Telemetry?

The fastest-growing region in the aerospace-and-defense-telemetry market is predicted to be North America, expected to grow from $3.56 billion in 2023 to $6.60 billion by 2033. The region benefits from high defense budgets and technological advancements.

Does ConsaInsights provide customized market report data for the aerospace And Defense Telemetry industry?

Yes, ConsaInsights offers customized market report data tailored to the aerospace-and-defense-telemetry industry, ensuring that clients receive insights specifically aligned with their strategic needs and market focus.

What deliverables can I expect from this aerospace And Defense Telemetry market research project?

Deliverables from the aerospace-and-defense-telemetry market research project include detailed reports on market size, trends, competitive landscape, forecasts, and segmented analysis to aid decision-making and strategy formulation.

What are the market trends of aerospace And Defense Telemetry?

Current trends in the aerospace-and-defense-telemetry market include the rise of wireless telemetry systems, increasing demand for unmanned aerial systems, and innovations in sensor technology, reflecting a shift towards more integrated and efficient data collection solutions.